Before you can get to $1 million, or invest $250,000, you must first get to $100,000. Even though $100,000 doesn't purchase the same amount of stuff as it did way back when, $100,000 is still a nice chunk of change. Let's go through how I'd invest $100,000 today.

For background, I've been investing since 1996, worked in investment banking at Goldman Sachs and Credit Suisse from 1999 – 2012, got my MBA from Berkeley, and have written over 2,500 personal finance articles on Financial Samurai since I started this site in 2009. Altogether, I've got eight figures invested.

With $100,000, you can pay for four years of tuition at public university. You could also buy one Patek Philippe complication watch or a BMW M4 and still have $20,000 leftover. Of course, you could also wisely invest the money and retire early.

Ever since getting repeatedly kicked in the nuts working in finance, I've focused most of my effort on turning new capital into passive income. I wanted to have children one day and was sick and tired of being told what to do as a grown man.

Today, most of us should be able to earn between 3% – 5% in relatively low-risk ways. Therefore, $100,000 should be able to generate $3,000 – $5,000 a year. But through investing, there's a possibility to make more.

A $100,000 Cash Position

Thanks to a surprise real estate crowdfunding distribution and stronger-than-expected rental income from my vacation property in Tahoe, I had about $100,000 in cash. As a result, I had to figure out how to invest the $100,000.

Perhaps you too have a good amount of cash piling up and are looking for ideas on what to invest in as well. Let me share with you what I'm thinking.

Please note, this is not my investment advice to you. This is a deep-dive mental exercise on how to best allocate capital today for potentially greater returns and more joy. Always do your own due diligence before investing any capital.

How I'd Invest $100,000 Today

Before investing, it's a good idea to look at all your existing asset classes. Go through them one by one and analyze their investment cases. After all, for every dollar you invest in one asset class, it is one less dollar you have to invest in another asset class.

How much you diversify your investments is partly dependent on where you are on your financial journey. If you're in your 20s, perhaps a concentrated position in your favorite asset class is appropriate.

For me, I've spread my chips around because I can't stand losing a lot of money. Visible loss is also why I like to invest in alternative investments and private funds. The wealthier you get, the more you won't mind paying a fee to have active managers try and make money for you.

Here's how I'd invest $100,000 today.

The S&P 500 – Up To $30,000

With the S&P 500 around 6,000, the market is looking expensive at 22X forward earnings versus 18X historical. The market has rebounded from a low of 3,577 in October 2022. Equity market internals are unhealthy given extreme concentration in the magnificent seven tech stocks. Valuations are expensive, and there continues to be inflation and geopolitical risks.

The current fear is a Fed-induced recession and now trade wars with China, Mexico, and Canada, which may cause analysts to cut earnings, thereby putting pressure on the S&P 500.

As a result, I would invest $30,000 in the S&P 500 spread out over 1% or greater dips. I’m buying the dips with $2,000 – $5,000 tranches until the $30,000 is used up. The easiest way to find courage to buy when stocks are selling off is to think about your children. In 10+ years, will they be happy you invested today? Probably.

Bonds – Up To $35,000 Due To High Interest Rates

With the 10-year bond yield still at around 4.6%, I'd allocate up to 20% of the $100,000 in Treasury bonds again. You're not going to get rich buying risk-free Treasury bonds. But at a 4.3% yield for a a one-year Treasury, that's pretty good since inflation is under 3%.

Since I don't believe there will be that much equity upside in 2025, a 4.3% – 4.6% risk-free return is reasonably attractive. Personally, I'm forecasting only about 4% – 5% in 2025 for the S&P 500.

As a person who wants to take things easier, I am happy that my current passive income streams will be going up due to rising rates. Below is my latest estimated passive income investments.

Related: The Proper Asset Allocation Of stocks And Bonds By Age

Speculative Investments / Individual Stocks – Up To $20,000

I'm mostly a tech investor because tech is where there is usually the most innovation and growth. All of my big winners (and losers) have come from tech.

Part of the reason why I enjoy living in San Francisco is because I get to meet a lot of new people doing new things. The people I've met have also gotten me into various venture funds that have or are doing well.

Now there is an artificial intelligence boom, which means San Francisco real estate should once again do well. With so much capital and talent concentrated in the San Francisco Bay Area, I would never count the area out.

Overall, I like to allocate between 10% – 20% of my investable assets in speculative investments. This way, if they get crushed, I'll still be alright. And if they become multi-baggers, then they'll make a difference. And perhaps most curiously, I won't suffer as much from investing FOMO.

Venture Capital Focus

I'm actively invested in Fundrise's Venture product. It invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 75% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. The investment minimum is also only $10. Most venture capital funds have a $200,000+ minimum.

I don't want my kids asking my in the year 2043 why I didn't invest in AI or work in AI. Therefore, I plan to invest $500,000 in funds that invest in AI companies over the next three years.

Here's my hour-long conversation with Ben Miller, CEO of Fundrise about AI and the Innovation Fund.

I also talked to Ben again about how an open-ended venture capital fund works and his outlook for 2025 for venture. Personally, I'm halting any investments in new closed-end venture funds because they charge much higher fees and are illiquid.

Debt Pay Down – Up to $5,000

Whenever I'm not feeling a lot of conviction, I always turn to paying down mortgage debt. And I've never regretted paying off a mortgage, even if the interest rate is low. The most surprising thing I experienced when I paid off my first mortgage was how much less motivation I had to hustle. When you free up more cash flow, you naturally don't need to work as hard.

When I had a vacation property mortgage of 4.25%, I would pay it down with extra cash flow here and there. However, it's now paid off and what remains is a rental property mortgage at only 2.625%. So I'm not in a rush to pay it off. But still, it's a good idea to hack away at debt so that you can pay off your mortgage by the time you retire or o longer want to work.

Paying off a mortgage early has a triple benefit, which are:

- Guaranteed Return Compared To A Potential Loss

- Mental Relief Due to Increased Cash Flow

- More Courage To Live Your Ideal Life

Stay On Top Of Your Asset-To-Liability Ratio

Because I also bought a forever home in 2020, I levered up further. I was able to get a 2.125%, 7/1 ARM primary residence mortgage, partly thanks to relationship pricing.

Since real estate has done well since purchase, the returns over the cost of debt kind of feels like free money. Therefore, I have no problem using some extra cash to pay off my higher rental property debt.

As you consider taking on debt to buy a home or some other asset, please pay close attention to your asset-to-liability ratio. Leverage feels nice on the way up, but feels terrible on the way down. Right now, times are good. But it is during good times when you should be the most proactive.

Before you declare financial independence, I think you should shoot to have an asset-to-liability ratio of 10:1 or higher. This way, you will have full peace of mind your debt will never get you in trouble.

Below is my suggested net worth and asset-to-liability target ratio by age. Of course, if you can get to a $3 million net worth with an asset-to-liability ratio of 10:1 or greater at an earlier age, then even better. You will have even more time and flexibility to do whatever the heck you want.

Hospitality Real Estate – Up to $10,000

With the Federal Reserve beginning to cut interest rates in September 2024, I expect to see a tailwind for real estate over the next two years. Real estate has been a lagging asset class, which I expect to catch up to stocks and other risk assets.

The one thing I've clearly noticed is the surge in hotel, Airbnb, and VRBO pricing post pandemic. My stronger-than-expected vacation rental income in Lake Tahoe is evidence that travel demand is back. People are booking months in advance.

Recently, I was looking to rent a very normal-looking 5-bedroom house in a middle-class neighborhood in Honolulu this summer. It would have cost me $32,000 for the month plus cleaning fees and other charges.

And you know what? I'm tempted to pay it because it is close to my parents' house. Further, we've made good investment returns since the pandemic began. Before the pandemic, I might have been willing to pay $10,000 for the month for this property.

The Opportunity Cost Of Not Investing

But instead of spending $32,000 + fees to rent this home that has three other properties on the lot and is not a “manor,” I'd rather invest the $32,000+ in a hospitality real estate deal instead!

This is the consistent and common “problem” we personal finance enthusiasts have. Opportunity cost. After one month of lounging around the pool, my $32,000+ would be gone forever.

What if I find a hospitality deal on CrowdStreet in a city that is about to see a massive influx of visitors for years to come? At a 10% Internal Rate Of Return (IRR) for 5 years, my $32,000 would turn into $51,536. It's worth signing up for free to take a look.

In my investment-focused mind, having perpetual income beats out one month of temporary pleasure 99 out of 100 times. I think it's worth actively looking at private real estate investment deals.

There is a window of opportunity to buy real estate at a discount before prices catch up to the stock market. Demand is weaker because mortgage rates are higher. But I think mortgage rates will inch down in 2025 and beyond and bidding wars will return. Demand for real estate is heating up and the asset class is the most attractive today given valuations.

The Solution To Living It Up Responsibly

At some point, we have got to start spending our money for a better life, rather than always investing it. We must do our part to contribute to the YOLO Economy right? After all, many of us are wealthier now than before the pandemic began.

Here's the solution to living it up responsibly. Go to the maximum of what you can afford. Explore it. Pretend you actually do spend that kind of money. Then come to a compromise. Psychologically, it will make you feel like you're getting a good deal.

For example, let's say your family could afford to pay $32,000 for a monthly vacation rental. But if you spent that much money, you would feel like a donkey. Instead, do what Economy Plus does for people who feel bad about paying for First Class, even if they can afford to. Come to a reasonable compromise.

Why not try and find a decent $12,000 a month vacation rental and invest the other $20,000 instead? This way, you can still make great memories while also investing for your future. A double win!

It's worth searching for hospitality deals in good locations today. We know that hospitality got crushed during the pandemic. But for those who are still standing and who are seeking capital as business revs up, I think there's an opportunity. Hotel and vacation rental prices are up between 2X – 4X their pandemic lows.

Investing In A Real Estate Fund

Another great way to invest $45,000 is to invest in a private real estate fund from Fundrise, my favorite private real estate investing platform. For most investors, investing in a diversified real estate fund is the way to go. You don't have to worry about each individual property. Further, you're gaining broader exposure to ride the real estate appreciation wave.

Fundrise has performed very well during times of volatility. When stocks go down, Fundrise portfolios have outperformed because they invest in single-family and multi-family properties in the Sunbelt. Sunbelt properties are showing tremendous rent growth, especially with housing affordability down. Valuations are also cheaper.

It all depends on your risk-tolerance and current asset allocation. Personally, I enjoy investing in funds so I don't have to think about the investments. I've currently got $954,000 in private real estate funds since 2016. I wish I had invested more because Sunbelt residential real estate boomed!

One Last Splurge That Doesn't Build Passive Income

For the first time in two years, I went to the shopping district in downtown San Francisco. I had a doctor's appointment, so I figured why not visit some stores now that I'm fully vaccinated. One store I visited was Shreve & Co, my favorite watch store.

I hadn't realized this, but it now costs $1,100 if you want to clean and change some springs in an automatic luxury watch! Back in 2008, the cost was “only” about $500. Rolex, for example, recommends its $1,100 cleaning every 5-8 years. You drop off your watch at a dealer who then sends it to Rolex HQ in Geneva, Switzerland.

Inflation truly creeps up on us. We often anchor prices at a certain point in time. The mind doesn't naturally do compound interest calculations. Therefore, please find ways to own assets that tend to appreciate in value.

With the remaining $25,000 in funds earmarked for better entry points in the stock and bond market, I'm thinking it might be time to get a watch. Like cars, I used to buy and sell luxury watches all the time for profit and for personal enjoyment. Maybe it's time to buy a forever watch at my age.

One timepiece which I find interesting is the 42 mm Panerai Submersible with a black ceramic bezel. Perfect for wearing in the hot tub while voice dictating a post! The cost? $9,800 pre-tax. Check it out.

But do I really want to spend $9,800 pre-tax on a timepiece? I could buy a $130 Casio G-SHOCK that works great the next time I go scuba diving 200 meters below sea level. Then I could invest the remaining $9,670 in a speculative investment that might one day turn into $100,000!

Then I'd be right back to where I started, writing this post again. Where's the joy already?!

Related: How I'd Invest $1 Million Today

Letting Existing Investments Do The Work For You

Unless the stock market falls by greater than 30% and the real estate market declines by greater than 15%, my family should have enough passive income to last indefinitely.

Given I believe the housing market will continue to stay strong for years to come, I expect rental income to increase. Further, I also expect dividend payouts from blue-chip companies to increase as well. Therefore, it may not be necessary to continue investing as aggressively anymore. Your current investments may just naturally continue to grow on their own.

If you're thinking about retiring or taking things easier, now might be one of the best times ever as the U.S. opens up. If you have enough money to be happy, you just need to fight greed.

Undoubtedly, if the bull market continues, many more people are going to get much richer than you if you take things easier. You just have to be OK with that as you spend more time on more important things.

Invest In Real Estate Strategically

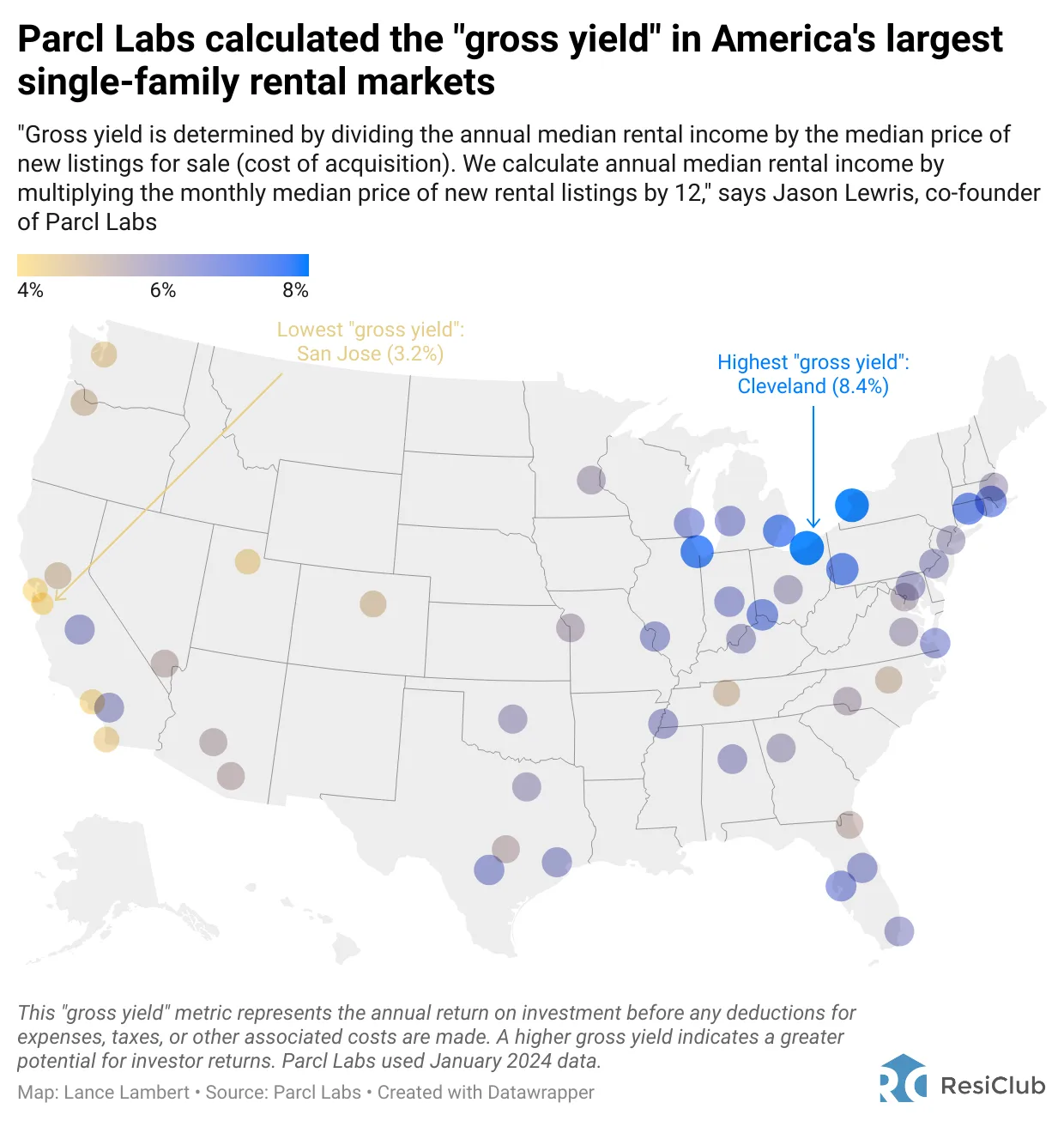

Look to diversify your real estate investments across the country where valuations are lower, net rental yields are higher, and growth rates may be higher. The global pandemic has accelerated demographic shifts towards lower cost areas of the country due to the work from home trend.

Check out Fundrise my favorite private real estate platform with over $3 billion in assets under management and 400,000+ investors. Fundrise focuses on residential real estate in the Sunbelt where valuations are cheaper and yields are higher.

Private funds give investors a way to diversify their real estate exposure with lower volatility compared to stocks. Income is completely passive and there is much less concentration risk.

Crowdstreet offers accredited investors individual deals run by sponsors that have been pre-vetted for strong track records. Many of their deals are in 18-hour cities where there is potentially greater upside. Crowdstreet is a solution where you can build your own select real estate portfolio. I've met the people at Crowdstreet on two separate occasions and came away impressed with their product offerings.

I've personally invested $954,000 in real estate crowdfunding across 18 properties to earn income 100% passively. My goal is to invest in real estate in cities with the highest gross rental yields for more income and diversification.

Both platforms are longtime sponsors of Financial samurai, and Financial samurai has invested over $300,000 in Fundrise.

Join 60,000+ others and sign up for my free weekly newsletter. Also check out my instant Wall Street Journal bestseller, Buy This, Not That. It is the best personal finance book you'll ever read.

Great information. Thank you. Why not focus more on growing your dividend portfolio that would be taxed at a lower rate than interest from Treasuries?

I have both. But at this time, Treasuries at 5%+ with no state taxes are more attractive than the majority of dividend-paying stocks after tax. But dividend stocks are my #1 passive income investment.

Sam, Check out cruises.com . I found a 30 day cruise from San Francisco to Hawaii , South Pacific New Zealand etc. Cruises are the way to travel. Food , Transportation, lodging covered and water view all day long. We just went on a 50 day cruise for the three of us for less than 20k.

Sounds like a wonderful trip!

We just bought our forever home, so we will likely stay out for a while. But good to know.

Don’t you pay taxes on earnings from CDs or high yield savings accounts? So doesn’t it make more sense to pay down a 4% mortgage than use money for a 5% CD/high yield savings? Just wondering

Are those net worth and asset to liability ratios applicable at a household level or individual? I am never sure if I am looking at those if I have to double them due to being married. Thanks!

Household, which can include individual or dual income household.

You can see: The Average Net Worth For The Above Average Married Couple

What type business entity do you use for investing in Fundrise? Or maybe you have that in a self-directed Roth. Thinking about investing myself and since nearing retirement I must consider how to handle taxes on profits. Thanks a bunch.

Charlotte

Listening to the audio book, and just ordered hard copy. Thanks for the insights. The post above was written last year I believe and looks to be update in August. The market has changed quite a bit since beginning of August. Any changes you would make to the above breakdown of investing $100K given the current macro and geo political environment? Thanks again.

I have a similar philosophy on emphasizing the yield component of every investment as I approach retirement. However, do you consider tax efficiency? How does that enter your decision process. Munis also have risks (I remember OC defaulting) and do not capture the credit or spread diversification you get from core bonds. Also wondering if any of the RE investments you cite appropriate for a taxable acct?

Was lucky enough that I just had $100k to spend or invest due to a real estate windfall after flipping a starter home. My husband and I are in our early thirties and only just worked our way up to well-paying jobs. It was my first time making investment decisions with real money.

Here’s how we used it:

$10k Fundrise

$10k Government I Bonds

$10k Index funds (taxable)

$15k Emergency fund (earning up to 3% in rewards checking at credit union)

$24k Max out IRAs for 2 years

$5k Jump-started three 529 plans (to save $40k per kid by 2034)

$5k Speculative investing in individual stocks and art via Masterworks

$13k Mountain bikes

$8k Used car

Yes, more on bikes than cars. We live in Colorado and biking is our main hobby / exercise.

We still have debt; $55k in student loans and car loans, and a mortgage as well. I didn’t want to just pay down the debt, which is at 0-3% interest or less until the student loans start charging interest again.

How did I do?

Just curious as to why you’d choose to invest any money in bonds, which pay 2% or less, when you could otherwise use that money to pay down mortgage debt at 3-4%? Yes, you may be able to write-off some of the mortgage debt, but given the spread between the two, why not pay down the mortgage as part of the “conservative/low-risk” allocation of the $100,000?

Hi,

I am a recent residency graduate (MD), wife, mother of 4 and I’ve worked really hard to pay off all of my school debt and build up about 50K for investing. I’d like to invest in real estate. Would you say there is a difference between investing in an eREIT like Fundrise or go with a private syndicate like Tom Burns’ Presario Ventures? Would you suggest one over the other?

Thank you for all, I’ve been following your blog for a while and very much appreciate all of your transparency, work and information.

F

Probably the minimums. Fundrise only has a $10 minimum to invest now, which helps for first-time investors. Always start small and work your way up as you understand and familiarize yourself with an investment.

You need to understand the track records of each real estate sponsor. I don’t know Tom Burn’s.

Related: Fundrise 3Q2021 Performance Review

Thanks!

Build an ADU in our backyard and rent it out. With the prefab boom, constructing such efficiency units is cheaper than ever, and recent California laws cannot be more friendly to expedite local government approval / permitting. Absolute best return if you already have California residential real estate and you meet the statewide criteria to build a qualifying ADU.

How much did the ADU cost to build and how long did it take?

I’d invest 100K in Japanese whiskies – Yamazaki, Chichibu, Mars, Karuizawa, Hakushu. This may not be the safest choice but I’m doing it more as a hobby.

In general, I highly recommend the paper “Neville et.al. (2021). The Best Strategies for Inflationary Times. http://dx.doi.org/10.2139/ssrn.3813202 ” for a in-depth analysis of various investment strategies and asset classes returns in historic environments of high and rising inflation.

Keep up the good work, Sam! Thank you!

Surprising that Options rarely, if ever, takes the stage in your articles or the comments sections. I mean it would be relatively easy to run a CSP/Wheel strategy with a 100k and generate the aforementioned 2-5% annual return in potentially a month’s (or less) time with weeklies/bi-weeklies. 2-3x annually with relatively stable priced companies doesn’t take too much effort.

A strong argument could be made for utilizing this strategy, rather than actively buying into most growth companies at current prices.

Happy to have a guest post on options if you’re interested! I don’t invest in options, which is why I don’t write about options. But I do invested in structured products, which uses options.

Well the absence of discussing them makes much more sense. I assumed you might be holding out! That possibly you did not want to delve into something that might be considered too much for the average person accustomed to index investing.

That was an interesting read. I have never looked into those products before. In one of the cases, S&P one I believe, it seemed very similar to a covered collar with LEAPs. I assume there is some fee/commission involved on the front end of the purchase in the case of the structured products (I think you referenced 1-3%)?

Okay Dogen, here’s what we would do with your 100 K headstart. Of course a lot of this has to do with stage of life.

We’d split it into our 2 granddaughters custodial accounts. Then equal parts to each of TSLA, (Musk is 500 years ahead of any other human being he is talking to), a FAANG etf which also has MSFT, a pre ipo tranche of Commonwealth Fusion Systens (not possible because of higher buy in limits, we know), FAN etf, TAN etf, and an etf which centers on the CRISPR based gene editing technologies. There a number of them.

After that our crystal ball gets a little hazy. When the kids hit age 18, the age of majority in their state, they’ll spend it on a car and clothes anyway, but by the rules of this exercise that’s not our concern. Maybe parenthetically that behavior would fit in t b e “and some fun” portion. :)

Wow! 50/50 in Tesla! As a shareholder of Tesla since 2018, I can’t complain! I’ve got a ~$200,000 position in Tesla now. Hmmm, maybe I should buy more. I’ve got to do more research.

I have $100k-$150k to invest due to a recent windfall. I want to invest in real estate. I live in the Bay Area. Undecided between buying an investment property or investing in a diversified real estate fund focused on the Sunbelt (ie. Fundrise)? I’ve also considered buying a rental in Atlanta where I have family and visit frequently. I already have a lot in stocks in my 401K ($2.25mm) and would prefer to diversify and generate passive income through real estate. I also could pay off a $70k loan at 3% to a family member but feel like I should be able to generate more than 3% return investing in real estate. The loan helped me fund a renovation of my primary residence. Maybe I should use $35k to pay down the loan and invest the rest in real estate?

Fun exercise. Agree with your take on each category. Even more so now than when you initially wrote it. We’ve been derisking our portfolio a bit over the last couple of weeks (ie putting cash in the war chest).

If I had an extra $100k right now, I’d properly buy rental property.

The most frustrating thing about investing, when you are not a pro and are still learning, financial planners will NOT recommend alternatives, only the stock market.

I’d have known nothing about real estate investments if I hadn’t, by a fluke, stumbled onto a local real estate investment group.

I just recently got a 250k cash infusion. I’ve invested 50k of it in stocks/reits/bdc etc and I am sitting on the rest, for now. How would I invest 100k? Right now, I wouldn’t. Down the road? Probably another 50k in stocks/reits/bdc and 50k in crypto. I’ll probably keep 100k or so in cash in the near future just because it makes feel good.

The asset to liability chart appears to be new. I don’t think that works for real estate investors. 45% of my net worth is in real estate and my debt to asset ratio is 43%. Leverage and real estate were the keys to building my wealth over the past 8 years from my early to late 40s.

Great post (as always) Sam! I think I’d agree with you on most things, but as I am still quite young, if I had $100,000 I’d weight it more towards riskier investments with higher potential. Maybe something like:

– $10,000 in ETFs

– $25,000 in individual stocks

– $25,000 in crypto

– $40,000 in real estate.

Thoughts?

Depends on what percentage $100,000 is of your net worth. I’m assuming $100,000 is high as a college student graduating in 2025. So you can definitely take more risk.

But if you had to work for your $100,000, you might not want to be as aggressive.

As a 19-20 year old, I wouldn’t buy physical real estate because I don’t know where I’ll be living/working after college. But I may buy college real estate and live in it, then rent it out to roommates.

I would invest the $100,000 in growth stocks that have fallen significantly since February. I would really love to be putting money into the market now. Since I don’t have the cash, I opened up a paper trading account with Webull and am looking forward to seeing how I do in the next twelve months. I started paper trading 17 business days ago. I was up 4% until the fed’s inflation news yesterday washed away all the gains. The loss was short lived since I’m back up 2% today. It’s disappointing to see days with losses (in my paper and real life accounts) but I remind myself that these investments are for the long-term and the stock market always moves up and to the right over time.

In March of 2019 I hypothetically invested $100,000 in nine categories (stocks, gold, commodities, fixed rate investments and cash) and actually started buying SFHs. This is where the value of the investments is as of 31 May 2021:

First TMP – TheMonopolyProject.com (2.0 Houses) $162,623

2nd VTSAX – Total Stock Market Index (1,425 shares) $151,221

3rd Gold (77 ounces) $146,885

4th WOOD – iShares Global Timber & Forestry (1,600 shares) $146,368

5th VGSLX – Vanguard REIT (845 shares) $119,610

6th VBLTX – Total Bond Market Index Fund (9,600 shares) $107,904

7th CD – Certificate of Deposit (3.1%) $106,938

8th US10YT – 10 yr Treasury Bond (2.82%) $106,293

9th USL – United States 12 Month Oil Fund, LP (4,500 shares) $105,525

10th Cash $100,000

Had I been more aggressive in timing and number, the SFH would be way ahead of all the other investments. I realize that this is primarily luck. I’m not a financial genius. Everyone makes money in an up market. Let see what happens when conditions turn.

My investments are split fairly evenly between the stock market (active value investing in my brokerage account and passive index investing in my 401k, IRA, and 529 plans) and real estate (seven single-family rentals and one commercial property).

My current focus is on my active stock investing, using traditional Benjamin Graham style as well as more modern Buffett style value investing. My portfolio has averaged a 40% annual return on average equity since the beginning of last year when I first start active equity investing.

Over the next few years, I plan to sell off the single-family rentals and transition that equity into commercial RE syndications for better cash flow. I plan to use that and other income sources to transition away from my day job, which I still have (I’m 40 with 4 kids).

I’m thinking of paying off my 50k mortgage I have left. The interest rate is 2.4% should I pay it off or keep it at that rate? I’m maxing out my savings and that’s spare cash i’d use.

“In my investment-focused mind, having perpetual income beats out one month of temporary pleasure 99 out of 100 times.”

I agree with your sentiment but as I get older (I’m 60), I’m finding that it is extremely difficult to change that mindset once established. I recently visited my parents in the US, and it finally dawned on me that unfortunately I have been following in my father’s footsteps. He is now 85 and one of his primary goals in life now is to pay no federal income tax. So every year, rather than enjoying the fruits of his wealth, he donates his minimum IRA withdrawals to charity so he does not have to pay any tax. When I point out that the charities he gives money to pay salaries to their employees who in turn pay federal income tax on those earning and that this is the equivalent of an alcoholic who gives a friend money to buy him booze so he can claim he never has purchased alcohol he only gets angry. I’m not disagreeing with his wanting to donate money but rather his flawed reasoning behind such donations rather than any altruism. One organization in particular is clearing taking advantage of him to ensure future donations – my mother sees this as well but is unable to convince him otherwise as well. She has to live with him, so she has simply remains quiet.

At what age, if any, do you think you might start prioritizing temporary pleasure over future income? This might actually be a good subject for a future article. Of course, I’m not one to write it as I fight with this concept on a daily basis!

I hope your dad is not getting too angry. Donating is a good thing to support other people.

For me, I’ve been slowly spending more money beyond the norm starting in Dec 2016 when I bought my 2015 Range Rover after leasing a Honda Fit in 2014.

I have been spending more money due to my property purchases in 2019, 2020. Although 2019 purchase was more an investment. 2020 house purchase was to live it up.

I think there’s a reason why people have a midlife crisis. And so perhaps the time to spend more money is once you hit that midlife crisis between the ages of 40 and 45.

My father in almost all cases, gets disappointed with the organizations that he donated money. He wants them to use the money in a particular way but it almost never works out that way. I have also tried to convince him to set up his own fund whereby he could actually control how the money is spent but he has little interest. His only goal seems to be to not pay taxes.

I’ve recently found out about creating your own fund for donations and will actively pursue it. The sad thing is that most people don’t know about this.