So you are shrewdly considering investing in real estate outside your state. Good news. Yes, you can get a mortgage in one state to buy a property in another state. With work-from-home booming, there are some fantastic demographic shifts happening across America.

Many people are now considering moving to a lower cost state due to the acceptance of working from home. At the same time, more people are considering moving to California and other states with high vaccination rates and low coronavirus rates. It's an interesting dynamic!

Given we have enough passive retirement income to sustain our lifestyle, there's really no need to remain in expensive San Francisco. As such, I'm thinking of getting a mortgage in California to buy property in Hawaii.

Getting A Mortgage In One State To Buy In Another State

After getting my preapproval letter of credit, I asked my lender the following question:

Question: Can one get preapproved for a mortgage in California to buy property in Hawaii?

Answer: Currently your preapproval is for a primary home in California, but it can be used to purchase a 2nd home in Hawaii if that is your desire. I would need to send your application back into underwriting.

But I don’t see an issue with this. You would need to explain why you had changed our minds about a primary home versus a vacation home.

As my lender had incorrectly assumed that I would be buying a vacation home in Hawaii instead of a primary home, I went on to explain to him that we would be buying a primary home in Hawaii instead and why.

In general, buying a vacation property requires a higher down payment and you will be charged a higher mortgage interest rate. I normally see vacation property loan-to-value ratios of 30% and up in order to get a mortgage. Vacation property mortgage interest rates are generally 0.5% higher as well.

Therefore, if you can somehow find a way to get a primary residence mortgage versus a rental property or vacation property mortgage, your terms will be more favorable.

Can You Buy A More Expensive Home In Another State With The Preapproved Amount?

Given you can get a mortgage in one state to buy a property in another state, the next logical question is whether you can use your preapproved mortgage amount to buy an even more expensive property than the initial estimated purchase price in another estate.

For example, I was preapproved for $1,700,000 with an estimated purchase price of $2,800,000. I erroneously focused on a specific property to buy. Instead, I should have tried to get preapproved for the maximum mortgage possible to give me more options.

Now that I'm looking at more expensive property in Honolulu with lots of land near the beach, I've somewhat limited myself based on the size of my down payment.

Here is my question to my mortgage officer on whether I can use my existing preapproved mortgage amount to buy a more expensive property and his answer.

Preapproved Mortgage To Buy Property In Another State

Question from me, a homebuyer: What if I decide to buy a $3.7 million property in Honolulu instead of a $2.8 million property in San Francisco? Is that OK if I put down $2 million to keep the borrowing amount unchanged at $1.7 million?

Answer from mortgage officer: I would need to run the numbers again for a higher purchase price. But the only real figures that might change are the property taxes and HOA, if applicable.

If you wanted to move down this path, we would need to send your file back in for loan approval. I would need to check that we meet the reserve requirements and debt to income ratios.

Your income is location-independent. Therefore, I don’t see this as an issue. We would, however, need to explain the switch in your thoughts which is okay. We just need to explain your logic. Let me know if this is something you are thinking about

Despite borrowing the same amount of money, your loan amount will need to get reevaluated mainly because it costs more to maintain a more expensive property due to property taxes, HOA expenses, maintenance expenses and insurance expenses.

Contain Your Housing Costs

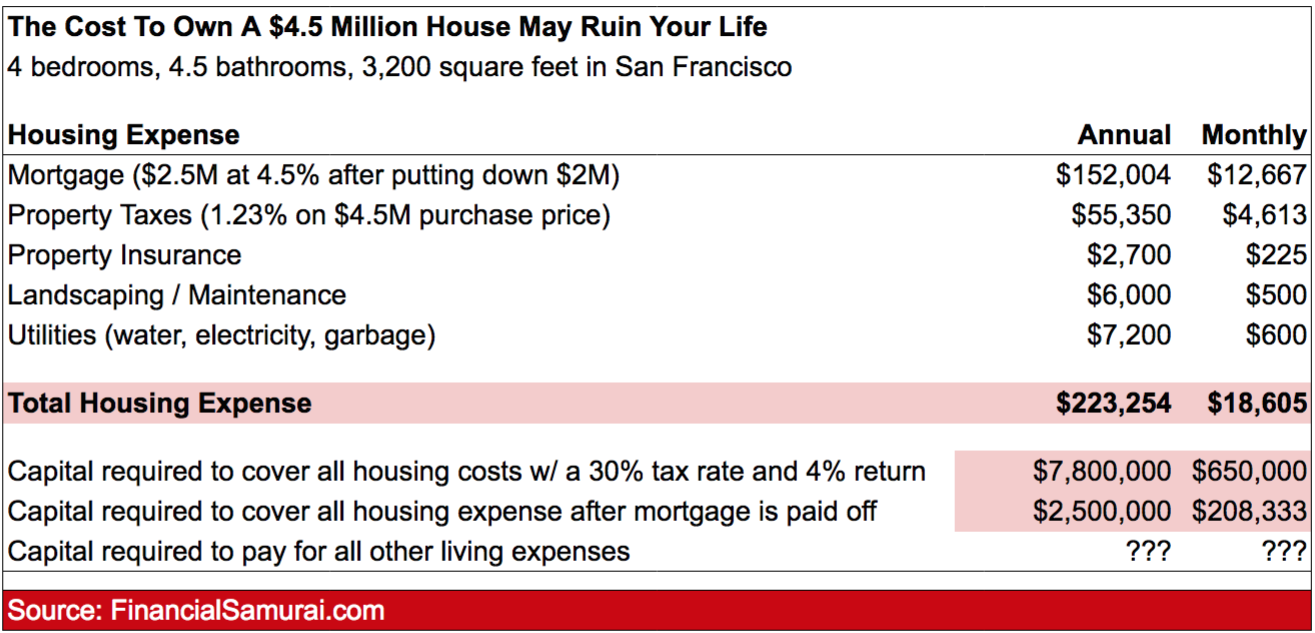

We discussed in the past how an expensive home can ruin your path to financial independence. The carrying cost for a luxury property really gets to be painful after a certain point.

Below is an example of the cost to own a $4.5 million house. Its property taxes alone are $55,000 a year!

Real estate FOMO is hard to beat. I've felt the real estate FOMO every year since I bought my first property in 2003. However, if you want to achieve financial independence, you must get your housing costs under control.

The Ease Of Money Flow

Most people are tied to their jobs. They cannot just get up and relocate to another city and state. However, as the work from home trend increases, it is logical for more people to consider relocating to a lower-cost area of the country. Or to an area that provides for a higher quality of life.

I've discussed this multi-decade migration trend in my post, Why I'm Investing In The Heartland Of America. The nationwide lockdowns are only going to accelerate this trend. Real estate is the obvious beneficiary. The difficulty is figuring out the right real estate investment and the best way to invest in real estate.

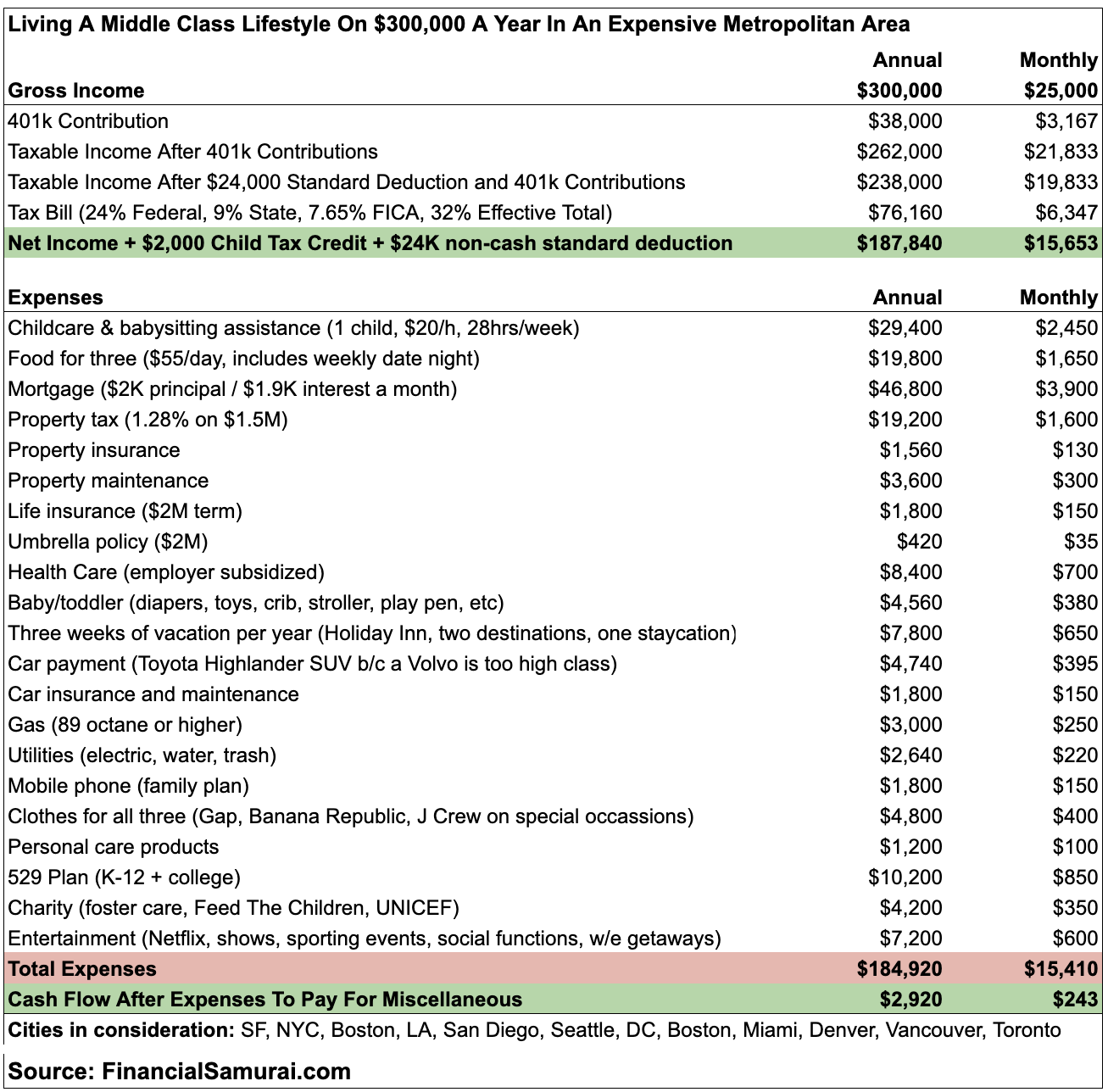

If you have a family and earn $300,000+ in most big cities, the quality of life is fairly good. You can own a modest home, afford to raise a couple kids, and max out your 401(k) every year. Heck, you can even take some nice family vacations once in a while.

However, even if you earn multiple six figures in the SF Bay Area, it doesn't mean much when the cost of living is so high here. You're squarely in the middle class. In order for us to boost our standard of living, we should move.

Relocating to Honolulu will stretch our dollars by ~30%. Therefore, our $250,000 in estimated passive retirement income would grow to roughly $325,000 in buying power. You can get a mortgage for a low rate and live in a different state to save.

I wouldn't have to go back to work for several more years to accumulate more capital. I could also just focus on writing on Financial Samurai instead of spending any time on business development.

Living in a nicer environment with increased buying power is an enticing proposition. Further, my parents would have extra support just in case they need help.

The Ability To Buy Out Of State Will Affect Prices

My original thought process was to try and buy another San Francisco property at a discount. Because the labor market is generally very strong in San Francisco, property prices should continue to do well. However, once I started seeing some big discounts in the Honolulu luxury market, I'm having second thoughts.

Thanks to being able to get a mortgage in one state to buy a property in another state, my down payment and preapproved capital is at high risk of being used to purchase a home in Honolulu instead of in San Francisco.

Pay attention to the migration trends of your city. If enough people decide to leave, your city's real estate prices may be negatively affected. Although, San Francisco bargain hunters will likely be disappointed. I fear that for every one person who leaves, 1.2 people will take that person's place.

If you are an investor, it is up to you to identify which are the best states and the best cities to buy property for capital appreciation and rental income appreciation. Luckily for you, I've done the work and will continue to report as conditions change.

Shop Around For A Lower Mortgage Today

If you're looking to refinance a mortgage or get a new mortgage, check online. Good to check a leading lending marketplace where lenders compete for your business. Get multiple quotes in minutes. Then you can make lenders compete for your business.

Invest In Real Estate More Surgically

If you're looking to invest in real estate check out Fundrise and CrowdStreet. They are my favorite real estate marketplaces to invest in real estate and earn more passive income. Personally, I'm diversifying my real estate holdings because I don't want to manage more rental properties.

Fundrise offers diversified eREIT funds, which is most appropriate for most investors. CrowdStreet offers individual commercial real estate deals in 18-hour cities. You just have to do extra due diligence on each sponsor and build your own diversified portfolio with CrowdStreet.

They enable you to invest in real estate across the country where valuations are lower and cap rates are higher. The work from home trend is here to stay. Both platforms are free to sign up and explore.

Personally, I've invested $954,000 in real estate crowdfunding in multiple properties and funds since 2016 to take advantage of lower valuations in the heartland of America. Further, I'm earning income 100% passively, which is awesome as a dad to two young children.

Roughly $100,000 of my $310,000 in estimated passive income comes from real estate crowdfunding. My plan is to continue diversifying across America to take advantage of the weakening housing market.

Can You Get A Mortgage In One State To Buy Property In Another State? is a Financial Samurai original post. I've been helping people reach financial independence since 2009. You can join 65,000+ others and sign up for my free weekly newsletter here.

I was recently told by a mortgage lender, after approval, that a person is not allowed to use a loan in one state to buy a home in another. She stated that I would have to move to the other state first. Is this true?

We had the very same problem, working in Arizona, but trying to buy a home in Florida. Allthe morgage companies gave use problems. We dont want a house in Arizona. The taxes are too high and its a desert. My husband is a college professor, I am a piano teacher. If we can buy a home, then we can make the job switch, or rent in Az and pay a mortgage in Florida. Thee mortgage guys are impossible.

Well I guess my question was too difficult for you

What question? You just made a statement in the previous comment.

I never checked back for a reply. But since you beg the question, It was a question in the form of a statement – you simply cannot get a lender to finance out of state property UNLESS YOU HAVE A PRIMARY RESIDENCE IN THE STATE OR SOMEHOW MANAGED TO ESCAPE all the economic pitfalls and squirrel away a million dollars – which you can always use to buy a home for cash – there are millions of renters who want to escape the overpriced states and buy a small home elsewhere, but the banking laws don’t even speak to that. If you can’t afford a home in your own state but found an affordable home in another state, they won’t finance it because they assume you need to live in that state – which is not true. Many people live in one state and commute or are self employed. It’s all the stupidity of the banking industry and the Congress preventing people from creative financing. So I decided to fork out what little cash I have saved over my lifetime of living in a country that only provides benefits to the rich, then buy a small used mobile home in my preferred state for cash. And the banks and lenders can just eat any profits they would have made from me.

Hi, did you need to provide any supporting evidence so that you can get a primary residence mortgage for the Hawaii property?

Sam:

Happy to hear you’re ready to pull the trigger on a potential move to Hawaii. There’s no tech gig keeping you in the Bay Area. This isn’t the same San Francisco you moved to back in the day. Both San Francisco and Seattle for that matter have lost much of their charm/appeal they both had not all that long ago. Good luck…we’ll be watching/cheering you on.

Thanks Jon. I’ve definitely given up on San Francisco. I’m not longer a young man with the hunger anymore to get rich. I’m a father who cares most about whether my son will be nice and play with me today or not!

SF is a young person’s city.

Hawai’i suits my state in life now.

You people are going to ruin any place you go to and turn it into a shithole like San Fran, Seattle, and NYC. Stay where you are and let the rest of us enjoy the communities that we have created.

What do you mean by “you people.”

Sam,

I am sure that you already know the answers to these and are just writing a post to educate the rest of us. I figure I would throw in my personal experience with 2 out of state purchases this year.

I currently own a primary residence in TX and have lived in this house just over 8 years. I have a 30 year mortgage that I recast just to learn how that worked. Since I had it locked in at 3.75 and was up on the interest curve and only owed like 130 on it, refi actually never made sense.

I bought my 1st rental property in Phoenix in January. It was super easy. My realtor knew a good loan officer and I used him. I sent all the info needed and was approved. They did make me put 25% down and the rates were like .75 to 1 higher than a 30 year fixed for primary. I had to use an investment loan type since I would not live in it >10% of the 2nd usage. Same thing with the 30 vs 5 year. At 165k loan type I didn’t get rates good enough to make it worth the effort of refinancing.

I just closed today on our new primary residence in Phoenix as we are relocating back home. I got 3.25% with 5% down (no recourse state, so putting less in since we are at all time highs). I just had to have my boss send a note to the lender saying that my move was approved and no pay cut.

They look at your income to debt ratio etc etc. It was really no different than buying my primary residence here in TX. I just had to send a few extra papers to show my rental was occupied (this removed 75% of the monthly payment from my ratio) and some addendum saying I would occupy the house for the 1st year before I rent it / air bnb or would have to refi the loan.

I have tried to do what you say on 5/1 7/1 but at the under 400k mark with loans the rates just don’t really make it worth the effort.

Forgot to say. In my experience the loan type is based on the location of the property and not your location. Both my loans are AZ loans for AZ properties.

Hi Sam;

Glad you decided to move to Honolulu. FYI, additional insurance will be required for property located in flood zone designation such as those you’re looking to buy. Good luck!

Yes you are right! Thankfully, the insurance doesn’t seem too expensive.

Great article and learned something new which is always a bonus. I am not shocked Hawaii real estate is struggling faster than SF. I wonder how many homes for sale are Airbnb or VRBO properties that need tourism to pay the mortgage? Also vacation homes are a enormous expense and even worse when you cant visit them, but still paying all of the monthly expenses to maintain! If you can find that perfect home in paradise, and want to move the family I would go for it!

Oooh, good thing. I’m in no position to buy real estate right now, as we’ve immigrated last year and we’re not even sure we’ll stay in this neighborhood more than one more year (we depend on kiddo’s school and hub’s future job), but I’d love to have this opportunity in 4-5 years, when we’re better prepared for such a decision. And moving to Hawaii … as someone who’s been living in a “4 season” climate for 40 years, I say bring it on :D

Good luck finding the perfect property in Hawaii. I heard on the news that people are evaluating city living again. It’s a lot harder to shelter in place when you live in a small apartment/condo in a crowded city. Lots of people are looking for a bigger place in the suburb or out further. I wonder if this trend will last. I suspect the property price in Portland will fall for a couple of years, at least. SF is different. I’m sure the price will hold up there. But tech workers don’t have to live locally now so maybe that will change too. Who knows? My brother got ahead of the trend and moved to NC a year ago. He’s working remotely now.

Given that Hawaii is not locked down and they have sensible measures to quarantine incoming passengers; it is definitely the smart move. You did mention lower cost of living in hawaii. On my last trip 2 years ago; it was more expensive than San Francisco. Or maybe I was paying tourist price

Hawaii is pretty locked down and they’ve been consistently arresting visitors who violate the 14-day quarantine rule.

As a tourist, you’re always going to pay tourist prices. Main cost that is cheaper is housing.

We are temporarily moving to Alaska where we have a nice SFH (not luxurious but comfortable with an ocean view). Like Hawaii, AK also locked down more rigorously, which enabled an earlier reopen with more cautions. Seems to us it is way safer (and cooler) than NoVa, where people pretty much ignore social distancing guidelines while cases are growing. Like Sam said, with the housing cost covered at local price, those touristy places aren’t that expensive to live, while offer fantastic outdoor and cultural benefits.

But unfortunately, my job is location bound. Soon after wfh ends, possibly in September or so, we will have to come back… Lucky Sam, Go for it!

Will do my best!

I went to Alaska once and Denali National Park. A beautiful state for the summer! Also saw the aurora borealis too.

I’ve gone through my banking representative located in New York to buy an investment property in New Jersey before. But I’m really not sure if it is a NYS mortgage for a NJ property. My guess is it is still a NJ state regulated mortgage with NJ standard mortgage and note terms.

The lender was Citibank at the time and my guess is that they operate in all 50 states. Citi probably just used a NJ attorney to close the financing.

If you are going through a big bank, I’m sure they have offices all over the US and can underwrite a mortgage in all states.

Are you referring to using SF standard mortgage terms for a HI purchase? If yes, then why would you want to do that as opposed to using HI mortgage terms for an HI purchase?

I’m being quoted a 2.125% interest rate, which is very competitive. Even if it goes up, it should still be competitive versus going with another bank.

I’d rather save 3 weeks of time and stick with a banking relationship I already know, than try and find a new one in HI. When I looked several years ago, the rates were not competitive versus the mainland.

Perhaps it’s b/c there is an oligopoly there with only local Hawaiian banks. And probably b/c I would have to transfer assets, which I don’t want to do again.

Leverage your existing banking relationships.

Howzit Sam, great post. I’m a mortgage & RE broker here in HI and know the underwriter will look at the source of your income to ultimately determine the eligibility of you counting the home here in Honolulu as a primary or 2nd. Rates on second homes are the same as primary so you won’t take a hit on the pricing. In your case, shouldn’t be an issue since it sounds like you generate a decent amount of your income through FS, so you can basically work from anywhere.

Drop me a line if you need a second opinion. Happy to help.

aloha,

john

Sounds good John. What rates are you seeing for a 5/1, 7/1, and 30-year fixed at the moment for jumbo loans?

Are you seeing weakness in the $3M+ market? How is deal flow overall?

thanks

As of this morning, here’s jumbo pricing for primary/second homes:

3.5% with .125% cost – 30 year

2.125% with .25% cost – 5/1

2.5% with .25% cost – 7/1

Overall, number of transactions were down significantly during lockdown – no surprise, but we continue to see prices increasing in the overall market.

Some stats on the market from April 2020, YOY:

No. of sales -22%

Median sales price +5.5% to $809,000

Avg sales price +7.5% to $941,708

Email me offline and ill send you a market analysis of the $3M+ market depending on the area you’re looking in.

Aloha,

john

Hello John,

Would you or anyone who knows the answer to the following question please enlighten me? My sister currently lives in a downtown Miami condo and realized that quarantine life is not suitable for her growing family so they are moving to Orlando to have more space. She was scheduled to close on an Orlando property this Friday. However, underwriting noticed her Miami address and told her that it was fraudulent to get a PRIMARY mortgage on the Orlando property since her employer, a Miami hospital, is not within a certain distance of the Orlando property. Due to COVID, hospitals were under a hiring freeze so she had not officially applied for any Orlando jobs but had been invited by the hospital CEO to apply once their hiring freeze was lifted. Luckily, she has an interview in a couple of days. In addition, their loan was also flagged since her husband is taking 3-months of FMLA to take care of their newborn but still receives is regular salary. What should a couple do under these circumstances so that they can get the more favorable primary mortgage loan interest rate since they will move to Orlando as soon as she has a job?

Fascinating. I had no idea you could use it for out of state. Makes sense as I’m sure it comes up a decent amount when people know they’re relocating out of state for a new job, to move closer to their parents, etc. It really will be interesting to see how companies handle working remotely as a permanent option going forward. It really could result in more people moving to lower cost of living areas and potentially still receiving their higher cost of living pay. I know my former employer offered people to move offices from NY or SF to Charlotte, BUT they would adjust compensation down. Moving to Hawaii sounds like a fun plan. Being able to shelter in place with your own pool sounds nice!

The hype of remote work is probably not going to match the reality as it takes A LOT to move, especially if you have family.

However, there is definitely going to be an acceleration b/c if schools are closed, clubs are closed, malls are closed, and WFH is enabled, etc…. what is the point of staying? If someone has the financial means and gumption, moving to a nicer place or a cheaper/nicer place is a logical move.

Is it true that if I work in California and rent a room that I can’t get a loan to buy a house in Nashville Tn unless I work there?