Here are Justice Anthony Kennedy's words after the Supreme Court voted on June 26, 2015 that same sex couples have a constitutional right to wed. Justice Kennedy was the swing vote.

Here are Justice Anthony Kennedy's words after the Supreme Court voted on June 26, 2015 that same sex couples have a constitutional right to wed. Justice Kennedy was the swing vote.

No union is more profound than marriage, for it embodies the highest ideals of love, fidelity, devotion, sacrifice, and family. In forming a marital union, two people become something greater than once they were. As some of the petitioners in these cases demonstrate, marriage embodies a love that may endure even past death. It would misunderstand these men and women to say they disrespect the idea of marriage. Their plea is that they do respect it, respect it so deeply that they seek to find its fulfillment for themselves. Their hope is not to be condemned to live in loneliness, excluded from one of civilization’s oldest institutions. They ask for equal dignity in the eyes of the law. The Constitution grants them that right.

20 years from now, we'll look back upon June 26, 2015 in wonderment. We'll wonder how the verdict to allow equal rights for same-sex couples to marry came down to such a contentious 5-4 vote. It's not like giving gays the right to marry hurts the freedom of others. I've read the arguments for both sides, and the unsurmountable truth is that discrimination is wrong. Rulings that side for equality are an inevitability.

We don't choose to be born gay, straight, Asian, Black, White, Hispanic, Transgender, rich, or poor. We only choose the actions we take in life. Now that an estimated 2% – 10% of the US population can legally marry, let's talk about what marriage means from a financial perspective for actually everyone!

FINANCIAL BENEFITS OF MARRIAGE

Potentially Lower Income Taxes. Married same-sex couples can now file joint state income tax returns, which typically leads to a lower tax liability than filing two individual returns. However, as I will clearly demonstrate in 10 different income variation examples in this post, there are also marriage tax penalties to contend with, especially those couples who make higher salaries, or when one spouse makes a much higher salary than the other.

Gift Tax: The current gift exclusion amount is $14,000 in 2015. Give any more than that to a girlfriend or boyfriend and you've got to pay taxes! As a married couple, you're allowed to give whatever you want, however many times you want to your spouse without incurring a gift tax penalty.

Estate Tax: If you die, the federal estate tax exemption rises to $5.43 million per person, and $10.86 million per married couple. If a couple so happens to have a $8.43 million estate to pass on when both die, unfortunately, $3 million of the estate will be taxed at around 50% if the couple is not married.

Health Benefits: In states that denied same-sex marriage, fully-insured medical plans could deny coverage to same-sex spouses. Not anymore! I'm paying $1,500 a month for health benefits for two healthy people. That's a ton of money an unemployed or underemployed partner would have to pay if they weren't allowed to join their partner's health plan.

Financial Security: One of the most important financial reasons to marry is Social Security. Let's say you pay 30 years of FICA tax and then die at age 62 or before. If you have no spouse, the government gets to KEEP all the money they were supposed to pay! What kind of bullshit is this? The government doesn't make it easy to designate a beneficiary other than a spouse. I've argued that Social Security can theoretically make us all millionaires in retirement.

In addition to Social Security, there will be similar rights to inherit rollover IRAs, 401ks and other retirement plans as well. Finally, in the event of a divorce, assets and earnings accumulated during the marriage get to be divided equally.

MARRIAGE PENALTY TAX EXAMPLES

Here are various fictitious couples with various income levels and deductions to give you an idea of how much extra you must pay the government in order to get married. Some of the arguments against gay marriage are due to the fact that the government will be able to collect more taxes as a result.

All data comes from this marriage penalty tax calculator by the Tax Policy Center. I also encourage you to input your own numbers and see what happens after this post as well.

Marriage Penalty Tax Example #1A

Each person makes $50,000, no children, no mortgage, no penalty. Hooray!

Marriage Penalty Tax Example #1B

Same example of $50,000 income each, mortgage, but with two children. It shows a marriage penalty, but the overall tax amount is lower due to child tax credits. From $11,638 to $7,863. So far so good. There is hope for humanity, but the government is saying you should have children as singles instead.

Marriage Penalty Tax Example #2

One person makes $100,000 and has a mortgage, another person earns $50,000. They have no children but it doesn't matter even if they did because they are past the $110,000 combined income threshold to receive full child tax credits. A $1,050 marriage penalty is created with their union. Not egregious, but not ideal.

Marriage Penalty Tax Example #3

Each spouse makes $200,000. They don't own a home, and have two children. The results are the same if they have no children. A whopping $15,162 marriage penalty tax is created for these two high income earners.

Marriage Penalty Tax Example #4

Each person makes $200,000, but this time they have $45,000 in deductions from a mortgage and property taxes. They have two children under the age of 17. The deductions drop their total tax bill down to $92,089 from $104,987 in the previous example, but if they weren't married, their combined taxes would only be $76,825 (17% lower).

Marriage Penalty Tax Example #5

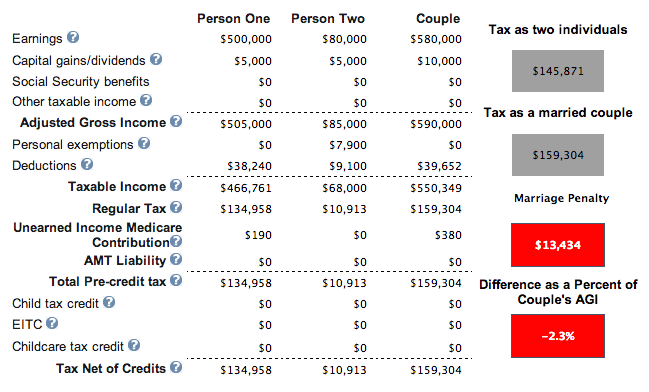

One person makes $500,000, the other person makes $80,000. They own a home with a mortgage and have one child. Lucky for the person making $80,000 to marry the person making $500,000. Not so lucky financially for the $500,000 income earner. After 20 years, this person will have paid $270,000 more in taxes than if he had stayed single or not married with the added $13,434 in taxes a year.

Marriage Penalty Tax Example #6

Two people make $85,000 each and have no kids and no mortgage. It looks like $170,000 in total income is where the marriage income tax starts to kick in.

Marriage Tax Credit Example #7

One person makes $60,000, the other person makes $40,000. There is no mortgage and zero kids. We have a winner! Because the combined income is under $110,000, the couple can decide to have a kid and claim $1,000 per child to lower their taxes even further to $10,638 from $11,638.

Marriage Tax Credit Example #8

One person makes $50,000 and marries someone making nothing. They do not have a mortgage or kids. If they were to have kids, their $3,548 tax liability would decline by $1,000 per kid. If they decide to have three kids, not only will they not have to pay any taxes, they'll “earn” about $700 bucks from the government every year. This is a fantastic income combination.

Marriage Tax Credit Example #9

Here is the beautiful scenario where one person makes $200,000 and one person makes $0. They have a couple kids (doesn't matter), mortgage interest of $18,000, pay state taxes of $12,000, and charitable contributions of $1,000. Why HELLO $7,330 tax credit!

Marriage Tax Credit Example #10

Here is the real home-dinger. One person makes $300,000 and marries another who makes $0. They pay $35,000 in State taxes, $25,000 in mortgage interest, $2,000 in charity and have a child. The $300,000 a year earner saves $11,162 a year in taxes. I tried higher than $300,000 a year and the marriage tax credit starts to decline.

THE IDEAL INCOME COMBOS TO AVOID THE MARRIAGE PENALTY TAX

Based on my analysis, the ideal income variations to avoid paying the marriage penalty tax are:

1) Have a total adjusted gross income below $110,000 to be able to claim $1,000 per child tax credit. You still get some child credit after $110,000, but there is a drastic phaseout. Depending on deduction levels, owning a home with a mortgage will reduce your tax bill further. It seems that a total income level hovering around $100,000 enables couples not to pay a marriage penalty tax and potentially even get a marriage tax credit.

2) One person with a MAGI $300,000 or below marries someone with $0 income. Example #8 ($50,000 + $0) is a common example that helps many middle class Americans. Example #8 shows how you can pay no taxes and actually earn money with kids. Example #9 ($200,000 + $0) and #10 ($300,000 + $0) are also a fantastic scenario that can help those living in high cost areas. After $300,000, the marriage tax credit starts to decline.

3) A combined income of around $150,000 – $170,000 doesn't create more than a $1,050 penalty (example #2). You've got to decide how much of a marriage penalty tax are you willing to pay for the benefits of being married. In examples #3 and #4, to pay an extra $15,000 in taxes a year seems egregious.

THE WORST INCOME COMBOS FOR MARRIAGE TAXES

1) When you have one super high income earner marrying a low income earner. For example, say you make $30,000 and marry someone making $600,000. Your $30,000 is no longer taxed at the 15% rate because it is added on to your partner's $600,000 income to be taxed at the 39.6% rate. That said, I'm sure the one making only $30,000 will be pretty pleased!

2) Two high income earners getting married. The reason is because 1 + 1 = 1.25 or less e.g. $406,750 + $406,750 = $457,600 for the 39.6% marginal tax bracket for example. The government assumes one person in the marriage will downshift or quit their jobs. This really is the worst of the worst combos. It's much better, from a financial perspective, to not get legally married until one of you is close to death. Remember, you want to get married for the Social Security and estate planning benefits.

Note: If same-sex couples plan to adopt, there is currently a federal adoption tax credit of up to $13,190 per child. The adoption tax credit is not a refundable credit, meaning you need to have at least $13,190 in federal income tax liability to be able to fully maximize the credit. The credit should only go up over time. Now if only governments around the world could make adopting one of the 100 million+ orphans easier.

MARRIAGE HAS ITS PLUSES AND MINUSES

Now that you know some of the financial positives and negatives of marriage, it's time to have a heart-to-heart about your respective finances before tying the knot! Being on the same page financially, while actively communicating ones feelings cannot be overemphasized for a healthy marriage no matter who you love!

Recommendation To Build Wealth

Track Your Wealth For Free: In order to optimize your finances, you've first got to track your finances. I recommend signing up for Personal Capital's free financial tools so you can track your net worth, analyze your investment portfolios for excessive fees, and run your financials through their fantastic Retirement Planning Calculator. Those who are on top of their finances build much greater wealth longer term than those who don't. I've used Personal Capital since 2012. It's the best free financial app out there to manage your money.

Updated for 2020 and beyond.

Woohoooo! But….

Definitely in favor of women’s rights and gay marriage, however, I am not in favor of a political Supreme Court. I always enjoyed the idea that we are a United States and not one big state. The country was designed with the idea that one could “vote with their feet” by moving to a new state. There was something to be said for the creators of our country and they created it with the intention that we have an apolitical court and individual state rights.

On the other hand, where is the viable third party to represent the working class and keep these issues out of the courts? The working class/taxpayers have no one to represent us. It sure isn’t either of the parties we have deciding our fate now. Perhaps the Supreme Court is our best option and they should run for president as a band.

For now though, I will ignore how we got here on the gay marriage issue and enjoy the outcome and the rainbow White House.

The idea that same sex marriage should somehow be a state issue doesn’t make much sense to me. Part of how the US was “designed” was with the idea that the majority cannot dictate the actions of the minority. The supreme court was correcting this, preventing the majority in the states prohibiting same sex marriage from deciding the marriage rights of the minority.

Good rational argument. Thank you.

You obviously never went to lawschool.

Care to elaborate and provide some value?

At a certain threshold for high income earners having more kids results in more taxes. My husband and I had our third child in December and it added an extra 2k to our tax bill. We earn well into 6 figures, plus live in a higher property tax area and gave to various charities causing us to trigger AMT.

Good to know. Thanks.

Love to hear your thoughts on this post then as it seems like it relates to you:

https://www.financialsamurai.com/scraping-by-on-500000-a-year-high-income-earners-struggling/

Adding insult to injury for dual income earners is that many wont qualify for the child tax credit. You wrote a great post several years back about how the child tax credit discriminates against higher income earners. It boggles me that we incentivize lower income parents to have large families by making higher income couples pay for their kids. Why not eliminate it and let people grow their families to a size that they can take care of?

Does anyone not visiting FI/RE and other financial type sites ever consider the child tax credit seriously when planning kids? Kids cost thousands of dollars, a tax credit hardly seems to touch that.

Just another way the government wants to influence people’s lives. And at the margin, I’m sure there are those who look forward to the tax credits or extra financial assistance from the government. But it’s only at the margin. I had a very interesting conversation with a woman and her family in the Sunnydale projects last week. She said both she and her husband work as janitors at SF Airport. That’s why they are paying $250 a month for a 3 bedroom. If they didn’t work, they would only be paying ~$50 a month. Then she pointed to their neighbor with 10 kids and no father. I’ll write a post about it later.

Everything is relative!

Mark Cuban even said the government should stay out of people’s bedroom. His advise to the GOP is to let gay marriage issue out. How gay marriage will affect insurance coverage, immigrant?

If the GOP can focus on military and economy, they can come out on top in 2018.

What’s happening in 2018? What does “issue out” mean?

If religious Republicans think gay marriage is an “issue”, they can “think” it, but they shouldn’t “act it”. They should leave it “out” of their debate and speeches.

I have always been a believer that same sex couples should be able to visit each other in the hospital and be afforded all of the other, and many, benefits of hetero couples.

But, is it just me or does the White House look really tacky like that?

Not sure if it’s just you, but here in San Francisco, everybody is beaming with pride!

What is the reaction from folks in Austin, Houston, etc?

Austin is pretty liberal on a national scale.

I would imagine that a lot of conservative minded people are looking around at the last week and wondering if the cultural cleansing will end in their being marched to re-education camps. I just saw a video of UT Austin students signing a petition to remove a George Washington statue because he was racist. I suppose Washington and Lee is really in for it.

You would think that many municipalities might take a big charge on health insurance. Think about the 300,000+ NYC civil servants and add a potential 50-100K spouses and adopted children to that list. It is going to be interesting how this plays out….

Many states have common law marriages which seems like a bad deal. No tax benefits but risk of losing assets in a divorce. I wonder why the government is involved in marriage at all. Why not make all marriages civil unions so that from the governments perspective it is nothing more than a legal contract for the purposes of identifying dependants, inheritance, and tax implications.

A clear separation of the legal definition of a union and what marriage ceremonies churches, temples, and mosques perform would help clarify all of the difficult questions to come.

Government has always wanted to decide the people’s private lives. The more decisions the government can make, the more powerful they are. That means more tax revenue and a higher ability to push agendas.

Actually, there are only seven states that still recognize some form of common law marriage. And as far as I’m concerned, there’s already a clear separation between civil marriage and sacramental marriage. That’s why judges can conduct marriage ceremonies, but churches can’t issue marriage licenses.

I was thrilled to hear the news about the Supreme Court’s ruling. You’re right that it’s still shocking the vote was that close even in today’s world, but I’m glad it passed. I was also surprised to read that there are still many states that do not have labor laws to protect workers from being fired at work because of their sexual orientation. As someone living in California, there have been labor laws here to protect against discrimination for so long it makes you think that those laws are also in every state, but not yet. Hopefully all the remaining states will adopt labor laws like in California next.

You make a good point about marriage tax penalties. Regardless of who is getting married the government is still penalizing a lot of people just because they wed in order to get more taxes. Hopefully marriage tax penalties will be the next thing to go. It sure would be nice to have a much simpler tax code.

I don’t think the marriage penalty tax will ever go away.

It’s up to us to figure out how to make levels that avoid such penalties instead. The good thing is, money after $200,000 doesn’t bring much more happiness. Therefore, might as well comply within the rules to avoid the penalties and not shoot for the stars.

Over the course of my 30 year marriage, my wife and I matched several of your examples at different times. As I was thinking about where we are now, the question came to mind “how does our joint income from investments factor into the marriage penalty/bonus equation? (We have about $60k/year in investment income from jointly held assets)

Hmmm, there is probably a bonus element to this as many couples look to retirement savings as a team e.g. save one income, spend the other.

Married or not married, you can still max out your 401k and IRA if available.

There’s probably a higher level of confidence to take a little more risk if married. What do you think?

Any financial benefits to being married can be lost and then some from a divorce. If a marriage does not work out, it can cost a lot more than the financial benefits of a marriage. I sure wouldn’t want to lose half my stuff and then have to pay alimony till eternity.

Nice optimistic outlook.

Is losing half, really losing half if you’re simply splitting wealth that was created together after the union?

Two words: prenuptial agreement.

Good information to help all couples determine tax consequences of marriage. Thanks! Now that it’s an option for some of us, we can know what marriage will mean tax-wise. Still lots of other benefits though besides taxes.