If you want to start your marriage right, then following these wedding spending rules so you don't end up broke and alone.

Given roughly half of marriages eventually end in a divorce and wedding ceremonies last for at most 12 hours in America, it's wise to spend as little as possible on a wedding just in case things don't work out.

If you're still in love and much wealthier after 10 years, you can then spend more lavishly on a wedding party. This is when you can renew your vows, invite your closest relatives and friends, and have a good time without feeling as much financial stress.

Despite such pure logic, the average cost of a wedding in America in 2020 was $19,000 according to The Knot's 2020 Wedding Survey. In 2021, the average cost of a wedding is running closer to $22,500, similar to pre-pandemic levels as people begin to gather again.

However, if you live in Manhattan, the average spend is closer to $77,000. In comparison, San Francisco weddings cost about $40,000 on average. Clearly, the costs of a wedding are even higher in 2025.

With the median household income in America at around $70,000 according to the latest US Census Bureau, spending $22,500 for a wedding is egregious. After paying taxes on a median $70,000 household income, the average couple is spending about 40% of their after-tax annual income on a wedding.

Why Couples Spend So Much On A Wedding

Here are some random responses I've received from couples who have spent $22,500 or more on their weddings:

“I wanted a night we'd never forget.”

“The wedding is more for our family than it is for us. We both have huge extended families that must all be invited.”

“Everything from the venue to the flowers cost so much nowadays. It's hard to spend less.”

“I already spent $18,000 on a ring. What's another $50,000 spread among 200 people?”

“I didn't want to spend $200,000 on the wedding, my wife did. I hate weddings and would rather have just gone to City Hall for a couple hundred bucks. It's all curated and fake for thirsty Instagram users.”

The problem is, a wedding only lasts a day. The opportunity cost of not investing the money in your new future cost result in hundreds of thousands of dollars in lost wealth.

New Wedding Spending Rules To Follow

Given I came up with engagement buying rules thousands of love birds have followed since 2010, it's only appropriate I come up with wedding spending rules for financial freedom.

Controlling wedding costs is arguably much more important than overspending on an engagement ring. At least with the engagement ring, it can be reused (aghast!), resold or passed down. Once your wedding is over, the money is gone forever. All that's left are pictures, videos, and hopefully wonderful memories.

Marriage is a leap of faith. Nobody goes into a marriage thinking they will breakup. But divorces happen all the time, even after having children. Therefore, let me provide you some wedding spending rules that will give you a 70% or greater chance of marriage success.

If you follow one of these wedding spending rules, I believe your marriage will last longer and you'll have more wealth than the average American who does not follow any of these rules.

And if for some reason your marriage ends before the average duration (eight years), or you end up having a lower household net worth for your age than the average, then you can simply blame each other for all your mistakes!

Here are my top wedding spending rules to follow.

Wedding Spending Rule #1 Spend no more than 10% of your newly combined household income.

If he makes $60,000 and she makes $80,000, then they should spend no more than $14,000 on a wedding. If their newly combined household income is $1,000,000, then they can ball out on a $100,000 wedding.

In other words, to spend the average $22,500 on a wedding in America, a couple should earn at least $225,000. For the median household income of $68,000, consider spending up to $6,800 for a wedding instead.

$6,800 might not sound like a lot. But it forces you to think about a more frugal venue and invite only the people that matter the most to you.

My wife and I had a $3,000 wedding on the beach with 16 guests. The beach was free. $3,000 included two roundtrip tickets to Honolulu from San Francisco and a Korean BBQ for 16 guests at our favorite restaurant.

Spending no more than 10% of your newly combined household income on a wedding is the easiest and most practical wedding spending rule to follow.

Wedding Spending Rule #2: Spend no more than 2% of the value of your combined pre-tax retirement plans.

Let's say at age 30, she has a Financial Samurai-recommended $150,000 in her 401(k). At 35, he has a Financial Samurai-recommended $300,000 in his 401(k); this couple can spend up to $9,000 on a wedding.

By drawing the couple's attention to their retirement savings plans, there will be a natural tendency to spend less given spending more means a later retirement. The more you hate your job, the less you will end up spending on a wedding as a result.

For more: Recommended 401(k) Savings By Age

Wedding Spending Rule #3: Spend no more than 50% of your combined side-hustle gross income.

Post-pandemic, the act of side hustling for more income has boomed. No longer are as many people solely relying on their day job income given how precarious things are. Instead, more people are taking on side jobs teaching, consulting, blogging, and starting online businesses to diversify their income streams.

Here are 20 side hustles you can do right now.

Spending no more than 50% of your combined side-hustle gross income is my favorite modern-day wedding spending rule. Let's say the couple has a combined W2 gross income of $120,000. In addition, they also makes $24,000 selling t-shirts and trinkets from their Etsy store. The couple can now spend up to $12,000 on their wedding.

The couple probably won't spend so much given how much sweat they had to put into their side business. But they will feel good knowing that they've bolstered their income sources and can if they want to.

Related: How To Build A Profitable Online Website

Wedding Spending Rule #4: Spend no more than 10% of your annual passive income.

Side-hustle income requires work. Passive income, on the other hand, requires little-to-no work at all once the investments are made. This is why everybody needs to focus on building their after-tax investment accounts for financial independence.

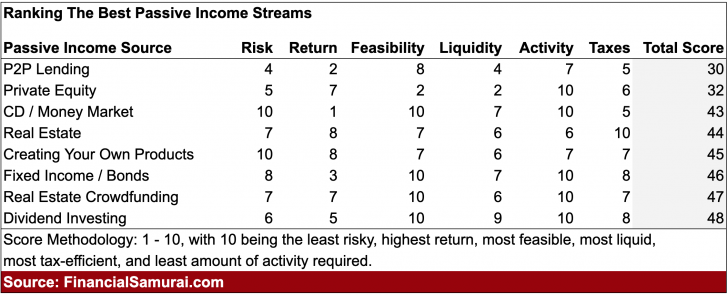

If the couple happens to save and invest aggressively for eight years to generate $30,000 in annual passive income, they're free to spend $3,000 on a wedding. Below is a table that ranks the best passive income streams. I've spent the last 10 years carefully analyzing these passive income investments as the world changes.

As a reality check, to spend $22,500 on the average American wedding, a couple would need to earn $225,000 in annual passive income. To earn $225,000 in annual passive income would require $5,625,000 in invested capital generating 4% returns or a 4% dividend.

In other words, the average American is spending way too much on a wedding based on the average American's investment amounts.

The key to retiring early or achieving financial independence is generating enough passive investment income to cover your desired living expenses. Therefore, I love this wedding spending rule because it focuses a couple's attention on investing for their future.

Wedding Spending Rule #5: Spend no more than $1,000 per year you've known each other.

If you guys started dating in college at 21 and decide to get married seven years later, you guys can spend up to $7,000 on a wedding. If you guys started off as work place friends at age 25, married other people, got divorced, and decided 20 years later you were always meant to be together, then spending up to $20,000 is probably OK. At 45, your wealth should be much greater than the typical newly wed.

When you've already gone through the ringer once, you presumably have a better idea of what you want with your superior earnings power in your early-40s. By then, you probably won't want to spend $20,000 because you have less people to impress.

Wedding Spending Rule #6: Spend as much as your respective parents want to spend.

If a couple is lucky enough to have wealthy parents who love them so much to cover all the costs of their wedding, then they should go right ahead and accept their generosity. However, every time generosity is accepted, there might be a mental debt overhang that will way on the couples.

If the parents who are paying for the wedding are not wealthy, then the newly weds might have to support the parents more later in the future.

I've always taken the view that as adult children, we should actively try to give back to our parents, not take from our parents. After all, they spent 18+ years taking care of us.

As a father of two young children, I'm exhausted every day. Of course, all I want are for my children to be happy. And if my children can find their life partners before I pass, I will be able to die a happier man. However, I hope he is financially independent enough to pay for the wedding he and his partner wants.

I'll happily pay for any auxiliary expenses. However, I hope he and his partner have the maturity and financial acumen to spend responsibly on their one-day event.

Save Your Marriage By Spending Appropriately

You're obviously free to spend more money on your marriage if you want to, especially if you're rich. But spending $22,500 for a wedding is truly a ridiculous amount for the average American household who only earns about $68,000 a year.

The key to a great wedding is having the people you care about most there to celebrate your special day. If your guests really care about you, you won't have to spend lavishly on a wedding. Further, the more you spend on a wedding, the more your guests will feel responsible spending more on you at the registry.

Getting married is a leap of faith. Therefore, it's wiser to start small and work your way up. You can always throw a lavish parter years later when you're much wealthier and no for sure you'll be together for the rest of your lives.

One of my friend's brothers got married and spend $160,000 on a wedding. My wife and I attended. It was a wonderful wedding with endless shrimp cocktail and lobster. Unfortunately, the couple divorced just three years later. The groom later said that marrying her was the biggest mistake of his life.

Then my own friend, who is also a doctor, got married. He spent about $140,000 on the wedding. Despite having a beautiful son, they haven't lived together for five years. She wanted to pursue her prestigious ophthalmology job at Wilis Eye Center. He wanted to build his cardiology practice in a different city.

The less you spend on a wedding, the lower your expectations will be. And one of the big secrets to being happy is having low expectations. If you end up spending six-figures on a wedding for 200 guests and it rains, you will be devastated. But if you spend $500 on a beach wedding and it rains, you may feel incredible joy.

Follow One Of My Wedding Spending Rules

If you follow at least one of my wedding spending rules, you’ll be able to get your marriage off to a great financial start.

Not only can you use the money saved to buy a house, pay your life insurance annual premium for the year, make your future child a 529 millionaire, or bolster up your respective retirement accounts. With a stronger finances, you’ll likely have much less money fights because you’ll have more of it.

As I review my wedding spending rules, my favorite is #2. Spend no more than 1% of your combined pre-tax retirement accounts on a wedding. Financial independence starts with saving, and the easiest thing everyone can do is max out their 401(k) and IRA.

Based on this rule, the average responsible American couple should spend between $2,000 – $5,000 on their wedding, not $22,500+.

What makes a great wedding is the presence of your friends and family. You don't have to spend a small fortune trying to impress them because all they want to do is celebrate you.

Invest Your Wedding Savings Instead

Instead of spending tens of thousands or even hundreds of thousands of dollars on a wedding, save and invest the money instead. You can invest in the S&P 500 index, private real estate funds, or my current favorite, private AI companies with tremendous future upside.

Consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Fundrise venture capital product, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 60% of the Fundrise venture product is invests in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Recommendation To Build Wealth

Sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool. It will show you exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible. Monte Carlo simulation algorithms are used to help see your future.

I’ve been using Empower since 2012. Since then, I have seen my net worth skyrocket during this time.

Related: The Average Net Worth For The Above Average Married Couple

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. Everything is written based off firsthand experience.

These rules suck and are so confusing. We make 200k combined and think 23k wedding is OK, a little lavish but I’m a hopeless romantic and Indian so I want my dream garden wedding

Rules generally suck if you aren’t following them or how to change to follow them. Feel free to spend as much money as you want on a wedding.

I like your tip to only spend 1% of your combined household income on a wedding. My daughter was just proposed to and now we need to start planning the wedding. However, they don’t have a large budget. I bet they could utilize this tip but they may also consider taking out a wedding loan.

How much did you spend on your wedding?

$2,800 including flights and reception. Only 13 people attended. Nice beach wedding.

You?

ROTFL. Someone should send this post to our little corner of heaven called Goa. Here most people will end up spending 2 or 3 years income on a wedding. Some even have to go into debt to be able to putt it off. All to keep their social status. I hope more people start seeing the sense in cutting down on the expenses.

As always an enjoyable read

It’s never made sense to me that some couples spend 10’s of percent of their annual income on a one day event. I’ve always thought that this money would be better spend on a house deposit, or something so that the couple could start their life together.

My wife and I got married in 2010 when the economy was still in the toilet. We had no money and I refused to spend what little we had on a wedding. Instead we got married on vacation that we already had planned in the Caribbean, put the cash down on a foreclosed home and remodeled it extensively. Best decision we made. We are into it for about $250k it’s worth 400k and we owe on it $95k! It’s funny some couples we know said things to the effect that they felt “sorry” for us for not having a wedding, but the sweetest things… those couples’ marriages are on the rocks now and one is already divorced!

I told a planner I didn’t want to spend any more than 20k and she basically blew me off with a ‘good luck with that’

I’m leaning more towards a very intimate wedding. Would rather spend money towards a house versus a wedding.

I love these because they are true and they really get people annoyed. Have you seen how much money people spend on toddlers birthday parties? If you’re spending 2k on your 2 year olds birthday party to have designer cake pops and professional photography when you make 45k after taxes, then 30k on a wedding almost sounds reasonable.

Lets talk about the normalization of having these weddings where they expect all of their friends to travel to the wedding and beforehand to multiple wedding events. The cost of which is several thousand dollars. LOLOLOL

At age 30 my husband and I got married at the courthouse. We went on a medium extravagant honeymoon that my parents paid for. At the time our combined income was about 180k and our net worth was around 500k. We are happily married 5 years later.

I think the hard thing about weddings is that they’re not just a financial decision. One of the main functions of a wedding is to communicate something about the marriage.

Weddings can have other purposes, (making memories, bringing people together, creating beauty, etc.) but they will always inherently communicate something about your values, both to each other and to your guests, and it’s good to think about what your decisions say about marriage. In a sense this is true about all financial decisions (they reflect your priorities and values, and they communicate something about what kind of person you are). But as a public celebration, weddings are especially heavy on communication.

Frugal weddings:

– Can be done for positive reasons and communicate positive things, like “I care about planning for your long-term well-being”, and “what matters is our commitment to each other, not how conspicuously we display our love”, and “we trust our guests to recognize that we care about them by including them in our special day, and that we don’t need michelin-start dining to prove that we care”.

– Can be done for negative reasons and communicate negative things, like “This marriage isn’t important enough for me to spend my hard-earned money on”, or “we’ll probably end up divorced anyway, so better not go overboard”, or “we’re too miserly to spend money on our guests”.

Extravagant weddings:

– Can be done for positive reasons and communicate positive things, like “Marriage is a significant and joyful event, worthy of great celebration”, and “this is a once-in-a-lifetime celebration” and “we want our guests to share in our joy here, have a delicious, extravagant, celebratory feast”

– Can be done for negative reasons and communicate negative things, like “we need to show how successful we are”, or “I care more about pleasing all these guests/family than about your future financial security”, or “we want to ‘honor’ all these people with invitations and extravagant gifts so they’ll feel like they owe us something” or even just “we didn’t put a lot of thought into this and just let the wedding industry push us around”.

The size of the wedding also communicates something, and this has cultural and religious ties. Small / destination/ courthouse / elopement weddings say something about how the marriage is mostly about the couple (and perhaps their closest friends or family). Bigger weddings can communicate that marriage is more of a community event, that it’s a bringing together of families, and that it’s the responsibility of this community to help uphold this union. Different couples are going to end up in different places with regards to those perspectives on marriage.

Then there are the tricky, external pressures with their own internal positives and negatives, like:

– Parents/in-laws – How much say do they get? If they’re paying, they probably get more say. To what degree do you defend your wedding as part of your marriage – something where you and your spouse are in control, and parents need to realize that there are boundaries and a new family unit? To what degree do you concede to their desires to express their love and care for you (maybe in not the ways you would have chosen) and to affirm the extended family relationships?

– Finances. Even if you really want to have a big expensive wedding and have positive reasons for it, maybe it’s just not feasible. Then you have to think about what compromises can be made while upholding the valid and positive things you wanted to achieve with a big wedding.

And of course there aren’t necessarily hard lines here, people can have lots of motivations for their decisions. Also, there are always going to be people you can’t please – you can decide to have a frugal wedding for good reasons and still have some guests who get all offended and think you’re cheap, and that’s okay. I just think it’s important to think about why you’re making the decisions you are, how to prioritize between the messages you’re sending and who you’re sending them to (especially when they come into conflict with each other). And I totally agree that people should take a hard look at what the wedding industry is trying to sell them and not just go with the ever-more-expensive flow.

We had a long discussion about whether to have a frugal wedding stating that there are other, more important things than throwing a big party that only lasts for a day, or to have a big party saying marriage is an important and significant event worthy of great celebration. We came down on the side of spending more (~$20k), because we wanted to communicate the significance, and to involve our community (friends/family/church) in our marriage. Parents kicked in ~$15k and that definitely played into our decision. They wanted to have a traditional wedding (so by going along with that we affirmed their desire to give us this gift). If we did it on our own dime at the time (age 22, fresh out of college), it would have definitely been more frugal! We probably would have still tried to invite as many of the same people as possible because we wanted to involve our community, but would have gone for cheaper food and held it at a park or something. If we did it now (age 29, ~170k combined income), we’d probably do something similar to our actual wedding (~20k), though we’d probably cover more of it ourselves. We’d still accept something from our parents because we want to affirm that relationship (and our parents aren’t too pushy, so we don’t feel a need to draw a line), but we’d try to split it so that we paid for more, maybe we do 15k and they do 5, and encourage them to save the money for retirement or for my sisters :).

By Sam’s rules we should have spent:

1) $300

2) $0

3) $0

4) $5 – wooh! sub 1% interest rates on savings accounts – with this RingPop, I thee wed… :)

5) $4000

Thanks for sharing! If your parents can afford to pay for most of it, then more power to you guys, seriously.

Both my parents and my parents in law are not wealthy, therefore, I didn’t want to burden them with our wedding. When I graduated from college, I was already anxiously trying to pay them back for the $40,000 they spent on me those for years. There was no way I could ask them to pay for our wedding. I felt too bad.

Sam, you could write about how much a couple should spend on their honeymoon. That would be interesting.

100% this

Ok, will put it in the queue.

I dug around a little and saw someone say the median was $15,000 which is better than $33,000 but still much more than the rules allow. So, 50% of weddings in the US cost less than $15,000.

My wife’s parents paid for our modest wedding. They called in favors for a cake and food. We did the decor ourselves and with family friends. An old friend of my family DJ’d. It was a few thousand dollars, I think. The ring was about $2500 (which seemed ludicrous but was under your car rule). That was 13 years ago.

We spent what we had saved for the wedding on a honeymoon trip.

I would’ve been happy to visit the courthouse instead. It was a great way to start.

Gave it an honest try, but couldn’t do it. I am still planning right now, but as much as I want to keep cost low, it will be in the mid to high 30k range. With large families for both myself and my fiancee, 150 guests is about as low as we can go without offending close friends and family by not extending an invite.

For reception, we looked at backyard style wedding to save on venue cost, but cost for catering, wine and liquor, plus chairs, table, cups, plates and silverware add up fast. At the end, the only option for me to significantly cut cost would be either 1) invite less people, or 2) have a ceremony but no reception. Oh and photographers are not cheap, but that I can justify because photos last forever.

We will likely skip decor, center pieces, flowers, and have a cut rate part time DJ, but that’s like having a diet coke with a supersize meal. Better than nothing, but hardly frugal at this point.

The only SAVING grace for us is our saving. Cash on hand so we are not going into debt for our wedding. Here’s to hoping the market will crash in the next 12-18 months anyhow, so at least I spend the money and get to enjoy, instead of seeing my savings vanish because of a market downturn.

I had the crazy 50k indian wedding! And it was fun!! I specifically chose to have the traditional experience bc it was important to me and my husband. And much of the $ goes to entertaining guests and friends (like we pay for their hotel rooms, all the food for the 3 days, their transportation etc). My parents saved for years and that was their gift to me.

In return, I will spend $ on theeir needs over their old age (gifts, travel, health needs). Thats the tradition and as long as everyone’s happy with it, it works :)

My sister on the other hand was given a deal – my parents offered to pay for the lavish wedding or hand them money – she took the money! Luckily both of us were thrilled with our deals and as late ng as you’re doing things with consciousness and intention instead of getting carried away, spend what you want!

*Raises hand* My husband and I are one of those under-30 couples who spent over $50k on a wedding (including European honeymoon, mostly booked with CC points though). It took us most of our year engagement to save for it but the only regret we have is how much we spent on flowers ($5k) since they went straight to the trash and I had no forethought to arrange donating them. It was the most awesome party/family reunion. We received almost half back in gifts but wasn’t anticipating that. I do think it is important for a couple to be able to pay for their own wedding! If anything I blame wedding-paying parents’ open checkbooks for the increasingly exorbitant cost! It’s like USA healthcare’s third-party payor system but in the wedding industry.

Our wedding cost under 1000 pounds. None of our family cared about a big event. Ceremony was at the town hall, my cousin ran a pub so we had the reception there. Ring s came from the mall, the are just symbols after all.

I think your advice on how much to limit your wedding expenses is a bit too harsh but I like your mindset on drawing the line of how much you should spend on it. Many couples planning out their wedding should high prioritize the financial aspect of their big day and know how much they can spend without going into debt or pay it off a month or two after their wedding. You don’t want this wedding debt to linger in the long term as newlyweds.

Also one thing to point out is the social pressures of spending a huge amount for a wedding. You attend other weddings and/or see them on TV and how extravagant it can be. It puts the bride and/or groom to try and compare it to their own wedding and spend so much because they want to have that same type of wedding. Being able to look through that and face your own realities is what many married couples to-be should try to do.

I live in the NYC area. One of my friends got married on the Bow Bridge in Central Park. That was followed by a dinner in a expensive restaurant for a few people. We had ours in the far suburbs, exurbs, I guess you call them. We still paid too much, and we had one of the cheapest wedding of all the people we know. One friend, whose parents are from India had an American wedding and an Indian style wedding (in America). both were wonderful, but the cost, well, I could not imagine.

This scale of a change in weddings would take a cultural change.

We’ve been married many years and our relationship is getting stronger. We had a civil wedding at a Chicago courthouse and had Chinese food for dinner afterward. Could not remember how much our dinner was but my biggest expense was a $500 engagement and wedding bands.

Sam, the 50% divorce statistic that is wildly popular among people today is VERY misleading. It double counts the data. They count couples who’ve already been divorced. If you adjust for that, it’s actually closer to 33%. 50% of ALL marriages may end up in divorce but only 33% of all first time marriages end up in divorce.

I will gently roll a grenade into the tent of discussion,

How much should one spend on a prenup, expressed as a fraction of the wedding cost?

A prenup is to a marriage as a trust is to a house, it is a private contract that allows private parties to adjudicate their financial disputes, rather than defaulting to the State as an arbiter of “fairness” in the disposition of assets and financial responsibilities.

So if preservation of wealth via frugality is one of the points of this article, one wonders why people skimp out on wealth preservers like prenups and splurge on depreciating assets like rings, rocks, and fancy dresses.

I’ve been married for 38 years and think my wedding back then must have been about $15,000. We were both still in graduate school and both sets of parents chipped in. Both could afford to spend on the wedding and even 38 years later I look at the photos and am happy we were able to have a nice wedding. We too got cash as gifts that probably almost paid for the wedding.

One other thought – if you are asking people to come from far away, and they need to spend for a hotel room and transportation to get to the wedding , you better plan on at least feeding them something more than a hamburger or crummy sandwich !

Having your respective parents pay for the wedding and receiving cash gifts is a double win! Congrats.

I’m curious to see data comparing the percent of total income spent on weddings to occurrences of divorce to see if there was a positive correlation. If there is a strong correlation vs just being two independent variables, then off to the courthouse we go!!!

I’m one of your Midwest readers and honestly I can’t see spending the 1% rule around here and I’ve been to wedding where hot dogs were an option. Mainly because a wedding is in celebration for the couple with their friends and family. You are not going to have a 20 person wedding you are going to have a 200 person wedding if you include “normal family” such as Aunt/Uncles and cousins. I ran a quick calculation assuming about 200 people with Hot Dogs and Hamburgers as the main course on food and such alone I’m at $475. (Hot dogs and Buns, Soda, Cups/Plates, Condiments, Chips/dip, Salad, vegetable tray, Fruit Tray, Cake). If you thrown in a new dress and new outfit for the couple you are likely over your $600 average already. Now say you are going to get fancy and Borrow your Uncle’s pig roaster, a whole hog is about $300 right now half of your budget. Add in Bud light 100 cans is going to be another $100. Don’t have a backyard, have it at a local park. Renting the Open shelter at my local county park, that is 1/4 of your budget at $150 so serving both hotdogs and hamburgers now puts you over the $600 budget.

I do think that $33,000 is too much. But I see a good budget for a low cost wedding needing to be $2000-3000 at least. Again assuming you actually want to celebrate with your friends and family.

Good thing there are 4 other wedding spending rules to follow!

Seems like a lot of folks are focused on the 1% rule, which makes sense since it is first.

But if a couple have known each other for 5 years before getting married, then $5,000 should cover the cost.

Wow so I usually am in line with most of the guides you post, but we went way over on our wedding due to our in-laws! We had 215 people at our wedding 3 years ago and the total cost was ~$75k with 95% paid for by the in-laws. Probably spent another $10k on a honeymoon in the Amalfi Coast and I flew us first class via credit card rewards. Wouldn’t change a thing but completely recognize the fact that getting married for us was a net positive financial event.

Now that we have a 7 month old daughter we are spending more money than ever before. It’s amazing having a kid but my life got significantly more expensive. We just bought a house and went from a small city condo to a 3k sq ft place in the burbs. Thankfully the net price difference was under $100k although we spent $75k on furniture & renovations. We’ll both likely need new cars within the next year or so.

PS You’ve written multiple times about your GS experiences but you were always vague about your precious role before retirement. I believe you said your severance is now complete with them? If so any future posts detailing your last few years moving up the corporate ladder?

Well done getting your in-laws to pay for 95% of the wedding! $75,000 is a lot of money. How did you convince them to do it and did your parents not want to help?

Agreed it was excessive but my in-laws were set on a big event for their only daughter, so I wasn’t going to complain! My parents threw a big rehearsal dinner but aren’t within the same means as my wife’s parents. Made for two unbelievable nights but if it were on my dime it would have been a much more low key event!

Here’s the next question: did your in-laws buy you guys a house too?

Seems to be a common progression for many folks.

The realtor in SF said 70%+ of her first time homebuying clients had homes paid for by a set of parents.

Haha, the house was all on us although we did get some small housewarming gifts from both of our parents. I’ve been fortunate enough to have a successful career so far so we want our parents to enjoy themselves and retirement.

Now that you’ve had a couple questions, are we going to get a little more of a “tell all” of your last few years at your employer? Sure it’d be very interesting to many of your younger readers that are trying to move up the ladder.

Cool. I think I told all in my severance negotiation book actually.

There’s not much to tell, just that I was able to escape with a severance, and I had an unceremonious departure because they prevented me from going into the office that last Friday b/c they thought I sent in sensitive client data to my personal email address. Check out: How One Email Almost Ruined My Severance