According to the Federal Reserve's Survey of Consumer Finances, the average US household net worth is a whopping $692,100! And that's based on data from 2016, when the stock market and real estate markets were much lower.

Therefore, the average household net worth in America in 2022 is likely at least 20% higher, or close to $850,000. By 2030, the average household net worth in America could top $1,000,000. Of course, the average is not the median. But the point is that the average household is getting wealthier over time.

What's also interesting from the chart below is that the average net worth for a college educated person is $1,511,000 compared to a net worth of only $249,600 for someone with just a high school diploma.

Further, the average net worth for a homeowner is $1,034,200 versus only $91,100 for a renter. A 11X difference is massive! For all of you who still think it's wiser to short the real estate market by renting over the long-term, the data does not support your belief.

Redemption For Above Average People

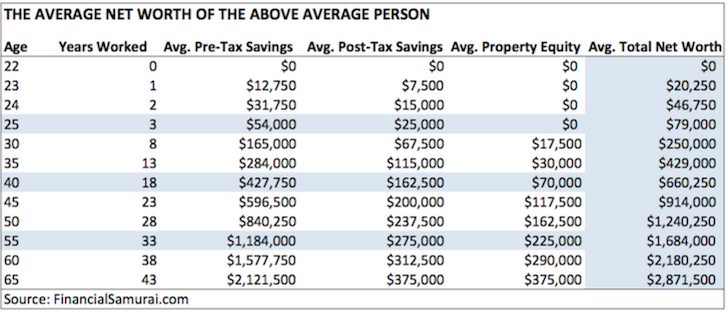

A lot of people have given me grief about my Average Net Worth For The Above Average Person post. People said my figures were too aggressive. Some even said I was out of touch with reality, implying their reality was more real than my reality. Fascinating!

But given the median age in America is about 38, you can see that my estimate of $660,250 for an above average 40-year-old is actually a little conservative compared to the Federal Reserve figures. This makes sense because when I created my net worth guideline chart in 2012, the S&P 500 was 25% lower than in 2016, and the real estate market still hadn't taken off.

Financial Samurai is not an average personal finance site. I want us to achieve financial independence ASAP through aggressive wealth accumulation. We can only save so much, which is why I'm so focused on investing, entrepreneurship, real estate, and alternative investments like venture debt and real estate crowdfunding.

My hope is that we can all live our best lives without needing to live like paupers in a cave somewhere. Aggressive savings is a given precept we should all practice. Financial independence is all about turning our savings into elite money warriors who will defend our freedom forever.

Given the latest data from the Federal Reserve, it's only right that I update my above average net worth figures for 2019 and beyond.

The Median US Household Net Worth

Clearly, the $692,100 average US household net worth figured is skewed by the super-rich who've done extremely well since the financial crisis. But it's still a good number to know if you want to compare yourself to the average.

The median net worth of US households is a more pedestrian $97,300. Median is the middle point where half the households have more and half have less.

$97,300 isn't terrible, but you're certainly not going to be retiring any time soon if that's all you got at around 38-40 years old. You will likely go the traditional route of working until at least 62 when you can start collecting Social Security.

I don't want Financial Samurai readers to compare their net worths to the median because it will give you a false sense of security. If you've got a $200,000 net worth at age 40, you might start patting yourself on the back, when in reality, you're just comparing yourself to the fella that slacked off in school and graduated with a D- GPA!

Here are the median and average net worth by age according to the Federal Reserve Survey:

Under 35: Median net worth: $11,100, Average net worth: $76,200

35-44: Median net worth $59,800, Average net worth: $288,700

45-54: Median net worth $124,200, Average net worth $727,500

55-64: Median net worth $187,300, Average net worth $1,167,400

65-74: Median net worth $224,100, Average net worth $1,066,000

75+: Median net worth: $264,800, Average net worth $1,067,000

As you can see from the data, the average 55+ year old is a millionaire, which is exactly what I expect all personal finance readers to be by the time they turn 55 years old as well. Heck, based on 401(k) alone, we should all be millionaires by 55.

It's reassuring to see that the median net worth amount for Americans eligible to start receiving Social Security benefits is around $200,000. Without any debt, living off a $2,000+ a month Social Security check + $500 – $800 a month in dividend income from $200,000 in investments is doable in most parts of the country.

Note: The current maximum Social Security benefit is $2,788 a month to those who had the maximum taxable earnings for at least 35 working years.

Top 1% Net Worth Levels By Age

Once again, don't get too comfortable with the Federal Reserve figures – median or average. Although the average household net worth is likely over $700,000 today, the average could be so much greater if Americans weren't so addicted to consumerism.

If you really want to get motivated, take a look at the chart I created below highlighting the top 1% income by age and multiplying each figure by an ideal income multiplier to figure out what the top 1% net worth is by age.

Yes, these net worth figures will be difficult to achieve, hence why only around 1% of the population can achieve them. But if you focus on building multiple income streams, continuously take calculated career and investment risks, religiously track your net worth, and stay disciplined with your consumption habits, you'll come closer to these figures than the average American who doesn't focus on their finances until it's too late.

Achieving a net worth equal to 20X your average annual income is the level where the true feeling of financial freedom begins to happen. Give it a go and when you get there, let me know if you agree.

Despite all the doom and gloom about how the average American is woefully unprepared for retirement, we now know that the average American is a big proponent of Stealth Wealth. Congratulations everyone! Time to treat yourself to something special.

My boy needs a new pair of shoes.

Go USA!

Keep Track Of Your Net Worth Like A Hawk

Sign up for Personal Capital, the web’s #1 free wealth management tool to get a better handle on your finances. Run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees.

After you link all your accounts, use their Retirement Planning calculator that pulls your real data to give you as pure an estimation of your financial future as possible using Monte Carlo simulation algorithms. What you measure can be optimized.

Diversify Your Investments Into Real Estate

The combination of rising rents and rising capital values is a very powerful wealth-builder. I highly recommend diversifying your investments into real estate to grow your net worth.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the easiest way to gain real estate exposure.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

What’s problematic about your article is that if the average (mean) and the median are so incredibly disparate, that means that there are significant outliers. In this case it means that the wealth is skewed up to a very small percentage of the population. Only 10% of the population is worth $1,000,000+ while as you noted half the population has a net worth of $100,000 or less. If you break it down even further, the brackets tell a story of a nation where the perceived great wealth if the nation is really only held by a few.

The median net worth and household income has been steadily rising for the past few years now. But yes, the wealthiest households have gotten much wealthier. However, the quality of life overall has improved for all households.

Few would trade being middle-class today for being rich 100 years ago. The quality of life overall is narrowing amongst all classes.

I kinda feel horrified by the average wealth being so high compared with the median, then I knew I’ve forgotten that wealth inequality is much higher than income inequality.

Anyway, I like your optimism, is really likeable indeed, but I also think you should consider that wealth accumulation (sorry if my english is bad) is much more dependent on what you parents and their parents (and so on) did than income, which is more skewed to the present.

I am, or was, a professional macro strategist until a couple of weeks ago and so, at 60, find myself very much in the territory of the Financial Samurai. First, the mean vs. median story is critical and you can see that in Household Incomes as well; the top tier are doing fine whereas the median REAL income is about where it was in 1999. In other words, no real gain. There’s much hype made over recent wage gains but if you extract inflation, real wage gains have been basically zero.

What the median story doesn’t address is that the population is older, which is to day you would expect (desire) that the aging population would have more Household Assets, or net worth, to handle retirement and the risk of a slowing in benefits like Social Security, Medicare to say nothing of the early retirees having to pay for their own healthcare.

By the way, the recent post on the “Negatives of Early Retirement Life” has hit me like a ton of bricks.

“My boy needs a new pair of shoes.

Go USA!”

Hahaha Sam I’m sitting in a public eatery and cracking up. Whoo new shoes! Haha. USA is an extraordinary country for wealth building. There’s maybe only 2 or 3 countries out there slightly better but we’re still the best.

What is actually quite scary here is the fact that the Mean (or average) Net Worth is 7 times the Median Net Worth. That indicates a massive disparity where a very small percent of extremely wealthy individuals or families are skewing the average. The Median Net Worth is really not all that great, especially if home equity is factored into net worth.

@Financial Samurai – what is the “$500 – $800 a month in dividend income from $200,000 in investments” that you mention in the post and on the podcast. Are these dividend growth stocks, CDs, income from an investment trust etc… or are you using ‘dividend’ in the broad sense to cover any passive income generated from an investment.

The 500 to 800 a month is a return of 3% – 4.8% per annum. In your thesis what is it that is generating that ‘dividend’? That was the only point of the post I was unclear on.

HH

Games people play with percentages. Nothing changes. I am not a 1-%er. Nor do I want to be one or even be associated with them. But I have cracked doorways to peek through.

It must be fun just being in the right place at the right time. Or having key pals in exalted locations. Take for instance Mr. K’s buddies of over 30 years ago who were complicit in a semi-rape… For the next week the most significant of the lot are getting week-long vacations (generously paid for by the Republican Party) in Canada, Mexico, or otherwise somewhere outside the U.S. to avoid being questioned by the FBI.

Those in power do whatever the hell they want to and get away with it all the time.

Can one be blamed for Not wanting to be associated with the 1%?

Thank you for the inspiring blog. Just to let you know that the blog is read also in the Nordics. Deapite some things differ (health care, social security, taxation etc) the fundamentals remain the same all ower the globe.

Interesting numbers. Obviously the average is skewed by the very rich, but better to aim at that than at the median.

Would be interesting to look at the standard deviation from the mean and then to aim for 1, 2 or 3 sigmas from the mean.

Talk about the discrepancy between median and average. The large skew one tail of the net worth distribution has really shows the concentration of wealth at the top end. This trend is likely to continue as more people at the top compound their wealth in years to come. Seeing a steady progression on the median level would be much more encouraging for the nation. This would provide more equitable outcomes and comfortable retirements for more Americans.

I’m not in the 1%, but hope to join through disciplined investing and paying attention to our savings rate. Thanks for providing an update with new Federal Reserve data.

The real story here is that Sam has 200 readers with net worth north of TEN Million Dollars… Holy smokes, that’s a crowd of ballers!

If only each one of them could Paypal me just 1% of their net worth, I’d have $20 million and be so rich! Surely, they can afford to donate such a little amount to compensate me for all my efforts over the years.

Sharing is caring!

Hmmm. What I’d love to see is the average net worth in the Bay Area/Silicon Valley….. (talk about a skewed distribution!)

Maybe triple the numbers due to the Bank of Mom & Dad assistance.

“Comparison is the thief of joy.”

After reading this article, I had a nasty taste in my mouth. You can do better than this.

Sorry. I will try and write another article to make you feel better about yourself. Bad Federal Reserve. Bad. All suggestions welcome!

Wow this was a great article. It really gives you insight into the disparity. When you look at Jeff Bezos and his worth it really is disheartening. I read somewhere that he could solve homelessness in the US and would still have billions – yet he pays his employees poorly. It’s hard to comprehend.

Re: net worth of renters vs. homeowners

Um, maybe there might be, just maybe, a small handful of confounding variables here? I would be a sizable portion of my own net worth that the average homeowner has a very, very different income and non-RE net worth profile than the average renter. They also are very likely to have different education levels, professions, etc.

Bill Gates walks into a room full of 40 recent college grads.. on average everyone is a billionaire in the room now.

In a world full of outliers…Medians matter

That’s one big room of 330 million Americans.

Do you not realize that the richest 1 percent of Americans own nearly half our country’s wealth? How can you possibly discount medians, did you stop taking math in 6th grade or 5th?

Using the mean to express average for a skewed distribution is a mistake. Net worth and income are skewed to the right by inequality by the fact that incomes are unbounded at the upper end but bounded by zero on the left (nobody has a negative salary). Only the median gives a representative average in such cases.

Imagine a room containing Jeff Bezos and 9 people earning $50k per year. The mean income doesn’t tell you anything useful, except that using it should be reserved for normal (bell shaped) distributions.

Maybe one solution is to change one’s circle of friends or whom one associates with? I hear you’re the average of the 5 people you most hang out with. But then again… there goes the use of the words average again.

Interesting theory – there might be some truth in it as people naturally select similar people as friends.

This works for any income level, but I’ll focus on top 1%. If you are following the progression in the charts above, you are saving a good chunk of it, and if you are in the top 1%, a large portion also goes to taxes. Do you really need 20x income? Wouldn’t you base it on expenses which would presumably be much lower?

Hmmmm your 1% numbers seem low. I’m 25 and worth over 500k+ self made and don’t live in an expensive coastal city. A few of my friends that are my age have NW north of 100k then the rest of friends/coworkers are closer to 0 from student loans, credit cards, car loans etc.

Doing my best to be a millionaire at 28 like you! I don’t get those IB bonuses though… but my business income seems strong!

GF does quite well also. We’ll hopefully hit 8 figures in my 30s :)

Congrats! What field are you in and what did you study or where did you go to school? Interested if your path is replicable.

I’m not sure if I’m ashamed to be below average or happy to be better off than 50% of the population.

I have to say I love when your blog posts include relevant tables of statistics. For all the interweb noise that currently passes for discussion, your blog is a breath of fresh air in distilling and parsing relevant data for those of us who have forsaken the horribly corrupt (financial) media. I know you’ve developed a relatively thick skin dealing with those who want to nitpick etc…but for what it’s worth, a lot of us get what you’re trying to do and appreciate it.

Appreciate the comment. And thanks for reading!

“Further, the average net worth for a homeowner is $1,034,200 versus only $91,100 for a renter. A 11X difference is massive! For all of you who still think it’s wiser to short the real estate market by renting over the long-term, the data does not support your belief.”

Correlation is not causation. I propose the vast majority of renters are so because they are too poor to buy a house. IMO, owning is probably better than renting in the long term but I don’t think this data point is useful in arguing for that position.

I don’t understand why so many of these comments are negative?

Is it because people are jealous of what others have made and saved? If so I’m in the clear bc I was one of the 4% of readers who voted and had a negative net worth:)

While I may have a negative net worth now I’m working every day to get to the other side by focusing on career, learning about investing/real estate, and practicing self-discipline. I think that is a much better plan than being upset about an article highlighting how wealthy most people are that live in America:)

Anyway, have a good day Sam and keep releasing these hard-hitting pieces.

Love the attitude!

Not sure exactly why there is so much agitation towards the Federal Reserve numbers as well. Either get agitated or get motivated.

Or someone once said, “get busy living or get busy dying.”

I’m not surprised. At the same time, I agree that it could be skewed by the super-rich. They know how to stay super-rich because once you achieve super-wealth, it’s smooth sailing and easy accumulation since the market performance has helped out so much over the past 10 years!

Thanks for highlighting these data points! Wow I wouldn’t have guessed the average or the median. That’s interesting that they’re at those levels based on 2016 data and that the stock market has climbed around 30% since then. I like looking at data points for motivation.