Are you looking to buy investment property? Smart move given there is an undersupply of homes and the economy is strong. This article will discuss how to correctly value and analyze an investment property for maximum potential profits.

I've been a real estate investor since 2003 and have made millions in capital gains on multiple properties since. At the same time, I've also lost hundreds of thousands of dollars in a vacation property before due to bad timing.

Unlike stocks, there's no easy way to ascertain the exact value of your current property or the property you plan to purchase. As a multi-property owner I'm glad there aren't any ticker symbols jumping around every weekday because they are just a distraction. I want to share how to correctly value and analyze investment property.

Real Estate Is The Best Asset Class To Build Wealth For Regular People

Getting wealthy in real estate is all about buying, maintaining, and holding for as long as possible. You want to let the power of compounding work for you. With stocks, plenty of people got scared and sold at the bottom in 2009 and again in March 2020. With real estate, it's much easier to hold a real asset for the long term.

Real estate currently makes up around 50% of my net worth where it will stay for the foreseeable future as I focus on entrepreneurial endeavors. Real estate also is responsible for about 60% of my passive income. Without real estate, I wouldn't have been able to retire early in 2012 at age 34 to live free.

Since 1999, when I worked in finance, I have invested the majority of my income in real estate to diversify away from equities. And due to this long history, real estate has become my favorite asset class to build wealth.

Boost your wealth through private real estate: Invest in real estate without the burden of a mortgage, tenants, or maintenance with Fundrise. With almost $3 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate. I’ve personally invested $300,000 with Fundrise to generate more passive income. The investment minimum is only $10, so it's easy for everybody to dollar-cost average in and build exposure.

How To Correctly Value An Investment Property

It's all about income.

As a real estate investor you must ascertain what is the realistic income the target property can generate on a sustainable basis year in and year out. The current and historical income figures are what matters most.

Once you have a income range then you can calculate a property's gross rental yield and price to earnings valuation to compare with other properties in the neighborhood.

Rental properties are much more valuable today because interest rates have come way down. In other words, it takes a lot more capital to generate the same amount of risk-adjust income. Therefore, I'm a buyer of rental properties post-pandemic. Rental properties have not gone up nearly as much as they should.

Price appreciation is secondary.

One of the big reasons why there was a housing bubble and then a collapse was because investors moved away from the income component of the property and just focused on potential property appreciation. Investors didn't care that they were hugely cashflow negative if they could ride the wave and flip for profits within a year or two.

Once the party stopped, speculators got crushed which caused a domino affect, hurting those neighbors who planned to buy and hold. If you are primarily focused on property appreciation and not income, you are a speculator. There is no real value for real estate if it does not generate income or save a person on rent.

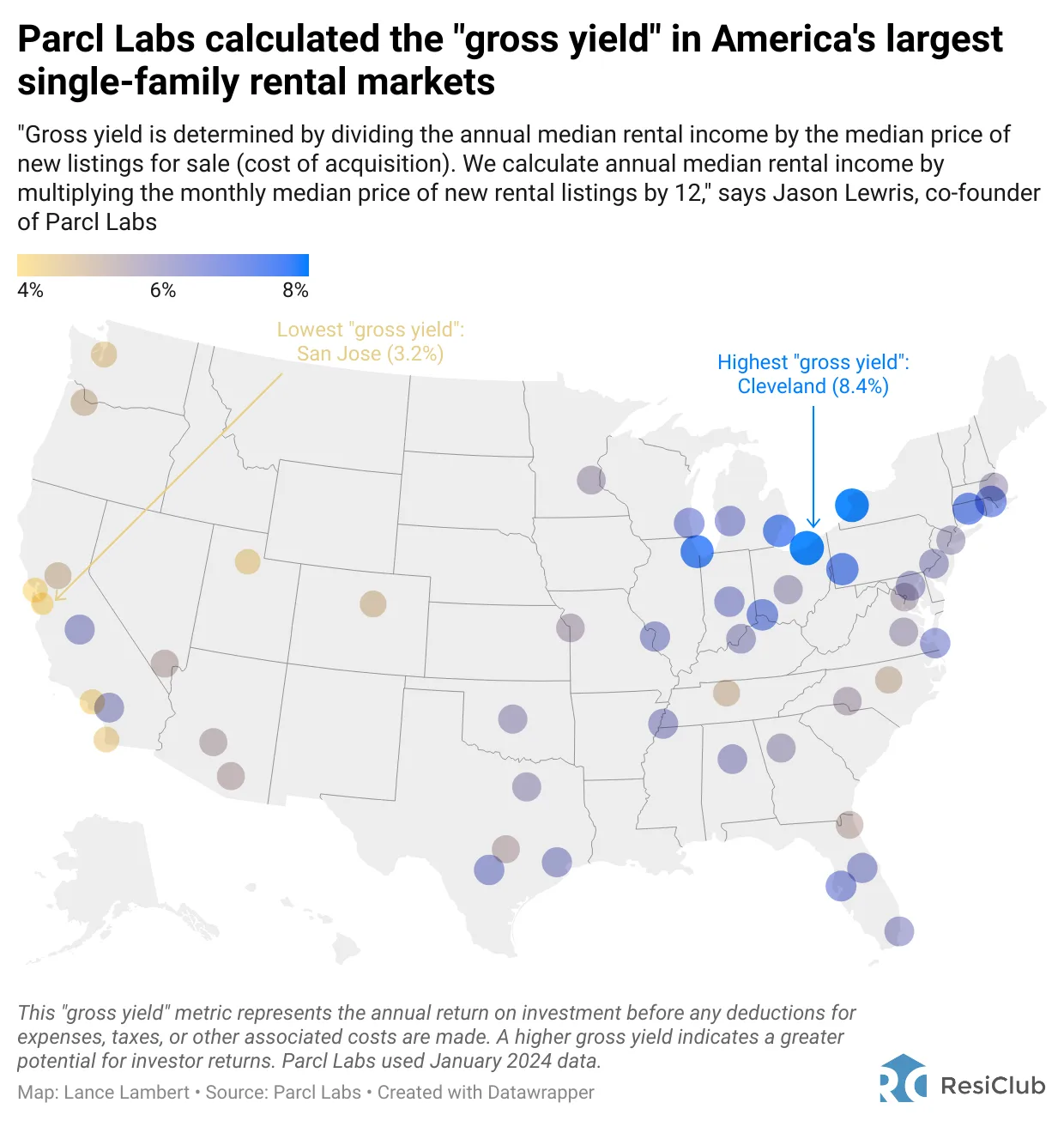

The higher the gross rental yield of a property, the greater the income usually if you get your expenses right. As a result, if you're looking for maximum rental income, you'll likely want to invest in lower-cost cities.

Property prices historically rise closely with inflation plus ~2%.

Property price appreciation generally tracks inflation plus 2%. In other words, if the latest inflation figure is 3%, you can expect a ~5% increase in national property prices. Over the years property price changes can fluctuate wildly of course. But if you look at property prices over a 10-year period you'll see a relatively smooth correlation.

When you start having expectations for consistent 10% annual price gains you're becoming delusional. Remember that you should think about property price appreciation as a secondary attribute. If it happens, great. If not, you are focused on your cash flow.

Property is always local.

Be careful not to extrapolate property statistics. Just because one report says San Francisco property prices are up 8% year over year doesn't mean I'll get to sell my home for 8% more. You can throw national statistics out the window as well.

The best price to find out what your home is worth is if your neighbor sells. Property price statistics tell you the general direction of prices and the relative areas of strength.

As a rental property investor or primary home buyer, it is important to research positive local economic catalysts that will boost property values over time. The more positive catalysts, the greater the chance properties in the neighborhood will increase in value.

Specific Ways To Value Your Property Correctly

Now let's move on to the basics of how to value investment property.

1) Calculate your annual gross rental yield.

Take the realistic monthly market rent based on comparables you find online and multiply by 12 to get your annual rent. Now take the gross annual rent and divide by the market price of the property.

For example: $2,000/month = $24,000/year. $24,000/$500,000 = 4.8% gross rental yield. The annual gross rental yield is to get a quick apples to apples snapshot of what the blue sky potential is for a property if one were to pay 100% cash and have no ongoing expenses.

2) Compare your gross rental yield to the risk free rate.

The risk free rate is the 10-year bond yield. Investors say “risk free” because there is practically 0 chance the US government will default on their debt obligations.

All investments need a risk premium over the risk free rate, otherwise, why bother risking your money investing. If the annual gross rental yield of the property is less than the risk free rate, either bargain harder or move on.

Note, if you want to invest in real estate passively, take a look at Fundrise, my favorite private real estate investment platform. Fundrise began in 2012 and runs almost $3 billion in assets. It predominantly investments in single-family and multi-family homes in the Sunbelt, where valuations are lower and yields are higher.

Valuations for commercial real estate have decline almost as much as they did during the 2008 global financial crisis. Yet, the economy and household balance sheets are much stronger. As a result, I think there's great value, especially in residential commercial real estate given the 2-3 million undersupply of homes in our country. I expect prices to rebound as they did after 2008.

3) Calculate your annual net rental yield (cap rate).

The net rental yield is basically your net operating income divided by the market value of the property. The way I like to calculate net operating income is by taking your annual gross rent minus mortgage interest, insurance, property taxes, HOA dues, marketing, and maintenance costs. In other words, we are calculating what is the actual bottom line annual profit. We can add by depreciation, which is a non cash expense, but I'm focused on cash flow.

For example: $24,000/year in rent – $3,000/year HOA dues – $4,800/year property taxes – $500/year insurance – $1,000/year maintenance – $10,000 in mortgage interest after tax adjustments = $4,700 NOP. $4,700/$500,000 = 1% net rental yield. Not so good, but at least cash flow positive from the get go.

Net rental yield can differ by each investor given some put more money down than others, while others are better at streamlining operating costs and charging top dollar for rent.

To calculate the cap rate, you don't use the mortgage expense. The formula is focused on the property alone and not the financing used to buy the property. Every investor uses a different combination of down payment and financing. So, a cap rate assumes a property is bought for cash without leverage.

4) Compare the net rental yield to the risk-free rate.

Ideally, the net rental yield should be equivalent or higher than the risk free rate. You will pay the principal down over time thereby increasing the net rental yield and spread over the risk free rate. If all goes well, rents will also go up and your property will appreciate.

There are plenty of properties in Nevada, Florida, California, and Arizona with net rental yields several percentage points higher than the current risk free rate after the collapse. The reason why more people weren't snatching them up in 2010-2012 was because buyers often had to pay cash because banks weren't lending.

Related: Follow FS20: A Leading Property Buying Indicator

5) Calculate the price to earnings ratio of your property.

The P/E ratio is simply the market value of your property divided by the current net operating profit. In the example above $500,000 / $4,700 = 106. Woah! It will take an owner 106 years of net operating profits to make back his or her investment! This obviously assumes the owner never pays down his mortgage and does not see an increase in rents which is highly unlikely.

A nicer way to calculate things is to get the gross rental income divided by the market value of the property = $500,000 / $24,000 = 20.8 for a blue sky scenario. Obviously, the lower the the P/E for the buyer the better and vice versa for the seller.

6) Forecast property price and rental expectations.

The P/E ratio and the rental yields are only snapshots in time. The real opportunity is properly forecasting expectations. As a real estate investor you want to take advantage of fear and unfortunate situations such as a divorce, a company relocation, a layoff, a bankrupt city, or a natural disaster. As a real estate seller you want to sell the dream of forever rising prices.

The best way to forecast the future is to compare what has happened in the past via online charts provided by DataQuick, Redfin, and Zillow and have realistic expectations about local employment growth. Are employers moving into the city or leaving? Is the city permitting tons more land to develop or do they have restrictions such as building heights? Is the city in financial trouble and looking to gouge owners with more property taxes?

7) Run various scenarios.

The final step is to obtain your realistic property price and rental forecasts and run various scenarios. If rents decrease for five years at a pace of 5% a year, will you be OK? What about if mortgage rates for 30-year fixed loans increase from 3.5% to 5% in five years, what will that do to demand? If the principal value declines another 20%, am I going to jump off a bridge?

Hopefully not if you live in one of the non-recourse states where you can hand back the keys and protect your other assets. Always run a bearish case, realistic case, and bullish case scenario as your bare minimum.

8) Be mindful of taxes and depreciation.

Almost all expenses related to owning a rental property is tax deductible including mortgage interest and property taxes. Think about owning a rental property like owning a business. Whatever expenses that are associated with keeping your rental property operating and getting top dollar is usually tax deductible.

What is also interesting to understand is depreciation, which is a non cash item that reduces your Net Operating Income (depreciation is a non cash cost), to lower your returns but also your tax bill.

Be aware but focus on the actual bottom line cash in the end. $250,000 of profits for individuals and $500,000 of profits for married couples is tax free if you live in the property for two out of the last five years. Read more about the $250,000/$500,000 tax-free profits rule from real estate.

There is also the 1031 exchange which allows investors to rollover proceeds to another property without realizing any gains and therefore taxes. The tax code is confusing but at the margin favors property owners.

9) Always check comparable sales.

Value investment property by checking comparable sales. The easiest best way to check comparable sales over the past six to twelve months is to punch in the property address on Redfin, which I believe has better price estimation algorithms than Zillow. There you will see the tax records, sales history, and comparables on the lower bottom right side.

You need to compare your target property's asking price with previous sales and measure it against what has changed since to make sure you are getting a good deal.

Property Analysis Example: Bay View Luxury Condo

Description from MLS. Breathtaking views of the Golden Gate Bridge, Palace of Fine Arts, Angel Island and the bay from this 3BR 2.5BA Cow Hollow condo. There is a huge walk-out deck on the top floor where the living room, dining area and kitchen are located to enjoy the view.

The kitchen has a center island, granite, eating area and balcony. A half bath complete this floor. The spacious master bedroom suite with jacuzzi tub, walk in closet and a balcony occupy the entire second floor.

The first floor has 2BRs in the rear with French doors in each to access the private garden. A bath and laundry room complete this floor. In addition to the beautiful north bay views, the neighboring manicured gardens are enjoyed from all 3 levels.Extra wide parking & storage.

| $1,699,000 (LP)Price/SqFt: 852.91 | 2533 Greenwich St, San Francisco, CA 94123 * Active | ||

| Beds: 3 | Baths: 2.50 | Sq Ft: 1992* | Lot Sz: |

| District: 7 – Cow Hollow | Yr: 1990* |

My Initial Take On The Property

Great location with a multi-million dollar view. I love the outdoor indoor combination. A property that a family of three or four can enjoy. A great property for a swinging bachelor or a couple as well given the proximity to all the shops and restaurants in the north end of San Francisco.

At $852.91 a square foot, the property is inexpensive based on a list of comparables I see on Zillow for $900-$1,100/sqft. Your realtor should also provide you a long list of comparables as well. Interesting to see that the property last sold on 10/07/1997 for $988,000 for a 72% increase if they get asking.

Annual Gross Rental Yield:

Monthly rent is anywhere from $6,000 – $8,000 a month based off comparables online. Let's take the midpoint of $7,000 and multiply by 12 to get $84,000. $84,000 divided by $1,700,000 = 4.9%. Not bad compared to the risk free rate of 2.15%.

Annual Net Rental Yield:

$84,000 – $18,000 in adjusted property taxes – $3,000 in estimated HOAs – $40,000 mortgage interest adjusted for taxes – $5,000 maintenance = $18,000 net rental income. $18,000 / $1,700,000 = 1.05%. To be cash flow positive in San Francisco from the beginning is very rare given San Francisco has historically a huge P/E compared to the rest of the country.

Price-To-Earnings Ratio:

$1,700,000 / $84,000 = 20.23 gross P/E. $1,700,000 / $18,000 = 94.5. Now compare the average P/E in San Francisco of 35-40X and you're in the ballpark. 35-40X is expensive compared to areas like Detroit at 15-18X. But again, real estate is local. Nobody goes on vacation to Detroit, but tons of people come to San Francisco.

Price Forecast:

Pricing trends are strong with employment growth surging due to Twitter, Facebook, Google, Pinterest, AirBnb, and a host of other internet companies. Over half of the 20 rental applicants I received for my rental property open house in 2013 came from these companies.

Real estate consultants are expecting San Francisco property prices to rise by another 5-8% a year for the next several years. Rents are expected to slowdown to a 5% per annum increase.

Now in 2025, the price of this rental property has increased by another 70%.

Investment Property Analysis Conclusion

The property's views are amazing, but the inside needs some updating. The entrance is oddly shared by its neighbor through an easement. There are also some structural issues that need to be addressed. If you are spending $1.7 million on a piece of property, I should hope that one has their own private entrance.

The other downside of the property is that it takes one flight of stairs to get up to the first floor. And the condo is three stories high. The number of steps won't be ideal for older folks. The housing layout could use improvement.

Despite the downsides, there are other great features including balconies in the back along with a small yard. The views are priceless. I would buy the property for $1.7 million if I planned on living there for the next 10 years.

From a price appreciation perspective, there's potential to hit the $1,000/sqft mark or basically $2 million dollars with a little bit of remodeling. Going from $1.7 million to $2 million is a 17% appreciation which can be achieved in four years at a rate of 4% a year give or take. Not bad, but not something to count on at all.

Not A Great Rental Property

From a rental perspective, this property isn't a great deal. This is usually the case with higher-priced properties due to more of the property's value being associated with luxuries that aren't fully appreciated e.g. fixtures, flooring, location, views.

In other words, look for lower-priced properties that are bare bones with only the basic necessities to maximize rental yields.

The real question to ask is:

How much do you think the property will sell for? Given how strong the market is in San Francisco, I'm guesstimating $1.85 million will be the final price.

A cap rate of ~1% is crazy expensive. But that's what it costs to live in the most beautiful city in North America. When you analyze investment property, you need to have objective and subjective measures.

How To Value Investment Property: Part Science Part Guess Work

The more open houses and transactions you follow from start to close, the more comfortable you will get with the exercise of assessing property values. It almost becomes a sixth sense where you instantly know whether the property is a good deal or not.

Everybody looking to buy property should definitely hit the weekly open houses for a couple months to get a feel for your local market. Here are some warning signs all prospective buyers should watch out for before buying.

Real Estate Commissions Will Be Coming Down

I cannot emphasize enough how property must be viewed as a long term investment largely due to high transaction costs. It's my sincere hope the public rises up against such egregious pricing practices by the real estate industry.

It is absolutely baffling to me why realtors are unwilling to cut their commissions to boost volume. Volume is down tremendously as seller go on strike. It's worth doing your own research and checking comparable prices online.

Thankfully, after the National Association of Realtors settlement on commission price fixing, I expect real estate commissions to come down by 1% – 4% by the end of 2024. Homeowners and buyers must actively negotiate down real estate commissions to save.

You can listen to my conversation with Michael Ketchmark, the lead trial attorney who won the lawsuit against the NAR, Keller Williams, and Home Services of America.

Invest Real Estate For The Long Term

Property is a tangible asset unlike stocks which can lose value in a nanosecond for countless reasons. What other asset class allows you to live potentially for free, positively affect the value, and make a profit without having to stress too much if you can afford the mortgage payments?

I hope this article has helped you learn how to value investment property. If you plan to invest in a real estate syndication or crowdfunding deal, here learn how to evaluate a real estate investment opportunity using the Who, What, When framework.

Diversify Your Wealth Into Real Assets

Now that you know how to value investment property, it's time to invest.

I encourage everyone to diversify their net worth into tangible assets such as property or anything that allows you to be a price setter. Real estate has been instrumental in helping me build wealth and generate enough semi-passive income to retire early and be free. Now that you know how to value investment property, it behooves you to start investing.

Below you can see physical rental property accounting for about 30% of my total passive income and real estate crowdfunding accounting for 30% of my passive income.

When my children were born in 2017 and 2019, I wanted to focus more on generating as much income passive as possible. As a result, real estate crowdfunding rose to the forefront. I now earn real estate income 100% passively so I can focus on raising my children.

Diversify Your Real Estate Investments

If you don't have the downpayment to buy a property, don't want to deal with the hassle of managing real estate, or don't want to tie up your liquidity in physical real estate, take a look at Fundrise. There's no need to learn how to value investment property because the Fundrise experts evaluate the properties for you.

Fundrise is one of the largest real estate crowdsourcing companies today. You don't have to know how to value investment property with Fundrise because the managers do the work for you. Fundrise has private eREITs that enable everyday investors to get concentrated, yet diversified real estate exposure across America.

My other favorite real estate crowdfunding platform is CrowdStreet. CrowdStreet is for accredited investors looking to invest in individual commercial real estate properties in 18-hour cities. 18-hour cities have lower valuations and higher net rental yields. They are beneficiaries of a long-term positive demographic trend towards lower-cost cities.

Both platforms are free to sign up and explore. I've personally invested $954,000 in real estate crowdfunding to diversify and earn income 100% passively. Both platforms are long-time sponsors of Financial Samurai and Financial Samurai is currently and investor in Fundrise.

How To Value Investment Property is a Financial Samurai original post. Feel free to join 60,000 others and sign up for my free newsletter.

The breakdown of how to actually value a rental property was really helpful. Focusing on cash flow instead of just expecting appreciation makes the whole approach feel more practical and less risky.

Great article! I found your tips on correctly valuing and analyzing investment property to be incredibly helpful. It’s so important to take a comprehensive approach and consider factors like location, cash flow, and potential for appreciation when assessing the value of a property. Your insights on how to calculate the capitalization rate and cash-on-cash return were especially insightful. As someone who’s interested in investing in real estate, I appreciate the guidance you’ve provided here. Thanks for sharing your expertise!

Hi Sam,

Thanks for publishing this article. I’m starting to look at possibly buying a rental property, and having a framework to understand how to value an investment and how to compare different properties is very helpful!

In calculating the Net Rental Yield (the net operating income divided by the market value of the property), you mention that “to calculate the cap rate, you don’t use the mortgage expense”. However, you are including mortgage interest. It would seem to me that the mortgage interest is a mortgage expense, or am I off on that?

In an other of your articles, What Is A Cap Rate And How Is It Calculated (https://www.financialsamurai.com/what-is-a-cap-rate-and-how-is-it-calculated/), you also state “NOI is a before-tax figure, appearing on a property’s income and cash flow statement, that excludes principal and interest payments on loans, capital expenditures, depreciation, and amortization”.

I am a bit confused as I feel like these two excerpts would indicate not to include the mortgagee interest in the cap rate calculation. Do you mind providing some clarification there?

Thanks,

Max

Great article!!!

This is a very well constructed article with so many golden nuggets inside. Although, I enjoy doing my own research when it comes to buying income producing assets such as investment properties; however, I highly value my time as well. Like you indicated, I would rather devote my time towards generating more passive income and thereby stick with real estate crowdfunding and other similar means. Thanks for making that so abundantly clear to me in this post.

Thanks for the tip to be realistic about the income the target property can generate if you’re a real estate investor. I think a lot of people want to have high hopes about their investments. This could easily distract them and cause them to use inflated numbers.

Awesome stuff, Sam. I don’t know how I missed this article when I priced out my first few rental properties. I still can’t believe SF rental valuations. I don’t know how people do it. The midwest is where it is at IMO.

Hey Sam – stumbled across this article while googling about property and love the blog!

Curious about how you would analyze a combo primary/rental property? For example if the choice is between A) buying a property, living in it for a couple of years, then renting it out vs B) just flat out renting for a couple of years.

Background is that I’m looking at a very expensive HCOL area and wondering if it makes sense sense to use money to pay down my principal for a couple of years vs paying rent. (Though in this case the rental income would not come close to covering the financing + maintenance cost of property).

Excellent article with a unique approach to looking at the financials of a rental.

I am curious why you use the market value of the property instead of the purchase price or cash outlay in your ratios. Buy and Hold investors are typically looking for a distressed property than can be bought at a discount even after making improvements. That’s usually the only way to make the numbers work. It’s hard to cash flow when buying off the MLS as you point out.

I like to use Net Operating Income as a % of Net Rental Income as the best indicator of the financial health of a rental. It accounts for both Revenues and Expenses before financing costs, depreciation, etc. I know if a property can yield 50% – 60% in NOI % Net Rental Income then there will be enough cash left to pay other expenses and still make a cash profit.

Then I use the Cash on Cash return to see if it’s a property worth holding. Anything less than 10% Cash return isn’t worth looking at.

Thanks for the great article!

Started in the metro Portland Oregon rental game in the 97230 zip. Invested about 500K about 18 months ago. I have 5 rental homes and 1 I live in. Refinanced 3 of my first and received 152K to purchase 2 more in the 2017. I put down 25% on each house and my model is at 10% recovery on initial investment in the first year. I make about 50K for 2016 which is pretty close to my model.The big money is in 3-4 bedroom homes with at least 2 baths in a good neighborhood. I pay just about no tax on the passive profit, depreciation and purchase right offs are great as well as maintenance. The caveat is I’m a retired journey level tradesman that is big and strong. Most will not make this return, this is for me and enjoy the experience and the money.

Hi Sam,

I’ve got a second home I’ve been renting out in the Washington DC area (near the Dulles tech corridor). I’ve taken a loss of between $30 and $60 per month; today because of property tax changes, it will approach $80 per month just to carry the property. I have not had a net profit on it since moving away over 7 years ago.

I’m not in the area, so fighting tooth and nail with the assessor’s office is not realistic. I’m very interested in any thoughts – should I hold out, or cut and run? DC ‘burbs have rebounded, but not to the degree of places like SF. Rent comps are meh – not much movement.

Anyway, not sure if you check these comments anymore, but if you see it and can drop a couple thoughts, I’d be most appreciative.

Hi im interested in your property. Would love to chat

I very much appreciated the article. Well written and easy to follow.

The “old” rule was if the property’s monthly rent was 1% of what you could buy it for (e.g., $100,000 property renting for $1,000/mo.), it may well be a good deal warranting further consideration. But as many of the posters have indicated, it is VERY difficult to locate properties which meet the 1% criteria nowadays.

Question: is there a minimum ratio of monthly rent to purchase price you require for investment rental properties, or is it a case by case analysis?

Hi – great article. I agree with everything you put in the article.

I found this analysis after doing my own analysis and I want to throw mine out there because I think it will further the conversation on this thread. A twist on what you’ve done here. Would love comments & feedback!

My real estate empire consists of two properties – the one I bought while single and the one my wife bought while single. Mine is a high value condo unit in a nice neighborhood in downtown of a major city (Boston). My wife’s is in a small NH town. I bought my 2BR condo for $415k in 2003 – found a roommate to pay $1k . So from that you can extrapolate a roughly 5% gross yield. From multiple sources (zillow,redfin,city assessments, refi appraisals) I know the unit is now worth double anywhere in the $800-$850k range. My recent rent adjustment put the rent just north of $3k so it hasn’t quite kept pace with the 5% yield. By contrast, my wife bought her condo for $62k in 2000 and its now worth $85k. We rent it out for $1k/month – so a yield exceeding 10%. So the question to myself was to run the analysis – did it make sense to sell the Boston property (a low yield now below 5%) and stock up on property in the 10% range? Some fascinating numbers came out …. including calculating ROI….

High Yield Property Analysis:

Case Study: A 3BR condo in the same NH town. Pics look good – decent sq. footage. Outside looks nice. Its in a decent part of town and near the main highway. Asking is $179 – and I think $1800/mo rent sounds about right. Let’s say I acquire for $170k – so slightly above 10% yield. Now let’s say I make it a requirement that I have to setup this up so its cash flow break even from day 1. I want the safety and security to know that this investment can pay for itself. Let’s also say I want my money back in 15 years. Let’s make some other reasonable assumptions where necessary but use the real numbers when available.

Monthly Expenses:

Mgmt Expenses (10%) $180 (paying 10% on current condo)

Insurance $75 (about double what I pay now on the $85k condo)

Maintenance $100 (contrary to comment above – my experience is this scales well)

Taxes $387 (actual: calculated from city assessment report)

Condo fees $275 (actual)

-> So this is $1017 out of my $1800 costs that I’ve allowed for myself [$783 remaining].

Well 40% down on $170k leaves $102 to finance. $102k @4% 15YR amort is a $755 payment.

Furthermore, by looking at the land/building split on the tax card – I see that when I take $170k/27.5 * building split % that total is above the yearly principal pay down (in year one and for many of the next 15 years to come). That is to say the depreciation tax write-off fully covers my tax year rental ‘profit’ – so cash flow neutral and tax neutral with an ever so slight tax advantage). Great – so what’s the ROI with this setup?

I break this up into 3 sources of return:

1) Mortgage paydown return: At the end of 15 years, I will now own the property outright.

But there are costs associated with getting my money back. Seller commissions, tax stamps, legal fees. Let’s say we can get 93-94% of the full value back. Well 93% of 170k = $158k+ = $68k down payment @ 5.8% annual growth. So -> 5.8% [capital gain tax rate / deferred depr]

2) capital appreciation:

well my current condo in the same town has gone from $62k to $85k in 15 years. So that’s 1.7% and in-line with current inflation. For a high yield property that sounds right to me. 1.7% [capital gains rate].

3) rental price increases over time: Well I think its reasonable to increase the rent on average at the rate of inflation. However, each additional dollar in rent isn’t an additional dollar of profit. The tax bill goes up, insurance goes up and condo fees go up over time too. My back of the napkin investigation gave me 60% profit on each dollar. 60% of 1.7% = 1%. [earned income].

Final Analysis = 7.5% ROI over 15 years w/ 40% down and a self-sustaining asset.

6.5% of which is taxed at the capital gains rate and 1% at earned income.

—–

So this is long already. I’ll cut straight to my final analysis if I were to buy right now my Boston condo.

Final Analysis = (1.5% mortgage paydown return) + (5% capital appreciation) + (2% rental price increases) = 8.5% ROI over 15 years w/ 80% down and a self-sustaining asset. 6.5% of which is taxed at the capital gains rate and 2% at earned income.

Final final analysis: I don’t need to spend the time/energy to flip my Boston unit into multiple units elsewhere. I’m not missing out on big chunks of money which was my concern. However, if I were to try and do some sort of risk adjusted return analysis – my gut tells me the high yield property is better. I’ll take the guaranteed return of a payed off mortgage vs. hoped for price appreciation. Though in my situation I do like that my calculation in the low yield property does include a fairly nasty country wide real estate downturn. Let me know what you think!

Hey Sam, following your advice, I tried Lending Tree Mortgage. But my search didn’t return any lenders. Have you experienced this before? Thank you!!

Catherine

[…] How To Properly Analyze And Value Rental Property […]

[…] Further reading: How To Correctly Value And Analyze A Rental Property […]

Hi. My property is located in the center of the town. 3600sqft home in 0.5 acre land and currently valued at 1M. I was recently approached by a big retail company wanting to lease my property. Do I sell my property per the current worth?

[…] Other people are always getting lucky. Getting told you’re lucky basically discredits any work or analysis you’ve put into making your investment. I remember being extremely excited, yet hesitant about putting a $580,500 offer for my condo back […]

I see this all the time. Management and vacancy need to be considered as well or your life will be filled with regret. Both vary with the investment, but figure 5%-10% of gross rents on both. The approach shown here is too optimistic in my opinion. To anyone reading this and thinking real estate is a good way to go, I recommend you start with the “50% rule” and a long time reading biggerpockets.com before jumping in!

$1,000 / year maintenance on a 1.7 million dollar condo? You’ll spend more than that on bathroom remodels alone over time!

Too optimistic? I would be willing to pay $1.85 million and the place sold for $2.3 million.

Can you tell us about your real estate portfolio and your real estate experience so we get a better understanding of where you are coming from?

Sam, If you run the numbers using only the down payment would it not be a totally different rate of return? Not sure why you calculated as if you are using 100% down payment.

Or maybe I am missing something?

Sure. That’s a cash on cash calculation.

Should we use market rate or price we paid when calculating? It’s hard to say what the true market rate is. I know Zillow was way off and undervalued my house by 40k.

Do both. It’s easy and worth the exercise to get a more complete picture.

I am pretty far from owning rental property but huge fan of the post (I was a lot closer before I used most of my cash to buy our new place a few months back lol). Question, and I think this comes to maybe what you and DGI were talking about…

With a cap rate (i.e. income flow) of 1%ish…why go through the hassle of owning property? I know I am missing something but I can’t put my finger on it. Is it the capital growth portion but you get that with stocks also? Is it the fact you are only putting X% down so you are using other people’s money? what is it?

Yep, capital appreciation with leverage would be the main reason. The rental income for my main property was simply used to pay for the holding cost. If I was cashflow positive, then great, but the income is insignificant in the beginning. Fast forward 10 years later, the income is significant now, which is great in this low interest rate environment. What I’m more pleased with is the value.

It all depends on where you are in your life. As a retiree, I now appreciate more the cashflow. As a young gun looking to build my financial nut, I was way more interested in capital appreciation since I had a job.

The key while young is to take some risks and build the nut. There are two investment classes for properties: Landlords or Investors.

Great Read! Based upon your insight I will project $1.95 mil.

A bullish price that hits a level 5 years from now. Maybe the future is now! Let’s see!

Good stuff, Sam. Good stuff. If this doesn’t go viral, I don’t know what will. This is a burning question in just about every wannabe real estate investor’s mind. I hope other big name bloggers give you love in their round-ups.

Highly doubt this post will go viral as it’s too useful focused to be popular. Gotta have some fluff and humor cause who wants to go so much into detail about investing in one of the most important asset classes to build wealth? Miley Cyrus and Lindsay Lohan coming up next!

Hello Matt, I’m really thank you for sharing this. I’m planning to try real estate investing when I have my own job and have saved enough money. I know that it’s early for me to plan things like this one but this article will help me a lot in the future. Kudos!