Let's say you find your dream home that you want to buy. Unfortunately, everybody else wants to buy your dream home too. With competition so difficult, let me share what to do if you real estate offer is rejected and you still want to buy. Sometimes, a home is just too good to pass up.

I firmly believe the housing market will recover as interest rates decline. With corporate earnings rebounding, strong consumer spending, AI, and mortgage rates coming back down again, I'm a buyer of real estate.

Real estate is one of the best ways to build wealth from the middle class.

Competitive Real Estate Market

There are many times when even after you submit what you think is a great real estate offer, it still ends up getting rejected. This has happened to me more times than I can count because I've been incorporating my “spray n' pray” methodology since 2015.

With the creation of Docusign, once your realtor has inputted the terms, it takes less than two minutes to sign and submit your real estate offer over a mobile phone. And unlike applying to colleges, there is no application fee. Therefore, you might as well submit as many lowball offers as possible. You never know what might hit!

Despite coming up $175,000 or 11% on price and writing a convincing real estate breakup letter, the sellers of the single-family home I wanted to buy rejected me. They didn't outright say no. Instead, they strategically dragged their feet on getting back to me.

Several days after I submitted my counteroffer, they told the listing agent to let me know they wanted to list the property for $1,980,000 on the MLS. Darn. There goes my $1,725,000 offer.

I felt that if they aggressively marketed the place for two weeks with two open houses, two broker showings, and a firm offer date, they would get their appraised value of $2 million or maybe more.

I considered giving up on this property, but with a second child on the way, I wanted more space. Therefore, I deployed several last moves to help seal the deal.

When your real estate offer gets rejected, don't give up. If you really want the house, here are three things to consider.

When Your Real Estate Offer Is Rejected

OK, so your real estate offer is rejected, but you still want to buy the home. Here are some steps to take.

1) Don't be afraid to swallow your pride.

Even if the seller calls your bluff about you submitting your best and final offer, don't be too proud to come up with an even better offer after some time has passed. I've seen too many deals come so close only to never close due to big egos.

Unless they have an exploding offer from someone else, I wouldn't come back the very next day. Instead, I'd wait two or three days to let them digest the magnitude of their decision. This also gives you time to think about whether you really want the property or not.

If you can pay all cash for a house, then see if an all cash offer might sway the seller. Include a fast close and maybe you might just win back the deal!

Whatever your final counteroffer is, make sure the numbers make sense for you. If they don't, move on. There are always other properties that come up for sale.

2) Set a hard deadline.

When you first make a counter-offer with your real estate rejection letter, you may elect not to make a hard deadline to show you are not desperate or because you want the sellers to feel comfortable making the best decision possible.

However, with your final offer, you must include a hard deadline. If you can combine a slightly higher price with slightly better terms and a hard deadline, you may be able to finally get the seller to acquiesce.

Deadlines make people get off the pot and take action.

3) Ask the sellers if there's anything else you can do to sweeten the offer.

Price is the main component for getting your offer accepted. But other things such as the amount of earnest money you put down, your total downpayment, inspection and financing contingencies, and the length to close are all important as well.

Many sellers are too afraid to say what they really want. It's the same thing as your significant other not telling you what she really wants until she blows a fuse and leaves you for someone else.

During your final maneuvers to get your best and final offer accepted, you should specifically ask whether there are any other contract conditions that can be changed to come to an agreement. For example, you could waive the home inspection contingency.

For example, going from a 30-day close to a 21-day close could make all the difference because the seller needs the proceeds to do a 1031 exchange. Or waiving the inspection condition might work because the seller is nervous you'll balk at the pest report.

You just never know until you ask. A real estate offer is often just the first move.

Your Best And Final Real Estate Offer

It's important to realize that if you're deploying my real estate offer strategy, you will get rejected MOST of the time because you are starting off at a low offer price.

In order to get a steal, you not only have to follow all my steps, but you also need to brace yourself against frequent rejection. It's only through constant rejection that you will ultimately win because getting a steal is a numbers game.

My Negotiation Process

As for my real estate negotiation, I told them they had five days to give me an answer on my final offer before I was gone, forever. I mentioned there was this other house I was in talks with just in case this one fell through.

With the five-day deadline, the sellers decided to put their property on the MLS before getting back to me. For them, it was the right thing to do. They couldn't stand not knowing what the price demand might be.

During the five-day deadline, the listing agent kept on asking me to raise my offer price from $1,725,000 to $1,850,000 She said she would be able to convince the sellers to give me the large discount, but I continued to refuse.

The listing agent was highly motivated to make a deal happen because she would earn a double commission representing me as well (a key strategy to use if you are an experienced real estate investor).

Raised My Real Estate Offer

On the last day of my five-day deadline, I decided to raise my offer by $20,888 to $1,745,888 to sweeten the deal. I knew other people were interested in buying the property because I came during a Tuesday open house and stayed for two hours listening to what prospective buyers were saying.

One buyer had come back a second time and brought his parents. If they held another open house on the weekend, I felt my chances of buying the property at my low offer price would drop to zero.

After one tense evening of waiting, the listing agent gave me the good news. She had convinced the sellers to accept my offer! Not only did the sellers not want to risk losing me, but the listing agent also didn't want to risk losing out on at least $15,000 in extra commission.

After my offer was accepted, two other buyers approached the listing agent and wanted to submit an offer. But the listing agent, true to her word, took the listing off the MLS and told the prospective buyers she was already in contract.

Write A Real Estate Love Letter

Finally, I highly recommend writing a real estate love letter to explain why the seller should accept your offer. The key is to make a connection and give the seller confidence the offer will go through.

I have written five real estate love letters that helped me seal the deal and/or get a lower price. A letter takes an hour of your time but could save you thousands.

Reviewing The Housing Purchase

Although I would have much rather preferred to have stumbled across this house in 2014 when prices were cheaper, I feel good about this purchase for the following reasons:

- I got the home for $255,000 or 12.5% below appraised value and $200,000 – $300,000 below market value. Further, the SF housing market has already weakened by 5% – 12% since 1Q2018. If the house had been listed at the peak, it may have gotten closer to $2,200,000.

- The S&P 500 went up about 31% in 2019, which enabled me to use about $500,000 in paper gains to help me buy the property with cash. I've always enjoyed turning funny money into real assets. Losing so much money on paper in 4Q2018 wasn't fun.

- Paying cash feels nice. Despite the significant purchase price, I am less concerned about the price had I purchased the property with a mortgage. Further, the house is 36% cheaper than the one I sold in 2017 that had an $815,000 mortgage.

- The $1,745,888 purchase price is close to the median-priced home in San Francisco of $1,600,000. This means there's more demand/liquidity for the house should I ever need to sell. Further, I bought this home for only $680/sqft versus the city average of ~$1,020.

Great Home Features We'll Enjoy

- The house is roughly 700 square feet larger than my existing home with one more bedroom, one more bathroom, and one more office to accommodate a larger family. Originally, I had considered building another story onto my ~1,920 square foot house. Thus, buying this house not only saved me at least one year's worth of construction headaches but it also saved me about $500,000 in construction costs. Going through the SF permitting process is a nightmare.

- The home has panoramic ocean views on all three levels. I strongly believe ocean view homes in San Francisco offer one of the world's best values because similar properties with water views in international cities trade at large premiums.

- The property is only a block away from our existing house, which means our existing house could turn into the new Financial Samurai office and/or be great for guests.

- I also have the option to rent out my entire existing house or just the upstairs section for income. My ultimate goal short-term goal is to generate an incremental $5,000 a month in investment income to get back to early retirement glory in 2022. Renting out the old house should generate a net increase in income of between $1,000 – $3,000 a month since I will lose some stock dividend income.

- I feel good providing for my family. As a husband and father, this is one of my principal duties.

Enjoying The Property

While much of this article and previous related articles focused on how to get a great purchase price, my main focus was not on making a great investment. My primary focus was on providing a right-sized home for my expanded family.

The house is large enough to accommodate an au pair and long-term guests if necessary. I also foresee a situation where we may have to take care of my parents or in-laws. The ground floor living area is perfect if this situation were to arise.

I'm content with wherever the value of the home goes from here. Our plan is to own it forever.

Remodeled The Property From 2020 – 2022

We expanded the downstairs area from about 300 square feet to 600 square feet. We gutted the place and are adding a full bedroom, living room, full bathroom, closet, and laundry room. Getting a remodeling permit took a year and the whole process took 2.5 years.

It was a painful process, but I'm glad I remodeled. We ended up renting out the top two floors for $6,800 a month and then the whole house for $8,200 once the remodel was complete.

The demand for single family homes on the west side of San Francisco is strong. People want more space and backyards. If you're thinking of buying property in a big city, I would do so before there is herd immunity. People are going to come rushing back.

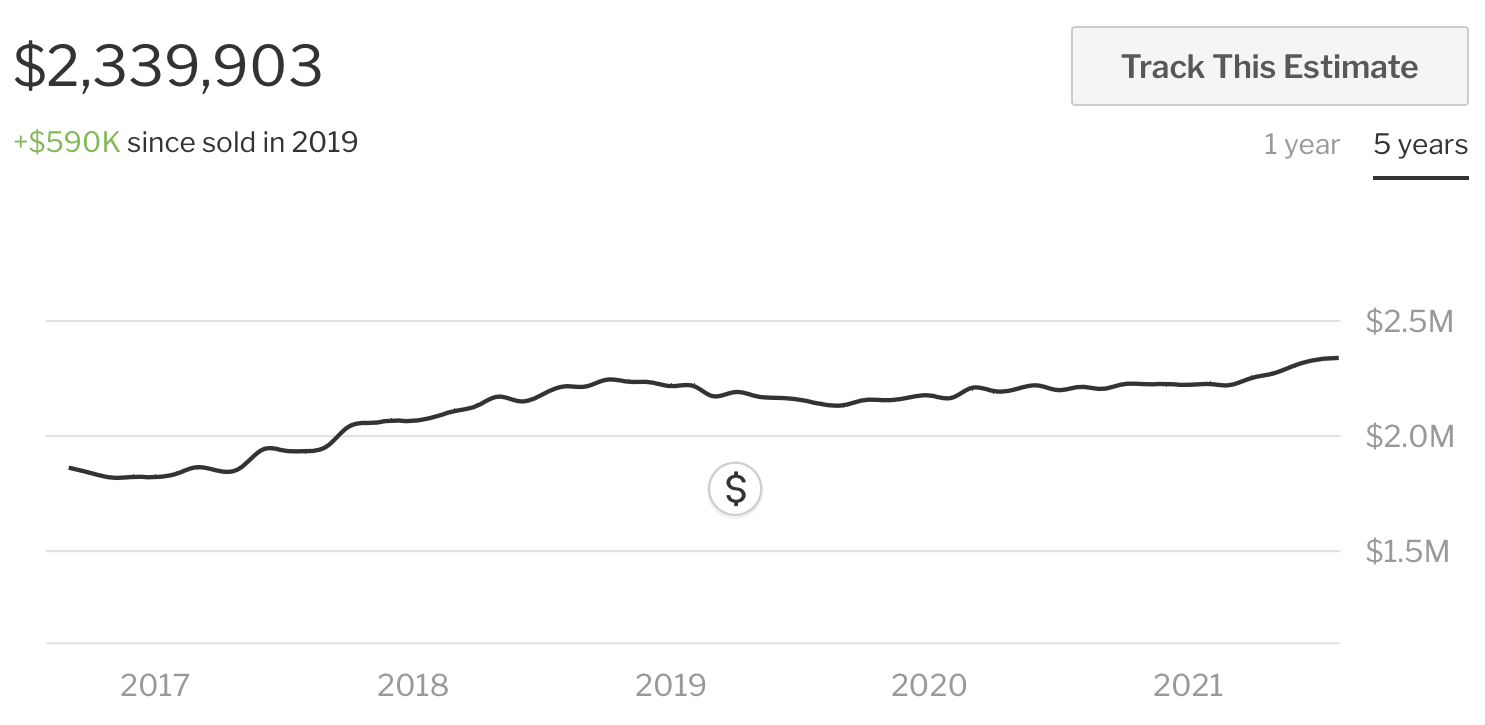

Without heavy negotiating and paying all cash for the house, my real estate offer likely wouldn't have been accepted. Now, the property is way in the money by over $550,000. The pandemic has really made real estate much more desirable since we're spending more time at home.

Recommendations For Real Estate Investors

Beyond owning a primary residence, it's a good idea to diversify your real estate holdings. You don't want to have too much concentration risk in one location.

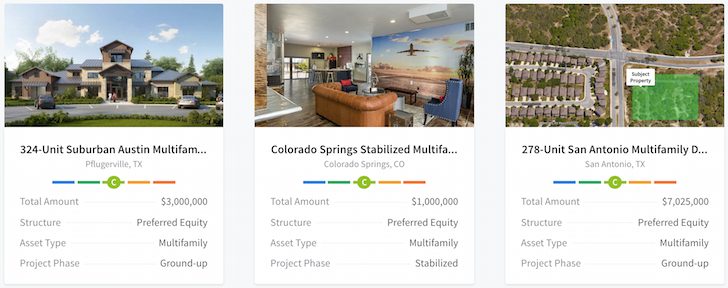

Today, you can invest in commercial real estate via Fundrise and CrowdStreet, my favorite platforms today.

Fundrise offers diversified private eREITs for passive income. Fundrise funds predominantly invest in the Sunbelt, where valuations are lower and yields are higher. For most people, investing in a diversified fund is the way to go.

CrowdStreet focuses on individual real estate properties mostly in 18-hour cities, which tend to be growing at a faster pace. If you are a real estate enthusiast who likes to pick and choose deals, CrowdStreet is a great platform. Just make sure to careful review each sponsor as you build your select portfolio.

Both platforms are free to sign up and explore. I've personally invested $953,000 in real estate crowdfunding since 2016. It's been nice to diversify my real estate holdings and earn income 100% passively.

Readers, what are some other strategies you use to get your rejected offer accepted? Anybody recently taken advantage of rising housing affordability and gotten a great bargain?

I don’t know whether to love or hate the desk in that image ;-)

Congratulations – and awesome view!

Really enjoyed your strategy story, thanks for sharing.

Did either the seller or their agent know who you are?

Do you think knowing might help or hurt (or not matter)?

Sam, congratulation on both your new born baby and fantastic house purchase. In Chinese saying, you have double good lucks which going well for Chinese New Year this Saturday. Not only you are an inspirational investor but also a great young father. IMO, not many father willing to wake up in the middle of night to feed the baby and change diaper. You are an exceptional person which will set a good example for any father. Your wife should really appreciate that you contribute to the family. Regarding to your new home, I like your strategies by full commission for seller agent, paying cash, and shorten the COE times to motivate seller to take your offer. I did the same when I purchase several bank owned properties in 2010. I would like you to add a talking point regarding how to be a real estate developer in the Bay Area. I would like to learn more about real estate developer business such as by demolishing a SFR and convert to duplexes or multifamily units. Thank You and Happy Chinese New Year.

Hi Danny, thank you!

Surely most dads are changing diapers and taking turns taking care of their newborn throughout the night no?

It’s too difficult for one person to do it all, especially with a toddler to care for too!

Happy Chinese NY!

Sweet deal. It’s nice to be able to pick up a forever home at a nice price.

While you state you don’t care about the future price movement of the house, it must be so nice to know that you are starting the ownership off with $250k of equity.

Nicely done!

That’s a crappy real estate agent if she convinced the seller’s to take less money then the market would likely support.

Maybe. Or maybe she believed a bird in the hand was better than trying to catch one in an uncertain market.

Do you split Kings when the dealer shows a King as well?

Maybe or maybe not. It depends on what is important to the seller. Certainly a cash deal with no financing contingency provides a level of comfort for the seller. Some sellers are willing to take less for a quick,easy and certain close. From the sellers point of view there is a cost each day for the property being on the market. In addition to the holding cost there maybe other factors we don’t know about such as the sellers trying to purchase another property but need to sell to buy. Maybe the seller has a timeline to purchase another property?

There is more to consider other than price. Just like your investment strategy, what works for one doesn’t work for another, it depends on motivation of the seller,buyer and outcome needed.

Thanks for letting me post.

Derek

Congratulations on your new home and your new baby! Great follow up post to your real estate love letter. I have learned so much from this site and appreciate all the work and research you do. Keep it up!!!!

Thank you! We feel bless (and exhausted), but mostly blessed.

It’s tough to keep the writing pace going, but I’ll definitely try!

Great summary of tactics. Would be interesting to hear why all cash (unless it’s just to close quick). Will you add a mortgage? I have trouble leaving much more then 50% in a property. All the money sitting there doing nothing when it should be earning me 10+ % in rental property or other assets. Seems like an added $100k to $200k+ a year in opportunity cost.

Sure. Paying all cash is a negotiating tactic. In this case, I think being able to pay all cash (not just a no-financing contingency) helped me save $50,000 – $100,000 off the purchase price.

I know it feels like we can all always earn 10%+/year from our investments given it’s been a bull market since 2009, but sometimes markets don’t go up.

Is the opportunity cost really $100K – $200K when a $1.75M mortgage at 3% is $7,318/month?

How long have you been investing and what is your asset allocation?

I’m for all cash deal to close fast and lower the price. The second offer after some time that’s above the ‘last and final’ with a deadline is a great addition to that approach.

Where I get stuck is not refinancing say $1mil of equity to invest. The 3%?! (or even 4.5%) mortgage vs a 10% ROI investment ends up with $70k a year difference, over 5yrs that a pretty decent sum. If the only option is in public stocks and bonds then I agree it’s maybe not worth it at these prices.

With cash flowing real estate and cost segregation it seems a total ROE of 15% is reasonable – especially if you have other business/earned income at a high tax rate.

I’ve been investing in mostly in small (under 50 people) private businesses for 20 years as well as a little bit of rental residential space for 7 years. Asset allocation is around 15% index funds, 10% real estate, 70% private companies, 5% other. With seller financed deals, 179 year one deductions and decent bank financing I see lots of good returns so it’s harder to look at all those dollars there not working their butts off for me. :)

As always I really appreciate the posts.

I guess it’s a game of riches. Moving money around takes time. And this house is not close to the majority of my assets.

If you can get me a guaranteed 10% return, I’m happy to give you several million to invest for me and pay you a handsome fee!

Yeah – the always optimizing is hard habit to break.

Funny, we are looking at issuing private debt, think around the 10% rate range – not a US government guarantee but solid debt coverage ratio of over 4x and pretty good history. Will see in the next few months. :)

Congrats Sam! How exciting and wow what an incredible view. Seeing the sunset over the ocean every day must be incredible.

Btw I totally agree with your advice on not going back to the seller with an offer right away. Sometimes it’s hard to resist reacting during a negotiation process, it pays to thoroughly think things through imo. Making the other party sweat can be quite advantageous.

Reminds me of a high needs client I had once. I learned to use long silent pauses as my negotiation tactic with him. He would get so antsy waiting for me to say something in regards to whatever request he was trying to get that he would back down on his demands every time.

Sam – Do you submit offers simultaneously for different properties, or do you pursue 1 at a time and then move on to a new one if that doesn’t work out? If you do submit simultaneous offers, do you use realtors? I ask because in our area (NY/NJ) realtors refuse to submit simultaneous offers for more than one property. They claim it is unethical. My position, of course, is that until I have a contract out of attorney review, neither I nor the selller is obligated, and submitting offers for more than 1 property at the same time should be no problem. Curious as to if you have had to deal with this issue.

Interesting question! I can see the moral dilemma here. It’s very rare that multiple properties would have the same offer deadline and that sellers would take more than 48 hours to get back to you.

I would just make staggered offers staggered closely together.

Congratulations for your second child and for the house!

I’ve been reading you for so many years that I feel truly happy for you like if you were a close friend :)

All great news and best way to start 2020!

Cheers from London,

Claire

Thanks Claire! I loved visiting London several years ago. I can’t get how good the chicken shashlik bhuna was at one restaurant off Aldgate East stop.

May you have a fantastic 2020 as well!

Well who knows, next time you visit with your family we can track down that chicken again! I would love that!

Congratulations Sam.

With your multiple posts on the subject I felt like I was there right with you for the journey..

Those panoramic water views look amazing and will be a great selling feature if you ever decide to sell in the future.

And best of all close proximity to your current home will make the move so much easier and also easy to keep tabs on the current home if you ever decide to rent.

Thanks Doc. The water views and the sunset views really are a killer. My regret in 2014 when I bought my other house was not to try and buy more view homes then. That said, I feel I found another opportunity since the p/sqft is only $680 vs. $1,020 median in SF.

I’m actually most excited about the number of new posts I can write on the topic of renovation, home office, etc.

Fun!

Sam,

Where do you find the market trends you report on? “SF market has declined since 1q18” etc.

Or is it just you hitting the pavement all the time creating your own data?

I look at every house I’m interested in and track their final sales price. I also look at industry data (Compass has the best data. They bought Paragon) and compare top down data with bottoms up.

I will fully admit I am obsessed with ocean view homes in SF, and will attempt to see as many as possible that come up.

Thank you Sam. I continue to learn from you and try to mirror your ways though at a much smaller level.

I have been wanting to buy an investment property in Phoenix where we are from for years but keep waiting because I know it “will go down” eventually since I missed 2010 lows. We are thinking of just getting one to get a start and buying another if it turns down. I have been trying to figure out neighborhoods that have the right numbers and was looking for good market data.

Congrats on baby 2 and good luck. I think your son is a bit older than our older son and we already had number 2. It has been really hard to adjust to a new job, try to build our investments, family life, and stay in shape with both in diapers. I am glad you have more time to help. It is a lot of fun seeing them play together.

Hi Josh – Given the large run-up in real estate since about 2012, it’s good to be very picky and patient with the properties you buy. Although I feel like I got a good deal, I wouldn’t be surprised if the SF real estate market falls by another 5% – 10%. But the thing is, I’m buying property first for lifestyle, then for rental income.

I want/need a larger house for my family. Buying investment property is a tougher move. Just run the numbers.

Congratulations Sam!

Personally I have gone back and forth wrt buying another house. Adding the homeless shelter at Embarcadero will cause the prices to fall which brings my larger concern on the SF policies. And the election of Chesa Boudin made me lose faith in my fellow SF residents.

Thanks. If you don’t need another house, definitely don’t buy one.

We needed more space and the location was perfect.

Sam, you are indeed “da man!” Love reading these strategies/thought processes and the what/why you were thinking during your negotiations. Once again, I come away from your blog with a great take-away.

Congratulations Sam! Nice work staying true to your strategy while also putting ego aside, and adjusting your offer to the true reality of the opportunity in front of you. The extra $24K is a drop in the bucket, and I’m sure you will look back at that in 10 years and think it was the best money you ever spent.

Sam – I’m about to go through the home buying process for the first time. It doesn’t look like it’s very common, but if you’ve used a realtor before on the purchasing side, have you (or have you heard of anyone) negotiating a buyer’s agent’s fee down? My wife and I know what we want, and believe we won’t need much hand holding. I’m wondering if anyone asks their buyer agent to kick back a portion of their fee.

It does happen, but ask yourself this – if your agent is willing to give so much of his own commission to you in that negotiation, do you think he will fight as much (or is capable of doing so) when it’s your interests rather than his own? Sometimes you get what you pay for.

I think there is no real way of telling unless you are experienced enough in real estate sales to be able to interview an agent effectively. If you are, then great, you’re just paying the cartel’s price of admission, but perhaps you might be able to also interview a discount agent effectively? If you are not, you’re rolling the dice either way.

If you don’t need hand holding use Redfin. My friend even used them for listing and the agent gave him tips on how to stage the house etc. Of course it was in Soma (SF) so sold quickly

I second Redfin if you know what you want. I bought place using them back in 2011 and at the time they gave a discount and only took 1.5% commission. They also had a clause in place for a resale that they would discount the commission as well. So I used them again for the resell in 2016 and they honored the agreement. Ended saving about 3.5% commission between the buy and the sell. Of course the seller paid for the first commission as well.

The resale clause is genius! Why didn’t I think of that…

Could’ve saved a lot of money :(

We are doing the same thing. We found a realtor and negotiated half her commission as closing credit to us. It is not unusual here. Redfin brought so much competition and technology made agents jobs much easier, so they routinely cut their commissions on the buyer side, too. Our realtor had her own firm, so she does not pay a percentage of her commission to the brokerage. So, she saves money there. But, I should say that between my husband and I, this is the 3 house we are buying, we also had an investment property, and we sold a house without a realtor before. So, we are not first time home buyers, but do not let this discourage you. All that people say about a good realtor negotiating for you is really not true imo. Nobody cares about your money as much as yourself, nobody will negotiate as hard as yourself. Both agents just want to close the deal and get their commissions. In fact, I found agents more detrimental to my buying process, because they would pressure me to buy houses, etc. Negotiating for a house is not really rocket science especially if you are not buying a multi-million dollar estate, look at your comps, determine your number, be ready to walk away at any moment, and do not get emotional.

Love competition in the real estate space, and love Redfin as well (shareholder). More competition the better for homebuyers and sellers!

if your agent happens to be a close friend dating back to college, can be the asset you need. In my case, she’s a much hard negotiator than I am, and offers the right mix of personally detached yet interested in my outcome.

This was a big gain for my swap in mid 2018 when we sought a West Portal home. Still in the mode of fearing outbids, was prepared to bid 120k over her recommendation as my wife was already rather attached to the street. Split the difference expecting a counter, but she told them that was best and final and they accepted. If we had gone with her’s, who knows. On the later selling side for the existing property on a busy road, she was the voice for when to just take the offer and be done with it.

I think I was surprised to find that selling was much harder than buying, but that’s also a reflection of the inconsistent softening of the SF market since the 2018 peak. I’ve seen flawed properties sell well over to the point I think money laundering, and strong ones falter. The right time to be a patient buyer that can take the route FS has put up here.