One of the best ways to eradicate financial distortion is by meticulously tracking all investments. I'm pretty sure none of us will remember the exact details of what we bought, when we bought, and how much we bought years from now. This may lead to a significant miscalculation in cashflow during retirement. As a result, I've decided to start a quarterly investment tracking series.

One of the best ways to eradicate financial distortion is by meticulously tracking all investments. I'm pretty sure none of us will remember the exact details of what we bought, when we bought, and how much we bought years from now. This may lead to a significant miscalculation in cashflow during retirement. As a result, I've decided to start a quarterly investment tracking series.

The other reasons for this new quarterly series include: 1) earning enough to invest $20,000+ a month, 2) getting feedback about my investments since I've made terrible choices before, 3) starting an ongoing discussion about any new investments to consider, and 4) discussing the current investment landscape. The ultimate goal for all of this is to be able to spend maximum time with the kid(s) when they arrive. I'm deathly afraid of having to go back to work full-time.

Most people in America just spend most of what they make. Others just contribute to a 401k or IRA and then spends the rest. I want you guys to max out your pre-tax retirement accounts AND invest an additional 20%+ in post-tax investments each year. If you want to achieve financial freedom sooner, you need to have a sizable after tax portfolio that throws off livable income.

1Q2017 Financial Samurai Investment Review

Because I've achieved my net worth target, I'm not looking to take on too much risk. Instead, if I can grow my net worth by ~5%, or 2X the risk-free rate of return, I'm content. I no longer look at my investments as a way to achieve financial freedom. Instead, I look at my investments as a way to maintain financial freedom while providing a slight tailwind for net worth growth.

The main driver of my net worth growth is my online business, which is currently trouncing every other asset class due to a high correlation with effort and reward. I worked my ass off in November, December, January and February to take advantage of the inevitable new year's rush. I'm now reinvesting that income to generate more passive income. Start your X Factor now while you still have the energy. It might change your life forever.

Here's my 1Q2017 investment tracker spreadsheet.

![]()

January Investments Overview

Stocks ($21,000): I was cautious on the stock market in January, but couldn't resist investing $21,000 in an Amazon structured note paying a 9% annual dividend net of fees for two years with a 25% downside barrier. I basically made a bet that Amazon would not decline by more than 25% for the reward of earning a 9% dividend. Amazon is a monopolistic juggernaut with two main businesses. They will use their monopoly to subsidize new businesses and crush the competition, exactly like Google.

Real Estate Crowdfunding ($25,000): I committed $250,000 to real estate crowdfunding because I'm bullish on the real estate crowdfunding sector, don't want to buy more physical property due to maintenance hassles, love having a real underlying asset, and figure who best to pick the best deals on their platform than the very people who vet all their deals? The preferred return is 8% with a target IRR of 15% over five years with a 0.8% management fee. Given the fund's goal is to invest in roughly 10 deals, each deal will be valued at $25,000 ($250,000 / 10 deals) in my portfolio. The money that is not invested sits in my account accruing interest.

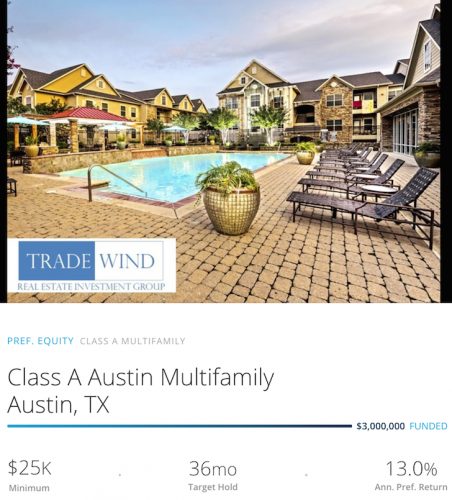

I'm very happy the fund decided to invest in an Austin, Texas multifamily property with a 13% preferred return since I'm bullish on Texas, and other heartland states. Although prices have moved higher in Austin like most of the country, valuations are still so much cheaper than coastal city real estate.

Update: Unfortunately, RealtyShares is no longer accepting new investors on their platform. I suggest taking a look at Fundrise, the pioneer in eREITs. They are also currently working on an Opportunity Fund to take advantage of tax-efficient Opportunity Zones. Fundrise was founded in 2012 and is open to all investors – accredited and non-accredited alike.

February Investment Overview

Stocks and bonds ($0): The S&P 500 performed incredibly well, making up the lion's share of 1Q's 5% gains. I could not commit any more money to the stock market due to valuation worries and a lack of attractive hedged investments. Instead, I rebalanced my SEP IRA, Solo 401k, and Rollover IRA from roughly 65% stocks / 35% bonds to 50% stocks / 50% bonds at the end of the month.

Real Estate Crowdfunding ($25,000): The real estate crowdfunding fund continued to stay active by investing in a Hayward, California multifamily project with a 19.2% target IRR. The fund targeted this project because of strong job growth in the East Bay as more people migrate out of more expensive San Francisco. The off-market transaction was acquired below replacement cost, providing for an attractive post-renovation yield.

Given I'm already long three properties in San Francisco, this project is not a property I would have invested in. I'm looking to diversify away from expensive coastal city markets because property prices are finally slowing. In the event of a tech/internet downturn, I don't want to be over-levered here. Having no investment say is one of the downsides of investing in a fund.

For those who don't live in the SF Bay Area, this investment looks intriguing because more companies are setting up shop in the East Bay (15-30 minutes across the Bay Bridge) due to lower costs (but it's getting pricey quick). I went to Berkeley for business school (East Bay) so I'm relatively familiar with the area, the warmer weather, and the price arbitrage opportunity. If the project can earn half its target 19.2% IRR, I'll be happy.

Home Improvement ($8,000): I started on the final phase of my home improvement plans with the landscaping of my backyard. Given I live on a hill, my backyard wasn't very user-friendly. The yard had also become overgrown with prickly blackberry briars. I decided to de-weed the entire yard and construct flat, multi-level tiers. The first tier is actually a 300 sqft kids playground. I've now got roughly 1,500 square feet more of flat lands. I'll show you the final pics in a future post.

March Investment Overview

Stocks ($10,000): Despite rebalancing all my pre-tax retirement funds to a 50/50 stock/bond allocation, I decided to invest $10,000 in a 5-year buffer note on the Russell 2000 Index (RTY). The upside participation rate is 140% with a capped maximum total return of 50% net of fees. The note has a 15% downside buffer at maturity. I like buffer notes because if I'm down 20% on my RTY investment in 5 years, I'm actually down only 5%. The 140% upside participation rate is interesting because if RTY is up 25% in 5 years, I'll actually be up 35%. The downsides of this note are the return cap and no dividends.

Bonds ($22,500): The 10-year yield reached 2.6% in March, so I bought more California municipal bonds. I purchased a $22,500 position in California Health Facilities Revenue Bond, with a 4.000% yield due 2/01/42. Getting a 4% net yield (equal to a 5.7% gross yield) because I was able to buy the bond close to par ($100) was enticing. 25 years left until the bonds expire is a long time, but I believe interest rates will stay low for the rest of our lives, thereby allowing bonds to maintain their value. I can always sell the bond before expiration.

My California municipal bond portfolio is now over $330,000, yielding roughly $8,800 a year in tax-free income. Since March, the 10-year bond yield has declined to 2.38% after Trump's failure to pass Trumpcare. As a result, my bond portfolio is currently slightly in the money.

Venture Debt ($11,345): I received a capital call of $11,345 for my second venture debt fund investment. The total investment in this second fund is only $50,000 (compared to $115,000 in the first fund). The latest debt investment is in a gaming device technology company and a cosmetic company. Both investments seek to earn 12%+ a year in interest payments for three years with warrant kickers that could bring total returns to over 20% a year. Pretty interesting huh? I have zero expertise in these investments, but I do like the business of lending to well-funded startups and making a double-digit return without the need for a liquidity event that may never come. Related: Investing In Venture Debt

Home Improvement ($9,300): I paid the remaining $9,300 for the backyard landscaping for a total cost of $17,300. I'm really pumped with how things turned out, especially since I got bids for $50,000+! Instead of going with a large landscaper, I directly hired the guys working for a large landscaper. They were working for three months on a neighbor's ~$120,000 project. So I just had a conversation with them one day to see if they wanted to work on mine on the weekends. Once you see the pictures, you'll realize how large my project was. All I need to do now is spend ~$1,000 (!) on plants.

Real Estate Crowdfunding ($25,000): The fund invested in Avesta Biscayne, a 402-unit apartment community located near the Biscayne Bay shoreline in Miami, FL. Avesta Biscayne was built in 1985, but is located in a growing submarket and has in-place cash flow with an average occupancy of 94%.

Florida is not a heartland state, but it is a red state. I've always liked Florida given the warm weather and no state income taxes, so I don't mind gaining exposure here. Miami is booming again. However, let's hope job growth continues because Miami also went through a massive condo bust during the downturn.

Ideally, I want to focus on Colorado, Utah, and Texas real estate, which can still be done with individual investments on Fundrise platform. You can also invest in their eREITs.

1Q2017 Investment Wrap Up

So far this year, I invested $163,145 in 1Q2017 compared to my objective of investing at least $60,000 a quarter. This difference makes me want to slow down because it seems like my new year's enthusiasm is overly influencing how much I should be investing.

That said, there were a number of positive financial events that occurred in 1Q17 including: 1) record online revenue growth, 2) getting my final severance check of $65,695, and 3) a $331,718.41 CD that came due seven years later ($250,000 initial value).

The image below shows my closed USAA CD hitting my bank account and a $225,000 transfer the very next day to invest in the crowdfunding fund. I reinvested so quickly because I spent 8 months researching the space prior in anticipation of the CD expiring.

I had already transferred $25,000 to the fund in January. Only ~$75,000 of the $250,000 has been deployed because only three investments have been made so far. The rest of the $175,000 is accruing interest at an 8% preferred rate. In upcoming quarterly updates, I'll add the remaining $175,000 balance as investments are made.

In order to maintain a passive income goal of $200,000 a year, I've got to find ways to prudently reinvest the $331,719 closed CD because it was providing a gross $13,268 a year in guaranteed passive income (4%). One way to recover the lost passive income is to earn an 8.13% return on the $163,145 I invested in 1Q17. It's possible, but I'm not banking on it. If my entire $250,000 allocation in the REC fund achieves a 8% return, that equals $20,000.

* The $200,000 income figure is important to me because I believe $200,000 – $250,000 is the ideal income for maximum happiness. It's also the income level required to live comfortably in an expensive city like SF.

The below chart shows my estimate total return for each asset class and the corresponding passive income amount for the quarter. I've tried to be on the conservative side, while also assigning zero returns for home improvement. For example, I'm confident the $21,000 Amazon position will pay out a 9% annual return because the stock is now 10% higher than where I bought it. Meaning, the stock has to go down 35% from here for me not to earn my 9%.

Future Investments

After paying 1H2017 property taxes, I'll have ~$205,000 in cash left over to invest. The problem is, I don't find stocks, bonds, or any private equity investments attractive at the moment. Do you? We just launched a missile strike against Syria, which means we're now vulnerable to more attacks at home.

I plan on making extra principal payments towards my 4.25% vacation property mortgage, meeting capital calls for my venture debt fund, and deploying real estate crowdfunding capital through various Fundrise funds per their investment schedule. Any money left over will simply be saved until the 10-year bond yield breaches 2.6% or the S&P 500 corrects by at least 5%.

The bull market has turned out far better than I could have imagined. I was serious in my April Fools Day post about how I couldn't bear buying a fancy car when the money could be invested for potential gains. Now the upside seems much less exciting, which conveniently makes it easier to spend.

Wealth Building Recommendation

Manage Your Money In One Place: Sign up for Personal Capital, the web's #1 free wealth management tool to get a better handle on your finances. In addition to better money oversight, you can run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. I was paying $1,700 a year in fees I had no idea I was paying.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. Definitely check to see how your finances are shaping up as it's free. I've been using Personal Capital since 2012 and have seen my net worth skyrocket during this time thanks to better money management.

Sam, when will you be posting your 2Q 2017 investment recap? I’m looking forward to it…

Next week. I just got done reviewing it and have some realizations in a post but I’ll polish tomorrow actually.

Excellent! Thanks for the update.

So far 2017 has money into a simple IRA and debt reduction, but boy do I like reading your thoughts on what you are doing. Thanks for this community service.

I read this article when you published it and revisiting after your email came in.

I’m a small time investor, but love to use these updates as guidance and inspiration. I am a school administrator in my early 30s, and was able to get in on a defined contribution retirement plan. I am in Washington state, so our pensions are very safe. My wife does not have a retirement plan through her employer, however. These factors help to determine how aggressive I am with our other investments, but I am risk-averse. Not by nature as I am a former Marine infantryman, but with my money ;)

Our post-tax savings rate at this point is roughly 20%, but would like to bump that up slowly over time while still being able to take a couple of trips a year. Travel hacking has helped significantly with that.

Here’s is my investing plan for 2017, with a goal of 6% return on the year.

1. Max out traditional IRA.

2. Max out Roth IRA.

3. Pay off student loan at 5% OR buy more in brokerage account if there’s a correction of more than 5%.

I’ve only got index funds with Vanguard. REITs are performing well, but small cap value is killing those returns and I currently lag the market for the year.

Your thoughts would be appreciated.

Thank you Sam! I truly enjoy reading your blog and newsletter, as a SAHM (Stay at Home Mom) with two little ones – my down time is well spent.

yo Sam,

i am looking at a PE investment that has some compelling positives but the founders are offering the angel round in the form of SAFE (Simple Agreement for Future Equity) with the conversion giving a 30% discount at the next capital raise. This was a curve ball to me and they have no sales at this point. It seems to be too founder friendly to me and kind of a bummer/turn off. Any familiarity with these? Thinking i will try to get another couple folks on the sideline to push for straight equity but trying to gather more information as well.

You are off to a great start this year.

Your portfolio is sophisticated.

The crowdfunding is fascinating and I need to study more about that.

Thanks for sharing.

My personal allocation (I’m in the low 7-figures net worth) is 33% spread across two long/short equity hedge fund limited partnerships (like the one you were invested in while employed at Goldman), 20% in crowdfunding, 8% in common stocks (I sell covered calls against them), the remaining 39% is in cash, though part of this is used to cover naked (actually cash-covered) puts I sell.

My personal investment strategy is that I sell puts on stocks I like and would own. The premium is collected from the sale of the put. If it expires worthless it’s equivalent to collecting the stock dividend without the risk of holding the common outright. IF the stock is put to me (happens only 15-20% of the time), I immediately sell an at-the-money covered call against the stock. This hedges the position and more premium is collected. I exit the stock when its called away.

Here’s an example (actual trade): Today I sold the QCOM May 5th 52.5 puts @ 1.22 each. I collected $122. per put option. If stock sells off further I own it at a discount from where it’s currently trading, plus the premium I collected. It’s like buying the stock @ a price of $51.28

You should try this Sam. I do it with large-cap, liquid, dividend-paying stocks. QCOM is a perfect for this type of trading.

hey Kirk,

do you say you get put stock 15-20% of the time based on the delta levels you’re selling puts at or that 15-20% has just been your experience so far? also, i wouldn’t describe selling an atm call as a hedge. that strategy puts a cap on your upside and still exposes you to almost 100% loss.

Slay,

15-20% is experience so far. With this market sell-off this number may increase. I look at trades and my methodology different than you. My strategy is selling puts on stocks I’d own anyway, but selling the puts reduces ownership costs if the stock is put to me. If the put expires worthless, that’s a perfect trade. It stock is put to me, it’s not a bad thing. I simply sell the atm call to generate income (along with stock dividend) to my total return is enhanced when you add up the put premium initially collected, the call premium collected and the dividend. in 100% of the cases, the stock is called away, that’s fine as it frees up capital (I favor holding a large cash position, as cash is a viable asset class) and I move on to the next trade.

Selling the covered call does act as a hedge to the amount of premium collected. You’re correct that I am exposed to 100% loss (in theory) but I don’t consider this risk worth worrying about. I only sell puts on solid dividend-paying companies that are down on headline risk (QCOM is a great example). These sell-offs in individual companies of my choosing are temporary. I’d never allow any stock position to drop further than the TOTAL premium I’ve collected, from both puts and calls. My mental stop loss is the total premium collected.

I wasn’t planning on carrying on an endless comment stream but you made a point and I needed to provide some clarity.

Bottom line is that we can all poke holes in various investment strategies. This one works for me, and had worked for me for several years. I am not about to change it.

Sam,

There’s a lot to like about having liquidity. Given the Geo-political concerns you have (I concur, I have same concerns!), I’d hold onto the left over $205k for dear life. I appreciate your obsession with earning $ on your cash by investing but some of your investments are very illiquid. I too am in real estate crowdfunding with a sizable portion of my net worth (20%) but this locks our money up for several years.

I’m all about having lots of cash on-hand. Look at pure financial (www.purefinancial.com) where you can 1.25% on your cash savings. Much less return than you’re wanting but at least it’s earning something (highest yielding savings in USA at present) and you have liquidity.

Kirk, my hope is that the world will not end, and even in a correction, these various assets still pay income.

I’m definitely focused on saving as much cash as possible now between April – Sept 1. I’ve gone a little too aggressive with capital deployment since November 2016, investing almost $400,000 into various bonds after the sell-off, and $250,000 in real estate crowdfunding. I’m not sure I would feel that good sitting on $400,000 + $250,000 + $205,000 in cash equaling $850,000 now because I’ve got nothing to buy. I don’t think my monthly cash flow will dry up, but if it starts to, then I’ve got to definitely be more conservative with my liquidity position. I just don’t see the ~$400,000 into muni bonds as a risky bet.

What are you investing in?

Sam, great work as always. That you for being such an educator and an inspiration all in one. I’ve been following your Realtyshares posts with great interest (no pun intended). I noticed that, “The rest of the $175,000 is accruing interest at an 8% preferred rate.”

How much risk is this sum exposed to relative to the dollars that are actually invested in a property? I hope I’m not mis-understanding something critical. Would you help explain a bit more about how Realtyshares can offer what looks like an 8% risk free return?

Thanks, and keep up the awesome work!

There’s definitely no 8% risk-free return. The idea is, is that the capital you commit with the fun accrues interest at 8%, and will start getting paid out once the initial investments start paying out. It could be a year before I get a single interest paid out if not longer.

A lot of fun set up a preferred rate of return they must hit before getting paid any other fees. So in that way, this is a guaranteed return for the Investor without having to pay fees or extra fees. It’s the money managers “hurdle rate” in other words.

RS can promise anything they want. And it is up to them to deliver. They have to figure out a realistic rate of return they can achieve and beat so they can continue to raise money and grow as a company. If they do not beat out of the gate, then they will hurt the reputation, and a good time as well and as capital flows to the best performing funds.

Can promise anything they want. And it is up to them to deliver. They have to figure out a realistic rate of return they can achieve and beat so they can continue to raise money and grow as a company. If they do not beat out of the gate, then they will hurt the reputation, and a good time as well and as capital flows to the best performing funds.

Everybody must realize that other than certificates of deposits, treasuries,and money market funds, there is no guaranteed rate of return.

I’ve achieved my initial real estate crowdfunding portfolio target for the year and will wait-and-see before committing more capital.

Thanks!

Hey Sam,

Its great to recap where the investment $ goes on a spreadsheet – as even after 2 months we tend to forget about these data. We are far off from your numbers, but in the game still.

We currently live in SF and we have just recently started with RS and Fundrise (Jan and Feb). Its fun to experiment with smaller portions and see how different deals will do.

As far as your February REC investment goes, it truly has tremendous potential. I visited that Hayward property multiple times and saw the changes. ( This time I am not going to charge you the third image right for showing my image on the FS site :) ) Although Hayward is not the most popular area of the East Bay at this time, this investment will certainly do well due to its location and filling up quickly after the renovation.

Of course a possible downturn in the next 5 years could hurt the area. We will be keeping a close eye on this property, too. Since the area is undervalued and the population keeps growing you can imagine this being a much better area 5-15 yrs from now.

Are you considering putting more into the RS investments in the Bay Area or based on your hard assets concentrated here you would rather focus the other 7/10 RS portion elsewhere even if a good opportunity arises?

Very cool you checked out my Hayward property investment. What are you doing out there anyway? I should probably take a look as well the next time I’m in the East Bay.

The real estate market is definitely softening in San Francisco on the higher end. That should put down the pricing pressure on the lower end. But Hayward is really kind of on the lower end so I probably won’t get affected as much.

I definitely don’t plan to put any more realty shares money into the bay area given I’m long three other problems here. I really want to diversify in the heartland of America where I see the most job growth opportunity with the cheapest valuations relative to the coastal city markets.

Hi Sam, I just happened to work with that capital group who acquired that property (doing their marketing materials and photography so I saw the before stage and current conditions as it goes through a remodel).

Hence the sample image above, which I took at the time it was being bought.-

I found out later that it goes onto RS so I missed the investing opportunity as we would have totally participated in it. Its not a fancy complex at this point, but its going thru a big change, eg. they are going to to put a large number of solar panels to the roof soon and revamping the common areas, too. That area, including this property, is just getting more valued from the low end after investments like this.

When I went to a recent crowdfunding companies meeting in downtown SF – where we also met – we decided with my wife to give RS a go. We are cautious and we will see how they will deliver. Will share our experiences here when time comes for sure.

Focusing on the heartland of America definitely makes more sense (I know you want to diversify geographically, too) as the relatively cheaper lifestyle attracts already a lot of talents and families. I know several Apple and Airbnb ex-colleagues who relocated to Austin and Denver after a good run in the Bay Area. They have the cash and the financial discipline to do well in these areas, enjoy life more while pushing property prices further in certain neighborhoods.

I agree REIT have the highest returns even against an unmanaged SnP 500 index fund. Better than bonds, median standard family home appreciation, against inflation. What do you guess your REIT company’s annual average return is? 20%+? 15%?

FS you are rocking it! Congrats! We also did some major backyard renos recently and I love looking outside every day and seeing a resort style backyard!

Q1 2017 saw us sell a vacation rental property we had owned for 4 years. Saw a 20% price increase during the 4 years but more importantly a 31% currency exchange profit (we are Canadians and bought the US property when our dollar was above par with the US dollar in 2012). After paying off the mortgage and keeping $100k in US funds we had $250,000 CDN left to invest and most of that is done now. Q1 was also a record sales quarter for my business and I am taking an extra $150,000 in bonus and dividends on top of my salary this quarter, all of which will be invested after paying a hefty tax bill and some tax instalments towards 2017 income tax.

Our investment strategy stays the same despite all the new money – simple ETF portfolio keeping 50% of the money in my wife’s name (trying to keep our accounts a similar size for equal income in retirement). Right now about 15% in cash but that will increase next week with new contributions. I should just deploy into our AA but with markets frothy I may wait a few months for a correction and if nothing major occurs just average in over a few months late summer early fall. My goal is to add $200k of new money plus the house proceeds into our portfolio this year and I am confident we will exceed this.

Ah yes! My wife and I had a vision of creating a “Ritz Carlton Oceanview Suite” type environment in our house that charges $2,000 a night! So over a month time frame, it would cost $60,000 to rent, but can be had for less than $4,000 :)

Nice job locking in the gain! I was telling any foreigner who wanted to listen to buy Lake Tahoe property 5 years ago for the double bonus of principal appreciation and currency appreciation since the USD was down in the dumps.

Good luck on adding the $200K!

Another good reason to keep track of investments locally is so you don’t have to go searching for cost basis when you sell – sometimes systems change and it becomes a big pain in the ass to find out what the basis was. Recording it locally means you always know where to find it.

Hey Sam – this is awesome! In the past I’d relied on Mint for my historical net worth but after I moved a few accounts around the historical data is all messed up. Gonna have to do this going forward. I’m looking to contribute $7k a month – a long way away from your $20k but hoping to get there someday! With equities up here I’m basically just paying down my mortgages and will look to re-engage when multiples make a little bit more sense. Assuming you may have run into these guys at Gavekal when you were in the investment world but they often talk about the Wicksellian Spread ) – interesting stuff for anyone that’s trying to make broader sense of the current bull market. I figure if I can make a guaranteed 4.25% on my mortgage then it’s still better than just sitting completely in cash (also have a balloon coming up in 4 years so it’s more or less like a floating if I refinance at the balloon payment date).

I really like paying down that 4.25% mortgage at current levels. Anything about a 4% rate of return w/ the 10-year yield below 2.5% is a no-brainer IMO!

First off, thanks for starting this and I am very excited to see these every quarter as inspiration and also guidance. I love the look of your overall portfolio.

Also really excited to see the yard as well. I live on a hill and just dug out all the overgrown bushes and falling down fence. Now is the rebuild and I have no idea what I want yet.

Overall as far as investing goes I still am buying large cap names and holding more cash than usual. It is harder to find a valuation I like but long term I still find some ETFs and REITs I can stomach adding to.

I have been following your RealtyShares investment and have been reading up on them some. I would be able to put an investment in them but again think having the cash isn’t all that bad. Sometimes the best investment you can make is cash and the growing level of uncertainty out there is a thorn in my investing side at the moment.

Thanks for sharing this!

No problem Cameron. I’m right now on a mission to build as large of a cash hoard as possible BEFORE two things occur:

1) The 10-year yield breaches 2.6%, in which case I will buy more municipal bonds and REITS

2) If the S&P 500 corrections by at least 5%, in which case I will start legging into some index ETFs

Best of luck! Let’s never confuse brains with a bull market!

Fantastically interesting brain you have. I’ve reread the post a few times but I haven’t studied the post I have to figure out exactly the benefit of it is and what my equivalent would be in investments every year. Since I am not adding new money from work or business to my net worth, would I list my net worth gains from each source (r/eappreciation, mortgage paydown, reinvestment of capital gains and dividends). What about rental and pension income which offsets expenses?

Re brains versus bull market, what if you are earning greater than the stock market gains? Can you take some credit for brains?

2017 (to April 30) Average TSX and DJIA (my portfolio roughly 50/50) = 3.95% My results = 11.29%

2016 15.47% versus Me 5.54%

2015 -6.66% versus Me 16.88%

2014 7.47% versus Me 24.55%

2013 17.09% versus Me 26.51%

2012 TSX 3.84% versus Me 11.53% [only Canadian stocks up to this point]

2011 TSC -12.45% vesus Me 4.17% [my first year actively managing my portfolio]

You should consider a profession in active fund management with those returns. They are consistently excellent. How much capital are you investing?

Great wrap-up of your investments over 1Q2017. I am tempted to get into Fundrise to diversify away from stocks/bonds, but I am waiting to read your review first. We are completely priced out of Portland Metro real estate at the moment, so no rentals here for now. My Vanguard REIT is outperforming my other ETFs at the moment, by the way.

My wife and I just came back from a 4-day trip to San Francisco. No rental car, and we walked at least 30 miles. I can see why so many people love living in San Francisco! However, the real estate prices, as you’ve talked about so many times before, is unreal. Coincidentally, on the flight down, I picked up a copy of the Portland Business Journal and came across this map that was reproduced digitally:

https://www.bizjournals.com/portland/news/2017/03/29/mapping-the-great-san-francisco-to-portland-worker.html

The attached print article, which is not available without subscription online, talked about how new execs can’t even afford to live in San Francisco. When you consider a flight from PDX to SFO is only an hour, it makes sense to work remotely if you can! A couple of other cities that stood out to me that I’ve visited recently and can actually see myself leaving Portland for: Austin and Denver. Both are in the Fundraise Heartland eREITs. I think I just talked myself into pulling the trigger!

Thanks, again, for these updates.

Hi Tim,

There’s definitely a great migration from here to Portland. One of my biggest regrets was NOT buying Seattle and Portland real estate about 10 years ago when I could. I just didn’t know how to efficiently do so and maintain the property. But RealtyShares and Fundrise have now made this so, albeit way later. So now, I’m just investing in the Heartland to find the next Portland and Seattle.

Here’s my comprehensive Fundrise review.

and

Fundrise Heartland eREIT Review: Crowdfunding For Non-Accredited Investors

Best,

Sam

“I directly hired the guys working for a large landscaper”

This is a great way to save on labor and you already know what the quality of work is like. I look forward to seeing the final product pics. My backyard is all hilly and triangle shape and weird and unusable so I’m interested to see what your outcome is like.

Yes! Will put this post together and share.

IYR is a real estate REIT ETF which has been underperforming SPY ETF. If you believe reversion to the mean, perhaps one could go long on IYR. With conservative option trades on IYR with relatively low risks, with a little monitoring and adjustment, one could potentially attain in the neighborhood of 10% annual return this year.

Thanks for the heads up. Will check it out. Love REITs in general, and have a good size position in O and OHI. I shoulda bought more OHI in Nov/December, but wanted to be conservative w/ my fixed income portfolio build .

Hey Sam,

I would like to do an additional 20% investment after the 457 & Ira, but cannot yet.

Currently 32% of my paycheck goes to the 457, Police Pension, and a retirement health savings account; 7% to the IRA; and 8% to mortgage principle (house paid off by the time I’m 50).

Throw in the CSPs for the kids and I’m as tapped out as your 500k couple in NYC :).

Seriously though, I am saving to the point where it hurts, and I’m comfortable with that.

I have achieved 3 to 4x pre tax return on my options portfolios over 5.5 years. I have been saving most of the after tax return (i.e., 80%). Based on the rule of spending no more than 10% of income on vehicles, purchasing my Porsche 911 turbo will have to wait. :)

I’d be careful about munis. If the US Govt needs to reduce spend, the muni benefit could be removed to find some wiggle room in the budget.

I like an inflation/deflation barbell. Seeds have been sown for inflation to take off, so you might benefit in some commodities or even TIPS (You could get fancy and short Treasuries/long TIPS). In deflation, the cost of previous debt increases. Look at decreasing debt and calculate real return based on opportunity cost.

Rite Aid provides a nice “fun money” investment right now if the deal with Walgreens go through (40% upside @ $6.50/sh possibly by July). There are quite a few high-discount CEFs out there, with the expectation of future hardships with lower-rated company (higher rates specifically).

So far munis have held up like a champ since the Nov/December sell-off. Will definitely be monitoring the inflation and gov’t fiscal situation. I really love the arbitrage of being able to earn a higher rate of return than the cost of my mortgage. I’ve got a simple goal of having a muni bond portfolio equal to the size of one of my rental property mortgages.

You are set for life, awesome job! I like those amazon notes…

Did you ever write a post about the your vacation rental property? I’ve been looking into that lately but it seems like it might involve a lot more stress and I prefer a more passive investment but see how short-term rentals can make good money, especially nowadays with AirBnb/VRBO, etc. How do you manage everything from afar? I found this company called Rent.com and they have property managers bid on your property and can offer a guaranteed return while handling all the day to day hassles of renting a vacation property. Couldn’t really find people who have used it though as it seems pretty new. Would be interested to read a post about vacation rentals! Thx

Hi Andrew,

Yes, I’ve written many posts about my ill-timed vacation property purchase in Tahoe. Here are some:

The Resort At Squaw Creek Two Bedroom, Two Bathroom Vacation Rental (details)

A Vacation Property Buying Rule To Follow

I would NOT buy a vacation property. Just rent and be free. Only if you have money coming out the wazoo, expect to work for years to come and plan to make more money would I buy a vacation property.

Best,

Sam

Sam, with respect to RealtyShare, do you have any concerns that most of the investments are equity and/or preferred equity positions? If the real estate market tanks again, it’s my understanding (limited) that these positions are often secondary to the lien holders. If there are any foreclosures, the underlying assets would pay off the primary investors, and assuming there’s any money left over, pay off the preferred equity investors second.

This explains why the returns are so much higher than comparable crowdfunding sites like peer street, which deals exclusively with 1st lien secured investments.

Just wondering what your thoughts are on this. Thanks

Yes, absolutely, which is why I’m investing in a fund that plans to invest in 10 or more deals across the country, and hopefully in lower valuation areas with strong job growth, than buy another physical property with 20% down, and levering up with a mortgage.

Relative to buying another physical property, the fund is much more conservative. It’s really the solution I’ve found for myself to still invest in my favorite asset class without having to spend money on maintenance etc.

Also, I’ve only allocated 50% of my desired ($500,000 allocation). I want to see how things go, and analyze what investments they make before committing more capital. I’ve also shared with them my thesis of the heartland as well. If they can return a 8% preferred return on $500,000, that’s a healthy $40,000 annual income. If they can achieve their 15% target IRR, I’ll be thoroughly surprised. I’m taking more risk for double the realistic return of my CD, which was risk-free.

How about you? What did you invest in for 1Q2017 and where are you investing your money in the future?

I’ve been very cautious with investments so far in 2017. I have about $500K sitting on the sidelines, and I’m trying to decide if I should keep being patient, or pull the trigger on anything.

The primary purpose of that cash stash is to generate decent passive income with reasonable risk.

I just recently invested about $10K with Peerstreet to try them out, and I’m waiting on Yieldstreet’s next offering to give them a shot with a similar initial investment.

I would like to build a similar passive income stream, but the fact that all these crowdfunding sites have never gone through any real trouble is holding me back from going in more aggressively.

I’m in no rush, so I’ll just see how my initial investments play out.

If you’re investing in Yieldstreet, be sure to log in and refresh the page as soon as a new offering goes live–they sell out in minutes sometimes. I think they have three new offerings coming up soon. I have about 65k with them right now, but I think I’m going to hold here and see how they perform over the next year or two. If they are consistent, I’ll try to increase my investment to around $200,000 for about $20k per year in passive income (gross). I’m keeping track of these investments, and my smaller investments in Fundrise on my website if you’re interested.

Why the investment in an individual municipal bond instead of a low-cost California municipal bond fund like Vanguard’s?

https://personal.vanguard.com/us/funds/snapshot?FundId=0575&FundIntExt=INT

It’s got a similar return profile across 787 holdings but it’s obviously less risky than a single revenue bond.

Much higher yield, and diversification beyond my main CMF, California Muni Bond holding. Out of a 100% bond allocation, 80% will be a core CA bond fund, and 20% will be individual muni bond funds like zero coupon muni bonds, and this one.

What did you invest in for 1Q and what’s your outlook and future investments for the year.

My investment portfolio has followed the same boring strategy for years: 25% goes into the total stock market (VTI), 25% into long-term Treasury bonds (TreasuryDirect and TLT), 25% into gold (bullion, IAU and GLD), and 25% into cash. I’d say 85%-90% of assets follows this strategy. The rest (10%-15% of assets) goes into 4-5 speculative, medium-term bets where I’m risking one dollar to make five. (So that a hit rate of 20% “returns the fund” so to speak.)

I’ve been researching municipals for my state but I’m concerned that 1) the 10-year Treasury yield could still move higher than 2.6%, and 2) tax cuts could drive buyers away from the municipal bond market. So my Q1 2017 outlook is to wait for tax reform.