The Yin Yang Investor Mindset post talks about looking for opposite investment opportunities whenever one asset class is roaring. I used the sell-off in bonds as an example of finally beginning to build a meaningful muni bond portfolio to earn double taxation free income.

Now I'd like to highlight more reasons why folks who have a large enough financial nut, are within five years of retirement, or are already in retirement should consider allocating more towards bonds.

For over 20 years, I was heavily invested in equity to try and build my financial nut as quickly and as large as possible. However, after a 10-year bull market in equities that began in 2009, I decided to take down risk. As a family-man now, the last thing I want to do is lose money and have to go back to work.

With interest rats at 17-year highs after the Fed's aggressive rate hikes, it's time to buy bonds. The aggregate bond index has declined tremendously since 2020.

Find A Purpose For Your Money

If you already live on less than you earn, making more money is meaningless if you don't earmark a specific purpose for your investment returns or paycheck.

The irony of equity investors making fun of bond investors is that bond investors tend to be much wealthier. Bond investors tend to want to protect the principal they've spent decades accumulating.

There's no greater joy than being able to live freely. Being able to do whatever you want, whenever you want cannot be overestimated. It is amazing. Take my word for it.

But what if you could live freely AND live for free? That would be heavenly. Some people get to do both, but experience no joy because everything was given to them. Good thing most of us have worked long and hard for our money. Reaching a goal based on merit is so much more satisfying.

With the goal of living freely and living for free, I began aggressively paying down mortgage debt. The property now generates about $3,050 a month in cash flow after all expenses.

The Case For Investing In Bonds

Since 1989, the worst year for the aggregate bond market was -2.9%. I was surprised when I saw this graphic by PIMCO, one of the largest bond managers in the world, because I was under the impression that 2008-2009 was such a bad period that bonds sold off more than -2.9%.

Domestic and foreigners were selling all US dollar denominated assets indiscriminately because it felt like the entire US financial system was going to collapse.

The reality is, if you had bought the iShares Core US Aggregate Bond Fund AGG you would have done just fine during the biggest financial meltdown of our lifetimes. See how stable the Aggregate Bond Fund has performed over the past 10 years.

Case Study For Buying Bonds

Of course history is no guarantee of future performance, but lets say the AGG stays flat over the next 10 years – one could earn a 2.375% gross annual yield. It's not amazing, but guess what? 2.375% is the exact interest rate on my recently refinanced 5/1 ARM that expires on August 1, 2021.

Below is a snapshot of my originally $981,000 5/1 mortgage that closed on August 1, 2016. I paid down about $131,000 of principal to refinance $850,000. The original monthly mortgage payment was ~$4,333 due to a larger principal balance and a higher 2.625% interest rate. Now the monthly mortgage is $3,303.55; $1,621.26 of which goes to principal.

To live for free, all I've got to do is invest $850,000 in AGG after the recent sell-off. There's just one problem. I don't have $850,000 lying around. I could sell off other investments to create this “live for free arbitrage,” but I don't want to just in case my other investments return better than 2.375% and the bond market sells off even more.

But, what I can do is focus on making NEW money in order to build a position in AGG to slowly chip away at living for free. The beauty of this strategy is that there's a two-pronged attack.

On the one side, I'm building a bond position to get to $850,000. On the other side, I'm automatically paying down the mortgage through monthly payments and random extra principal payments so that I DON'T have to amass an $850,000 live-for-free bond portfolio!

How fun is this challenge? So fun for a financial enthusiastic. Living for free with great investment returns that make more than your active income sets yourself up for a very comfortable retirement.

Given I've got a higher risk tolerance, I'm building a California Municipal Bond fund position as part of my bond portfolio mix. CMF has a ~2.5% double tax free yield, equivalent to over a ~4.3% gross yield based on my tax rate. CMF is more volatile than AGG and has corrected by a maximum of 10% over its lifetime. But a 10% correction fits nicely with my risk-tolerance. Any more than a 10% loss feels too painful for me.

Who wants to just live for free when one can actually get paid to live in a cozy house and potentially make money from a house that inflates with inflation over the long run? With CMF, I earn a gross adjusted yield of almost 2% over my 2.375% mortgage rate. I'm willing to take more risk for this even better scenario.

Build Your Money Army

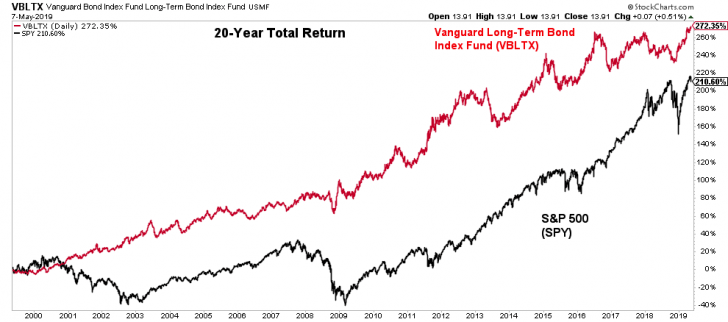

I hope people get motivated to earn more and save more. If you check out the chart above, you'll see that the Vanguard Long-Term Bond Index Fund has done quite well compared to stocks – practically even performance actually, with less volatility.

Further, when stocks are melting down, as they are with the coronavirus in 2020, bonds can actually play offense and make you a lot of money. Take a look at this chart below with various bond funds and ETFs.

Having a Money Army work for you so you don't have to is a good scenario. If your Money Army can also allow you to live for free, even better!

To recap the investment case to buy bonds:

1) Having a purpose for your money makes saving, working, and investing that much more fun and meaningful.

2) The aggregate bond market's worst annual decline since 1989 was only 2.9%. Those of you who are near retirement, in retirement, or looking for less volatility in their investment portfolio should consider increasing bond exposure after the recent sell-off. There are no investment guarantees. Bonds can continue to sell off. We've only seen that bonds are much less volatile than stocks.

3) There are all different types of bonds with varying levels of risk and return profiles. US Treasury bonds are the least risky, followed by municipal bonds from states with strong balance sheets. Emerging market high yield corporate bonds are some of the most risky e.g. Greek bank bonds. Bonds provide diversification, income, and potential return.

4) For those in a 33% or higher federal marginal income tax bracket and who also live in a high income tax state such as California (13.3% top rate), Oregon (9.9%), Minnesota (9.85%), Iowa (8.98%), New Jersey (8.97%), Vermont (8.95%), District of Columbia (8.985%) or New York (8.82%), municipal bonds provide better relative value. If you don't like munis, AGG offers the total bond market exposure.

5) Make sure you have a diversified portfolio that matches your risk tolerance. We could very well be at a turning point in the US bond market's 35+ year bull run. Unlikely, but possible. After significant moves in any asset class, it's always good to give your investments a checkup to compare your current allocation to a recommended allocation. You may be surprised at what your results might find.

6) Interest rates are at 17-year highs. Take advantage after the Fed has been aggressively raising rates. Treasury bond yields are over 5% now. Here's how to buy Treasury bonds.

Here's an example of running one of my investment portfolios through Empowerls free Investment Checkup tool. Earning risk-free higher returns is wonderful. When you've made a lot of money since the global financial crisis, a good idea is to keep it!

Updated for 2021+: The 10-year bond has collapsed all the way down to 0.5% in 1H2020 from 3.28% in October 2018 due to coronavirus fears. Real estate crowdfunding should outperform and everyone should be refinancing their mortgage today.

Hi Sam! Thank you for your regular articles and newsletters. I thoroughly enjoy reading them and using them to analyze my situation with your perspectives in mind. You’ve saved me a bunch of money!

One question I do have: what are your thoughts on EE saving bonds? I was given around $6k Face Value worth of these bonds over the course of 15 years (with earliest one maturing in 2025 and last one maturing in 2039). The interest rates range from 1% to 3.6%.

As a 25 year old, do you recommend cashing them in now and reinvesting into something to get a higher return? Or do you recommend I only cash them in as they mature?

Would love to know your thoughts!

Thanks,

Sawyer

What about the ETF PFFD a preferred stock index fund for Income

I like how you said that US Treasury bonds are the least risky, followed by municipal bonds from states with strong balance sheets. My friend likes to invest his money in stock and he is always looking for ways to make extra money. I will share this article with him so he can think about investing money in municipal bonds.

You might want to look into I-bonds. You can buy them direct with no sales charge and hold them in a treasury.gov account. Also I disagree with the premise of paying down mortgages to be “free”. You’re never free. When you have a low interest rate mortgage, you are stealing from the bank. Because your house is going to appreciate far quicker in a hot market like San Francisco, IMO you’re much better to build up a large I-bond position or Muni bond position while paying the regular mortgage, rather than paying it down. For most people if you lose your job or have a crisis, the first thing you want is to access the money locked in your house. Guess what, nobody’s going to give you a HELOC when you’re out of work. Plus there’s always property taxes. So you’re never truly free until you sell that house. I bought a house in Alabama that’s about 60 minutes from the beach with 1 acre, and the property taxes are $250 Per YEAR. I also have three house rentals and three mortgages, 3.25, 3.26, and 2.25, so why pay them off? The properties all generate money and are appreciating, no reason to pay them off, you’re stealing from the bank. You could have made that arguement in 1980 when mortgages were 12% but not now. We’re at the long end of a historic bull market in bonds, the only reason they don’t go up is the market is holding the bond market hostage.

Hi,

I am 34 and starting my financial journey to build Muni bond portfolio.

Where can i buy California muni bonds directly in primary market without any brokerage/fees, if available.

I read that Fidelity is recommended but are the fees high enough to dip my returns?

Suman,

In 2010, we started buy individual muni bonds from LPL, HSBC, Citibank to generate tax free passive income to start our journey to FI.

In 2015, after we learned that banks and LPL charges 1.25% to 2% more per bond, we started to buy individual muni bonds ONLY from Fidelity due to the low 0.10 markup fee which is $10 per $10,000.

Citibank charges 1.25% which is $125 per $10,000

HSBC charges 1.75% which is $175 per $10,000

LPL charged 2% which is $200 per $10,000 (this was several years)

Chase charged around 1.5% -1.75% more per bond than Fidelity

Adam

Are you content to buy bond ETFs rather than actual bonds, because of the long-term stability of the bond market? With a bond, you get interest and then your principal back at maturity. With a bond ETF (or mutual fund), you never get your principal back; you sell the bond at the current market price to get your money out.

So: risk? If the bond market can go down sharply and for a long time (because interest rates generally go up), then one risks losing principal by holding funds rather than bonds.

It is a bit harder sometimes to buy bonds, and of course a fund diversifies better than buying individual bonds. Too bad if the issuer of the bond one buys goes belly-up!

So if you are confident that you can sell the fund at more or less what one paid for it, then your principal is safe and you collect the interest for as long as you choose to hold it.

Does that sound right to you?

Bond rate exceeded 2.7% today. Do you have any updated thoughts?

Also, what do you think of Nuveen munibond ETF, NAC in particular? It’s a Cali munibond etf with 5% yield.

I’m following my 2018 investment framework and buying muni bonds.

Thanks Sam as always! Currently looking for ways to diversify as I’m heavy on stocks, real estate yet no bonds. A friend of mine recommended I look into Muni Bonds and sure enough my first google search was: “financial samurai muni bonds”. :)

I have 10% of my portfolio in cash and want to minimize to 2%. I want to build a bond portfolio as well with low fees and relative high yield, I’m OK with risk (given I have no bonds!).

For AGG and CMF – I bank with Schwab. Do you recommend a specific brokerage to buy these?

Also – what should I be looking at when comparing Muni Bonds and potential purchase. How can I find NAME City Bond | Yield | risk?

Any help is greatly appreciated!

I have a banking relationship with Citibank and Fidelity, so I use those too. Fidelity seems like it has the most options with the best prices. I think they are fantastic.

Just ask your representative to pull up a list of specific bonds with certain minimum ratings and yields.

Just be aware though that bonds have rallied back to even before Trump got elected. I’d patiently wait for another opportunity. In the meantime, I’m diversifying away from coastal city real estate and buying heartland real estate through my preferred real estate crowdfunding platform, RealtyShares.

Next time, hopefully Financial Samurai will show up when you just search “muni bonds”! But I know that it’s a tough search term. But I’d love it if more people did “Financial Samurai XXX” in search, b/c I think I’ve covered the vast majority of topics in depth.

Great post FS. I am very interested in Muni bonds right now. I have been a long time reader, but first time poster. My wife and I have just started our journey on to FI at 33 & 28. When discussing our situation with our financial advisor, he suggested as an alternative to muni bonds we could look into a 10 pay life policy. He said that since we were starting so young it may be worth the upfront costs to have the guaranteed 3.5% (he said after dividends ~5%) net return. He said it would be a way to provide a safe harbor for money and provide an eventual inheritance. He was very upfront that there were many upfront fees, but they may be lower now since we were young. I was just curious as to your thoughts on such an arrangement in the long term since you can then perhaps fulfill the bond portion of a portfolio with this option and be more aggressive with the equities you may have? We are just looking for ways to further diversify, protect assets and not be linked directly to the market with all of our money (outside of the home we currently have).

OMG I hope you did not buy into the “financial advisor” suggestion of life insurance. I am 59 years old, fell for this a number of years ago, and wish I had not. It is the most embarrassing thing in my portfolio. Since I am now an avid reader of financial planning articles and blogs, and have learned to pay close attention to my investments, I realize that almost no independent and credible financial writer recommends any form of life insurance products as “investments”. The old advice to buy term life for your life insurance needs and diversify the rest in low cost investments, is still true. The reason is obvious: there is no magic money making secret the insurance company has that can make up for the huge amount you are paying in commissions, up front (whether hidden or not). They have a hundred clever ways of tailoring these products so as to obscure this simple reality.

Need some advice: Married with 2 kids in NY. I’m self employed wife is an attorney I’m 47. We own 3 homes, primary, rental and a vacation home. Combined total mortgage $1,150,000. We have $110,000 in a savings account earning 1.05%. Continuing to save for possible buying another rental. We don’t own any stocks or bonds. Nor do we have retirement plans. Any suggestions?

Gasho, Financial Sumari! As a retiree and investor, I’d like to know if you’ve ever read the work (website) of Martin Armstrong on capital flows and economic cycles. He certainly has some very surprising things to say on government debt and investor confidence in the current cycle. Your penchant for research and analysis could be useful to your readers regarding his work. His AI software predicted major upheavals in 2016 in the EU (Brexit) and the US presidential elections – over 20 years ago!

I would prefer to use less cash to generate an equivalent return using TLT options. By selling a cash secured put, you take the same risk as if you were purchasing the asset at the strike price (so in the case of AGG you risk 2.9 loss in the cash you are using) but recieve a premium to keep which offers a nice buffer. In the event that your position gets assigned, you simply end up purchasing TLT and immediately sell calls against it to reduce your cost basis further. If the calls get assigned, you return to selling puts. Doing this can match the returns while using far less cash than simply buying the funds outright while also smoothing out volatility and controlling risk. Risk is controlled by minimizing position size on order entry, volitility by trading non-correlated assets and bringing in premium consistently.

Interesting. So a gross oversimplification of the big picture is:

1. Rates go up forever- Bond ETF gets killed as even new bonds added to ETF lose value as rates rise forever.

2. Rates go up and stabilize – Bond ETF loses value short/medium-term until lower yield bonds mature and new higher yields are added. Percentage change in value and velocity dependent on average duration.

3. Rates stabilize or go down – Bond ETF remains stable or increases.

4. Rates randomly walk in whatever direction they want – At lease Bonds have a yield right? :)

I think I have a good idea of which one of these four probably won’t happen.

Great post and comments everyone! Maybe I’m completely missing something here, but I have a question about bond etfs such as MUB, AGG, and VTEB. What I’m wondering is since these etf’s have bonds that are constantly maturing and being replaced by new bonds at prevailing rates, in a rising interest environment, shouldn’t that reduce some of the “beating” they will take? I know it has to do with the average maturity of the bonds in the fund, I guess I’m just wondering what the relationship is if say the 10-year goes up 1%, how will each bong etf be affected. If rates rise and then stabilize for a long period, shouldn’t the bonds recover from their “beating” as new higher yield bonds replace the older ones?

Good question. It all depends on the bond duration makeup of the fund. For example, if the fund is 90% short maturity bonds, it will outperform a fund with 90% long maturity bonds in an sudden interest rate increase. This is why you see TLT (20 year bond ETF) sell-off more than IEF (7-10 year bond ETF).

Let’s hope the 10-year yield doesn’t go up another 1% from here! If so, the economy is going to grind to a half and go in reverse IMO.

I think we’ll see 10-year Treasury yield stabilize at around 2.5% in Q1 2017; there’s so much pent-up demand for U.S. debt that it becomes self-stabilizing.

Hi Sam,

Do you think with the new administration coming soon that interest rates will rise, thus causing bond prices to come down and entice buyers to buy more bonds? I was initially thinking about buying some bonds, but if there is a good chance the price will drop in the upcoming months, I might as well wait and accumulate a bit more cash in the process.

Hmmm, I thought I addressed your question with this post. Let me know where it’s unclear and I can elaborate. Thx

I found this “Now that interest rates have moved higher, at least temporarily, I’ve realized something very significant that all of us who took my refinancing advice earlier this year can do. We can buy the Aggregate Bond Market through ETF, AGG and live for free!”

Maybe I should wait until next year, looks like the rates have a likelihood of continuing to go up.

Since the 10-year Treasury yield has surged past 2%, have you looked into long-term U.S. Treasury bonds (e.g., TLT) compared to munis or AGG?

Of course, the interest income from Treasury bonds are exempt from state and local taxes, which is useful in a high-tax state like California. Plus, long-term U.S. Treasury bonds have had a much better return profile than AGG over the past ten years (AGG includes exposure to shorter durations and corporate bonds with much higher credit risk). “Past performance…” and all that, but I’m curious if something like TLT (or individual bonds from TreasuryDirect) fits your risk tolerance better.

I have, and I’m nibbling on TLT and IEF in my rollover IRA and self-employed 401k.

For my after-tax investments, I’m focused on muni bonds since they won’t be taxed.

Sam, I have 3 mortgages all fixed rate 30 year for the lowest rates I could get. I look at these like long term shorts of the current rates. The stock market has averaged a long term return of 7% in real terms so all income I invest I lean towards equities with a portion in bonds and cash for safety and income. My target portfolio return is to beat my 30 year interest rates (4-5%) so that I use the mortgages as leverage for my current investments.

However I agree that bonds are getting more attractive. US equities are at very high valuations and I have been selling off for the past 2 years. In terms of equities I have been recommending defensive sector etf’s such as the consumer staple etf’s (VDC and KXI) this sector has beaten the S&P 500 over a 40 year period and only fell 16% during the 2008-2009 crisis. I also agree that muni bonds are the way to go, for those with more risk tolerance there are also closed end funds that offer muni tax free returns with some leverage such as PNI.

That’s a very interesting proposition, FS. I am like you, very little invested into bonds, but similarly, I benefited from being almost exclusively exposed to stocks as they provided a significant basis for growth in recent years. In your case, having this as a platform for “living for free” is a great psychological tool, and I think it also signifies a shift from your side towards more conservative, less yielding investing opportunities. Great stuff, will continue to watch your developments.

At the moment 100% in stocks and realestate. Currently however with the surprise election of trump And expected dec. Fed rate rise I see an interesting opportunity to jump into muni bonds.

1. Taxes should go lower under trump for very high income earners and that will lessen the attractiveness of munis dropping prices as people move out of the field

2. The fed will raise rates creating a psychological shift in addition to the true shift we’re seeing now with the 10 year yield.

3. Panic selling from people that have piled into munis or inappropriately been placed into them by robo-advisor programs that thought these were “ultra-conservative” investments

The opportunity is that I see all these things as short term. In the long, long run I see higher taxes, lower rates for a longer time and then a true beneficial shift back into munis.

So I have an eye out. Overall I think it will be beneficial especially as you approach/pass the 77k income threshold from other passive sources you’all utilize in your hopefully early retirement. I’m currently planning on working at least through a trump 4 year term. 8 if he stays in. After that if taxes go up (and I suspect they will) I’ll look forward to living “in poverty” under the tax level (currently anyway) from dividends and real estate (minus depreciation) with a nice tax free bonus from munis…maybe food stamps won’t be so bad.

The irony is that taxes will go UP for the middle class $90K – $190K individual income earner by 5%. Therefore, there may be a higher interest in munis from the mass affluent even though the top 1% federal marginal income tax pay decline by 6.4%.

Possibly but I think the mass affluent class is likely to be heavily weighted in tax advantaged accounts rather than investment in taxable account. So munis wouldn’t appeal to them outside what little over they save. I haven’t seen numbers but suspect most mass affluent are there due to 401ks and primary residence.

I may be wrong but either way am going to wait and see how the shift plays out. Not in munis at this time but have my eyes open to a move.

Sam,

Given that you are planning to purchase another house in the next 2 years; where are you storing the down payment? Is it in bonds or you have other thoughts?

It’s certainly nice to be debt-free. But I also like the power of leverage. I’d rather have 2x the number of properties, each with a 50% mortgage. So, both for rental properties as well as my primary residence I’m in no rush to pay off mortgages. It’s just taking a page out of the playbook of large successful real estate investors (or any other investor for that matter): Most (all?) REITs and Private Equity real estate investors use leverage. You wouldn’t be able to generate competitive returns without leverage. Of course, everything should be done in moderation, because we don’t want a 2008/9 repeat, but I know many RE investors who did just fine during that period.

I strongly do not recommend people getting into a lot of leverage at this point in the cycle. Seriously, the cost of leverage has gone up in real estate prices are softening around the country. Please, please, please for those who are reading this or have friends who want to lever up right now, please do not do so.

What is your story about how much leverage you had in the previous financial crisis and how much did you have invested? I’m always curious to know from people who have retired early what they did during the previous downturns. Thanks

Just to be clear: I am not retired (yet). I plan to retire in 2018. During the last two downturns, I have been invested pretty much in 100% equities (or equity-like investments) with 30-year mortgages on my respective primary residences. I never made a payment above the minimum required and invested in assets with a higher expected return than 3.25%*(1-Tax Rate).

That said, housing in early retirement is something on my radar screen:

https://earlyretirementnow.com/2016/11/16/housing-choices-in-early-retirement-rent-vs-own/

Owning a house mortgage-free normally falls behind the leveraged option, but I also like the peace of mind of a mortgage-free house as a hedge against bad equity markets. Big decisions coming up in 2018!!!

My current real estate investments are with several Private Equity funds that invest in multifamily housing properties. I prefer the diversification and the professional management without any time commitment on my part. All properties are leveraged with mortgages. Not heavily, but enough to juice up the expected return, otherwise they couldn’t be competitive in that space. All Private Equity investors I work with have several decades under their belt and did very well during the 2001 and 2008/9 recessions. I wasn’t invested back then, though.

Retiring in 2018 is close enough! I’m excited for you. You should read: Overcoming The “One More Year” Syndrome To Do Something New. A lot of early retirees found it VERY difficult to leave the security of their day job so they kept on delaying the decision.

Also check out: The Fear Of Running Out Of Money In Retirement Is Overblown

Good luck! I’ll check out some of your latest articles.

Thanks, Sam! Yes, these two articles are true classics! Thanks for the reminder! :)

Cheers,

ERN

What about the inverse relationship between interest rates and bond prices? Interest rates are nearly at an all time low so they can only go up and kill bond prices. Wouldn’t that make it a bad time to go into bonds? I personally will wait till interest rates are higher before going into bonds.

Indeed. Where do you think interest rates will go before you buy? I’m deploying the rest of my position at 10Y 2.5%.

Being that I live in the state of MA, I have a MA muni bond fund from Vanguard. Is there anything you’d recommend from Vanguard, as i’d like to buy more bonds…

I don’t like bonds. Even less so because I am in Canada where I don’t know of any tax free bonds like the munis down south and 10 year govt yield is even lower here than US (around 1.6%). Thus, with inflation around 1.5-2%, I am basically guaranteeing I will be losing money on an after-tax, after inflation basis. I allocate my networth to 35% real estate, 2.5-5% cash, 10-12.5% 5 year CD ladder, 5% preferred stocks, and 45% dividend common stocks (both are in ETF’s so no company specific risks). The goal is eventually for the 50% dividend and preferred stocks to generate enough tax preferred income to cover lifestyle. The 35% real estate would include a paid off primary residence and secondary property for vacation/rental purpose (the rental income here would just be bonus as the 50% stock side covers my income needs. So I am never dependent on stock prices ever, only on dividends which are much less volatile but still volatile. Let’s say I have to prepare for a worst case scenario of a 33% drop in dividend income for a series of years due to financial calamity which has likely seen stock and real estate prices crash. Well on the real estate side I don’t care because I’m still living in my house and using my secondary property or getting bonus rental income from it. On the stock side, I don’t worry about the price as I only have to look at dividends. That 5 year CD ladder helps here. The 10% allocation to it would represent approximately 5 years of living expenses. So each year the CD that comes due would replace any dividend shortfall and the remainder reinvested to a 5 year CD. Such a system can withstand a 33% dividend income fall for 15 years. Even during the depression dividend income had recovered by then. Where would I need bonds in this plan? I don’t.

Really appreciate everyone’s perspectives and insight on this. I am new to your site, but as a finance guy and 50 yr old who doesn’t want to go to work everyday in the same office for the same thing for another 15 years, I am really looking for ways to produce passive income that produces an after-tax yield in the 5-7% range. I have been buying some Nuveen muni funds and some specific higher-yielding stocks in the utility sector (Southern Cos) and insurance sector (Pru). It appears I can’t get into my desired yield range even with muni funds, as the after expense net yield is closer to 5% than 7%.

I am intent on building a portfolio that produces $150k of annual cash yield, hoping beyond hope that it will sustain me until my pension kicks in at 65 and SS kicks in at 61.5(?). Not sure about the SS timeframe. I will continue to read this sight for thoughts on how to do what I want to do, but I wanted to tell you how glad I am that FS has created a place where people of the same persuasion (those who want their money to work for them) can come and learn.

I’d like to know what people think about dollar valuation and its impact on interest rates. My initial thoughts are that we may need to someday soon undertake QE again to maintain dollar parity vs other currencies (here I’m thinking dollar valuation may get too heated), and that will keep interest rates low and bond prices stable/increasing. Another way to look at it is, if interest rates increase at the Fed, the economy uses up more dollars in debt service and dollars become scarcer, thereby increasing relative dollar value. Am I right? Does anyone believe differently? Trying to make a case for buying bonds in a low-rate environment that has been around for the greater part of 10 years and feels like it should revert back to a long term norm.

Thanks

Chomps

Don’t think QE will be in the works for at least another 2-3 years. A strong dollar to me means more buying power of foreign goods domestic and abroad and an increase in wealth relative to foreigners.

My Chinese mainland neighbor who plunked $2.25M cash earlier this year is probably feeling pretty good right now. Good diversification of their wealth.

If you look at the long-term norm of the 10-year bond yield, it’s basically straight down for 35 years. You will see 1-2% fluctuations over the past 10 years, but the trend is down. Nobody can say for sure whether the trend is now broken, but maybe. I don’t think so, which is why I’ve been buying CMF now. I’m not done yet, as it will take 4-5 years to build a $800K+ position.

Did you guys see the recent article on Barron’s with Gundlach predicting bonds could be at 6% in 5 years? Thoughts?

I have some cash I need to invest for the medium term.

Saw it. If that happens, the bond market will take a huge beating, down ~20%-50%, depending on what type of bonds.

If he is talking the 10-year yield at 6%, that would mean 30-year mortgage rates will go to 8% – 8.5%.

Could happen! Doubt it. If it does, let’s hope it is because inflation has jumped from 2% today to 5% and we’re all getting incredibly rich owning assets.