Although difficult times are unpleasant, it can make you a better investor.

In high school, I developed an interest in investing by going over stock ticker symbols in the newspaper with my father. From there, I began trading stocks online in college and eventually parlayed my interest into a career in Institutional Equities at a couple investment banks.

For many people, investing in the stock market over a lifetime, has been financially rewarding. I know plenty of people who have retired early due to their investments. On the flip side, I know several people who lost their shirts during the dotcom crash and housing meltdown due to margin. They invested way too much at the wrong time.

The sooner you can start investing, the better. You'll learn from your mistakes when you have less money, so you can make better decisions when you have much more. Always start small and work your way up!

INVESTING IN A DISMAL YEAR

Investing during a dismal year is a great way to learn about investing or hone your investing skills. Bull markets give people a false sense of invincibility, which leads them to do crazy things like quit their jobs to day trade their tiny portfolio for a living or go on maximum margin because they think they just can't lose.

In Q3 2015 I went from 100% equities to a 80% equity / 20% bond split in my Motif portfolio. The thinking was that volatility would worsen due to China, Europe and negative signaling from the commodities market.

I was right, but I didn't do enough to protect my portfolio from the violent declines in Q3. I should have gone 100% into cash or bonds to lock in my then, 3.5% gain. In retrospect, at least a 50/50 split would have been wise.

Take a look at my 30 position Motif portfolio as of October 8, 2015.

My overall return to date is an uninspiring 0.1%! I started my portfolio with a little over $10,000, and that's where I still am today. The portfolio is neck in neck with cash.

My Motif portfolio is down 3.4% since I last rebalanced all 30 positions in 2Q 2015 for $9.95. The only bright side is that relative to the S&P 500 or Dow Jones Industrial Average, my portfolio is outperforming the two by ~3% – 5%.

If you look at the “Weight” column, you'll see one big outlier at 21.3%. This is my municipal bond fund, MUB. The weighting started off at 20% in Q2, and has grown due to an increase in MUB and a decline in everything else. In a taxable investment portfolio, it's a good idea to be tax conscience e.g. hold tax free muni bonds here instead of in a 401k or IRA, look into dividend stocks, and keep portfolio turnover to a minimum.

I've purposefully not contributed to my Motif portfolio so as to not obfuscate the returns. I've noticed some bloggers either quit updating their performance once it goes down, or they add to their portfolio without saying how much they added to make it seem like they are doing better than they really are.

I want to experience the embarrassment of underperformance or the glory of outperformance every quarter! My hope is to keep a pulse on the market and learn from any mistakes or wins to better manage my larger portfolios.

4th QUARTER STOCK MARKET RALLY?

As an investor, you've always got to be thinking ahead. In the short term, it's good to be aware of seasonal variations in the year. In the long term, it's all about expected earnings, execution, the competitive landscape, and other exogenous variables. Let's look at the very short term.

October is generally one of the worst performing months of the year for the stock market, even if the previous months were pretty terrible already! In other words, don't think for a second we're out of the volatility woods yet.

Take a look at these charts Bloomberg put together about previous lower lows in 1990, 1998, and 2011.

Bear Markets Are Common

After nasty falls in August and September (much like how we've experienced this year), we could be in for an equally nasty sell-off in October. Why the schizophrenia? It's hard to say.

The good thing is that if you've come up with your investing game plan, you should have some ammunition to invest if the market starts tanking again. I have three more tranches ready to deploy if the stock market breaks its 2015 low by 2% or greater.

The other takeaway from the charts is that there were subsequent “Santa Clause” rallies into the New Year. Given the S&P 500 is at ~1,990 currently, if one held on during each of the years displayed in the charts, they'd have made a lot more money.

I don't believe the Fed will raise rates in 2015, nor do I believe interest rates for mortgages and consumer credit will go up even if the Fed does raise in 2016. China has already corrected by 40%, and oil prices (Brent Crude and WTI) have probably seen their worst in the low $40s range per barrel. The S&P 500 is trading at 15x forward earnings, which is in-line with long term historical valuations. Given these factors, I'm comfortable with an 80% equity / 20% fixed income split.

IT'S WORTH GETTING STARTED

For those who do not currently invest in the stock and bond market, the only way you can get comfortable investing is by getting started. Cash can definitely be a good short-term investment, but over the long run, cash will get killed by inflation. Always try to at least get neutral inflation by owning enough assets that will inflate over time.

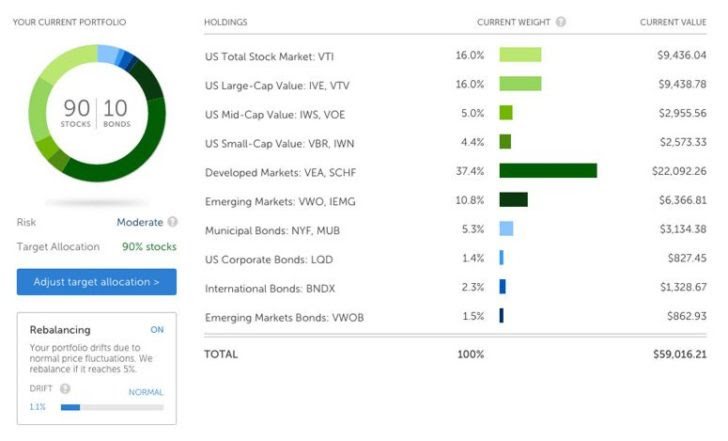

Invest Your Money Efficiently: Empower, the leading digital wealth advisor, is an excellent choice for those who want the lowest fees and can't be bothered with actively managing their money themselves once they've gone through the discovery process. All you'll be responsible for is methodically contributing to your investment account over time to build wealth.

In the long run, it is very hard to outperform any index, therefore, the key is to pay the lowest fees possible while being invested in the market. Let Betterment build a customized portfolio for you based on your risk tolerance.

nvest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

About the Author: Sam began investing his own money ever since he opened an online brokerage account online in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at Goldman Sachs and Credit Suisse Group. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate.

About the Author: Sam began investing his own money ever since he opened an online brokerage account online in 1995. Sam loved investing so much that he decided to make a career out of investing by spending the next 13 years after college working at Goldman Sachs and Credit Suisse Group. During this time, Sam received his MBA from UC Berkeley with a focus on finance and real estate.

In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income. He is aggressively investing in real estate crowdfunding to arbitrage low valuations and take advantage of positive demographic trends away from expensive coastal cities.

Hi Sam,

I truly enjoyed reading every bit of information in your website. Your success story is very inspiring and motivational and I am pretty sure many are blessed.

My question to you is: considering the market turn around, can I still invest in income generating property and which area should I be looking at? Currently residing in the Bay Area. Looking forward to hear from you. Pls send your reply in my email: glenne05@hotmail.com.

Thanks for your precious time.

Hi Glenna,

Check out: The Best Place To Buy Property In San Francisco Today.

I think the market is slowing, so opportunities await!

Sam

I love it! This is the kind of reverse logic I try to preach all the time: when everything is crazy and everyone is going nuts, be contrarian. Be patient and steadfast. Cut out all the emotion and get to the heart of it. Chaos and panic sells well for the media and publishers regardless of the outcome. As an intelligent investor, you have the discipline to overlook that and get to the heart of the financial markets.

I like that you’re keeping the Motif account ‘clean’ to make the returns easy to observe. It’s definitely a pain to keep track of returns if you’re constantly accumulating or just chopping and changing.

I had stopped sharing my own portfolio recently for privacy reasons, and to help avoid getting too obsessed over it and keep life a little more balanced. But having read your comment, readers probably think I’m one of those who got scared when the market fell! I’ve actually re-jigged my portfolio in the past couple of months (still 100% equities, but finally diversifying away from the Australian market), and it’s definitely one of the tricky balances – trying to set up a portfolio that doesn’t need much attention, but making sure not to over-handle it and incur too many transaction costs!

Would love to see Motif broaden it’s horizons beyond the US, is definitely something I’d consider using as part of the portfolio…

Jason,

What were the privacy reason concerns if you already published your portfolio in previous posts? Did you delete your older posts about your portfolio?

I never intended to share my own portfolio when I started the blog, but felt somewhat obliged with others doing the same, and thought the accountability might be helpful – just kinda got caught up in it all.

I wouldn’t mind keeping it up, but just a little uncomfortable with having more personal details out there at the moment (and my wife even more so!), particularly as more friends learn about my blog as I’m not super-anonymous about it.

I’m leaning more towards creating a ‘model’ portfolio which I can use as a platform for sharing investment ideas, even though it’s not quite the same as your own real money on the line!

Hi,

I just began to invest, and as you mentioned, i tried with yahoo portfolio but it’s no where near effective in learning as a real account with Motif. But with small amount it makes trade/readjust not cost effective. Do you have any advice for this? I thought about saving a big enough amount of cash to invest but then that go against my sole purpose is just to learn.

You can build a 30 position Motif for only $9.95. But really, it’s free because you get up to a $150 credit (1 Trade = $50 | 3 Trades = $75 | 5 Trades = $150). Given the minimum is only $250 to start, going through the steps to build a portfolio like a real professional fund manager is very valuable for the long term. It forces you to think about sector weightings, risk, portfolio composition, etc.

Compare that to paying $7.95 per trade on Etrade or Fidelity, Motif is a game changer for the typical retail investor. Online brokerages skew retail investors to take too much risk and trade too much imo.

Motif is definitely a game changer when it comes to building a diversified portfolio.

However, I would also encourage investors to negotiate their commission structure with their brokers.

I did and I pay nowhere near the commission rates advertised. And I have successfully helped negotiate commission rates for friends and family.

To give you all an idea, I have most of my equity investments with TD Ameritrade. The advertised rate for equities is $9.99/order and options are $9.99/order plus $0.75/contract.

I personally only pay $0.01/share for equities and $0.75/contract for options, with no ticket minimums.

Most people just never ask the question. I found the most effective way to lower your commission structure is to threaten a potential move to Interactive Brokers, which has some of the lowest rates in the biz.

Just my 2 cents!

I’m a firm believer in dollar cost averaging. I used to trade individual stocks and day trade currency when I was in college but now that I have a full time job, I just don’t have it in me anymore to think about it. I’ll be buying a little of my commission free S&P small cap ETF every couple of weeks no matter what happens. That said, I do also set aside 10% of my stock portfolio for home run plays and long term options strategies. My stock portfolio is probably down around 5% ytd, but most of my investable assets are either in 1-5% yielding savings accounts or fixed income (lending club and muni bonds) to save up for my next home purchase.

I’m a little bit above 10 percent for the year. Won’t know for sure until PC weekly update email arrives. Early in the year (maybe summer) I was in the 20s percentage wise. So, I’ve dropped 10 to 12 percent since my yearly high. I still have a core belief that this is one of the cheapest markets (now and last few years) in my lifetime.

Thanks for the post. I think I generally just have a pessimistic attitude when it comes to the market, and I’m always thinking a huge decline is near and then I miss out on opportunities. So I definitely appreciate your investing strategy of holding on to tranches and waiting for certain decline thresholds — this is a new way of thinking for me, and having a game plan seems to be more logical.

It seems like depending on who you talk to, opinions are split on whether the Fed will increase rates this year. If they don’t increase the rates, I almost feel like that’s a worse sign for the economy than if they do.

You’re talking to the wrong people if they think the Fed will raise the Fed Funds rate this year. Happy to bet on this!

Hahaha, I’m surprised at your confidence! I’m not ready to bet money bc seems to be a guess one way or the other in my opinion, so maybe if you gave me some better odds I’d take you up. But I should have clarified, seems everything I read (i.e., economist perspectives) takes a different stance on whether rates will rise this year or not. But seems many including the head of the New York Fed think a rate hike remains likely, while other economists and bankers think it will still get pushed off. Maybe you have more info than NY Fed, or what is driving your prediction?

Best job in the world is being an economist. Doesn’t matter whether you are right or wrong. You just have to keep changing your forecasts.

Haha, yes this is true

I love the volatility! When it comes to stock market investing, I stick with the dividend payers. There’s nothing like having a swath of companies pay me a growing dividend each quarter. And I don’t have to do anything to achieve this either (no keyword research or link building, no sales quotas or customer satisfaction metrics, just money without having to do anything). What’s best is that a market downturn doesn’t erode my dividends because they are paid out in cash, rather than the paper wealth of stock prices. The market’s down? China’s facing a correction? Uncertainty about interest rates? Who cares? As long as the businesses I own are inherently strong and sound (even if a weak quarter or two lies ahead, or even a weak year), that drop in price means I buy more.

I’m hoping for another downturn soon. I know I seem to be the only one here, but I need those dividend stocks at the cheapest prices possible. Now I just need my second job to give me a start date so I can begin investing more and faster.

Sincerely,

ARB–Angry Retail Banker

I agree with you 100%, Banker. Dividend stocks are a thing of beauty.

Be careful what you wish for. A downturn means your job will be more at risk because business activity will decline. Fear will increase and the natural instinct is to raise capital, not invest.

I think it is worth noting that rebalancing your portfolio can be accomplished by where you decide to put new money. You don’t always have to sell out of positions to rebalance.

Thanks for the update on your Motif – I was wondering how it was weathering this storm.

You hit on a subject that a lot of younger people to the PF space seem to miss, the market does correct. History does repeat itself and no one hits home runs all the time. Slow and steady with a solid approach wins the race.

We have not changed a single thing to our investment strategy this year. The only we have done is re-balanced our portfolio in July and converted some college funds to cash for my youngest daughter’s enrollment next year.

Before I looked at it, I was honestly wondering whether my Motif portfolio’s performance would be an utter embarrassment since it is so heavily weighted in tech. I’m glad things have held up, but there are some really bad losses in there!

You make great points but I disagree with one statement. You say that in Q3 you “should have gone 100% into cash or bonds to lock in my then, 3.5% gain.” Maybe, but it assumes you’re an expert market timer (which 99% of investors are not) and that you’d know the precise right time to get back in. I read something a few years ago that JPM Asset Management conducted a study of the S&P 500 from 1993 to 2013. If an investor had stayed fully invested over that period, he/she would have experienced an annualized return of over 9%. However, if the investor traded in and out such that he/she missed merely 10 of the best trading days, those gains would be cut nearly in half; 20 days, by 2/3; 30 days by 100%; and so forth. God bless you if you can time the market exceptionally well . . .

Ah, but going into 100% cash in 2Q as a better move is a truism, especially if I bought back in, or was still holding 100% cash since I’d still be up 3.5%. 3.5% > 0%.

It’s always easy to look back and say what one shoulda done.

I don’t rebalance so aggressively anymore, but I do fluctuate between a 50/50 split up to a 100/0 equity/bonds split all the time w/ my actively run portfolios.

I wholeheartedly agree that investing makes you smarter over time. You start caring about the news and current events around the world.

Not sure how the market will do in Q4, but since people tend to spend more money around the holidays I hope it will be better than August and September! Time horizon also plays a big role. Most of my investments are for retirement, which is realistically 25-30 years away. So trying to time the market is not really for me. But I do like keeping up with financial news because I would like to have a small portion of my portfolio in individual stocks once I pay off some more school debt.

Here’s hoping for a Santa Claus rally and peace and calm around the world!

I published the historical charts because it’s always good to see what happened in the past, even if the future is entirely different. The goal is to have a game plan, so as to NOT whig out whenever things seem to be going bad.

Great post. This pull back has been excellent for adding hi quality stocks at a more reasonable valuation.

I had dinner with some couple friends last night – both 29, both with great jobs paying 80k plus. Just starting to invest. I told them if they’re smart they can be millionaires if they save and invest big the next 15 years. The wife was impressed at how her acorn account has blossomed into a sizeable amount in just 8 months. I told her to keep at it and max that 401k and time will do the trick.

Good job passing on the financial motivation! Hope they stop by here one day.

Nothing beats decision making in real life, vs. paper trading. :)

…Unless you get badly hurt because you were overconfident in a strategy that “couldn’t lose” at the time. As the recipient of this type of ass kicking 30 years and again 15 years ago, I suggest you do start small and build gradually. Do not “go all in” no matter how confident you might be until you have shown you can ride the ups and downs well.

Q3 was a great opportunity for me to deploy a portion of the more than 50% cash I had raised in my investment accounts. I was fortunate to sell some puts in the SPY near the August lows.

I also covered some short positions I had on via short call spreads.

Our last email conversation around investing transparency had inspired a new post series that I will start in 2016. Like you I want to take my licks when the market goes against my strategy and bask in the glory when I out perform.

Thinking of providing screenshots of positions and brokerage statements (with personal info blurred out).

I have to think through the format, since not many invest with options as heavily as I do.

I think the rest of 2015 will be range bound with no new highs or lows for the year. I have positions on that profit anywhere in between 190 and 210 on the SPY or 1,900 and 2,100 equivalent on the S&P 500 index.

In 2016 it is hard to imagine a fed that raises rate in any meaningful way. Kind of in the camp that they stay low longer than anyone thinks they will. It’s also an election year, and nobody wants to rock the boat.

No matter what, there will always be plenty of opportunity.

My only ask to the market gods is that volatility remains elevated.

Cheers!

Very cool. What is your YTD performance given all your moves?

I up ~4% on a YTD basis as of today’s close.

I ended 2014 with $87,074 in total account value. The closing value up my accounts today was $114,880. So, although my total account is up almost 32% (gain of $27,806), most of that is from new money being contributed.

This year, I have contributed $24,164 so far (28% of the 32% increase).

The remaining increase of $3,642 (the other 4% of the 32% gain) is the combination of both realized and unrealized gains.

The SPY ETF is down -2% as of today’s close. I am pretty happy with a 6% out performance. Especially since I have generated that return not using more than 65% of my capital so far this year.

Cheers!

4% is good! One of the big difficulties you find is whether you will be able to take the same amount of risks as your portfolio grows. You might think you can, but it’s different when the position amounts grow in size.

Once you reach your nut, your #1 priority should be to protect it!

Sounds like a challenge I am up for. All I have to do is come back to your site, which is a treasure chest of knowledge :)

What is so cool about this space, is the diverse ideas that exist. I have my own, but I also draw from the rest of the community.

Sam – I really have to say thanks for all the wicked good content you put out. It set’s the bar really high for the rest of us that attempt to do what you have been doing for over 5 years now.

I love content around real experience. The thing I hated most when I was in school is when a finance professor was purely academic and had no real world experience.

Have a great weekend!

Dom

Ideally, I’d love to create a crowdsourced investing fund. It worked with the Samurai Fund years ago. It just takes time to maintain and gather input.

My returns haven’t been great, but I’m trying not to think about it too much and instead just keep pumping money into my investment accounts. I completely agree that the sooner you start investing the better. When I first started, I was 22 and had no clue about investing. I was so scared that I would make a bad choice and lose money, and I did! But it was such a valuable learning experience, and the money lost was really minimal. Now, I’m much more comfortable investing, even in a bad market like this.

It’s a good idea to have an investing plan beyond just adding money to your investment accounts. I’d like everyone to consistently think about asset allocation.

Good job figuring things out at a younger age!

I’m glad I had some curiosity about the stock market in my 20s and tried to make money on single name retail stocks that interested me. I was utterly terrible at it but at least it was fun. The experience quickly taught me that there’s a lot more to picking a winner than just picking brands you like. Once I finally sold out of my last retail stock I decided to go bigger picture and longer term investing from then on. It’s worked pretty well for me and is much easier with my schedule.

Thanks for keeping it real with your Motif performance updates. Your 21% weight in the iShares has done really well and being flat isn’t bad at all with all the volatility we’ve had lately. It’s interesting to see those charts with the dips in August and October. It sure does make me think the same will happen this month looking at those patterns. But hopefully not. It would be nice to at least get some stability back in the markets.

I hope this rebound lasts, and the year’s bottom has been made. Who really knows. But, each of us should develop various scenario analysis.

Focusing on asset allocation and index funds/ETFs really is the way to go for 95% of investors out there. Keep costs low. I like Motif b/c you can build a 30 position portfolio for only $9.95, and you can rebalance all 30 positions for $9.95 too.

If I had built a diversified portfolio with my active investments in the past, I probably would have lost less and made more.

I had a similar experience; my dad let me pick out and follow three stocks when I was a kid, and I loved looking in the newspaper to see the process every day. That sparked an interest that led to me trading under my desk in high school and college, and then a career in asset management.

My portfolio is pro-cyclical, so I got crushed during 3Q. However, I added to my investments and shorted vol, so the recent bounce has more than offset it.

I’m always curious to know how professional asset managers do with their own portfolio. Care to share the specifics of YTD performance?

I’m up 2.4% YTD. In the depths of the correction, I was down about 15%, but rotated into commodities and shorted volatility, which helped a ton. I’m not usually an active trader, except during periods of dislocation like this.

“Bull markets give people a false sense of invincibility, which leads them to do crazy things like quit their jobs to invest their tiny portfolio for a living or go on maximum margin because they think they just can’t lose.” – contractor did exactly this a couple of years back. Is now back in the cubicle after day trading his money away!

Not sure I would be confident enough to deploy my money based on charts, hence my more passive approach :) – will be interesting to see if history repeats itself!

The last few years have made some pretty confident if they are in the markets, either that they will carry on climbing or that they are a bullet proof investor. Good to get our asses kicked every now and then.

MrZ

I brought up the charts b/c I was doing some research on previous 4th quarter performances based on similar price actions we’ve experienced in 2015. Without managing this Motif portfolio, I probably would have never bothered looking into this stuff. And this, is the main point of the article. Putting your money where your mouth is helps make you a more knowledgeable, better investor.

The S&P 500 is trading at 15X forward earnings. That’s right inline with historical averages, hence why I’m comfortable w/ my 80/20 equity/bonds asset allocation.

How have you done YTD?

Simply having a war chest of cash, and using it at the right time are two separate outcomes I’ve learned. I’m building my cash war chest right now, so I can get more value once the market gets worse. Insightful post, especially the graphs!

Glad you are. I’m doing the same, but deployed three tranches during the correction. Time to build it aggressively back up again.

I invest for the long term with most of my money but I have a “system” where I move a portion of assets in and out of the market based on PE (TTM) and a couple of other factors. Not full proof of course but has worked for me 80 percent of the time. This is at the edges though. I don’t have the guts to make huge moves.

The volatility in the equity markets also reminds me of why I am trying to build passive streams of income (thank you Sam!). I am finding that knowing I will have income lessons the anxiety of market fluctuations. I have been using Fundrise to build dividend paying real estate positions. Have you ever looked at that service Sam?

Wow, I’m impressed you started reading about stocks in high school. This year’s returns have been dismal for me, too. But I’ve been focused on building up some cash over the past few months for some home projects. I’m ready for a downturn!

I hope there is no downturn, but it sure feels like one may be coming.

I’m thankful my dad spend time to educate me on the markets. There’s definitely a nurture element involved regarding personal and non personal finance.