This post is a reminder that we can and will lose money if we invest in risk assets for a long enough period of time. The only way to never lose money again is if we never make any investments. Let's discuss some things to do before making any investment. We keep our money in a money market fund or Treasury bills, which incidentally, are paying 5%+ now thanks to aggressive Fed rate hikes!

To build great wealth over time, it's important to take calculated risks and continuously invest for the long term. Over time, stocks, real estate, and bonds have shown to beat inflation and provide a real rate of return. With the power of compounding, it's only a matter of time before investors build a healthy nest egg.

Things To Do Before Making An Investment: A Cautionary Tale

To show the dangers of investing and getting caught up in the hype, let's take a look at the rise and fall of cryptocurrencies. Even though Bitcoin is back close to all-time highs, it went through a deep downward spiral in 2017.

There is this one guy who boasted making minimum wage a year ago and is now a cryptocurrency millionaire. He shows his electronic wallet on social media for all to see in order to create FOMO in his followers. Many do follow along.

Then, he began aggressively promoting Bitconnect in 2H2017, a bitcoin based lending platform where they take your cash or Bitcoin and give you a GUARANTEED interest of between 0.25% – 1% a DAY with Bitconnect currency. They said they have a “proprietary bitcoin trading bot” that produces such returns.

In other words, if you invested $1,000, after 3 years of 1% daily compounding interest, you would have something like $53,000,000! Come on! Check out this chart from Bitconnect highlighting their promised returns and capital back time table.

Scammers And Grifters Coming Out

When the Bitconnect platform realized they were running out of money to pay their new users, they decided to shut down their exchange, leaving all those who gave them cash or Bitcoin stranded. Their Bitconnect currency proceeded to plummet 90% overnight and its fate remains to be seen. Where did all the cash and Bitcoin they collected go? Who knows!

Once I saw the price plunge and learned about the promoters and how Bitconnect worked, I thought to myself there's no way anybody could have been so gullible and fall for this scam. Not only is there a lot of cryptocurrency grift, there's also a lot of government grift throughout the country.

Here's a comment after the plunge that parodies an Eminem song.

People Losing Lots Of Money

OK, people must be joking. Nobody could have given Bitconnect money right? Then I saw more serious comments from people who claim to have lost a lot of money in Bitconnect. Here's one from a guy who supposedly invested $500,000 in Bitconnect and wants to take out a $5,000,000 loan to invest more in cryptocurrency!

Still unconvinced about the seriousness of these comments, I kept on reading the feedback and stumbled across this Youtube video of a guy who lost $30,000 in loans in Bitconnect. After watching this video, I'm now convinced there were actually people who did fall for Bitconnect's wild promises. It does not look like he's acting.

Seeing all the carnage, I couldn't help but feel it's my duty as a personal finance blogger to make sure more people don't lose a ton of money investing in scams. I've gotten scammed before and so have some of my loved ones and I hate it! Here's a list of potential crypto ponzi schemes to watch out for created on Reddit.

Let me share some exercises I go through before making ANY investment. Hopefully these exercises will help keep you grounded as you seek to build your fortune.

Related: How Does Geopolitical Risk Affect Stock Prices?

Things To Do Before Making Any Investment

1) Calculate how many hours, days, weeks, or months you need to work to make up for a loss.

Let's say you make a $10,000 investment in anything that has risk. You earn $20/hour. If you lose all your money, you will have to work at least 500 hours to get all your money back. Since you have to pay taxes, you have to work more like 650 hours. Given

you're only making $20/hour, the job probably isn't something you love to do. Knowing the “pain of recovery period” will help keep your FOMO in check and help you make more risk appropriate investment decisions.

I've come up with FS-SEER, the way to quantify your risk tolerance using time as a key variable. Once you quantify your losses in terms of how much time you need to spend working to make up for your losses, it puts your risk tolerance to the test.

2) Look for keywords such as “can't lose,” “guarantee,” and “get rich quick” in the marketing material.

If you find any of these keywords, run the other way. There is NO GUARANTEE to any investment except for an FDIC insured savings account up to $250,000 per person or holding a US Treasury bond until maturity. Even then, the US economy could blow up.

3) Ask yourself whether you truly understand the product and business model.

If you cannot easily explain the business model with a straight face to a loved one, you do not understand what you are investing in. If you don't understand what you are investing in, you should not invest in the product.

For example, I had one guy ask me why he hadn't received any returns three months after making a $25,000 equity investment in a three year real estate crowdfunding deal. He'd confused an equity investment with a debt investment and obviously hadn't understood the literature about the deal discussing their strategy of selling the property in three years for a target profit.

4) Calculate your net worth composition to understand risk.

You must understand your net worth composition in order to understand how much risk exposure you have or are comfortably able to take. Losing $30,000 in Bitconnect is survivable if you're worth at least $300,000 and have a steady job making at least $60,000.

But it doesn't sound like the guy in the video has much more than $30,000 to his name since he said he “lost his life's savings.” There's a reason why professional money managers diversify client holdings.

Related: Recommended Net Worth Allocation By Age

5) Limit all alternative and speculative investments to no more than 20% of your net worth.

I define alternative investments as any investment other than publicly traded stocks, bonds, CDs, and physical real estate. Investing in stocks, bonds, and physical real estate is good enough to build enough wealth for financial independence. There is NO NEED to invest in anything else.

Alternative investments do have the ability to generate higher returns or diversified returns than non-alternative investments, but they are often illiquid, more difficult to understand, carry higher fees, and may carry much higher risk.

You are not the ~$35B Yale endowment with ~70% of their fund in alternative investments because you don't have the same amount of access, power, and team of investment professionals tracking the fund full-time.

Personally, I'm bullish on artificial intelligence. As a result, I'm investing money in private AI companies through open-ended venture capital with Fundrise. I've invested over $140,000 so far. However, I'm keep my exposure to private AI companies to no more than 10% of my total investable capital to protect myself from downside risk. 10% is also enough to make a significant difference to gains.

6) For goodness sake, please don't take out a loan to invest in alternative investments.

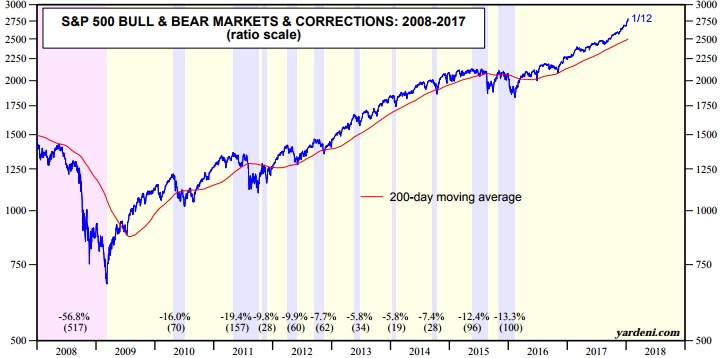

The people who get into real trouble during a correction are those who not only invest too much of their net worth in the investment, but also take out a loan. Yes, margin investing in the stock market is at all-time highs, which is scary because the stock market is also at all time highs. Yes, taking out a mortgage you can't afford when real estate prices are at all-time highs is also a terrible idea as we saw in the 2008-2010 financial crisis.

If you lose 100% of 10% of your net worth, you will be pissed off, but survive. If you lose 100% of 100% of your net worth, you will be devastated and perpetually depressed, but will likely survive if you have a job. But if you lose 100% of 200% of your net worth due to debt, you will be ruined and likely stay poor forever.

Related: Only A Petulant Fool Borrows From Their 401k

7) Please understand the background and history of the person trying to sell you something.

If the person is a broke fella who was packing boxes for minimum wage a year ago and is now telling you how to get rich, be wary.When a person is a high school student teaching you about the fundamentals of investing, be wary. If the person only highlights his wins and never his losses, be wary.

The person should have a multi-year track record before you listen to their advice. And even still, be wary. There's a reason why institutions wait until a fund has at least a 3-year investment track record before investing any money. There's a reason why funds that have a 10-year or longer track record tend to have the most assets under management.

“Hey, hey, heyyyyyy!” Long live Carlos Matta and his Bitconnect promotional video! It's no longer available, but was such a classic.

8) Get feedback from at least three people before making an investment.

It is easy for us to get excited about an investment that could make us rich. We start fantasizing about what we would buy with our profits, where we would travel, or how we would quit our jobs. Yes, money makes us go crazy. Therefore, you must share your investment thesis with at least three people: a parent, a sibling or best friend, and the smartest person you know. Listen to all their criticism.

I get someone telling me I'm an idiot every week for my investment decisions, and I appreciate it because there is no guarantee! It's when everybody agrees with what I'm doing when I start getting worried. If you have truly listened and still believe in your investment thesis, then go ahead and take a risk with no more than 10% of your net worth.

Invest Responsibly Please

Please review all the things to do before making any investment if you want to save money. One of the reasons why I'm so much happier just being a personal finance blogger than working in investment banking is because I'm not calling or e-mailing anybody to buy anything.

If people want to read my writing you can bookmark this site, subscribe to my e-mail feed and private newsletter, and listen to my podcast on Apple, or Spotify.

Please invest responsibly folks. Don't ever give your money to someone you don't know or invest in something you don't thoroughly understand. Be wary of folks who are saying you just can't lose. Please try and tame your desire for getting rich quickly. If you can avoid stepping on financial land mines, you will be able to reach financial independence more easily.

What I'm Doing With My Money In 2025

As for me, I see plenty of opportunities in the real estate market given prices are down and the Fed is now cutting rates. Therefore, I'm dollar-cost averaging into private real estate funds like Fundrise and looking for individual invest deals on CrowdStreet.

If you think about it, every investment except for hard assets like real estate or your 1952 Mickey Mantle rookie card are just digital numbers on the screen. Your screen might show a fortune one day and a big fat ZERO the next. It's the reason why I'm so much more comfortable investing in physical real estate than any other investment.

Investing In Private Growth Companies

I'm also diversifying into private growth companies through Fundrise Venture. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Fundrise Venture invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 65% of Fundrise Venture is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum.

Finally, I leave you with this final investing thought. You can never lose if you lock in a gain. Yes, you might sell something too soon and kick yourself for not holding on for more gains. But selling early is much better than selling too late. The floor drops out from under you when everybody starts to panic. I experienced this firsthand when I tried to sell my house in 2012.

Things To Do Before Making An Investment is a Financial Samurai original post.

Great stuff, after reading this post of your I expect more people will take your opinion and start investing. Nowadays many of them start investing without having a better understanding of the market.

Worked in the Medical field for most of my adult life, grew to be an expert and worked as hard as I could. Friend of mine introduced me to IQ options worst mistake of my life, My Broker Mr Graham absolutely cunning to say the least I lost all my life savings to this crooks. To make matters worst a certain wealth recovery website offered to get me my funds, lost more money to them too. I only wanted to get what was owed to me the right way and was put in contact with (stealthlegalservices.com). From the beginning of my dealings with them I felt so reassuring till finally getting most of my funds back thanks again guys couldn’t help but share to others.

This is a great post with good nuggets of advice, and it foreshadowed the larger bitcoin bubble bursting that we have now witnessed since Q1 2018. Many people just got an extremely painful lesson in the risks of speculation and following the herd. It is tough to sit on the sidelines when you hear of people making thousands of dollars overnight, but the moment you get the urge to jump in because of those stories is the exact moment that you should hit the pause button and reevaluate your decision making process. You must resist the urge to jump into an “investment” simply because you don’t want to miss out on the “opportunity” that is making everyone else rich. There is a reason that successful investors like Warren Buffett and his mentor, Benjamin Graham, stress the distinction between speculating and investing so much – many people think they are investing, but really they are 100% speculating, and that is when there is blood in the streets when the markets turn and bubbles burst. Everyone should pick up a copy of the Intelligent Investor by Benjamin Graham and study the chapters on investing vs. speculation. At a minimum, take to heart the 8 points noted by Sam in the post above, as those points echo a lot of the sentiments in the Intelligent Investor.

FS – great post. Sound advice for people navigating investments with their disposable income. You have the heart of Yoda. Except you’re not 2 feet tall and green. I think.

Having made ignorant financial decisions and financing crap that only loses value, I never lost my life savings thankfully. Not that I didn’t give it a quality effort.

I know of people recently who were trying to liquidate their 457 accounts to speculate in bitcoin. Fear of missing out overwhelmed them. People lose their minds reading about alleged overnight millionaires. People disregard logic when they see supposed easy money.

Inevitable corrections are coming. Don’t panic. If you believe in the long term economy of the US and the economies of the world, invest consistently, over time, and in multiple market sectors. Building wealth takes time, just like making a quality smoked green Chile Pork.

Pay off all debt, live on a budget, live below your means, invest the difference. Rinse and repeat. Don’t get sucked in by the most effective marketing in history for credit cards, new phones, financing new cars, etc etc etc.

These are money skills everyone can implement. They work. That doesn’t mean it occurs quickly. Short deliberate steps get you there. There is/are no vodoo magic shortcuts. If you don’t start your own business that accelerates wealth building, you have to adhere to proven princples to achieve financial independence over time. Then pass this knowledge to your children.

FS you are having a positive impact on a plethora of humans. I think plethora means a lot but I’m not sure.

Regardless, keep doing what you do FS, it makes a difference. I still love ROTH accounts.

I can’t remember if you recommended “The Great Depression: A Diary,” which is simply the journal of a small business owner, an attorney, during and after the depression. It really helped to remind me that investments should be understandable to you and having the cash on hand to carry you and your business through a long lean time is great security. He noted all of the folks who bought “investments” on margin and how quickly that destroyed so many people. That so many businesses/banks were never actually profitable and were thus terrible investments. That you need to understand who is profiting off of the sale and what their vested interests are. They may not align with your own.

Eeeek That’s one crazy price crash. I haven’t touched cryptocurrencies and have no desire to, not my thing.

Great reminder steps regarding investment decisions. Limiting alternative investments to no more than 10% of your net worth is an important one!

Hey Sam,

The Podcasts are great. they work better for me than the blog and you have a good voice for it. Please keep it up. It helps those of us that don’t get on the blog much.

Knowing that the percentage of the population that is addicted to gambling is not trivial, I’m not surprised at how people invest a significant potion of their wealth in speculative investments they don’t understand — just like people who don’t understand basic probability keep spending night after night at the casino.

I wonder where can these losses be entered on a tax return? Capital loss? Casualty and theft? Or gambling losses?

———

In general,

I think that successful people tend to self select to comment on the blogosphere. One has a lot more energy time and enthusiasm to post their successes rather than their failures. There are a lot of failures out there that have little motivation to relive their downfalls by describing them on the web. The overall picture out there is not as rosy for those who have sought FI and failed. Most failure stays silent.

That being said, in the end, overall gains do dominate overall losses, the difference accounting for economic growth — which seems to be irreversibly accelerating (long term) due to the tremendous and exponentially increasing leverage of technology.

How the hell do you take out a $500k loan to invest in the most obvious ponzi scheme of all time… dear lord! Ponzi schemes aren’t even new!

Just look at the one of first lines in the Wikipedia article for High-yield investment program:

https://en.wikipedia.org/wiki/High-yield_investment_program

“A high-yield investment program (HYIP) is a type of Ponzi scheme

[…]

Operators generally set up a website offering an “investment program” which promises very high returns, such as 1% per day”

“1% return per day” is literally exactly what Bitconnect promised. I couldn’t even believe it when I read that a few days ago.

I hope more people will take your advice on investing. It’s so easy for some people to fall into the hype of something and invest in it without having lots of knowledge. Hopefully more people will read up on something like bitcoin then take action to their best interest.

I’m getting a ruler. I’m going to measure this mattress and see how many bills it can hold…

Honestly im still waiting to get scammed or just flat out lose a ton of money. I do a lot of real estate investing and try to do it as smart as I can with always having clear exit strategies but it seem inevitable that at some point there will be failure.

I have yet to hit any of those failures or lose a ton of money but I do think about it a lot. Its crazy some of those people lost so much money to bitconnect.

No one wants the government’s involvement in their wealth/money until they lose money to some crook. Sigh.

Ah, hubris. The cause of much human suffering. Thanks for this well-needed reality check when it comes to investing.

The bitconnect scam and crypto mania look a lot like how a ringing bell would sound. Same with a Stockmarket posting higher highs and a fear index which seems limp.

Notwithstanding, as I mentioned in a previous post, a (very small) allocation to bitcoin would be great! I would have loved to have some skin in the game during the tulip days of Amsterdam. Cheap lesson and lots of fun during the ride. Oh the memories we could have (or fabulous wealth if this time really is different!)

I’ve done some dough on individual stock picks and then made some to compensate. Currently I am investing like yourself Sam, keeping roughly what I’ve got and prepping for the next downturn by adding to my cash balance.

I think I’d rephrase your second sentence — “one way to guarantee losing out in the long run is by never making any investments.” Risk-free returns are below the inflation rate so what feels safe today will slowly erode over time. Over decades this slow erosion will compound into major losses.

The time-tested investment approach is to dollar cost average into a highly diversified mutual fund or ETF, ideally in a tax deferred account such as a 401k, and to annually rebalance according to your target date asset allocation. It doesn’t matter whether the market indexes, consumer confidence, or geopolitical news flow seems good or bad, you just keep on keeping on with every paycheck.

As for research, there’s no point digging into the individual names held in your mutual funds– there are too many of them and and not enough hours in the day. Major investment losses typically come from trying to outsmart the market whether by picking just one name or market timing. With widely diversified funds all you need to look at is the expense ratio, and choose the lowest one (hint Vanguard usually wins).

Finally understand that this approach does not carry a “never lose” guarantee. Chronic losses are much less likely here than from a get-rich-quick scheme, but they can happen, so you need a cash emergency fund separate from your investments.

After researching for many months, I finally took the crypto plunge. I only plan to buy etherium. I believe it has value. All these ICO’s that are popping up are based on Etherium. I don’t plan to buy any of the ICO’s based on Etherium only Ether. If in the future I ever want to use services like rentberry or musiccoin, I’ll already have the ether needed.

The only other ICO that I’m looking forward to is Telegram. I plan to try and get in on that one. I don’t intend to own any bitcoin or litecoin.

Sam, thank you, thank you for this comprehensive post. This post is golden for a financial dummy like me who’s trying to get into the stock market by researching online, and trying make sound financial decisions. I read your site before I invested in my first two stocks and stuck to numbers 4 and 5. I can’t wait to try out the others. (I already knew numbers 2 & 6.)

I really think people lost money in Bitconnect because their mentality is the same as gamblers, always expecting the next big one on the next roll. I feel so sorry for them. They truly are trapped.

By the way, the comments are also really, really helpful.

Wow, I assumed there were some pretty nasty scams going on in the crypto market because it is a market that is valued fully on belief. I figured there would be some people who would be sold a dream and a stack of lies. I didn’t know there was anything as blatantly fraudulent as Bitconnect going on.

Thanks for laying it out honestly and openly for anyone willing to try and learn. Hopefully some people looking at scams like this read your post and take heed.

Another gut check for an investment is would it make it to the lobby and potentially it fit in a large pension plan’s asset allocation. CPP investment boards allocation in roughly 25% high quality bonds, 25% Real Estate and Infrastructure (ports and pipelines) and 50% public and private equity (mostly public). Those are all pretty un-exotic asset classes but pretty easy to understand.

I like your rule about no more than 10% to alts. I currently have less than 1% in alts but i think the 10% rule is something i will follow through my investing career. if i can find some alts that are interesting enough. I was actually thinking of buying a dozen cows for my alt allocation, also for laughs cause why not.

Great post Sam! I do own some cryptocurrencies on a few platforms like Coinbase. I have less than 5% of my money in this; my wife wouldn’t let me go in with any more (too risky she says). I have spread my bets and bought a little bit of everything. In a way I believe this is the only way to be able to get some gains; diversifying for cryptos. Investing very little so that there is little downside is key. The upside could be very big given the technology behind the cryptos. Many have compared this crypto frenzy to the internet boom of the late 90’s. Interesting thing is that Google and Amazon came out of that boom and bust. This crypto boom is surely going to bust but hard to call the Googles and Amazons from this. Hence, I have decided to spread my bets and diversify with the money I am comfortable losing.

I think unless you’ve gone through a downturn or two you’d think the market only goes up. I’m close to 45 now and should be in more bonds to reduce some risk, but then see rates rising and considering not adding any more as I’m at about 10% along with my muni bonds. Kind of feel like i’m in a pickle with this market. Not sure if I should keep adding to my positions as I get that eerie feeling I’ve seen this before… I don’t have a target # to achieve, but at this point in the cycle I’m beginning to build up more cash than normal.

Instead of being on the side lines completly, I want to take some any extra cash and invest in me. Starting some side hustles for more passive income. I have enough risk in the markets, so its time to bet more on myself. I think for long term growth I still need to be in stocks and ride the market up and down along the way.

I’ll add too, that I wouldn’t have considered sites like Prosper and Fundrise until I started reading your blog. So it’s opened me up to new ideas, so thank you. I consider managing my money as a part time job and I make sure I’m informed as much as possible.

I certainly learned from the Dotcom crash. Just starting out in my early 20’s and piled into only tech stocks with the can’t lose mentality. When it the fan I piled on more money because I didn’t think it would keep going down. Furthering my losses when I eventually bailed and lost 35k in the market. It took me about 7 years to get back to even before the next downturn happened.

However during 2008 I had learned and had a better allocation, so I didn’t get burned as bad. I also learned that just like 2000 it will bounce back, so I wasn’t afraid to get back in. Now with the market at great heights again, I’m putting trailing stops on a lot of my positions. In the past I wouldn’t do that and would ride a stock down because I kept thinking I would bounce back. Or was afraid to take a profit because of taxes. So, i’d rather pay taxes and make a little.

Today have a mix of stock, reits, bonds, CD’s and some money in sites like Prosper and Fundrise along with a rental property. Hope that’s enough to be diversified and thinking of building more cash at this point.

The good thing about losing $35,000 in your 20s is that you were only in your 20s with $35,000! It sounds bad, but it’s great that you didn’t have a lot more money or work close to retirement. You used your experienced a better position yourself and better control your risk. Managing risk is so key, and is probably being ignored by many investors who have less than 10 years experience.

When do you anticipate calling it a day am totally dialing down your risk? Do you have a target Number to achieve?

I think unless you’ve gone through a downturn or two you’d think the market only goes up. I’m close to 45 now and should be in more bonds to reduce some risk, but then see rates rising and considering not adding any more as I’m at about 10% along with my muni bonds. Kind of feel like i’m in a pickle with this market. Not sure if I should keep adding to my positions as I get that eerie feeling I’ve seen this before… I don’t have a target # to achieve, but at this point in the cycle I’m beginning to build up more cash than normal.

Instead of being on the side lines completly, I want to take some any extra cash and invest in me. Starting some side hustles for more passive income. I have enough risk in the markets, so its time to bet more on myself. I think for long term growth I still need to be in stocks and ride the market up and down along the way.

I’ll add too, that I wouldn’t have considered sites like Prosper and Fundrise until I started reading your blog. So it’s opened me up to new ideas, so thank you. I consider managing my money as a part time job and I make sure I’m informed as much as possible.

Unfortunately it’s human nature to be greedy. When it looks like a win-win situation and easy money to be made, people jump in without doing much research or evaluation. I have no idea there’s such lending platform for Bitcoin. Boy that “daily” interest makes absolutely no sense at all.

So about that wife who left her spouse when her spouse lost $40,000 in bitconnect. Is she right for leaving someone of low enough character that they would lose ‘a hell of a lot’ of money in a gamble? Or is she wrong because of the whole for richer or poorer thing? Could it be that the spouse’s investment paid off HUGE despite going to 0 since now the spouse knows her word is so fickle that she can be bought and sold for $40,000? Or should he go after her because two people can make up the 7881.77 hours quicker than one person can?

Ugh you have blown my mind. I no longer feel the need to find a date for the upcoming Valentine’s Day.

That is a great post, no question about it.

But the thing is… I would guess most Financial Samurai readers would not make those “mistakes”.

So… to make this post even more useful, we have to share it… to spread the word… and maybe reach the people who need this most…

Funny, I had exactly the same thought initially – this might be true for the scams that offer ‘guarantees’ and the ability to ‘get rich quick’, but I think absolutely anyone is potentially vulnerable to making these mistakes. It’s hard to know what could potentially tip you over the edge, or when you might be blinded to risk. Even the smartest people can become over-confident in their own abilities.

A bit like ‘responsible’ people who drink and believe they could never become alcoholics… the people who slip up never seem to expect it to happen to them. All the more reason to be vigilant…