After-tax contributions to your 401(k) is exactly what it means – contributing after-tax dollars after maximizing pre-tax 401(k) contributions. But should you make after-tax contributions? Probably not.

Under current regulations, an employee may contribute up to $19,500 of pre-tax earnings to an employer sponsored 401(k) plan ($25,000 if you are age 50 or older).

However, the maximum anyone may contribute to any and all tax-deferred retirement plans is $58,000 (or $64,000 if you are age 50 or older).

In other words, employees under age 50 are able to contribute an additional $38,500 a year in after-tax contributions on top of their $19,500 in pre-tax contribution, provided the employer doesn't contribute anything. The after tax contribution limit goes to $44,000 if you are over 50.

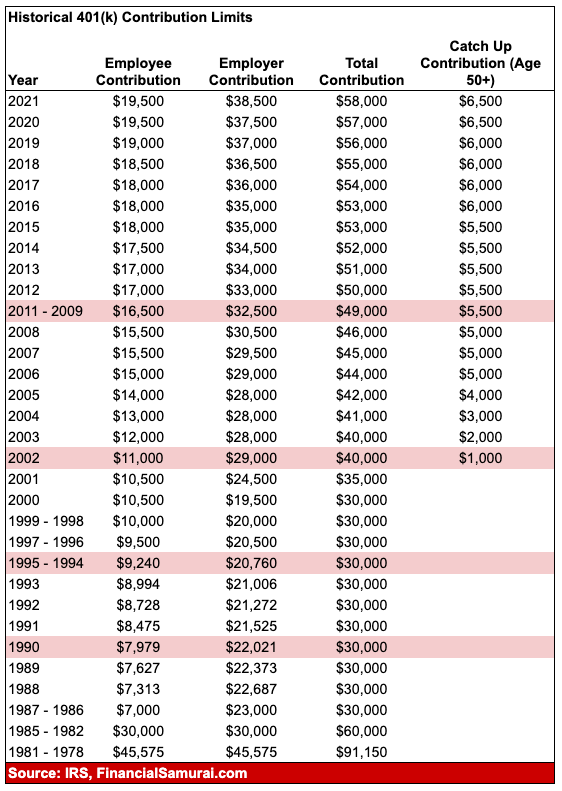

See the historical maximum 401(k) contribution limits in the chart below. About every two or three years, the contribution limits increase by $500 on average.

The thing is, most people don't contribute more than the pre-tax maximum contribution to their 401(k). People either don't have the cash flow, don't see the benefit of contributing after tax dollars to a 401(k) plan with investment option limitations, or have other uses for their cash flow e.g. buying a house.

Related: The Latest Average 401(k) Balance By Age Vs. Recommended For A Comfortable Retirement

Why You May Want To Contribute After-Tax Contributions To A 401(k)

Even though you can’t deduct the contributions beyond $19,500, making them on an after-tax basis still has some benefits.

The main benefit is that additional contributions accumulate investment income on a tax-deferred basis, just like the funds in any other type of tax-deferred retirement plan.

If you are just bursting with cash flow, being able to contribute a total $58,000 a year in your 401(k) will surely make you a 401(k) millionaire after a couple decades of contributions. All the stock market and bond market need to do i the stock and bond market return even just half their historical norms.

There is thing to be aware of. The earnings on after-tax contributions, just like all distributions from pre-tax contributions, are taxed as ordinary income.

If the money had been invested in a taxable account, most if not all of the gains would be taxed at the lower rate associated with long-term capital gains. But, there is still another advantage that could make after-tax 401(k) contributions irresistible.

Consider The Roth Rollover

Instead of after-tax contributions to a 401(k), you might want to consider doing a Roth rollover or rollover IRA instead. A Roth rollover is likely your best solution for more tax benefits. Since your contributions in excess of $19,500 are made on an after-tax basis, you can convert the non-deductible portion of your 401(k) to a Roth IRA and do so without incurring any income tax liability on the conversion.

Once you roll the funds over to a Roth IRA, you will be converting future withdrawals from tax-deferred to tax-free status. This is huge!

Imagine if, instead of contributing $6,000 per year to a Roth IRA (the IRA contribution limit), you instead contribute effectively up to $38,500 per year in after-tax 401(k) contributions? You can also do a backdoor Roth as well if you find yourself in a down earnings year.

Although $6,000 a year in Roth IRA contributions is nice, it's not really going to supercharge your retirement portfolio like $37,500 a year from a 401(k) Roth rollover.

This is even better than doing the standard Roth IRA conversion, since that tactic typically requires paying tax on the amount converted. Since you never received a tax deduction on your after tax 401(k) contributions, there will be no tax on the conversion.

Some of you might be wondering about doing a Roth 401(k). The problem with the Roth 401(k) is that there is a contribution limit of $19,500 a year in total in combination with contributions to your regular 401(k) plan. Using the after-tax 401(k) contributions, your contributions to a Roth plan can be dramatically higher.

Related: Should I Convert My 401(k) Into A Rollover IRA?

Build Your Regular After-Tax Portfolio

Before contributing any after tax dollars to a 401(k) account, it is imperative you make sure all your other financial needs are met first. Build a taxable investment portfolio so you can generate passive income for financial freedom.

The big goal for most people is having enough after-tax money to purchase a primary residence or rental property. Therefore, after you've maxed out your 401(k), work to build your down payment fund. You want to get NEUTRAL real estate by owning your primary residence once you've found a place to stay for the next 5 – 10+ years.

The housing market will likely stay strong for years to come post-pandemic. If you rent, you are technically short the housing market. That tends not to work out well over the long-term thanks to inflation.

Save For College

Other common financial needs include paying for your child's grade school and/or college tuition. Private middle school costs $30,000 – $55,000 a year in cities like San Francisco or New York. If you want to send your child to Boston University, like Democratic Socialist Alexandria Ocasio-Cortez, you'll have to fork out $78,000 a year all-in!

Besides housing and tuition, then there are medical expenses for your family and perhaps your parents to consider. You might also want to buy a nice car to protect your family.

Only when you have a sufficient amount of savings and investments to handle those spending priorities should you consider putting additional money into after-tax 401(k) contributions.

Finally, the biggest expense might be if you want to retire before the age of 59.5, when you can withdraw from your 401(k) and IRA penalty-free.

See: Save For A House Down Payment Or Invest In My 401(k)?

Below is a conservative chart I put together which highlights how much in pre-tax and post-tax investment accounts you should have by age if you want to retire early.

Invest Your Money Wisely

Your after-tax investment accounts in a brokerage account, or digital wealth advisor like Betterment (my favorite) are what's necessary to generate passive income.

Having enough passive income to fund all your expenses is the key to a comfortable early retirement lifestyle.

At the end of the day, there is no wrong way to save and invest for your retirement future. We're talking about how best to maximum our retirement accounts while minimizing our tax liability.

Most Americans are not even thinking about their retirement future, which is why the median retirement account balance is less than $10,000 per household.

Related: Should I Contribute To My 401k During A Recession?

Always Stay On Top Of Your Finances

What every financially wise person should do is diligently track their finances. In the past, we'd use an Excel spreadsheet. Today, I recommend signing up for Personal Capital, the #1 one free financial app on the web.

I've used Personal Capital since 2012 to track my net worth, analyze my investments for excessive fees, and plan for my retirement cash flow. All you have to do is sign up and link all your financial accounts to get organized. It is truly the best app.

Below is a chart of their Retirement Planner, where the app makes cash flow projections based on your current investments, income, and spending habits. There is no rewind button in life. It's best to stay on top of your finances and make sure you end up with too much, rather than too little.

About the Author: Sam started Financial Samurai in 2009 as a way to make sense of the financial crisis. He proceeded to spend the next 13 years after attending The College of William & Mary and UC Berkeley for b-school working at Goldman Sachs and Credit Suisse. He owns properties in San Francisco, Lake Tahoe, and Honolulu and has a total of $810,000 invested in real estate crowdfunding.

In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $220,000 a year in passive income. He spends time playing tennis, hanging out with family, consulting for leading fintech companies and writing online to help others achieve financial freedom.