Although being a millionaire sounds nice, it's not that impressive anymore thanks to inflation. In order to be a real millionaire, you will need to have a net worth of at least $3 million, not $1 million. A $1 million net worth provided a great lifestyle before 1990. Not so much today.

If you retired today at 65 with $1 million, you may be able to spend $40,000 a year (4% withdrawal rate) for 25 years. But you might also run out of money before you die as well. In a relatively low interest rate environment, it's only natural to expect lower risk-adjusted returns.

In a higher interest rate environment, your dynamic safe withdrawal rate can go up. However, you've also got to be careful withdrawing too much because your asset values may be declining. In 2022, we saw the S&P 500 tumble by 20% because the Fed hiked rates aggressively. Thankfully, we’ve recovered after another scare in April 2025.

Back in the 1990s or earlier, when the risk-free rate was closer to 5%, achieving a $1 million net worth was fantastic. Almost everything was cheaper back then. Can you imagine being able to go back in time and buy real estate at those prices? Back in 1990, the median home price was only $117,000. Today, the median home price is closer to $430,000.

Or how about being able to pay college tuition prices from the 1980s? If you had a $1 million net worth back then, you were pretty much set for life! Further, think how much your $1 million would be worth now.

Today, if you are a $1 million millionaire, you should still feel good. However, it's not like you're popping Cristal Champagne in the hot tub on your luxury yacht in the South of France. Interestingly, according to the latest Federal Reserve Consumer Finance Survey, the average American household is a millionaire! But the median household income is only about $192,000.

Order My New Book: Millionaire Milestones

If you’re ready to build more wealth than 94% of the population, grab a copy of my new USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones (Amazon) is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

Why $3 Million Is The New $1 Million

The reality is, withdrawing at a 4% rate is no longer recommended. Further expected returns for stocks, bonds, and other investments are down. Meanwhile, the risk-free rate of return is around 4% and likely heading lower as the economy fades and inflation declines.

Instead of sticking to a fixed withdrawal rate or net worth multiple target, adopt of dynamic safe withdrawal rate. This way, you'll adapt with the changing times.

Today, to be a real millionaire, you will need much more than $1 million. With $3 million, you can withdraw at a more appropriate 3% or 4% rate and generate $90,000 – $120,000 a year. $90,000 – $120,000 a year still isn't living a rich lifestyle. But it's above the real median household income of roughly $75,000.

In addition, we should all pray the government doesn't raise the minimum Social Security age to something absurd like 70+ years old to make the system whole. The average American should also pray the government doesn't drastically cut payouts.

If our prayers aren't answered, let's hope our 401(k)s and IRAs don't get taxed out the wazoo come distribution time. If our hopes for a well-managed government are crushed, then surely we'll have developed multiple income streams by retirement so no one event can get us down!

Inflation Really Makes Having Millions More Necessary

When I was working at McDonald's for $4.00 an hour in 1994, I filled up my 1987 Toyota Corolla FX16 babe-mobile for $1 a gallon. I distinctly remember not being excited about making $4.00 an hour.

However, I had to do it because my parents didn't give me much spending money. Besides, I wanted to do more than treat the ladies to free apple pies and Mcflurries.

The minimum wage in America is now between $7.25 – $18 an hour. Meanwhile, a gallon of gas is anywhere from $3.3 – $4.8 a gallon depending on where and what type you get.

It's interesting the minimum wage used to be 4X the amount of one gallon of gas ($4 vs. $1). Now the gap has fallen to only ~3X as the cost of goods has surged faster than wage inflation.

It's important to grow your earnings faster than your costs. Increase that gap as wide as possible. If you haven't asked for a raise in more than one year, it's time to get that hike. In addition, it is important to own real assets like real estate to ride the inflation wave. Both rents and real estate will appreciate with or faster than inflation.

Inflation will likely stay above the target 2% for years due to excess pandemic stimulus.

Dreams Of Becoming A Real Millionaire

The most I ever thought I'd make after graduating from my public university, The College of William & Mary, was $100,000. That's how much a senior foreign service official was making back in the late 1990s. I respected my father's work and used him as a barometer for success.

I thought I'd start off at $30,000 and work my way up to that elusive six-figure mark by the time I was 60. If I diligently saved at least 20% of my income and invested wisely, reaching the magical $1 million figure would be achieved.

But instead of going into the public sector, I joined a bulge bracket Wall Street firm that paid handsomely. Actually, it didn't for the first year with a base salary of $40,000 in expensive New York City. In exchange for the potential to make six-figures one day, I worked like an indentured servant.

Every single MD at Goldman Sachs was a millionaire. I quickly became accustomed to the fact that I'd join their ranks if I stayed the course. Going public in 1999 was a cataclysmic event of wealth for everyone at the firm.

In 2012, I retired at age 34 with a $3 million net worth. I started Financial Samurai in 2009 and it is the top personal finance website with over one million visitors a month. Today, my net worth has grown to multiple eight figures. Everything is written based on firsthand experience because money is too important to be left up to pontification.

No Relief Hitting The Million Dollar Mark

At 28, I crossed the one million net worth mark. But, I didn't really know it until I started religiously tracking my finances after the financial crisis hit at age 31.

After 10 years working in finance, I was already beginning to lose motivation. I started regularly dreaming of doing something else, but I had not yet started my X-Factor. Therefore, I felt trapped. All I could do was take the punishment and keep on going.

Did I feel rich as a low single-digit millionaire in 2008? Not really. Even with no kids and a new spouse, I had a big mortgage and an unstable job. Further, I was thinking about a future in San Francisco or Honolulu with kids. If you’re curious, here’s how you’ll feel reaching various millionaire milestones.

As the economy began to crumble, I felt like I was about to lose everything thanks to leverage. Luckily, I “only” lost about 35% of my net worth before the economy finally found a solid footing.

Focus On Your Millionaire Journey

I encourage people to develop individual financial wealth. Yes, it's nice to grow your wealth together with your partner. However, divorces happen all the time. Be independent, so that no matter what happens, nobody can take away your financial freedom!

At the same time, it's often easier building wealth as a couple. Therefore, I suggest you read my post, The Average Net worth For The Above Average Couple. The post will give you some rational targets to shoot for.

There are about 15 million millionaire households in America or about 4.6% of the total population or 9.7% of the working population. To put these percentages into context, the Asian population in America is roughly 6.5%, and you see Asian people everywhere!

Further, thanks to the Stealth Wealth Movement, there is more untraceable wealth the government doesn't know about. After the boom in risk assets since the pandemic began, surely there will be even more millionaires once the Sentinels tally the results a year from now.

I fully expect the vast majority of Financial Samurai readers under 40 to be millionaires by their 60s. If you are fortunate to have a job for so long, accumulating a million dollars in your 401k or rollover IRA alone by 60 should be the reality for most.

Current Prices vs. Historical Prices

Here's a chart I put together with rough prices of goods and services today vs. in the past. This chart shows why having a $1 million net worth is not longer enough to be considered a real millionaire.

The most absurd rises in costs are college tuition, automobile, and housing prices.

Unless you are already rich or receive a scholarship, I don't think it's worth paying $60,000 in tuition to attend AOC's alma mater Boston University or similar private universities. Education is free now thanks to the internet. Go to a public school and use those savings to start a business or invest instead.

$49,500 for the average automobile price today vs. $75,000 for the median household income is also an interesting comparison. It shows why it's so easy for the typical person to get into so much financial trouble. Sure, financing and leasing makes cars more affordable. But borrowing money gives people a false sense of wealth, especially if they aren't aggressively saving already.

Finally, housing continues to be the most expensive cost for most people. Therefore, it makes sense for most people to get neutral housing by owning their own primary residence. Once you see yourself living somewhere for 5+ years, I would buy real estate following my 30/30/3 rule.

After studying the above chart, if you want to build wealth, you should be more motivated to go long housing, healthcare stocks, food and beverage stocks, commodities, farmland, and education.

Inflation is picking up so much that the Social Security cost-of-living adjustment keeps rising too, which is good. Those who are not consistently investing are getting left behind. At least the government is taking care of our current retirees.

If you can't beat inflation, invest in inflation. Inflation is simply too powerful a force to combat long term.

Why You May Need Millions To Retire Comfortably

Here's a chart I put together of a real family of three just getting by on $300,000 a year. This family has over a $5 million net worth and is living a relatively middle class lifestyle.

$5 million is a lot of money. However, it's hard to generate enough risk-adjusted cash flow to pay for all your living expenses in an expensive metropolitan area.

The reality is, to generate $300,000 a year from your invested capital would take at least $7,500,000 at a 4% rate of return. Therefore, having a $5 million net worth may not be enough to retire early with kids in a big city.

The family could take on more risk to try and get higher returns. However, when you've already won the game, you tend to stop playing as aggressively. The best move is probably for the family to relocate to a lower-cost area of the country. The only problem with this move is leaving behind a network of friends and family.

The New Millionaire Realty

Being a millionaire is nice, but it's not what it used to be. Inflation is like a sneaky cat that steals all your food when you’re not looking. If you want to be a real millionaire, shoot for at least a $3 million net worth. Aim to hit the net worth targets in my average net worth for the above average person post.

With a $3 million net worth and no government support at age 65, you can spend a comfortable $60,000 – $90,000 a year without fear of running out of money. You can probably go nuts and spend up to $150,000 a year for several years to really live it up.

Remember, we're trying to replicate in today's dollars the type of lifestyle a $1 million net worth would have provided 30+ years ago. Not only are we looking to mimic the lifestyle, we're also trying to mimic a person's financial state of mind. After all, one of the main purposes of having lots of money is so you can worry less about money.

At least shoot for having at least $1 million in investable assets in retirement excluding the value of your primary residence. Once you have your housing squared away and all your debt paid off, you don't need a six-figure retirement income to live a great life.

Life Should Still Be Good With Less

If you don't reach a $3 million net worth figure by retirement, don't worry! Depending on your tastes, needs, and where you live, you won't need $3 million. Besides, not everybody has the same chances of becoming a millionaire. A lot of luck is involved in building outsized wealth.

Further, Social Security should be there for most of us by our mid-60s. With the average Social Security payment of roughly $1,543 a month, we're talking an extra $18,516 a year in income. For those who retire at full retirement age (70+), the maximum Social Security benefit is $4,555 a month in 2023. $54,660 a year is like having $1.366 million at a 4% withdrawal rate. Not bad!

Therefore, even if you don't retire a real millionaire thanks to inflation, life is still pretty good. Think about how happy you were when you hardly had any money. Today, our social safety net is growing. There's also an ongoing massive generational wealth transfer that will make plenty of heirs rich without having to do anything.

Finally, if our government and our parents screw us, then at least we've got peace in America and free internet! With so many big media sites going behind paywalls, how cool is it that Financial Samurai still remains free? For the people surfing the internet at public libraries, I always think of you when writing my articles.

Best of luck on your millionaire journey. As you go about building your wealth, don't forget to also focus on your health. There's no use being a multi-millionaire if you don't feel good physically and mentally every day.

Become A Millionaire Owning Real Assets

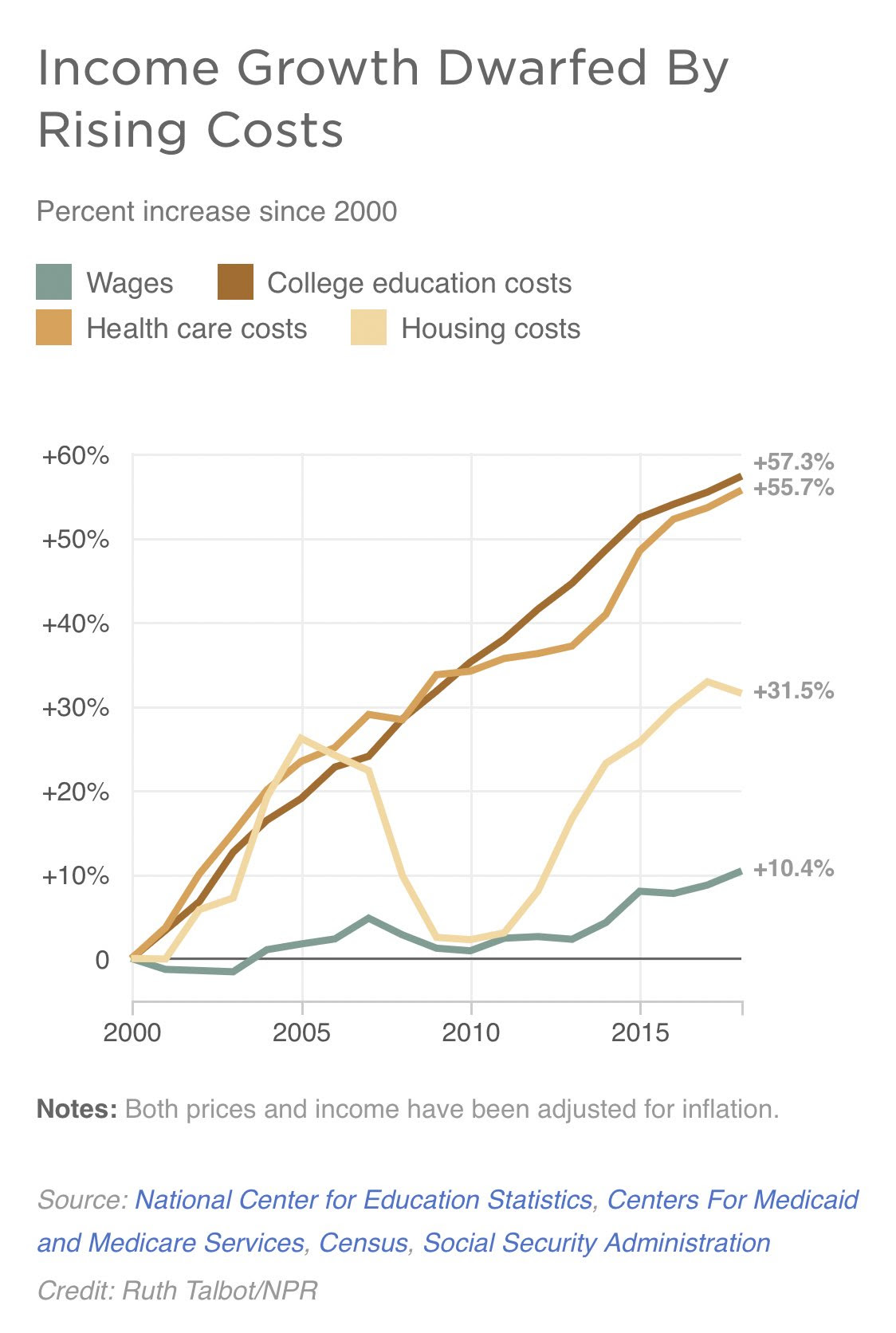

It's hard to become a millionaire simply through savings. Further, income growth has not kept up with housing costs, college education costs, and health care costs. Therefore, in order to benefit from such rising costs, you should probably invest in these assets.

After you get neutral housing inflation by owning your primary residence, you can invest in real estate through ETFs, REITs, and rental properties. One of my favorite way to invest in real estate is through real estate crowdfunding.

I've invested $954,000 in real estate across the heartland of America to take advantage of faster growth and potentially higher returns.

Inflation acts as a tailwind for property prices. Meanwhile, inflation whittles down the real cost of debt. This one-two combination can create tremendous wealth over time.

Best Private Real Estate Platform

My favorite real estate crowdfunding platform is Fundrise. It is one of the largest and oldest platforms, founded in 2012 with about $3 billion under management and over 380,000 investors. Fundrise smartly created private real estate funds to earn income 100% passively. For most people, investing in a diversified real estate funds is the most appropriate way to go.

Fundrise is a long-time Financial Samurai and Financial Samurai has invested over $300,000 in Fundrise to diversify and earn more passive income.

Manage Your Finances In One Place

All millionaires diligently track their finances. Do the same by signing up with Empower. They are a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize your money.

The best feature is their Portfolio Fee Analyzer, which runs your investment portfolio(s) through its software in a click of a button to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was hemorrhaging!

There is no better financial tool online that has helped me more to achieve financial freedom. It only takes a minute to sign up.

Related posts:

Who Makes A Million Dollars A Year? Discovering The Top 0.1% Income Earners

$10 Million: The Ideal Net Worth To Retire

Readers, what do you think constitutes a real millionaire nowadays? Why do you think some people are still stuck on a $1 million net worth providing the same lifestyle from decades ago? Are we so slow to change our way of thinking? Or is inflation too sneaky of a cat to notice as it creeps up on us?

Join 65,000+ others and subscribe to my free weekly newsletter. Since 2009, the newsletter has helped people achieve financial freedom sooner, rather than later. Are You A Real Millionaire is a FS original post.

This whole article assumes a Biden economy. This is not how it’s going to be in a trump economy. next year, we will get a new fed chair and inflation will be near zero. the economy will be gangbusters with no inflation. stocks have already gone up on trump’s peace deals dividends and as these tariff threats lead to more favorable trade deals (remember the tariffs are simply threats), we will see economic growth like never before. i’m expecting 20% growth for the next 5 years. if you had 3 million and then assumed 20% growth for 5 years you’re already at 8 mill.

Didn’t realize I wrote this article assuming a Biden economy.

Are you assuming $8 million is the real $1 million? Maybe.

Also it sounds like you’re saying there’s way more millionaires than 6.5% of the US population. Could be thanks to Stealth Wealth.

If you have $1M in cash or investments, and it earns 4% per year, that’s a $40k withdraw without touching your principle. At a 4% rate, and we’ll assume it compounds monthly, over 25 years you could withdraw a little over $63,000 a year to hit 0. If you think you’ll live to be 100, you can withdraw around $53k a year. That’s still not a fortune, but many people who own their homes and just have ancillary expenses can afford that.

CrYstal??? Ya kiddin’? It’s spelled C -R -I -S -T -A -L

Oh, but when you’ve only got $1 million, you need the CrYstal Champagne version, a cheaper knockoff that’s 60% less, but only tastes 15% worse. Good value!

But once you get to the $20 million net worth or more, then you can go for the original Cristal.

It tends to be all relative. If you go back to 1900 or 1850, your definition of what $1m today would be even more extreme. But what about salaries today? Minimum wages? Bonuses of corporate workers? Gains one could (have) made in stocks and/or real estate and/or metals? And the one thing that can’t adequately have a monetary value assigned….the standard of living. Electricity, internet, cars, interstate, online banking, self-checkouts, online shopping, small computers that can connect to anywhere in the world, cell phones that are something out of Dick Tracy, and more. Yes, there has been inflation, but part of that is due to the very breakthroughs that make our lives easier, hopefully better, hopefully more informed while also more fragmented. Yes, the dollar is worth less today than the past; pick almost any two “normal” times in US history and that will be the case. M

I feel the same way as Shark Tank’s Mr. Wonderful in that if you can get to $5M USD then you can handle pretty much anything that comes your way.

I personally have an IRA/Roth/401k so that I can have options come retirement time. The Roth has no RMD’s and is tax-free. I want to build each account up to $1M so that I could basically choose which one to use and leave the others virtually untouched. At that point, I would have $3M. Just my 2 cents.

Thanks,

Greenbacks Magnet

Hi Sam,

Loved your latest newsletter!

For anecdotal data, the new 3-million threshold to what once was a millionaire sounds/feels about right. Ballooning real estate value alone is making people asset millionaires.

My wife (64) and I (73) are at roughly the 3-mil net worth level. We have zero debt, so my $65k passive income (my SSI + small pension) alone works just fine here in East Tennessee, even without what I continue to bring in from my business that I love.

The real issue at our age is not knowing how many years we have left to eventually start drawing down funds and spoil ourselves (while we still can). That said, from my vantage point, I think for me to really feel “wealthy,” that’d be at $10 million (easily accessible) net worth. That way, short of yachts and all, whatever one really wants and needs is easily accessible via passive income alone.

Spiraling education costs are a hideous travesty. Even if, due to an aging population, Big Education eventually runs out of “customers” and there will be competition. The whole system is out of whack. It simply makes zero sense to push/shame everyone into a college education. How many academics and true higher-education folks does a nation need? 5-10%? We need to get back to a good balance between “academia” and apprenticeships/trade schools. And one could also argue that education should entirely be public, because it’s for the good and survival of a nation. Which is precisely the way it was in Switzerland when I grew up there.

nVidia, honestly, I don’t get it. I wish, of course, I had gotten their stock years ago, but as for product, obnoxious graphics cards that draw way too much power and run way too hot…? I am all in with AI, but I can’t see why nVidia should be THAT important, even if its server GPUs are now their primary business.

Conrad

Thanks for the great article Sam. We just crossed the $3 million net worth mark this week. My wife said “I don’t feel rich” and I said that’s exactly the reason we are. We live well below our means. I’m 45 and my wife is 40. Right now we have roughly 2.5 million in investable assets and 500K in real-estate. She is a full time stay at home caretaker for our one child. I can’t wait to retire and spend my time doing things I’m passionate about (some of which make a little money). But I’ll keep plowing at my job while it lasts (fingers crossed). If it does hold out, I’ll likely retire at 48/49 and then pursue my hobbies and interests which likely means I work “part time” but doing things I love.

Congrats! Do you feel the pressure of being the sole income earner? If she goes back to work, you can practice Wife FIRE and retire, as several of my peers have done.

48/49 is only 3-4 years away. Might as well keep grinding, saving, and investing as much as possible until then!

No pressure on being the sole income earner. It’s been this way for a long time now, but in the last couple of years I was fortunate to land a job that pays a silly amount. If it holds for a few more years then we should be all set to live comfortably without worries. If things go south, then I have to take comfort in the fact that our current net worth was once my retirement goal when I made much less (and we can in fact live on the returns, although we would have to revert our lifestyle back a few years). If the job vanishes then I’ll probably grab another similar job for a few years extra that pays a fraction of my current income, but it would allow our investments to grow and also cover expenses, insurance, and allow more modest contributions to our retirement accounts. Overall we are feeling very fortunate and lucky as we both come from very modest backgrounds.

Sorry, but what withdrawal rates are you talking about? Why would one who is retired like to withdraw a penny from life savings other than for grave emergencies? Maybe it’s us, but we do not intend to withdraw anything to support ourselves in retirement other than RMDs. And after taking those I intend to pay taxes and the rest to the last penny plow in into ETFs, which should generate growing stream of dividends so we could live well and still be able to save about 15% each year. Now to the point: My wife and I receive about $70K in Social Security, about 6K tax-free annuity, $60K in royalties, $75K in dividends, and $50-100K in other investment income (all of which is reinvested), not counting RMDs. With two houses paid off and cars bought for cash, why would I even bother to withdraw anything other than RMD (about $120K 2 yrs from now), which after paying tax will be plowed in to investments (fortunately we live in states with below average cost of living). Thanks God 20% of our money is already in Roth that greedy government won’t force us to touch. So if people (including those pursuing FIRE ) can’t generate enough cash flow from investments to live on, maybe they are NOT ready to retire to begin with. Just my two cents.

Ed K.

I see your point about FIRE readiness, but I think you need to take total annual expenses and compare that to your Net Worth to calculate the withdrawal rate. When folks reference “withdrawal rates”, they mean “withdrawing” from Net Worth, not necessarily exclusively from retirement accounts.

Sounds like you have been fortunate and invested well – congratulations.

We’re early 50’s with a liquid net worth of about $3 million but definitely don’t feel financially secure. If we include our investment properties our net worth more then doubles to over $6 million, but with two kids to put through college soon and aging parents it never seems to feel like enough. I think one of the problems is that we keep very little in actual cash (although this is changing because of higher interest rates) with the majority of our money invested. With large market shifts our net worth can go up or down 10’s of thousands of dollars on any given day. I think my problem is that I look at these numbers on a daily basis which I know you shouldn’t do but unfortunately I work in finance. It also doesn’t help that we live in high cost NYC.

Maybe you’ll feel much richer once your kids graduate from college? I definitely think you’ll feel richer once you no longer have to work for a living and have a lot more free time. As I get older, the freedom to do whatI want, becomes more and more valuable.

Iam turning 60 next yr and I will retire.

I own 3 properties outright worth 4.5million . When I retire 2 of my properties will give me $80,000 in rent per yr . I have $500,000 in super which I will draw out $20,000 per yr for 25 yrs giving me a total income to retire on of $100,000 ! I have no debts . My car is 2 yrs old . That is more then enough money for me to live on quite comfortably .

Congrats! What do you think is the ideal age to retire To minimize regret and maximize happiness? It’s a topic we are talking about here.

Great article and discussion. Years ago, I set my “exit target” from corporate life as $3M in investment portfolio, paid off house, and kids’ college funds fully funded. The last 10 years have been good to me and I’m approaching those targets (at $2.6M in market but other goals achieved).

I agree with most everything in your article but question the reasoning of the classic 4% rule. I agree it’s safe level but think 6% is probably reasoanble as long as >60% of your assets are in the mutual funds tracking indices like S&P 500 and Russell 2000. Since you should have enough assets to cover extended downturns of up to 10 years, you SHOULD be able to live at 6-8% of your portfolio per year as long as the market is growing at >10% and then buckle down a bit if it starts dropping. I think the 4% rule is assuming you’ve put your portfolio largely in “SAFE” guaranteed funds that are paying at 80%). His point was that, if you look at the last 50 years of the stock market, gains have averaged >8% per year on average. While he didn’t predict the drops in 2000, 2008, etc., his guidelines proved right over the long-term. I maintained ~90% in index funds and it paid off far more than had I had a more conservative portfolio. It didn’t grow well from 2000 –> 2010 but 2010 –> 2021 more than made up for that.

Okay, please present countering opinions – I really do want to hear another side?

I think you should feel free to do whatever you think is comfortable given we all have different risk tolerance and goals.

Here’s a post arguing why you may want to lower your withdrawal rate in retirement. As a reference, I have not had a day job since 2012 and I have two young children.

One of the things you might realize after you leave your day job is a high reluctance to withdraw money given it won’t be what you are used to for so long.

https://www.financialsamurai.com/proper-safe-withdrawal-rate/

Would love to get your thoughts now, with the market down 20%-30%.

I’m 52 and worth $3.3 million. I think the only thing keeping me from leaving my job is inertia (doing the same thing over and over again without thinking about it). What is your and everyone here’s opinion on at what point should a person give up their job (not happy but not miserable working at) and move on? I make about $120k a year at my job and have about $60k a year in net rental income, also have about $10k a year in dividend income.

Inertia is definitely a powerful force. Lots of comfort in the known.

I suggest reading this post to help overcome your inertia if you aren’t excited at your job.

https://www.financialsamurai.com/overcoming-the-one-more-year-syndrome/

I left in 2012 with about a $3 million net worth. So you are in a similar position as to where I was nine years ago.

Interesting, although I’d argue that the $300k couple only needs $150k once they quit working to maintain the same lifestyle. Can increase their fun money by $50k/yr and still only need 2/3 what they were bringing in before:

No more FICA taxes, lower marginal income taxes, no more childcare, no more “baby/toddler” stuff, no more mortgage payment, no more 401k savings, no more college savings, no more life insurance. Those categories add up to close to $152k+ of that $300k.

I live in one of the larger metro areas of Oklahoma. I hit 2 million in net assets after turning 64. I’m single and live in the same 2 bedroom, 1000 square foot home I purchased in 1986, my only debt is a car payment. Being full invested in the stock market, mostly in technology and I feel wealthy.

The state is a great tax haven and I like living with a population of less than 4 million. I’ve travelled the world through out my life which is my passion, and plan continuing to do so. Visiting U.S. destinations and exploring places like L.A., S.F., N.Y., D.C., and Boston is always fun, but I don’t want to live there. I don’t need a McMansion, or live on the East or West coast or have an expensive address to impress anybody. It seems like so many people are seeking something elusive when they should just appreciate what they have.

Happens to be our base target for retirement as well. So now that you brought it up, yes, I do view 3 million as the new 1 million. Hopefully 4 million won’t be the new 3 million by the time my wife and I retire, although going mostly stocks will certainly make it a wild and interesting ride. :)

Do you really just take the standard deduction? Or is that just for easy math on the example you presented?

I think this article is sadly right on the money. I thought for years that I’d be set once I crossed million dollar nw mark. Nope. My wife and I are now close to halfway mark to the second million (which has progressed surprisingly fast). At this point, I don’t think we’ll ever live on the streets but you never know. Do I feel like I have enough money to be able to do anything I want anytime I want? Not even close.

The scary thing is I run into people my age- 50’s- all the time who have little or nothing saved for retirement and substantial mortgages. And they’re not exactly irresponsible people either.

I see 50ish older people floating along financially as if the endgame is not approaching. And some of them are people I respect and love. I have had little success giving financial advice and having it stick. Broke people need financial advisors more than rich people.

OMG, that last statement is so true. Unfortunately, the broke people won’t follow the best advice, which is frustrating. I also know good people who are broke, and it drives me crazy to see them suffer when it could have been prevented.

“Inflation acts as a tailwind for property prices. Meanwhile, inflation whittles down the real cost of debt. This one-two combination can create tremendous wealth over time.”

Agreed but inflation is rearing its nasty head right now with lumber, gas, housing prices, new cars, etc. That’s got to hurt those in retirement on fixed incomes. Thoughts?

Good post. Didn’t quite understand this statement though:

“If you retired today at 65 with $1 million, you may be able to spend $40,000 a year (4% withdrawal rate) for 25 years.” – In the statement, “may” was italicized, as if that outcome was uncertain. But if you park that money in an insured, no-interest account, you will be able to meet that goal exactly. This plan does not necessarily represent optimal retirement planning, but it’s ability to meet the stated goal is not in question.

The following statement “But you might also run out of money before you die as well.” is certainly true, but doesn’t directly relate to the previous statement.

In one’s investments might go down. One might have a costly medical mishap. Any number of things can happen over a 25 year., Especially during your more advanced ages.

Many people who retire at 65 today will have Social Security, so they may not need to use $40,000 per year from the cash account. Some will have more than $40,000 per year from a pension, so they may not need any money from the cash account.

Hi Sam,

How do you think about real estate equity for personal residences in the context of net worth? For us it’s half the balance sheet, but we wouldn’t cash out to move to a lower cost market, so I ignore it from a personal finance perspective.

Sam– one question that I never had a chance to ask, but with these rules of thumb around withdrawal rates… i.e., $3mm with 2% withdrawal ($60k in income). This assumes you don’t touch the principle. While I can appreciate the conversation nature of this approach, what happens to the $3mm… is the idea that you leave it for your heirs?

If so, that’s quite generous and while I want to help out the next generation, it seems rather excessive.

I have the same question; anxious to hear from Sam

A fair question. I do believe the ideal withdrawal rate does not touch principal if one is under the estate tax threshold limit. But that is more of an extreme or ultra conservative view.

$3 million sounds like a decent amount today. But let’s say we die in 40 years. It’s the same thing. It won’t seem like a lot when our kids inherit it.

Only the most risk loving person will try to calculate and time dying with zero. There are simply too many variables to not have a good financial buffer. Further, there are plenty of people and organization that need financial help.

Thanks for the response.

The actuary in me is always calculating my chance of dying ;)

So, the goal isn’t to die with zero, but I also find it a bit odd to “not touch principle”. I think the answer is somewhere in the middle— have a good cushion, but perhaps don’t have to live miserly on $60k (if you are in a HCOL area).

Perhaps an idea for another article— how much to leave behind, and why retiring with $3mm is more than enough.

I think the article is a good idea and I welcome you to write it. I can help you edit it as well. Let me know. Thanks

I’d like to explore this… How do I reach you to figure out next steps?

While you are in the accumulation phase and saving for retirement, I think the goal should be to save and invest as if you would “never touch the principle.” This sets the bar high and helps you to maximize savings and investment decisions accordingly. Once you cross into retirement you can then determine how realistic it is to maintain your lifestyle without touching principle.

Nicely written, you mention really good points.

I use to want to resist Sam’s $300k to live a comfortable life, but he is accurate on the area in which he lives and based on the lifestyle. Appreciate that he mentions that you can decrease this number based on cost of living in your area. In our area, SoCal, for $150k we can afford to include a comfortable lifestyle and a mortgage on a ocean view condo, but that’s b/c other costs are lower-which doesn’t mean deprivation.

Here’s where numbers can be deceiving and it’s so important to diversify. Personal Capital shows our NW as $1.1 million. But, the amount we can generate from our wealth is $160,000– bulk is in real estate, the rest from pension and stocks/bonds. With 3.5% SWR, we would need $4.57 in stocks/bonds to generate this amount. If we were to use Sam’s 2% SWR, we would need $8 million to generate this amount. That’s pretty crazy, especially b/c we never had super high paying jobs.

Sam has brainwashed me a bit (my future self will appreciate it), I am now looking forward to increasing passive income to $200k to spend when we hit 50. I don’t foresee adding $44k passive income to be that challenging if we continue to do a mix of RE and equities. We finally FIRE’d this year, and since there we have an excess, it allows us to keep investing. There is a lot we can do to help others with the money we generate.

100 million and above- (top .02%)Is what you think of when the millionaire phrase was coined. Means a real mansion 10 thousand plus square feet, yacht, private plane, etc. (Elite Wall Streeters, Elite Tech, Celebrity actors and athletes, old money.)

11 million -Luxury lifestyle top 1%, McMansion, First class flights, Private schools, Small yacht, etc. Still need to be careful how much you spend. Can retire early.

Tech executives, Wall Streeters, small business owners, celebrity actors and athletes, Trust fund babies)

I think its tough for lawyers, doctor, dentists, upper middle management to make it to 1%. They’d usually have to live in NYC or San Fran, where real estate helped alot in networth.

Most White collar professionals can get to about 5 million with good saving practices.

I think 3 million is enough to retire early and live a great lifestyle for one person, but you’d have to be really careful. In investing especially if inflation returns to double digits like the 70’s.

Great observation James, I am a veterinarian that owns my own practice the last few years has been excellent coupled with a very aggressive savings rate and performance in the stock market has pushed my net worth close to the top 1% that you mention. I live in a more rural part of California and my competition is much less fierce as opposed to an urban area. Once I reach my financial goals I plan to retire and relocate to a more tax/business friendly state.

Appreciate the article. I concur, like everything in life, I suppose it is all relative. Much of it probably has to do with one’s fixed expenses and where they are living geographically. I am in my mid-30s and I am in the mid to high 3M level. Also, steady income in excess of $500K annually and I feel fortunate to have saved that much at a young age, but feel very far from “rich”. I am not sure what that number would be like, but in today’s environment and everyone making so much money in crypto, I don’t quite feel like 3 to 4 mil is very much. It seems that so many people on Twitter are making millions every day and some of these alt coins, crazy world.

No longer a need to feel jealous of the crypto bros. At least for now.

Agree with all of this too.

Age 40, major West Coast city, $3.5M net worth and do not feel wealthy or even successful (corporate slave here). I will probably feel wealthy at $5M, so the equivalent of current net worth plus totally paid off homes – primary plus rental.

Where I live, some of these numbers are way off base. My primary home insurance runs ~$5k/year (yes I have priced with multiple insurers) and my electric bill is $300-700/month. This is for a 2400sf home plus 1000sf detached office, so not living small but also not in a McMansion. No kids or spouse, but I spend about $5k/month on in-home parent care and maintenance for my two disabled parents. Without that monthly obligation, maybe I’d feel wealthy now!

Doesn’t Medicaid cover home health aides ?