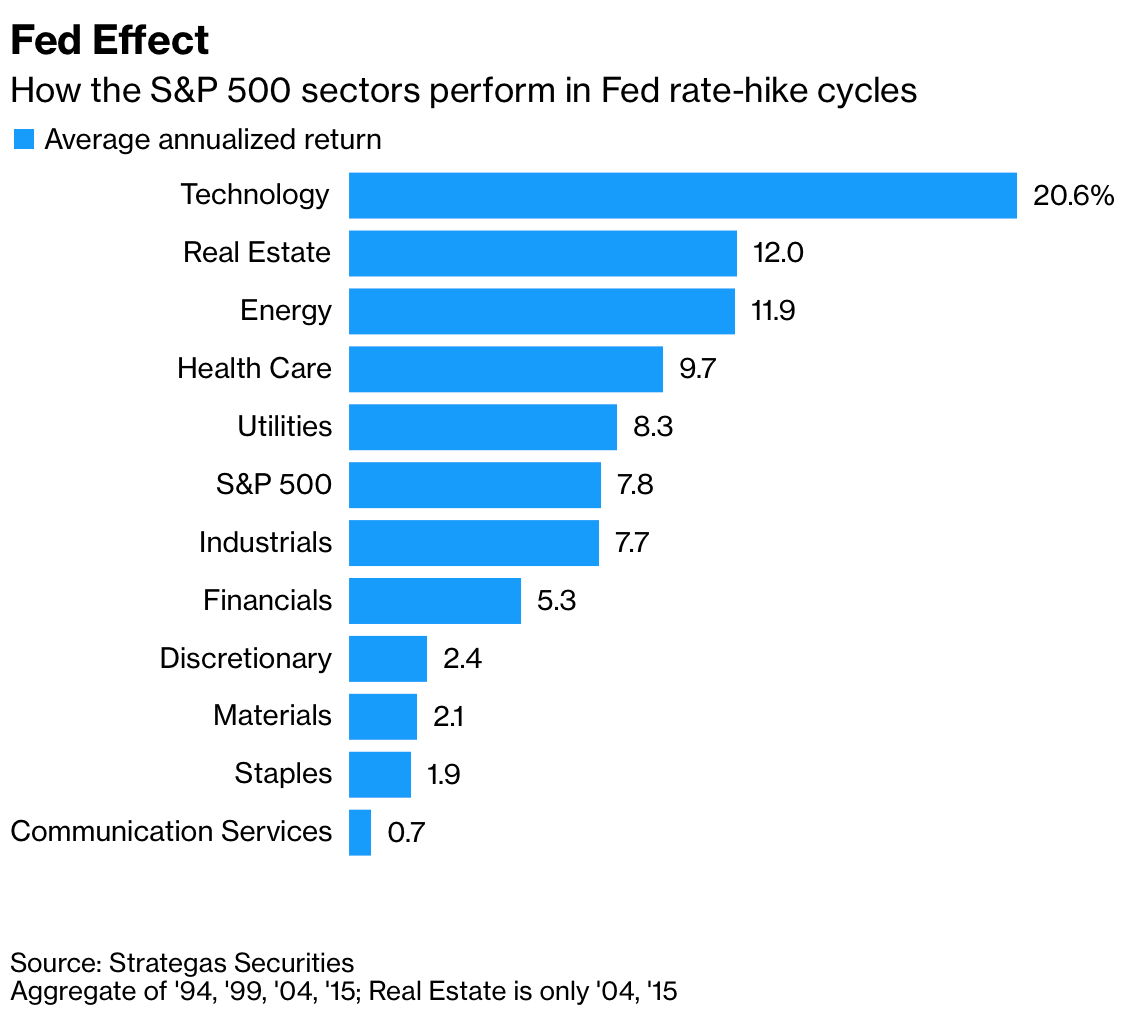

Let's look at real estate performance during a rising interest rate environment. You would think that real estate might not perform well when borrowing costs are going up. However, the evidence shows that real estate is a top-three-performing sector as borrowing costs increase. The other two being technology and energy.

The reason why real estate performs well is because rising rents outweigh the negatives of rising mortgage rates. The Fed tends to hike interest rates in a strong economy, not a weak one. Further, real estate performance improves with rising inflation given real estate is a key component of CPI.

Overall, the empirical evidence says real estate has grown by 12% annualized during previous Fed rate-hike cycles. Future real estate performance is not guaranteed. However, history has shown real estate performs well once the Fed starts hiking rates.

Before we get into the details about real estate performance when rates are rising, it's good to get an overview about what the Federal Reserve has planned for us.

Federal Reserve Guidance For Rate Hikes

We finally got clarity on the Fed rate-hike cycle after the Fed hiked rates on March 16, 2022. This was the first rate hike since December 2018.

Even though the Federal Reserve decided to telegraph a more aggressive rate-hike plan (six more hikes for the year versus consensus expectations of four), the clarity was welcome.

A more aggressive Fed rate-hike plan does three things:

1) Shows the Federal Reserve believes in the strength of the economy to weather such hikes. Fed Chair Powell flat out said he doesn't expect a recession.

2) Gives the Federal Reserve more room to slow down or cut again in 2023 if the economy and/or inflation slows down more than expected.

3) Enables borrowers to plan well in advance to slow down borrowing, refinance their variable loans to fixed loans, and pay down debt. The Fed's goal is to engineer a soft landing where inflation fades back down towards 2%-3% and the unemployment rate stays around 3.5% – 4%.

Moral Suasion In Effect Or Not

What is moral suasion you ask? Moral suasion seeks to persuade an entity to act in a certain way through rhetorical appeals, persuasion, or implicit threats, as opposed to the use of outright coercion or physical force. In this case, the entity is the U.S. consumer.

In early 2022 the Fed signaled it planed to hike nine times through 2023 to about 2.5% – 2.75% for the Fed Funds Rate. They added the extra three rate hikes in 2023 as a beat-down stick or insurance policy. I didn't expect they would follow through. After all, they could get the Fed Funds rate to 1.75% – 2% on the and then stop or start cutting again.

The Fed could use moral suasion to try and get people to stop spending and borrowing so much. That could be an effective way to slow down consumers. And if rates aren'r raised as much as expected, that helps with real estate affordability and demand.

But how do you enjoy your life after the Fed decides to ruin the world? The Fed Funds rate ended 2022 around 4.33! Then, the Fed's first meeting in 2023 brought another rate increase to 4.5%-4.75%. This overaggressive tightening is inevitably expected to send the US into a recession again in 2023.

Time to preserve capital. Make sure you're actively working on all of these top financial moves to keep your wealth headed in the right direction.

Economic And Political Issues Are Self-Correcting

I would be shocked if the war in Ukraine is still going on by the end of the year. Russia doesn't want to permanently lose 30 years of economic progress. Energy prices have already been normalizing.

As inventories build back up, I expect supply-side issues to further diminish. We didn't get to the Fed's consensus inflation estimate of 4.3% for 2022. But, the year ended at 6.45% inflation, which is better than it was earlier at 8%.

Finally, rising prices on anything serves to naturally reduce demand. For example, demand for used vehicles accelerated a lot in 2022 while demand for new cars decreased.

The Price Of Used Cars Is Increasing

Given the average used car price was $22,000 in 2020, used car prices have gained between $4,400 to $8,800 in value over the past two years. Therefore, many cars have successfully beat back the depreciation curve. Today, cars purchased in 2020 and 2021 can basically be resold for their purchase price.

Therefore, even though it's a bummer to pay higher gas prices. Psychologically, once you realize your car has held its value, you may feel better about consumption. And if you feel psychologically better about your wealth, you'll have a greater propensity to buy real estate.

Technology And Real Estate Are The Winners In A Rising Interest Rate Environment

Based on historical data, technology and real estate are the winning sectors in a rate-hike cycle. It's surprising, but true. Real estate performance is up 12% annualized, while technology performance is up 20.6% annualized.

I explain in detail why in my post on stock market performance during previous rate hike cycles. The article includes some good insights about where mortgage rates could be by end of this year and the end of 2023.

Personally, I'd rather have 12% returns with lower volatility. The massive swings in real estate are too much for a person like me who doesn't want to work so hard for a living. However, I do have a lot of tech stocks because I believe in technology's future. Further, I've lived in San Francisco since 2001.

I'm holding onto all my technology stocks and have been buying the dips. I've been a long-time holder of Amazon, Apple, Google, Tesla, and Nvidia.

In previous rate-hike cycles, technology stocks didn't correct as much as they have now before this new rate-hike cycle. Therefore, I feel better about holding and buying.

With real estate, I also plan to continue holding all my physical properties and adding to my real estate ETFs and my private real estate funds just as I have with stocks.

S&P 500 Performance After Four-Consecutive 1% Gains

Below is a hopeful chart that shows strong future S&P 500 returns after four consecutive 1% gains like we had in March 2022. In other words, equity investors should all try to hold onto their equities for at least six months, if not much longer.

Better Real Estate Deals

I go open-house hunting every weekend for exercise and research. We are currently in an air pocket where demand for real estate has temporarily declined mostly due to the war. The uncertainty has caused potential homebuyers to calm down.

Homes that would have sold in two weeks prewar are sitting longer. Other homes that would have sold for 3-5% over asking prewar are selling for asking. People are taking a wait-and-see approach, which may be your mini-opportunity to buy.

I say mini-opportunity because the greatest opportunity to buy in recent times was between April – May 2020, during maximum uncertainty. That was when you could get a 5% – 10% discount. But real estate prices are not going back to 2020 or even 2021 valuation levels like many individual growth stocks have.

Being able to buy a property you love without having to get into a bidding war is great for your peace of mind and your wallet. Real estate performance should resume once the war is over.

If you're looking for a primary residence, I would bargain more aggressively for a deal. A rally in the stock market can be seen as a leading indicator for real estate investor sentiment.

Of course, the stock market could go right back down. But real estate is usually much slower to react than stocks.

The housing price forecasts for 2023 are all over the place. However, the overarching consensus is down. I expect the median housing price for 2023 to decline by 8% with about 75% certainty.

Patiently Waiting To Buy The Dip Again

If the S&P 500 gets below 4,200 again, I'm going to be buying the dip again. I just need some time to reload my cash. I've earmarked a lot of funds toward capital calls for several venture debt and venture capital funds.

Here is a snapshot of me buying the dip in VTI. Whenever the S&P 500 is declining by greater than 1%, 5%, and 10%, I like to buy. I've been doing this for years.

I enjoy investing in private funds over the long term because they don't have visible volatility. I've found that once I allocate capital to a private fund, the stress of having to manage the capital goes away. The diversification into private funds is also welcome.

Buying Real Estate As Interest Rates Rise

I believe in the strength of the U.S. economy. After two years of COVID, we've finally gotten the virus under better control. As a result, more people will be spending their pent-up cash on everything, include nicer homes.

I would try to pick off some poorly marketed real estate listings right now, but I don't have a spare $300,000 – $600,000 lying around for a down payment. In 2020, I bought my forever home, which required a seven-figure down payment.

Therefore, I'm simply going to buy the dips in real ETFs and continue to add to private real estate funds like Fundrise.

Fundrise is my favorite real estate investing platform because it is vertically integrated, invest in the Sunbelt, and has a cautious and focused CEO. I spoke to Ben Miller for an hour the other month and I really like his real estate investing philosophy.

Real estate is my favorite asset class for 2023 and beyond. The Millennial generation, the largest generation, is in full-on home-buying mode. Meanwhile, the supply of real estate continues to be very low.

Firms like Fundrise are well-positioned to capture upside real estate performance given they've been investing in single-family and multi-family rentals throughout the entire pandemic. You can invest in Fundrise with as little as $10, which makes building a larger position over time easier.

Regards,

Sam – Financial freedom sooner, rather than later.

If you're interested in joining 50,000 others and reading my free newsletter, sign up here. You can also sign up for my posts. Everything is free as I try my best to help us maximize wealth, understand what the heck is going on, and live our best lives. I tend to take action around my beliefs, otherwise, there's no point!