The last thing any couple should want to do when they start a marriage is get buried in debt and stress. Debt and financial stress can break relationships down. Instead of creating unnecessary anxieties, have a budget wedding and start your married life on the right foot!

What's the average wedding cost in the US you wonder? It's $38,000 in 2024 and frankly that's too high. In some states like New Jersey, the average wedding cost is even significantly steeper at over $63,000.

Spending ~$38,000 on the average cost of a wedding in America today feels kind of ridiculous. If you live in a coastal city like NYC, the average wedding costs closer to $80,000. That's more than the median income in the US!

Having been happily married for over 12 years, I can attest that prioritizing your financial future as a couple is the way to go. Forget about splurging on a wedding beyond your means.

Have a budget wedding, and you'll be ahead of the game. That's what my wife and I did. We felt good about opting for a budget wedding when we got married, and we still do to this day.

Related: What Is The Average Cost Of An Engagement Ring?

The Happiest Moment Of My Life

In the middle of the financial crisis, I decided to propose and get married to my lovely wife. It was the happiest moment of my life.

When people ask me to recollect the horrors of the financial crisis, I've got to think real hard because I proposed in early 2008, got married at the end of 2008, then started Financial Samurai in mid-2009.

Despite losing about 35% of my net worth, I'm overwhelmed with memories of joy during this time period. I knew that even if I lost everything, at least I'd still have my wife. We met in college when we had nothing. So starting over wouldn't be too bad.

For those of you love birds thinking about going the budget wedding route, this post is for you.

The Detailed Breakdown Of Our Budget Wedding

Our 16-person wedding on the beach ended up costing around $2,745. The costs included:

- $700. Two roundtrip economy class tickets to Hawaii from San Francisco. Hawaiian Airlines has a two-seat, four-seat, two-seat configuration. We aren't very big, so sitting next to each other in a two-seat configuration in coach felt fine.

- $1,100. Wedding ceremony on the beach performed by a licensed Hawaii officiate with a ukulele player in the background. The wedding package included two fresh flower leis, a floral bouquet, and a keepsake Hawaiian wedding certificate.

- $300. Wedding photographer for our one-hour ceremony. We also got tons of free photographs and videos from our relatives, two of whom are really into photography and had all the fancy equipment.

- $560. Reception for 16 people at our favorite Korean BBQ place where I first took my wife on a date.

- $80. Wedding dress. My wife went to Target and got a simple white beach dress. I wore my favorite Aloha shirt that I bought a couple of years ago at Goodwill for $5, trousers, and flip flops.

Total: $2,745

The Average Wedding Cost In America

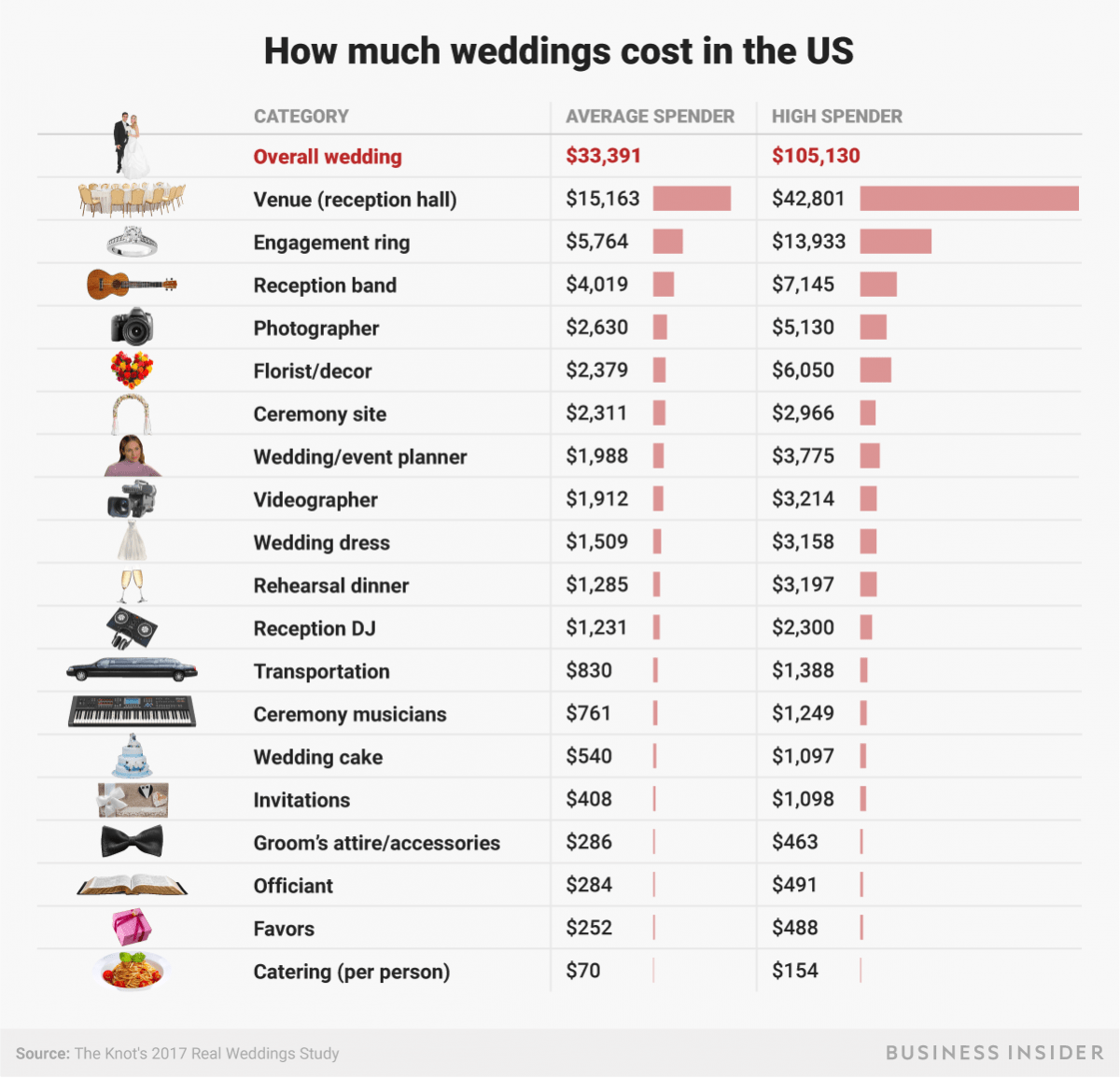

Here is the average overall wedding cost according to a wedding study by The Knot. Due to inflation, the figures are higher today.

The main thing missing from my budget is the engagement ring, which was about $6,800. If the average cost of a wedding normally includes the engagement ring, then our wedding was closer to $9,500. Then again, I included the cost of our flights, which The Knot's study did not.

Thoughts On Having A Budget Wedding

My wife and I could have afforded a more expensive wedding, but it just wasn't us. We're both frugal people and we wanted to save money. Our main goals were to go simple, have a nice honeymoon, and focus on creating a wonderful, financially secure future together.

Here are some more reasons why we chose to have a budget wedding. Perhaps our experience will inspire you to do something similar.

1) There was no stress.

Not only was there no money stress, there also wasn't any planning stress. My wife found our wedding package online, paid for the ceremony via Paypal, and we e-mailed invites to our respective family members.

We didn't want to be bothered with picking out a fancy stationery or going to the printers. We just typed in the basic details of our plan and clicked “send.”

The day of our wedding, we got dressed, drove down the hill to the beach just seven minutes away and exchanged vows. Because only 16 people attended, everybody arrived on time.

There were no hiccups, which can happen at large and complicated weddings, and we all left smiling.

2) We started out on the same financial page.

Having a simple wedding reflected our values. We are simple people who like to be frugal. There wasn't a mismatch where one was a spender and another was the saver. My wife's favorite store is Target. And my favorite beverage is water with a slice of lemon.

We both found it unnecessary to spend tens of thousands of dollars in one evening. Instead, we were much more excited about investing the money we could have spent on a big wedding for our future.

In 2008, we were both already focused on reaching financial independence. Our original goal was to both work until 2017. Little did we know then that we'd exit much sooner. We both found a way to get paid to quit our jobs and now have the flexibility to work for ourselves.

If you're unsure how to get your finances in order, a great place to start is my top financial products list. Also, you can sign up for free wealth management to securely track your accounts in one place, analyze your net worth and investments, plan for retirement, and more.

3) A small wedding didn't put any pressure on our guests to give.

We knew from attending past lavish weddings there was sometimes an expectation for guests to give money or presents. In some Asian cultures, couples sometimes wind up making more from monetary guest gifts than the cost of the wedding itself!

We didn't want anything from our guests, only their attendance. By keeping things simple, there were no expectations for gifts.

4) We avoided guest list complications.

Agreeing on a guest list for a wedding can be a very stressful process. What if you invite one colleague, but not another? You might limit your career!

Instead of inviting everyone to our wedding, we decided to invite only our immediate family members. By excluding distant relatives, friends, and coworkers, there was no discrimination or hard feelings. Plus, the savings and simplicity of the logistics were marvelous.

When we got home we threw a celebratory party for friends and colleagues at our home. This way we still got to celebrate with people outside of our family. And it was a heck of a lot cheaper. The party only cost a couple hundred bucks for light snacks and drinks. And it was a cinch to plan.

5) No drama over the bill.

When you're hosting an average $34,000 wedding in America, or something more extravagant, there likely will be some drama on how to divvy up all the expenses. After all, the average $34,000 wedding is spent by the median household income of roughly $68,000.

Some couples go into debt to pay for a wedding, which is a terrible idea. Other couples make the bride's parents pay, which might cause some resentment and vice versa.

Because my wife and I had a budget wedding, we were able to comfortably pay for all our expenses in cash.

6) Nobody cares how simple or lavish your wedding is.

I've been to $1,000,000 weddings and I've been to $2,800 weddings. So long as you are surrounded by good people, good food, good drinks, a ceremony that runs on schedule, and good pictures, that's all that matters.

Maybe I'm just insulated from wedding gossip as a man, but I've never once heard someone bag a wedding for its size or estimated cost. The only people I imagine who would bad mouth a wedding are those who didn't attend or shallow people you really don't want in your lives.

The people who attend your wedding are what matter most. It is they who will make you feel loved. Going into debt so you can have an exclusive venue, a 5 star caterer, giant bouquets of flowers everywhere, professional lighting, an MC, or anything else like that is just not worth it.

Two weddings I went to that cost in the $80-100,000 range sadly resulted in divorce. Perhaps if they had focused more on each other and not on trying to impress other people for one day, they would have stayed together.

A Budget Wedding Is Just Fine

I'm not sure how much more fun we'd have if we spent 12X more on our wedding to match the national average. Perhaps 20% more fun? More likely, we'd have 50% less fun because we'd feel more financial stress for such an ephemeral event.

One of the things we did with our wedding savings was return to Hawaii every year until 2016 and pretend we were on another honeymoon each time. We'd always return to the beach where we got married and celebrate afterward. It was a fun way to keep our wedding memories going for a long time.

We put our trips on pause in 2017 once our son was born. But I decided to superfund my boy's 529 plan with $70,000. ~$70,000 is the amount we had earned by investing $34,000 in the stock market at the end of 2008 instead of spending it on an average wedding.

To this day we still feel great about our decision to have a budget wedding. Despite being wealthier today, I still don't think we'd spend more than an inflation-adjusted $3,800 on a wedding. We'd much rather invest the difference in our children's future.

If you spent big bucks on your wedding and had a blast, that's awesome! A wedding is a priceless experience. However, for those of you deliberating on how much to spend for a wedding, I think you'll have a fantastic time if you go the budget route.

Invest Your Wedding Savings Instead

Instead of spending tens of thousands or even hundreds of thousands of dollars on a wedding, save and invest the money instead. You can invest in the S&P 500 index, private real estate funds, or my current favorite, private AI companies with tremendous future upside.

Consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Fundrise venture capital product, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 60% of the Fundrise venture product is invests in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Recommendation To Build Wealth As A Couple

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. It will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible. Monte Carlo simulation algorithms are used to help see your future.

I’ve been using Empower since 2012. Since then, I have seen my net worth skyrocket during this time.

Related posts:

Wedding Spending Rules To Follow If You Don't Want To End Up Broke And Alone

How To Dress To The 9s For A Black Tie Wedding Without Spending A Fortune

The New Rule For Engagement Ring Buying

Readers, any of you have a budget wedding? If so, how much did you spend and what were the individual costs? What do you think drives the average household to pay the average $34,000 cost for a wedding? If ~50% of marriages end in divorce, isn't spending so much money on a wedding risky? I'd love to get a wedding insider's perspective about wedding costs and wedding stories, good and bad.

Mine was <$10k even with 70 people invited in the Bay Area. Key savings:

– Ring was ~$500 (not diamond)

– Free photography (family/friends took pictures, they are amateur photographers so actually turned out very good)

– Free ceremony (family member officiated, has experience)

– Ceremony + reception in a restaurant, so no extra cost for venue after minimum food cost

– <$500 spent on decorations/flowers because restaurant already has decorations

– No live band

I can't imagine it being any better than it was so I'm very happy about it. TBH I would have been sad to have only invited 16 people. A lot of my favorite times at the wedding involved my friends or relatives that wouldn't have made the cut.

Don’t worry. I threw a house party at our house for 70+ people when we got back.

Good stuff on a $500 ring. I would say a majority of women in the Bay Area wouldn’t accept that. Woman will be judged by other women (and men) and think their husband was cheap or dont love them enough. That’s society for you!

My side gig is working for a caterer that owns the reception hall. I see how much food has to be wasted.

Great post Sam! We also love budget wedding and we manage to spend about $3,700 for having it in a beautiful redwood grove near San Francisco, California.

What was important to us was that be thoughtful about why we wanted this day and what we wanted it to be about. We also wanted it to be a gathering of our loved one where we could have their presence and support to help us transition into this next big chapter of our lives as both of us decided to become full time nomadic after that. So we approached our wedding planning with many of the values that we apply on our nomadic journey: less is more, love nature and create joyful memories and we did not regret it at all.

For people that are interested, we are sharing all our budget expenses in details at: https://www.nomadnumbers.com/our-dream-wedding-in-california-redwoods-under-4000/

Budget weddings are awesome! We plan to do ours at under $10K in the Bay Area and only invite family and close friends. By going the budget route, we choose to not worry about all the typical fringes of a Pinterest wedding. We’re both introverts and prefer small, low-key parties so going budget just feels more natural. Better save the hard-earned money for retirement or something that creates good memories like travel.

We flew from California to D.C. for our wedding. We paid for a wedding package with a local company called Pop Wed and also booked a few hours in a gorgeous yoga studio to have the small ceremony and take some of the pictures. It was an intimate ceremony with my D.C local grandparents as witnesses. Afterwards we took photos around DuPont Circle and had lunch with the grandparents. Then we drove to Virginia Beach for our honeymoon. The wedding package was $3200, upgraded venue was $500 and there were assorted Amazon purchases for wedding venue decorations and wedding clothes, the car rental, flights, meals, makeup artist for my wife, etc. Total wedding cost was under $5000.

Wow. That is a super cheap wedding (In a good way). It seem’s like you definitely got your money worth.

I know so many people who spend a minimum of $15k+ just for their venue. Then when its all said and done are easy in for $30k+. I think you did it the right way. Very reasonable price, great location, and surrounded by family and friends.

Couple of years ago I was traveling in Chile with a friend and we ended up in Easter Island, there is a beautiful beach there named Anakena. We swam in the ocean, relaxed and then went and sat down on a bench close to the beach to kill some time before our taxi shows up. All of a sudden of small group of people showed up and turned out that it was a wedding party. It was the smallest and simplest and most fun wedding that I have ever been to, without even being invited to. There were even couple of chickens running around. Everybody was happy and relaxed and having a good time. We enjoyed it a lot too, I have been to many ritzy weddings in my life. One of them in Ritz Carlton and another Fairmont in SF. But this one by far sticks out the most in my mind, reminded me of your wedding..

Ours cost about $3000 including cost of wedding rings (gold and platinum). No engagement ring. That was in 2008. My mother and brother flew from the other side of the world. I’m not including their costs.

$50 for a judge to marry us at the courthouse. $600 for ring from Craigslist. $1200 for honeymoon (cruise), which includes gas to get to port and one night in a hotel.

We don’t think of ourselves as cheap, but did not see the point in having a large party for everybody else. So worth it.

Wow, $2,745? My wife and I thought we were frugal but now feel embarrassed in light of the other comments. We are Italian and live in a HCOL coastal city. We spent $25,000 all in with 115 guests not long ago with the honeymoon. This doesn’t include by wife’s rings, which were $15,000. We broke even with gifts. In our community, our wedding was by far the least extravagant of our friends and family. We are both high earning professionals so we were even bigger outliers compared to our colleagues. Most people we know got family help and spent $75,000 to $110,000. One friend spent $75,000 on his honeymoon and $40,000 on the engagement ring.

Hitching Expenses

May ’16: Cambridge, MA City Hall + Cake + Dinner for 7 guests = U$D1000. Another grand for new suit & dress (incl. tailoring), wedbands, those flower things for couple and mothers. Went heirloom route with engagement ring. ($2000)

May ’17: Negril, Jamaica

Same wife ;-) This was the “wedding” w/ 75guests at boutique resort takeover on the picturesque cliffs. Avoided the beach gawkers for main event but had Welcome Dinner on the beach. Flights to and from BOS, comp’ed 3night stay, ceremony food and beverages plus gratuity, Rev, DJ, photographer friend. Flowers aside, we in-sourced A LOT of decorations (candles, vases, place mats, small signage etc) and paid like 200 in baggage fees. Not breaking “unapproved vendor” rules when it’s your our sh*t. Rounded up figure of 12000

That’s 14K all in. Our budget for city hall + wedding was 15K. Folks were too busy wowing the setting that we lucked out on them not drinking as much…phew! They probably thought we paid 51K. Burned points for two night stay at chain resort to decompress before returning stateside.

Honeymoon: well, thyphoon wrecked our 2wk Vietnam travel plans but insurance covered us and had time to back out. Wildfires struck our Napa/Sonoma backup as we were ready to book :-( Either of those would’ve been 3K. We actually ending up moving South after the wedding and “settled” on heading down the road to Charleston and Savannah on a 5day self indulgence trip ($2000).

Not even “destination” weddings need to be that much. Both were equally goose bumpy exciting but the city hall version was intimate and sufficently perfect. Invest in your partner save on your wedding :-)

I agree that you don’t have to spend $80k on a wedding today. We celebrated our 25-year anniversary this year and didn’t spend nearly as much (inflation-adjusted we spent about half that). However, we clearly spent far more than your $2,700, and don’t regret it. I have a big family, and most of us live very closely together. The wedding was a family celebration, and as much about parents, grandparents, close friends, etc, as it was about us as a couple. We had over 100 people there and knew everyone there, and it will be the only time everyone can get together like that — some people have passed away, or as other family members get married, the exact make-up of the crowd changes. So by all means be judicious about your spend but don’t cut the guest list too much just to save a bit.

Timely post- my son just got engaged. They are in their 30s but have decided on a somewhat traditional higher end wedding in a HCOL city. I’m guessing that all in including dress, venue, music, flowers and photography and invitations etc will be about $80,000 for about 100 guests. They have a good income and have waited years to meet the right person. So they will pay for most of it but we will contribute a decent amount also.

~$1000 for my wedding in my backyard. I bought and cooked three whole briskets and a couple of coolers of alcohol. We did potluck where the guests were asked to bring a dish of their choice instead of a present. I happened to play ultimate frisbee with the Humanist Chaplain at Harvard. The wife wore a Patagonia sundress that she already owned and still wears 10 years on. The DJ was someone’s iPod on shuffle. Our scheduled time for the “ceremony” was whenever we felt like it during the party. Our “invites” were just an email sent via gmail. Not only was it cheap, it was almost stress free as there was no concern about the band, who sat next to each other, the food, booking the venue, selecting outfits, or whatever.

It has been fun over the last 10 years having friends and family do something similar after they saw that it was okay to not go into debt to get married.

Our $10k wedding was scheduled for Saturday, 9/15/01, but due to travel disruptions related to 9/11 we had to cancel the wedding. Instead, a family friend married us in a Zoroastrian ceremony (in Sanskrit) near the water feature of my brother’s townhouse complex in front of a dozen friends and family. Someone purchased a premade cake at the local grocery store and we celebrated at a local Italian restaurant. Probably $1100 in total, including $550 in lost deposits.

My wife and I have been married for 20 years. We spent less than $5,000 on the wedding and neither of us had debt. At the time, we were both young and just starting out in this world. We save and continued that practice even today. We could retire at 43 if we wanted. Two homes, no debt, and good income. As someone who works in finance, I see people spend 100,00 or more on wedding – and yes, a few of those don’t last. I always wonder what could have been made with those funds. Yeah, you only live once, but if we used that excuse for everything, we would never have any money.

Spend if you can afford it, but still spend it wisely. My wife and I met and married later in life, and we spent around the US average, but it was still ~2% of our retirement savings.

We think we got good value for our ~$35k – we had a 5 day house party for 50 family and friends, and that included accommodation for almost everyone.

We rented a big house with 20 bedrooms for almost everyone to stay onsite, we mostly self-catered and everyone chipped in with the cooking and clean up (except the wedding day itself when we had caterers), we called in favours to borrow lighting and props to decorate, we had 3 wedding “cakes” none of which cost more than $100 and doubled as evening nibbles saving on catering, we made our own invitations, we made table decorations rather than spend thousands on flowers.

You can spend an infinite amount of money on pointless nonsense for weddings, and any time you mention the “w” word the price immediately triples. With a lot of suppliers we told them it was a “family party”…

We got time to hang out with our closest friends, time to chat, reminisce, have fun and relax. The wedding day itself was a whirlwind but we were so happy to have the extra time.

You need a partner on board to depart from the norm – no bridezillas or groomzillas! – but perhaps wedding planning is a good test for how you will work together in marriage.

Yessss!!! I swear at least half of your posts are totally relevant to my life, Sam — and especially this one! My fiancee and I are currently planning a budget destination wedding at a medieval castle in France (which we got for a whole week for less than half the price of a coastal California venue for a day!). Our goal is to keep the whole thing under $10,000, but we’ve recently been experiencing the dreaded “wedding creep” phenomenon (i.e., an expanding guest list) due mostly to the fact that my fiancée’s parents really wanted us to invite her extended family. But we’re cutting back on lots of things that most people spend money on but we don’t care about (flowers, live band, cake, etc.) and trying to be really innovative by doing things like making our own rehearsal dinner instead of having it catered.

So inspiring that you did yours for under $3000. At this point it looks like we’ll probably come in just over the $10,000 budget, but still totally on budget based on your 1% rule! And you’d be super-proud of our honeymoon budget — a three-week self-guided adventure hiking tour through the Alps and Dolomites, ending in Venice, that should cost less than $2000!

Sam – when I initially read just the title of your post, I took it to mean budget the cost of your wedding. I immediately started nodding my head up and down. Of course you should budget for the wedding expense.

Obviously how much to spend on a wedding is a personal choice but I am not a big fan of a budget (very inexpensive) wedding. I think people need to be reasonable with their wedding spend but if it’s once in a lifetime for a majority of people, I believe it is okay to spend.

Now the question is how much?

You wisely recommended the purchase price of a car should not be more than 10% of annual income. I would place the wedding spend above a car in importance.

So let’s say cap the total out of pocket wedding spend at 25% (3 months’ salary) of annual net cash income. Add in any monetary wedding gifts expected to be received and you have your total budget for the wedding (excluding engagement ring).

What are the reasons why you think it’s more important to spend money on a wedding versus a car?

Italian families do it up big. Mine was 40k+, maybe 50k.

$165 per plate x 150 people.

Limo

Tux

DJ

Photographer.

Church payment

Parents chipped in maybe 10k and broke even or came up a little.

It was worth it, had all relatives and friends on both sides. You only live once…

If you have the ways and the means, go and spend for whatever makes you happy. The money you can find, the memories and experiences are the only ones you can take in your death bed.

Life is short. Never live in excess. Share your blessings.

When someone you love writes the homily of your life someday, they are more apt to remember your attitude, character, creativity and spirit of generosity. Not what how much wealth you have accumulated. In the end there is little room in a coffin or the urn except us.

How fun to have a stress free beach wedding! Impressive budget too! One of my best friends had a six-figure wedding. It was insane – I never knew people actually hired lighting crews for weddings before hers. I think her parents contributed a lot towards the cost and she really wanted a fancy wedding, and is still happily married, so things worked out well for her. I would have never paid even a fraction of that cost, but it was a lot of fun to attend as a guest and things went really well except for one guest who couldn’t hold her liquor.

Camellia or Million BBQ? : )

I’m not positive of the wedding costs because as some others have mentioned, my wife’s father paid for a lot of it. But I believe it would have been pretty close to $17K in today’s dollars.

The overwhelming bulk of the cost was due to having a relatively large guest list at ~ 250 and the associated cost for that many people at a country-club type dinner reception and party thereafter. I would have been happier with a total list of maybe 40 family and close friends and was a bit dismayed at her parents for inviting so many people my wife barely knew, but as long as they were footing the bill and it made them happy, and my wife didn’t mind, so be it.

I paid maybe $600 for engagement ring and wedding bands. She picked them out and the engagement ring was what suited her tastes – an anniversary band with the diamonds inset around the band. She was active in basketball and volleyball and the thought of a big solitaire standing up was a non-starter for her.

Our honeymoon cost $1000 (today’s dollar) including meals and entertainment for a week spent in a state park lodge, hiking and canoeing and a bit of shopping/dining in the nearest town.

This is our wedding cost from 23 years ago.

Venue $600.

Priest $300

Food and drink (Safeway Food Platters, Keg Beer, and cheap wine) $1200

Cake $200

Photographer $400 ( this was a waste, the disposable camera pictures were way better)

Flowers $200 (Safeway again)

Dress $350

Tux Rental $95

DJ $350

Honeymoon $1500 ( Oregon coast )

Total wedding and honeymoon $5195

My wife and I really wanted to elope to Vegas, We had already dated 7 years and felt the wedding was more of a formality. The family pressure got to us so we had a traditional wedding instead.

We ended up receiving a little over $10,000 in gifts from family and friends. (Very Generous)

I took the 5k extra and bought a stock called National Auto Credit(NAKD) It ended up going out of business and we lost it all. In hindsight probably the best thing to happen to us since it pushed me to Index funds before index funds were in vogue