The current environment in 2Q2022 feels much like the 2000 Dotcom crash with stocks selling off. With names such as Netflix, Teladoc, Facebook giving up years of gains, the NASDAQ is down 21.2% YTD through April. It is the worst start ever for the NASDAQ.

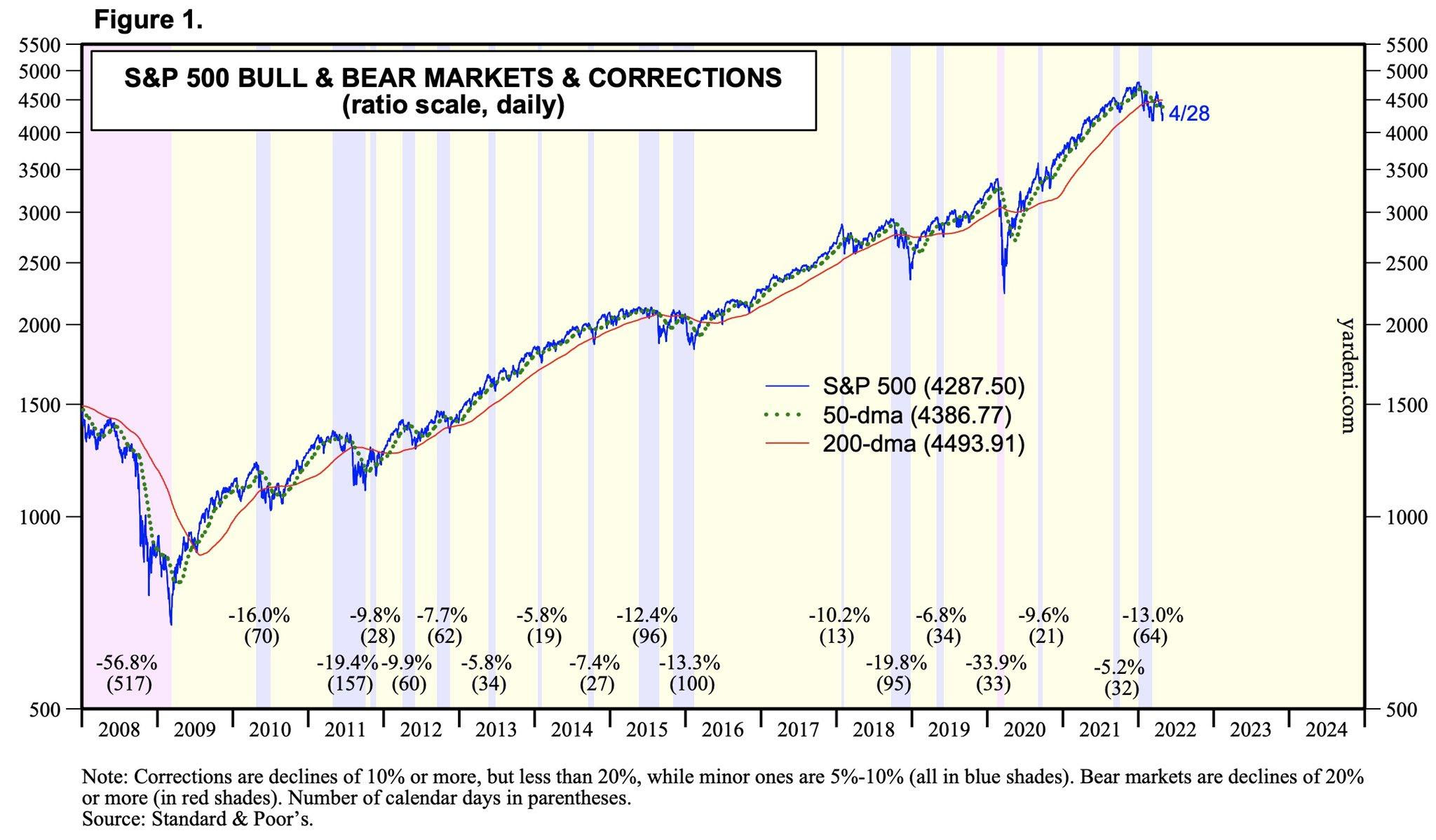

Meanwhile, YTD the S&P 500 is down 13% and the DJIA is down 9%. Not fun, but it is the risk equity investors take for potential gains. To give the S&P 500 decline some perspective, over the last 100 years, the average market drop has been about 15%.

So what does history tell us about the future? And will the Fed really hike 9X to 3%+ through 2023? It's hard to see the latter happening given the pace of deceleration in the economy after a -1.4% surprise 1Q2022 GDP print versus +1%+ expectations.

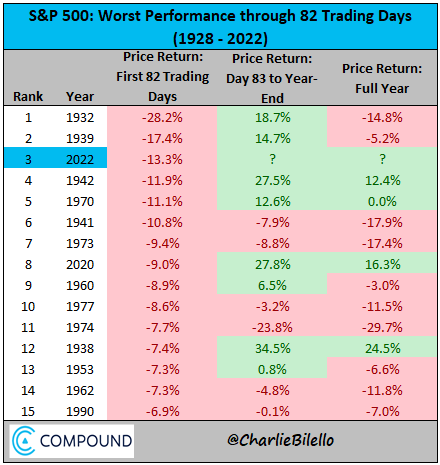

Price Returns After A Poor Start To The Year

Based on the data below, 8 out of the worst 14 starts of the year (57%) showed gains from day 83 to year-end. However, in only 4 (if you count 0.0%) out of the 14 years did the full year return positive.

1932 and 1939 were during the Great Depression, so maybe we can throw those two years out since I doubt things will get that bad. Perhaps 1974, 1977, 1973, and 1970 are better comparison years given high inflation and rising rates. I'm rooting for 2022 to mimic 1970!

How To Find Strength & Feel Better With Stocks Selling Off

As investors, we often have to overcome mental hurdles in order to stay the course. After all, every correction or bear market has paved the way for a bull market so far.

Here are five things that have helped me get through a stock market downturn.

1) Tally up your spending since the recent S&P 500 high.

It feels better knowing you got something or an experience out of your spending rather than losing it in the stock market. It also helps remind you that money is meant to be spent, not hoarded. I've been on a revenge spending mission since February 2021.

For example, this January, it felt a little painful to spend about $20,000 to repaint a rental house. However, we had a major rainstorm and I wanted to also finally professionally seal a window leak that had been bugging me for seven years. Scaffolding was needed, so I figured what the hell. Now every time I walk by the rental house, I feel great to have not dumped that money into more tech stocks.

Instead of painting, maybe you spent big bucks on a car or a nice anniversary dinner for a loved one. Or maybe you plunked $50,000 for your daughter's education. Revisit your spending!

2) Ask yourself whether your lifestyle has changed at all?

If you're still waking up at a similar time, eating the same food, doing your same job, hanging out with your same friends, and continuing to dollar-cost average, then the latest correction is no big deal.

If your lifestyle has changed, then you will revisit your net worth asset allocation and rebalance accordingly. You are a rational investor who tries to allocate capital based on your goals and risk tolerance.

3) Elongate your time frame to feel better about stocks selling off

The longer you zoom out, the easier it will be to stay the course when stocks are selling off. After I became a father, I found it easier to invest for the long term because now I was no longer just investing for myself.

During a correction, I always imagine having a conversation with my kids 25 years from now. I will reminisce about the good old days and they will tell me how cheap stocks, real estate, and other assets were. So I figure, given I have the opportunity to invest for them today, I might as well do so.

Even if you don't have kids, you can pretend to have a conversation with your future kids, nieces, or nephews. Once you start investing for someone else, you will feel more motivated to keep on going.

4) Think about your other investments

In the post, How Real Estate Gets Impacted By A Decline In Stock Prices, I write an S&P 500 correction between 10% – 15% is the ideal correction level where real estate outperforms the most. We're here now.

The real estate outperformance usually has more to do with stocks correcting rather than real estate prices ripping higher. Although, so far, U.S. median home prices have gone up by 2-3% in 1Q2022 and +13% YoY in March.

Real estate price appreciation is most certainly going to slow due to higher rates and higher home prices, bringing down affordability. However, everything is relative in finance.

Therefore, if your goal is to feel better about your stock market losses, then start thinking about your real estate portfolio or any other investment that has outperformed so far.

Stocks Are Selling Off But Hospitality Real Estate Is Booming

If you're looking to find more real estate investment opportunities, take a look at CrowdStreet's individual deals. They're focusing more on hospitality and multifamily opportunities in 18-hour cities, which makes sense. 18-hour cities tend to have lower valuations and higher growth rates.

I've been looking at hotel prices and Airbnbs in Honolulu for this summer and the prices are out of control! We're talking $1,000+/night hotel rooms that used to cost $400/night. Honolulu just banned stays at Airbnbs for less than 90 days outside of resort areas, thereby devastating the Honolulu Airbnb market.

There is now a hotel staffing shortage and an Airbnb unit shortage. I guess I'll just have to cram the family in with mom and dad when we visit. Good luck to us!

5) Focus on friends and family

The stock market can take away our gains, but it can never take away our relationships!

My kids could give two licks about Netflix crashing by 70% in a year. But they will care if I ignore them or seem stressed out.

When stocks are selling off, I say challenge yourself to spend more time with family and friends. Even if the stock market continues to down, this way you're always winning.

To Your Financial Freedom,

Sam

Financial Samurai is a third party advertiser for CrowdStreet. The statements made herein are made solely by the third party and are based solely upon the opinions of Financial Samurai. All information contained is obtained by Financial Samurai from sources believed by Financial Samurai to be reliable. CrowdStreet or its affiliates do not warrant, express or implied, the accuracy, timeliness, or completeness, of this information. Under no circumstances shall CrowdStreet or any of its affiliates have any liability resulting from the use of any such information. Nothing herein should be construed as an offer, recommendation, or solicitation to buy or sell any security or investment product issued by CrowdStreet or otherwise.