SPAC is an acronym that stands for Special Purpose Acquisition Company. SPACs have been making headlines primarily for helping some notable private companies go public.

As a curious investor, it's always good to explore new ways to potentially make money. But it is even more important to only invest in something you thoroughly understand.

This article will cover all the basics you need to know about SPACs. We'll discuss:

- What are SPACs?

- Who is creating them

- Benefits

- Differences from traditional IPOs

- Famous examples

- Trends

- What critics are saying

A Simple Definition Of A SPAC

A SPAC is a shell company that raises funds in an IPO (initial public offering) with the aim of acquiring a private company, which then becomes public as result of the merger. It's sort of like a backdoor way of going public.

What's odd about a SPAC compared to a traditional company, is that a SPAC doesn't make any products. Nor does it sell anything. A SPAC doesn't have any commercial operations at all.

SPACs are just shell companies created for M&A purposes. Another nickname for a special purpose acquisition company is a “blank check” company because people investing in them don't know upfront what their money is going to buy.

Who is creating SPACs? Today, they are typically formed by a team of institutional investors, CEOs, prominent entrepreneurs, hedge funds, or private equity professionals on Wall Street. Even billionaires, athletes, and other celebrities have created them. Richard Branson and Tilman Feritta are just a couple examples of billionaires who have started their own SPACs.

How Does A SPAC Raise Money For Private Companies?

You're probably wondering why anyone would want to raise money for a special purpose acquisition company to go public when it's just a shell company. To add to that, investors in the IPO don't even know what company the SPAC plans to acquire or if it will even raise enough capital to do so.

One thing the rich do know is that owning equity is one of the best ways to get richer. Of course there's no guarantee that investing in any startup or private company will be a good investment. Most startups fail after all. And plenty of companies that were hyped up before going public fizzled out. But, owning a stake in the rare gem that does take off huge is like winning the lottery.

For a SPAC to be able to IPO, it needs experienced, knowledgable founders that attract interest by their reputation, network, and skillsets. In addition, large institutional investors with great track records are also well equipped to lure investors to hand over their “blank checks.”

As someone once put it, it's like betting on a jockey (the founders) instead of the horse (the company.)

For example, I think Orlando Bravo is a smart guy and good tennis player. We even attended a friend's 50th birthday party in London together one year. Therefore, I may be inclined to invest in his Thoma Bravo Advantage SPAC. After all, his team had the foresight to buy Ellie Mae for $3.7 billion in 2019 and sell it for $11 billion just two years later.

Ultimately, there are many unknowns and uncertainty surrounding SPACs. Therefore, investing in a special purpose acquisition company is not for the inexperienced investor.

Quick Overview Of The Pre/Post Acquisition Process

After a SPAC raises capital and goes public, the management team places those funds into a trust account that earns interest. Then the investors sit back and wait for management to locate a private company interested in getting acquired.

Next, the shareholders of the special purpose acquisition company vote to approve the proposed acquitision. If everything goes smoothly, these investors can then exchange their initial shares for those in the newly merged company. Alternatively, they could redeem their initial shares for their original investment plus accrued interest to date.

Typically, the SPAC management team has two years to complete an acquisition. It's kind of like having a time limit for doing a 1031 exchange to defer capital gains tax. If they're unsuccessful, the special purpose acquisition company is liquidated. And the investors should be able to walk away with their initial investment plus interest.

However, when things go well and a SPAC merger is successful, the SPAC shares merge into the new company. Existing investors can cash out immediately and walk away if they wish because there is no lockup period unlike with traditional IPOs. Or they can go the opposite route and exercise warrants to purchase even more stock, typically at below market prices.

Since SPACs can vary from one to the next, prospective investors should always read the company’s prospectus thoroughly to understand their rights.

Check out this article by the SEC if you want some more technical background on SPACs.

Benefits Of A SPAC Merger Vs Traditional IPO

Why would a private company choose to go public through a SPAC versus a traditional IPO? Here are some of the benefits of going public through a merger with a special purpose acquisition company.

- Greater access to capital via the public market.

- Small and mid-sized companies can access liquidity otherwise unavailable.

- Helps private companies go public faster.

- Access to experienced sponsors and management teams.

- Target companies can negotiate and lock in a price for their stock.

- Helps shield a target company's value from market uncertainty.

- Flexibility to negotiate deal terms.

Despite the benefits, there are also plenty of risks because the transactions are generally less transparent. Further, smaller companies may not be as operationally strong as larger companies that go IPO. As you'll see below, the performance of many SPACs have not been good.

Differences Between A Traditional IPO And Using A SPAC To IPO

Here's a graphic by PwC on the differences between how a private company can go public via a traditional IPO versus through a SPAC acquisition.

Notice how much faster the SPAC merger process can be compared to the traditional IPO route. We're talking 5-6 months vs 12-24 months. It tries to sidestep many regulations that have helped protect investors from unscrupulous businesses.

Examples Of Companies That Went Public Using SPACs

Here are a few of the most well known companies that went public using a special purpose acquisition company.

- DraftKings (DKNG) – One of the best performers

- Virgin Galactic (SPCE) – Extremely volatile but still up

- Opendoor (OPEN) – Recovering

- Nikola Motor Co (NKLA) – At its low

- Butterfly Network (BFLY) – Close to its low

- 23andMe (ME) – All-time low

- WeWork (WE) – Bombed out

- Metromile (MILE) – Bombed out

- Clover Health Investments (CLOV) – Bombed out

Below is an example of Chamath Palihapitiya's SPAC, IPOD, which has yet to name a merger target yet. Chamath has been dubbed the “SPAC King” given he helped bring many SPACS to market in 2020.

As you can see from the chart, there was a tremendous amount of hype for SPACs during the end of 2020 and early 2021. Let’s see what IPOD comes up with. SPACs usually start trading at $10/share, whereas the starting price of traditional IPOs is typically determined by a company or an underwriter.

SPAC trends

Although special purpose acquisition companies seem like a new avenue for private companies to go public, they're not. They've actually been around for decades since the 1990s. But, the extreme stock market volatility brought on by the 2020 pandemic really increased their usage and brought them into the spotlight.

Many companies who wanted to go public, but didn't want to worry about market volatility ruining their public debut chose to go the SPAC route.

SPACs were also an easier way to raise funds, as evidenced by how much quicker the SPAC merger process is than going the traditional IPO route. The the world was falling apart, finding a quicker and easier way to boost capital was paramount.

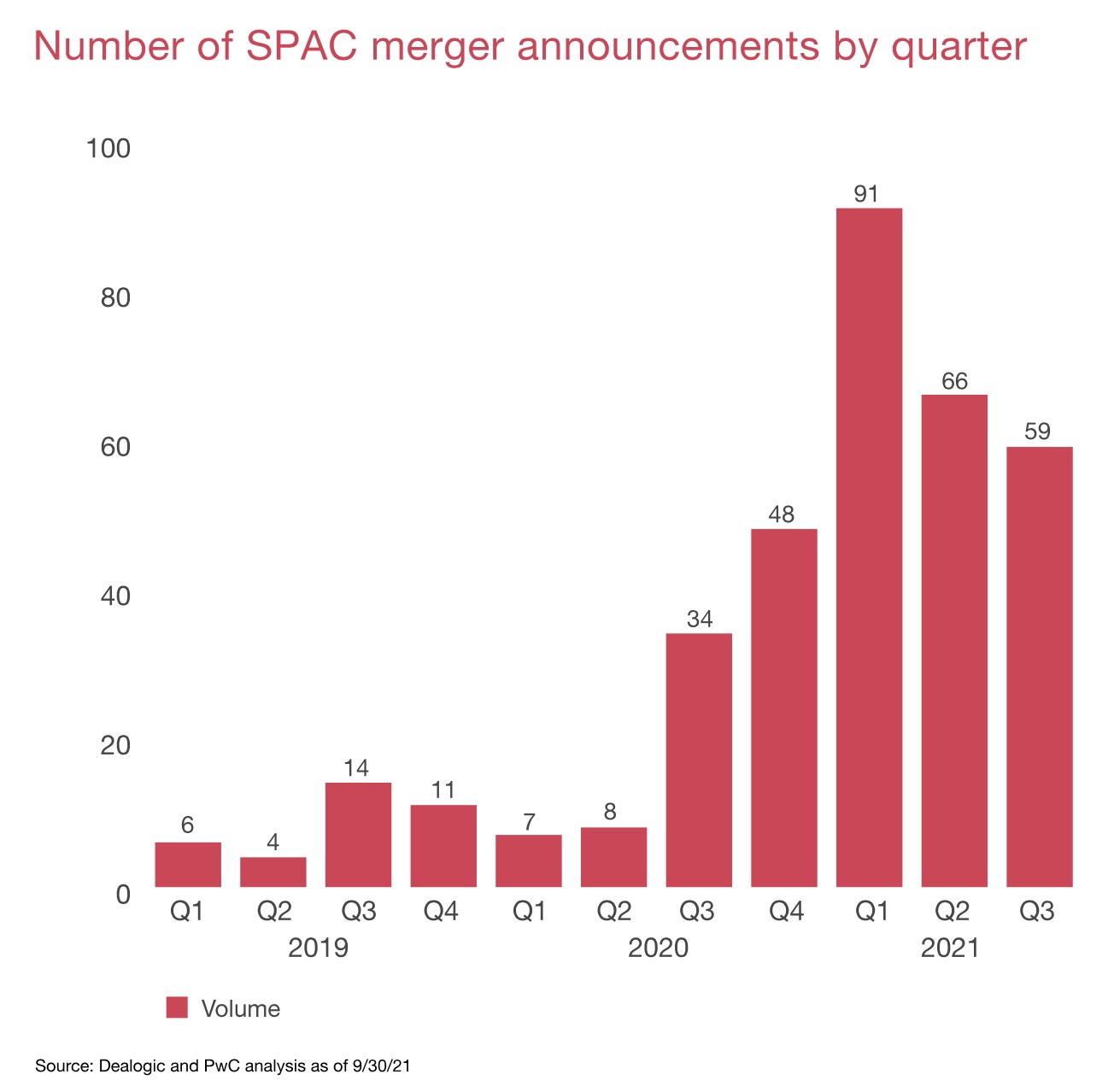

Here are some interesting facts on the trends. In 2020, a record breaking 248 SPACs were listed versus 209 traditional IPOs according to Forbes. And special purpose acquisition companies raised more money in Q12021 alone than all of 2020.

A Lot Of SPAC Bag-holders Forming

Although the rush of new special purpose acquisition companies has started to cool down due to increased regulatory scrutiny, there's still a lot of capital in play.

Q32021 had 88 SPAC IPOs that raised $16 billion. This was a 38% increase in volume from Q2. During Q32021, 59 new SPAC mergers were also announced. But this was more than a 20% decline from the Q1 record.

PwC reports that SPACs who announced mergers in Q3 had -1% returns, underperforming the broader market indices. But SPAC mergers could continue to prove their popularity in 2022 and beyond.

In addition, CNN reported that Goldman Sachs estimates that $900 billion in mergers and acquisitions from SPACs could occur over the next two years. There's already $129 billion of capital actively looking for target companies to acquire.

Unfortunately, just like how the NFT market is collapsing, so is the SPAC market. Beware.

Here's What SPAC Critics Are Saying

Just like with any booming trend like NFTs, there are negatives to consider before investing. Here are some issues that critics of special purpose acquisition companies are wary about.

- Investors go into a SPAC blind without knowing where their money will end up going.

- Not every deal is worth making and shareholders may choose to reject acquisition targets.

- The due diligence process is not as thorough as it is for traditional IPOs.

- Sponsors can end up overpaying for a deal or chose a suboptimal one just to beat the 2-year merger deadline.

- The average returns of SPAC mergers between 2015 and 2020 didn't outperform the average post-market IPO returns for investors according to Renaissance Capital.

- More regulatory scrutiny is cooling down the boom and enthusiasm is fading.

Before you invest in any SPAC, please understand the economic incentives of the SPAC creator as well as the founders of the private company merging with the SPAC.

Key Takeaways About SPACs

Let's recap what we've covered today. SPAC stands for special purpose acquisition company. They've been around since the 1990s, but exploded in popularity in 2020 as more companies looked to raise capital quickly. The increase in market volatility due to the global pandemic made them appealing to both founders and investors.

The people who are creating SPACs lately are Wall Street professionals, entrepreneurs, venture capitalists, CEOs, billionaires, and institutional investors. Investors are drawn to invest in them due to the skillset, experience, and reputation of the founders. Just beware of the special incentives some of these SPAC creators are getting versus the general public.

The sole purpose of a SPAC is to raise capital through an IPO in order to merge with or acquire a private company. There is typically a 2-year deadline for an acquisition to take place. If the management team is unsuccessful in securing a deal, the special purpose acquisition company is dissolved.

SPACs come with many benefits like a faster timeline for companies to go public, greater access to capital and liquidity, and flexibility. But increased scrutiny by regulators, less market volatility, and various risks are cooling down the craze.

Invest In Private Growth Companies

Instead of investing in a SPAC, I'd invest in a private growth fund. One of the most interesting funds I'm allocating new capital toward is the Innovation Fund. The Innovation fund invests in:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Related Investing Posts:

Readers, have you been following SPACs? What do you think about businesses who are choosing to go public by SPAC merger versus a traditional IPO? For more interesting investment insights, sign up for my free weekly newsletter.

Thank you for explaining to us that SPAC stands for Special Purpose Acquisition Company, wherein a shell company raises funds in an IPO to acquire a private company that will become public through a merger. My brother runs a pharmaceutical startup company, and it seems like he needs a valuation for one of the shell companies he is interested in. I’ll take note of this while I look for appraisal experts to hire for the SPAC valuation he needs soon.

SPACs are too speculative for my personal investing habits, but I can see why some investors enjoy the risks and rewards of investing in them. Do you invest in SPACs given your more conservative investment choices, Sam?

My SPAC story. I really liked the idea of investing in a SPAC. The idea of getting in pre-IPO is appealing, but I didn’t like the idea of not knowing the actual business being selected. But then I learned about Beachbody, which had a 3-way SPAC merger with executives I actually heard of, including the former Disney+ exec Kevin Mayer who launched the SPAC. I liked their proposed business model and I invested at a $13 price point. Not far above the $10 Nav floor so many people think is the actual floor. Well, I saw the price drop to $9 as a SPAC. And months after the ipo my shares are worth $5.30. The short sellers ran with it. But I am keeping my initial holding and waiting long haul because it’s not money I need right now. But I won’t be spaculating again in the future.

“spaculating”! Clever!

I wonder how the founders and the creator of the SPAC made out.

Samurai, keep me honest here but I understand the share value in the SPAC is $10 regardless of the actual market sale price so you’re also paying a premium versus the equity value you eventually get in the acquisition. Nothing feels worse than taking a haircut on day 1.

Looks like the winners in the SPAC game are the founders…?

“Looks like the winners in the SPAC game are the founders…?”

… the promoters. SPAC Jesus ! ;-)

https://twitter.com/chamath/status/1397608473991385088

Yes, that is usually the case where the founders of the company benefit as well as the creator of the SPAC.

I wanted to show in this the post how many of the most popular SPACs have NOT done well, except for DraftKings. So buyer beware.

I pass on SPAC. Never bought a IPO either.

I prefer to invest in companies that have proven themselves over several years, and that are going through extreme difficulties temporarily. Tesla was a good example in 2018. Alibaba is another good example in 2021.

Not gonna find good deals like that in IPO or SPAC. Most are either overvalued or don’t have a profit or revenues yet. I stick to what’s working for me.

Plenty of IPOs have done well though. So I wouldn’t discount them completely.

I remember my firm being one of the book runners to take Google public. That was a great IPO!

Google was one of the rare exceptional IPO at one of the worst market time (after the tech bubble crash in 2000-01). I was also not a good investor back then, so I would not have been able to take advantage of it.

I hope I’m better now. Bought Google in 2019 at 1117$. Now up +150%. :)

The problem with IPOs is they usually all come together near a market top. So it’s very hard to make a good investment out of them. I like AirBNB for example. But it is so expensive and they are losing money. I would be very unconfortable holding the stock for long periods of time, not knowing if they will make a profit or not in the future.

But I agree I should evaluate each company on their own merits and not disregard them completely just because it’s an IPO. I try to always improve myself. That’s an area I have to get better.

Interesting stuff man. I’ve heard the word SPAC thrown around, but never really understood what the heck they were. Thanks for making something rather complex so easy to understand. It’s interesting how there’s the two year deadline for a SPAC to find a company to merge with. Sounds like a long time, but it really isn’t that long when you think about it from an investment perspective.

I’m not a single-stock type of investor these days, so I plan to just stick to reading about SPACs instead of trying to invest in them. But if I was back in my 20s again I’d probably take a few bets to try and find a winner and see what could happen. But like you pointed out, even if a SPAC successfully does a merger to bring a company public, there’s no guarantee it’s going to perform well in the market!