Partially due to the pandemic, partly due to larger balances, more people are wondering whether they should withdraw funds from a 401k or IRA before retirement to help pay for life. There are plenty of reasons to withdraw money from a 401k or IRA early. Unfortunately, some people go too far and end up using their 401k or IRA like a checking account instead of as a retirement account.

Withdrawing funds early from a 401k or IRA is like constantly picking at a scab. The more you do it, the slower your wound will heal. Pick it too often and the wound might actually begin to fester and result in a potential amputation (terrible retirement).

Once you start withdrawing from your 401k or IRA early to pay for things, you may come to rely on your retirement funds as a crutch. As a result, you may never end up building a strong third leg for your retirement stool.

In general, treat your 401k and IRA like a black hole where money only goes in and never comes out. Then work to build your after-tax investment accounts in order to generate passive income.

Of course, if you are facing a life or death situation and the funds in your 401k or IRA are all you have, then withdraw what you need. But look what happened to stocks in 2020. The S&P 500 closed up 18% and the NASDAQ closed up 43%. If you withdrew funds from your 401k, you missed out.

CARES Act Changes Withdrawal Rules For 401k And IRA

The rules regarding the withdrawal of funds from a 401k and IRA are somewhat complicated. They are also constantly changing. If you find any errors, please feel free to let me know so I can correct them.

Normally, if you withdraw money from a traditional IRA or 401k before reaching age 59 ½, you have to pay a 10 percent early withdrawal penalty.

In addition, emergency withdrawals from your current employer-provided plans are limited to a set of approved hardships. These may include avoiding foreclosure, home repairs after a disaster, or medical expenses.

Pandemic Special Rules (Temporary)

However, thanks to the CARES Act, the 10 percent early withdrawal penalty was temporarily no more in 2020 if the pandemic has negatively affected your finances, e.g. furloughed, laid off, hours cut, unable to work due to lack of child care, etc.

One-third of the money you withdraw will be counted as income in your taxes for each of the next three years unless you elect otherwise. The CARES Act also allows you to pay back what you withdrew from your accounts if you’re able to do so.

But in 2022, the 10% for early withdrawals from your 401k or IRA will return. Hence, I don't recommend touching your retirement funds unless you absolutely have to.

How Much Can You Withdraw From A 401k Or IRA Early?

Before the pandemic, according to the IRS, the maximum amount that the retirement plan can permit as a loan is (1) the greater of $10,000 or 50% of your vested account balance, or (2) $50,000, whichever is less.

For example, if you have a 401k balance of $40,000, the maximum amount that you can borrow from the account is $20,000.

After the CARES Act passed, you are now allowed withdrawals of up to $100,000 per person taken in 2020 to be exempt from the 10 percent penalty. You can’t get the special tax and CARES Act treatments for withdrawn amounts greater than $100,000 in total across all of your accounts. Now that it's 2021, there may be new rules. Double check with your accountant.

The CARES Act also eliminates the 20 percent automatic withholding that is used as an advance payment on the taxes that you may owe on employer-provided plans like your 401k.

Just know that hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, you'll be paying income taxes on the contributions and earnings withdrawn.

You then get a three-year period to pay the taxes to the IRS. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

With Biden as President, there continues to be pandemic relief of all sorts.

Legitimate Reasons To Withdraw Funds From A 401k Or IRA

Now let's go through the most legitimate reasons for withdrawing funds from a 401k or IRA before retirement. (Note: For withdrawals made during the pandemic, I'm assuming that the main withdrawal reason is to pay for daily living expenses.) Some of these withdrawals are penalty-free, some are not. Always double check with you HR department.

1) Education

You are allowed to take an IRA distribution for qualified higher education expenses, such as tuition, books, fees, and supplies. This distribution is still subject to income tax, but there is no withdrawal penalty.

For instance, if you want to get an MBA, you can tap your retirement fund for tuition. The rule also allows you to use this exception for your spouse, children, or their descendants as well. Keep in mind this exception is for IRAs only. 401ks or other Qualified Plans are subject to a different ruleset.

Specifically, some 401k plans will allow what is called a “hardship withdrawal,” with education expenses sometimes falling under this clause. Expenses eligible for a hardship withdrawal will vary depending on your 401k plan administrator. Therefore, make sure you ask first before withdrawing. Some providers do not allow hardship withdrawals at all.

Withdrawals from your 401k to pay for education are subject to a 10 percent penalty.

Personal Thoughts

To use your pre-tax retirement accounts to pay for an overpriced education that is rapidly depreciating in value may be a poor financial decision.

Instead, I suggest getting extra education part-time during the evenings or weekends. Better yet, get your employer to pay. Although it was a PITA for three years, I'm glad I was able to get my MBA part-time between 2003-2006. My employer ended up paying 80% of the tuition, or roughly $70,000 without me losing any career progress.

2) First-Time Home Purchase

You can take up to $10,000 out of your IRA penalty-free for a first-time home purchase. If you are married, your spouse can do the same for a total of $20,000.

Just like the education exclusion, you can also tap this option for the benefit of your family. Your children, parents, or other qualified relatives may receive the same $10,000 for their purchases. This is even if you’ve used this benefit for yourself previously or already own a home.

There’s no specific penalty exemption for first-time home purchases when you pull money out of a 401k. Technically, you're making a hardship withdrawal to buy your first home. However, it is doubtful buying a first home would be considered a hardship.

Therefore, you are likely to incur a 10 percent penalty on the amount you withdraw from your 401k. To avoid the penalty, you meet very stringent rules for an exemption. Even then, you will still owe income taxes on the amount withdrawn.

Personal Thoughts

Withdrawing from your pre-tax retirement accounts to borrow money from a bank in order to buy your first home is risky. Such a move could wipe away your entire net worth in a few short years if the real estate market turns south and you've got to sell. Besides, paying a 10 percent penalty shouldn't sit well with you.

Instead, you're much better off building your savings and taxable investment portfolio that can provide for a 20% down payment. If you don't have at least a 20% down payment in cash plus a 10% buffer, you probably cannot comfortably afford to buy your first home.

Renting is good value now in many big cities. Please keep your pre-tax retirement accounts and your real estate investments separate.

3) Family Circumstances

If you are required by a court to provide funds to a divorced spouse, children, or dependents, the 10 percent penalty can be waived.

Personal Thoughts

Contentious divorces happen all the time. We must follow the court rules, otherwise, we may get into bigger trouble. As parents, we should always support our kids until they become adults. I'm not so sure the same can be said about ex-spouses.

4) Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you can pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year, then the penalty will likely be waived.

Personal Thoughts

In my opinion, a surprise medical expense is the most legitimate reason for withdrawing early from a 401k or an IRA. Nobody goes through life wanting to get a surprise medical expense beyond the cost of what insurance covers.

Medical expenses are often unforeseeable and can be extraordinarily expensive without sufficient insurance.

Series of Substantially Equal Payments

If none of the above exceptions match your individual circumstances, you can consider taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution.

The amount of these payments is based on a calculation involving your current age and the size of your retirement account. Visit the IRS’ website for more details.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

The 401k Loan Is A Better Option

If you have to pay a 10 percent penalty on a withdrawal, then a better solution is to borrow against your 401k and pay yourself back. A 401k loan does not have a 10 percent penalty. If your plan allows loans, your employer sets the terms.

Before the CARES Act, the maximum loan amount permitted by the IRS was $50,000 or half of your 401k’s vested account balance, whichever is less. During the loan, you pay principal and interest to yourself at a couple points above the prime rate, which comes out of your paycheck on an after-tax basis.

Under the CARES Act, you can now borrow up to $100,000 of your 401(k) balance, with up to six years to pay yourself back for the loan. In this scenario, you do not accrue any tax liability. And as you pay back the loan, those amounts get reinvested faster than if you delay paying the tax liability on a distribution. The interest rate for a 401k loan is generally between 2.5% – 6.5%.

Just remember that the CARES Act pertains only to 2020 so far. I assume the rules will revert to the way they were pre-CARES in 2021 and beyond.

Borrowing from your 401k is a good alternative because you do not need a credit check, nothing appears on your credit report, and interest is paid to you instead of a bank or credit card company.

But again, if you habitually borrow from your 401k, you'll likely never be able to save enough in your 401k for retirement.

Motivation To Not Withdraw Funds From A 401k

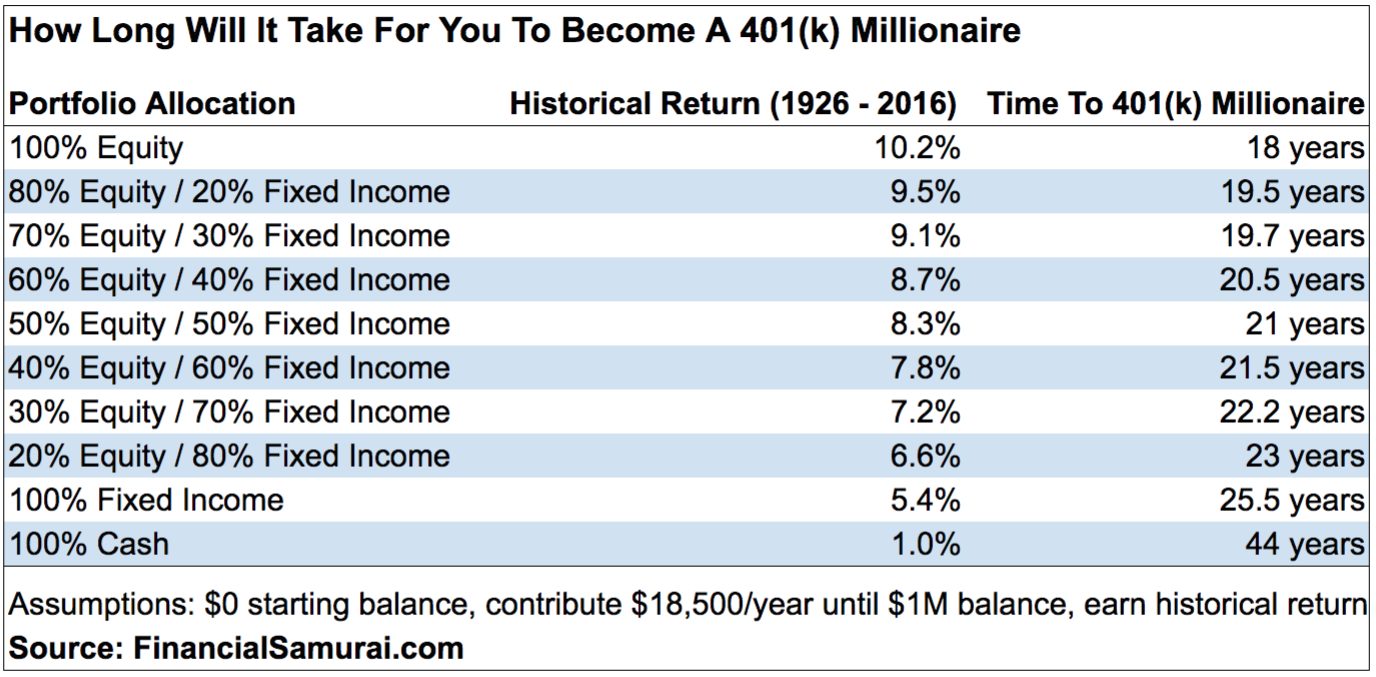

Every time you're tempted to borrow from your 401k, take a look at this chart below. It shows you when you will become a 401k millionaire based on various portfolio allocations and return assumptions.

Not only is paying a 10 percent penalty painful for a hardship withdrawal, so is losing out on years of compounding.

IRA Rollover Bridge Loan

There is one final way to “borrow” from your 401k or IRA on a short-term basis: roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due in the new retirement account for 60 days. During that period, you can do whatever you want with the cash.

However, if the entire amount is not safely deposited in an IRA when the time is up, the IRS will consider it an early distribution and you will be subject to penalties on the full amount.

This is a risky move and is not generally recommended. But if you want an interest-free bridge loan and are sure you can pay it back, it’s an option.

Withdraw Money From Different Accounts First

Given 401k and IRA contributions are pre-tax contributions, from the government's point of view it makes sense there should be penalties assessed for early withdrawals.

The IRS doesn't like that you haven't paid taxes on your contributions and received the benefits of tax-free compounding, yet still want to withdraw funds for some random expense you don't need.

The better practice is to go through the following succession of fund pilfering:

- Savings

- After-tax investments

- Side job income

- Borrow money interest-free from a friend or family member

- Cajole your parents into giving you some of your inheritance today

- Take out a personal loan with an interest rate under 10%

- Roth IRA

- 401k or IRA

With the Roth IRA, since you've already paid taxes on your contributions, you can withdraw contributions you made to your Roth IRA anytime, tax- and penalty-free. However, you may have to pay taxes and penalties on earnings in your Roth IRA if you've held for less than five years.

After you’ve held the account for five years, you can withdraw up to $10,000 in earnings without penalty or tax for the purchase, repair, or remodel of a first home. In other words, you can withdraw all of your contributions plus another $10,000 from earnings and not pay the 10% penalty or taxes on any of it.

There is one caveat, however: you only have 120 days to spend the withdrawal or you may be liable for paying the 10% penalty. Also, for your convenience, your financial services firm should be able to automatically prioritize the withdrawal of all of your contributions from a Roth IRA before any earnings.

Try Not To Touch Your 401k Or IRA

It may be tempting to withdraw funds from a 401k or IRA to pay for a car or a fancy vacation. If you do, however, you're just hurting your retirement. It's much better to pay for superfluous things through other sources.

Hopefully, you never reach the point where you have to consider withdrawing funds early from a 401k or IRA for a necessity, even without a 10 percent penalty.

Continuously build your financial buffers. The more you have, the more protected your 401k or IRA will be. When you finally retire, you will be happy that you left your funds untouched all those years.

Build More Passive Income Through Real Estate

One way to prevent yourself from withdrawing funds from a 401k or IRA is by developing perpetual passive income streams. One of the best ways to generate passive income is through real estate. By the time I was 30, I had bought two properties in San Francisco and one property in Lake Tahoe. These properties now generate a significant amount of mostly passive income.

In 2016, I started diversifying into heartland real estate to take advantage of lower valuations and higher cap rates. I did so by investing $810,000 with real estate crowdfunding platforms. With interest rates down, the value of cash flow is up. Further, the pandemic has made working from home more common.

Take a look at my two favorite real estate crowdfunding platforms. Both are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

Recommendation To Better Manage Your 401k

Manage your 401k better with Personal Capital, a free financial tool. I've used Personal Capital since 2012 and have seen my 401k skyrocket.

With Personal Capital, you can analyze you 401k for excessive fees. Personal Capital's Investment Checkup tool also analyzes your asset allocation and provides rebalancing recommendations.

Further, Personal Capital has a fantastic Retirement Planner tool to help you plan for your retirement future.

Related posts on 401k:

Explanations From Real People Why The Median 401k Balance Is So Low

Being as it defers taxes to a later date, the 401k is considered better for folks that plan on making less money after retirement, while the Roth IRA, with all the taxes already having been paid (and no tax on increases in value when money is drawn from the account) is considered better for folks that plan on having more taxable income after they retire. This makes it sound like they should be mutually exclusive, even if someone is able to max them both.

So why would someone do both?

It’s complicated.

Because they anticipate a drop in taxable income when they stop working and retire around age 60 or so. This makes the 401k plan quite useful, especially if they move to a state with no income tax, so they will be paying around 8% less tax when they do pay tax on it, just to start with.

If Roth back door conversions did not exist, this would still be the time to get as much money out of the 401K plans as they can, without raising the top marginal tax bracket they are paying. Why? Because at their income level, paying 15% capital gains on their future growth and earnings is better than paying income tax on it.

Plus, at 72, they have to start taking RMDs, which can result in them having to take more money out each year than they would prefer, raising their taxable income into another marginal tax bracket, or even two of them.

But rather than just bailing out of the 401K plans as fast as practical, they can, instead, convert as much 401K money into their Roth IRAs as they can before reaching 72 (again, without climbing into too high a tax bracket), because paying no taxes on growth and earnings is better than paying 15% capital gains on it (or more). It might be possible to convert as much as a million in this kind of time frame, perhaps more.

Normal logic says to use non-retirement funds to pay the taxes on conversions, especially if they have enough they can do that. But they are over age 59.5 and, at this point, as we already said, they value non-retirement investments more than 401K plan balances because, in their situation, the 401K funds will necessarily cost them more tax in the future than the non-retirement funds.

Sam –

Good article. When you often say to generate passive income are you referring to the S&P 500, REITS, Real Estate Crowdfunding, and High Dividend funds among other types.

Do you invest in international stocks and bonds for passive income?

Yes. All investment-related income.

Thanks. So my other question was do you personally invest in international funds (stock, REITS, high dividend, bonds)?

I have another reason to take money out of an IRA early: To shift money from pre-tax account to post-tax retirement savings. This is what I am doing now that my 401(k) and IRA investments have grown faster than expected. I am 45, married, and we now have about $2.4M in 401(k)/IRA.

I now see the possibility of retiring early if I get a good income stream going with post-tax savings (don’t have much post-tax savings now but I am making it my top priority now… I even stopped contributions to 401(k) because my company does not do matching contributions.. putting all savings into post-tax side).

I have taken advantage of CARES act by taking $75K out of IRA to fund a crowdfunding investment. I intend to have most of my post-tax retirement funds in crowdfunding. Next I want to take out all of our Roth contributions (~$60K tax and penalty-free) and put them toward more crowdfunding, followed by a Roth IRA ladder shifting IRA to Roth IRA, which in 5 years will give me more funds available to shift to post-tax savings/crowdfunding (~$100K).

The “problem” I am trying to solve is that while I believe I will have plenty in 401(k)/IRA accounts in retirement, I cannot access this money until age 59 (or maybe 55) if I want to retire early unless I suffer the penalties. I suppose the 72t will be an option if I need it, but it seems a little complicated. I would like to be able to retire at age 50 of I hit $5M net worth, which seems possible if market does ok over next 5 years, but I would need some money to bridge me to those pre-tax accounts if that is going to happen. Any advice? If I cannot retire at 50 I can probably reduce my work week from 5 days to 3.

That is a nice amount in the retirement accounts at 45. Could you share what age you started and how much you put in each year as an example for others to follow?

V,

I am an engineer and my wife is a teacher. Until last year I always contributed 10% of my paycheck to my 401(k). In 1997 I started out making about $35,000 including overtime. Now 23 years later I’m making about $170,000 per year including overtime. Pretty average incomes for where we live. My wife and I also contributed the max we could to each of our Roth IRAs up until about 8 years ago when our income became too high. My company does not have a 401(k) match, but has an annual profit-sharing contribution that has pretty much been equivalent to a 5% match.

Here is where I have been very fortunate: I work for a very small company

with only about 5 employees. Very early in my career, my boss set up our 401(k) accounts with Schwab so that we could invest the money in pretty much anything (it’s like a regular brokerage account). I invested almost everything in individual stocks and got fantastic returns. I can take credit for my approach, which has been very patient and allowing my investments to grow long-term. However, I can take no credit for the individual stock picks. That credit has to go mostly to the Gardner brothers at Motley Fool. I took a liking to their online content back when all of their advice was free and have continued with a few of their pay services over the years. I am very fortunate that it has paid off.

Enji-Ninja you’ve got a good problem. Congrats. $2.4M in retirement savings at age 45 is pretty good. That puts you in the top 1% of Americans. Yours is not a lack of retirement savings as do most Americans but how to manage your money to enable you retire early.

Given the size of your account at this point and the fact that your employer does not match any 401k contributions, I agree it does not make sense to continue contributing to your pre-tax 401k if your goal is to retire in 5 years.

If I were in your situation, I would shift my contributions to post-tax brokerage and Roth IRA accounts. You’ll need to save enough in your Roth IRA accounts though to be able to draw down until age 59.5 when your 401k becomes available for distributions.

Your other option of cutting your work hours so you can still work until age 55 when you’ll be able to start taking distribution from your employer 401k is also good. But that means you’ll have to still work for at least another 10 years.

I think overall the problem you have is a good one. You’ll have to decide which is best for you. If I were in your situation, I would target retiring at age 55 working full time all the way. I would concentrate on contributing to my Roth 401k, Roth IRA, and brokerage accounts and focusing in income generating investments.

What percentage of your net worth is the $2.4 million in your 401k/IRA?

I would focus most of your effort on building a taxable retirement portfolio for the next 5 years for sure.

Then look at activities you enjoy doing where you can earn supplemental income to fill that gap between 50-59.5.

Nothing wrong with using 72 at age 50.

Yea, but the problem with 72t is that you don’t get very much in annual distributions. The calculation is designed to make very minimal annual distributions. I wouldn’t count on it.

Sam and Sam O.:

Thanks for the advice. I’ve stopped all contributions to my 401(k) and will now stop all of the (minimal) contributions to wife’s 403(b) to focus on taxable retirement portfolio. I’ll only worry about the 72t if I think I need to in about five years.

Sam – to answer your question – our 401(k)/IRA make up 87% of out net worth. Our college savings for our two kids is doing well, and we have some money set aside for them also which I don’t count in net worth. With that large percentage of our net worth not too accessible for another 10 years at least, it’s very easy for us to practice stealth wealth, but still gives me a good secure feeling. I’m so glad I found this website a couple of years ago. I am trying to use all the knowledge I am gaining from Financial Samurai to close the deal on becoming financially independent. I feel like we are getting close and feel very blessed, just need to now bridge the gap to 55/59.

Are you able to up your employer 401k contributions over the course of 3 years to pay back what was taken out from the CARES act?

“You then get a three-year period to pay the taxes to the IRS. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.”

Your employer separates your allowable annual contribution limit from your loan repayments. For example, in 2020 if you had a 401k loan, you will be able to contribute the maximum allowable $19500 pre-tax plus additional deductions post-tax towards your loans. Normally, your employer will spread out your loan repayments evenly over the payment period you agreed to in your loan contract. In sum, your employer accounts for your regular 401k annual contributions and loan repayments separately.

I’m terrible at timing the market.. But curious what people think about at least re-allocating 401K funds to larger percentage in CASH reserves pre-election. Civil unrest feels like an inevitability post-election, whoever wins. And if it’s contested or close election… AND we have a bad resurgence of Covid this winter, or even just a bad Flu Season we are talking a perfect storm for a economic drop this winter.

Feel like civil unrest could lead to a mid-march drop in stocks. I still have vivid memories of the looting in Santa Monica. It was quite the spectacle seeing indiscriminate looting of a wealthy area with no police presence. I could see it happening again if Trump is re-elected, but possibly less “peaceful”.

Then if Biden wins… I feel like we may get some very restrictive lockdowns this winter when flu season is in full swing. No way to differentiate quickly the common cold and flu from COVID and it will definitely panic people and keep people way from the hardest hit sectors well into 2021.

If you take the long term view, you will not worry much about the unknowable. I have learned so from experience. A couple of things are fundamental to the financial markets. (1) Over time, the financial markets trend upwards; (2) The US economy will continue to expand for the foreseeable future.

If you believe in those two philosophies, there is no need to try and time the market. From my experience, people that do so often than not always lose.

Could happen. Could not.

You say you’re terrible at timing the market. So why are you considering it? If you want to gamble on your retirement, go for it. If you’re right maybe you’ll retire a year or two earlier. If you’re wrong maybe you won’t retire.

I think there’s a good chance we’ll see a relief rally, whoever wins. Market likes clarity, and finally deciding an eventual winner in November will provide such clarity.

Related: https://www.financialsamurai.com/stock-market-performance-under-a-democrat-or-a-republican-president/ (doesn’t really matter)

Sam,

This topic made me think about the Mega Backdoor Roth I have heard about recently using your 401k. Any chance one of your future articles might cover this topic?

Thanks

Maybe one day. I’m just never a fan of paying taxes up front and taking away optionality.

Related: https://www.financialsamurai.com/is-a-backdoor-roth-ira-for-high-income-earners-a-good-move/

I look at any early withdrawal from a qualified retirement account as theft. Yes, it’s theft from yourself, but it’s your future self which I consider to be a totally separate person from your current self. Would you steal money from someone? The answer should be a “possibly yes” if, and only if, it’s a true life or death situation.

Great way to look at it, stealing from yourself.

The thing is.. there is also a hedge against an early death. It would be a shame not to spend our wealth before we pass… hence the post:

https://www.financialsamurai.com/ideal-age-to-retire/

Sam,

FYI You missed the #1 reason where it is OK to withdraw from my IRA and that is to pay myself (and wife) in retirement. Called a drawdown schedule which I update at least 2x per year. I have taken my 1st withdrawal in Jan 2020 and I plan on an annual withdrawal to live on along with social security.

Steve

Very true! However, I was focused on withdrawal of funds before retirement. I’ll make that even more clear by using the words “early” and “penalty” more often. I’ve added “early” to the title for more clarity.

Enjoy your retirement!

Sam,

Great post as always.

I live in NYC, and I had COVID-19 in the spring, my wife’s hours at work were reduced, and I was furloughed from my second, part-time job. So, we are eligible for the COVID hardship withdrawal.

I am still fully employed as a teacher.

I have a substantial amount in my 403B, as I have maxed it out annually, and have a guaranteed rate of return of 7%, thanks to the Teacher’s Retirement System.

That and my defined benefit pension will be the primary two legs in our retirement plan. I consider myself very fortunate to have these two exceptional retirement benefits.

My wife has about $50,000 in her 401k. She just took the match that her employer offered her on the first 5% of her contributions, invested in an S&P 500 fund, and here we are. She rolled it over to her new job, and they offer no match…

I am considering draining the account and putting the cash back in our column so we can have a larger down payment on a house in the next few years.

I am kind of torn as to whether this is prudent. This would basically increase our liquid payment from $220,000 to about $260,000, after we pay taxes on the withdrawal.

This is a princely sum in most of America, but really a pittance here in the Tri-State…

We have a two-year-old, and are considering a move to the suburbs in the next 3-5 years.

Not sure if this the right move, but I feel we should take advantage of this change in the tax law now.

Any insight from you or your readers is always welcome. Thanks for all that you do!

Why would you want to drain your wife’s retirement account just because she’s no longer getting an employer match? The employer match is just an additional benefit of saving for retirement which could help accelerate your time to financial independence. But not having a match does not negate the need to keep saving unless by default you are insinuating that the account is costing her more by way of fees than her returns. Think for a moment if the tables are turned and she is the one asking to drain your own 403b account. You should be encouraging your wife to continue to build a healthy financial habit of saving for her retirement. I would recommend you use the 220k you already saved up for your down payment and leave your wife’s 401k account alone.

Good insight. Thanks man.

3-5 years is a LONG ways away. Can you not boost your down payment amount by $40,000+ in that time period?

I wouldn’t touch your retirement plans for the house. Stay the course.

Thanks Sam! Your cogent analysis and insight is always appreciated.

My wife is furloughed indefinitely due to Covid and I had a drop in pay in 2020. We withdrew 80k from our traditional IRA and paid off our house. My logic:

– The investments have already doubled in value so good time to cash out

– I still have money in other IRAs

– 20k mortgage interest savings, which I estimate is greater than any income tax hit spread over 3 years

– I just halved my monthly expenses so I have more leeway to ride out a big recession, start a new career, accumulate dry powder, etc.

Smart? Dumb? A bit of both?

I am assuming the 20k interest savings is over the remaining term of your mortgage. I don’t have that information to do a full analysis. But did you factor into your calculation the potential earnings your 80k would have accrued over that same period? Did you also factor in inflation? The longer you pay your mortgage the less the value of your payments plus the tax deduction you get from mortgage interest etc. I’m assuming you have a fixed rate mortgage.

Overall, it’s hard to tell. Paying off a mortgage gives one a peace of mind, which is hard to quantify. I would say that if you and your wife feel good about it, you are probably okay. But I would not have drained my retirement account to pay down a mortgage.

Given you already did it, I won’t say anything negative :)

I’ve never met someone who has regretted paying off debt.

How much left do you have in your overall retirement accounts?

Thanks Sam! While I agree with everything you’ve written, there’s this voice in my head that says “destroy the mortgage. End it with the 401k and start building from there.” If paying off a mortgage is like saving for future self, why not kill it with fire while you can?

I can’t see a situation where killing the mortgage with retirement funds would be beneficial unless you’re 55+ years old and you intend to have a very conservative retirement portfolio, in which case, maybe a mortgage-eliminating downsize is in order. Or, you could refi to a shorter term and better rate.

It seems that you’re after stability, not wealth.

Because a 401k loan is going to return a guaranteed rate of return and if you do not spend the money, what do you think about using it as a hedge against a market downturn?

Really interesting way to look at a 401k loan.

It depends on two things:

1) whether you can time in the market properly. Hard to do over the long term.

2) what do you plan to spend the money on. Maybe nothing. But in that case, perhaps you’d be better off selling instead and holding cash.

In general, I think it’s bad to try to go in and out of your 401(k) or IRA. These are the accounts were we should have the highest ability to just buy and hold for the long term. At the same time, given there are no tax consequences for trades, there may be a tendency to trade more often.

The loan is just paying back yourself. So you’re not really gaining. Just moving money between accounts.

Related: https://www.financialsamurai.com/how-to-make-lots-of-money-during-the-next-downturn/

There are a couple of problems with the idea of taking a 401k loan and using it as a hedge.

(1) There’s no guarantee the market will go down. Even if the market does go down, you can never know when it will recover.

(2) Will you be holding it in cash? The effective rate of return on cash is zero at the moment.

(3) The concept of double taxation. Your 401k loan is taken from pre-tax contributions. But your repayments are made with post-tax money. When you begin taking distributions, you pay taxes again on the money.

I would be open to taking a 401k loan with the intent of not paying it back if and only if you find a great investment opportunity outside of your 401k plan.

no one knows how the market will go but in this thought it was to make a BET against the market. as stated above the loan money would not be spent so in case a market upturn the loan could be paid back quickly to re-enter the market. this thought isn’t about finding a better investment with the money its about reducing your exposure to the market for a temporary period of time.

Yea, but once you take out the loan, it becomes repayable immediately with interest via payroll installments. And you’ll be repaying it with after-tax dollars.

I get what you are saying from market volatility perspective. Sure, if the market falls precipitously right after you take the loan, you could come out on top. But who knows that?