If you're thinking about cashing out and walking away from your job, please don't just quit. A baby panda dies in the woods every time you quit. Instead, negotiate a severance and get laid off instead. By negotiating a severance and getting laid off, you get to walk away with cash in your pocket. If you quit, you get nothing.

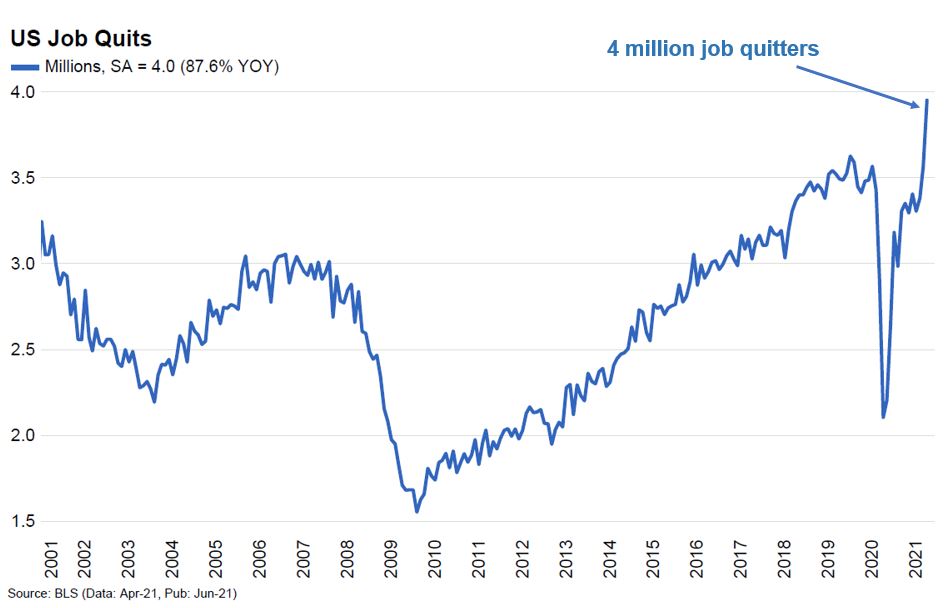

During the pandemic there's been this great resignation. Millions of people suddenly found themselves in a suboptimal situation where they had to put their lives at risk to work. Further, millions more started questioning what the hell they were doing with their one and only lives!

I had my cashing out moment in 2012 when I walked away from a six-figure job working in investment banking. I was 34 years old at the time and figured I had enough F You Money to do as I pleased. However, before cashing out, I had to plan for a full year.

Cashing Out By Negotiating A Severance

Imagine being 34 years old earning a $250,000 base salary in investment banking. Your year-end bonus ranges from $0 – $500,000, with an average of around $300,000. Walking away from over a half-million dollars in annual compensation is a lot! I bet most people my age wouldn't do so.

But I was burned the hell out. I no longer wanted to deal with a micromanager boss. Nor did I want to do the same thing I had been doing for 13 years in a row. I wanted to cash out, but I also was too afraid to walk away from the money.

As an Executive Director, the majority of my year-end bonus was paid in deferred cash and stock. The stock vested over a three-year period. Therefore, if I decided to quit my job, I would have lost at least three years worth of stock compensation amounting to multiple six figures.

Further, in 2010, management made us invest a portion of our compensation in “toxic assets” the company had invested in in 2008-2009. These investments had a seven-year vesting period. As it turns out, the investments in 2010 turned out great, but I would have forfeited their gains if I left.

The solution was negotiating a severance where I would stay on for another three months to train my subordinate. After three months, I would get laid off with a severance equal to three weeks of pay for every year worked plus all my deferred stock and cash compensation.

Management agreed. I had been at my firm for 11 years and they knew my heart was no longer in it. Management wanted a hungrier and cheaper employee. Further, management wanted a seamless transition, which I would provide.

Cash Out In The Smartest Way Possible

If you quit your job you receive no severance, no healthcare benefits, and certainly no severance. Quitting your job with only a two-week notice might actually create bad blood between you and your old employer. Never get fired or quit! Get laid off instead.

In such a strong labor market where demand for employment is so high, quitting your job will leave your employer stranded. It might take them three to six months to find a suitable replacement. Then it might take another three to six months to properly train your replacement.

Cashing out by negotiating a severance is a much more thoughtful way to leave. By trying to make the transition as seamless as possible, you put your boss's biggest fears to rest. In other words, you might even say that quitting your job is selfish. You're just looking out for yourself, like breaking up with someone over text message.

To your boss and your company, paying you a severance is no big deal, especially if you've been with the company for years. The more loyal you are, the more the company will want to pay you a severance.

A severance is simply a business expense. Meanwhile, severances are paid to lower-performing employees all the time. Therefore, why wouldn't a company want to pay a normal-performing or high-performing employee severance who has been loyal? Of course they would, especially if the employee is willing to train their replacement.

Building Enough Wealth Is The Key To Cashing Out

If you don't like what you do, then you must find ways to change. To do so, you need to get your finances straight first. This means contributing to your tax-advantaged retirement accounts, building a taxable investment portfolio, and growing your passive income.

Once you are the right financial track, cashing out becomes easier. In fact, once your investments are able to generate enough passive income to cover your basic living expenses, you are free! At this point, you most certainly can negotiate a severance and do something new.

And if you find yourself unwilling to walk away from a job you dislike, it more than likely means you have not built enough wealth. Or, maybe you don't really hate your job as much as you think you do!

It's only when you have the courage to act and change a suboptimal situation when you know you are truly financially independent.

No Regrets Cashing Out Early

Even though I left millions of dollars of income behind when I left my finance job in 2012, I have no regrets cashing out. I walked away with a severance package that paid for five years of living expenses. During this time, I was able to grow Financial Samurai into a cash cow of its own, while having lots of fun in the process!

The fear of running out of money in retirement or after you leave your day job is overblown. You will find a way to make more money if you need to. This is especially true the younger you cash out. There are so many consulting opportunities and ways to make money online today.

Working a day job is still going to be the main source of income for most. It's a fine way to make a living, especially if you like what you do. However, sooner or later, you will no longer have the same amount of passion for your work as you do now.

Therefore, you need to plan years in advance before cashing out. Once that day comes, you'll be ready to make your move without fear or regret!

About The Author

Sam Dogen is the author of Buy This, Not That: How To Spend Your Way To Wealth And Freedom. It is the best personal finance book today for those who want to achieve financial freedom sooner. The book also tackles some of life biggest dilemmas, including cashing out from traditional work to retire early or be more entrepreneurial. Here's also a great BTNT book review.

Sam started Financial Samurai in 2009 to make sense of the financial chaos during the global financial crisis. Financial Samurai is now one of the largest independently-owned personal finance sites with over one million visitors a month.

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. To get my posts in your inbox as soon as they are published, sign up here.