During market panics, debtors and investors win, while savors lose. Let me explain.

I'm feeling a little sadistic right now. A large part of me is hoping the equity markets take a big dump again before the end of summer. Bring on the pain baby!

I thought I was absolutely done with refinancing my primary residential mortgage in 2010 when I got 3.625% for 5 years. But, I just called my banker on 2/3/2015 and he says I can now get 2.25% jumbo and no points or fees for the same duration! Because I would simply refinance with the same bank, the process would be streamlined since they have all my documentation.

What is this world coming to? Who does that, putting more money in the pockets of consumers who never asked for it? Why save me thousands of dollars a year in interest expense when there's a guy who's been out of work for over two years and needs it more?

If I do the refi, living in my house will be cheaper than living in a 2 bedroom rental. Something is wrong with how government policies are working. The more the Fed and the Treasury meddle, the more unintended consequences result.

Those with debt are the bad guys right? We're living in houses we can't afford to pay in cash, and we refuse to live in crappy rentals whose landlords never do any updating. Debtors are living it up because they can, and know there's only one life to live.

There's no point making money if you aren't spending your money. Meanwhile, savers are getting squeezed as their rates head to 0% and their equity investments go down the tubes. Debtors are being rewarded again for living beyond their means and that's just fine by America and our politicians.

Market Panics And Cheap Money

I had 2.25% to lock down during the most violent of +/- 400+ point swings, but I got greedy and wanted another 1/4 credit from the bank i.e. they pay me 0.25% X value of my mortgage. The loan officer's manager wasn't in, and I decided to wait for her to return so we could get down to business.

If the equity markets rally, and the bond markets sell off, rates rise, putting me at risk for even getting my 3.25% locked, let alone getting a 1/4 credit. However, with the amount of volatility in the markets, I figure I'm hedged. If the equity markets go up, great, that's good for the equity portfolio and the economy. And if not, “Hello juicy refi!”

At “no cost” (costs are just embedded in the rate), I would be saving hundreds of dollars a month for the remaining 5 years of my loans. A 5/1 ARM is the duration I like to borrow on the yield curve, and a time-frame where I can comfortable pay off my loan if necessary.

It's generally a good idea to match fixed duration with the length of time you plan to live in your home. What we all should have been doing over the past 10 years, however, is borrowing at the shortest end possible since rates have done nothing but go down.

With the Fed telegraphing they won't raise their Fed Funds rates until mid 2013, all of us literally have a green light to borrow at the short end of the curve. For example, those who qualify can get a 1 month floating rate mortgage for only ~1.5%!

That is some serious savings, even compared to my 5 year fixed rate of 2.25%. For those who know they plan on selling or paying off their homes at the end of two years, go for it. I plan on owning my house for another 5-10 years, and don't particularly like the process of refinancing so the 1 month floating loan isn't for me.

Borrowing Costs And Asset Values

Remember, at today's 10-year risk free rate of ~1.8% as of 2/3/2015 (<1% in 2021), every $200 decrease in interest expense (or increase in cash flow) is like having an extra $100,000 in the bank.

In other words, if you had $100,000 in risk-free US 10-year government bonds, you would generate $2,400 in interest income a year or $200 a month. Or put it another way, if I am a home buyer and it now costs $200/month less to own the same home, I can now afford to finance a house that costs $100,000 more.

Interest rates are a critical element to housing, consumption, and the overall economy. This is a very important concept to understand. The Fed has never before given such clarity in their interest rate policy. I believe it is a good move because when people know what their future borrowing costs are, they tend to spend.

It's the same thing with taxes. A temporary tax decrease does nothing because most people would save for the impending tax increase. No wonder why senior corporate leaders and small business leaders have no desire of hiring people, despite tremendous balance sheets.

Here's hoping to a 1 hour market meltdown, a locked in refinance during that time frame, and then a recovery! I'm ready! Are you?

Important point: The last time the 10-year yield was at 2.25% was in 2009 when the Dow was under 7,000. The world was ending then. It is amazing to see yields at such levels with the markets 50% higher! In other words, we are much wealthier now and yet, get to borrow money at Armageddon levels.

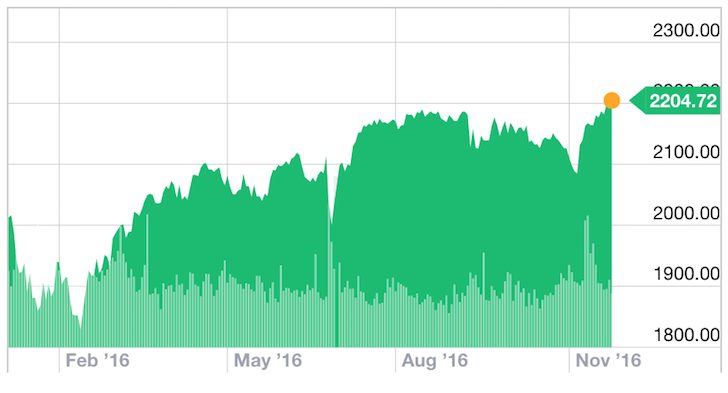

After each of the previous 10-year yield dips, you saw the Dow rally a full year afterward. With the S&P500 yielding 2.4%, I have been buying the markets aggressively close to S&P 1,100 / Dow 10,800-11,000 levels.

Blue line: Dow Jones. Green Line: 10-year Treasury Yield.

Recommendation To Counteract Market Panics

Manage Your Finances In One Place. One of the best way to become financially independent and protect yourself is to get a handle on your finances by signing up with Personal Capital. They are a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize your money.

Before Personal Capital, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances on an Excel spreadsheet. Now, I can just log into Personal Capital to see how all my accounts are doing, including my net worth. I can also see how much I’m spending and saving every month through their cash flow tool.

The best feature is their Portfolio Fee Analyzer, which runs your investment portfolio(s) through its software in a click of a button to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was hemorrhaging! There is no better financial tool online that has helped me more to achieve financial freedom. It only takes a minute to sign up.

I always found that 30 year thing ridiculous…

I’m taking advantage of a 2.30% variable rate right now and see no reason to pay down the mortgage faster. These low interest rates are ridiculous, but they also help me out as a debtor. Why not a fixed rate? Because it was around 4.5% to 5% for 5 years at the time I was looking, and I’m sure that the variable will be lower than that for most of the next 5 years. After that we’ll see. At the same time I am saving a lot of income, though with rates so low this is more of a long-term thing. I wouldn’t mind if the markets go lower.

Wow, 2.3% is AWESOME! I would totally do a one month floating rate too if I could get a bank to lend me the amount of money I want to borrow!

Our house is totally paid off too. We’re retired, in our 60’s & didn’t even think about taking money out of our house. Since it was always our goal to have it paid off in retirement it seems counterintuitive. (We don’t plant to move or downsize.) On the other hand, it’s cash we could use for travel. Hmmmmm . . . that sounds so irresponsible.

Nice job Maggie! I don’t think you’ll regret the travel when you look back on your life at all!

Thanks, Sam! We are planning some trips (including some big ones) using our savings. At our age we can’t postpone travel indefinitely! That’s a weird feeling, since we still feel like we’re in our 20s. We just try to keep fit as much as possible so we can do what we like.

There is something to be said for always having money on the side to exploit panic opportunties. I have a friend who’s pretty wealthy that sold his house back in 2007 and he’s been renting ever since. They’re not the types to “rent” really. They have a lot of money, live in suburbia and have kids. But he’s been hanging on for that final massive housing crash. When and if it comes, he’ll be able to buy a $2 Million home in the heyday for $500K. I guess it will have been worth it.

As far as what the Fed’s doing, they’re just pushing cash into risk assets. Should have been obvious to everyone, wish it were moreso to me early on or I would have leveraged further. Can’t fight the Fed!

Can’t fight the Fed indeed. Calling the broker this morning and asking for that 3/8th credit with the 10-yr at 2.04!

Let’s go market massacre!

It’s good the Fed’s being clear because the markets got walloped after the credit rating drop. Great point about us being richer, but still get to borrow at Armageddon prices. Looks like things are turning around, but a little scary as we came so close yet again to Armageddon!

We didn’t even come close to Armageddon Buck! Thanks to Bernanke’s rate telegraph, perhaps several hundred thousand jobs will be spares this yr.

That’s true. Guess we’ve been pretty lucky kicking the can down the road. Wonder if one day we will really hit Armageddon where we have no moves left. Will the US ever get checkmated?

We will never go down. We have too many nuclear weapons!

No mortgage, lots of savings and investments. Low interest rates suck!

Indeed, low interest rates do suck, which is why you’ve got to save on the long end of the curve and borrow on the short end.

At least our savings are above a 0% return this year vs. stocks!

Agreed …. and I would love to be borrowing. However, I am half of couple and the other half is v-e-r-y risk averse (and also right a lot of the time!) So I probably won’t participate in the borrow this time – although I would love to dive into the real estate bargains!

Time to buy your first mansion JT and short treasuries by going long a mortgage!

My 30 years mortgage is already at 4.5%. I’ll check around and see if I can get it any lower. 20 years @3.25 sounds great!

4.5% is pretty darn good Joe. Might as well call and see anyway. I’ve seen conforming 30yearfixed rates close to 4% now. If youcan get that, with a less than 13 month break even period, I’d do it!

I tried to refinance my 15 year mortgage recently, but it did not make sense. My existing loan is 5% and I was offered 3.1%. Normally, the difference in interest rate would signal to refinance, however I have a very small balance. The small balance offsets the difference in interest rates.

Am I wealthier now versus 2-3 years ago? If you compare 2008 to now, yes! Is that reassuring? No! I have a long term plan and monitoring my progress is a little disturbing. As with any plan, I will adjust my effortto meet my milestones.

Time to borrow some more! The more you borrow, the more you save :)

We’re all wealthier than in 2008-09, yet we get to still borrow at Armageddon levels. Awesome!

You are right! It is a great time to get the cheapest money in my lifetime! If I were considerably younger, I would do it. The problem when ou get old(er), you become more conservative and less willing to take chances. I may be missing out on a n opportunity, but I have less time to regenerate the nest egg. Also, I have real desire to start an active business or use borrowed funds to invest. In fact, my wife and I talked about this lat night. Being comfortable financially has its benefits.

I am doing better than 2 years ago. Haven’t done much investing lately but I did rebalance my 401k to lock in some gains. Good luck with your refi. That’s an awesome rate!

You will never lose if you lock in a gain! Good job!

I’m taking advantage of the interest rates now and refinancing my 30 year mortgage at 5% into a 20 year mortgage at 3.25%. My payment only increases by $5 per month, but it will save me almost $200,000!

That is sweet and so cheap for a 20 yr! Nice! Hope the break even cost is short. And to think, you were probably ecstatic at 5%!

Let cheap money rain!

I was ecstatic at 5% two years ago! And it is with my same bank for no points or fees! Sweet deal!

I can’t see how keeping the rate at 0 will boost things much at this point, since people are so used to it. My worry is that we are setting people up for yet another debt crash by allowing them to believe this is the “new normal.” My question is that while we have all seen the charts showing that variable rates will save mortgage owners money 90% of the time, could it be the best policy to lock in a 10 or 15 year mortgage right now at 3.5-4%? The historical average is around 7% (in Canada anyway) and I worry that eventually all this increase in the money supply will lead to some inflation. I’ve always said “I will have the courage to stick it out with variable rates,” but I’ve been more and more curious as to if it would make sense to lock in long term right now.

Also, as a sidenote, if the Feds take away the sweet mortgage-deductible tax break you guys get down there, we have something called the Smith Manoeuvre up here in Canada that smart investors having been using for years to essentially make their mortgages tax deductible through home equity lines of credit. I guarantee it will be worth talking about with your advisor if that political gambit succeeds.

Hi Mate,

Gotta admit, it is sweet to be able to deduct the interest on $1.1 million of mortgage on our incomes! The more you make, the better it is due to a higher tax bracket.

We’ll never lose the mortgage deduction bc ~65% of Americans own their own homes, hence the majority will just vote it down. I heard of the Smith M though!

Rates have been going down for 30 years in a row now. If there is big inflation, that’s alright for homeowners too as their homes inflate in value & incomes inflate by definition.

Sam

Since you guys have the option to lock in such long terms, then why not? In Canada the rates become prohibitive once you go to the 10 year, and I think that’s the longest term you can have.

On the other hand, isn’t this what destroyed the banks in the S&L crisis of the 80s? If the rates do go up, someone has to eat the loss. Seems like a big risk to loan out 20 to 30 years for such a low rate.