A bear market is a part of investing. We must accept that losing money is the price of admission. There was a terrible bear market in March 2020, when the S&P 500 tanked by 32% in just a month. Thankfully, the bear market recovered and a bull market ensued until the end of 2021.

In 2022, another bear market smacked us in the face. Inflation is running rampant. The Fed is hiking rates and corporate earnings and consumer spending will likely slow. In fact, the Fed hiked rates so aggressively and quickly that it caused Silicon Valley Bank to collapse, threatening the entire global economy!

The worst bear market in our lifetimes was from October 9, 2007 through March 9, 2009, when the S&P 500 fell by 57%. It took roughly five years after the beginning of the 2008-2009 Global Financial Crisis to get back to even. The average bear market declines about 37% over 380 days.

Losing time due to financial loss is the worst. Ask yourself how much you'd be willing to sacrifice to live five years longer. Or what would you give to be able to spend five years raising your child before never seeing then again. For many, that time is priceless.

This post will provide a bear market checklist to thriving in a downturn. Another one could easily come again with stubbornly high inflation and frothy stock market valuations. The more prepared you are, the higher the chance of surviving in a downturn and coming out stronger.

It's during bull markets when we should prepare the most for bad times!

Historical Bull & Bear Market Cycles

The below chart gives a great historical perspective on previous bull and bear market cycles. What's particularly interesting about the below chart are the regression trend lines.

Thankfully, bull markets last longer than bear markets. But when you're in a bear market, it feels terrible. It's important you do a deep-dive review every year of your finances. This way, you can understand your true investment risk profile and invest accordingly.

Thriving In A Bear Market Downturn With A Pre-Mortem Checklist

You always want to have a pre-mortem checklist for things such as:

- What to do if you get into a car accident

- What to do if your baby or toddler is choking

- What to do if an intruder is breaking into your house

- What to do if you're having a heart attack

- What to do if your spouse passes away suddenly

When disaster strikes, we often CANNOT think clearly. As a result, we tend to make suboptimal choices. With a pre-mortem checklist, we don't have to think. Instead, we can follow instructions that were created when we were thinking clearly.

Hopefully, this post will spur you into action. Here are some easy things to do now to prepare for the inevitable downturn. It's important to change your investment strategy in a rising interest rate environment.

Things To Do Before Another Downturn Returns

Before a bear market and during a bear market, here are some of the things you should do. Your goal is to become a good-enough investor so your money can take care of you in the future. Being a great investor is overrated. A good-enough investor knows bear markets are a part of investing.

1) Make sure you have enough cash to last through a downturn.

Since 1980, the three bear markets have lasted between three months and 2.1 years. Therefore, it's best you have enough cash to cover three to 36 months worth of living expenses.

Personally, I'd shoot for at least 12 months worth of expenses in cash given we're close to a record high above trend. With cash yielding ~0.5%, cash provides some returns.

If there is a downturn, you will sure appreciate your cash hoard as stocks lose big. Cash in money market accounts or Treasury bonds are now yielding ~5%. That's a great risk-free rate to protect yourself against a bear market. In fact, in my post “How I'd Invest $250,000 Today,” I write that I would allocate 50% of the money to Treasury bonds.

2) Make sure your portfolio is diversified enough to match your risk tolerance.

If you have a regular stock and bond portfolio, you should understand what the historical returns are for various compositions and be OK with the potential upside and downside.

Due to a 12-year bull market, I believe most investors overestimate their true risk tolerance either because they've never lost more than 20% in one year or they've simply forgotten what it's like. A bear market checklist helps you think more clearly.

3) Write out your investment objectives.

With each investment objective comes an investment time horizon. Once you clearly understand your time horizon, you can better match your risk tolerance.

For example, if you're investing for your child's college education 16 years away, you can afford to be more aggressive with your investments. However, if you're planning on purchasing a home within the next 12-24 months, then you should likely be more conservative.

Part of writing out your investment objectives include writing out a regular financial progress report to discuss with your loved ones. If you're single, you'll find the process of writing to be incredibly enlightening.

4) Run a Financial SEER Analysis to quantify your risk tolerance.

After you've studied historical returns and written out your investment objectives, it's time to quantify your risk tolerance through Financial SEER. Our minds often belie our actions.

Financial SEER forces you to come to terms with how many more months you must work to make up for your potential investment losses and adjust accordingly.

You also want to review your net worth asset allocation to make sure it matches up with your risk tolerance. If you are unwilling to lose 30% of the value of your investments within a year, your investment allocation is too risky.

5) Make sure your work relationships are strong.

The people who get fired first during a downturn are those who are most disliked, followed by those who are the worst performers. If you do not have a wide and strong safety net of colleagues who will go to bat for you, then you best develop these relationships now well before you need them.

Take colleagues out for lunch or coffee. Go to happy hour even though all you want to do is go straight home and rest. I have personally survived ~20 rounds of layoffs during my time in finance and I can assure you that high performers are not safe if they are reclusive and/or prickly.

A growing number of folks are going through a silent recession even though the economy is still strong. They are facing the rising cost of everything, including home prices, which is really putting a damper on renters' spirits. When a technical recession does occur, all the more reason to strengthen your network of friends and colleagues.

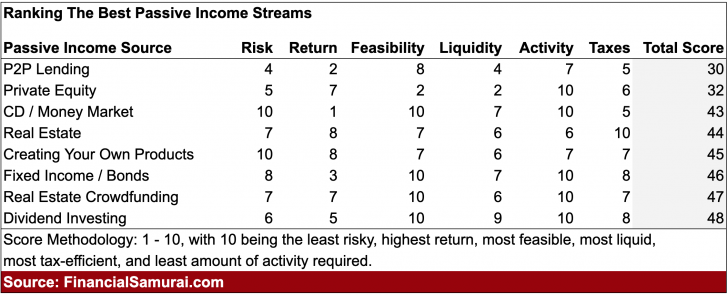

6) Have at least one alternative source of steady income.

The more income streams beyond your day job, the better. But you must have at least one alternative income stream that can help cover your basic living expenses as you try and survive tough times.

Ideally, this alternative income stream can grow if you spend more effort. For example, you might be a freelance writer making $500 a month with 10 hours of work. You could easily put in 40 hours of work a month to earn $2,000 if necessary.

Side hustle opportunities, dividends, and returns all tend to decline during a bear market. Therefore, look for countercyclical income and investment opportunities as well.

I'm personally heavily invested in real estate crowdfunding to diversify my real estate holdings across the heartland of America. Real estate tends to outperform when stocks are crashing. However, in this particular bear market, real estate will likely slowdown given interest rates have come up a lot from their lows.

My favorite real estate investing platform is Fundrise, which focuses on single-family and multi-family rental properties in the Sunbelt. The Sunbelt has lower-cost homes and higher cap rates. I'm going to continue plowing money into Sunbelt real estate because rents are continuing to go up. The long-term demographic trend is for people to move to the heartland.

7) Collect on outstanding debt now.

Defaults skyrocket during a recession. If you have any outstanding loans, you should consider collecting when times are good. If you like to invest in debt instruments, perhaps it's best to only invest in loans with short maturities. The same goes for private equity or real estate investments.

The middle-class will likely feel a tremendous amount of pain with millions of upcoming job losses thanks to an overly aggressive Fed. Although, there is upside for the middle-class as we stay in a bear market.

8) Check in with your tenants.

Only professional landlords with zero emotions can capture the maximum amount of rent when times are good. For most mom and pop landlords, we feel badly raising the rents to keep up with inflation or stay even with the market, so we don't.

However, individual landlords should absolutely treat their rental properties like a business. Check in on your tenants to see how they're doing. See if you can do something extra for them or fix something that's been nagging them to build a solid relationship.

Depending on your tenant situation, you may want to get your rents close to market if it's been more than three years of no rent increases. I have one rental that hasn't had its rent increased in three years because I feel bad doing so. It could probably earn at least $400 more a month, or $4,800 a year. But I'm unwilling to send them an e-mail notification because they've been good tenants.

Yet, I'm willing to fight tooth and nail to refinance my primary mortgage down in order to save $250 a month in interest to improve my family's financial situation. Go figure.

9) Reconsider your safe withdrawal rate during a bear market.

If you are already retired, see if you can reduce your withdrawal rate and still live a comfortable lifestyle. For example, if you've been regularly drawing down 4% of your portfolio, see if you can live off a 3% instead.

Even if you match your withdrawal rate to the risk-free rate of return, it still might be too high because your investments will likely lose money during a bear market. Therefore, the more of a buffer you can build in retirement, the more you can withstand a bear market.

The time to be flexible is during a bear market. Overall, as part of this bear market checklist, I recommend you follow a dynamic safe withdrawal rate so you can better adapt with the times.

10) Don't retire until things get really ugly. Counterintuitive, I know.

Retiring in a bull market is more dangerous than retiring in a bear market. The main reason is that we tend to extrapolate our returns and withdraw more aggressively when times are good.

If you retire in a bear market, the chances of things getting much worse are low. But if you're able to retire in a bear market because your investments and alternative income streams cover your desired living expenses, any incremental improvement in the markets and in the economy is just gravy.

You get to make max money during a bull market. Take advantage of the good times for as long as possible until things turn bad. Only after 1-2 years of living through a bear market should you consider giving up your main source of income.

11) Don't forget to spend your money and enjoy life.

If you've had tremendous gains, as you should in a bull market, you should consider taking some profits and spending some of your gains.

After being locked down for so long, consider revenge spending to improve the quality of your life. It feels great to use your gains on something that will last.

So there you have it, my comprehensive bear market checklist to survive the bad times.

Bear Markets Don't Last Forever

Although going through a bear market is painful, the stock market has made money 95 percent of the time over rolling 10-year periods since 1926. Over a rolling 20-year period, it's made money 100 percent of the time.

Unfortunately, we will all eventually run out of time. Running out of time is why I've put together a bull market and bear market checklist. Ideally, I want us to live our best lives possible all of the time.

Eventually, decumulation is in order so you don't die with too much. If you do, that means you wasted a lot of hours and stress making money you'll never end up spending. You could have used that energy while you were younger to enjoy life more.

Having to spend time to recoup losses is a terrible waste of time. As you get older and wealthier, you no longer want to worry about money anymore. All you want to do is spend time on what really matters.

Buy The Best Personal Finance Book

If you want to read the best book on achieving financial freedom sooner, check out my Wall Street Journal bestselling book, Buy This, Not That: How to Spend Your Way To Wealth And Freedom.

BTNT is jam-packed with all my insights after spending 30 years working in, studying, and writing about personal finance.

Building wealth is only a part of the equation. Consistently making optimal decisions on some of life's biggest dilemmas is the other. My book helps you minimize regret and live a more purposeful life. Whether you're in a bear market or a bull market, my book will help you thrive.

The richest people in the world are always reading and always learning new things.

Stay On Top Of Your Finances

Stay on top of your net worth with Empower, the web's #1 free financial app. Track your cash flow, x-ray your investment portfolio for excessive fees and inappropriate risk exposure, and use their retirement calculator to plan for the future. There's no rewind button in life. Make the most of everything.

Readers, what are some other bear market checklist items? How are you preparing for an impending downturn? Are you properly hedged? What could you do more of to improve your financial situation if a bear market hits? This bear market checklist should help if there's another downturn.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. To get my posts in your inbox as soon as they are published, sign up here.

M1 take a look at it. It jumped 11 T in May 2020

And is over 20T today. We have never had that much cash sitting around in a bull market or a bear market. Even with savings rate fell to 4 % in April 2022 we are still over 20T. It has to go somewhere. Why not the stock market ? Please give me your thoughts

Bear markets are the best opportunities to become wealthy IMO. The last bear market in March 2020 was insane and I was able to leverage the cash I had lying in savings to increase my DCA multifold. This has paid off big time. I am not flinching with the market being down this year. It is just another opportunity to buy at last year’s prices. Staying the course and not trying to time the market is the best strategy.

Great points to consider and agree with all of them. Networking with colleagues is a particularly insightful piece of advice. I’ve worked in at least 2 industries and it’s unbelievable how intertwined the communities are. You never know who will help you get your next job. (And don’t forget to help your colleagues out where you can.) Internal referrals are invaluable and the referrer gets a nice little bonus if hired!

I’m currently overweight in cash, which aligns with conventional wisdom of building up an emergency fund, especially in light of a potential recession as you mention. What blows my mind is the prevalent polarized opposition to cash. A large majority of FinTwit believe in keeping cash to an absolute minimum (likely given the massive recent returns and given the massive levels of inflation). I wonder how this seemingly pervasive belief will play out if a recession actually occurs.

S&P500, 1999 – 1,469

S&P500, 2012 – 1,426 and did not exceed the 1999 closing number until 2013, thirteen years later.

This wealth destruction is intentional. Using past Bear Markets as any kind of metric won’t make sense, until metrics like P/E ratio, Unemployment, Money Supply and Inflation can be compared to the same time period. The Federal Reserve has two mandates: Unemployment and Inflation. But people have now been conditioned to expect ‘helicopter money’ to save their retirement. 62% of the U.S. pays zero income taxes. Make of that what you will. Make your own happy ending!:-)

Nibbling at S&P500 and growth ETFs and plan to hold for 10+ years. Hopefully it’ll be significantly higher by then. :-)

i am not sure i understand. if you hit your SEER limit of paper losses in stocks are you saying that is when you sell everything and go completely in cash? then when do you get back in? isn’t it better to just hold 2-3 year expenses in cash at all times so then you don’t need to touch the stock portion? that’s what i do so i don’t need to make those. decisions about getting out and the harder one of when to get back in.

No. That is what your true risk tolerance is tested. If you Are OK with the losses and are willing to work to make up for them, then you are fine. It’s a discovery process. So maybe you may want to increase exposure to equity risk since you are OK.

Assessing your risk-tolerance is a discovery process, that always changes.

Interesting, I have always thought I had a low risk tolerance, because I keep so much cash (400-600k) – 2-3 years of expenses. Total stock investments about 2.6 mill. If I didn’t do that I would panic sell in times like these. Friends think I am crazy to keep so much in cash. They keep like 1-3 months.

I sold out at lows in 2010 and 2000, so lessons learned.

Financial SEER is a risk tolerance metric that compares your equity exposure, the potential downside, and how many years you would need to work to make up for the losses. I change money to time, the most precious asset.

So with $2.6 million if it declines by 35%, that’s $910,000 loss. How many months of after tax income or savings would cover the $910,000 loss? I want people to think in terms of time lost when they lose money.

This too shall pass is a good way to put it. Definitely sucks going through it, but just have to keep our focus on the horizon. I’m trying to pay down some debt and get my portfolio more balanced by putting some idle cash to work. It’s not easy putting money into the markets when everything seems to be collapsing, so I go in with small tranches little by little. Just gotta hold strong and ride out this ugly storm

“Readers, what are some other bear market checklist items? How are you preparing for an impending downturn? Are you properly hedged?”

Same as usual for me. I’m 100% equity + leveraged. Not changing anything.

This too shall pass…

I am in the military and have my funds in the fortune 500 (18% Rate of return past 12 months) and what’s called the L2050 (14% Rate of return past 12 months). L2050 basically a diversified fund that’s aggressive for those planning to retire in 2050. My question is, what would it hurt to take all my shares and put them into the G fund (Bonds) when I am sure that the recession has begun and then replace them into the aggressive funds when it seems to have bottomed out? 2008-9 bonds were at 3.75% rate of return while the aggressive funds lost -37 and -38.

https://www.tsp.gov/InvestmentFunds/FundPerformance/monthlyReturns.html?fundChoice=option3&disp=2008

If you can time the market accurately then you need to start a hedge fund. I’ll buy in. No one has been able to consistently do that except maybe the medallion fund.

I only hope that when The Crash comes, that that Thing is in the White House to take all due credit for it!

Well, now, how confusing was this comment—and how poorly did it age? Did the commenter genuinely wish for “that Thing” to be in the White House now? How shocking! Because if I’m correct in assuming the reference, “that Thing” presided over a rather impressive bull market.

Moot point, regardless, because now that The Crash appears to indeed be upon us, three years on, an entirely different Thing is in the White House, and taking no “credit” for it whatsoever.

Batten down the hatches, boys; we may be in for a long haul…

My personal Asset Allocation (at 46-years-old with around $1.1 million in retirement assets) is 75% equity / 25% bonds. I follow a 4-fund Boglehead approach to investing (all low cost Vanguard index funds). So, when winter arrives (and it will) my plan is simple. Once my Asset Allocation is off by 5% I will rebalance and get back to 75/25. Will I pick the bottom? Nope. Will I pick the top? Nope. Do I care? Nope. I have my plan and fully intend to stay the course. The ONLY deviation to this plan will be to slowly increase my fixed income allocation as I near retirement. But this will be an age based decision… not a market timing or recession timing decision.

You have done very well to have that much saved for retirement at 46! My age is close to yours, and I have far less than half that amount — and I thought I wasn’t doing too bad. I’m a bit discouraged now, but I’ll keep on. :-)

Don’t be too discouraged. At 40 I was closer to you than Ron but I increased my savings substantially and ran into a bull market.

The next downturn will come. E prepared to keep investing and you will start catching up.

Ron,

Nice accumulation to date. I’m 46 and have just a tad more in retirement funds to date. I largely agree with you less is more philosophy. However, why 25% in bonds at 46? You have a minimum of 13.5 yrs until you can withdraw without penalty and being such a good saver you will probably not touch your retirement accounts until closer to mandatory distributions at 70.5 (possibly going higher with the new legislation). Although the ride with be a tad bumpier, that opportunity cost on the 25% in bonds vs equity over 13-23 years in HUGE. I’m 100% in equities in retirement accounts and except for a 2 year cash reserve, 100% in equities in my non-retirement portfolio (mostly index and dividend paying ETFs).

One way I have created a hedge for a bear market is by investing in industries that profit when recessions happen. Example, when job loss is high, rentals become scarce because people are reluctant to buy a home in case they lose their job, or they have to rent because they lost their job and are downsizing, etc.

On the other hand, when there is a bull market, the rental also stays packed with working professionals since I have taken your advice and invested in the Heartland (Indianapolis suburbs).

Another lesser known fact, stock in the Material Handling industry (Fork Trucks) is pretty cheap and also raises during recessions (Research Toyota Industries Corp.”TYIDF”) This is because most of these companies profit from the sale of the fork truck mechanical parts. And during a recession, businesses tend to invest heavily in replacing mechanical parts rather than buying new fork trucks.

Speculation: I know the margin on storage companies is pretty high (because it doesn’t take many employees to run). I would imagine prices increase on storage rental units because recessions usually correlate with families having to move.

Please do your own research here. I just thought I would spark this little thought. Thanks for the article Sam!

Agenda 2030 is something to watch for.

They might want to sovietize the population after the crash by using mandatory greening of houses as an excuse to relocate populations to campuses of shoebox apartments. People will simply be taxed/penalized into leaving their homes. Greening will be too costly.

Thanks for the article, Sam. A lot of good things. Something for every kind of investor no matter their objective. One thing that struck me is how difficult it is to judge one’s risk tolerance in a market that has gone up as much and as long as this Bull has run. Any dip of relative significance since March of 2009 has been bought in short order. “Buy the dip” has become the mantra and the norm. I’ve been trading and investing over 35 years and I study past markets. I’ve never seen anything like this one. There’s nevery been any extreme uphoria or pessimism. Pessimistic prognosticators like Richard Rosenberg, Bill Gross and Jeffrey Gundlach, all longtime well respected investors in their individual areas of expertise have been wrong for years now. The Fed since Greenspan has overtly supported risk taking.

Risk.

It’s hard to judge how tolerant one is of it when one hasn’t seen a major downturn in years or at all in their investment lifetimes.

This is my first comment since discovering Financial Samurai, Sam. It’s a fantastic new source of information for me. Thanks for creating it.

Rule of thumb is that bears are 1/3 the length of the preceding bull. If we measure this secular bull from 1974 to 2019 then the secular bear could be 15 years. Problem is, the economy & govt finances have been financialized. Any drop in stocks & bonds & RE presents an existential threat to the fiscal status of the government. This could explain why the FFR is above IOER. Treasury supply is being channel stuffed onto primary dealers. The FED will have to step in and finance the government.

Negative rates are coming and equity purchases by the FED. Junk debt and bailouts for pensions and students as well. This is what gold is sniffing out.

“Negative rates are coming and equity purchases by the FED.”

The same thing was being said back in 2008.

Milbank

I agree. Something feels diff about this market.with the feds balance sheet at an unprecedented 9 trillion $ we are now going into a QT cycle which we have no idea what will happen. The dispersion between economists who see inflation, deflation, recession, growth is also unprecedented.

There are no places to hide. And this is worldwide. Europe, US and soon. China. This is a supply/energy/credit storm all at once. I agree with Sam about having multiple in one streams as well as a cash reserve but I think it may have to withstand a 3-5 yr period of stagflation like the 70’s. Some think we never see double digit interest rates. I think it’s unavoidable me with a concurrent major slowdown and a decline in all assets. I hope I am wrong.

I expect to increase my financial footprint by at least 20 fold with this next crisis. Negative rates are coming.

There’s no question that a bear market is coming. The only question is “when”. And frankly, I welcome it.

We’ve been culturally conditioned to think of rising stock markets as good and falling ones as bad. But that’s not universally true. If you’re a young person still working and still in the accumulation phase like I am, then a market correction–or even a crash–is like a Christmas and birthday gift rolled into one. With depressed prices, my 401(k) contributions go much farther. My $200/paycheck into my taxable dividend stock portfolio buys more dividends. Yes, as Sam said, it takes some time for the market to rebound to where it was. I would hope it takes its sweet time and gives me more time to supercharge my investments.

Market downturns aren’t good for everybody, naturally. I don’t wish anything bad on other investors. But for young investors with a long runway to retire, wealth is built by taking advantage of bear markets, not by praying they never come.

Bring on the bears already!

Sincerely,

ARB–Angry Retail Banker

Unless you loose your job and can’t find another one. Unemployment usually skyrockets in a depression.

Great article! One nice thing with all of this concern in the air is that a lot of people will squirrel away cash to invest in a downturn which can place a floor on the decline. It just seems like there has to be a ton of money sitting on the sidelines ready to go to work once the slide starts and then levels off near the low point of the recession. One can hope that the next recession is relatively mild and short-lived and maybe this safe harbor cash helps encourage that.

Nice checklist items to keep in mind in order to thrive in a downturn.

A few more items I would add onto my own list:

(1) Figure out when I should exit stock, especially in light of your regression chart.

(2) Determine in advance when it might be a good time to buy back in and the strategy used. As you mentioned, hard to make good decision when the sky is falling.

(3) Spend on the small ticket items on my wish list. Since times are good, I can do it. When times are bad, I might not be so generous.

(4) Do not spend on the big ticket items on my wish list. Need to hoard cash now to take advantage of good buying opportunities in the future.

(5) Try to create liquidity (take out HELOC, look for low financing opportunities). Once again this is to create dry powder for opportunities.

I like your 1).

As an individual stock investor, this is very important. Look at names like Tesla, once a market darling, and now sucking wind for 1+ year as fundamentals caught up to valuations. Do the work on when to get out based on valuations or other deteriorating business indicators.

And coming up with a price target with the S&P 500 or whatever index is a good idea as well.

“(1) (1) Figure out when I should exit stock, especially in light of your regression chart.”

Warren Buffett’s favorite holding period for stocks is forever. You shouldn’t be “exiting” stocks (with accompanying capital gains, loss of growth potential, loss of dividends, etc.) ever, although you should rebalance and/or perhaps shift some of your new allocations to cash/bonds/etc. if you think the market may be overpriced.

Market timing is a fool’s game. What Sam is advocating here, though, is playing defense against a potential bear market, which is just sound advice.

Quote: “If we lose 50% in our investments, we will need a 100% return to get back to even. Worse, we will also lose years of financial progress.”

This is true, but this is just one side of the coin. The other side is that if the stock market drops by 50%, it will be a great buying opportunity, especially for those of us who are years away from retirement.

Definitely. If you still have a job and have extra money to put to work.

Some people are always fully invested, and cannot take advantage of downturns when they happen. Meanwhile, some people feel tremendous fear that they will lose everything. The last thing they want to do is invest their remaining liquidity.

Unless you have a significant amount of capital to invest, that makes a difference in your overall portfolio, you should not wish for a downturn to take it vantage of lower prices.

Do you remember what you did in 2008 and 2009? That will be a good indicator for what you will do during the next downturn.

“Do you remember what you did in 2008 and 2009? That will be a good indicator for what you will do during the next downturn.”

Yes, very good point.

I continued contributing to my 401(k) and to my Roth IRA in 2008 and 2009, at the same levels that I did before the stock market went down, and I kept the same asset allocations in those accounts. In retrospect, I wish I had increased my contributions to retirement accounts during that time, but I admit that I didn’t quite have the guts to go that far in the heat of the moment.

However, I grant you that I was able to continue investing only because I kept my job through that time, and because I had a good level of emergency savings. If I had lost my job, then yes, it would have been very difficult for me to continue to invest during that time.

Good stuff. Often, making regular 401(k) or IRA contributions is the easiest thing one can do because often times it is automatic.

The hard thing to do in a bear market, is not only having extra capital, but risking that extra capital for potentially bigger returns in the market.

Regularly contributing to tax advantageous retirement accounts is a foregone conclusion no matter what the environment is.

His comment about being able to buy when the market is down sounds just like the talking heads on the TV during the great one and in 2000. In 2006 everyone was saying you should be fully invested and to buy that extra property and you are a fool to have cash just sitting there. So naturally most everyone was fully invested and buying that rental house. Then in 2009 the TV talking heads where saying now is a great time to buy, use your stash of cash to buy. How on earth could you be buying when you just lost 50+% of your portfolio and your home and rental properties are worth less than 50% of what you owe, and 1/4 of everyone lost their jobs. Unless you have your stash of cash in the bank right this minute you will not be buying when the correction comes. Or at least only buying within your 401k (new money), and with the max contribution levels of $18500 you are not getting super rich, that is of course if you still had a job.

But the world population of consumers has stops growing in 2023 and declines thereafter.

How will all these claims on wealth be honored?

“How will all these claims on wealth be honored?”

The easy solution is with currency debasement. Cost nothing. Everyone’s happy.

Who on earth would want a painful debt deflation ?

I’m 27 and have a little over $25k in my 401k accounts and they are currently in an aggressive allocation. Would it be a bad idea to move it to the conservative allocation while I wait for the recession to hit?

“Would it be a bad idea to move it to the conservative allocation while I wait for the recession to hit?”

In my opinion, yes, that would be a bad idea. No one knows what will happen to stocks in the short term. Could the S&P 500 drop from 3,000 to 2,000 by next summer? Sure. But it could also go to 3,500 or 4,000. No one knows. You shouldn’t try to time the market, especially when you have so many years for your investments to grow.

Considering that you are only 27 years old, it shouldn’t matter to you what the stock market does this year, or the next five years, or even the next ten years. Figure out what asset allocation you want to have at age 27, at age 30, at age 35, at age 40, and so on. (Or if this is too complicated, then simply invest in a target date fund that will gradually adjust your asset allocation to be more conservative as you get older.) Then stick with your plan, through thick and thin. If the total value of your retirement account goes from $25,000 to $15,000 now, when you are 27, you should be happy! Because that means that every dollar that you put in will buy more shares, as long as stock prices remain low. And when stock prices go up again (which they almost certainly will, sooner or later), you’ll have more value than you would have had if stock prices had never taken that dip.

One more thought on this: I think that when you’re many years away from retirement, it’s best not to get too attached to the number that represents your total retirement account value today.

For example, Eric mentions that he is 27 and has $25,000 in 401(k) accounts. Eric probably won’t (and shouldn’t) make withdrawals from his 401(k) accounts until he is at least 59 1/2 years old, which is more than 30 years from now. If he isn’t going to take money out for over 30 years, then why does it matter what the account value is today?

What really matters is how many shares he has of a diversified stock portfolio (e.g., index mutual funds), and what those shares will be worth when he sells them in the distant future. He probably will sell some shares sooner than 30 years, as he gradually moves to a more conservative allocation over time, but he will probably hold the majority of those shares for at least two decades if not longer. And the short-term fluctuations in value of those shares have little to do with what those shares will be worth decades from now.

When I look at my own retirement account balance, I try not to get too attached to the total account value, because I know that’s simply what it’s worth today, and I have no intention of selling today or any time soon. Instead, I try to think of my balance in terms of a range. For example, with stock prices being higher than the long-term trend right now, if my retirement balance were $25,000, I might look at that as really being somewhere in the range of $15,000 to $30,000. Then if the account value actually drops to $15,000, I hopefully won’t be terribly shocked or disappointed.

Put it all in TGLDX and forget about it for ten years.

On Point #8. I have a current tenant for a 6 year period and only raised the rent once two years ago. I’ve had bad tenants and having a solid tenant that pays on time and you like is worth it sometimes. Keeps turnover lower if the rent is a little under market as they know if they move they will pay more. I know as soon as my tenant wants to move, i’ll have to repaint and do other minor wear and tear repairs. With the vacancy time and repair cost I may lose one month’s rent. I’ll probably increase the rent again, next year but in a smaller increment.

I guess when you’re been burned once before you can be more conservative.

Yes, getting burned by the tenant is the worst. Or just having disrespectful tenants who do not pay on time and who do not maintain the property are terrible.

A great tenant is worth a lot. Thanks for making me feel better!

Currently it is almost like a two-sided market. Then always add some negative deltas to hedge your portfolio(s) to avoid getting too long. I said it before and I say it again. There are tools to assess and mitigate your portfolio risks. Very few people care to learn to manage their monies. They would rather spend more time managing their vacation planning.

Good, detailed post! As a young investor who has only been in the market space for little over 5 years, it feels almost like a dooms-day scenario to wait recession to come. However, when you invest long term, recession means that everything is ON SALE which is always super nice :)

Of course, seeing your portfolio value dropping like a bass is never a beautiful thing to see. As I wrote to my blog: Be greedy when others are fearful!

-NF

Hey man, at least credit Warren Buffet for what you “wrote” :)

I love reminders like this that the good times in the markets don’t last forever. It’s easy to forget what it feels like to be in a recession as more time passes, but I don’t want to forget. It is such an awful, sinking, worrying feeling to see money bleeding out of our accounts day after day after day with no end in sight.

I feel good that at least my accounts are much more diversified now than going into the last recession. I know I will still lose money when the next one comes, but hopefully not as drastically. I didn’t panic sell at least, so that was good. But I also didn’t buy when prices were depressed. Great reminder on using SEER and I love your focus on premortem. Makes so much sense!

Same for me. I am more diversified than I ever was. Some people would argue I am too diversified. But in times like this, it works wonderfully. Perhaps a well-diversified portfolio of investments is the “Holy Grail of Investing”.

The vast majority of my investments are down a lot this year. But I have a few outliers that are up more than +50%. So I could use some of those gains to buy more shares where prices have dropped too much.

Cash is definitely king for myself. I keep 10 years of lifestyle expenses in CD”s, munis, and corporates. My lifestyle expense includes everything I currently do now including my weekly stock purchases. When the market drops, and it will, I don’t want to miss out on the inevitable stock sales.

As my stock portfolio has grown over the last 25 years the only way I can sleep at night is with a large cash buffer. During the Great Recession, Cramer said don’t invest any money you might need in the next 5 years. I decided 10 years works better for me.

it’s always good to be prepared for anything, not just in terms of retirement, definitely a good idea to cope with the upcoming markets and also be humbled by what’s to come