2023 housing price forecasts from various institutions range from -22% to + 5.4%. There is no consensus as to which way house prices will go. However, the bias is towards the downside.

There is also the issue of forecasting the national median home price and the price of your local housing market. While we care about the national median home price forecast, we care way more about our local housing market forecast.

For background, I expected the median sales price in the United States to rise by 8% to 10% in 2022. My estimate was less bullish than the majority of firms expecting 12% – 18% price increases.

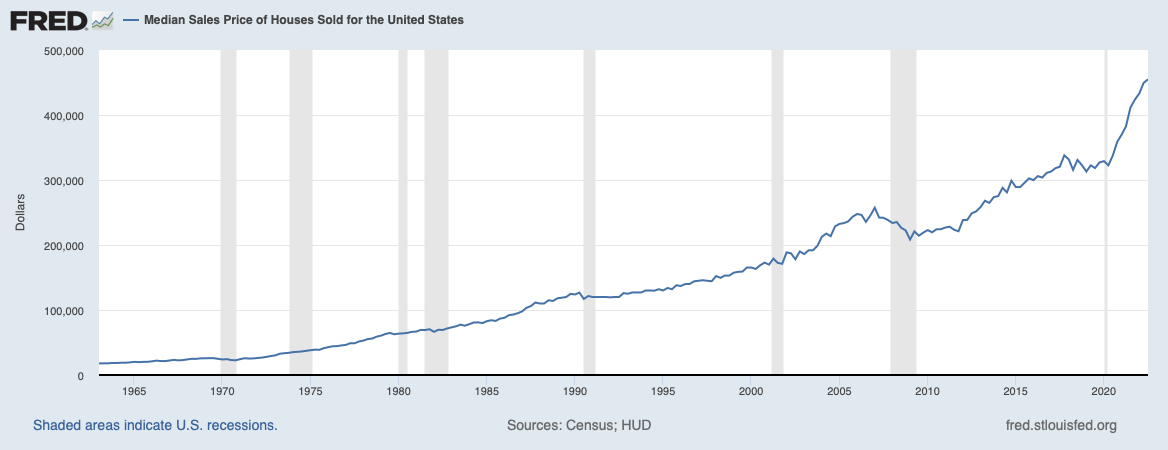

The 4Q2021 median home price was $423,600. The latest pricing data available, 3Q 2022, shows the median home price of $454,900, or a 7.4% increase. 4Q 2022 housing price data will be released in 1Q 2023.

2023 Housing Price Forecasts

Take a look at the housing price forecasts for 2023 from some popular real estate or real estate-related institutions. They are all over the place!

All housing price forecasts are subject to change over time as datapoints and conditions change. I will update the changes as they happen.

Starting in May 2023, there is a window of opportunity to buy real estate again. Prices have indeed come down between 5 to 10% and the S&P 500 has rebound by 10% year to date. I think real estate prices will catch up and be higher by 5 to 10% by mid 2024

The Most Bearish Housing Forecasts For 2023

John Burns Real Estate Consulting (JBREC): -20% to -22%

Zonda: -10%

Goldman Sachs: -5% to -10%

Redfin: -4%

The Most Bullish Housing Price Forecasts For 2023

Realtor.com: +5.4%

CoreLogic: +4.1%

National Association Of Realtors: +1.2%

The Most Boring Housing Price Forecasts For 2023

Fannie Mae: -1.5%

Freddie Mac: -0.2%

MBA: +0.7%

Zillow: +0.8%

My Thoughts On The Extreme Housing Price Forecasts

When it comes to forecasting, it's good to first look at the tail ends. It helps to see who is delusional and whether you have any blind spots.

Most Bearish Call

I like the work of John Burns Real Estate Consulting (JBREC). However, they are too pessimistic forecasting a -20% to -22% decline in housing prices in 2023. A 20% median home price decline would bring the national median home price down to about $364,000.

A 20% – 22% price decline would mean a GREATER decline than the one during the global financial crisis. Median home prices declined from $257,000 in 1Q 2007 to $208,400 in 1Q 2009, or -18.9%. Further, it took two years for national median home prices to decline by 18.9%.

It is improbable the national median home price will decline by more than it did during the global financial crisis in half the amount of time. Credit standards are much higher than they were before the 2008 crisis. Meanwhile, the vast majority of homeowners locked in mortgage rates below 5%.

If we say this housing downturn is 30% as bad as the one from 2007 – 2009, then we'd get to a -5.7% housing price decline.

Most Bullish Call

On the flip side, there's the +5.4% housing price forecast by Realtor dot com. Realtor dot com is a website that helps you find a realtor to buy or sell a home. The realtor pays a referral fee on closed transactions. The stronger the housing market, the more business Realtor dot com will generate.

It's not a coincidence CoreLogic (+4.1%),the National Association Of Realtors (+1.2%), Mortgage Bankers Association (+0.7%), and Zillow (+0.8%) are all also looking for higher median house prices in 2023. I fear they suffer from business sector bias.

With a Fed-induced recession likely in 2023 and higher average mortgage rates, I think every forecast that shows an increase in 2023 housing prices is wrong. Housing prices lag, not lead.

My 2023 Housing Price Forecast

With an 70% conviction level, I expect the median housing price for 2023 to decline by 8% to $419,000. I'm assuming the median house price ends 2022 at $455,000 based on the St. Louis Fed data.

The reasons include:

- A global recession by the end of 2023

- The Fed insisting on hiking to a 5% – 5.125% terminal rate even though inflation is clearly declining and annualizing under 2%

- The inescapable correlation between risk assets as the S&P 500 goes nowhere in 2023

- A higher risk-free rate makes investing in risk assets less appealing

An 8% decline in housing prices is disappointing for real estate owners. However, real estate has outperformed the S&P 500 by over 25% in 2022. Giving back 8% is not that bad, especially if you bought responsibility or have little-to-no mortgage left.

Reasons why I don't expect home prices to decline by more than 8% are:

- 30-year fixed mortgage rates should decline from their peak of 7% by end-2023. 5% – 5.5% 30-year fixed mortgage rates should bring back demand.

- The Treasury bond market has stopped listening to the Fed. The 10-year bond yield did not move after the Fed raised rates another 50 bps on December 14, 2022. The huge yield inversion between the 10-year and the 3-month Treasury bond is saying the Fed is making a mistake. And retail mortgage rates are priced largely off the 10-year bond yield.

- Consumers still have “excess” savings thanks to tremendous stimulus spending in 2020 and 2021.

- There will continue to be an undersupply of homes. The vast majority of homeowners have 30-year fixed mortgage rates under 5%. Therefore, there's no need for most to sell.

- The will be a continued capital shift towards real assets and away from funny money assets like stocks, cryptocurrencies, and anything else that provides zero utility.

- The average credit score for borrowers of new mortgages is over 720.

- There is a huge amount of home equity built over the years. Home prices would need to fall by over 40% to have the same proportion of homes under water starting in 2008.

- As of April 21, 2023, home prices have come down several percentage points. But now I see a buying opportunity in mid-2023 due to a rebound in stocks, declining mortgage rates, and pent-up demand.

Downside Risks To My Negative Housing Price Forecast: Desperation

One of the biggest unknowns is how much new housing supply will come to market during the traditionally strong spring season. If there are too many desperate sellers, we could see home prices fall by more than 8%.

You also have funky scenarios where a house is priced too high and becomes “stale fish.” You might also encounter extremely motivated sellers going through a divorce. One short-sale can ruin the values of a dozen neighboring homes.

The other main downside risk to my negative housing price forecast is a more aggressive Fed. Although the Treasury bond market has stopped believing the Fed, a 5.125% Fed Funds rate will squeeze consumer debt borrowers. Everything from credit card rates to auto loan rates will go up.

A minority of thinly stretched borrowers can cause harm to the majority who have their finances in order. During the global financial crisis, even some of the elites decided to stop paying their mortgages, despite having the money.

Seeing prices fall by 8%+ in your local housing market is not hard, especially if your housing market showed the most robust gains in 2020 and 2021. Prices in Boise and Austin could easily fall by 20% from their peaks before bottoming if the Fed stays aggressive.

Biggest Upside Risk To My Negative Housing Price Forecast: Stealth Wealth

I may be underestimating the amount of liquid wealth potential buyers are secretly holding. Further, I may also be underestimating how much demand will return to the housing market if mortgage rates do decline by 2% – 3% in 2023.

Personally, I have a lot of cash and short-term Treasury bonds. So do all of my friends. I have a feeling, many Financial Samurai readers have an elevated amount of cash as well.

If many of us are going to be hunting for housing deals in 2023, will housing prices really decline by my forecasted 8%? Maybe not.

When it comes to housing prices, prices tend to get bid up quicker than they fall due to real estate FOMO. Hence, buyers might only have a six-month window remaining to take advantage of big price discounts.

Mortgage Demand Highly Sensitive To Even High Rates

Take a look at this chart below. It shows a surge in mortgage purchase applications as the average 30-year fixed rate fell from 7.1% in October 2022 to 6.3% in mid-December 2022. 6.3% is still high compared to a year ago. Yet mortgage purchase applications still went up 13.8%. That’s surprising during the slow winter months.

Hence, if mortgage rates fall to 4% – 5% by mid-2023, perhaps we will see a 25%+ increase in mortgage purchase applications. The longer the inactivity in real estate transactions, the greater the pent-up demand.

Major Upward Revision To Home Price Forecasts

Now that it's 3Q 2023, how have these home price forecasts for 2023 done? Essentially, most of us were too bearish. Home prices did indeed decline in 1Q 2023, however, despite higher mortgage rates, home prices started recovering.

Below are the 12/2022 home price forecasts for 2023 by several firms compared to their forecasts eight months later. All of them have revised up their forecasts.

It seems like higher interest rates were warranted after all given the strength of the U.S. economy. Maybe the investment narrative will eventually turn from restrictive interest rates hurting real estate prices to healthy inflation rates boosting real estate prices once more.

I'm particularly sensitive about the real estate market's future because I'm in the final stages of my home escrow period with contingencies. I've got to decide whether to release contingencies at the end of the month or not.

If you've ever struggled with emotional attachment when selling or buying a new home, here's a new post to read: 5 Ways To Overcome The Emotional Attachment To Buy A New Home.

There Will Always Be Real Estate Opportunities

Real estate continues to be my favorite asset class to build wealth for most people.

Even if all my properties were to decline by 15% on average in 2023, I won’t care because I won’t feel it. I will continue to raise my family in our primary residence. Then I'll continue to collect my rental income to help pay for our lifestyles.

An asset that provides both income and utility is the best type of asset class to own. However, tenant headaches, maintenance issues, and property taxes can get to even the most patient of real estate investors.

As a result, a diversification of investments into stocks, private real estate, bonds, and alternatives that provide truly passive income is recommended.

If you want to buy real estate in 2023, there will be plenty of opportunities to do so at more reasonable prices. Be patient.

When that time comes, I just hope nobody bids against me. Being able to buy my current forever home after the lockdowns began on March 18, 2020, was ideal. If I had faced competition, I would have easily paid 4% more.

2023 Median Sales Price Of Existing Homes Now That The Year Is Almost Done

I'm updating this post on December 4, 2023, and according to data below, the median home price in America is up about 10% through September 2023. But this was after a 12.7% price decline from June 2022 to January 2023.

Reader Questions And Suggestions

Readers, what are your housing price forecasts for 2023 and why? Are you planning on hunting for deals in 2023? What would cause you to sell your property in 2023?

If you want to invest in real estate more surgically and dollar-cost average into a weak market, take a look at Fundrise. I just had an hour-long conversation with Ben Miller, CEO of Fundrise. Its income fund is generating an 8%+ yield. Further, Fundrise is using its existing cash to hunt for distressed deals with 12-14% yields. Our views about 2023 housing prices are very similar.

For 2024, I expect home prices to strengthen because mortgage rates will be coming down. There is a lot of pent-up demand for real estate since mid-2022, due to aggressive Fed rate cuts.

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Here are the 2024 home price forecasts, which mostly call for a rise in prices.

Given how slowly the economic impacts from the Fed rate hikes are progressing, I don’t believe we will enter a recession until Q2 or Q3 2023. This means that people won’t start losing jobs en masse until then. I don’t foresee any big deals in real estate until Q1 of 2024, at the earliest.

As for price drop forecasts, like all things in real estate, it will be local. As discussed above in the comments, highly-desirable properties will continue to sell in all markets. However, as we have already seen start to play out, overheated markets like Phoenix, Austin and Boise will have more sharp price declines because the home prices were bid up by out-of-market buyers. Now that those buyers have stepped back, it is up to local buyers to sustain the market and the prices are not affordable to them, so they have to fall more.

Obviously, the caveats to all of the above are the Fed (and interest rates) reversing course, which will improve affordability for local buyers.

Good points everyone – if someone has a low, fixed-rate loan and doesn’t need to sell, it probably won’t really be big deal.

But, in terms of cap rates, inventory, interest rate, inflation, it is potentially looking like more of a bubble for investors (imho).

For example, it looks like there’s almost an inversion of cap rate vs. 6-month treasury rate.

Also, if you look at some markets, a house was 50k in 2018, then sold for $200k in early 2022, now asking $250k with no upgrades, just going for a flip and has been sitting unsold on the MLS.

In general, there seems to be like a lot of unfinished inventory. Also, relative to the Case-Schiller, it looks somewhat like 2008.

In general, what is more concerning to me in the long run is the federal government’s debt ratios, etc.

Here’s a fairly bearish outlook re:real estate, that has some of the graphs that I just mentioned:

https://www.reventure.app/blog/rents-are-dropping-fast-investors-dont-know-what-to-do

The case for optimism: most well-run biz that provide good value (including real estate biz) will likely do well in the long run.

In any case, best wishes to everyone!

Thank you for speaking to the obvious elephant in the room, the high percentage of sales over the past decade that have been investor sales. The combination of cash flow and short term rental listings surging while demand is falling, especially for short term rentals, will be a key driver for the pricing collapse, though the Fed has telegraphed explicity their plan to hold rates high and that this will cause a “housing recession”. Banks will also play a role as a property is only worth what a bank agreed to lend against it. Also, I have heard it is currently very very difficult to get any kind of mortgage without W2 income despite the size of your portfolio, which will further impede the investor space.

https://www.parealtors.org/housing-report/

Interesting. In Pennsylvania, November home sales down 28% year over year, but median sales price up 14% year over year, and up 3% from October 2022.

Less volume but pricing remains solid. No distressed sellers showing up at this point.

Happy Holiday’s Sam,

These recessions unlock opportunities for those who don’t panic or are forced to sell (default). During the great recession my neighbor who paid $3.4M for his house in 2004 lost it and it traded in 2009 for $1.7M and another neighbor on my street bought it, sold it for $2.4M a few months later another one sold for $1.35M that was trashed by squatters. Both homes are worth over $3.5M today, down from $4M a year ago.

You are correct in the analysis that housing is far less risky, because most people have much more equity than the last correction, so far. That is the beautiful thing about inflation, equity grows, and the debt is static. There will be opportunities, as the job losses mount, and people expand their credit, some will end up in default.

Example, I already know someone who reached out to me and is looking for help. Current on his 1st of $800K, but has defaulted on his HELOC and the balance is $300K, waited way too long to try to figure it out and is only a few weeks from a foreclosure. House was worth $2.5M, now worth maybe $2M, but a foreclosure sale may find footing much lower.

This is just the beginning of these types of stories. If the sale happens, and a white knight fails to help him, someone will get a good deal. This will be very common and one big factor is a result of the “Great Recession” that is many new lending laws to prevent Predatory Lending Practices, but that also prevents some solutions because lenders are concerned about lawsuits and would rather not help and refinance a viable borrower in this climate. Just food for thought.

Enjoy the kids, and the season, 2023 will be wrought with challenges.

Best Regards, Ben

Sam,

Excellent analysis on real estate. The chart on the increase of purchase mtg applications in December reveals that real estate prices won’t be dropping much more than they already have from there peak in Ca of 8-10%, if at all. (Silicon Valley might be an exception with tech contraction)

30 yr fixed rates were down to 5.75% on Friday. (I own a mortgage co) We have a lot of buyers getting pre-approved now to pull the trigger with a purchase after the first of the year. Demand will only increase as mortgage rates continue to decline.

As you state the inverted yield curve reveals investors recognize Powell is off base with the economy and the need to go to 5% plus.

The good news to Powell is he has proven to be willing to flip positions when he is wrong, which is most of the time. He waited way too long to increase rates and he is waiting too long to pull his foot from the brake.

I believe mtg rates reach 4.0-4.5% by June and real estate sales and prices are stable. Consequently, the best time to buy real estate at a discounted price is between now and March 31.

I hope you and your family have a Merry Christmas,

MP

Home values during the economic crisis dropped ~28% nationwide, that 18% given is far too low. I can easily see a downturn as significant as 2008 at LEAST, given a few reasons…

1. Boomers are beginning to die off or downsize. As they own, by far, the majority of homes, supply will become robust once again in the coming decade. Possibly the most saturated it has ever been.

2. Milennials and younger generations are avoiding having families. As a result less of them feel the need to own a home as the market will be more comprised of single people living in their own smaller space. Condos and townhouses may see some popularity if this is the case. I could even see communes and/or shared accomadations becoming more popular (think along the lines of that settlement zoomers created during the George Floyd riots). Piggyback on this…

3. Milennials and younger generations can’t afford homes in the first place. The appreciation of homes has far outperformed the appreciation of their salaries. What was an easy thing to do as a boomer is far more difficult as a younger individual today. The market will have no choice but to be on a decline and reflect lower prices if boomers want to sell their homes one day. The milennials simply can’t afford it and will exercise plenty of caution.

4. Milennials have little interest in the idea of homeownership at all. The younger generations are waking up in greater numbers and seeing how condemned this country (and world frankly) is. Opportunity is diminishing, the social structure is a mess, and their investments are being gambled by entities who will simply get bailed out when their asinine investments go belly up. They no longer want to live by society and its rules, and they don’t want to be tied down to a single location in an asset that is more of a headache than just paying a landlord money and living there lives stress free.

I can see a Japan-style deflation period for the next decade or two. As far as home values are concerned, 30-40% declines on average would not at all shock me. The FED has made it clear they will suicide the housing market if it means nipping inflation, so to say rates will return to 4-5% over the course of next year is dangerously optimistic.

I know this seems like a very pessimistic point of view, but we have to face the music at some point. What we are doing is not sustainable, and the piper will have to be paid soon. A decade plus of artificially low interest rates have essentially destroyed the economy and its fundamentals. We are in a new era where speculative investing is king, and comfortable retirement will soon be a rare luxury. I can see traditional investments (houses included) see stagnation and/or depreciation over the long term. I don’t like it one bit, but I fear this is the new reality.

I’ve been a Mortgage Banker for 25 years, and I talk with potential buyers daily. The overwhelming consensus for those not buying now is “I’m going to wait and see what rates do”. Meanwhile the Mortgage Bankers Association forecasts rates in the high 4’s for a conventional 30 yr fixed loan in the next 12 months. Peak inflation is behind us. It’s not over by any means, but the worst has occurred and the Fed still using lagging indicators to dictate policy.

We were already tracking toward 5% pre-Covid and are simply reverting to where things would have been without artificial interference of the markets. My feeling is for those wanting to buy property, get busy NOW and perhaps for the next 6 months or so as many of the wait-and-see crowd will all be competing with each other once it’s unanimous the rate trajectory is lower.

One thing is for sure: In 10 years none of this will matter. House prices will be MUCH higher.

Thanks for your insights. My biggest fear as a bargain hunter is the wait-and-see crowd suddenly all deciding to buy before mid-2023.

Real estate FOMO is the strongest type of FOMO.

Hi Sam,

How do you feel about the real estate market after Fed’s meeting minutes today? Risk appetite for sure returned for the equity market, and I wonder how it will impact the real estate market for the rest of the year. I have been house shopping for a family member since late November. Reasonably priced listings (in San Diego) still get a few offers within 3 days. I would say the price is maybe 5~10% off from the Spring 2022 peak, but still significantly higher than 2020. How are you determining what is considered a “good bargain”? I have about $300K (either to be invested in stock market) for a down pay, and I’m thinking to buy another investment property. Are you actively looking now or are you still in the “wait and see” mode?

I think if you can get a home for 10% off 2022 prices, that’s about as good as it’s going to get. Mortgage rates are coming down and will likely continue to come down.

Thanks Sam! So from your perspective, you’re not looking for prices to go back to Fall 2020 level is that right? Would you say comparable pricing as in 2021 would already be reasonable now that we are in 2023?

Correct. An 8% decline in the median home price in 2023 still results in home prices 15%-20% higher than in Fall 2020.

Here in northern Virginia, recently sold prices are already 10-15% off peak price (Q1 23). So someone already got deals IF they are cash buyers.

But it always depends on the house. There is a luxurious house just sold 50% more than its 2020 purchase price without any further updates. The crappy and ordinary houses benefited from the COVID boom is falling back to earth. But the stars (real stars, not builder grade McMansions – great location, land, architectural style, layout, building quality and design choices) are still appreciating handsomely.

So my forecast for 2023 is for this divergence to deepen: bad houses can easily fall back to pre-COVID prices, while great houses hold up value and go up more than inflation.

The star houses always outperform bc they are at the top of the pyramid. They just got that much rarer as the pyramid of demand gets that much wider each year.

Not sure non-star houses decline all the way to pre-pandemic levels. I doubt it actually. But their growth rates may very well trend back to pre-pandemic levels.

What criteria do you use to define a “star home?”

– Building materials

– Housing age

– House size

– Layout and amenities

– Lot size

– Location

– School district

I would agree with you Maria. Out here in the Bay Area homes that do not fit the star properties are sitting and have price reductions but the star properties, location, finishes, schools and so on are moving fast and above ask. During the peak of this market any house was selling and it didn’t matter where it was located at or the condition it was gone in days at some crazy price. The the three words we realtors have always used are never more true today, Location, Location, Location.

Great article, Sam.

Rather than median sales price, have you ever looked into the repeat-sales indexes like Case-Shiller or OFHEO indexes? They give a more accurate view of prices of owned assets over time than just a simple median price. They’re also available for all the major metro areas. Here are some links:

Case-Shiller (these indexes are the best):

https://fred.stlouisfed.org/searchresults/?st=case%20shiller%20indexes

https://fred.stlouisfed.org/series/CSUSHPISA

https://fred.stlouisfed.org/series/SFXRSA

OFHEO (less precise, but exist for a broader range of metro areas):

https://fred.stlouisfed.org/tags/series?t=fhfa%3Bhousing

https://fred.stlouisfed.org/series/HPIPONM226S

https://fred.stlouisfed.org/series/ATNHPIUS06075A

I am in agreement on the housing softening and pullback here. It should be less severe than the 2007-2012 down cycle, I would think, but will still be meaningful.

On a related topic, does it make sense to maintain a mortgage if you are FI? The tax deduction is nice but doesn’t cover the interest expense. If I can pay off my mortgage rapidly without tapping stock investments, is there any reason not to do so?

In such a negative real interest rate environment, I wouldn’t.

Maybe you can resume paying extra a year from now if inflation is sub 4%.

Thanks Sam – nice analysis but how does it play out at various points in the mortgage? If you’re in year 20 of a 30 year mortgage and mostly paying down principal it makes sense to drag that out as long as possible, but in the first several years I’m paying almost entirely interest, which doesn’t seem that much different from renting.

Don’t know bc I’m not sure about your situation, mortgage rate, savings, income growth etc.

I’m curious if the NAR has EVER predicted a price decline in its history. I suspect not.

I live in Irvine, southern california. Here the market has gone up close to 25-30% just from 2021-2022. I really hope we see at least 10-15% price drop so new home buyers can get a decent deal.

I think down 10% is highly feasible in Irvine. If you look hard enough, you’ll be able to find deals for sure. Especially people who are listing right now.

I put down less than 5% in 2023, although I wouldn’t be shocked if prices rise in 2023 either. Still is a huge imbalance between supply of homes and demand and when mortgage rates drop back into the 4% range combined with wages up 5-7% y/y, I think you’ll see an increase in the 2H. Of course, the returns by city versus national will likely be quite a huge range of results. You won’t see forced selling in large numbers – 97% of mortgages sold in the last 5 years were fixed, most in the 3% interest range, and the average credit was around 775, basically record highs. Forced selling is usually what drives price declines in housing.

I would love for housing prices to drop though, great entry point to buy more rentals.

I saw what you noticed Sam about homes going pending in recent weeks with mortgage rates going down albeit still high rates. It’s really interesting all the variables in play to include a shortage in supply of homes. I could see things going either way, which may end up balancing out in the end (so put me under “boring forecast” ha!). I do think interest rates mostly determine what happens as buyers are extrememely sensitive to them, as shown in recent years. Thanks for your thoughts!

Homes going pending during the winter always surprise me. Who, but the most savvy of buyers are looking during the holidays.

One of the X factors really is pent-up demand. The more inaction there is, the greater the pent-up demand. COULD be explosive demand with six months more of inactivity if rates do come down, which I think they will.

Precisely. Every home I own has been bought in the winter.. no coincidence there. In fact, I closed on a home in Scottsdale, AZ last week. Paid 68% of the original list price, highly motivated seller and I closed in 5 days. True discount to actual value was probably 20% or so, but hey, that’s a 2018 price in December, 2022.

There are one-off deals in every city out there if you look hard enough and have the capacity to close quickly, and winter is by far the best time to make it happen. Nobody “wants” to list their home for sale in the winter, so there’s generally reasons why and most equate to seller being motivated.

I feel 1 year is noise after all the taxes, transaction costs, and sheer labor that goes into buying and selling a house. So I wouldn’t measure over 1 year. For the city where I live —- Seattle—- I feel over the next 10 years housing prices probably will beat inflation by a couple percent.

Good to think about the long term. But we live in the here and now. Many people are deciding whether to buy or sell in 2023, including myself. Hence, it’s good to discuss what could happen.

Great info! As someone who bought in Boise last year, I hope you’re wrong about -20%. Regardless, me and folks I know are at 40%+ equity on a 3% loan. I think most will do what it takes to keep that home.

Oh man, I hope not too then. Hopefully you have a buffer where prices continued to go up for several months after you bought.

Sam, love the housing market forecasts! 5%-10% seems reasonable. Personally, would love to take advantage and upgrade to a more expensive home with new construction this year. That said, hard to imagine how imperfect of a science it has to be for builders to come up with initial phase pricing on new developments. Would have to think they would start conservatively considering price drops and a looming global recession are looming. I mean, it would have to be bad for business to have to drop prices before the initial buyer’s homes are completed 12-18 months from now, right?

Maybe new home builders will have to provide discounts, otherwise, enough buyers will walk away from their deposits.

Or maybe instead of price discounts, some nice free upgrades.

True! I guess that would be a worst case scenario for the buyer (leaving the deposit behind). Would be tough to leave 5% of a million(+) home behind if things got really bad! I wonder how much a builder would care if buyers walked, if the buyers are leaving large deposits behind? Didn’t think about this back in ‘07. I wonder how this scenario played out then before builders stopped building?

Thank you for putting together such a thorough look at housing predictions! Wow that’s a lot of work. I anticipate 2023 to be a tough year all around including housing. I wish it won’t be. But there are too many signs indicating rough times ahead. I expect we’ll get through it ok but it could be bumpy. And we just gotta hunker down and ride out the storm. There should be blue skies on the other side if we stay patient enough!