Are you wondering how the stock market has performed during previous Fed-rate-hike cycles? This article will explore whether stocks perform well or poorly when borrowing costs rise.

On March 16, 2022, the Federal Reserve approved its first rate hike since December 2018. 11 Fed rate hikes later, the Fed Funds rate is at 5.25% – 5.5% to combat what was once 40-year high inflation in 2022. The Fed-rate-hike cycle is over, but rates could stay elevated for longer due to the strength of the U.S. consumer.

However, the 10-year bond yield is at about 4.5%, meaning the yield curve remains inverted. With an inverted yield curve, fears of another recession within the next 12 months is increasing.

Inflation has proven stickier than expected unfortunately. Here are some straightforward ways to combat inflation if you want to reduce costs.

The impact to borrowing costs won't be that great if the Fed hikes gradually. Consumers on variable rates will have plenty of time to refinance to a fixed rate. Unfortunately, the Fed has been aggressive and both consumer borrowing costs and mortgage rates have increased tremendously.

Let's discuss how the stock market has historically performed during Fed-rate-hike cycles. We'll also look at how specific sectors have performed when interest rates are rising.

How Fed Rate Hikes Affect Stock Market Returns

During the previous four rate hike cycles, equity markets ended up performing well over the next 12 months. Unfortunately, 2022 turned out to be a bear market, with the S&P 500 down about 19.6%. It was down worse at one point.

However, the S&P 500 roared back in 2023 with over a 24% return. So far, the markets are strong in 2024, partly thanks to the explosive growth of artificial intelligence. AI is the defining technology of our time that improves productivity for those who know how to use it.

For those interested in investing in private AI companies, check out the Fundrise Innovation Fund. It is an open-ended venture capital fund that invests roughly 35% of its fund in AI companies and other private growth companies. The investment minimum is only $10 compared to usually $250,000+ minimums at closed-end VC funds.

Take a look at this great chart created by LPL Research and Bloomberg. It shows the S&P 500 is positive 50%, 75%, and 100% of the time three months, six months, and 12 months after the first rate hike. 2023's performance proved the positive trend of the stock market after 12 months.

Therefore, based on historical performance, we should stay invested and dollar-cost average for as long as possible. Tell yourself to hold on for at least a year. Instead of selling stocks during a correction or bear market, buying stocks may be more appropriate.

The only time we should be selling stocks is if we realize our risk exposure is too great. And the only way of really knowing whether our risk exposure is too great is to go through a down market and analyze how you feel.

During up markets, we tend to feel more risk-loving than we really are. It's easy to confuse brains and courage during a bull market. See how stocks perform under different political presidents too.

Unfortunately, the Fed embarked on the quickest and most aggressive rate hike in decades in 2022 and 2023.

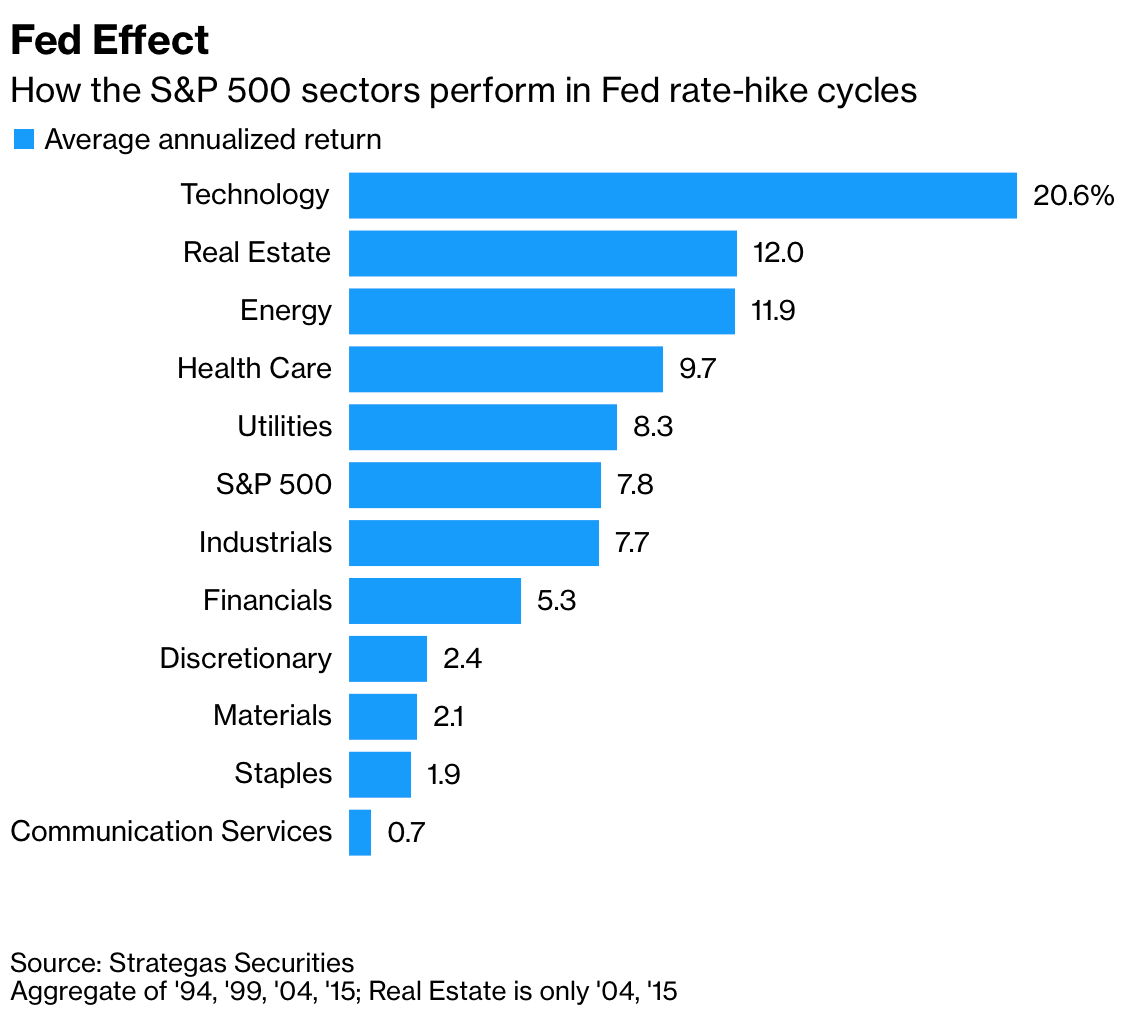

How S&P 500 Sectors Perform In Fed Rate-Hike Cycles

Here's a great chart from Strategas Securities. It breaks down the average annualized return by S&P 500 sector during Fed-rate-hike cycles. Technology, Real Estate, Energy, Health Care, and Utilities performed the best. These sectors outperformed the S&P 500 when interest rates were rising.

Why Tech Stocks Outperform In A Rising Interest Rate Environment

Some of you may be surprised the technology sector is the best performing S&P 500 sector during historical Fed-rate-hike cycles. The technology sector is usually more sensitive to rising rates given a higher discount rate reduces the present value of its expected cash flow when conducting a DCF analysis.

Technology stocks tend to trade more on future expected earnings, which are more uncertain, versus say, the utilities sector. And in 2023 and 2024, tech stocks have proven to be the biggest winners.

One reason S&P 500 tech earnings are less sensitive to changes in interest rates than other S&P 500 sector earnings is because tech companies usually have less debt financing than non-tech sectors. Gorillas like Apple, Google, and Microsoft are cash cows with massive balance sheets. Therefore, they would actually earn higher interest income than those companies with weaker balance sheets when rates go up.

Another reason the technology sector tends to perform well during a Fed-rate-hike cycle is that technology stocks do not sell big-ticket items their customers have to finance. For example, most people buying Apple Air Pods can pay cash or charge it on a credit card and pay it off after one billing cycle. The same goes for subscribing to cloud software.

Here's an interesting chart that shows how valuations for the S&P 500 technology sector sometimes increases as the 10-year Treasury yield increases. Fascinating stuff!

With many technology stocks beaten to a pulp since November 2021, investing in technology stocks now looks more enticing. I'm buying more shares in tech leaders such as Google, Amazon, Nvidia, and Apple. I've owned these names for years. I'm also nibbling on bombed-out names like DocuSign and Affirm.

Disclaimer: Please do your own due diligence. Do not invest in something you don't understand. Your investment choices are yours alone. There are no guarantees with any risk investments.

Why Real Estate Tends To Outperform When Interest Rates Are Rising

The real estate sector tends to do well because real estate benefits more from rising rents than it gets hurt by rising mortgage rates. Further, given real estate is a key component of inflation, real estate tends to ride the inflation wave.

The Federal Reserve tends to hike the Fed Funds Rate in a strong economic environment, not a weak one. Therefore, real estate tends to outperform when interest rates are rising because the strength of the labor market, corporate earnings, and wage growth overwhelms rising borrowing costs. As a rental property investors, you want to hold on when inflation is elevated.

But here's a point worth repeating. Mortgage rates don't necessarily rise as much when the Fed hikes rates. Take a look at this Federal Reserve Economic Data (FRED) chart comparing the average 30-year fixed-rate mortgage and the effective Federal Funds rate.

It is highly likely that mortgage rates will trend downward again as inflationary pressures wane. In fact, many institutions have upgraded their outlooks for home prices in 2023 and 2024. Zillow forecasts housing prices will increase by 6.5% through July 2024. That's hugely bullish if it happens.

Where Will Mortgage Rates Be By The End Of The Fed Rate-Hike Cycle?

There are two important observations from the chart above.

The first observation is that interest rates have been declining since the 1980s. Therefore, taking out an adjustable-rate mortgage (ARM) over a 30-year fixed-rate mortgage is the better move. You can refinance before the ARM adjusts or if it does adjust. The rate has a high likelihood of staying at a similar rate.

The second observation is the average 30-year fixed-rate mortgage does not go up as much as the Fed Funds Rate during a rate-hike cycle. As a result, mortgage rates, which are more determined by the 10-year Treasury bond yield, don't increase as significantly either.

Look at the periods between 2004 – 2007 and 2016 – 2019. The average 30-year fixed-rate mortgage increased by less than half the magnitude increase of the Fed Funds Rate. I believe we're past the bottom of the current real estate cycle as interest rates begin declining in 2024+.

Here's my conversation with the CEO and co-founder of Fundrise, my preferred private real estate platform. Fundrise predominantly invests its $3.5 billion in assets in Sunbelt real estate, where valuations are lower and yields are higher.

Mortgage Rate Increase Example

30-year fixed mortgage rates are based on spreads above the 10-year Treasury bond yield. The spread generally ranges between 1.5% to 3%. For example, if the 10-year bond yield rises to 4.5%, we can expect a 30-year fixed rate mortgage to average 6% to 7.5%.

Watch out for negative real mortgage rates during a high inflation environment as well. Negative real mortgage rates are great for borrowers as inflation inflates away the cost of debt. Further, wages and corporate earnings will continue to grow, strengthening both consumer and corporate balances.

As a result, buying single-family rentals and multifamily properties makes sense. So is investing in build-to-rent funds and other private real estate funds that specialize in rental properties. Half of my net worth is in real estate partially because I believe in history. I also like the stability and utility of real estate.

A Resilient And Strong Economy

The speed of change is increasing in the financial markets. Oil might surge by 30% one week and collapse by 30% a couple weeks later. This would make a recession suddenly less likely. The Federal Reserve could hike by 3% over five meetings. Then they might change its mind and pause due to another damn COVID variant.

Despite all these moving parts, the one thing we do know is that the U.S. economy is resilient. We, the people, are also resilient. Therefore, the optimal decision is to stay invested in U.S. stocks and real estate over the long term.

Sure, we may have strong home country bias. However, I wouldn't bet against the American people. We will find ways to adapt and overcome future challenges. As a result, we will continue to grow more prosperous long term.

Diversify Your Investments In Real Estate

Stocks have historically provided long-term appreciation, but they are volatile. To reduce volatility while increasing wealth, diversify your investments into private real estate. You no longer have to own physical rental property to manage. Take a look at my favorite to private real estate platforms.

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages almost $3 billion for 350,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations and higher rental yields. These cities also have higher growth potential due to job growth and demographic trends.

If you are a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

I've invested $954,000 in real estate crowdfunding so far. My goal is to diversify my expensive SF real estate holdings and earn more 100% passive income. I plan to continue dollar-cost investing into private real estate for the next decade.

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter. Get your posts in your inbox by signing up here. Stock Market Performance During Rate-Hike Cycles is a FS original post.

What do you think 10 year treasury rates will end up at and when do you think it will peak.

Sam, long time reader of your blog. I’m a little skeptical of your view that the impact of higher interest rates will be benign on RE markets and the stock market. I like the data you’ve provided, but I think you have to go back further – like the 70s and early 80s – to really find a similar environment to the one we’re in now. Namely, when inflation was out of control and the Fed had to dramatically increase interest rates…more so than they’re currently predicting. See Larry Summers’ comments about the Fed funds rate having to go to 4-5%: https://www.bloomberg.com/news/articles/2022-03-18/summers-says-fed-will-need-to-hike-to-4-5-to-cool-inflation

Have you considered a scenario where more pronounced interest rate increases lead to higher debt burdens for both consumers and companies? While it’s true many large tech companies have good cash positions and low/no debt, high prices and higher debt costs will lead less strong companies and most consumers to cut back on spending. How can earnings not be impacted if the current levels of consumption can’t be maintained? Housing affordability will also be impacted and home buying demand won’t be there over the next 12 mos (a 2% increase in the interest rate for a 30-yr mortgage will make the monthly payment 25% higher). Perhaps more folks will rent, but how much higher can rents go before breaking?

Looking forward to your thoughts –

Good night in the way that it helps cool off housing demand and slows down price appreciation. It’s happening, and I see that as a good thing for buyers trying to get in.

The froth and frenzy is coming off. And I don’t think it’s good for people to win crazy bidding wars at all.

There is no way the fed funds rate is going to 4% – 5%. Inflation will fade by sometime next year.

You’ve got to believe in capitalism. And capitalism right now is trying their best to produce more supply to take advantage of elevated prices. This is why you say boom bust cycles.

What do you think 10 year treasury rates will end up at and when do you think it will peak.

Great analysis on the fed funds rate and mortgage rates. I fully concur the federal reserve will not raise rates as much as they have telegraphed. I also don’t think the average 30 year fixed rate mortgage will surpass 5.25% by 2023.

Although we might go into a recession, I don’t think it will be that bad or very long – less than 6 months.

If you’d like to give me a portion of the bet you have with the one reader, I’d love to take some of your exposure!

Real estate is going to continue to do well.

Thanks. I don’t think a recession will be very deep either, if one happens.

Sorry, for now, I’m going to hold onto my $7,500 exposure to the mortgage rate bet.

Hello, I’m hoping that you can help me. I own a house which gives me $3300/rent/month. I’m thinking about selling this property and buying another property which would pay me 7k/month. I would incur a mortgage of around 450k. I’m in Canada and have to pay capital gains of around 120k. What should I do?

Thanks so much for your answer. M

Sounds complicated. I’m more a fan of owning a property, enjoying it, then renting it out, and buying a new one if you can afford to.

I hate selling and paying capital gains tax, especially if you can roll it over into a 1031 exchange.

It’s just challenging coming up with that next down payment, especially if the next house a person is looking to enjoy is an upgrade. For instance, in Cali a 1M plus home is common. If the house that was enjoyed is already paid off and an upgrade to say a 1.5M takes place, that’s at least a 300K down payment with a 1.3M mortgage. Hard to make this plan work in an expensive state like Cali. Would love to see a future article on how to make this happen in the land of expensive real estate.

Hi Sam, I also worked at Goldman in investment banking in NYV. During what years were you there?

There year of IPO, 1999 start after getting my offer on 1998 and meeting with everybody, until 2001.

You back in the office having fun? You responded to the wrong person.

Great article Sam! I’ve recently invested in Apple. If it’s good enough for Nancy Pelosi, it is for me :-)

Super insightful, thank you! This is why I love your blog. I’m always learning something. I guessed 3 rate hikes for the rest of the year in your last post, so I was clearly way off lol. Six more rate hikes sure sounds like a lot for the next 9 months. But if they’re 25bps each that seems manageable and likely for the best. Was nice to finally see an up day in the markets today.

Notice how Fed fund rate raises seem to stair step down, each peak reaching about half the previous hiking period. So, 1.25 to 1.5 or so before something breaks? Outstanding public and private debt are at all time highs. Market is already pricing in a full percent cut for 2023. Pump Powell needs to reload his cannon as fast as he can.

The long-term trend of interest rates is down. Let us see if the Fed gets to 1.75%+ or not. If it does, it should mean the economy continues to be strong and inflation continues to be above 5% or 4.3% at least. But if inflation drops below the 4.3% Fed expectations for 2022, it may slow down its hikes.

Where do you see market pricing in a full percentage cut for 2023 already?

I started a Fundrise account and I’m really happy with it.

I have a lot of exposure to the stock market and a lot of money in semiconductor stocks.

I wanted to diversify into real estate and Fundrise has been great.

Me too, Bret. Jan 1 I rolled 20k into there. Been adding every two weeks since. Looking to load a good amount into the Heartland fund, too.

Good to hear. The stability has been nice. I spoke to Ben, the Co-Founder and CEO of Fundrise a month ago and he expected 8% inflation to last for longer. I was doubtful, but he’s turning out to be right!

Ben is very cautious, which is what I want a CEO of a real estate investing firm to be. When all I hear are go-go bullish cheerleaders, I get nervous.

I agree with Ben about inflation risk lasting longer. So far team transitory and the it will come down soon team has been dead wrong and I’ve seen almost no evidence they are correct. Supply chain issues are just a part of the reason for inflation, other items driving inflation include high demand, significant increase in the money supply, massive government spending and rising wages, very tight labor market, among others. And the longer it goes on, the more likely it becomes a perpetual loop here.

I am approaching a 6 digit account in Fundrise but still prefer direct rental investments where I can – just bought my 6th rental property in the last year a few weeks ago and under contract for another property today. It is getting harder to find rentals that I can yield 7-9% cash with a property maintenance reserve (plus principal paydown + appreciation yielding 25-30%+ annually) though as rent increases are lagging home appreciation. I imagine Fundrise team is seeing some of the same.

And Ben made the call before the war in Ukraine began. So yes, he is proving to be correct. Hard to see the Fed’s consensus estimate of inflation dropping to 4.3% come true. But anything can happen, and boom busts in the supply chain can be quick. Also look at oil prices whipsaw huge.

I simply have no more energy buying more physical rental properties any longer. I also am facing annual six-figure property tax bills now, which feels like way too much. Hence, my strong preference for private real estate funds and online real estate.

100k in property tax is a lot! My to be 10 properties (9 rental + primary) collectively is about $35k but property taxes aren’t too bad here in NC/SC area. I wish I had the desire to blog or I’d go the same route you are going, but I’d rather own more rentals when I retire in the next 2-3 years. I’m just focused on buying rentals within a 20 minute drive from me so they are easy to manage. Plus my retired father is helping me here or there for a very reasonable rate since I’m still working 55-60hrs/week in corp america.

Yeah will be interesting to see how the supply chain affects things. Will oil be like lumber last year which spiked, crashed and is now stabalizing near highs from last years? US producers seem reluctant to attempt to drill more even at current prices due to the political landscape and risk prices do come down. But I still expect inflation to be at least 6% this year – just owners equivalent rent matching reality would add 2-3% to the existing inflation rate. Would be great if it were lower than 6%, especially without crashing the economy

Blogging is a lot more fun. But real estate is more sustainable long term.

Here is a comparison: https://www.financialsamurai.com/real-estate-versus-blogging-which-is-a-better-investment/

Buying more physical real estate or cashing in on equity/appreciation and upgrading the existing primary home is intriguing. I don’t see the appreciation slowing down any time soon with the lack of inventory, ability for workers to flee urban areas like the Bay Area to work remotely, and still low interest rates (from a historical perspective). The question is whether to keep the primary or cash out the equity to fund the upgrade, which will require a sizable down payment.

We’re hit an air pocket right now, during the war. I’m seeing more hopes sit for longer than 2-3 weeks, which has been standard here in SF.

The opportunities are emerging.

I don’t like taking out equity to borrow money to buy another home. Not at this stage. But that’s just me.

Can you offer your reasoning on that? Are you not a fan of that in general or due to current conditions?

Just for clarification, in terms of taking out equity, I was referring to selling the existing primary to upgrade the primary, not pull out equity and keep the current primary.

My view is a little bit different, although I agree with most of your investment choices.

I think we will face something like an “inflationary recession”.

That’s true that Fed funds rates should increase to about 2.5% by the end of 2023, and it’s possible that long term rates might stay in the range they are actually, or move slightly higher, but not as fast as variable rates.

But nobody think those rates are not high enough in a 7.9% inflationary environment. And nobody think inflation could stay very high. And I’m not sure to understand why. Because, usually, inflation feeds on itself. Meaning rising prices forces more price increases. Which push inflation higher. What we use to call an “inflationary spiral”.

So, by “inflationary recession”, I mean that generally, people will have more money (higher wage, increase in government benefits, pensions). Business and investing revenues will also be higher. But at the same time, the cost of everything we buy will be up even more. Forcing people to reduce their overall quantities of things they buy.

Rent is a good example. Increased rents provide more revenues for landlords. It also provide a bigger incentive for renters to buy a home (to avoid paying rent). Prices of houses rise. But at a certain point, those still renting can’t afford to buy a home. Since rent prices are still rising, they have no choices but to pay higher rent. Eventually, they have to cut back on other expenses. It takes some time to happen, but after a few years of this medicine, inflation really starts to bite.

The same goes on with other non-discretionary expenses like food, transportation (gas, car), and utilities.

When they all increase at the same time, then the spending on discretionary items (travel, entertainment, large purchases, etc), has to decrease eventually. But I have no idea where consumers will cut back at this time and how long it will take to get to this point.

Price increases in an inflationary period should be particularly acute on commodities. This is because there are only a limited quantities of resources. And because they enter in the production of many goods, higher commodity prices also affect prices of other items, including food, car and houses.

When you think about it… a house is nothing less than a assembling of various commodities. Same goes for cars and many other items we buy.

I think, unlike the 2008 recession, the coming recession will “feel” good, because of rising revenues, but unease will come from higher costs in everything we buy.

My investing strategy recently has been to focus more on commodities and other necessities.

At the top of my list are gold and oil. I also have various investments in great companies like Procter & Gamble, Pepsi, Johnson & Johnson and Verizon. Those companies should do well in an inflationary environment, even if it gets to the point that consumers have to cut back on expenses.

I recently added to my position in Alibaba (which sells almost every necessities, but in China). I am more careful with tech because they have increased so much in recent years (before 2021).

The main investments I have in tech are Apple, Google and Tesla. The first two are almost in the category of “utility”, as we can’t really live our life without them anymore. And Tesla enters in the category of “transportation” and should benefit if oil prices really go “berserk” at some point in the futures, which oil is well-known for doing from time to time…

I’m continuing to invest in Vanguard’s Growth ETF (VUG).

“I’m buying more shares in tech leaders such as Google, Amazon, Nvidia, and Apple. I’ve owned these names for years. I’m also nibbling on bombed-out names like DocuSign and Affirm.”

Do you have many individual stocks? If so, how do you find the time to keep up to date on their latest news and data, especially while investing in other asset classes?

Yes, around 25% – 30% of my portfolio is in individual stocks I’ve held for years.

I almost always buy and hold for 3-5-year time frames. But I’m also an investing enthusiastic who reads, watches, and listens to stock, business, and economic data.

I even write about stocks, economics, and business. Hope you notice! If you have any other articles with this type of detail on the Fed rate-hike cycle and investments, pls send it over.

Also, I don’t have a day job, so maybe I have more time than the average person.

How about you?

Hey Sam,

I too have a portfolio of 20 individual stocks that make up about a 3rd of my overall portfolio. The other thirds are a SEP that follows the Swensen model, Fundrise for RE exposure, and a very small amount in cryptocurrency.

I have some stocks that are double and triple baggers and I always hear people saying you should take some profits off the table and deploy them elsewhere or not get greedy.

I’m a little confused as to how to do this strategically. Do I trim and invest more in other stocks? If so, how much should I trim? I also think about the tax consequences and don’t need to add more to an already high tax bill.

Maybe this would be a good topic to write about?

Great article, keep putting out informative content like this

Check out Fundrise, my favorite real estate crowdfunding platform. I’ve personally invested $810,000 in real estate crowdfunding to take advantage of lower valuations and higher cap rates in the heartland of America. Roughly $150,000 of my annual passive income comes from real estate. And passive income is the key to being free.

Is there a Fundrise Fund that corresponds with this “HEARTLAND OF AMERICA”- i am interested in this concept and want to make sure I am allocating correctly–What Funds do I invest in to be correctly placed? thats all,

thanks as always

Craig

There is a Heartland Fund. I’m not 100% sure its still open, but you can sign in and poke around. The heartland fund was up one of the most in 2021, so I actually wouldn’t put most of my funds there.

Most of the Fundrise funds invest in the Sunbelt and in single-family and multi-family properties. Sunbelt is their bread and butter. And they’ve been investing in the Sunbelt all throughout the pandemic.

Related:

Fundrise Overview

100% agree with your assessment on Tech stocks. Software that’s duplicatable infinitely, instantly, and freely always seems prove its benefits over companies that operate on physical inventory during times when financing is more expensive.

I wonder about income real estate though. It seems that landlords are making up for the eviction moratorium by raising rents above normal pace.

Maybe. But that’s just normalization, which is normal.

The pace of rent and property price hikes should slow. But they should still go up.

I’d much rather invest in a normalized market rather than a frenzied market and potentially overpay.

“it seems that landlords are making up for the eviction moratorium by raising rents above normal pace.”

On the margin, but the majority of reason are the three following

1) the cost to acquire rentals has gone up even faster, (or alternatively, your income from selling the rental unit has gone up as home prices have risen) so you have to have higher rents to justify your rental

2) Property taxes have gone up – in some cases massively – Mine averaged an 18% increase last year.

3) Maintenance and renovation (and other) costs have increased massively over the last couple years so your maintenance reserve has to go up as well

Rents have actually lagged home price increases so I expect rents to continue to show strong growth for a few years. To your point, the eviction moratorium certainly didn’t help but about 95% of tenants were still paying nationally, only slightly worse than before. In a couple of dark “blue” areas that was worse, though.

Good data driven article