Fundrise is one of the leading real estate crowdfunding today. They were founded in 2012 after the JOBS Act was passed and have grown into one of the largest and trusted platforms. This post will highlight Fundrise performance and growth figures.

Fundrise is a vertically integrated online real estate company that enables non-accredited investors buy into private commercial and residential properties across the country by pooling their assets through an investment platform.

The company’s main products are eREITs, an asset class in which they pioneered. Their eREITs are specialized funds they invest in various types of real estate investments for different purposes e.g. growth, income, western part of the U.S., etc.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is an investor in Fundrise funds.

Investing In Fundrise For More Passive Income And Diversification

As a real estate investor, you ideally want to earn profits in as hassle-free a manner as possible. Passive income is one of the reasons why real estate crowdfunding has grown so fast since 2012.

If you don't have to deal with tenants and maintenance issues, and can earn a higher rate of return around the country, then why not? I sold my SF rental property in 2017 because it was a pain to manage and it only had a 2.5% cap rate.

I then reinvested $550,000 of the proceeds into private real estate funds in the heartland with a 10%+ cap rate. I've been an avid supporter of Fundrise since 2017 and continue to regularly get updates from their team and CEO, Ben Miller.

Let's take a look at Fundrise's latest performance review, growth figures, and historical performance. You'll quickly see why Fundrise is one of the leading real estate investing platforms today.

This post will also go into detail highlighting Fundrise returns vs comparables, current and past assets under management, and their real estate outlook for 2023 and beyond.

Fundrise Performance Review And Growth Figures

Curious how Fundrise has been performing? Below you'll find the latest available Fundrise performance review details as well as historical returns for recent years.

2023 has been a difficult year for real estate with surging mortgage rates. However, with inflation peaking and the Fed set to cut rates in 2H 2024, savvy investors are dollar-cost averaging into real estate again.

Ben Miller, CEO of Fundrise, believes we are past the bottom of the real estate market. As a result, he is bullish and is actively buying choice properties in 2024 and beyond.

Fundrise Returns 2022

In 2022, Fundrise returned 1.5% overall compared to -25.10% for Public REITs, -18.11% for Public Stocks net of dividends, and -11.99% for Bonds net of coupon payments.

2022 was clearly a difficult year for risk assets overall. However, Fundrise overall significantly outperformed due to:

- Lower leverage (40% LTV vs. 70%+ other funds)

- A concentration of single-family and multi-family property, which outperformed other commercial real estate

- A concentration of properties in the Sunbelt / Heartland, which saw strong rent growth

In addition, here's a look at Fundrise returns as of the end of Q3. Notice the strong outperformance during stock bear markets in 2022 and 2018.

Fundrise Performance 2021

I had an hour-long video chat with Ben Miller, CEO, and Co-Founder of Fundrise about their 2021 results and outlook for 2022. During our conversation we reviewed the overall performance for 2021.

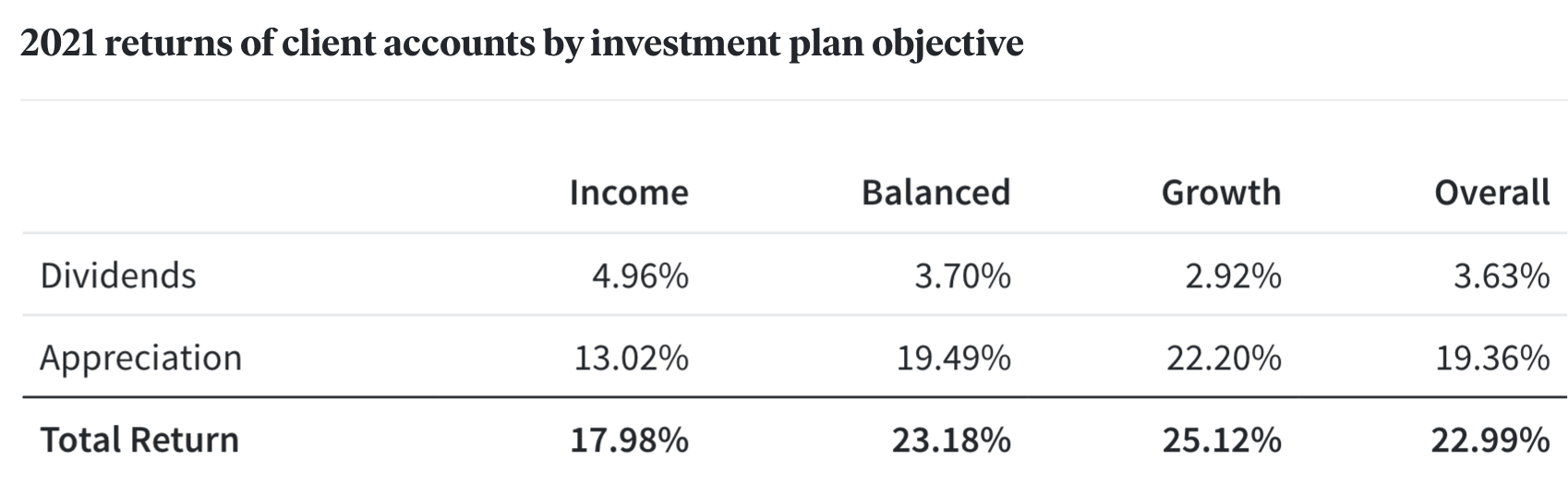

2021 was an outstanding year for Fundrise investors. Below are the Fundrise 2021 returns of client accounts by investment plan objective.

Income: +17.98%

Balanced: 23.18%

Growth: 25.12%

Overall: 22.99%

Further, their new Flagship Interval Fund was up 28.1% after not even a full year of operation. If the Fundrise Interval Fund was in operation all of 2021, it would have returned slightly over 40%!

Why Was Fundrise 2021 Performance So Strong?

Ben Miller attributed the strength of Fundrise's 2021 performance to the following four reasons:

1) Making strategic investments in multi-family, single-family, and build-to-rent properties in 2020

2) Net migration to lower-cost Sunbelt metro areas

3) The home replaced the traditional office

4) Inflation driving outsized rent growth vs. pre-pandemic

Inflation came in at 7% in 2021, which acted as a big tailwind for rent and property price increases. Further, more people are staying at home due to the pandemic. As a result, more people want to buy homes and larger homes with offices and more space.

Finally, the migration trend towards the Sunbelt/Heartland is something I've written about since 2016. The pandemic served to accelerated the migration to lower-cost areas of the country where workers can work from home.

Below is a case study of what happened to one of Fundrise's properties in 2021. Fundrise acquired a 376-unit luxury apartment in Las Vegas before 2021. It saw its average market rent rise by 19.8% and its value rise by 24.9%.

A Look At Ben Miller's Fundrise Real Estate Outlook For 2024

For those of you who are curious, here's a look at what Ben Miller, CEO of Fundrise shared with me on his outlook for real estate in 2024. He was spot on regarding his slowdown outlook for 2023.

In essence, Ben is cautious about real estate in 2024. However, he thinks that as mortgage rates come down, the demand for real estate will pick up and so will prices.

You can read more about real estate opportunities for the next year.

Staying Positive On Real Estate

Ben continues to be very measured in his outlook. He's constantly thinking about what could go wrong, which is exactly how people with great responsibility should think. I prefer this demeanor than a CEO who is always bullish and super optimistic.

Having a more cautious mindset helps with pre-mortem planning – to preserve capital on the downside and take advantage of upside opportunities.

I think Ben's views come from the experience he has with his father, Herb Miller. Herb and his company, Western Development Corp, developed over 20 million square feet of retail, commercial, and residential space since the 1980s. Therefore, he's seen it all.

Historical Fundrise Performance Figures And Discussion

Fundrise Performance 2020

After a tumultuous 2020 in the stock market, Fundrise performance held steady. During the worst of the downturn in March 2020, Fundrise was actually slightly up. Below you can see how Fundrise closed up 7.42%. Fundrise underperform the S&P 500, but significantly outperformed VNQ, the Vanguard Real Estate ETF.

I've written an entire post about how real estate gets impacted by a decline in stocks. Fundrise holds steady when stocks decline. However, real estate ETFs and public REITs tend to be more volatile and decline more.

Fundrise’s five-year average platform portfolio has also done quite well, yielding a 10.79% return versus 7.92% for the Vanguard Total Stock Market ETF and 7.4% for the Vanguard Real Estate ETF.

Fundrise Performance 2018 – 2019

Their massive 14%+ outperformance in 2018 versus the Vanguard Total Stock Market ETF is particularly impressive.

After generating a strong 6-year return by 2018, Fundrise took a huge step forward in proving what they have believed for so long: that a model of individuals diversifying into real estate through a direct, low-cost technology platform is a superior investment alternative to owning only publicly traded stocks and bonds.

2019 was a year of underperformance, but steady growth because the S&P 500 performed so well.

Take a look at the chart below that shows Fundrise returns of investments into eREITs and eFunds over the course of three years.

Fundrise Assets Under Management And Number Of Investors

Back in 1Q2021, when Fundrise was featured by the Wall Street Journal for investing in a Texas housing division, it had around $1 billion in AUM; 150,000 active clients, and about 100 employees.

At the end of 2021, Fundrise managed over $2.1 billion in assets under management. Fundrise also ended the year with over 210,000 investors on the platform. In other words, their growth really accelerated.

With continued real estate appreciation and awareness, Fundrise continues to grow their assets under management. As of 2024, Fundrise now has over $3.3 billion in assets under management and has over 450,000 active investors.

Other interesting stats are they reached $7 billion in total asset transaction value and investors have earned over $226 million in net dividends.

Fundrise Is Good For

- Investors with a long-term outlook. These investments are not traded on a public exchange — that means they’re illiquid. If you can hold for 1-3 years, your duration matches Fundrise's most common duration.

- Investors looking for diversification. You may already own expensive coastal city real estate and don't want any more exposure. Instead, you want to invest in the heartland of America where demographics are rapidly shifting towards lower cost areas of the country thanks to technology.

- Investors looking for completely passive income. As you get older and busier with life, you may no longer want to manage tenants and call the plumber. Fundrise does all the heavy lifting so you don't have to. I rank real estate crowdfunding as a top three passive income investment.

By investing in a diversified eREIT, Fundrise provides investors exposure without as much risk as investing in an individual commercial real estate investment.

Fundrise eREITs

Fundrise is mainly know for its eREITS, a product which it pioneered. They currently have seven main eREITs to choose from. Some are not always available due to excess demand. Each eREIT can only have up to $50 million in assets due to regulations.

- Income eREITs I and II: Focus on debt investments in commercial properties

- Growth eREITs I and II: Focus on commercial properties, particularly multifamily buildings, that will appreciate over time

- East Coast eREIT: Focuses on debt and equity investments on the East Coast

- Heartland eREIT: Focuses on debt and equity investments in the Midwest

- West Coast eREIT: Focuses on debt and equity investments on the West Coast

Fundrise eFunds

Fundrise also has eFunds, which are a little more adventurous. eFunds invest in the development and sale of residential real estate in major U.S. cities, like Los Angeles and Washington D.C, where housing supply is in a shortage.

With each of the eFunds and eREITs, you are investing in a limited liability corporation that conducts the deals. Therefore, in the unlikely circumstance that Fundrise goes under, there is still an LLC there to manage your investments. In other words, your investment on the Fundrise platform is not co-mingled with an investments in Fundrise, the company.

Fundrise Portfolios

Fundrise currently offers four investment portfolios, each of which invests in a diverse mix of the company’s eREITs and eFunds: the Starter Portfolio, Supplemental Income plan, Balanced Investing plan and Long-term Growth plan, each of which has the following terms:

- Minimum investment: $10

- Advisory fee: 0.15%

- Management fee: 0.85%

There’s also a retirement account option. With a minimum investment of $1,000, investors can open an IRA via the Fundrise platform (the custodian is Millennium Trust Company, an outside company that maintains self-directed IRAs for people seeking to invest in alternative assets) and can invest in any of the eREITs or one of the investment plans, for a $75 annual fee per eREIT (fee capped at $125 annually).

Fundrise Is One Of The Best

I've been working with Fundrise since 2016, and I believe they are the most innovative and best-run real estate crowdfunding platform online today. As someone with a lot of real estate holdings in expensive San Francisco, Fundrise is a great solution for me to diversify my real estate assets and earn more money passively.

Fundrise performance and growth figures have been solid. And with inflation picking up, I believe the returns will continue to be solid.

Real estate is one of the best ways to build wealth over time. With a company like Fundrise, investors can now invest in real estate projects that were once only available to ultra high net worth individuals or institutional investors.

There are of course no guarantees when it comes to investing. It's always important to due your research before investing in anything. Start small and work your way up. Thankfully, Fundrise allows investors to invest as little as $500 to get started.

Fundrise is free to sign up and explore.

About the Author:

Sam worked in investing banking for 13 years at GS and CS. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley.

In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income, most recently helped by real estate crowdfunding.

Fundrise is a sponsor of Financial Samurai and Financial Samurai has invested over $134,000 in Fundrise funds. Sunbelt real estate has lower valuations and higher yields. It is a great way to diversify away from expensive San Francisco real estate, where Sam owns multiple properties.

Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.