Let's look at the historical stock market performance when interest rates rise. Even though interest rates have been coming down since the late 1980s, there is a chance interest rates will rise with the economy heating up post pandemic.

Some investors currently fear that a rising interest rate environment might derail our longstanding bull market. It's a fair assumption given the Fed Funds rate stands at 0 – 0.25%% versus a historical average closer to 4.5%. Further, the stock market has recovered so far since the 2009 crash.

As we come out of the pandemic, demand for everything is surging in the economy. Therefore, inflation is also rising. It is an inevitability interest rates will rise.

Historical Stock Market Performance When Interest Rates Rise

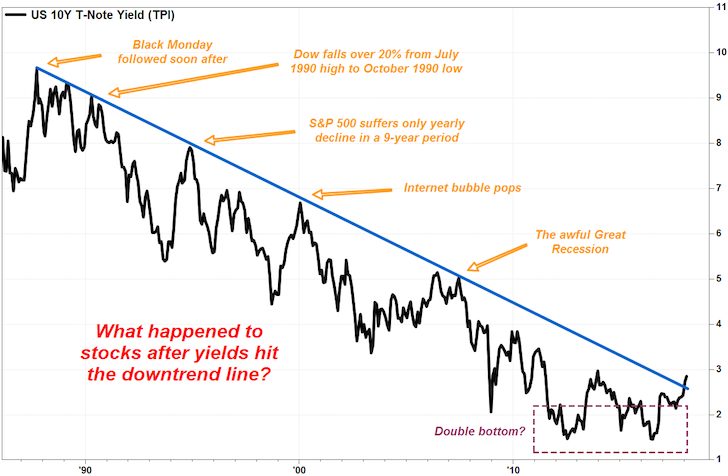

See this bearish chart below that shows what happens to the S&P 500 once the 10-year yield hit surpass their downtrend line. In other words, if the 10-year yield breaches around 2% – 2.5% again, expect to see stocks take a hit.

If the 10-year yield does indeed breach 2.5% for a sustainable period of time, it's logical to conclude that a pullback in stocks or larger than normal volatility may ensue as the stock market tries to adjust to what higher rates mean for earnings.

Related: How I'd Invest $100,00 Today For Some Gains And Joy

How Much The S&P 500 Has Gained In A Rising Interest Rate Environment

On the bullish front, here's a chart that shows the S&P 500 on average has gained roughly 20% in a rising interest rate period since 1971.

Meanwhile, every single sector and style in the S&P 500 has shown positive performance. What's interest to see is that real estate performs the worst, since real estate is the most leverage sector, while Technology, Energy, and Industrials perform the best.

Rates Must Rise At A Moderate Pace

Both the Fed Funds rate and the 10-year bond yield may rise and not derail a bull market in equities. But they must rise in a moderate way that does not choke off credit demand too quickly. Further, the Federal Reserve must communicate clearly and appropriately with the public to give investors confidence.

The best way to protect yourself from increased volatility or a bear market is to construct a portfolio that is appropriate for your risk tolerance and financial needs. Both stocks and bonds have shown upside performance over the long run. Just realize that no investment goes up in a straight line forever.

Interest rates are going up again as the Fed decides to taper its bond purchases. As a result, investor need to take caution. Buying opportunities could be ahead!

Build Wealth Through Real Estate

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. In an inflationary environment, real estate benefits because inflation acts as a tailwind for capital appreciation. Further, inflation reduces the real cost of a mortgage.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. They are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Recommendation To Build Wealth

Manage Your Money In One Place. Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. You can use Personal Capital to help monitor illegal use of your credit cards and other accounts with their tracking software. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely run your numbers to see how you’re doing. I’ve been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

About the Author

Sam began investing his own money ever since he opened an online brokerage account in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at two of the leading financial service firms in the world. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate.

FinancialSamurai.com was started in 2009 and is one of the most trusted personal finance sites today with over 1.5 million organic pageviews a month. Financial Samurai has been featured in top publications such as the LA Times, The Chicago Tribune, Bloomberg and The Wall Street Journal.

For more nuanced personal finance content, join 100,000+ others and sign up for the free Financial Samurai newsletter. Everything is written based off firsthand experience to help you achieve financial freedom sooner!

Historical Stock Market Performance When Interest Rates Rise is a FS original post.