To achieve financial independence, everyone needs to boost savings and control spending. Once that's done, it's time to maximize earnings. The wider you grow this gap, the wealthier you will become over time.

The only problem when you boost savings so much is that it may begin to burn a hole in your pocket after it exceeds a certain threshold.

When I was a kid, I remember it was always hard to save a $20 bill my grandmother gave me, so I spent it instantly on candy and coin-op video games. Since then, I've built up a tolerance against spending any cash under $50,000. I've seen too many missed opportunities and financial tragedies to not have a decent financial cushion.

My tolerance against spending is being tested with a 4X accumulation of what I'm used to because I don't see many good investment opportunities now that the markets are at record highs in 2019. At least cash nowadays is yielding a healthy 2.3% from an online savings account.

I suspect many of you will be tempted to spend some of your extra money on wasteful things as well. It's like going all day without eating and then denying yourself a freshly baked apple pie in order to continue starving yourself. Why punish yourself?!

Daydreaming Of How To Spend

I've thought of a number of things to do with my excess savings:

1) Pay down $180,000 of mortgage debt. Boring! But the responsible thing to do.

2) Buy a $195,000 Bentley Continental GT. Fun! But completely ludicrous for someone with only $200,000 saved. You'd need more like $2M in liquid cash to buy a $200,000 car.

3) Give $20,000 to my in-laws. Definitely a good thing to do, but I'm being met with resistance as they are too proud to accept financial help. I'll figure out a way to give them some money through gift cards at places they shop.

4) Pay for a $20,000 – $30,000 around the world cruise for my parents who are happy with an inner cabin room after the pandemic is over. I want them to enjoy a room with a veranda so they can see and smell the ocean breeze. But my parents are also frugal and never seem to want any financial gifts from me. Maybe I should just give my editor dad a raise. Oh wait, that requires paying extra taxes. Forget that.

5) Build a 700 sqft extension to my house for $200,000, even though I'm perfectly happy living in ~1,910 sqft of space. The extension would add at least $400,000 in value, but it would be a stressful year long project. Always focus on expansion over remodeling if you want to create more value to your house.

How About Some Really Fun Things?

6) Buy a more reasonable mid-life crisis 2011 Porsche 911 GTS for ~$65,000. Sounds like a good deal compared to a $195,000 Bentley Continental GT.

7) Continue saving for the winter of 2020/201 when I anticipate the housing market will be the slowest so I can have the option of buying another property. Real estate agents and buyers are currently in denial, saying, “Only the $3M+ housing market is soft, everything else is strong.” Hello. A downturn always starts with the top and works its way down.

8) Invest $200,000 in Personal Capital, the leading digital wealth advisor for retirement so I don't have to think about what to do with the money. Automatically paying and investing yourself first is what everybody should do. You can at least get a free portfolio construction tailored to your risk tolerance without having to fund the account.

9) Do a combination of wise and wasteful spending.

It's actually fun to think about all the things to do with excess cash. But it's the idea of spending that gets me excited rather than the actual spending. After being frugal for so long, spending money actually kind of hurts. Please tell me some of you feel the same way!

Paying down debt might not be very exciting, but it's the responsible thing to do. Whenever I buy or invest in anything, I always fear feeling like an idiot because the only way to lose money is by actually deploying it. You may lose to inflation, but that would be different from my recent experience of losing part of my investment because of a 50% decline in Twitter stock.

Controlling The Urge To Splurge

Building wealth is all about exercising good money habits. Discipline is key. For those of you with excess cash or who want to boost savings, here are some easy tips.

1) Calculate how much in gross income is needed to buy.

To buy a $50,000 car takes about $75,000 in gross income at a 30% effective tax rate. At a 25% effective tax rate, it requires $2000 in gross income to purchase the newest $1,500 TV. Take whatever you want to buy and multiply it by 1.5X to see how much it really costs before tax. Suddenly, what you want to buy doesn't seem as affordable.

2) Calculate how many hours of work it takes for you to buy.

This is where being a freelancer is advantageous because we are generally more cognizant about the relationship between our time and income. To buy a $65,000 second-hand Porsche 911 GTS will take me 2,600 hours driving for Uber at $25/hour after operating expenses.

Let's say I drive for 40 hours a week, it would take me one year and three months. But wait, I still need to pay taxes on my $25/hour, so it will really take me more like 1.8 years of driving to just purchase the car. Calculating required labor is one of the best ways to restrain spending and boost savings.

3) Automatically pay yourself first.

So long as you are maxing out your 401k and saving a certain percentage of your after tax income before spending a penny, you've basically got carte blanche to spend however you like with your remaining money. Automate your way to boost savings.

One goal I had for 13 years was to max out my 401k and then save 100% of every other pay check and 100% of my year end bonus. Since I was paid twice a month, I ensured an easy way to save at least 50% of my after tax income every year. After the first year, living off one paycheck became just a way of life. Given it became easy, I pushed myself to save even more.

4) Compare yourself to different people.

Appreciate what you have and recognize how fortunate you are compared to the billions of people who weren't born in a developed country. Making more than $35,000 a year puts you in the top 1% of global income earners.

According to the United Nations world food program, some 795 million people in the world do not have enough food to lead a healthy active life. As soon as I moved to a less expensive neighborhood in 2014, I felt much happier because there was less ostentatious wealth.

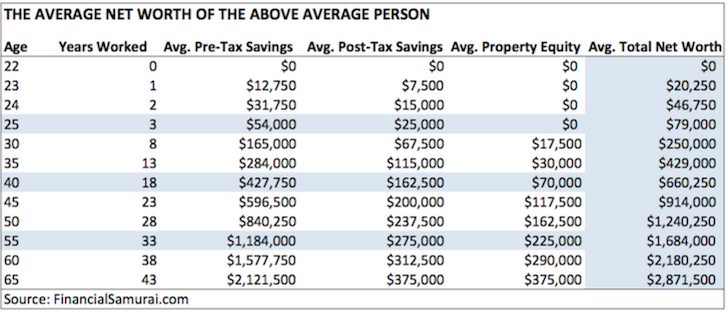

Alternatively, you can try and really motivate yourself by comparing your career or wealth to other people your age who are doing better and have more. Tell yourself, “Only until I get that promotion or reach a certain amount of net worth will I buy XYZ.” Here's a good net worth guideline by age to shoot for.

5) Establish a goal that must be achieved before spending a penny.

I've always told people who object to my 1/10th rule for car buying, “If you want to buy a $30,000 car, why not just try and make $300,000 first?” Then they get pissed off for some reason. By tethering your desires, you force yourself to achieve certain financial goals before wasting money.

You might just find that after spending all that time earning or pursuing a goal, you'll lose your desire to splurge! I've already created a mid-life crisis investment fund for a fancy car that I doubt I'll buy. You can create other goals like losing a certain amount of weight or finding a life partner before splurging. Boost savings to meet your urges.

6) Visualize the opportunity cost of your purchase.

If the total return (principal appreciation + dividends) of the S&P 500 averages 7.2% a year for the next 10 years, you will have doubled any money you invest today in the index. Therefore, the $10,000 vacation or $65,000 luxury car you buy today might be worth $20,000 and $130,000, respectively in the future.

Thinking about opportunity cost is the hardest way to prevent spending, because what you give up is so far in the future. Therefore, you should run your finances through a retirement calculator so you can visualize whether you are on track or have a ways to go. You should input different future expense and income variables to see what works.

It's easier to boost savings when you use a free tool like Personal Capital.

Boost Savings And Invest Wisely

The reason I love simple financial guidelines is because it cuts through all the noise and gives people targets to shoot for. If you can amass a net worth equal to 20X your average gross income, I'm pretty sure you will experience financial freedom and never have to work again.

If you're finding it hard to resist spending your excess cash, couple your good money decisions with your bad money decisions. Always be mindful of Financial Yin Yang.

In case you're wondering what I did with my excess cash, I ended up investing $550,000 of it in real estate crowdfunding to take advantage of the lower valuations and higher net rental yields in the heartland of America. Fundrise is the best real estate crowdfunding platform with a variety of highly vetted offerings.

I think there's going to be a multi-decade demographic trend away from expensive coastal cities due to technology and the rise of remote work. With higher yields and no work involved, I'm a big fan of real estate crowdfunding. Fundrise is free to sign up and explore.

For more nuanced personal finance content, join 50,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009. I help people get rich and live the lifestyles they want.

I recently found this website and I will take some time to see what benefit I can glean. Some of the figures you state are way out of my league. I’m 63 and for the first time in my life earned $50K in one year in 2018. Lots and lots of overtime made that possible (I am hourly). My wife (retired) and I owe $189K on our house (started at $305K). We have to be extremely frugal, but I am finally seeing some light after years of struggle. I don’t mean this as a ‘woe is me’ story, I’m just wondering if these principles can be applied for lower income folk like me. I am working to get rid of what most would call modest credit card debt (although it bugs me personally) and throwing what I can into savings along with my 401(K). If there’s a section for someone like me, please let me know.

I’m having a big issue resisting the splurge.

I already have all the luxury items I want (nice clothes, nice camera, nice cooking gear, shop at whole foods/farmers market, etc)

I am maxing 401k

I am saving 20% after tax

I have good equity in my home in a good area.

Not sure what to do with all these savings. We don’t plan on having any children, I’m sure I could retire early, but as I have read in one of your earlier posts, it’s no fun when the rest of your friends are working.

I feel a hole burning in my pocket with all the extra cash. I need to resist the urge to do something sporadic like buy a vacation house.

Great Post! This is Insane Value! My real question is how are other people sharing hate over free high value content?? I just stumbled upon your site today and the information is literally life changing. Literally. I can’t thank you enough. For all you haters, y’all are idiots, fucking morons, mind my language. This guy is awesome!

I can’t understand half of what you’re saying Sam, but I’m about to read every article on your site, religiously. For a broke dude from an inner city this is nothing but motivation when I make more multiple streams of income, buy my dream house and save $100,000 from the goose egg of today. I will credit that to you. Salute brother!

Thanks Manny! May your financial journey be a fortuitous and prosperous one. It’s always nice to have new readers on Financial Samurai. It’s been a fun and long road since I first started the site in 2009 during the crisis.

You may enjoy this post:

Abolish Welfare Mentality: A Janitor Makes $271,000

Please, I give credit when’s it due! Thank you sam, I hope the same for me and your future endeavors also, PS what a read, I’m printing out your abdunance post. Sorry not sorry haha . Take care my friend.

I have been saving about 40% of my after tax income for about 4-5 years now (usually adding up to about $60k-$70k give or take at the end of each year). At this point, I actually get more excited thinking about what kind of asset I am going to buy over what kind of toy I could buy. As much as I love luxuries, I couldn’t stand the thought of buying a brand new Bentley and just watching the value just get utterly crushed year after year. I would much rather buy a nice piece of cash flow real estate, watch it appreciate over the next 10-15 years, then pull out some equity through a refi and buy another piece of cash flow real estate. The thought of pyramiding my wealth gets me so much more excited than 1 single toy I could buy today. At some point, I imagine I will be bringing in enough income each year that a $195k Bentley will barely make a dent in my income… At that point you can expect me to have a variety of high priced automobiles ;)

I usually try to have 4-5 yrs in expenses in a mixture of cash and munis. Beyond that, if you find nothing, real estate is always a decent way to go. Not on the coasts, midwest, south, etc, places with commercial leases yielding 6-8% for decades. Buy, put a small amount of leverage on it if you want, and earn. Usually it is best with at least $500k or so invested, but that is a goal!

I make 500K+ a year, my wife just got a job and will be making 60K + benefits.

Plan: Invest all my income, max out her 401K, and live(survive) off the rest for the next 3 years.

Goal: Save a million dollars in 3 years.

My wife just stares at me when I tell her my idea, she thinks I’m insane but she is a saint though, she is with me on this. It will be extremely difficult as she will only be making 19000 after taxes and maxing out her 401k.

how old are you and line of work?

Excellent points.

Whenever I’ve extra money (I’ve always extra cash) and pass by some car dealership or I see the latest mobile phone, I feel the urge to buy.

Here comes my second thought, it’s a kind of defence mechanism build in my brain.

Do I need that shiny new car or cell phone?

I start to elaborate, for a car my thoughts go along these lines:

– How much cost in insurance?

– Petrol cost (usually nice cars have big engine)

– Cleaning costs (you want to show off your nice car well polished, isn’t it?)

– Parking problems (nice cars are big and difficult to park if you live in the city)

– What I need a new car for (here I think like you Sam, going from A to B… any car can do the job).

Instead of thinking:

– I can show off

– I’m succesfull and I’m going to show the world

– I feel proud

– My neighbour will envy me

Nothing make me more excited than investing the extra cash and see my little soldiers work hard for me… The more they work, the less I work…

Forget all the materalistic things in this world, we don’t need them.

Don’t take my word for it, instead go for an holiday in the Asia’s countryside where farmer are living an happy life with a modest income but are very happy.

I started with a pre owned Jetta, then bought a new CRV, just got a new RWD BMW 228i a few months ago. The drive is worth every penny. It’s not that expensive either, 34K. It’s like flying economy vs first class every single day. My colleague bought an M5, 0-60 is 3.6 secs, costs 120K. He brags about it every day, I just enjoy my drive, 0-60 in 4.9 secs!

unless you just started to make 50kk, ehich you probably started from the bottom, you could afford pretty much any car. if not why?

how does your colleague is bragging about a 120k car? when most of you probably earn about the same?

anyways what line of work you do to make 500k a year? i have to step my game up, i was thinking about 500k almost for 2 weeks now. i think is doable in 2 years for me.

Agree with the pessimistic outlook on stocks, but real estate always has promise depending on the area. I have some cash burning a hole and am aiming to buy a place purely to rent it out on Airbnb. With mortgage interest tax benefits, it should yield 15-20 pct, but I do live in a city with lots of business and tourist demand (which also means high purchase prices). Fortunately, I am in no way tempted to buy a Porsche. And I live in one of those states where P2P is banned, which is a bummer.

Tethering, opportunity cost, and comparison are my go-to techniques for controlling my urges to spend. Typically, tethering helps me to avoid the splurge, as even when I have reached the associated goal, I no longer feel that I NEED the related purchase. Sometimes I wonder if it is all a psychological game I play in my own mind in order to remain motivated.

At the end of the day, I continue to believe that success in personal finance is behavior-driven. Maintaining sufficient checks, as you outlined, to encourage wise behavior is the ticket to winning.

Currently, eliminating my graduate school student loan debt is my primary tether. I don’t have plans to let myself go crazy when it is paid for at the end of May 2016, but I would like to live a little. I am afraid that I will experience spending guilt when that time comes, as I have lived somewhat frugally for the past several years.

I control my spending by being too busy to spend it right now. I wonder what I will spend like when I am not working as much. Hopefully I will remember all the ridiculous time I put in to achieve financial freedom, and show respect to the work I did.

I have this disease right now of always imagining the opportunity cost of everything I buy. I actually sit there and do the math. Its kind of scary. I totally agree about charity. Here is my advice. Save 50% for the Real Estate opportunity, spend 5% on eating out, give 20% to charity (you will never regret it), invest 15% into a new money-making passive-income idea, invest 10% in the stock market. Don’t pay down any debt yet – that is truly boring! Interesting article as always.

I have the same disease!!! If I can invest in this business upgrade and get a 25% ROI half the time it’s a no brainier. The $50k I would spend on a car would be a waste compared to that. – The curse of seeing high ROI’s

2017/2018 is coming up soon! With how long it takes to reach the bottom, we would likely need to see something get started in the short term. A crashing economy doesn’t look good for democrats, which means Trump gets elected. Then who knows what will happen to the world….

While my number isn’t nearly as large as yours, hack off a zero, I’m currently in the same predicament. A house we were looking at fell through, and we’re no longer in the real estate market right now. I’m no where near financial security at this point, so I will be prudent and put some money into P2P Lending and some into paying off debt. I’ll leave the rest of it available in case something enticing comes along.

If I were you though, and in your financial situation, I would say let loose! Buy that Porsche. You’ve mentioned wanting one in three or four articles over almost six months! But if you’re still not keen on the market, why not buy a few option spreads? You think your portfolio is going to decrease, so write some calls or buy some puts. If the market goes up, your portfolio does too and you eat the option fees. If it goes down, you offset some of your total losses.

You suggest the SFR market will decline…what are your thoughts about the multi-family residential market.

I guess it all depends on what you want to do in your life. I am a business analyst, and I always deal with requirements. And that is the toughest part to do in a project.

If it were me, and I have 200K to deploy, I would drop it in VTSAX straight cash. But that is what I want to do.

Thank you for all that you do. Much respect.

I like your conviction in VTSAX! Sadly, I’m not looking for more equity exposure now. I’m looking for less debt and more cash. I truly hope the markets continue to go up. I just see various crumbling sin the foundation.

Definitely a #2 here – when you spend so much time at work, it’s easier to relate the cost of a purchase to the number of hours, or days, required to pay for it. When you’re trading a finite quantity like time for something of potentially limited usefulness, it casts the trade off in a very clear light.

Sam,

If you want to spend some money on a depreciating asset, I’ll give you some individual stock picks. All of mine tend to lose value over time!

Thanks, Bill

LoL!

Right on! I’m right there with you blowing myself recently on some picks. How about them Apple stock at a two year low!

The best thing everybody can focus on is asset allocation in index etfs, while spending their energy earning through their job or entrepreneurial activity.

Sam,

I recently signed up with Prosper and am trying P2P lending. I am avoiding the AA A and HR investments. Any pointers/strategies that you look at with P2P? I wonder if Lending Club might be a better option long term because they seem to have a larger user base and a larger investment base to work with.

Funny you should mention LC, their stock is down 40%+ this week (!) as their CEO stepped down due to some impropriety. I would hold off on investing with LC for now if you insist on going with LC.

Thank you for the head’s up! Luckily, I didn’t choose LC, so maybe I dodged a bullet there.

I bought shares in the IPO. Not my finest move.

I’m looking to get into Prosper. Why are you avoiding those types of notes? Isn’t A and AA the safest.

Suggestions on where should I be putting my non-deductible traditional IRA money in the near future if REIT isn’t looking so hot?

Still in college so I do not have these kind of savings but I resist spending as I have been putting a lot of my money into stocks. I have an emergency fund and about 10% of my portfolio sitting in cash for two reasons: I am about to enter the working world and need some extra cash and secondly in case the market suddenly pulls back I want to dive right in so I do not miss out on the gains.

I’m on track to save about 30k a year for loans/saving. After working for 6 months straight out of college and paid 10k student loans already, I still don’t feel uncomfortable to shell out 1.5k for a new gaming computer (which should last 5+ years and i do game a lot as a cheap hobby). Although I have set aside 5k for vacation/fun spending this year, it’s the fact that i see no to little return (except for relaxation) in this investment that drives me kinda nut. Seeing how my friends who makes less and spend a lot more (after 4 years of bachelor), i wonder how people can really do that. However, one can argue that 100k in salary (total) isn’t much for a single person in the san jose/south bay area. I don’t feel richer since I graduated college (scrapping on 20k total a year in LA). I guess the only thing I really spend on so far is decent food, which is due to the fact that I eat outside for the most part (work pretty long hours). At least, I have that going on for me.

Currently, I’m renting a room for $550 and live like i did during the college days. I hope with good investments and wise spending, i will be able to afford a house before my 30 in silicon valley.

Living like you did during college for as long as possible is a good strategy. I lived in a studio w/ my buddy for two years in Manhattan. I figured, why not save money b/c I was working to much to enjoy my place!

Keep your frugal habit for as long as possible. You won’t regret it.

Hi Sam,

Your posts have been quite helpful for me. As a 23 years old male, I think we all have that clock ticking on top of our head. We may as well spend our money wisely, and stop wasting our seconds and energy to get that money back. Now that I’ve followed the site for a while, I approach everything with an investment mentality. I ask myself (aside from under 15 dollars meals) what does this investment give me back in return.

I may as well continue to burnout my 1997 infinity car (lend, not even mine), and invest in a decent, passable car for uber on the weekend on top of the current salary for the future. It should be a great way to improve my people and social skills :)

I think investing the money is the most sound of all the options especially biding your time like a spider, lying in wait for the unsuspecting housing market. Gifting people money seems a wonderful idea that is until you see them spend it. Unless of course you are one of those rare souls that can let them spend the money and not pass judgement or feel remorse as you watch them buy frivolous items like cellphones and clothing instead of paying for education and utility bills (but then that’s not your parents or in-laws current problems).

As for the cars, I think you should follow your full throttle “male” instinct if that’s the option you choose.

Having grown up in a house that is STILL a building project, I would say an emphatic NO! Just spare yourself the punishment and torture. However, you could burn some money by “greening” your house. One day, when I make it, I want a solar geyser, to be independent of the municipal grid (running on solar), a jo-jo tank to harvest rainwater and my own composter (worms away!) and bee hive (the see-through one with the tap I saw on crowdfunder :D ).

I like the ideas for controlling the urge to splurge. Admittedly I’ve only thought about and follow number two. It’s been my biggest motivator. Before I spend, I think of how many hours I have to spend in a hostile environment just to make that money. It’s reined in my spending habits and made me aim for more.

Hi Sam,

Thanks for this post. It really got me thinking. I resonate with your remark where you mentioned that once you became more mindful of your saving and spending habits that it hurts to spend – this is true more so in the last two years…I kinda don’t like the feeling.

What helps me stop spending money mindlessly is thinking of it from a value for money perspective. If I purchase a jacket, I think how much use I’m going to get out of it. My five hundred dollar jacket has lasted four years wearing it daily for four months of the year. That works out to a dollar a day and will become less with time. Or if I contemplate another car, I figure out how much driving I’ll actually do and work out the cost per trip. With this approach, That’s how I justified my last expensive purse purchase by telling my hubby that I haven’t bought one in ten years and the use I’ll get with the new one is many many years :)

Here are a few more spending ideas that does some good: some going to a charity, taking a worldly travel sabbatical, scholarship, spending money on a couple of expensive trainers with a personal chef to get you super duper fit!

Why not do a bit of everything, but only 1 car. Wise and fun. It’s your money Sam, what do you WANT to do?

Tristan

I resist spending urges by giving myself permission to buy at a later date IF I still want the object of my desire as much as I do in the moment I first want it. If I see a shirt or necklace that I like and still want it just as much in 2 weeks, it’s mine. If I still want the car in 6 months, it’s mine. Etc etc. Needless to say, almost nothing ever gets purchased after the “cooling off period.” But if I still want it just as much or even more as time passes, then I know it’s truly a deep desire and will really make me happy and isn’t just a passing fancy. My most recent “big financial commitment” was adopting a dog 11 months ago … after wanting to adopt for over a year.

And though you did not ask for your reader’s opinions, I’d vote for paying down the mortgage debt for you.

Creating a later date buy date is a great strategy. So often, our desire fades if we wait long enough. Sometimes it’s tricky with motor vehicles via private party though. For rarer vehicles in high demand, it’s sometimes necessary to make a decision more quickly. That said, there’s always enough supply if you look hard enough.

+1

I avoided buying lots of junk following that technique!