Are you wondering: Is an MBA a big waste of time and money? With the cost of MBA tuition going way up and missing out on two years worth of work, getting an MBA is more expensive than ever before.

I got my MBA from UC Berkeley in 2006, but I did so part-time over a three-year period. As a result, I didn't miss out on income or career progression.

But the three years it took to get my MBA was damn hard! In retrospect, I think getting an MBA was worth it. My employer paid for 80% of the tuition, I learned some new things, and made some friends.

However, if I went full-time to get my MBA, I'm not so sure. Six years after I got my MBA part-time, I decided to leave Corporate America for good. Therefore, the return on my MBA by going full-time would have been uncomfortably low to spend so much money and time.

Let's discuss whether getting an MBA is worth the money and time.

Is An MBA A Big Waste Of Time And Money?

During the summer of 2014, Personal Capital, a fintech company that offers everyone free financial tools to manage and optimize their wealthy, had the luxury of hosting three MBA interns in the marketing department where I consult part-time.

One was actually a Harvard JD/MBA, which is darn impressive because she has to get into both schools separately. The other two were from Stanford. They did a great job brainstorming and executing fantastic ideas.

In addition to our summer MBA interns, our head of business development (Stanford), our head of client engagement (Stanford), our digital marketing executive (Michigan), our CMO (Cornell), and our CEO (Harvard) also have MBAs.

Then there's me, a Berkeley MBA grad. In other words, the marketing department is a majority MBAs. But having an MBA isn't a requirement for joining. Relevant experience is much more important.

Most MBA graduates will probably say that an MBA is money and time well spent. It's kind of like spending big bucks on a fancy dinner. To justify the extravagant expense, of course you're going to tell yourself and all your friends, how incredibly amazing the dinner was. But we all know that spending $250 per person at Jean Georges isn't worth 100X more than a tasty In N' Out cheeseburger for $2.5.

For similar reasons why going to private university without a scholarship is probably not the best use of your money unless you have plenty of it, getting an MBA is also becoming a tougher choice today.

For those of you with MBAs, be forewarned. This is not a cuddly, feel-good post on why getting an MBA is a no-brainer. There are a lot of hard truths from what I witnessed as a manager who consistently interviewed MBAs during multiple bull and bear markets. I'm also providing the perspective as an MBA eight years after graduating. Readers trust me to speak candidly, so that is what I will do.

Should You Get An MBA?

Here are some realities about getting an MBA and whether getting one is a big waste of money or not.

1) Many MBAs couldn't survive downturns.

There's a perception that MBAs are highly qualified individuals with tremendous amounts of interpersonal, leadership, and managerial skills. Sure, many MBAs are well-rounded individuals with plenty of charisma. However, there is a reason why MBA applications surge during recessions.

Employees get laid off left and right during recessions, global pandemics, and competitive difficulties. Going to graduate school is the logical safe haven step many laid off employees take. During the 2000-2003 and 2008-2010 meltdown, business school applications rose by 20-40% a year.

Of course not everybody who gets laid off is a poor performer. They are usually just at the bottom 10-20% of the heap. Employers can't lay everybody off. In other cases, there might be a complete department shutdown, a company bankruptcy, or a merger where those who are not politically connected lose. There's no fault in that.

For those employers hiring MBAs two or three years after a recession, ask them about about why they left their previous employer because chances are, they really didn't have a choice.

Those who were able to survive and get promoted during difficult times might be the true performers. And perhaps the most amazing candidates are those who gave it all up during a bull market to go back to school. I realize that this section may offend a lot of MBAs who went to school during recession times, but we can't deny the statistical data.

2) One big intense vacation.

If you're a 20-something year old and still finding your “purpose” in life, then getting an MBA is a great way to explore new things. An MBA is like one amazing two-year vacation filled with networking events, group projects, morality training, traveling and hobnobbing with many well-to-do foreign students.

Some students utilize their MBA experience to the maximum. They start companies, work multiple internships, and build incredible personal networks that will help them in the future. Other MBA students use their time to unwind and ponder the meaning of life.

Recharging is healthy for the mind, but being out of the work force could leave you quite rusty given technology is changing so quickly. As an employer, be prepared to question the candidate on practical matters.

3) You don't learn or remember very many hard skills.

Unlike going to trade school, you can't really do something specific with your MBA degree. An MBA gives you very broad knowledge in finance, marketing, communications, leadership, economics, organizational behavior, and more. You learn to be a well-rounded person who should be able to socialize better with more of the population.

Even if you are the greatest student in your class, you'll probably end up only retaining a maximum of 20% of what you've learned in school. And if you don't constantly review your case studies and text books, you'll probably forget 90%+ of everything after a couple years.

Post business school jobs have pretty specific responsibilities. It's highly likely most of what an MBA learns or remembers will not apply to the specific job function. However, soft skills such as communications, strategic thinking, and leadership will always be there.

Just be careful not to hire too many thinkers, and not enough doers. Ideas are useless unless acted upon.

During a pandemic, you lose out on a lot of the in-person interaction. As a result, at the margin, getting an MBA during a pandemic isn't as rewarding.

4) An MBA is incredibly expensive.

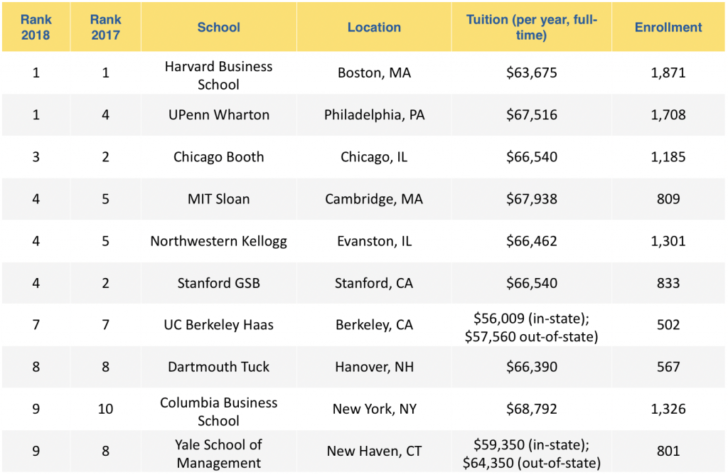

Whether you attend a public business school or a private business school, expect to pay between $50,000 – $100,000 in tuition alone. But the real opportunity cost is the salary you forgo and the two years of career experience you lose.

If you are in banking, two years is an eternity because it generally takes three years to get promoted to the next level e.g. three years as an Associate before you can be considered for VP, three years as a VP before you can be considered for Director, and three-to-four years as a Director before you can be considered for Managing Director.

If you truly do not like what you are doing, and find no other way to get in a field that you think you'll enjoy, get an MBA. You still have to go through the rounds of interviews to land a coveted job, don't forget. Just know that getting an MBA could easily set you back three to five years worth of savings as you pay instead of earn.

5) There is a glut of MBAs.

Whenever there's increased supply, prices go down. Marina Murray, associate director of research at the Graduate Management Admission Council (GMAC), estimates there are at least 250,000 students enrolled in MBA programs annually, and some 100,000 MBA degrees are awarded per year, representing at least 66 percent of all graduate business degrees conferred in the US. Universities are now conferring 74 percent more business degrees than they did in the 2000-2001 school year.

From the chart above, it sure looks like the red student loan debt line is about to surpass the gold income line. Imagine getting an MBA and deciding not to work after five years due to family or whatever reason. Such is the making of a financially poor scenario. If you are going to get your MBA, promise to at least work for 10 years after graduation.

The Benefits Of Getting An MBA

So far I've described a pretty weak value proposition for getting an MBA. But the reality is that companies are hiring MBAs quite steadily during good times and bad times.

For example, in 2022, 92 percent of the MBA graduating class enjoyed full-time employment upon graduation. It's almost as if getting an MBA makes you somewhat recession-proof. Here are five other benefits of getting an MBA below.

1) Getting into specific industries.

I've argued that there's no need to go to private school to get a good job and get paid. But if you want to go into specific fields like private equity and certain money management funds, an MBA from a specific set of schools is all but mandatory.

One money management firm down in San Diego requires all their research analysts and portfolio managers to have MBAs and CFAs, for example. VC and PE firms are very incestuous in who they hire from particular business schools.

2) Potentially massive pay.

Every other week I play tennis with a friend who so happens to be the #2 guy at a large private equity shop in San Francisco. I teach his high school daughter tennis during the off season for fun and coaching experience.

I asked him whether it was true that fresh MBA grads with previous work experience get hired on for $400,000+ a year, and he said, “it's in the ballpark.” $400,000 is an absolutely incredible amount of money for a 28-31 year old to make. Even more incredible is that his or her salary will likely rise to well over $1 million within the next five to ten years.

Below are some investment banking salary + bonuses. Not bad income post MBA for Associates and above! Just know that many MBAs working in banking, big law, and strategy consulting are quite miserable. First-year investment banking analysts now have base salaries of $110,000 and up in 2023.

Just don't do what this private equity associate is doing and giving up a $600,000 compensation to go back to business school. Completely illogical since he wants to return to the industry!

3) Gain more purpose in life.

In an incredible Gallup poll survey, 70% of employees revealed they were “not engaged” or “actively disengaged” at work. That is a travesty! Can you imagine going through your entire 40 year working career not really enjoying or caring what you do?

Getting an MBA allows you two years to find something you think will provide more happiness and meaning in your life. Perhaps this ability to find more purpose is an MBA's greatest gift given an MBA gives you the knowledge and tools necessary to switch careers.

4) Gain more confidence.

There are certain ages that allow people to feel more confident. Age 30 was a big one for me. When I was in my 20s, I felt somewhat like a faker for sharing my thoughts on Asian politics, economics, and stock markets with clients. But after I turned 30, I quit feeling like a novice, and started believing I had just as much credibility as anybody.

I also just graduated from business school at age 29, which further gave me confidence in the workplace. If you believe in yourself, you will more than likely go much farther in your career than if you lack confidence.

Related: The Secret To Your Success: 10 Years Of Experience

5) A more senior alumni network.

MBAs are a very cliquey group of people. There's something about giving up two years of pay and all the bonding events that make MBAs gravitate towards taking care of other MBAs. Remember, we like to justify our sacrifice, even if the sacrifice might not be worth it.

As more MBAs get older and more senior in the work force, it could become more of a detriment to employees who don't have an MBA. If you are planning to join a firm full of MBAs, then it's best you get one beforehand or part-time.

On the flip side, watch out for senior management who do not have MBAs. They will likely have an equally opposite bias where they believe an MBA is not worth it given they got to where they are without one.

An MBA Is Nice To Have

Getting an MBA is great, however, everything gets diluted over time.

Just like how a dollar in the future is worth less than a dollar today, the MBA degree will probably be worth less in the future as well due to the increasing supply. Given it's becoming more commonplace to receive an MBA in certain industries, those without MBAs will become more and more of an outlier.

To put things in perspective, only about 35% of Americans hold bachelor's degrees, and only 12% hold master's degrees. Therefore, we still have a long way to go before we get to a majority of Americans holding college degrees.

That said, it's evident that it's becoming harder for Americans to get positions that may have only required a high school or undergraduate degree in the past.

One of the biggest ironies about getting an MBA is that an MBA is most useful for entrepreneurs. An entrepreneur needs to utilize almost everything she or he has learned in business school to get ahead e.g. marketing, finance, pricing, financial accounting, communications, etc.

At the same time, many successful entrepreneurs don't have MBAs. You will likely learn for more from running a business than you will by sitting in a classroom.

I've reflected on my years of running an online business since 2009 if you're interested in learning more. People earn a lot more money online than you think. In retrospect, it was good to get my MBA because I was able to implement most of what I learned by running a business.

Go To A Top 25 MBA School

Unless you go to a Top 25 school, it's going to be difficult justifying getting an MBA, unless your main purpose is to change industries and find more meaning to a profession.

Before attending a full-time business school, see if there are part-time MBA programs in your vicinity and attend an info session. US News & World Report rank UC Berkeley, Chicago, Northwestern, NYU, and UCLA in the top 5 for 2021-2022.

Student loans can crush your dreams and happiness. Make sure you run a cost / benefit analysis before you send in your deposit. Make yourself a promise to work for at least 10 years after graduation to get a decent return on your investment. Otherwise, there's always the strategy of finding a wealthy spouse while in school!

I know this post comes across as quite critical of the degree. I just want those who are about to give up two years of salary and work experience to really think things through before attending. Chances are high you will have an absolutely fantastic time attending business school. It's one of those experiences that appreciates over time.

The MBA is more than anything, a career passport stamp that provides employers and clients some confidence in your abilities. Whether you have an MBA or not, it's up to you to prove your value. Don't be like one of those Harvard graduates who ends up being a nobody!

Manage Your Money With Personal Capital

Whether you plan to get your MBA or not, it's important to keep track of your finances to build great wealth over time. Sign up with Personal Capital, a free online platform which aggregates all your financial accounts in one place so you can see where you can optimize.

Before Personal Capital, I had to log into eight different systems to track 25+ difference accounts (brokerage, multiple banks, 401K, etc) to manage my finances and waste a whole bunch of time. Now, I can just log into Personal Capital to see how my stock accounts are doing and how my net worth is progressing. I can also see how much I’m spending every month.

The best tool is their Portfolio Fee Analyzer which runs your investment portfolio through its software to see what you are paying. I found out I was paying $1,700 a year in portfolio fees I had no idea I was paying! Next, link up your investment accounts and run them through their amazing Retirement Planning Calculator to see whether you're on track.

There is no better financial tool online that has helped me more to achieve financial freedom. It only takes a minute to sign up.

Related post: Should I Get A Ph.D?

For more personal finance content, join 55,000+ others and subscribe to my free weekly newsletter. I’ve been writing about living the lifestyle you want with the money you have since 2009.

Hi Sam,

I’m currently a 27yo in hospital IT with a 64K a year salary and have a BA in economics. My net worth is around 40k and is mostly in stocks/bonds. The stress is low but the income potential seems low as well. I’ve been thinking about an MBA for sometime now to get my income and net worth up and potentially using that to switch career paths to finance. I don’t want to work forever and at my current income it seems inevitable with a 11% saving rate and a spouse. However I know that finance can be stressful, long hours etc.. is there a specialty in finance that you would recommend that is both low stress and has high upside? I believe in one of your articles you mentioned venture capital being a little less stressful.

I think it really depends. I now not having an MBA has massively hurt my job chances. I’ve been repeatedly passed over and looked at like a weirdo and had people asking about my major in college and “what does that mean?” “why did you study that?” — I have a graduate level social sciences degree but many MANY years now of business work experience. I’ve hit a ceiling and feel getting an MBA is the only way to have some form of job choice (vs taking whatever I can get) at this point. I even had some lady literally look me up and down (like a dog) and my resume (also like a dog) and say “I don’t think you want to work for us” despite being in business attire. Like.. um ok– ><.

I think if a person has the money to go to one- and doesn't get crazy (like not over 40k) it can probably be worth it. I've saved my money so will have zero student debt when I get out. Would it be nice to just get a 100k job somewhere? Sure– but if you've hit a ceiling of being auto-disqualified for not having "a business major or background" then well you have to do something. I live in an expensive city, so anything under 80k a year does not cut it at all.

Hi Sam I graduated in 2008 with my MBA, my Bachelors is in Social Work, I am 57 years old now and my confidence is very low. I am told I my age will be a factor of not getting a job using my , MBA, I have 20 years of experience in Social Work, every time I look for a job with my MBA companies wants 2 to 3 years experience. I have no experience in Business, I do have years of management experience in the Social Work experience.I am afraid that is not enough I do not know where to turn I have to pay back all the student loans I took out to go to grad school I do not have a job using my MBA so I can get a higher salary to pay back my student loans. I was told I should try management jobs with a social work agency since my experience is in social work I am tired of social work.I am beginning feel to I should have never went to Business school.

I am a social worker. Have you considered working as a nursing home administrator or a director of admissions? It’s a great way to learn the long term care industry which is also related to the health care industry. Or have you thought about managing social worker? We are notorious for not wanting to be managers. Social workers need good managers.

Whether your MBA is from Harvard or not, it’s worthless.

Hey Sam,

I am literally in the throngs of this issue as I am trying to figure out whether or not to make the leap to a top tier or not. I’m in a top Cybersecurity program and doing very well. Even before graduating it provided a 200% ROI and I’m close to making 6 figures before graduation. Although, the problem is that my uGPA from a UMCP at the #1 Criminology & Criminal Justice program (at the time) fell short (sub3.0) due to “life” kicking me in the balls. I have been able to get into a BIG 4 and work for them for some time as well. I want to know if you think that attempting to apply to a top 25 program would be advised, since I’m experienced. I’d need to make over my current salary to make it a wise investment (+2-300k). Do you think it’s worth a shot?

Hi,

I have been following your blogs for a while and they have had a huge positive impact in instilling a sense of financial discipline in me. Thank you!

I have been considering doing an MBA so that I can move out and explore other roles. I am a PhD and as a result I have responsibilities for very specific projects in my industry.

Doing an MBA would deplete a part of my savings and I will fall short of your recommendation of the net worth for an above avg person.

Is MBA worth the money? What factors do I take into account before deciding one way or the other?

Thanks!

My experience with a MBA:

Pre-MBA Annual Comp Target: $70,000

4 Years Post MBA Annual Comp Target: $275,000 (in the south, where cost of living is very low)

I’d note three things with this:

1) I went to one of the weekend programs so I didn’t give up a salary

2) I went to a T10 program. After a lot of research, I realized the marginal cost of a top program was worth it

3) I got work to pay for the whole thing, including extra days off after a year and a half of lobbying

I think MBAs are worth it for people that are smart, already doing fairly well in a corporate environment, want to fast forward their corporate career in short order, and are willing to take on some risks (eg: I moved out of Operations and into FP&A during the program, and then moved to more general Finance and IR couple years out)

Which program did you attend?

Sam,

Thanks for article. I am considering to get an MBA after working as a software engineer for the last 4 years. I enjoyed my job a lot in the beginning since it was my first job out of a 4 year UC and was learning at a very fast pace. Since then, I’ve been settling down and a lot of my work now is very repetitive. I don’t envision myself to be an engineer for the rest of my career.

Business has been a long term interest of mine and I want to learn more about it. I can see myself working in the finance industry, but not sure exactly which type of work yet. I’ve decided to take the GMAT and see which type of MBA schools I can get into. My employer will not pay for it. My salary is not high, currently at mid-80k. I’ve been maxing out my 401k and IRA so my retirement planning is on track.

I am 27 years old this year. Is it worth it for me to pursue MBA to change my career and find out what I would like to do while in B-school?

Thanks!

Hi Sam,

I’ve only recently started reading financialsamurai a couple weeks ago but I am quickly learning that I need to make some major life changes. I just switched my 401k contributions from the company 6% match to the maximum and I hope to catch my net worth up to the range for my age/years worked. I am 29 years old, I spend 6 years on my undergrad, switching from art to electrical engineering and have now been working at a defense contractor for 5 years. I started as an electrical engineer, then moved into a technical sales role and recently moved into a program management role. Luckily I was able to start a part time MBA locally and have my company pay for it, however it is only a top 50 school.

A couple years from now when it is complete and I have some real program management experience under my belt, I plan on leaving the company. Raises have been <2% every year since I started and I'm only making low a $70K. Fellow employees with Eng degrees and MBAs aren't doing much better than I am here. It feels like it could take another 5-10 years of work to break $100k at this company. My original plan was to jump to a higher paying defense contractor and continue down the program management route, however after reading the 2) section "Potentially Massive Pay" I'm starting to think that it might make more sense to switch career paths. I feel as though my interest in engineering has faded over the years, I do enjoy the front end of the business and I want to continue down that path.

I'm on my fifth class and I have a 3.7 gpa but it sounds like I might have an uphill battle competing in the job market because I am not going to a top 15-20 school. I need to figure out what I want to concentrate in so that I can become specialized but I am not sure which paths make the most sense in today's world.

What direction would you recommend that I move in? I'm accustomed to 50-60 hour workweeks with no overtime/going to school part time and I'm not afraid of working hard. What are some pros and cons of the various career paths for the MBA graduate?

Thanks!

Andy

Hi Andy,

Welcome to my site. Here is a list of six figure jobs in various industries if you’re interested.

Engineers will make a good income and have a stable life. There just won’t be any massive upside. The upside comes from revenue production and management jobs.

If you’re not afraid to work hard, start your own website today and brand yourself. You’ll stand out from the crowd and find a much easier time getting new work you want b/c nobody really bothers to brand themselves online.

Sam

Sam,

Thanks for the advise. I checked out your blogging posts and I think I’m going to start a fitness blog that also touches on relationships and style (The things that I’m really passionate about in life). My coworkers often come to me for advise on those topics and I trade them information for help on the job. Having a blog that I could point them toward instead of repeating myself would be beneficial whether or not the blog ever made me rich.

I’m a natural men’s physique competitor. I’ve structured my lifestyle to balance the workouts, meal prep, work, a part-time MBA while still going out and enjoy myself on the weekends. I think that I could offer value to a lot of guys who are stuck in a rut who don’t know how to get started in improving themselves outside of the office.

I’m going to get started and do some brainstorming. Thanks again!

Andy

Columbia MBA. Massive waste of time and money. An MBA only makes sense from a networking perspective for people who are career switchers and those who didn’t have the capacity to make friends in high school, college or post college and need a formal structure in place to do so. I would say the latter represents approximately 30% of those who enroll in top 10 MBA programs. From a career perspective, if you have a strong career trajectory, stick with it and try to find a role that suits your needs better rather than spending two years figuring it out. There are people in business school who came from really terrible jobs and the expectation that you will definitely make more coming out versus going in are unfounded. Don’t expect any financial aid unless you worked at a non profit before school or fit into a niche affinity group. That means a 200k+ sticker price at Columbia. Average debt load is very skewed (barbelled) since so many students are sponsored by their employers. School has been pleasant. I have learned a lot, traveled and met a lot of great people but 100% not worth the crippling debt load and opportunity costs.

I just finished the first semester at a top 10 business and realized that I want to work on a more technical role in data analytics in the Bay Area. I started applying for jobs and realized that a technical degree would be cheaper and more helpful. I think it really does depend on what you want to do and what makes you happy. Additionally, as I started to apply for full-time jobs, I realized that I can get a job that’s closer to what I want that would pay me the average starting salary from a top 10 business school.

Sometimes I think that it’s dangerous to pin one’s hopes and dreams in a program or area just because it has historically worked and that we expect the future to resemble the past, at least a little.

I question the wisdom that I can really plan my life for the long-term because the world is so complicated. Human beings don’t like uncertainty, so MBA feels like a call/put option on myself that costs $200+. Even though I can put together a synthetic instrument that sets a floor for my losses, I am not sure if any particular pay-off is guaranteed. I think that’s why the value of an MBA or really anything can only be evaluated looking back. But in my situation, I would rather code and run statistical analysis that talk about strategy at this point in my life, so the choice to take a leave of absence from business school seems unsettling but clear.

I’ve thought about the MBA question as well. I feel like after you reach a certain income threshold ($80-100K), the risk of not getting a high return rises. It’s also more accurate to use the immediate pay bump you get the first 5-10 years out of b-school than to look at total lifetime earnings – 10 years out, any pay increases are likely due to your connections and skills and not your degree.

For the rest of my perspective, check out my post here: https://invibed.com/career/is-grad-school-worth-the-cost/

Hi Sam,

I’m a regular reader, first time poster. First I’d like to start off with saying that Financial Samurai is my favorite blog on the Internet and that I absolutely enjoy your articles! Not only do they make me think and give me new ideas they also give me hope that there are others out there who also think about these topics as I do. It gets to the point sometimes that my wife gets annoyed of me sending her your blog posts.

I’d like to specifically know your thoughts about pursuing an employer sponsored part-time MBA at over next few years based on the life/financial position I provide you below. I have been thinking about this question for quite some time and am still having a hard time making a decision. Should I do it, should I not, what do you think? Additionally any comments you have for me in terms of my progress or strategy would also be greatly appreciated.

I have the opportunity to pursue a Masters Degree paid for by my employer, with reimbursement up to $50,000. This includes tuition and books but not things such as travel and the reimbursement comes with a required four years of employment with the employer or else I will have to pay back a prorated portion of reimbursement total. I do see myself staying with this employer though and have no plans to leave. I am considering pursuing a close by part-time MBA program ranked in the top 70-40 schools for an MBA and is the fastest rising program in rankings in the country. I can reasonably estimate that I can complete the MBA in 3 years, taking one class at a time, and that I will receive scholarship because of my academic/work background and GMAT score. This would reduce the amount of capital I have invested in my MBA at any time (as my employer only reimburses after you receive a B or hire in a class) and I would likely pay nothing for the MBA in total. My mentors at my employer have told me however that the MBA will have little to no Impact on my advancement and pay at the company and that the value is primarily in if I am aiming to rise above the level of CIO or if I might eventually leave the company.

I am 25 years old and married. I work in IT and focus on Cloud and Big Data, two of the most lucrative areas in technology right now. I graduated from a top 20 undergraduate business school with a degree in MIS (business and IT) with a 3.87 GPA, Magna Cum Laude, University Honors, and Business Honors. I also a graduate of my company’s two year Information Technology Leadership Program, the best ranked company IT leadership program in the world My current salary is $80,500 and I am expecting this to eclipse $100,000 in the next two years and $120,000 by the time I turn 30 without the MBA based on the trajectory I have seen with others who have been down a similar path to me. As I live in a low cost area (cost of living index at 93) adjusting for San Francisco (173/93 = 1.86 = cost of living index adjustment) means that these numbers would be $149,747 current salary, $186,021 in 2 years and 223,225 in 5 years in San Francisco dollars. I have a condo in a high appreciation area on a 15 year loan (roughly 20% in equity, $23,500), $60,000 in retirement savings (60-70% Roth, I know you hate Roth but the tax advantages are just too good at this young age), $17,500 in after tax savings in ETFs, and $15,000 in emergency fund/everyday living savings. All in, $92,500 assets or $116,500 if counting equity in our home sans appreciation. As a total of our entire income ($110,500) my wife and I save roughly 35%, $38,675 a year. Additionally, our only debt is our house/HOA and her car payment (roughly $1,300 a month between the two, $1,100 being for the condo).

My wife and I are also starting a rental property business. She is currently working to get her real estate license to give us some added advantages while running the business and we plan to buy our first multi-family rental property spring of next year. We hope to grow this business as a passive income stream and replace my wife’s income with it by age 30 (she is also 25 now), allowing her to leave her current job and focus on the business and possibly raising a child if we decide to have one. In this business I would focus on the strategy, business, legal and finance end and my wife would focus on property management and tenant issues. I worry about the MBA getting in the way of this business plan but I also realize that an MBA would give me better skills to manage a business. I also have the opportunity to make a third of the classes I take in my MBA real estate related allowing me to build applicable skills and get a graduate certificate in real estate. (PS. Thoughts on if we should use an LLC or a Qualified Joint Venture with an Umbrella Insurance policy for our business structure/asset protection would be great!)

Finally, we have a three tier strategy for retirement where each tier could support us to the tune of roughly $100,000 a year after taxes adjusted for current day dollars. $300,000 a year total if all three take shape. Tier 1 would occur at age 45 and is based on rental business income. Tier 2 would occur at age 50 and is based on after-tax inheritance income saved. Tier 3 would occur at age 55 and is based on retirement income saved. Our ultimate number one goal is financial freedom.

I apologize for the length of this post but I would greatly appreciate to hear what you have to say. Thank you.

Hi Jon,

Nice to hear from you.

I would absolutely get your MBA part-time if the employer is paying for it. This is exactly what I did, and I loved the experience and will never regret the extra time spent. The professors acted like consultants for my day job, and I met a lot of cool people.

Education is worth it, especially if it is free!

I do personal finance 1X1 consulting if you’re interested in chatting more.

Best,

Sam

Thanks Sam! I appreciate the advice. It aligns with my own thinking even though I still have misgivings about the value proposition and time investment.

I will keep your personal consulting in mind in the future but at this time it is too expensive for me.

See you around the site!

[…] not sure I would have gotten a good job in finance that lasted for 13 consecutive years while getting my MBA concurrently on the side. Both had constantly ass whipping […]

Anticipating a layoff, I took the GMAT in ’97 and scored 720. While that score didn’t get me into Stanford, it did get me decent scholarship offers at a few well-rated state universities. I ended up going to the University of FL (regularly a Top-50 program) for a total tuition of $5000 for the traditional 2-year program. The MBA opened up significantly more opportunities and industries that what I had with just my BS Computer Science; though the financial payoff has not been very good. Due to a couple of blown opportunities and non-optimal career decisions and the “Great Recession,” my salary in 2015 is exactly what it was in 1998 before starting the MBA (well under $100K).

Fortunately, due to fairly low-cost living, consistent investments into CDs and low-cost balanced mutual funds, and a couple of timely real estate foreclosure purchases, I built a $1 million net worth by 50 y/o.

@smartest woman: If you don’t mind me asking, what were your blown opportunities and non-optimal career decisions? I find it hard to believe that with an MBA you can’t find an opportunity paying more than $100k regardless of your career trajectory.

[…] I don’t blame my MBA intern for taking a multiple six-figure job out of business school. She or her parents just forked over $100,000+ in tuition and another $200,000+ in lost wages. Accepting a job that provides the highest ROI is a savvy business move! (Related: Is Business School A Big Waste Of Time And Money?) […]

This post and your recent one makes it seem like getting an MBA is an easy path to $300k+ starting salary. Aren’t you only referring to top MBAs? There are a lot of MBA grads and no way most of them can get a $300k job fairly easily. If there’s a straightforward way with high demand for $300k+ jobs for MBAs, please post some examples!

[…] Update on the MBA eight years later: Is An MBA A Big Waste Of Time And Money? […]

[…] You don’t have to leave your job, lose your main source of income for two years, and get your MBA like I did. You can go to school part-time while working. There’s nothing wrong with […]

Mba cfa work is really all education with key differences.

Other than a More broad education, Mba is valued for its network. When you enter a prestigious one everyone has been vetted or well connected. You pay for the privilege to be associated with the brand school. If you work for any big company this will matter. If you are rich do this.

Cfa accepts anyone with a bs degree that can pass a test and have investment experience. What you pay for is time. Expect to study over 1000 hrs. Assuming ibanking hourly rate, that’s 30k, and only 20 percent will achieve the charter. Assuming you go all the way to 3 spend 1000 hours the discounted value is a 150k. This only matter in the investment field, corp finance don’t count. If you are poor do this.

Work gets you paid but the amount of learning can vary. Where you work, and what you are paid, and your personal preference determine its true value to u. This is up to you. If you are content do this.

Got my MBA last week (not kidding). I went part time as my Tuition Assistance Program at work would not cover the cost of going to school full time. In the end, I was out of pocket only around $2K. I went because I was in a rut. I figured the degree was basically free and I needed a new challenge. Plus, if there is a massive layoff at my company, I wanted to have a leg up on my fellow employees. You were right-on about a lack of hard skills obtained. I did learn a lot, but could have learned the same by someone listing 10 texts to read back to back.

I have a good friend who got his MBA at Berkeley. He took his MBA and started a multi-million dollar manufacturing company. Maybe I should have done that with mine (dreaming).

Hello Sam,

I graduated from a top 10 school in Canada with an Economics degree. Before graduating, I landed a back office role at one of the Canadian banks in a support role for institutional bond trading. After a few lateral promotions (and no salary increases), I decided to write the level 1 CFA exam. As I was still 2 years out from school and didn’t have a clear sight on the direction of my career, I had spent most of my time on my relationship and neglected to put more time into passing the exam. I failed it by 6 points (passing grade was a 70), then failed it again a year later. Mind you, I joined the bank in 2007 and lived through the credit crisis. After failing level 1 the second time around, my confidence was shot and I needed a degree that could propel me out of a support role as the company had been consistently laying off staff every year and was on the cusp of outsourcing jobs to India. I enrolled in a part-time MBA program with a Certified Management Accountant (now CPA) designation. This program, as advertised, took 3.3 years to complete and had high pass rates (almost 99%). I started the program with doubt as society brainwashes us to believe that going to a well-known university is the only way to make it in the corporate world. Anyways, each year of the program, I struggled to land other opportunities outside of the same bank. I didn’t tell my manager about my enrollment either as the relationship between management and employee was an antagonistic one (you could get fired anytime). Every time I went for an interview, I got to the final round was given the no. Because I was living at home, I managed to pay off the dual degree (MBA/CMA) in the latter part of the 2 year of enrollment and was debt free. I was still stuck in the same entry level job for 6 years and felt that it was a complete waste of time. But I get persisting and never let the thoughts of depression settle in. I was desperate to make my degree worthwhile. On the day that I attended my MBA graduation ceremony, I literally got a call from a job I had applied for right after the ceremony as I remember checking my newly purchased Rolex the time they called me. Long story short, at the age of 27, I now work in Buy-side portfolio management managing a $3.5 billion fixed income portfolio and increased my salary by 167% with a defined benefit pension plan because of the dual degree and my 6 years of work experience in back office. Now, my manager, who is close to retirement, has laid solid plans for me and another trader to one day take over the shop as the baby boomer retirement issue is of great concern for this organization. I plan to re-write the CFA for the third time and I feel less pressure as I am in a career that I am truly passionate about and am studying for the sake of studying and not solely for promotional purposes (all paid for by the organization). The payback period for my MBA was less than a year and the increase in my salary was tremendous.

I never gave up and persistent paid off. I use to make less than the average salary of all people in Canada and now I am at the top 10%. I use to eat Burger King for dinner while attending evening classes in the MBA program, now the banks take us out the finest restaurants overlooking the skyline of the city. I wake up every morning excited about the opportunities and possibilities of my future, the things I can afford, and the people I can help. All this was possible because of the MBA program.

Congrats on your progress! Must feel wonderful to go from not passing the CFA to getting your MBA and seeing results.

That’s the other thing… getting into an MBA almost assures you to receive one. A CFA is no guarantee. Therefore, big props to those who’ve been able to get through all 3 levels!

I am a early-mid 30’s investment banker. I will probably make around $400k this year (note this would be my best year ever). I work at a boutique that lets me work from home in a rural area, so I don’t have high cost of living like if I was in NYC or San Francisco ( where I just moved from). Despite all this, I am thinking of going to get an MBA for one of the main reasons I went to undergrad: you don’t go to school to get a job, you go to school to get an education. I really enjoy learning and the academic environment, as well as college life. That being said, I really do not think the cost is justified at a non-top 15 school. This may seem counterintuitive at first, but while I want to go back to school for a mainly intangible reason, I am practical enough that I would only be willing to sacrifice so much financially in pursuit of intangibles if there is at least some tangible value to be had. And I think top tier schools are the only ones that really offer any semblance of financial sense to get an MBA.

I donno man. Sounds like you have a good gig for $400k. Id keep banking that for as long as possible and read books or take community college classes or online classes for eduction.

Are you burnt out?

I did a part-time MBA over 3 years with my employer picking up half of the tab. I tripled my starting salary and landed a job with a bank that paid my previous employer back via signing bonus. This was all done at a top-25 public university. It’s absolutely worth it if the school is decent.

I’ve looked at getting an MBA for a while now but every time I look at the cost my brain tells me it’s not worth it. Maybe if I can get my work to pay for the degree partially and do it part time it might be worth it. Still doing some research myself.

Like same Sam says a PHD and executive MBA is a powerful combination. My best friend got an executive MBA at Wharton, price tag $120k, but his income went from $300k to over $600k as a director of a major hospital.