I believe 2021+ is a good time to buy real estate, especially in big cities. Whether you're looking to buy property in an expensive coastal city or whether you're looking to buy property in the heartland of America, the timing is as good as it has ever been in recent history.

Interest rates will likely stay low. We've got a new President who is determined to provide as much stimulus money as possible. The Federal Reserve has promised to stay supportive. Further, the intrinsic value of a home has gone up since we're all spending more time at home.

There will likely be a tremendous amount of capital looking to purchase rental properties around the country as well. The value of income has gone way up because rates have come way down. In other words, it takes a lot more capital to generate the same amount of risk-adjusted income. Yet, rental property prices haven't properly reflected this increase in value.

My Real Estate Investing Background

I've been a multi-property owner in San Francisco, Lake Tahoe, and Honolulu since 2003. But I did sell one of my SF rental properties in 2017 because I didn't want to deal with being a landlord to a bunch of rowdy tenants. Besides, I was able to get $2.75 million, or 30X annual gross rent for the place so I took it.

I used the proceeds from the sale to reinvest $550,000 in real estate crowdfunding. I wanted to diversify across many real estate projects around the country that had lower valuations and higher cap rates.

My current property portfolio consists of three rental properties in San Francisco, one rental property in Honolulu, one vacation property in Lake Tahoe, and 18 real estate crowdfunding deals in the heartland.

I've been writing about investing in real estate since I started Financial Samurai in 2009 where the site currently gets over 1 million visitors a month. I worked in investment banking from 1999 – 2012 and received my MBA from UC Berkeley in 2006. Property has been a core part of my passive income portfolio that allowed me to permanently retire in 2012.

As of 2021, my passive income portfolio is as follows:

Let met get into detail why I think buying real estate in 2021 is a good investment.

Why Real Estate Is A Good Investment In 2021

Here are all the reasons why I believe 2021 and beyond is a good time to buy real estate.

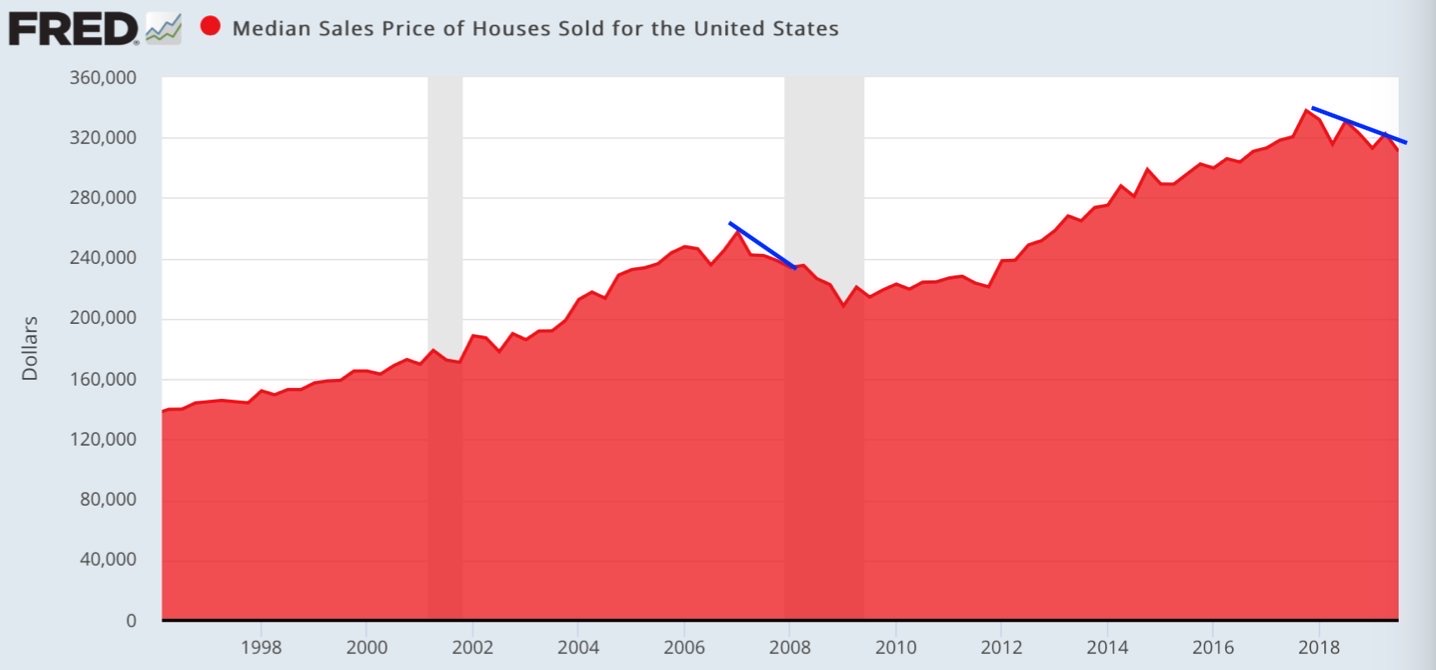

1) Prices have been weakening since 2017. According to the Federal Reserve Economic Data (FRED), the median sales price of houses sold in the United States has been weakening since 2017.

If we look what happened after the previous peak in late 2006, we saw the median sales price go from $255,000 down to $210,000 (-17%) over the course of 2.5 years. Some time in 2H2009, home prices bottomed.

Home prices gradually ticked higher from late 2009 until 2012, before exploding ~55% higher from $220,000 to $340,000 in 2H2017.

The median sales price has since fallen from $340,000 to roughly $310,000 in 4Q2019, for a 9% decline.

2) Mortgage rates have come down. Mortgage rates have declined by over 1% across various mortgage types since their highs in 2018. Although the average mortgage rate for a 30-year fixed is 3.75% and 3.4% for a 5/1 ARM according to Freddie Mac below, if you employ my mortgage rate strategies, you can do better.

For example, I refinanced my primary mortgage to a 2.25%, 7/1 ARM at no-cost. I first checked online with Credible and then used their quotes to pressure my existing lender to beat the rates. Credible provides free, no-obligation quotes from competing lenders in minutes.

With hundreds of thousands of homeowners refinancing in 2020, hundreds of thousands of people will have greater cash flow in 2021 and beyond. That's great for the economy.

3) The stock market is holding up strong. Stock investors got rich in 2019, with the S&P 500 closing the year up 31%. Then the S&P 500 miraculously closed up 16% in 2020. The S&P 500 is a good indicator of the economy's health as it is an expectation of future earnings growth. If U.S. corporates are doing well, unemployment will remain low and wage growth should continue to grow.

Further, look at various REITs, homebuilders, and Home Depot stock prices. They are mostly outperforming the S&P 500 YTD. This divergence between share price performance and underlying asset price performance can't continue.

4) A new President provides more stimulus. If we know one thing about power-hungry politicians, it's that in order to stay in power, they will do everything possible to help ensure the economy keeps growing. The stock market and economy prefer certainty over uncertainty. Joe Biden has promised to spend trillions in stimulus. If you've ever though of retiring, retiring under Joe Biden may be just the ticket.

5) The SALT tax deduction might increase. Once the state income and property tax deduction limit of $10,000 was introduced and the mortgage interest deduction limit was lowered from $1,000,000 to $750,000 for 2018, there was a lot of uncertainty regarding how this would affect a homeowner’s tax bill. Now that homeowners have gotten to see what the exact damage is, homeowners and tax experts can now make more calculated homeownership decisions going forward.

In my opinion, the SALT cap limit hasn’t hurt as badly as some people feared due to the doubling of the standard deduction and the decline in mortgage rates. I personally haven’t noticed any difference and even got a small federal tax refund.

6) Rents continue to go up. The value of a property is ultimately based on its rental income. Some coastal cities will have lower cap rates due to faster property price appreciation. While heartland cities will have higher cap rates, which offer tremendous value to income-seeking investors.

7) The Millennial generation is in its prime buying years. Millennials are now in their 30s, which means they've had 10+ years to save for a downpayment. They're also at a stage where they are settling down and having children. There's probably no bigger catalyst to own a property than children. Your nesting instincts go into overdrive as you strive for stability.

You can see from the chart below by the National Association of Realtors® Home Buyer and Seller Generational Trends study that married couples dominate the home buyer demographic, followed by single females. No surprise, the single male is way behind the single female when it comes to home buying.

Below is another graphic that shows Millennials are buying the most homes in the heartland of America. I've now got Ogden, Grand Rapids, and Des Moines on the top of my radar when I look at deals on CrowdStreet (mostly for accredited investors) and Fundrise (accredited and non-accredited) my two favorite real estate crowdfunding platforms.

Just like how stock investors shouldn't fight the Fed, real estate investors shouldn't fight multi-decade demographic trends. Now is a good time to buy real estate in the heartland.

Google is spending $13 billion on real estate in Nevada, Ohio, Texas, and Nebraska in 2019 and beyond. Uber signed a 450,000-square-foot lease within The Epic, a mixed-use development in Dallas, Texas. Their office is set to open in 2022. The trend towards the heartland is as clear as day.

8) Wage growth is reaching new highs. Strong employment plus wage growth are keys to real estate price appreciation. The strong share price appreciation of the various homebuilders and home-related companies knows this, and so should you.

Real median household income finally broke out to new all-time highs in 2020, reaching $68,000.

9) Foreigners are hibernating. Before 2017, a lot of coastal city buyers had to compete with wealthy foreign money, especially from China. Foreign buyers caused bidding wars and a lot of competition for potential local buyers. The Chinese government has since clamped down on hot money outflow to purchase foreign property. As a result, Chinese buyers of U.S. real estate is down over 50% YoY in 2019.

From a foreign capital competition perspective, the time to buy is when their spigots have been shut off. Eventually, foreign money will come flooding into America again, especially if there is a resolution with the trade war. There have been over two years of pent up demand for U.S. property. When the demand is finally unleashed, it will probably result in all-cash bidding wars once again.

10) The next recession won't be as deep. Anybody with a decent amount of money can still viscerally remember the prior 2008-2009 financial crisis. I personally lost 35% of my net worth in just six months.

However, we are a long way from the conditions that led up to the previous financial crisis. Lending standards are tight, homeowners have massive equity, and corporate profits are high, and corporate balance sheets are massive.

During the 2008-2009 financial crisis, the median home price in America declined by ~17% over a 2.5 year period. We've already seen a home price decline of 9% from 2H2017 to 2H2019. There's not much more to go if we were to experience the same magnitude of a slump.

With so much home equity that has been accumulated since 2009 by very creditworthy borrowers, most homeowners should be able to weather a financial crisis much easier than in the past.

The housing market won't collapse any time soon.

Good Time To Buy Real Estate

I invest in everything from stocks, bonds, private equity, venture debt, metals & mining, and real estate. I don't play favorites. I'm mainly interested in maximizing my investments to make the most amount of possible with the least amount of stress as possible.

With real estate, affordability is up, and I think real estate prices will catch up with other asset classes. Now is a good time to buy real estate.

If you don't want to take out a loan to buy real estate, that's fine too. Consider investing in real estate with a real estate crowdfunding platform like Fundrise.

With Fundrise, you can invest in real estate for as little as $500, and you don't need to leverage up at all. This way, you can easily diversify your real estate exposure and earn income passively.

I've personally got $810,000 invested in real estate crowdfunding after selling my SF rental property. So far, things have worked out great, as I'm on track to earn a 12% IRR since 2016 without having to manage tenants and do any maintenance work.

Check out Fundrise and explore all they have to offer for free. They are the best real estate crowdfunding platform for non-accredited investors. I particularly like their reigonal eREIT funds.

If you are an accredited investor ($1M+ net worth), then you should also check out CrowdStreet for free too. CrowdStreet specifically focuses on secondary cities with higher growth, higher net rental yields, and lower valuations.

Both platforms are free to sign up and explore. Now is a good time to buy real estate.