There are many downsides of paying all cash for a house. But in general, people focus on the positives of paying all cash.

Paying all cash for a house is one of the best ways to beat out your competition and get a better deal. With all cash, you don't have to submit an offer with a financing contingency, which sellers dislike.

As a result, you increase your chances of winning a bidding war at a reasonable price. Further, with all cash, you might be able to get a larger discount.

I paid all cash for a home in 2019 and was able to save about $150,000 off the market purchase price. Being a neighbor, going dual agency, writing a solid love letter, and having a fast close were also important variables.

Although paying all cash makes the home-buying process easier, there are still some downsides to be aware of. Let's discuss!

The Downsides Of Paying All Cash For A House

The older I've gotten and the higher interest rates go, the less motivated I am to take on a mortgage to buy a house.

Getting pre-approved for a mortgage is a cumbersome process that requires a lot of paperwork and a tremendous amount of patience. There is also the mortgage application fee, which could easily run between $2,000 – $10,000. Hence, if I'm able to pay all cash for a house, it is my preference.

However, there are downsides to everything. These are the main ones if you're considering paying all cash for a home.

1) Capital gains tax

Perhaps the biggest downside to paying cash for a house is paying capital gains tax on the assets you sell to raise cash. The longer you own your investments, usually, the greater the gains. The key is to try and sell your investments in a way that matches enough losers with winners to minimize your capital gains tax.

But after a long bull market, paying capital gains taxes on asset sales might be an inevitability. You may eventually be overwhelmed with too many winners.

The only way to avoid capital gains tax is if you can utilize uninvested cash to buy a home. You might even reduce your tax liability because you'll no longer have to pay federal and state income taxes on the income earned by your cash.

But unless you never plan to sell your investments, you will eventually have to pay capital gains tax. It's good to sell stocks on occasion when you've earned enough to buy whatever you want. Otherwise, what's the point of investing in the first place?

2) You might miss out on further gains

The S&P 500's historical annual return is about 10% compared to only a 4.6% historical annual return on real estate. Therefore, chances are high if you sell the S&P 500 index to buy a home with all cash, your transferred capital will underperform over the long run.

The greater the percentage of your net worth is in a home compared to stocks, the slower your net worth may grow. Of course, your net worth could also outperform if you so happen to sell stocks before a crash and home prices outperform stocks, as they did from 2000 – 2006.

But overall, paying all cash for a home by selling stocks will likely cause a slowdown in the pace of your net worth growth. Alternatively, if you are rich enough to pay for a home with idle cash, then you have a better chance of accelerating your net worth by buying a home with all cash.

For example, in 2025, you can earn ~4% in a high-yield savings account. But let's say real estate prices rise in six months by 5.5%—the transfer of your cash to a home might make you richer. This would especially be true if interest rates decline and real estate prices start to accelerate upward. So keep an eye on housing forecasts that realtors, brokerage houses, Redfin, and Zillow predict. Just take them with a grain of salt as nobody knows the future and forecasts change all the time.

3) Paying all cash reduces your potential return on your home

Leverage is great on the way up and damaging on the way down. If you pay all cash for a home and prices go up by 5% in one year, you earn a 5% gross return. However, if you only put down 20%, then your gross return on your cash increases by 25%.

The main way to grow your net worth faster with real estate compared with stocks is with a mortgage. Even though real estate is usually considered less risky than stocks, you can ironically make a lot more. But this is an article about paying all cash for a home.

Perhaps one strategy is to pay all cash for a home, assess the real estate market over the next year or two, and then do a cash-out refinance if you are bullish. This way, you buy yourself more time to make a potentially more optimal cash utilization decision.

Just be aware that when it's time to access your home's equity, some banks may no longer offer Home Equity Lines of Credit (HELOC) or cash-out refinances. Best to double check with your bank now.

4) You lose a tremendous amount of risk-free income and security

You would think paying all cash for your home would provide you a greater amount of security. Once you've got your home fully paid off, life is much easier.

However, here's the irony in a high interest rate environment. If you can pay all cash for a house, it means you also have the ability to earn a hefty amount of risk-free income. This also means you could be forgoing financial security. The higher the risk-free interest income, the greater the opportunity cost.

Let's say you can pay $2 million cash for a house. If you were to just invest the $2 million in a 5%-yielding money market fund, you'd earn $100,000 a year risk-free. The vast majority of us with no major health issues and no debt should be able to happily live off $100,000 a year in gross income. Some might even consider this a Fat FIRE lifestyle in lower-cost areas of the country.

But if you decide to utilize your $2 million cash to buy a home, your $100,000 in risk-free income goes away. Not only that, but with a new home, you will now have to pay additional property taxes, insurance, HOA (where relevant), and ongoing maintenance expenses forever.

Hence, even if you plan to buy a home with all cash, I recommend following my net worth guide for home buying. See the right three columns of the chart below. I'm going to tailor the guideline in the future for cash buyers in a new post.

5) You will still feel anxious despite paying all cash for a home

You'd think paying all cash for a home would give you tremendous peace of mind. After all, with no mortgage, there is no bank out there than can take your home away from you. Even the government will have a tough time kicking you out if you don't pay your property taxes. Meanwhile, a downturn in the real estate market won't wipe away 100% of your equity.

Paying all cash for a home is simply an asset transfer. The transfer can be from your idle cash or from other investments like municipal bonds, stocks, and private real estate investments. That said, you will still feel unsettled about the asset transfer because the cash you inject into a new home becomes unproductive.

You will constantly wonder whether there were better uses for your cash than tying it up in a home you may not need. The only way to quiet these doubts is by creating wonderful experiences in the new home for several years. But that takes time.

Your anxiousness may make you more irritable or stressed. And a sour mood is not good for your family and friends.

Hence, if you are going to pay all cash for a home, you had better have even more cash and liquid securities behind. Feeling house rich cash poor is a disconcerting. Over time, the anxiety should fade as you rebuild your cash or liquid reserves.

6) You have to figure out what to do with your old home

If you're currently renting and pay all cash for a new home, then you have no worries. Give your landlord a 30-day notice or longer that you're moving out and you're good to go. Just make sure your new home is actually ready to move in once your lease is over.

But if you own your existing home and buy a new home with all cash, then you've got to figure out what to do with your existing home. Will you hire a real estate agent to sell it? Or will you try to find renters and build your passive income portfolio for financial freedom?

Personally, I like buying a property every 3-10 years and then renting it out when it's time to buy another primary residence. Do this over thirty years and you'll be able to fund your retirement with rental properties no problem.

I plan on renting out my old home to generate more tax-efficient passive income. Ideally, I'd like to keep our old home in the portfolio until our kids are adults. I raised them for three years in the home during the pandemic and it is a special home.

7) You may skip getting home insurance

One of the “benefits” of paying all cash for a home is that you don't need to get home insurance. You may still want insurance, but it's not required when you're fully funding the purchase up front. Also, lenders don't require borrowers to get a more expensive replacement cost value home insurance policy. You can get a cheaper actual cost value home insurance policy or have zero home insurance policy.

Chances are high you will save money by getting cheaper home insurance or no home insurance during your duration of homeownership. However, in the case of a terrible fire or natural disaster that destroys your entire home, you will lose a lot of money if you don't have home insurance.

Hence, please carefully weigh the risks and rewards of not getting the best home insurance policy possible. f you plan to save on home insurance, then make sure you have tremendous cash flow and extra liquidity.

Feeling Nervous About Buying A Home With All Cash

I'm considering buying another home with all cash. But now that I'm in contract with contingencies, I'm second-guessing my decision, as I always do.

Maybe I didn't need to sell as many assets and pay all cash in the first place. Given how long the escrow period has been, taking out a mortgage would have been just fine. But that's kind of like saying maybe I didn't need to have good grades and test scores after I got accepted to a great college!

The psychology that goes into paying cash for a house is quite deep, especially if you are a hybrid cash buyer. A hybrid cash buyer is one who has to sell other assets to raise cash versus the true cash buyer who just has tons of cash lying around since they are so rich.

When it comes to making a massive purchase like a house, even if you have a lot of cash, the decision can be difficult. The psychology of paying cash for a house can be very difficult to reconcile. Just know that you're in a much better financial situation than most homebuyers.

Easier To Pay All Cash In A Bull Market

There's a comfort in seeing other people buy homes during a bull market. It means that other people want what you want and are helping justify your decision, even if it may be the wrong one. But during a bear market, you feel like a lonely fish out of water, wondering whether the tide will ever return.

Can people simply not afford to pay all cash or take out a mortgage at these rates? Or are people waiting because they expect real estate prices to crash? It's a disconcerting feeling not knowing what's keeping people from taking advantage of deals.

One positive sign is that the percentage of homebuyers paying all cash continues to increase. So I'm not alone and neither are you if you're considering.

Why I Offered All Cash

I wanted to make my offer enticing enough for the seller to accept. I was offering to pay 14% below last year's asking price and 7.5% below this year's new asking price. By offering to pay all cash, I hoped to make my offer attractive enough for him to consider. Insulting a seller with a low-ball offer is not the way to win deals.

Initially, the seller declined my offer via his listing agent. But then a month went by and the listing agent contacted me again to say the seller would be moving in. This was my last chance to make a competitive offer!

I didn't feel much real estate FOMO given I was happy with our existing home, so I just stood firm on my offer price. But I also decided to spend 35 minutes writing a real estate love letter, explaining why my family would be a great choice.

The seller wrote back a letter of his own saying how much he appreciated my letter. I had touched upon everything from how much I valued his remodeling, to the importance of family, to our mutual love of tennis, and our similar culture. Maybe writing 2,500+ articles on Financial Samurai since 2009 has some benefits after all!

The Final Strategy

Once I was able to make a connection with the seller, then I was able to convince the listing agent to reduce her overall commissions by 2.5% in lieu of her also representing me through dual agency. She initially refused because she didn't want to earn less. But I explained to her she wouldn't be earning less because she would have had to have paid the 2.5% commission to a buyer's broker anyway.

I was thus able to convince her to give me at least a 2.5% price discount and just represent me. It was that, or no transaction at all. Finally, she was able to convince the seller to go forward.

Raising The Stakes By Buying Something I Don't Need

As I mentioned to my wife in a previous podcast episode (Apple), “Nobody needs nothing.” We don't need anything more than a studio apartment, water, and cereal to survive. As a result, I often question the point of buying anything we don't really need. We are frugal folks.

Paying all cash for a new home raises the financial stakes because it reduces our passive retirement income. As a result, I will feel more pressure to make more money and grow our net worth further.

The first two years of ownership will keep me in a heightened state of anxiety because our finances will be most at risk. The anxiety won't be debilitating to the point where I won't be able to sleep or function. It'll just be higher than I'm used to since leaving work in 2012. I hope I'll be able to adapt.

Maybe I will use this anxiety as motivation to write more books and/or find a well-paying job. When my son was born, my motivation to earn shot through the roof! Further, I plan on giving up on early retirement anyway once both kids go to school full-time. So the stars seem to align.

In conclusion, be aware of the downsides of paying all cash for a home. Use your all-cash offer to get a lower price and then quickly replenish your cash reserves after you close. If you do, you'll feel much better about your purchase.

Real Estate Suggestion

Don't have all cash to buy a house? No worries. You can invest in private real estate with Fundrise with as little as $10. Fundrise funds primarily invest in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher.

Personally, I've invested over seven figures in private real estate deals since 2016 to diversify away from my expensive San Francisco real estate holdings and earn more passive income.

Fundrise is a long-time sponsor of Financial Samurai and Financial Samurai is a six-figure investor in Fundrise funds.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

“Leverage is great on the way up and damaging on the way down. If you pay all cash for a home and prices go up by 5% in one year, you earn a 5% gross return. However, if you only put down 20%, then your gross return on your cash increases by 25%.”

i have no idea what this is saying. can you be more simple for me please?

Sure. Let’s say you buy a $1 million house with $200K down and a $800K mortgage. If it appreciates by 20% to $1.2 million, you’ve now got $400K in equity. Your $200K down is now up 100%+, despite the house only being up 20%. That’s leverage.

Hey Sam!

Been following your blog for quite a while, and this post really helped me think about a situation I’m trying to figure out.

Wife and I own a home in the SF Sunset worth 2.5m (fully paid off)—no plans on selling that one—and about $7m in index funds plus 500k in cash. We bought another house in Seattle last year after relocating, 1.75m purchase price with a 20% down 30-year fixed loan. Well, the value of that one promptly dropped to 1.55m, thanks to the rising interest rates. Not great but can’t time everything perfectly.

Unfortunately, we need to move back to SF and are kinda stuck on what to do with the Seattle house. Selling would essentially wipe out our down payment. Renting the house could be an option and it would rent for about $4.5-5k/month, but that would create a negative cash flow of -$3-4k/month considering our large mortgage, taxes, vacancy, maintenance, etc. Flip-side, I think this home has good long term growth potential.

I’m toying with the idea of using our 500k in cash to recast the mortgage to reduce our burn or to just pay off the house outright. But your post got me thinking twice, especially about going against leverage if the market starts recovering.

Curious what you’d do in this situation? Our lifestyle is pretty simple and the dividends from our index funds already cover our fixed costs so the negative cash flow isn’t a big burden on paper. But mentally, it’s hard to feel ok about it. Would love to get your thoughts on whether to sell the Seattle house, rent and deal with the negative cash flow, or use our cash to tweak our mortgage situation.

There are some missing variables, such as whether your San Francisco house is being rented out, whether you can just stay in Seattle, and your work goals.

Losing $200,000-$250,000 stinks, but with $7 million in index funds, that’s only 3%.

I’m a buyer of real estate now, not a seller. What is it that you do and how old are you?

Ah, yes, the devil’s in the details. We’re in our early 40s with our first kid on the way. We’re both engineers and recently “retired,” but we plan to focus on our own endeavors and take on consulting roles when opportunities arise. Our SF home is currently vacant. With a child on the way, there’s a strong pull to move back to be near our core group of friends and family again, something we didn’t anticipate, and it’s throwing a wrench into our plans. We could rent out our SF house, but that would prevent us from returning.

I completely agree with you. I’ve run my own mental exercise and would be a buyer of our Seattle home at the current prices and not a seller. We bought our first SF home in 2012, and it felt risky at the time, but in hindsight, it turned out well. So don’t want to be too reactionary to the current conditions. Your post has me reflecting on whether I’m limiting myself in my pursuit to minimize negative cash flow drag. Or, given our circumstances, do you think a bit more caution is actually warranted?

Forgot to mention. Have a 4.15% rate on the home.

Hi Sam, thanks for all your wise and insightful information, they are always very helpful.

I am considering doing a full cash purchase of a home. The home is worth ~45% of our household’s total net worth. 90% of the money is idle cash and we will cover the remaining 10% by selling some stocks (or should we get a mortgage instead?)

Our question for you – at such a high current interest rate, are there any advantages of getting a home loan, if someone can pull off buying a home with cash?

I wouldn’t get a mortgage for just 10% of the house mainly due to the cost to get a mortgage and the pain it is to get one.

Doing an all cash offer for this new homes with mello roos in orange county. ~895k for the house.

1,285,000 in liquid assets not including 401ks.

Will be left with 366,000 to put into ~5% savings account.

Property tax with mello roos is $20,653 == 1417 bucks a month.

Putting 70 percent of my liquid assets into the house. But will be more like 50% with 401k.

Predicting housing will slowly fall to a bottom the next 5 years, then go back to where it is now in another 5 years.

I am 46 years old, I don’t have time to wait 5 years? Making the decision based on age, otherwise I would wait a few months. But this is Orange County, prices might just stay flat or go up.

I meet the 30/30/3 rule I think but 70% of liquid into housing seems too much, using 401k to convince myself it is okay. Please chime in and see what I am doing is legit.

Is your net worth around $1.8 million? The ideal percentage of net worth in a primary residence is 30% in my opinion. But given your pay in cash, it’s not bad if you plan to continue to earn and build your net worth. Do you?

What is the reason why you cannot wait for several years? I have the same issue.

You have to be careful in toronto paying all cash for a house because of our criminals. Do a fast search and see all the people who lost their life savings buying a house slightly under priced by 10% that was never own by the seller to begin with. Wire hundreds of thousands of dollars and never get real ownership of the house. Money transferred into the criminal sellers’ bank account and withdrawn never to be seen or heard again. Its called selling a house you do not own in toronto.

Yes, be careful of wire fraud! Always call and confirm first before sending anything.

Hi, Sam: This is one of the best advice I wished I’ve got in 2009 – when I bought my home with all cash and happily boasted to an very old and wise real-estate investor in the bay area, who immediately chided me for the same reasons you mentioned above! Turned out he was absolutely right – even though the home I bought was a bargain at the bottom of market, my home price went up by 3x since then but the stocks I sold in 2009 to buy my home went up by 10x! Even though there’s a peace of mind that came with a home free and clear of mortgages, I’m not sure it’s worth the 10x I’ve left on the table. I’d say a more prudent and better thing to do would’ve been: 1) pay as little down payment as possible (20-30%), 2) as an unemployment buffer, keep 2 years of living expense (including mortgage payments) as cash, 3) keep the rest still in stocks (or S&P 500).

In the long run, stock market always outperforms real-estate market (except real-estate market you can leverage). Maybe that’s why Charlie Munger started with real-estate but later just focusing on stocks.

I hear yah. But hopefully you built up your stock portfolio and benefitted too?

I’m considering paying all cash for a house now and am debating. https://www.financialsamurai.com/the-downsides-of-paying-all-cash-for-a-house/

My family purchased our home with an all cash offer in February 2022. Our market was very hot and we had been waiting about 2 years for the right property in a specific neighborhood. We saw the home on a Saturday morning and were under contract that evening, beating out a dozen other offers. The sellers made clear the all cash piece was a differentiator. At the time, we were about 7 years into a 30-year fixed on our first home (4.25%). I used a HELOC on our equity to make up the gap in our cash on hand. Our old home was sold about 6 weeks after we had the accepted offer on the new home and we only had to pay one month of HELOC interest. We saw about a 35% increase on our first home from what we paid, which was a pleasant surprise. Only had one weekend for showings and fielded a dozen or so offers.

We decided to pay all cash for a few reasons, but mostly for security. The reason we were in a position to deploy that cash was due to an inheritance from my late father. We have been very intentional with how we have used that money, specifically by only using it in ways that will make our family more secure and fulfilled, i.e. 529s for our kids and our family home. Sometimes I have thoughts of “what if” when looking at the market. I had those thoughts more often when we were sitting on the cash in 2021 waiting for the right property. Since we purchased the home, having no mortgage has provided a great amount of security and calmness over family finances. The biggest anxiety I’ve felt is lifestyle creep when freeing up the mortgage cashflow. Despite being a finance professional, I’ve found that once you’ve reached a certain level of income and are entrenched in your social circle, lifestyle creep can really start to infiltrate your planning.

Also knowing that we plan to be in our home for many years, I’m less concerned with checking the value periodically. Of course I’m interested when nearby homes go up for sale but just as a general market and temperature check of our neighborhood’s trending. Really all we NEED to worry about is making enough for basic living expenses and the taxes. That is a very liberating feeling when you’ve seen others get themselves in trouble and put their homes at risk. By and large, the FS readership is in the upper tier of financial responsibility and more focused on maximization of their assets, rather than devising strategies to ensure food and shelter aren’t compromised. Thanks as always for the thoughtful reading and dialogue.

Hi MGB,

Thanks for your feedback!

“The biggest anxiety I’ve felt is lifestyle creep when freeing up the mortgage cashflow. Despite being a finance professional, I’ve found that once you’ve reached a certain level of income and are entrenched in your social circle, lifestyle creep can really start to infiltrate your planning.”

That is interesting.. the potential lifestyle creep given you have more free cash flow. Do you not feel it’s easier to actually NOT spend money given the money you used to pay for your house could be earning a high risk-free interest rate?

I think about this opportunity cost, which is why the last thing I will do is spend more of my free cash flow. Instead, I will use 100% of my free cash flow to try and build up my cash hoard and investments back to the way it was.

Thanks!

Hi Sam,

For me it’s about diligence and sticking to a plan to reach goals. The free cash flow can be enticing to touch, just like cash flow increases from promotions/raises. I find the best “cure” for that is seeing the benefits of deploying any free cash flow into appreciating assets of your choosing. When an executed plan starts to show momentum, it’s much more of a dopamine hit than spending on services or general consumerism. My point with the lifestyle creep is that there are always things ready to replace previous obligations. If someone is thinking of paying all cash for real estate, it’s prudent to have a concrete plan for that freed CF.

Sam, I always appreciate your insight and this article was no exception.

I have always thought of home ownership as largely an expense. Sweat equity can increase value, a good deal could move you forward, fortunate market rises can kick you ahead, but generally a mortgage is a large required cost associated with a slow gain in equity.

Having just retired and joining the contracting ranks of the pensioner community, I find the thought of a paid off residence very comforting. At the same time,I am perfectly happy carrying a mortgage on rental property. If needed, I can hunker down for a month or two if unexpected expenses pop up without risking anything on the home front.

Paid cash 18 months ago, leaving cali for TN. Zero anxiety whatsoever after riding the CA housing roller coaster from 2004 to the present. Don’t care too much about valuations any more – I’m looking at the property differently, it’s a home and not a financial instrument.

Perhaps it’s partly because the house you paid cash for is much cheaper?

How did you decide to leave since living in CA since 2004?

Family and career reasons…. Wrapping up a 20+ year military career and relocating closer to family. The military pension is substantially more impactful if you live in a lower cost of living state with no state income tax. We’re highly flexible after years of moves and deployments. Staying in cali = more work not on my terms, moving = close to family, FIRE, and the chance to start some side hustles and have some fun in the process. Cali will always be there to visit, not a fan of the politics either.

Cool, enjoy! How does the lifestyle compare so far?

One thing I didn’t realize, but seems like it should have been obvious to me now, is that you can only get a home equity loan or HELOC on a property you bought for cash and you can’t get a first mortgage, which has lower rates. I was looking into buying land, and was thinking I could take out a mortgage to pay cash for the land and get some interest rate deductions on top of it. But nope. Also it seems like banks don’t like to make lot loans to people who are just buying land and not buying a house from a builder. It would be great if you had some tips about buying land for cash. There seems to be a lot of scams, ie, people selling land that they don’t own. I would have thought a title search would solve that problem but it seems that it’s not as straightforward as that.

I just did this land drill a few months ago, looking to buy some land adjacent to a property we already own so it wouldn’t be over developed…. Long story short is that we shelved the project – way too many variables that I didn’t have time to research. There are a lot of rabbit holes that you can and should go down, and most of these rabbit holes can only be researched locally – ie boots on the ground and talking to local authorities. Development/infrastructure is huge – if buying raw land what is the plan for water, sewer, power, roads etc? That’s months of research right there. Soil samples, perk tests, drainage, burial grounds, protected species (this is big in CA)…. Deed claims….You get the point. Totally worth it if you have the time and money. In my opinion this process is the antidote to the crap homes that big builders are throwing up. Probably costs the same or a little more in the end but you have a home that you understand every inch of, im not discouraged, will just reattack when I have more time – good luck!!!!

This was a really interesting read because I find myself in a relevant situation. I haven’t worked in the last 5 years (prior to that I worked for 10 years in corporate healthcare). During that time I’ve taken my money and invested just about every dollar. ~80% in the market, ~10% in Fundrise (thanks to you) and another ~10% in miscellaneous one-off investments. By doing this I’ve been able to not work, live a great life, travel, do all the things I love, and still 5 years later have almost the same level of net worth.

But now my girlfriend and I are looking to buy a house. Since I haven’t worked and won’t be able to show any income, I won’t be able to get a mortgage. So I’ve been thinking about liquidating my Fundrise and individual stocks to pay cash (I’ve slowly started this process). But since starting to do this, and since reading your post, I’m re-thinking that plan.

Once we get settled in a new location (we’ve been nomadic since moving out of Los Angeles in December 2022) my plan is to start working. So now I’m thinking that if I rent for a year and get back to generating income, at the end of the year I can take out a mortgage, and leave my money invested.

The only downside to that plan is I’m unsure where the market and housing market will go over that time (who ever does know?). If the indications are correct and the market is about to drop, then maybe it makes sense to pull out some cash and diversify a little more by buying a house. One of the things though that I’m most hesitant about is how illiquid a house is. Right now I enjoy the freedom of pulling money out of the market whenever I need it.

Tough to tell what the right move will be, but your post was helpful and right on time for the process I’m going through.

P.S. – I also loved your recent episode with Chad Carson.

Cheers,

JA

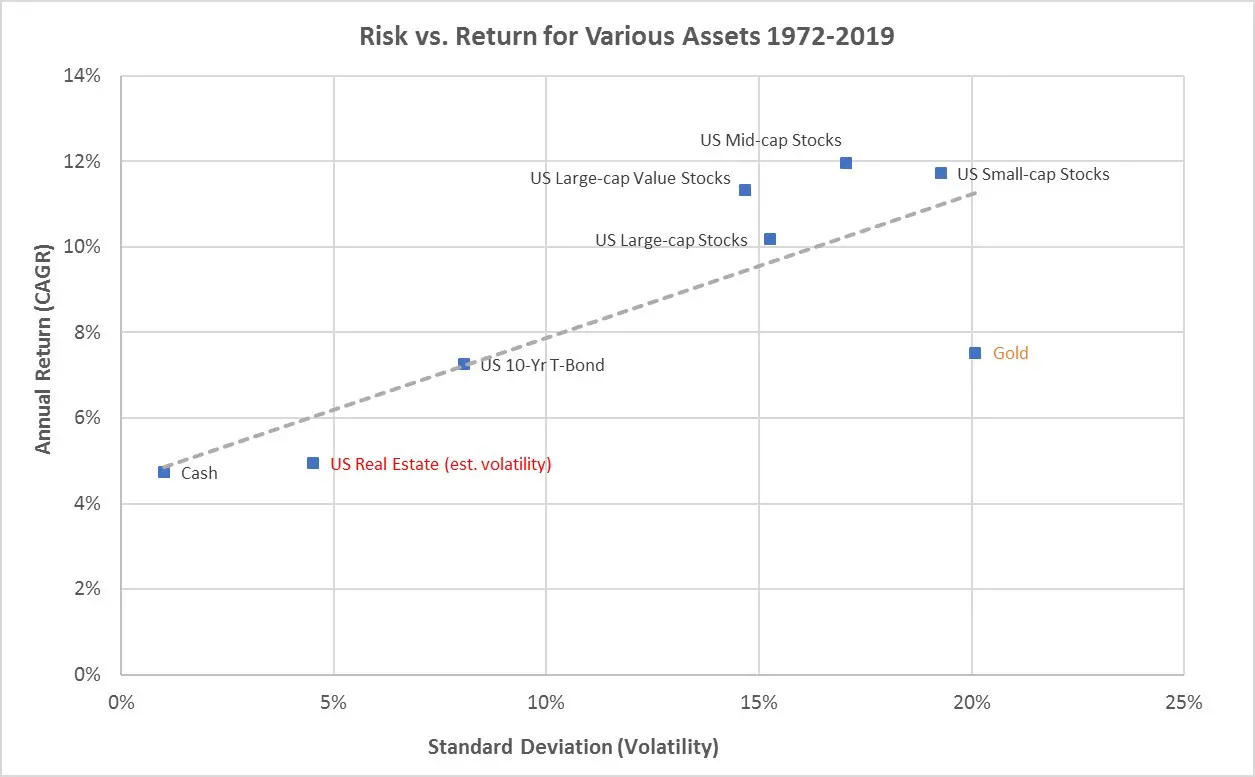

re: Risk vs Return for Various Assets, 1972 – 2019

I was surprised to see gold was MORE volatile with LESS of a return than ALL four categories of US stocks. Especially when gold is so heavily marketed to be a “safe haven” from stock market volatility. Maybe that’s why I’ve never heeded my older brother’s advice to buy gold???

Nice analysis. How would considerations change if you are considering buying a rental property as opposed to a primary residence?

Have to compare your rental yield to the risk-free rate of return doing nothing. Then you’ve got to really crunch the income and expense numbers.

The rental is an income producing asset and a money making move. Buying a primary residence with all cash is more a lifestyle move.

I haven’t been in a situation where I could pay all cash for a home yet. I could probably pay cash if I were to move in 5 to 10 years, timed the sale of my current place, and wasn’t significantly changing price points. Feeling a heightened sense of anxiety after paying cash makes a lot of sense to me. Even though I haven’t been in that specific situation, I can visualize what that could be like pretty clearly. Buying a home is a huge cost and commitment!

Nice work Sam! Standing firm on your purchase price while at the same time discounting the purchase price at the cost of your dual agent’s second commission! Hopefully we can all get agent discounts moving forward in various fashions!

Thanks. As an economics major, I just feel bad when there is such a huge spread. It is inefficient.

You can always get a mortgage later if really want to.

Exactly. Bought house with all cash offer but in fact closed with a mortgage, seller only cares I did not have a financing contingency.

I decided to get a mortgage because I wanted to be short interest rates at the time and there was no better instrument to a retail investor other than a mortgage (unless u can figure out how to enter into an ISDA lol)

That was in 2021. Happy with decision. I would prob do an ARM if I was buying today and had to have a mortgage.

I paid “all cash” (sort of – I’ll explain) for my rental property, and I think it gave me a huge advantage over the other potential buyers who were planning on taking out financing. The seller wanted a quick close of escrow, and by not having a financing contingency and not having to wait for the bank to be ready to close, he knew it was more likely to close and that we could get it done in about 2-3 weeks instead of 30+ days.

My situation was a little unusual, in that my family owned a bigger rental property (“Big Property”) that we were selling. We had a second mortgage on Big Property (about $600k) that represented money borrowed from a different family business, which it had borrowed from a bank. (Confusing, I know. Bank loaned to Company 1, Company 1 loaned that same money to Big Property.) Long story short, if we repaid that second mortgage early, we would have had a pretty sizeable prepayment penalty.

I knew I wanted to buy a replacement investment, so I talked to the leader of Company 1 and asked if the $600k loan could be transferred to me instead of paid off. That saved Big Property the cost of the prepayment penalty, and didn’t cost Company 1 anything. I qualified for the loan, so Company 1 said yes. I assumed personal liability for that loan, and when Big Property sold, that $600k loan payoff was paid to me in cash instead of really paying off that loan. I then had enough cash to buy my property, and I was pre-obligated on that $600k loan to Company 1.

Advantage for me: I could put in “all cash” offers, because the money really was in my bank account, AND I got the benefit of having a leveraged investment. The only scary part was being pre-obligated for a loan, because I was responsible for interest from day 1 of the loan assumption, and if the transaction didn’t close, I’d have to pay interest on $600k until I was able to close on a new investment.

You could duplicate this result by not selling your other assets to pay all cash, but borrowing against them and using that to pay all cash for a new property. You avoid capital gains tax because you’re not selling an asset, and you still get the benefit of leverage, it’s just spread across two (or more) properties. You would still have to pay interest on the amount borrowed at today’s rates, but if you have enough equity in your existing property, qualifying for the loan should be doable and with an all cash offer you could be more aggressive in negotiating, like you did with your recent purchase. Then when rates drop again eventually, you can refi for a lower rate.

Glad things worked out! Can you talk more about assuming the mortgage? That seems like a no brainer given how everybody refinanced in 2020-2022. If more buyers could assume the sellers’ mortgages, there would be more transactions.

How rigorous was the lender’s review process of your finances? Was it just like applying for a new mortgage or refinance?

“Let’s say you can pay $2 million cash for a house. If you were to just invest the $2 million in a 5%-yielding money market fund, you’d earn $100,000 a year risk-free. The vast majority of us with no major health issues and no debt should be able to happily live off $100,000 a year in gross income. Some might even consider this a Fat FIRE lifestyle in lower-cost areas of the country.

But if you decide to utilize your $2 million cash to buy a home, your $100,000 in risk-free income goes away. Not only that, but with a new home, you will now have to pay additional property taxes, insurance, HOA (where relevant), and ongoing maintenance expenses forever.

Hence, even if you plan to buy a home with all cash, I recommend following my net worth guide for home buying. See the right three columns of the chart below. I’m going to tailor the guideline in the future for cash buyers in a new post.”

While I somewhat agree with this sentiment, I think you’re ignoring the fact that if you don’t use the $2M of cash to pay for the home, then you will be taking out at least a $2M mortgage. At a 6.5% rate, a $2M mortgage is going to cost about $15K per month or $180K per year (including taxes & insurance), while would quickly eat up the $100K of annual risk-free income.

Yes, that’s right. I just don’t have taking out a mortgage with today’s rates as an option in my opportunity cost calculation. I refuse, and would rather turn some funny money that has rebounded into a house.

Our current house was purchased with all cash from the sale of highly appreciated stock. Yes, the capital gains were eye-watering. Also, new taxes popped out of nowhere, such as California’s 1% Mental Health Tax, it was news to me. I am also paying taxes on my taxes since I sold stock the following January to pay Q4 estimated taxes.

On the plus side, we have cash from the sale of our previous home earning ~5% interest and I get to slowly ease into bond purchases.

Glad you turned some funny money into something you get to enjoy!

I just bought an apartment all “Cash” in Mexico City, as the system there would not allow me to take out a mortgage. I put about 35% cash into it, and took the rest out in personal loans. (Gah, high interest rates, but I’ll have the house paid off in 5-6 years). I was renting in Mexico City, and rents were going through the roof all over in that town due to Gringo gentrification. Like literally doubling once leases are being renewed. Also, the peso has really strong this year (in Dec 1 USD = 20 pesos, now it’s like 1USD = 16.5 or 17 pesos). So having a loan in dollars, while I’m still earning in dollars was a good option, as well. As due to USD depreciation, each month my rent was rising!

Overall, I’m happy with the option to put a lot of cash into my property. Like you said, Sam. If you were renting before, and now you are earning, paying all cash (or any mix of loans, I’d say), is much better. You will have less regret. I have properties in DC, but I’m not living in those anymore, so was essentially a renter in Mexico until now. I love owning my property there, and am currently renovating it to be apartment I love, and I do think that I’m gaining sweat equity, which gives me more confidence.

I’ve always wanted to visit Mexico City, but haven’t. I heard it’s a great place with a lot of great food and wonderful attractions. Maybe I’ll hit you up if I go!