As an MBA holder from UC Berkeley, I should be very pro-business school. But after seeing the latest tuition figures compiled by US News & World Report, I cannot in good conscience recommend getting an MBA full-time today if you are paying full price.

Only if you are already rich, screwed up massively in college, want to take a long vacation (and rich), or despise your job and want a career change should you consider an MBA.

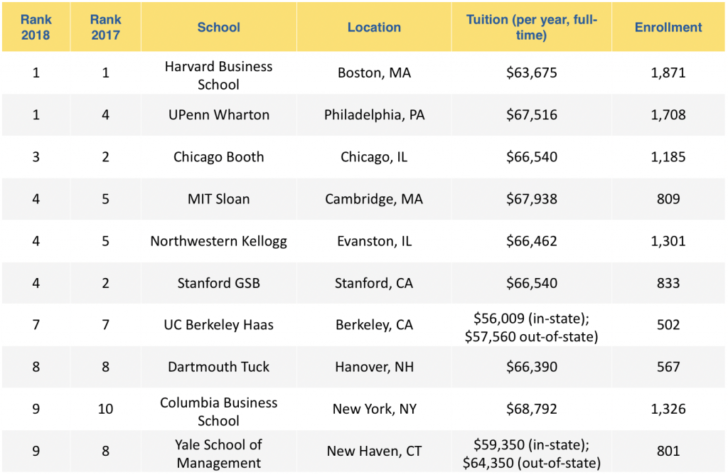

Take a look at the details yourself.

The first thing that stands out clearly is how wrong the rankings are. UC Berkeley Haas should be #1 since the school is located in the booming SF Bay Area and has the “cheapest” tuition. But besides the egregious rankings, the second most eye-opening part in this chart is the tuition.

Who in their right mind spends more than $65,000 a year on tuition alone?! Once you add food and shelter, we're easily talking $100,000+ a year. Students are not only giving up two years of experience, but they're also giving up another $150,000 – $300,000 in median lost income.

Yes, getting an MBA full-time is like taking a long work vacation for many people. But unless you are already rich, or are willing to work for decades after graduating, I'd much rather have the $300,000 – $450,000 in paid tuition and lost wages instead. Taking 4-6 weeks off a year in my late 20s and early 30s was good enough for me. How about you?

Some of you might think that given the MBA is a graduate degree, many schools provide grants to attract the highest caliber of people. Unfortunately, MBA programs are not like graduate programs in the sciences or humanities, where scholarships are readily available. MBA programs are businesses that seldom give out free money to students.

The Better MBA Solution: Get Your Employer To Pay

When I went to Berkeley Haas between 2003 – 2006, tuition was around $28,000 a year. I felt that was a steep price to pay back then as well. As a result, I applied to the part-time program because my employer was willing to pay 100% of the tuition if I stayed on for at least two years after graduating.

The program took me three years to complete. Every Saturday for nine months a year, I would go to class from 8:30am – 5pm and then spend another 10 hours a week doing homework and group projects. The first year was brutal due to the adjustment and all the core classes I had to take. But by the second year, the program was a lot of fun due to the electives I selected.

I could have finished the program in 2.5 years if I took two summers of classes, but I needed a break. I was regularly working 60+ hours a week in finance and was doing a lot of traveling.

Although the three years were tough, they went by quick. I worked for six more years before I finally left my employer in 2012. It was a good trade for both parties.

If you are considering getting an MBA, please first check with your employer to see if they have a tuition reimbursement program. It's a business expense for them as well as a recruiting and retaining tool for their top employees.

If you plan on paying the entire bill yourself, then do research on how you can deduct the tuition of an MBA on your taxes. For example, if you earn under $80,000 the year you go to school or $160,000 if you are married, you can deduct all tuition and school-related fees. See more tuition deduction info from the IRS here and check with an accountant.

The Main Things I Learned From My MBA

Here are some of the things I learned in business school:

* How to create an income, balance sheet, and cash flow statement

* How to be a better negotiator

* How to be a better communicator

* How to properly analyze real estate transactions

* How to lead more effectively

* How to play nice with eager beavers

But the main thing I learned in business school was confidence. The more information I knew, the more confident I became. With an added diploma and three more years of work experience, I started to finally feel like I belonged in the finance world.

The problem with MBA programs right now is demand. Applications were down 5% – 10% for the top 25 schools last year and will likely decline even further this year once the data comes out.

The schools blame the decline of international applicants scared off by anti-immigration talk in the US, hurricanes in Texas, and white supremacist protests in Virginia for their declining demand.

But one variable they do not discuss is the extraordinary cost of tuition, which is just too obvious to me and any rational person working in a strong economy today. If business schools want to increase demand, they simply must lower price. You don't have to go to business school to understand this concept!

Check out this chart highlighting the year-over-year change in MBA applications.

Getting A Graduate Degree Is Contrary To FIRE

If your goal is to retire early, then getting a graduate degree doesn't make sense unless you can go part-time or get your graduate degree in your early 20s.

The goal of FIRE is to break free from the grind as young as comfortably possible. By spending 1 – 4 years in graduate school, you are sacrificing precious time and money in order to hopefully leverage your degree for as long as possible.

Originally, I had thought that once I got my MBA at 29, I would work full-time until age 40. But I couldn't take six more years of indentured servitude so I engineered my layoff at age 34. Not all was lost though as my MBA gave me some tools to figure out how to make money with my own two hands.

The only person I know who had a lower return on their MBA than me is a friend who went to Harvard Business School full-time. When she graduated at 29, she proudly told me, “I never plan to stop working Sam!”

But after she had a baby girl three years later, she never went back to work. Despite only working one year longer than the time she went to school, she met her husband in business school, who ended up making multiple millions at a hardware device startup. They live in a $4M+ house and life is good, so perhaps her return was stellar after all.

Still No MBA Regrets

Despite the ridiculously high cost of getting an MBA, you will likely not regret going. You'll meet a lot of interesting people, go on amazing school trips, and be forever part of a fraternity that will always believe their MBA was worth it.

Just make sure you either work for at least 10 years after graduating or make at least 10X the total cost of getting an MBA before you stop working, whichever comes first. After all, getting an MBA is all about maxing your return on investment.

Further, an MBA is a great way to reset your career if you screwed up in high school or slacked off in college or work at a terrible job you absolutely hate. If this is the case, go for it and figure out how to deduct the cost on your taxes.

As for me, of course I don't regret getting my MBA because it was largely free. It was painful to be working 80 hours a week for three years, but once I was done, working only 60 hours a week felt like a breeze. Hard work should never be an excuse for regret.

Staying in San Francisco for more than 12 years after graduating has proven to be a wise decision given a Berkeley MBA carries more weight here than in other parts of the country.

Finally, now that you know I got an MBA from Berkeley, doesn't it seem like you're getting even better value for what you're reading on Financial Samurai? If not, I'll gladly give you your money back. Go Bears!

Looking to refinance your student loans? Check out Credible, a student loan marketplace that has qualified lenders competing for your business. Credible provides real rates for you to compare so you can lower your interest rate and save. Getting a quote is easy and free. Take advantage of our low interest rate environment today!

Related: Is An MBA A Big Waste Of Time And Money?

Readers, do you think getting an MBA is still worth it today? What types of people are willing to pay so much to get an MBA nowadays? Do you know anybody who went to graduate school and ended up becoming a stay at home parent or retiring shortly after?

Note: Some people really dislike folks with MBAs, especially those who didn't get an MBA. There's also tension sometimes between the engineer “creators” and the business development, sales, and marketing types (MBAs). The reality is, you need all types of people to make a business run well. Know the culture of the firm you want to work for before getting an MBA or applying to that firm.

Very helpful post, Thanks! My GF is applying for part-time MBA programs, and tuition is definitely a big concern. Although her employer can cover up to $8000 a year through the tuition-reimbursement program, she still needs to pay $52000 plus living cost out of pocket. Plus, the 2018 Tax law made tuition non-deductible, which is another $10,000 loss… She can still afford it, barely… as a senior associate already having 3 years+ working experience. However, we are still thinking whether it’s worth it to invest it in a 3-year part-time MBA degree, or to spend the same amount on some other investments which can generate more passive incomes. IMHO, the US higher education is totally crazy! This kind of situation doesn’t seem to be sustainable in the long run!

I don’t think it is worth it for myself. For some people, it can be great for a career transition or promotion. I’m also not sure how many scholarships these programs give out, but that would be a game changer. For me, it doesn’t seem to help with my career progression (can get promoted without MBA), currently making $140k and will get up to about $230k next year most likely, so that’s a total of $370k in lost income (~$250k after tax) if I were to do the MBA. Plus nearly $75k/year in MBA tuition ($150k for 2 years). That comes to a grand total of $400k opportunity cost. Doesn’t seem worth it to me. I don’t want to take on student debt and I enjoy work-work more than school-work.

You nailed it great! I am absolutely against student loan debt and I honestly feel even from top elite schools like Harvard or Stanford in any in-demand field that one there is no guarantee of getting the best, preferred job as other top, elite grads are competing and networking too and two I feel that being chained to debt affects career passion. Tuition must be abolished everywhere as education free of cost is a universal human right.

I am glad I did not pursue an MBA and pursued a Masters in Urban Planning 9 years after finishing undergrad and after working. Like how the MURP I am pursuing at my acctedited state university is cheaper with my two AmeriCorps Ed awards knocking out 1st half of tuition. Love how my degree is usually required in the field and translates to public service, public health, Economic Development and city and town Planning with sustainability which are my passions unlike investment banking, finance, private equity or reaping profits on and on without a true social mission towards uplifting thr less fortunate.

I graduate from an M7 in June 2019 and just accepted an offer this week. My pre-MBA income was less than $100K and my new job will pay right above $100K. Although it is less than the median salary of my classmates, I will be relocating to the South whereas the majority of my classmates move to Boston, SF, or NYC. Although I am excited about the firm and have significantly increased my salary, I just told someone this week that I believe MBA tuition has reached the threshold of being a good investment.

I am excited about how the network helps me in 10+ years though.

Congrats and good luck! Just make sure to stick with your career for at least 10 years post MBA and I think you will have made a fine ROI.

I agree 100% with this post.

Unfortunately in some areas having a master’s degree will be a technicality to advancement. My girlfriend and I are in the middle of part-time master’s that we are paying for out of pocket. For me, an MBA at just under $15K online from a state school that is ranked decently in the Princeton Review online rankings. For her, a master’s of nursing (MSN) in education from a state school for under $9K. Both schools are flexible and work with their students, unlike some other private schools we’ve dealt with.

I might lose the prestige of one of the big name schools, but I have an Ivy League degree on my resume from undergrad where I was lucky enough to have essentially free tuition through my mom’s job. For both of us, WHERE we go to school is less important for our career paths than that we actually got the degree. This obviously doesn’t hold for every industry, but for healthcare/our paths, the networks that come from a “prestigious” university was not of much value.

There are other affordable options out there for people looking to do part-time. Many state schools (particularly those in the middle of the US) offer online students in-state tuition rates regardless of where they reside. Not right for everyone, but perfect for a lot of people who probably don’t know about it and are taking on unnecessary debt.

I would only consider an MBA if I was desperate to change careers and the career I wanted to go into has a lot of MBAs. Even a few years ago the cost seemed outrageous when I was considering it, and it has only gone up since. My local state school, Arizona State, recently made their full time MBA tuition free so that looks a bit more attractive but I am more interested in doing a masters in Statistics part time while I keep working.

Though isn’t it true that for some fields where one wants to switch careers to that an MBA may not be right choice due to functional and specific skills required? I ask as this many healthcare, other types of jobs or other trades require specific skills besides MBA?

Thanks for your encouragement and advice which I acknowledge. Just curious reason some people refer to MBA as general all around ticket for changing careers as there are a vast array of careers?.

Best,

Samar

Sam. How about reviewing the online MBA programs only and their cost to value ratio versus those institutions where you have to attend in-person or some form of a hybrid where it’s some online but still requires mostly on-site presence.

And are part-time MBA programs and classes another way to start the process to ensure the MBA program you’re committing too is the best one suited to your career, hopefully with some government loan assistance and work sponsorship too.

$5-10k from NYC firm’s barely makes a dent in today’s priced moderate MBA programs, let alone the well known and more elite programs…many thanks.

Sam,

Med school is even worse because super high tuition and the very long times it takes to train an MD… think 4 years of medical school , 3-5 yrs residency, 1-3 yrs fellowship— 2 YR MBA opportunity cost is NOTHING compared to MD opportunity costs…esp saddle with 300K of student debt at the low end. Below is my Alma mater UCLA School of Medicine tuition for IN STATE tuition someone living off campus (what i did back in the day). Given how poor compensation is for many specialities these days, being an MD more than ever has to remain a “calling” a certainly not a terrific financial decision vs being a PA or RN with much lower tuition and compensation rivaling primary care MDs with 1/3 or less # of years

Cost of attendance for California resident student living on campus, off campus, or with parents.

Living in University or Off – Campus Apartment

Year 1. Year 2. Summer. Yr 3. Yr 4

Tuition & Fees $ 40,714 $40,714 $3,937 $40,714 $40,714

Room/Board** $21,050 $23,155 $2,955 $23,155 $23,155

Books/Supplies**$4,520 $1,555 — $990 $510

Transportation $5,130 $5,643 $770 $5,643 $5,643

Misc.**** $2,290 $3,149 $344 $2,519 $4,414

Total $73,704 $74,216 $8,006 $73,021 $74,436

Commuter – Living with Parents

Indeed. However, being a doctor is one of the most honorable professions in the world. And you wil Be gainfully employed for life.

Further, with New York University offering free tuition, I have to match on that other similar institutions will start doing the same or at least offer discounted tuition.

Tell me you don’t feel proud being a doctor? It is such a great accomplishment that I give all doctors all the respect in the world.

Agreed Sam. I am extremely proud to be a MD but doctors have less and less respect for their craft by the day (esp from hospital admin) and unless you own your own practice (becoming much rarer today than ever) it always involves trading time for dollars… typically 50-60+hrs /week or more amounts of time which are not trivial. Plus much higher liability risk vs MBA, engineering or law degrees or other prof degrees. It is STILL a privilege to be a doctor but w/all of the admin hassles and loss of autonomy etc it is not nearly as rosy from practice standpoint nor financially as it has been traditionally considered.

High five for being honest.. I am so glad you nailed it and it has been a shame with extreme misfortune that my Asian Indian culture always emphasized for us younger ones to become a doctor along with engineer or even lawyer. With more and more said in our seminars and writings and saying out loud hopefully many elders are getting as not right to have imposed anything and even thoughtful, encouraging words pointing to only these professions as only such can be extremely hurtful as thoughts and words can hurt. I am glad to have found many successful Indians in none of those fields and loving their work with fame. How funny in our Indian culture dentist, architect, city planner, big businessman, accountant or even teacher or nurse not mentioned with hype as those three. My heart really goes out to certain children who only studied what their parents or grandparents wanted them to as not right with many surely feeling resentment towards their elders and is not their true interest or value.

I wish you all the best Doc and know all will be fine.

Big question: As you mentioned the dilemma with hospital admin affecting docs’ satisfactions, would you say that physician hospitalists are usually imposed or pressured to prescribe conventional medications with side effects and not suggest healthy lifestyle when truly better as they may get fired from the hospital? Does same refer to docs having to usually recommend unnecessary procedures as chemo or surgeries to stay in line with hospitals’ rules and for bottom line?

Thanks for your thoughts, though I and many others would not give an ounce of respect as logical to doctors that have committed sinful acts with their patients along with those that overprescribe and reap profits from prescriptions and procedures. Too bad not all doctors even after earning it are not the same and the bad apples tarnish the image of the profession.

I personally would prefer a doctor who prescribes best long term healthy lifestyle and food over meds or unnecessary procedures. Plus, I happy to go to someone else besides a doctor that can cure my health dilemma when not needed.

Overall, I am grateful and proud of anybody in any profession who works with genuine service, interest and not daring to bilk whom they serve.

You’re right that the opportunity costs of going full-time are hard to make work. I am currently finishing my MBA part-time and I still struggle with the ROI given I already have 10+ years of work experience in structured finance. I also don’t perceive a huge pay bump at this point in my career. My employer is subsidizing the cost somewhat, but with having two small kids now, the opportunity costs are mounting. The saving grace is that I truly do enjoy the coursework and I resonate with what you said regarding confidence. Despite my work experience and undergrad economics degree, this process has increased my confidence tenfold.

Hey Sam!

Currently a first year at one of the programs on the US News top 10 list. I’ve been a long time reader of your blog and your advice that we should invest in ourselves as much as possible. I’m currently paying sticker price for my full-time MBA (ouch!) but exited my previous company with a large equity payout, which helps. It’s a huge gamble and I both doubt and reinforce my decision for doing this everyday.

ROI data on MBAs is largely short-sighted and incomplete. The schools have plenty of data on salaries just after completing the program, but my guess is that the folks who are still working 10, 15, and 20 years out of their top MBA are doing quite well and don’t report the salaries (because no one asks!)

There’s a few people here that have gone for the “value” MBA rather than the “top school” and seem to have made a great ROI. I’m probably in that category – I took a non-US, 1 year full-time program, with “only” $40k in fees – and less time not earning too. Compared to the price of a top US school, that’s a bargain.

The school is top 20 to 40 worldwide, depending on whose league table you believe (some are more weighted by earnings increase, which favours US schools with young cohorts going into finance).

I was earning 3x my pre-MBA salary by 3 years after graduating, and I was not at an early stage in my career.

Once you get outside the top 5-10 “brand” schools, I’ve found it seems nobody really cares where you got your MBA from, but having one definitely adds value.

I got my MBA in my early 30s, part-time at night over several years. My employer at the time paid the entire bill. It was the highest priced MBA in the Indianapolis area at the time (early 2000s). Total cost was $24K. I got massive return as it allowed me to double my salary within four years of completing it (eventually becoming a VP at a different company). I’m possibly a rare person that can say it paid huge dividends. My concentration was Finance, so more importantly it really helped me in my investing and entrepreneurial side hustles that almost equal my full time salary now. And, I really enjoyed the experience. Being surrounded by motivated leaders and professionals from the area in classes each week was uplifting and allowed me to network at higher levels that also paid dividends after the MBA was done as I’ve done deals and business with many of these former classmates. Home run.

Different people will have different perspectives on your post. As a mechanical engineer, I was working with a very well known US firm back in India (I had graduated from a premier engineering school in India as well). Based on my work experience, I was paid higher than the industry standard, but I still fell short of $15k gross annual income.

I’ll be honest and tell you that seeing some extremely dumb people making 3-4x my salary just because they were sitting in the US did irritate me at times. I was hired for a leadership program after my bachelors, and through multiple rotations I soon realized that even though I had a strong technical acumen, affecting the financial aspect of my firm’s business (through procurement, strategic sourcing, etc.) gave me immense pleasure. Hence, within the first two years itself I realized that I would rather put my eggs in an MBA program than an MS program. I am from one of the MBA programs that you have mentioned in your screenshots, and I would be graduating in 2019. Over the summer, I was working with a consulting firm in a 60+ hours/week job and helped a major US retailer significantly improve its procurement and accounting divisions. I wouldn’t have been able to add this value without the MBA program. I would be continuing with the firm full time. The job that I would be joining would pay me $150k (Greater than 10x bump, and a bonus of $25k after that).

I’ve significantly improved my communication skills, have learnt about and follow smart people like you (can’t talk enough about how much value you create in this world!), know how to make more convincing presentations, know at least 25% of my class really well (read: network), understand financial markets way better than I did 1.5 years ago (I used to invest back in India as well, but I now have a better grasp of markets and investing strategies). I don’t know whether I’ll be able to retain this job for long (because hey, I don’t know whether I’ll make it to the H1B lottery), but I am sure that even if I have to go back to India, I am much more skilled than I was 1.5 years back, and would be able to find a job that would put me in a better spot financially (even though I took a debt of $100k+ in a weaker currency @11.5% APR), than I would have been by not doing an MBA.

Agreed that I’ll have to toil in this intense job for much longer to achieve my FIRE objectives (as my starting point is a significantly negative net worth), but looking at where I started, I have come a long way. I owe that primarily to my hard work and dedication, but in some part to my MBA program as well!

I’d love to hear everyone’s thoughts on getting an online MBA. I am aware of at least two programs that offer very inexpensive programs while also appearing reputable.

Gies College at University of Illinois has an ‘iMBA’ that is all online. The cost is around $22,000 for 18 courses.

Texas A&M Corpus Christi also has an online MBA that costs a little over $12,000 for 10 classes and can be completed in a year, going full-time. If you don’t already have a BBA, you’ll need to take four prep classes for an additional cost.

Obviously MBAs from these colleges wouldn’t be as prestigious as one from an Ivy, but I imagine that isn’t an issue for many people, whether due to location or intended career choice/goals.

Are these programs worth consideration or a waste of time?

If it’s for your personal benefit (I.e. Want to learn leadership skils, want a refresher on financial statement analysis / modeling) then do it if it doesn’t hurt your bank account. You will make the most of it and hopefully perform better at your current job.

If you’re counting on this degree for a leg up in joh hunting, no it will have no effect and it would be money wasted.

My sense is that you have be pretty far up in your class to benefit from any professional degree, even at a top school. The degree itself is simply not enough. What say you, Sam?

Not the case, IMO, for top MBA programs. Unlike law school and med school, grades in MBA matter very little. Employers are looking for smart enough people (you check that box by being admitted) and then it’s all about drive, passion, and leadership potential (mostly DRIVE).

Unless you’re going into high-level quant stuff, most employers don’t really care.

I went to Wharton BTW.

My MBA was completely paid for by my job. When they offered the first year I grabbed at it. They held classes on the campus of my employment from Golden Gate University. It was Areli 20,000 dollars a year at the time. And glad I did it. In subsequent years the only paid part of the tuition. And then later not all the classes were held at my job, had to drive an hour.

I recommend getting a job and have them pay for it while you are working.

Great post Sam

There are lot of discussions on this subject indeed lately

In my view the bottom line is the ROI

If an MBA from a Top school (let’s say total cost 350K$) will secure you a job that will allow you to recoup the total cost in 5y the investment is worth it

Otherwise is not

There are tons of statistics out there such us average salary, percentage of employed after 1y, salary increase after MBA completation etc etc

Is it worth it?

Again…do your math and guess the ROI

Back to the original question: are the tuition too high?

Yes in absolute value ($)

Gotta love the propaganda as to rational provided for declining applications – LOL.

It can’t be due to the value proposition of the product not being so good anymore, can it??

Seriously – a white supremacist rally would affect MBA applications? Hahahahaha

Either:

1) this is a load of leftist propaganda crap or

2) potential applicants are the wimpiest bunch of snowflakes ever.

I’m gonna go with #1.

No need to overly politicize it. Comments like yours give bad names to political conservatives / Trump supportors.

The fact of the matter is a number of employers that, in past years, extended offers to large classes of MBA students including internationals, changed their recruiting policies in 2016 – 2017 school year to only accept US Citizens and Permanent Residents, because Trump tightened work visa policies (bulge bracket IB – Morgan Stanley, Citigroup for sure, maybe even management consultants). Some of international MBA applicants were hoping to work in the US / UK after graduation, and word got around quickly that visa issues were preventing them from doing so, so they ditched the programs and went elsewhere. It’s $200k+ tuition plus living expenses they’re talking about. Most of these internationals are probably more well off than you or me, but they won’t waste it on an MBA program if it doesn’t do what it promises to do.

If you stop trolling maybe you can get into one of the top programs yourself. Then you can thank your parents for giving you the right to work in this country barrier free.

I fall into that last category of “working in a job you hate and looking for a career change”. I was absolutely miserable in my last job and felt stuck. Really wanted to get into a new industry but was having no luck when applying for jobs. Decided that if I could get into a top tier business school i’d go for it. Ended up doing that, and was able to get a job in my chosen industry upon graduation. I’m actually earning less (mostly due to moving to a lower cost of living area) than before, but am much happier. I guess for me it was worth it, but from an ROI perspective it probably wasn’t.

I’m doing grad school part time on the weekends. I earn too much for the standard tuition deduction but have not heard of the business deduction. Do you need to be 1099 or self-employed to take advantage of this?

Under the IRS’s tuition and fee deduction, a student’s annual income can’t exceed $80,000 if filing as an individual on the return. That limit goes up to $160,000 if the taxpayer is married and filing jointly.

https://www.irs.gov/publications/p970

Sam one thing to note I believe the ability to deduct mba tuition as an unreimbursed business expense is no longer available due to the tax law changes. However, tuition and school related expenses can still be deducted from business income fully but you have to own your own business.

Thanks for the heads up. Check with an accountant folks!

Great post. I also did my MBA part time, at Georgetown. Made a great network of friends and potential work colleagues, while minimizing expense.

While I agree the cost is significant, an MBA is probably one of the few graduate degrees actually worth the cost because of the ROI and a relatively short payback period.

One other note: MBAs are quite applicable and can provide career flexibility. Years down the line, someone with an MBA can pursue finance, marketing, economics, accounting, etc.

Thx Chris. What is it you do now and how many years of work left in you do you have?

Didn’t know Georgetown had a PT program. Wave of the future!

I got my MS & MBA as part of the fast track bachelors + masters program. I had a 4 year scholarship. My freshman year, I figured out I could graduate early and then get my Master’s in 1 year. I started taking grad courses my 3rd year of college. My 4th year of college I was doing my Master’s (taking 21-25 hour credit grad semesters). I had to get special permission from the Dean’s office. I finished in 4 years. I only had 3 more classes to finish up my MBA because I took so many credits. My company hired me when I finished the 4th year and then paid for the rest of my MBA.

Granted, because I did it so fast and finished everything by the time I was 23, I may not have been able to relate it to the real world. But honestly, in the workplace nobody cares. I have 2 graduate degrees on my resume plus tons of great work experience at top companies. At 27, I was making same/or more than some peers who were 30 and 31 who had taken 2 years off and gone to get their MBA. I know this because at my last company they hired fresh out of MBA school grads, and I was senior to most of them. I, also, outperformed them.

Do I wish I had gone to an Ivy League school? Yes, sometimes. But I can tell you I love having no student loans. Especially since my goal is to FIRE by 40ish. I rather take time off in my 40s with money.

I’ve learned so much, and I’m using what I learn to help my younger brother get an edge in the workforce.

In summary, it can be done without an Ivy League degree. If you have parents who are funding the degree, then obviously go for it. But if you’re like me when everything was funded by applying for scholarships, there may very well be a different route.

Sounds like you are well on your way to FIRE by 40! Congrats.

Hi Sam,

I have the same thought whenever I think about getting an MBA – the cost is outrageously high, especially factoring in opportunity cost. I’m in my mid 20s, making high 5 figures with a year of experience. Nevertheless, I am leaning towards applying to an MBA. Why?

My work experience is in a very small niche of finance that isn’t very transferable to other jobs in the industry. I know in investment banking you can obtain an analyst to associate promotion, however in my niche the norm is to be pushed out to an MBA program after your analyst years. On the plus side, my superiors are extremely supportive of MBA applications, and everyone I know from my job has gotten into a top 15 program.

To me the high cost may simply be the price I have to pay to continue to move up the chain as an associate and beyond. Do you think it’s worth it to take the 200k hit from a FT MBA program if this is the only clear way to make the jump to the next level?

Go part-time. Do the math on what $200K turns to in 10 years at a 5% – 8% rate of return.

FIRE readers might be interested in the Full-time MBA program at the University of Florida, a top ten public university. All admitted students in the Full Time MBA Programs will receive a 100% Tuition scholarship, https://warrington.ufl.edu/mba/program-options/full-time-mba/.

Everyone has their personal experience, of course. For me, getting an MBA allowed me to transition into a finance career and was a good investment of time and money.

The big downside is that it pushes FOMO and “keeping up with the Joneses” to a whole new level. Both my wife and I went to top programs and now live in a HCOL area. Most of our friends are grads of these schools and in lucrative careers.

When you surround yourself with these high earners, it’s really hard to maintain FIRE and frugality mindset. Also if you just have a “normal” post-MBA career (which is generally pretty sweet), you feel inadequate because your classmates are running companies, founding hedge funds and taking their startups public.

Yep, I hear you. MAX FOMO baby!

One reason why I moved to the western part of SF, to escape the madness. And one reason why I want to live in Hawaii for at least 3 months a year. Even though I don’t go to work, I STILL feel more relaxed in Hawaii.