As a homeowner and real estate investor, I want home prices and rents to rise. Real estate is an integral part of my Fat FIRE strategy of perpetually generating six figures in passive income. So when I saw Zillow's latest bullish housing price forecasts, I was thrilled!

Zillow believes national home prices will increase by 6.5% through July 2024, which seems overly aggressive in this high interest rate environment. The reasons include lower mortgage rates, below-average supply, and an economic soft landing.

If you have a 20% downpayment or 20% equity, a 6.5% price increase is like making a 32.5% gross return on your cash or home equity. That's a pretty hefty return.

Zillow Is Probably Wrong About Its Forecasts

After feeling good for a moment about my real estate portfolio increasing in value next year, reality set in. In the past, Zillow has been wrong consistently when it comes to forecasting housing prices. I don't think this time is any different.

Since the publication of this post, Zillow has already changed its 2024 housing price forecast a couple of times. Now it’s predicting that U.S. home prices will rise this year, with an increase of 3.5% between December 2023 and December 2024. If that prediction comes to fruition, it would mean that national home prices in 2024 would see almost identical home price growth as in 2023, which was 3.2%.

For 2025, Zillow expects home-price growth of 2.6% in 2025, which is largely in line with growth from this year.

Zillow Housing Price Forecasts By Region And State

See the map below showing Zillow's home price forecasts by region. Notice how Zillow believes home prices will rise by 2% to 10% in every state except for three regions in Louisiana.

As you may recall in a May 2, 2023 post, A Window Of Opportunity To Buy Real Estate Emerges, I also believed there was upside potential to real estate prices.

So maybe three months later, Zillow and other institutions are coming around to my point of view? I just think 6.5% is too aggressive by at least two percentage points.

Why Zillow's Housing Price Forecasts Are Likely Wrong

Here are five reasons why I Zillow's home price forecast is likely wrong.

1) Affordability is at or near an all-time low

With housing affordability at near an all-time low due to high mortgage rates and high home prices, an aggressive home price appreciation forecast of 6.5% makes no sense.

Below is a chart that highlights the US median housing payment as a percentage of median income. At ~43.2% today, the percentage is higher than it was right before home prices started declining in 2H2006.

Here's another chart highlighting the Bloomberg Housing Affordability Index for first-time buyers. Based on the below chart, the index is at an all-time low.

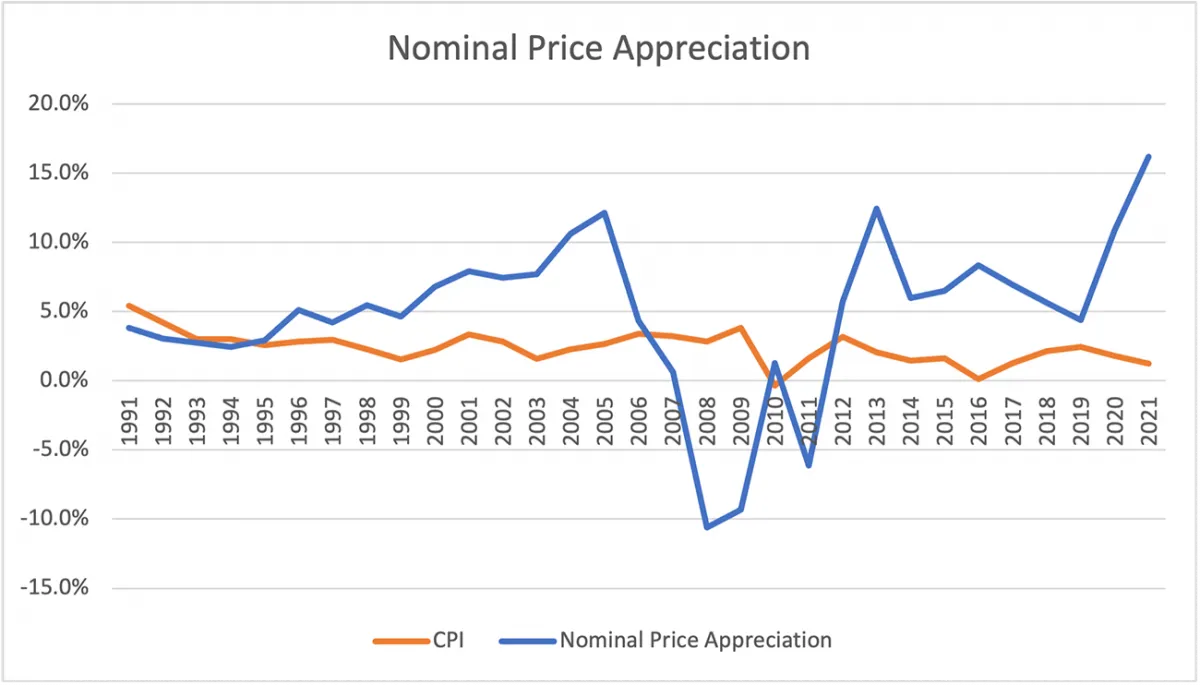

2) Historical home price appreciation is closer to 4.6% per year

Since 1992, the historical annual home price appreciation has been closer to 4.6%, about 2.6% above the Fed's target inflation rate of 2%.

If inflation rebounds to around 4%, then Zillow's 6.5% home price appreciation forecast could come true. But over the next 12 months, CPI will likely stay below 4%.

The lag effect from the Fed rate hikes should continue to slow the economy. Therefore, it doesn't make sense for Zillow to forecast 6.5% home price appreciation, a rate 43% higher than the historical average.

Looking at this historical nominal home price appreciation chart, a 6.5% home price appreciation through 2024 is certainly possible. However, it's more likely that nominal price appreciation undershoots after overshooting far beyond the historical 4.6% nominal price appreciation rate.

3) Zillow is too biased to have accurate forecasts

Zillow makes more money when housing prices go up and when there are more real estate transactions. The stronger the housing market, the more real estate agents want to advertise their services on Zillow.

When the housing market is weak, home sales volume dries up, leading to a decline in advertising revenue from real estate agents and property management companies.

Therefore, Zillow is incentivized to have a more bullish bias on housing than average. Their entire business model depends on a strong and rising housing market. In fact, Zillow recently launched a 1% down program for qualified buyers.

Given Zillow's bias towards a strong housing market, we must discount Zillow's bullish views. We know bias exists everywhere in society – from first-generation college admissions officers accepting more first-generation applicants to 95% of Black voters voting for Obama in 2008.

We can't help but show preference for things and people that are most similar to ourselves or help us the most.

4) Revisionist history

Years ago, I wrote you can't trust Zillow's estimates because I had noticed large inconsistencies. Zillow would have one estimate on a home, then completely change its historical estimates after the home was sold. By doing so, Zillow removed evidence of how wrong its estimates originally were.

As a result, I mainly use Zillow (and Redfin) to determine trends in my local real estate market. Both platforms are good resources to track sold homes, which you can then use to formulate your own price estimates.

In fact, I have a whole guide on how to use bad pricing estimates by Zillow and Redfin to get better deals. Buyers and sellers can cherry-pick favorable data given the plethora of inconsistent data to get a cheaper purchase price or greater selling price.

5) Zillow doesn't even trust itself

Finally, when Zillow launched its iBuying business in December 2019, I was eager to see how it would do. If Zillow's housing estimates were accurate, then Zillow would be able to buy properties at an attractive prices and later sell these properties for healthy profits.

However, Zillow's iBuying business was a complete dud. In 2022, Zillow took a $540 million write-off (loss) and laid off over 2,000 staff because it shut down its iBuying business.

In other words, even Zillow couldn't trust its own estimates! Most buyers who buy at the wrong price don't just hand over the keys and file for bankruptcy. Instead, most of these homeowners gut it out by refinancing, renting out rooms, or figuring out ways to make more money.

But not Zillow. As a public company, Zillow's main goal is to grow profits to hopefully boost its share price for its shareholders. As a result, Zillow is more focused on short-term quarterly results.

6) The San Francisco Bay Area Is Booming

Perhaps the most obvious reason why Zillow's housing price forecast is wrong is due to its negative growth prediction for San Francisco Bay Area real estate. After a record 2024, with big tech stocks like Apple, Meta, and Netflix reaching all-time highs and far surpassing the S&P 500, hundreds of thousands of homebuyers are far wealthier.

In addition, the artificial intelligence boom is in full swing, with firms like OpenAI and Anthropic seeing their enormous valuations triple or more in a year. AI is going to be a 10-year-plus phenomenon, creating massive fortunes in the process. I expect San Francisco Bay Area real estate to keep going up as a result.

I'm particularly positive on real estate in the west side of San Francisco. The area is experience so many strong local economic catalysts that should drive single-family home prices higher.

The Direction Of Home Prices In America

Going through this exercise actually makes me less bullish on home price appreciation over the next year. Instead of a more reasonable 2% home price appreciation, why couldn't national median home prices actually decline by 5%, especially if there's another recession?

The S&P CoreLogic Case-Shiller National Home Price Index shows national prices are flat in 2023 vs. last year. Although home price appreciation is ticking up in 2023, it could just as easily tick back down again in 2024 too.

The rate-lock effect is discouraging homeowners from selling their homes, which keeps supply low and supports prices. The main question is whether supply or demand will increase at a greater rate if mortgage rates decline over the next 12 months.

The worry for potential homebuyers sitting on the sidelines is that pent-up demand is building each month that home sale volume hovers at record lows. If mortgage rates decline, then bidding wars will likely resume, quickly pushing prices back up.

The worry for potential home sellers is that once mortgage rates decline, too many homeowners will start listing their homes and cause an oversupply situation. Builders might ramp up construction as well, creating even more incremental supply and declining prices.

My Previous Bad Luck Will Throttle Home Prices

Perhaps the final reason why I think Zillow's home price forecast is too high is because I'm currently trying to buy a home with contingencies. Although I'd like to think I understand real estate well given I've invested in multiple properties since 2003, I've also gotten burned before.

In 2007, I decided to buy a vacation property in Lake Tahoe for about 12% off its original sales price in 2006. I thought I was getting a great deal. Of course, the global financial crisis hit, causing the condo I bought to depreciate by another 50% at its low point!

I don't think the home I want to buy will depreciate by a similar magnitude since it is a single-family home in a prime location as opposed to a condotel. But this single-family home could easily depreciate by another 5% – 10% if the economy tanks again.

Given my history of bad luck, I highly doubt I'll bottom-tick this beautiful home and then see it appreciate by 6.5% a year later. Real estate down cycles often take years to play out. Instead, I'm mentally and financially prepared for my target home's value to continue depreciating by another two-to-three years.

So Why Buy A Home Now?

I'm trying to buy now because I've identified the nicest home I can afford. I've got 12-15 years before my kids leave home, so I figure why not go for the upgrade when prices are down. I’ve convinced my wife to move and the kids love the home as well.

There is a lull in demand due to high interest rates. Meanwhile, the higher the price point you go, the better deals you can usually get. I don't want to get into a potential bidding war if mortgage rates decline in the future.

I'd love for Zillow to be right about its housing price forecast. I did some housing price analysis and it sure seems like bidding wars are back in 2024. But based on its track record, I think Zillow will be wrong like Donkey Kong again.

Real Estate Investment Suggestion

If you want to dollar-cost average into a strengthening real estate market, check out Fundrise. You can invest in a Fundrise fund with as little as $10. Fundrise primarily invests in residential and industrial properties in the Sunbelt, where valuations are lower and yields are higher. The real estate investor manages over $3.2 billion in assets for over 350,000 investors.

Financial Samurai is a six-figure investor in Fundrise funds and Fundrise is a long-time sponsor of Financial Samurai.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

My wife and I are struggling with trying to look into the housing/rental crystal ball right now. We bought a duplex in a desirable MCOL area outside Minneapolis ten years ago and lived in half because that was the only way we could afford to move there. Fast forward ten years and it now cash flows enough to pay 75% of the mortgage on the primary home we live in. We bought it for $162k on a 3% mortgage and recent comps have been selling for nearly $400k. We had a big hailstorm come through last year and now have an entirely new roof and exterior paint.

We are very, very tempted to call the top of the market and walk away with $200k which would be lifechanging money on our family’s minimalist budget. All while de-risking ourselves from vacancies, bad tenants, etc (none of which we have had yet in ten years). But the strong, consistent cash flow, depreciation benefits, and more than $60k tax bill we would have tells me to keep riding it out. Not to mention we likely won’t find a better rate of return anywhere else.

Thoughts? I might have answered my own question just writing this all out.

What’s your ages? The goal of real estate is to own as long as you possibility can. If you have children; it helps to think about them. Imagine if they could buy today, 20 years from now.

But if managing rental property is painful, I’d sell. Life is too short for pain and stress.

My wife and I are 35 and 36 respectively, kids are 2 and 6. The last payment on the mortgage will take place the same month as my oldest graduates high school.

Over ten years I’ve definitely gotten the middle of the night calls but overall, it’s been pretty easy. I got a property manager last year who has done a really good job and that was more just so that we could take off on more trips and not have to worry about things.

would you say this is an over-simplification of the real math?

“…If you have a 20% downpayment or 20% equity, a 6.5% price increase is like making a 32.5% gross return on your cash or home equity. That’s a pretty hefty return.”

for a couple reasons;

1.) what good is an unrealized return? its only as good as it lasts and eventually can be converted into cash, is it not? (like the tahoe home?)

2.) what is the real return after all home costs, sales costs, interest costs, taxes and or tax deductions? is there any easy way to figure this out? i assume it changes for 1st, 2nd, 3rd… homes and also for income properties?

thanks,

i also dont trust gozillow

Yes. Don’t forget rent too.

Property tax golden handcuffs? In california you can take your old Property tax bill with you when you sell And transfer it to your new home. I believe it’s called prop 19.

Don’t think so. But that would be nice.

This works but I believe for 55 and older in CA.

Yes. California property owner here approaching age 55. Due to a new law that passed we can take the property tax from our current place (taxes are permanently tied to the price paid in 2012 and not current value) and transfer them to a new, more expensive place one time. One benefit of getting older I guess!

What law is this?

When I look at my home’s Zillow value, the price of similar homes for sale in my neighborhood are at the very bottom of the price range. So yes, I would say they are inflated. I suggest that the nationwide stats are really not all that useful given how regional real estate prices are. The wild card may be investors and AirBmB owners, should they decide in mass to sell. Everyone else will hold on to their paid off (or 3% mortgage) homes, won’t sell unless they have to (pressure building but no mass selling). Many long-term existing homeowners also have property tax golden handcuffs, where if they were to move, their tax bill would double even if thy just switched equivalent homes (esp. in CA).

Regarding predictions – an interesting hobby is to note predictions of all types in a diary: financial, doom and gloom, then follow up in a year or so to see what happened. Remember last year all the talk of famine? Natural gas shortages? From my tally, some predictions are right, most are wrong. Many predictions with very strong arguments are wrong. What made the difference? They don’t take into account how flexible in the face of challenges we humans are. Adaptation is our superpower…. As for Zillo, we will see next year, my guess it will be way off, but in the end it is just for selling/promotion purposes. It has already succeeded, this post and many others are all talking about it. We are such pawns :)

>If you have a 20% downpayment or 20% equity, a 6.5% price increase

>is like making a 32.5% gross return on your cash or home equity

This math left me puzzled. If one covers only 20% of equity then 80% equity is financed. Purchasing now is 6.5-7% mortgage? That one’s debt will grow faster than the property value. At that mortgage rate it might be wiser to use your other assets to pay the mortgage thus avoiding paying interest.

Sure. Just to isolate the return, you would subtract the cost of rent to the cost of the mortgage.

Where do you think home prices are going and why?

I was hoping the capital gains tax break was going to change for single homeowners from 250k to 500k and for married folks, 500k to one million….they are discussing this in congress to loosen up housing market. I have worked very hard all by myself to pay for my victorian home and wish they would remove the whole single discrimination “penalty.” it is ONE transaction tand the government should not be rewarding one type of relationship over another. archaic. what are your thoughts and knowledge on these two topics, Sam?

That would be amazing if Congress allowed for up to $1 million in tax free profits for sold homes. That would be hugely beneficial to so many homeowners. Although, that might also cause a flood of supply, potentially hurting prices.

The two tier tax-free profit is kind of like discrimination, I agree! I guess the gov’t thinks two people can buy more home, and hence, have more profit.

All I’ve written about the topic is here: Clarifying The $250,000 / $500,000 Tax-Free Profit Rule

Let me put your topic in the draft queue.

I completely agree with your assessment of Zillow. I find little value in their service

One of my favorite saying when discussing Real Estate:

Q: What does the “A” in Zillow stand for?

A: Accuracy.

Your cautionary approach to Zillow’s bullish forecast is a reminder to consider multiple angles before making real estate decisions. The transparency about your personal experiences adds a relatable touch to the article. Well done!

You should ask Zillow for their logic and then write a follow up about that.

Lower mortgage rates, pentu-up demand, not enough supply, and economic soft landing.

The Zillow model benefits from high numbers. Potential sellers who use the platform want to see the high numbers and Zillow knows that. That’s how they get more users etc. Potential buyers see the numbers and believe them without even checking them out…

“The worry for potential home sellers is that once mortgage rates decline, too many homeowners will start listing their homes and cause an oversupply situation. Builders might ramp up construction as well, creating even more incremental supply and declining prices.”

Why would more list than were listing when rates were low before and there was a lack of homes for sale? Builders ramping up construction to the point that it’s impactful would take a long time with the average new home taking about a year to build after permits and everything else is approved. Builder have been playing catch-up sine 2012 with seemingly no ability to close the shortage created from the Great Recession and now COVID.

Pent-up demand is similar to pent-up supply. The longer sellers way to list. Their homes, more sellers will flood the market. Life happens, such aThe longer sellers way too list. Their homes, more sellers will flood the market. Life happens, such as marriage, kids, divorce, and death.

If I buy a new property, I wouldn’t mind selling one rental property to maintain the number of rentals I manage at three. But I don’t want a list now when rates are high and demand is lower than average. So I hope that when I list in the future, not everybody has the same idea when mortgage rates are down.

And if Zillow’s estimate is correct, I might as well wait another year anyway.

I agree with Justin, prices will rise in spite of interest rate increases because the housing supply remains incredibly tight and there isn’t any apparent relief coming.

A paywalled article at Marketwatch delved into numbers last week on why, if interest rates are rising, housing prices are not declining (title: A hellish imbalance in the housing market is frustrating buyers). It pointed out that the majority of home sales are of “used” houses; i.e., existing homeowners selling, and with so many of those owners having locked in ultra low-rate mortgages, most are holding on to their homes instead of putting them back into the market. Consequently, the supply burden falls on builders, who can’t possibly build enough to meet all the demand, are still struggling with increased lumber and labor costs, and wouldn’t build more even if costs were low for fear of overbuilding and flooding the market.

I remember that post you wrote about how unreliable Zillow’s estimates are. I totally agree they are very biased. And I find it ridiculous that the government’s property assessors’ office uses Zillow to asses values, but that’s a bigger discussion for another day.

Fascinating on Zillow’s 1% down program. This if the first time I’ve heard about it. Looks like it’s only available in Arizona right now. I have my doubts that the program will survive long enough to make it into all 50 states.

Hi Sam, I can see you are conflicted, but agree with your points. Is this a case of not seeing the wood for the trees? Covid provided a once in a lifetime opportunity worldwide to purchase at incredibly low rates. However, in the US buyers had a once in a lifetime opportunity of their lifetime on dirt cheap rates and then mortgage free living. In most other parts of the world 30 year mortgages don’t exist. So the rates rises are causing mayhem for buyers at 2% now facing revised rates of 6-7% if they fixed for only 1-3 years. In New Zealand over 50% of mortgages will face that dilemma over the next 12 months. The only thing preventing accommodation Armageddon in NZ is an exceptionally low unemployment rate and large wage increases. Prices in big cities are still down 15-20%. Hence any US citizen who bought like yourself at ultra low rates would be very unwise to sell right now aka ‘Golden handcuffs’. Moreover with more home from home many have chosen to remodel to get their ‘bigger is better’ fix. In summation the US housing market is in a stasis. Moreover with ever increasing pent up demand from FHB’s prices must continue to rise. Not to mention all the renters reading your column who have learned about ‘dead money’ rent payments.

I don’t plan to sell. I plan to buy, as I wrote in my article.

Can you clarify what you exactly mean by me not seeing the wood for the trees? Thanks

My apologies, I was born in the English Motherland albeit departed some 30 years ago. In American you say ‘can’t see the forest for the trees’. The meaning is people can be so engrossed in the details of something that the importance of the whole thing can be overlooked. My point being that the once in a lifetime Covid opportunity has changed the fundamentals for many would be buyers or sellers. Buyers because ‘nobody’ wants to sell, developers cannot currently get financing to build and sellers find themselves conflicted by their current once in a lifetime rates. Whilst I recognise that America is a far more transient country than most many owners must just want to hang on at low rates until more opportune times. Hence the stasis thus existing stock must continue to rise. Whilst I knew you were buying I had made the assumption that you would sell a property to fund the buy and avoid more tenants going forward. Clearly that assumption was wrong; my bad.

All that aside I would just like to state that I think your site, podcast and newsletters are wonderful. The insight and theories are both instructive and altruistic. A most worthy combination. I spend many an hour listening to your thought provoking, topical and timely podcasts whilst hiking a day away. Thank you.

Finally do you intend to release a paper back version of BTNT? It would undermine the paperback pirates and paperbacks are far more user friendly than a heavy tome.

Did you end up upgrading Sam?

I just upgraded a $363k house to a $1M house and DO NOT REGRET IT! go for it.

Not yet! Congrats! Although, it might be too early to regret anything yet!I hope all goes well.

Housing supply continues to be incredibly tight. Many homeowners are delaying moves or just renovating to hold onto their sub 3% mortgages. Already, there aren’t enough housing starts in most metro areas to meet regular population growth demand, and this interest rate dynamic is just exacerbating a long standing trend in the American housing sector.

I’d say it’s quite possible house prices continue to rise in the face of intense supply shortages. The irony about the fed wanting to keep raising rates to take the top off inflation is that a good sized chunk of current inflation is attributable to housing. But by making housing increasingly unaffordable, by raising rates (even if longer term rates are less impacted by the fed rate), the fed could be said to be perpetuating the supply crunch.

Strange times. The fed should re-examine its priors on housing if it wants to get back down to its stated 2% inflation target.

It is an irony, or unintended consequence of a rapid increase in rates indeed.

I just don’t think +6.5% in one year is likely. That’s a hot housing market.

Not forecasting, but it would be interesting to see if Tim Scott were the GOP nominee (not likely), if 95% of black voters would choose him (also not likely.)

I did what you recommended, removed photos and downplayed the features of my home on Zillow and Redfin so that it wouldn’t be overly assessed for property taxes.

I think it worked, but now my next door neighbors are struggling to sell their house. If they have to continue to drop the price because Zillow is downplaying the neighborhood’s value on my account, it will negatively affect my home’s value because of the comp.

Do you think this thought is valid?

Are you able to share what contingencies you are using to buy this new place? I assume it is on the sale of your primary or maybe another one of your rentals? Is there another service you believe is more accurate like redfin?

I’m using a home inspection contingency. And even after I release contingencies, there is a to do list the seller must do before I move forward.

You can see this post for all the various contingencies you can use and listen to my podcast episode about the topic.

I think you are spot-on in your forecast, Sam!

I find flaws in this responce to others analysis. His lack of performance and opinions are not an effective foundation for his conclusions. Regional exceptions will continue to grow therefore on average Zillow may be correct.

Thank you. Feel free to share your analysis and housing price forecast.

It is interesting the power my conclusion has negated my entire 5-point analysis in your mind. Good to know for future posts.

Like him predicting that Trump would win the election three years ago.