One of the most disappointing things about the government is their institution of the marriage penalty tax. The government is smart to laud the act of marriage in order to collect more taxes. When you're in love, what's an extra $1,000 or $10,000 a year in taxes you've got to pay? Love is blind and the government tries to take full advantage of you.

Lucky for us, we are not blind. We don't mindlessly follow everything our politicians have to say.

For example, we question why the government suddenly allowed Roth IRA conversions during the height of the financial crisis. Could it be because the government desperately wanted our tax dollars due to budget overruns? Of course!

We think for ourselves, and that's why the lot of us are going to be much better off than the rest.

Marriage Penalty Tax Income Threshold 2024

For 2024, the marriage penalty tax kicks in starting at $731,201. In other words, if a married couple were single and making over a combined $731,201, it would be better if the couple stay single to save on taxes.

Below are the 2024 federal marginal income tax brackets.

Notice how income thresholds are double until you get to the 35% tax bracket. Instead of doubling $609,350 for singles to $1,218,700, the income threshold only goes up to $731,200 until you have to pay the 37% tax bracket.

The marriage penalty tax is a 2% greater tax on all income between $731,200 to $1,218,700. At the maximum income of $1,218,700, that's an extra $9,750 in taxes you have to pay.

Marriage Penalty Tax Examples With Various Income Combinations

This post will present examples of various fictitious couples with various income levels and deductions to give you an idea of how much extra you must pay the government in order to get married. All data comes from this marriage penalty tax calculator by the Tax Policy Center. You will understand when the marriage penalty tax kicks in by income.

I encourage you to input your own numbers and see what happens after this post as well. Remember, please take your anger out on the government, not on me.

I'm just the investigator trying to shine a bright light on this ludicrous situation. Just the fact that I had to spend loads of time figuring out various income permutations to see when the marriage penalty tax kicks in is maddening.

Marriage Penalty Tax Example #1A

Here are some various marriage penalty tax permutations for several years ago. For 2024, you can add about 20% to each of the income levels to account for inflation and an increase in income thresholds.

In this example, each person makes $50,000, no children, no mortgage, no marriage penalty tax. Hooray!

Marriage Penalty Tax Example #1B

Same example of $50,000 income each, mortgage, but with two children. It shows a marriage penalty, but the overall tax amount is lower due to child tax credits. From $11,638 to $7,863. So far so good. There is hope for humanity, but the government is saying you should have children as singles instead.

Marriage Penalty Tax Example #2

One person makes $100,000 and has a mortgage, another person earns $50,000. They have no children but it doesn't matter even if they did because they are past the $110,000 combined income threshold to receive full child tax credits. A $1,050 marriage penalty is created with their union. Not egregious, but not ideal.

Marriage Penalty Tax Example #3

Each person makes $200,000. They don't own a home, and have two children. The results are the same if they have no children. A whopping $15,162 marriage penalty tax is created for these two high income earners.

Marriage Penalty Tax Example #4

Each person makes $200,000, but this time they have $45,000 in deductions from a mortgage and property taxes. They have two children under the age of 17. The deductions drop their total tax bill down to $92,089 from $104,987 in the previous example, but if they weren't married, their combined taxes would only be $76,825 (17% lower).

Marriage Penalty Tax Example #5

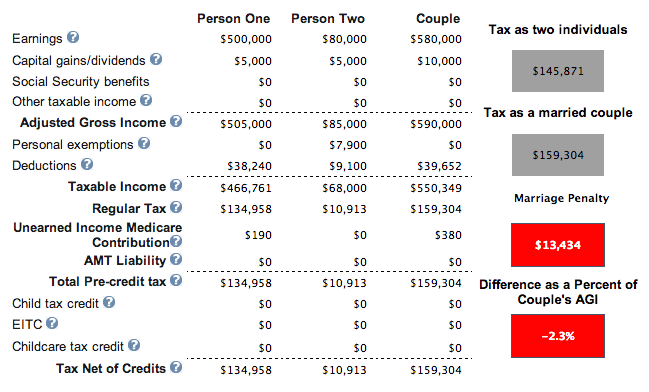

One person makes $500,000, the other person makes $80,000. They own a home with a mortgage and have one child. Lucky for the person making $80,000 to marry the person making $500,000. Not so lucky financially for the $500,000 income earner. After 20 years, this person will have paid $270,000 more in taxes than if he had stayed single or not married with the added $13,434 in taxes a year.

Marriage Penalty Tax Example #6

Two people make $85,000 each and have no kids and no mortgage. It looks like $170,000 in total income is where the marriage income tax starts to kick in.

Marriage Tax Credit Example #7

One person makes $60,000, the other person makes $40,000. There is no mortgage and zero kids. We have a winner! Because the combined income is under $110,000, the couple can decide to have a kid and claim $1,000 per child to lower their taxes even further to $10,638 from $11,638.

Marriage Tax Credit Example #8

One person makes $50,000 and marries someone making nothing. They do not have a mortgage or kids. If they were to have kids, their $3,548 tax liability would decline by $1,000 per kid. If they decide to have three kids, not only will they not have to pay any taxes, they'll “earn” about $700 bucks from the government every year. This is a fantastic income combination.

Marriage Tax Credit Example #9

Here is the beautiful scenario where one person makes $200,000 and one person makes $0. They have a couple kids (doesn't matter), mortgage interest of $18,000, pay state taxes of $12,000, and charitable contributions of $1,000. Why HELLO $7,330 tax credit!

Marriage Tax Credit Example #10

Here is the real home-dinger. One person makes $300,000 and marries another who makes $0. They pay $35,000 in State taxes, $25,000 in mortgage interest, $2,000 in charity and have a child. The $300,000 a year earner saves $11,162 a year in taxes. I tried higher than $300,000 a year and the marriage tax credit starts to decline.

THE IDEAL INCOME TO AVOID THE MARRIAGE PENALTY TAX

Based on my analysis, the ideal income variations to avoid paying the marriage penalty tax are:

1) Have a total income (MAGI) below $110,000 to be able to claim $1,000 per child tax credit. You still get some child credit after $110,000, but there is a drastic phaseout. Depending on deduction levels, owning a home with a mortgage will reduce your tax bill further. It seems that a total income level hovering around $100,000 enables couples not to pay a marriage penalty tax and potentially even get a marriage tax credit.

2) One person with a MAGI $300,000 or below marries someone with $0 income. Example #8 ($50,000 + $0) is a common example that helps many middle class Americans. Then example #8 shows how you can pay no taxes and actually earn money with kids. Example #9 ($200,000 + $0) and #10 ($300,000 + $0) are also a fantastic scenario that can help those living in high cost areas. After $300,000, the marriage tax credit starts to decline.

3) Don't have a combined income of more than $170,000 (Example 7 with $26 penalty) if two people are working, although at $150,000 total income (Example #2 has a $1,050 penalty)! Baffling. Best to just keep total income below $110,000 or have one spouse not work with total income at $300,000 or below.

Worst Income Combination That Pays The Most In Marriage Penalty Tax

The worst scenarios are when you have one high income earner marrying a low income earner or two high income earners getting married. The reason is because 1 + 1 = 1.25 or less e.g. $406,750 + $406,750 = $457,600 for the 39.6% marginal tax bracket for example. The government assumes one person in the marriage will downshift or quit their jobs. How sexist is that?

Meanwhile, in the case of a low income earner marrying a high income earner, the low income earner's income will just get taxed at the highest marginal tax rate. For example, say you make $30,000 and marry someone making $800,000. Your $30,000 is no longer taxed at the 15% rate because it is added on to your partner's $800,000 income to be taxed at the 39.6% rate.

Still Want To Get Married If You're Rich?

With the passage of new tax reform under President Trump, the marriage penalty tax is now practically abolished in 2018 and beyond.

Based on the 2024 federal income tax brackets, there is tax EQUALITY up until $365,600 in taxable income per person. In other words, two individuals who make $365,600 in taxable income and get married for a combined income of $731,200 will pay roughly the same amount of tax as if they were single.

Single filers who earn between $243,725 – $609,350 pay a 35% federal marginal income tax rate. However, married filers that earn between $487,450 – $731,200 also pay a 35% rate.

If there wasn't a marriage penalty tax, the income range for married filers at the 35% rate would be $487,450 – $1,218,700, or exactly double the single filers income range threshold. But it is not!

So if you are fortunate enough to make over $731,200 as two single individuals, you may want to continue staying single.

Benefit Of Legally Getting Married

It used to be the only financial reason to get married is to prevent the government from stealing from you if you die before you start collecting Social Security. Isn't it absurd that if you die early, your Social Security benefits go back to the government and not to a designated family member?

By legally marrying someone, your surviving spouse gets to at least collect your Social Security benefits when the time comes for distribution.

Yes, there is something to be said for following tradition and being a romantic. I'm sure some reading this will think, “Gawd, love is not just about money you know!”, which is true. Now finally, we can all marry and not have to pay the government for such a privilege!

Achieve Financial Freedom Through Real Estate

If you want to pay less taxes and make more money, one way is by investing in real estate. Rental property owners get to deduct non-cash amortization expense each year that lower their taxable income.

Real estate is my favorite way to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $954,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Here are the two main private real estate platforms:

Fundrise: A way for all investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and now manages over $3.3 billion for over 400,000 investors. The company primarily invests in residential and industrial real estate in the Sunbelt region, where valuations are lower and yields are higher.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. You can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Related marriage penalty tax posts:

The Average Net Worth For The Above Average Married Couple

Financial DEpendence Is The Worst: Why Every Spouse Should Have Their Own Bank Account

You deliberately biased this entire analysis. Where are the tax rates for Married filing Separately? There is no penalty in that case, but that would undermine your whole piece, wouldn’t it. Can’t have that! You have a bone to pick and facts be damned! And you want people to pay you for advice?

Why so angry? Shouldn’t you be happy 99% of couples getting married no longer have to pay the marriage penalty tax?

Where am I asking people to pay me for advice? Everything you read on Financial Samurai is free.

If you are having a difficult time with taxes or with your marriage, please focus on fixing the root of the problem.

Im still very conused and i dont see an example from the little amount i and fiance make… i make 24,000 and he makes 10,000. We have 2 kids… i really want to get married but i cant afford a penalty, we already dont make enough…are we safe?… taxes are so confusing to me… :'(

Evelyn – Being that both you and your partner do not have high income, you would *not* experience the marriage penalty. In fact, marriage (and the fact you have kids) would provide you with some benefits at yearly tax time. The marriage penalty typically kicks in when both partners are high-income earners (think around $100K/year and more each incomes). When they marry, their income bracket jumps up even more, usually costing them several thousand in taxes at tax time. Typically, the marriage penalty would also *not* kick in if one spouse was a high-income earner but the other earned low or no income. But for you, you definitely would not take a hit in marriage with your current financial income. On a side note, is that accurate that you both only make a combined income per year of $34,000? Where in the US do you live on that kind of income?

Thanks for posting this reply. Me and my partner have almost the identical income as Evelyn’s family and I found your post very helpful. I make around $10-13k a year (12 years in same profession), my boyfriend makes $24k (bachelors degree). We have one child. You asked Evelyn where do you get by on that kind of income? Well, if it’s helpful we live in a college town in the SE. We rent a 2 bedroom apartment downtown ($725 a month), own 1 car, walk or bike to work. We too want to get married but have been worried about a lower tax return, as that has been our safely net.

Never replied in triplicate. Seems like the govrnment will pay you or at least make it so you all will have no tax once you reach 5 person house so go for it

This is so helpful! But check your info about there not being a marriage penalty under the new tax plan. My husband and I got a $6k penalty. We have a situation where I am the higher earner and own property. He makes 1/3 my income and would normally benefit from the standard deduction. Once married he couldn’t use the standard deduction and my deductions essentially had to be applied to both our incomes. Major bummer.

Please do this one for 2018/2019 taxes!

Sure. See: The Marriage Penalty Tax Has Been Abolished – HOORAY!

It would be interesting to see how things change with this new tax laws for 2018.

I think overall, it wil significantly reduce the marriage penalty for most (unless you’re in the top bracket). If you’re in a high tax state, you’re capped at 10k for SALT for married couples but if you are two single, you can both claim 20k for SALT. I don’t think this will affect many couples but is somethign to consdier. Otherwise, the new plan essentially eliminates the penalty.

Wow. I’m happily married, but I wonder if we should get a divorce. $125,000 joint income, no kids, no property. Just some student loan interest to write off. We don’t WANT to own a home nor have children. We just want to figure out how to keep more of our money. This stuff is all so overwhelming. Thanks for laying it out. It is a little easier for me to understand.

Great read! I’ve been fidling with this concept and that same calculator you used for quite some time now. We aren’t religious or care for traditions much but my GF is your typical girly girl believing in whatever romantic fantasy/rite of passage comes with marriage. After sitting her down and telling her we’d likely owe ~5k more in taxes a year and this number will only go up as we continue to work, she quickly saw the light. We also live in NYC, which is probably the worst place in the country as far as taxes and cost of living go and there’s zero chance that either of us are capable of supporting the other.

We ran the calculator a few times and with our 35k of mortgage interest and property taxes (I made 160 and gf made 100), we get around 3k of tax penalty. But if you look closely at the tax brackets, the penalty really kicks in hard after a combined MAGI of $230k because that is where married filing jointly goes from 28% to 33%.

We then ran another scenario where I made 175k and she made 150k (combined of 325k) and the tax penalty more than doubled to 6k! And then we added scenarios where we had kids and another property, rental income etc. and we easily surpassed 10k. Safe to say, we know what must be done now.

Nevertheless, we will still have a wedding, rings, and all the other nonsense because well? We can and it’s a good party. However, we will NOT go to the courtroom to sign that piece of paper stating we’re “legally” married. Because, why must I have the government tell me we are committed to each other? That little piece of paper could cost of up to half milion dollars by the time we’re done working! And even if we were religious, I’m not sure why that piece of paper is so important because the ceremony is at a church, administered by a priest no? Not some paper pusher at the local courtroom.

You absolutely don’t need to register and pay more taxes to demonstrate your love for someone else!

Best of luck! It’s nice to keep things simple. Think about all the vacations you can spend with your extra tax “savings”!

Check out: The Average Net Worth For The Above Average Married Couple

Hi Johnny!

My BF and I are in the same boat as you. However, it can sometimes be tricky to find an officiant that will “announce you husband and wife” if they don’t see the legal paperwork….it’s something about it could jeopardize their job/title. This doesn’t mean you can’t find one, but it might be tricky to find one on board with you plan.

Another idea though is a symbolic wedding! Mexico does these where it’s the whole wedding without the legal part. You can do it legally in MX as well, but that requires bloodwork and who wants to give blood to the MX government?? So look into a Mexican symbolic wedding. I think some other Caribbean countries do it too, but MX seems to be the easiest.

I agree with Nikki on the symbolic wedding. My brother and his wife got married at the court house months before they had their wedding. Our family decided to do a Caribbean destination wedding for them, had a symbolic ceremony on the beach (I asked my boyfriend to play officiator, which he did an amazing job at), booked a nice reception at a fancy venue for 50+ guests, cake, band, photographer, the whole nine yard! Half the guests knew they were already married, but it didn’t make the wedding any less special. Everyone had a blast celebrating their belated “I do”.

So back to the topic of this article, my bf and I have been living together for 7 years now, no kids, no mortgage. He will finish residency in a couple of months and his salary will jump from upper 60K to 300K at least, and will continue to rise each year. I’m currently in residency as well, and when I’m done in a couple of years, I will be starting out at around 200K. We will both have student loans to pay back. We plan to get married next year, settle down, buy a house, and start our little family in the suburbs. I’m almost positive the better decision for our situation is to not make our marriage legal.We’ll still have a wedding and everything, but no one needs to know we aren’t legally married on paper. That’s between me and him. I haven’t discussed this with him yet, but hopefully he agrees. If not, I’ll let him read this article (thanks Sam for the great info!).

I’m glad to see these comments still going because this topic is of great interest to me! I mentioned to my husband the topic of marriage (at least officially) not being “worth it” from a tax standpoint. After he was done being insulted, he mentioned the problem of inheritance. When you are married and one spouse dies, the deceased spouse’s property automatically goes to the surviving spouse without estate tax (unless you specifically designate a different beneficiary in your account). I guess there are problems with estate taxes if you are not legally married? Maybe someone could weigh in on this? His point is that by not being married, you save taxes now, but could be burned down the road.

Hi Frankie! Your husband asks a great question, and my fiance and I have already looked into this. Estate taxes (and inheritance taxes if your state has it) vary state by state. Typically estates are exempt of being taxed until it reaches a certain value amount. That amount could me several million dollars or as low as about $650,000…which is still decent.

Secondly, it’s all about titling! Your house. If it’s only in his name or only in your name and you’re worried about probate being that you’re legally unmarried, you do one simple thing: you title your assets in BOTH of your names. For example, the *mortgage* is only in my fiance’s name just because he got a better interest rate than when I tried to get on it. However, that doesn’t mean I can’t also be named on the deed. This idea would follow to anything else you want to be sure goes to each other if one passes away: vehicles, boats, rental real estate, etc.

If you have individual bank accounts, you can make them POD (Payable on Death) to your non-legal spouse. These forms aren’t always easily found on your own, but just call your bank and tell them you’d like to add a POD name to your account. This way, if you pass away, that person listed will have access to those funds.

For more info on state-by-state estate taxes and inheritance taxes, you can start at this link and continue Googling the topic:

https://taxfoundation.org/blog/does-your-state-have-estate-or-inheritance-tax

Regarding something different, social security, only legally-married couples get expect to get their spouse’s SS check if they pass away. BUT, there’s a dirty little “secret”…saw it happen to my own grandfather. His wife of 67 years passed away and because her SS check was less than his SS check, he does NOT get to continue getting her check after death. How messed up is that??!

Have your wills written. Have you health directives written!! Yes, they can be challenged, but honestly, this is where it comes into play that no one but you guys should know that you’re not legally married. That in itself is a protection if you ask me. Even if you think a family member is “cool” with it, don’t tell them. If things ever got bad where one of you is in the hospital, you are husband and wife and no one will challenge you like they will if they know you’re not really married.

I know I am late to this discussion, but you laid out the marriage penalty really well. My husband made $360,000 and I made only $47,000 last year (only worked part of the year). I thought I withheld the appropriate amount from my paycheck but because of my job (I was a SAHM the year before), we ended up owing a ton of money. The accountant ran the numbers and said I only made a net contribution of $23,000 to the household income. So that’s half my small salary that disappeared. I told my husband we would be better off getting divorced and he was not amused. So is the government telling me it’s not worth trying to find fulfillment while my kids are at school? Can you explain how my husband’s income gets taxed at 39% and I effectively get taxed at 50%? I know these a “rich people problems” and nobody will sympathize, but I put in my day’s work like everyone else. Thanks.

That is correct. Government uses tax laws to persuade you to stay at home and make it uneconomical for you to find outside career interests.

Most people have no idea about the tax penalties bc most people make less than 100k each. But discrimination is still wrong, even if you aren’t being discriminated against.

Thank you very much for your thoughtful and quick response. I am shocked that I gave up my summer vacation (didn’t accrue any vacation days yet) and put my kids in camp, only to make that little. I do feel pressure from the job market to work–I feel like I would be permanently unemployable if I have another long period of unemployment at my age. But the government penalizes me for working–so I’m screwed either way. Great!

How about this example?

One person’s income is $115,000/year and the other person is $220,000/year. No children. Mortgage. Rental income.

Thank you!

Those are two relatively high income earners. My guess is that you will see a tax penalty of about ~$4,500.

Thank you for your thoughts! I also have talked about this with my tax guy and he’s gonna run our 2014 taxes with both married statuses so we can compare all 3 options (single, married separate, married joint).

I wanted to follow up on this and say that @Financial Samurai is pretty much right on the money (no pun intended! lol) My fiance makes over $200K and I make over $100K. We have no children. We have a mortgage. We have rental income. We are exactly your example. We had our Enrolled Agent run our taxes as married filing jointly, and it made our taxes go up over $5,000!

So until that marriage penalty doesn’t cost so much each year, we’re just not going to get legally married. Instead we have umbrella insurance to help protect assets if sued. We have all our major assets titled in both of our names. We have other paperwork in place to protect each other such as Advanced Health Directives, Wills, Power of Attorney, and trusts. Hope this helps!

Good thing you are “only” paying $5,000 extra. I’ve seen many worse cases with your income levels!

I know this is an old thread, but I saw the comment on annuities and thought I’d put my two cents in. I did well in an IRA that I had and basically wanted to just create an income stream that I could not lose in the market. With rates super low the options were not that plentiful. I stumbled into an old article I kept from the Wall Street Journal about secondary annuities. Basically what the deal is, is that you are buying other people’s payment streams that they sell to an intermediary. The returns are markedly higher than buying a single premium immediate annuity. Personally, I don’t want people to be looking at this option because it creates competition and reduces returns. I know there are a lot of people who hear the word annuity and cringe, but that’s their loss. I’m perfectly agnostic about what vehicle provides me with a safe and decent return on my money. The main issue is these products are illiquid, so if you might need the money for something else soon take a pass. Thanks for your blog and best wishes “S” man :)

A big issue is USA’s immigration laws. You have no choice but to marry your long term girlfriend if she isn’t from America. She won’t be able to live in the country for long periods of time with tourist visas. The year we got married was my first year working in the US after college. I made $52,000. My wife couldn’t legally work so we were example #8. Now she works and I’m making more so we are starting to hit the marriage penalty. The government are a bunch of thieves. :)

Sorry you had to marry her! J/K :)

Yes, the gov’t is smart in taking as much money from people as possible. Good thing the masses don’t realize this, or else there would be a revolution. Go John Galt!

[…] Taxes ($185,600, 40% effective tax rate): The government doesn’t believe in two high-earning working spouses. They want one spouse to stay at home and take care of the kids. If they didn’t, why did President Obama campaign aggressively for $200,000 + $200,000 = $250,000 before taxes go up for the top? Equality would dictate that $200,000 + $200,000 = $400,000. Living in NYC is expensive due to Federal, State, and City taxes. Unfortunately, NYC is where the jobs are. This couple is paying roughly $8,000 – $10,000 extra a year due to the marriage penalty tax. […]

[…] and promise to write laudatory words about government-backed things such as Clash For Clunkers, the marriage penalty tax, ROTH IRA conversions, and taxation based on sexism. I mean, if the median household income is […]

Great article. Thanks for giving the many examples. Is there a place where I can use to play around with our numbers? Trying to toy around the idea of ‘if it is more beneficial for the lower income person not to work’.

Thanks!

I had always wondered of the reason you never got married was financial. I have my answer.

Who says I’m not married? :)

[…] would like to ensure your Social Security benefits don’t go to waste, a good strategy is to delay marriage for as long as possible to avoid paying the marriage penalty tax, then get legally married at the age of 61, a year […]

I am a novice when it comes to tax filing and all things tax. I am newly married. Using the Turbo Tax software, I entered our income figures two ways, married filed jointly and married filed separately. The outcome of filing separately was more advantageous. How did that happen?

Love this post! I was just writing a blog post on this exact topic ) because I’m of age to get married and now don’t want to!

I want to have kids, a husband (I’m already living with my partner of 8+ years and we are going to aim to have our first kid in 2016/2017) and a stable life… just marriage seems so antiquated, silly, and costly!

If I got married I definitely would be more interested in being a stay-at-home mother but that would be such a waste — I’m going to work and as my salary with bonus at 30 has ranged between $120k and $150k I can only imagine I will earn that or more throughout the next 30 years. Even if I consult and half that when I have young kids I’ll still make too much to see any benefit from marriage (I’m assuming my partner will make at least $50k per year if he goes the social services route he’s thinking about… he currently makes $90k.)

I brought up the idea of NOT getting married to him today and he seems really sad about it. His parents were never married so I know it’s important to him, but I’m hoping the numbers speak louder than feelings. We can still have a ceremony and discuss our lifetime love for each other… and then pay for that ceremony and then some with the tax savings from not getting married!

I’m still not sure… but I can’t find a good reason to actually go through with legit marriage if we both plan to keep working.

Ran the calculator at $110K and $74K incomes (so $184K combined), no kids, $20K itemized deductions. Difference was only -$171. Not enough to lose sleep about.

That’s good.

$200,000 is the magic number. Sounds like you have some good mortgage interest.

About $5k is mortage interest. The rest of the deductions are sales taxes, charity, and property taxes (doubled up this past year since paid in Jan and Dec).

Wow what an eye opener. I’ve heard about the marriage penalty but never seen it laid out like this. We’re thankfully currently in the category of one person earning a lot and the other earning nothing (my wife is staying home to take care of our son). Still able to get the full child credit because of 401k and HSA contributions. I hope we can maintain this ideal situation as it’s working out great for the family.

Crazy for many huh? You are in a sweet spot with your marriage situation. Congrats! Now help make everyone feel like they are benefitting financially too by spreading the world about this inequality. Thanks!

love this post. Ive been preaching about the marriage penalty for years and it is the very reason my “partner” and I decided NOT to get married. most people have no idea that a significantly increased tax burden awaits them after marriage.

When you ran your scenarios for people who have kids did you include the ability to file head of household? My partner and I make ~$220K/year combined and I file her as head of household which reduces her effective rate to ~6-7%.

Incidentally I saw this article today which I thought you might find amusing:

Yes, there is such thing as a girlfriend tax break! More reason not to get married I suppose.

Incredible! And one person can make up to $250,000 before the phaseout begins.

I might have to write a dedicated post about this!

The scary part is how comparatively low the individual incomes have to be in order to be hit with the marriage penalty. One of the reasons me and my partner decided not to get married after we had a child is the realization that we would have to pay 10k extra in federal taxes for the privilege to be married. In the last 3 years we have saved $28k, and that is the years we counted the difference, I am sure the actual number is larger if we counted all the way back to when we moved in together.

The more the government can punish, the more the government can control people to do their bidding.

Glad you are saving $28,000 after 3 years and doing what you want to do. Don’t let the gov’t keep you down!

Awesome analysis! Had no idea that the tax situation would change so dramatically in those different situations between being married and being single. Think we’ll see more high earners choose to remain single?!? What if you live together long term?

Yes, sire. We will see more high income earners stay single and just cohabitate.

This post is fantastic. I’ve always wanted to know where the sweet spot was and you did a nice job showing the breakdown. We fall in category #5 except we have 2 kids and I was always peeved when I saw my paycheck and how married filing jointly hurt my income (by about $6000 per year).

So to be clear, the $13k marriage tax hit you calculated in scenario #5 does or does not include the hit to the lower income earner? Not understanding how the higher earner is “not so lucky financially” when the lower earner is getting hit harder (percentage wise)!

Congrats for being in #5 in terms of income.

The way I see if, if the high income earner never married the low income earner, they’d have $13,000+ more a year in example #5. Is that you? I hope s/he is worth it!

For the low income earner, all is good cause s/he is living a better life than if s/he was single at $80,000.