As a general rule of thumb, the best time to refinance your mortgage is when the cost to refinance is covered within 12 months. In other words, if your refinance costs $3,000, your monthly interest savings should be at least $250 or $3,000 a year. You can also get a no-cost mortgage refinance where you get instant savings.

Refinance cost include fees for the following: appraisal, application, processing, underwriting, title, and escrow. The total usually ranges from around $3,000 – $5,000. Sometimes refinance fees are negotiable. It never hurts to ask and get clarification of where there's wiggle room to save money.

In addition, the larger your loan, the greater the potential for getting a fee credit that goes towards your closing costs. And in general, the larger the loan, the better deal you will get because the bank is making a larger absolute dollar profit off you over the long run.

Best Time To Refinance A Mortgage

The 12-month barometer is on the condition you will live in your house for at least 13 months and preferably much longer. The longer you plan to live in or own your home, the more you can afford to violate the 12-month rule.

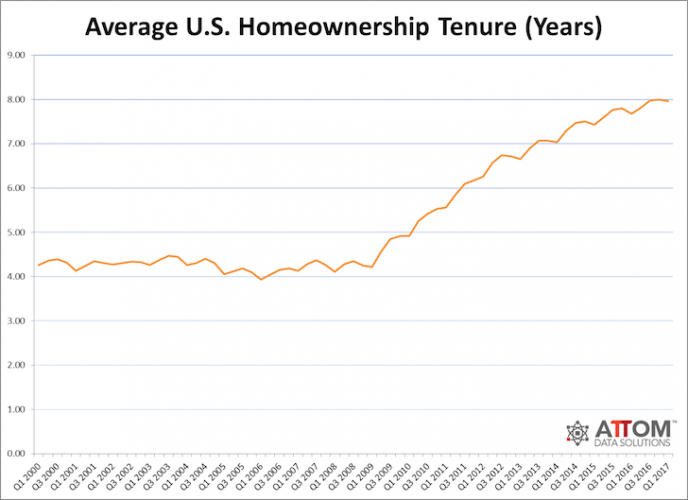

I recommend sticking to at most a maximum 24 months break even given the average homeowner lives in his or her home for only about eight years.

You might think you'll own and stay in your home forever, but things change all the time. You might get married, have kids, get a new job, get laid off, or simply decide your forever home is not for you.

There is also the hassle to refinance to consider as well. You'll have to provide your last two years of tax returns, last two months of pay stubs, and potentially other financial documents to the bank during the underwriting process. Then you'll need to sign a binder full of documents and set up new auto payments.

But if you can cover your refinance cost within 24 months, then it behooves you to put in the effort to refinance. It usually takes roughly 45-60 days on average to successfully refinance a loan.

Related: Why An Adjustable Rate Mortgage Is Most Attractive

Other Good Times To Refinance

Another important time to refinance is when you are about to leave your full-time day job. Once you lose your W2 income, you become DEAD to banks. They will NOT loan you anything without stable income.

Even if you earn $1,000,000 in 1099 freelance income, banks won't count that income towards your loan eligibility. You will need at least two years of 1099 freelance income, if not longer.

Another important time to refinance is when the yield curve starts flattening out or inverting. An inverted yield curve signals a slowdown in the economy, and can often foreshadow a recession within the next 18 months.

See the chart below that shows how a recession ensues every time the 10-year bond yield gets below the 3-month bond yield. The yield curve inverted in 2018 and then we saw a drawdown in the stock market at the end of 2018. The 10Y and 2Y yield curve inverted again in 2022, but has since steepened.

If a recession is really going to hit, you'll be happy to be saving money each month. If the good times continue, you'll be happy to not only be saving money but also experiencing further appreciation of your property.

Compare Mortgage Refinance Rates

One of the best places to get a free mortgage quote is through Credible, as opposed to going to each lender one by one. They have a massive mortgage lending market where they make lenders compete for your business. The best time to refinance a mortgage is when you can leverage technology to save. Click here to check the latest mortgage rates online in just minutes for free with no-obligation.

Once you get a written offer from one of the lenders, I'd take the offer and see if your existing relationship bank can match or beat the offer, especially if you like your bank.

Related: The Biggest Mortgage Mistakes You Can Make

Refinance As Often As You Can

The best time to refinance a mortgage is when you can save. Interest rates will likely stay low for the rest of our working lifetimes because the Federal Reserve has gotten a better handle on inflation and unemployment over the decades.

If you look back since 1980, the 10-year bond yield has been coming down, down, down. There will obviously be mini spikes in between, like what we are experiencing in 2022 and 2023, but the general trend is down. Therefore, I still think getting an adjustable rate mortgage over a 30-year fixed will save you more money over the long run.

Currently, the percentage of loans that are ARMs is only about 5%. However, I expect ARMs as a percentage of total loans will increase again in a rising interest rate environment.

When it comes to growing your wealth, it's all about saving as much money as possible while increasing your income. Not only should everyone take advantage of lower rates, savvy readers should also look towards private real estate opportunities in the heartland of America where valuations are much lower and net rental yields are much higher.

Recommendations

Check the latest mortgage rates online. Access one of the largest networks of lenders that compete for your business. Your goal should be to get as many written offers as possible and then use the offers as leverage to get the lowest interest rate possible from them or your existing bank.

Take advantage of being able to compare multiple real quotes, all in one place for free with no-obligation.

There is a multi-decade demographic shift going on away from expensive coastal cities like San Francisco and New York to the inland empire. Real estate crowdfunding companies like Fundrise, my favorite platform, allows investors to sign up for free and invest in commercial real estate projects with as little as $1,000.

Real estate is absolutely my favorite asset class to build long term wealth. I own my primary residence and three rental properties in San Francisco that have done well for me since 2003.

Buy a home to live in for life and invest in real estate to build your net worth over time. You won't regret it decades from now when you no longer have the desire to work.