CIT Bank is consistently an online and with the highest savings interest rate. The reason why is because CIT Bank has no expensive retail chains or large overhead. As a result, savers like you and I can take advantage.

See CIT's highest savings rates in seconds here. It'll surprise you!

Due to policies by the Federal Reserve, savings account interest rates were woefully light for years. The average saving interest rate was stuck around 0.1% and wouldn't budge. That was pretty pathetic.

However, the Fed finally started raising rates again in 2022. Savings account interest rates and CD rates followed suit and became attractive again in 2023. As of mid-2025, rates remain appealing for those looking to earn interest on their cash balances or reduce exposure to the stock market.

Highest Savings Interest Rate Account Benefits

What are some of the main benefits of having a savings account with a high interest rate? They include:

- Security

- Liquidity

- Easy access to funds

- Capital preservation

- Earning passive income

- Overdraft protection for a linked checking account

- FDIC Insurance up to $250,000

- Automatic bill pay

Keep in mind, the purpose of a savings account is not for investment purposes. The purpose of a savings account is for liquidity and capital preservation purposes. Thus, it's inappropriate to compare a savings interest rate return to a stock, bond, structured note, or even a CD.

The appropriate comparison to a savings account is another savings account or a checking account.

Many years ago, I had about $80,000 in a Citibank savings account that was only yielding 0.2%. I kept it there because I had property taxes to pay, trips to take, and wanted a cash reserve just in case the stock markets got very ugly so I could invest. The problem was, I hate it when my money isn't working for me.

It hit me how pathetic my 0.2% savings interest rate was after I noticed just a $197 interest return for the entire year with an average balance of $100,000. As a result, I moved my money to CIT Bank and started earning significantly more interest! They are my go-to bank for high-yield CDs and savings accounts. CIT has consistently offered the best CDs and highest savings interest rate accounts around.

CIT Bank Savings Account Review

CIT Bank currently offers Platinum Savings accounts with a nationwide top-tier rate on balances $5,000 and up.

In addition, CIT also has Savings Connect accounts with high-yield interest rates and no minimum balance, just a $100 minimum initial deposit. If you want a safe place to park your cash, CIT is fantastic for that.

If you have other cash that you want to invest in the markets, be sure to check out my article on growth stocks versus dividend stocks and real estate crowdfunding.

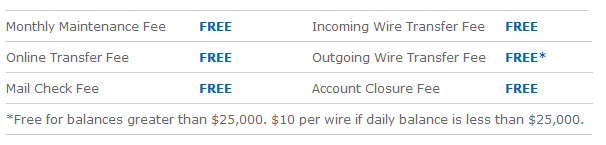

CIT Bank Online Savings Account Fees

A CIT Bank account doesn’t require as many fees due to the lack of overhead given it is an online-only bank. There are no physical branches to maintain, so that savings gets passed down to account holders in the form of fewer fees and higher interest rates. In fact, CIT Bank doesn’t charge any fees at depending on balance.

CIT Bank Highest Savings Account Rates

Even though this account is basically free to maintain, it still offers one of the most competitive interest rates currently available for comparable accounts. CIT Bank consistently has the highest savings interest rate I've seen.

How Do I Transfer Money In And Out Of An Online Savings Account?

One of the things that tends to scare people away from online-only savings accounts is the fact that there’s no physical branch to visit. They wonder how it’s possible to make deposits without putting a check in the mail. Or fear that withdrawing money when it’s urgently needed will take too long.

While some online savings accounts are definitely less than convenient, CIT Bank savings accounts make transferring money very easy, fast, and secure.

By linking an existing checking account to the CIT Bank savings account, you can electronically transfer money in and out of the account whenever you want as well. The checking account doesn’t have to be a CIT Bank account either.

After linking the checking account, you can call and request an activation of outbound transfer if needed. I've got accounts open with multiple banks due to the $250,000 FDIC limit, hence access to cash is quite easy.

You also have the option of requesting a check get mailed to your home. Outgoing wire transfers are also available and free for CIT Bank savings accounts with a balance of $25,000 or greater.

I've used CIT Bank for years and have been very pleased with their customer service and offerings. CIT Bank consistently offers the highest savings interest rate accounts today.

Never Stop Optimizing Your Finances

To build wealth, you've got to be persistent in looking for the best deals to earn you more and save you more. The internet makes finding the best rates easy. For example, a 1% difference in interest compounded over 30 years makes a huge difference to the amount of money you'll end up with later.

In the past, I sat on $80,000 cash at 0.2% because I was just too lazy to move money away from my existing bank. Before the internet, it was a pain to move money. Now it just takes several clicks of a button.

The key really is to take stock of all your cash during volatile times and optimize your cash for the best returns possible while you wait.

How To Open An Account With The Highest Savings Interest Rate

If you're ready to start earning more money through a high-yield savings account, now is the time. You can open a Platinum Savings account right now with CIT Bank in minutes to get started.

If you want to learn even more about CIT Bank, check out our extensive CIT Bank Review. Also be sure to read about CIT's high-yield CDs.

They offer many different types of CDs including term CDs and no-penalty 11-month CDs.

Free Financial Tool Recommendation

Track Your Net Worth Easily For Free. In order to optimize your finances, you've first got to track your finances. I recommend signing up for Empower's free financial tools so you can track your net worth, analyze your investment portfolios for excessive fees, and run your financials through their amazing Retirement Planning Calculator.

Those who come up with a financial plan build much greater wealth over the longer term than those who don't!

Related post: How Much Savings Should I Have Accumulated By Age?

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. I help people get rich and live the lifestyles they want.

I use Royal Bank of Missouri online banking. 2.42% (APY) up to $25k, and you get .75% for any balance above that. I have been a customer for years, and have never had any issues. An added bonus is an ATM card that can be used anywhere (they reimburse the fees monthly, up to $25 per month). No fees for transfers in & out (I move money to & from my Fidelity accounts occasionally (1 year return on my roth +36.79%, ytd on my 401k +10.10%). And they’ll even send you a card for your birthday!

Joe, that savings rate sounds too good to be true. I checked online and it’s below 1%. Do you mind sending me a link to that online savings rate?

Thanks!

Here ya go!

Gotcha. So it’s a checking account that is fluid and requires transactions it seems. Not a bad deal for those with less than 25k indeed.

I am open to suggestions on where I should park the excess funds. 75 bps seems decent for money that I want to keep safe & liquid.

thoughts anybody?

To me, it makes no sense to keep large amount like $25K in saving account. I keep about $1K in checking and $5K in saving only. For rest of emergency fund, we use treasury direct to create monthly ladder with I-series bond. After one year the money is available with only 3 mos of interest penalty, and after 5 years without penalty. Even with CIT, the return is paltry compared to US Treasury I-series Bond with better risk profile.

I use ING and Capital One. I understand ING is being taken over by Capital One in the US so I’m not sure if that limits the FDIC cover to what is covered by one bank? Maybe I should look for another just in case?

I’d be shocked if Cap One or ING do not have the same $250,000 FDIC insurance guarantee as CIT Bank.

After the financial crisis, I spread my assets to multiple banks due to the $250,000 cap.

I meant when they were separate they had 250 + 250 coverage, now do they just have 250 combined because they are the same institution. I’m not sure.

I get .80 from my credit union – thus I will not be opening an account.

Right now I have about $50,000 there but I will make a decision about a good portion of that money early next year. I will likely use it to pay down my mortgage.

I also have about $210,000 in I bonds purchased 10 plus years ago that pay 5-8 percent interest.

Gotta love them i bonds!

Maybe in the past before the time of internet. But now, it’s actually counterproductive to keep your liquid money in 0.1% rates when the Internet has allowed us to move money and find great rates with a click of a button. Everybody certainly should be refinancing down their debts no question about it.

Earning $1,005 off of a $100,000 average savings balance might not be worth it toyou, but for me, I enjoy the added income. Making money and saving money is much an attitude as it is about doing it.

Please share what you are doing with your money.

Thx!

When I was at Wells Fargo I believe my interest rate was 0.01%. Don’t quote me, because it was a few years ago that I jumped ship, so I might not be remembering correctly. Now I’m at Ally where I’m getting 0.95%.

I used to use CIT for equipment financing for our customers. I did not know they act a bank now. Online savings has created a very interesting market for online only banks and brick and mortar banks too. I wonder if personal lending and saving may become the specialties of the internet.

For those that don’t have $25k minimum, they can open a Sallie Mae MMA, which has no minimum and offers 1.05%. I recently switched $50k over to them (from DollarSavingsDirect, which is down to 0.70%). Although I would have met the CIT minimum, I didn’t like the idea of CIT dropping the rate if for some reason I had to use part of that emergency fund.

Good to know, although Sallie Mae MMA can drop their rate anytime as well.

The only account that does not change their rates is a CD account and I’m not an advocate of CDs at current rates anymore. New post coming up.

Yes, they can drop their rate. I was referring to the tiered rate based on account balance. With Sallie Mae, you get the same rate whether you have a balance of $10,000 or $50,000.

There’s no way I would lock up money with a CD at these rates. Instead, I have been using Vanguard’s VFIIX for the last 3-4 years. Unfortunately the returns have been going down as people have been refinancing, but it has given me a better return than 5-year CDs without having the time commitment.

Savings account rates are sad now. We save with ING Online Direct and it’s been fine but it’s just insurance for times when we need cash. It does lead me to wonder if there are other places that our money should be.

I always wondered how the no branch thing works. Thanks for explaining that. Makes perfect sense. I think I will always have at least one traditional bank but I like their savings rates way more than what I’m getting now!

Makes me wonder how banks like Chase are going to be able to compete. They have branches about every 1-2 blocks in SF. Their overhead costs must be ginormous!!

Rates do change indeed. A bank can decide to raise their rates if they want more deposits, or lower their rates if they have enough and can’t find anything else to lend/invest in. Inflation, the economy, and all sorts of exogenous variables happen.

This is why I love my RateBrain widget up top to keep track of all rates for me. We need to be vigilant b/c banks have specials all the time. During the Financial Crisis, WAMU was offering 4.5% CD rates… a full 0.5%-0.75% higher than everyone else b/c they desperately needed the money! All is safe for deposits under 250K per person.

CIT and Ally have the best rate right now. I transfer my cash saving to CIT and I’m happy with it so far.

You need to call and request an activation of outbound transfer if you want to withdraw. Linking the accounts is not enough. I found out last week.

Great to know! Have included the detail in the post. Thx.

It takes too long for me to transfer stuff from my online savings account to my checking. For only < 1% yield it's not worth it. For yield I usually just stick to stocks. The Fed is really forcing me to ignore SAs these days.

My current savings account offers just 0.05% interest, which is even more pathetic and lower than the average rate, haha. It’s so low that I don’t even bother checking anymore, and just assume it’s earning me 0% interest. Then again, I only have a few thousand in there serving as my “just in case”/minor-emergency fund.

1.05% sounds like a good deal! $700 for 10 minutes of work? Hard to beat that!

Wow… 0.05% interest sucks. I would be really mad if my bank just gave me that! Ask them if they have different options, like a high interest checking option at the very least. It’s the principle that counts at this point!

Seems like a decent account. I would not advice anyone to hold more than what is covered by FDIC in any bank.

I am getting 1.35% on my savings account (in Canada) with ING with no minimum balance. You may want to check them out. They offer no fee banking as well.

Just checked online and their latest savings rate says 0.75% in the US unfortunately. Canada and US although neighbors, are different countries, have different inflation rates, and regulations etc. If I go to India, I can get a 7% yielding online savings account no problem!