Bill Gates has taken on many roles over the course of his career: affable tech nerd, aloof billionaire, tennis player, visionary philanthropist. Before divorcing, Bill and Melinda Gates added a new title to that list: largest owners of US farmland.

One way to get rich is to observe what rich people do with their money. Therefore, I think you'll enjoy this look into why Bill Gates is buying so much U.S. farmland. If buying farmland is good enough for Bill and Melinda, perhaps buying farmland is good for the rest of us as well.

The following is a post by FarmTogether, a leading farmland real estate investing platforms and Financial Samurai content partner. As someone who appreciates owning real assets, please enjoy.

Bill and Melinda Gates’ Unrivaled Farmland Portfolio

In January 2021, The Land Report broke the news that Bill and Melinda Gates are now the largest private owners of US farmland. The two own 242,000 acres of farmland through their investment manager Cascade Investment LLC. This puts the Gates’ ahead of the second largest owner of farmland, the Offutt family, by over 50,000 acres.

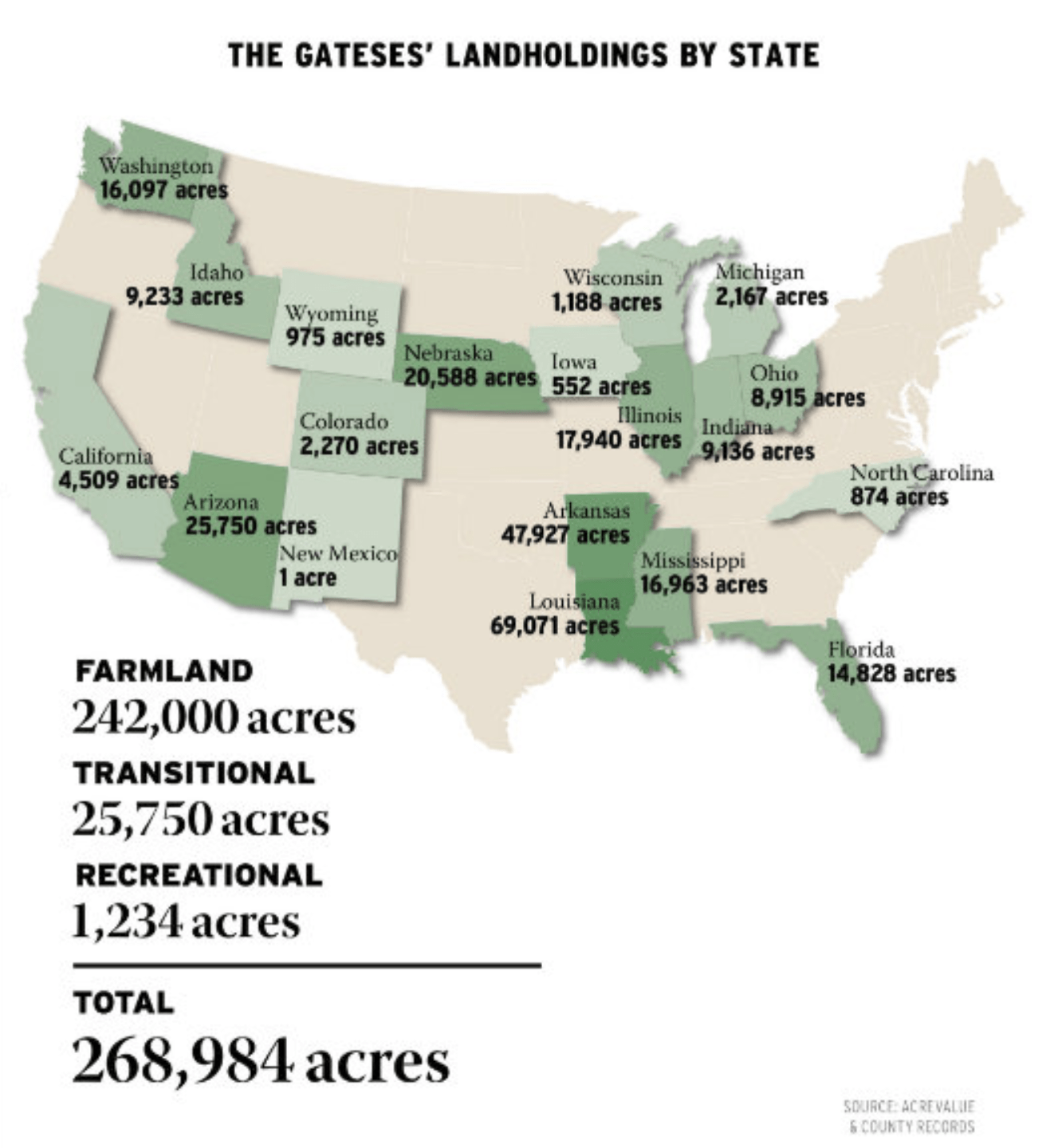

Bill and Melinda Gates own other real estate as well. In addition to farmland, they own 25,750 acres of transitional land and 1,234 acres of recreational land. Their total land holdings equals an astounding 268,984 acres. Of this, the largest holdings are in Louisiana (69,071 acres), Arkansas (47,927 acres) and Arizona (25,750 acres).

Cascade Investment Buying Up Farmland

Cascade Investment, Bill and Melinda Gates' investment arm, has been buying up US farmland for almost a decade. In 2014, according to the Wall Street Journal, the fund owned “at least 100,000 acres of farmland in California, Illinois, Iowa, Louisiana and other states.”

Cascade’s single largest investment was made in 2017. The fund acquired $520 million of farmland assets from the Canadian Pension Plan Investment Board (CPPIB), a major Canadian pension fund. This collection of holdings was previously owned by the Agricultural Company of America (AgCoA). It accounts for the majority of Cascade’s farmland acreage today.

At the time AgCoA was acquired by CPPIB in 2013, it was one of the leading institutional investors in row crop farmland in the United States.

In 2018, Cascade followed this acquisition with the $170 million purchase of around 14,500 acres of prime Washington farmland. The seller was John Hancock Life Insurance, another major institutional investor.

Many in the media speculated that Gates’ purchases may have been part of a wider focus on sustainability in agriculture. The Gates Foundation has been investing in agriculture for over 10 years. Their investments include grantmaking to promote high-yield, sustainable agriculture, and research into the development of climate-resistant crops.

Others note that Cottonwood Ag Management, one of Cascade’s subsidiaries, is a member of Leading Harvest, a non-profit created to promote sustainable agricultural practices.

Why Is Bill Gates Buying Up So Much Farmland?

Thus, many people wonder why would a tech billionaire like Bill Gates be buying up something as seemingly low-tech as farmland? As it happens, farmland has many qualities that make it a good option for investors looking to branch out from traditional publicly traded investments.

Let's look at five investing benefits of farmland.

Farmland Investing Benefit #1: Strong Historical Returns

First and foremost, US farmland offers solid returns. Between 1992 and 2020, farmland offered an average annual return of 11.0%. This compares favorably to an average annual return of 8.0% from the stock market.

The returns from farmland come in two forms. 1) current income from rental and crop payments. And 2) price appreciation from the sale of the underlying asset.

Farmland Investing Benefit #2: Passive Returns

Farmland provides an attractive source of passive income, which allows investors to diversify their income streams.

Second, the price of crop payments fluctuates with the price of commodities. This means farmland functions as an effective hedge against inflation.

Farmland Investing Benefit #3: Diversification

A third benefit of farmland is that it offers excellent diversification. Bill Gates may have made his billions in technology. However, he also understands the importance of investing in multiple uncorrelated asset classes for building and preserving long-term wealth. It is estimated that more than half of Bill Gates' wealth is invested outside of technology.

The performance of farmland is uncorrelated with the performance of other major asset classes. Those include stocks, bonds, commercial real estate, and gold. Shocks that negatively impact the performance of these asset classes often have little or no impact on the performance of farmland.

For example, during the Great Financial Crisis, the maximum decline of the S&P 500 was -46%. In the same time period, the NCREIF farmland index increased by 17%.

Farmland Investing Benefit #4: Low Volatility

Fourth, farmland is an extremely low-volatility asset class. As shown in the chart above, stock market volatility was 17.2% between 1992 and 2020. In contrast, the volatility of US farmland was only 6.9%. This difference of volatility was illustrated during the first few months of the Covid-19 pandemic.

In Q1 2020, the stock market declined by -19.8%, as pandemic lockdowns led to widespread economic curtailment and investor fear. The next quarter, the market rebounded nearly as quickly, delivering returns of 20.0%. In contrast, the impact of Covid on farmland returns was significantly more muted. Farmland returns declined to -0.1% in Q1 2020 and increased to 0.6% in Q2 2020.

Farmland Investing Benefit #5: Sustainability

Fifth, investing in farmland is an opportunity to invest in an asset that benefits the global economy and increases sustainability. According to National Geographic, farms could double or triple their yields by incorporating technology and sustainable farming approaches. As a result, farmland investing is vital in providing food for the planet's anticipated 9 billion people.

Sustainable farming practices also increase the value of the land, which creates a benefit for the planet and investors. However, investing in new technologies requires upfront investment. For this reason, investing in farmland is a win-win for farmers, investors, and the environment.

Farmland Investing Is No Longer Just For The Ultra-Wealthy

Fortunately, you don’t need to have Bill Gates’ level of wealth in order to invest in farmland. Technology-enabled investment platforms like FarmTogether are creating opportunities for accredited investors to get started in farmland investing for as little as $15,000.

FarmTogether’s diverse team of investment professionals curate high-quality farmland opportunities. Using the platform, investors can view the latest offerings, read diligence materials, sign legal documents and manage their investments, all in one place.

Interested in learning more about whether farmland is a good fit for your portfolio? Sign-up for an account today.

We like the REIT LAND. Been going up quietly and steadily since we included it in our portfolio. Try not to tell to many people. Keep it under your straw hat.

John and Rosemary

More land isn’t being created so I understand the appreciation possibles. My parents own a 66 acre parcel in CA. Being rented to raise cattle. The return is horrible. Land cost 460k rents at 12k per year. Yes maybe if they rented for farming of almonds, tomatoes, Alfaya their could be a slightly better return. I just don’t see how farmland returns are higher than other investments.

We all could stop idolizing billionaires and instead work harder on our goals and plans to improve OUR lives. Remember what Bill Gates and Warren Buffet wrote down on a piece paper, as their key for success: FOCUS

Billionaires invest into all types of areas, as they invest in different areas. Some invest into startups, others own their own business. Some invest into real estate, stocks, farmland and you name it!

Great article as always, Sam! Appreciate all you do… you sold me on FarmTogether and I created an account. They had an investment opportunity in an Almond Farm in Sutter Counrty yesterday that they said opened to new investors at noon EST and was open for 24 hours before it went site wide. I logged on at 1210 thinking “Wow! I’m going to be on the bow wave for this one…” After filling out all the online forms, it said the investment was already full and I “may” be put on a waitlist…. Wow! How many people ready your newsletter???

Is this what I should expect? Does every offering go this quickly? I felt like I was trying to get concert tickets!

Any advice on how to get in once I find an offering that sounds good enough to invest in?

Thanks! Keep up the great work (though it sounds like you’re on the home stretch… bummer!)

Cheers,

Greg

Hi Greg!

Thanks for sharing your feedback. There has been a tremendous shortage of supply and tremendous demand over the past couple of years.

And from FT’s perspective, I’m sure they are doing their best to try to source supply, but they are likely facing competition as well.

People are wealthier after the pandemic and cashed up. With rates still very low, people are looking for a higher yields and stability as well.

I totally empathize with you on trying to get concert tickets! Those were the days. Now, I just stay at home like an old man and watch Netflix.

Sam

Oh wow…

I just looked up the average farm size in the U.S. and according to usfarmdata, it is 444 acres. Unsurprisingly, Bill / Melinda owns 606x more than the average farmer.

I really want to know what is so special about that 1 acre in New Mexico. Outliers interest me.

Is there a farmland related index fund/ETF you can buy from a regular brokerage?

I suggest to stop chasing the latest hottest ‘investing trends’ and instead become great at one or two areas. That’s how folks I know became Ultra High Net Worth Rich.

Yup. Gladstone Land Corporation. (LAND). Just recently increased their dividend (to 2.32 %) They buy, own and lease out 127 farms in 13 states. You can be a gentleman farmer from your easy chair. Just don’t take the John Deere into the south 40 too soon after it rains.

Does the financialization of everything make anyone else nervous? Also, will the rise of platforms like FarmTogether and AcreTrader make farmland investments more volatile?

Thanks for posting this article, very informative.

What other options are available to me (not qualified as an accredited investor), that are similar to FarmTogether?

I think most require you to be an accredited investor, other than maybe a farmland REIT? But I read that the SEC expanded the qualifications for accredited investor to include those who have a series 7, 65, or 82. 7 and 82 require sponsorship but 65 does not. So for a small fee and some studying, seems you can now qualify without the net worth or income! Sam or anyone, can you confirm?

I’ve looked into this recently after reading Sam’s previous post about FarmTogether, and as part of a larger effort to begin diversifying my investment assets once my debts are paid down, and the only two I’ve found are Steward and Harvest Returns.

Steward only does farm LOANS, which would be the equivalent of farming bonds as opposed to farming stock. Harvest Returns, which has less info available without joining, apparently does both. (I would include links, but I don’t know if that’s against this site’s policies…they’re easy enough to find with Google).

I read one review on Steward, and its description of how Steward pays out interest put me off. I’m hoping it’s incorrect, but I haven’t found any other info on it.

Wow! 270,000 acres of farmland is incredible! So many billionaires are buying up the land. Probably no, Mark Zuckerberg bought several hundred acres of land in Kaui and then Larry Ellison bought the entire island of lanai.

Thanks for highlight what the super rich are doing. Farmland does seem very intriguing for diversification and steady returns.

Bill gates is also getting a divorce, could that be a good idea as well?

Only if you really can’t stand your spouse and the cost of divorce is cheaper than the cost of your sanity.

Good thing Bill Gates isn’t a marriage expert!

I don’t think Bill Gates or the Gates Foundation are real estate experts either!

Sure. But the wealthy have a good strategy of hiring experts who know.

Yes, the “wealthy” do have a lot of resources that the rest of us don’t. But I think you would agree that we’re not in the same league as the gates foundation or Ted Turner. The investments made with billion dollar fortunes don’t scale well to multi millionaires like us, and vice versa.

If it helps their quality of life…..YES!

How fascinating. I had no idea Bill Gates was so heavily invested in farmland. Intriguing on the high percentages in Louisiana and Arkansas. Actually, that whole graphic of where he’s invested is very enlightening.

I never really thought of Arizona as a place for farmland. I always thought it was mostly just dry desert there. Goes to show how little I know about our state’s geography. I think it’s funny that he only owns one acre in New Mexico. Maybe it’s from an Arizona farm that spills over the state border. Otherwise it sounds like quite a small farm.

Anyway, really cool facts thanks. If farmland is that big of an investment to Bill Gates, that makes me convinced it’s worth exploring and diversifying into.