Are you trying to decide if you should do your own taxes or hire a professional instead? Every year I use TurboTax software to do my own taxes and encourage others to do the same. Yet every year someone scoffs at me for spending a couple hours of my life learning, understanding, and optimizing my finances to pay the least amount of taxes legally possible.

A part-time tax preparer who'll make $375 filing my returns isn't going to know more than me. A full-time tax preparer with a CPA who charges $1,000 might be worth it. But after doing my taxes for 12 years, I've learned so much. And the only way a CPA will save me more money is by cheating. There is no secret magic that only tax accountants can use to reduce taxes.

Learn About Taxes By DIY

The best way to learn about something is to do it yourself. Remember when you were growing up and your mom taught you how to do a math problem? But, you'd completely forget how to do it come test time? How about reading all those SAT test prep books and then getting a mediocre score because you didn't take enough sample tests?

Being instructed on how to do something is helpful. But, getting in the weeds and solving different variations of the problem is the only way to achieve mastery. The same concept goes for understanding and minimizing your taxes. When you do your own taxes, you'll learn so much more about how the system works.

Main Reasons Why You Should Do Your Own Taxes

1) Nobody cares more about your money than you.

Do you really think some tax preparer is going to care as much about your money as you do? He's got another 50 reports to do after yours, on tight deadlines. Of course not.

He most likely has neither the time nor the interest. You, however, are motivated to read everything you can. Learn about rental property depreciation, mortgage interest deductions, alternative minimum taxes, and so forth. Tax software is so sophisticated nowadays that even someone with no experience can do their own taxes. All you need are all your documents to plug in the numbers.

Related: Audit Rates By Income: Your Chance Of Getting Audited By The IRS

2) You can create test cases.

My favorite thing about doing my own taxes is creating pro forma scenarios. I like to see what my tax liability will look like based on various levels of income and deductions. If you really want to know what making $1 million a year means, input $1 million into the software. See how much you'd owe in taxes and get bent over.

Then try entering a poverty wage, or a median household income, and see just how much (or how little) is left over. Thinking of seeing how much a mortgage can help reduce your tax liability? Plug one in based on a realistic interest rate to find out.

You can also see how your tax liability changes if most of your income comes from dividends, long term capital gains, and rental income instead of earned income. Once you figure out what's ideal, you can make appropriate changes instead of flying blind.

3) Gives you goals to strive for.

My goal each year is to pay no more than $40,000 a year in federal income tax and $10,000 a year in state income tax. With a $50,000 limit in mind, I figure out income goals for each type of income stream to achieve this balance.

You might have goals such as doubling your income, or reducing your tax bill to under $10,000 a year total. It's easier said than done. Doing your own taxes lets you map out specific goals across your various income streams.

Related: Bar Stool Economics Show Why A Progressive Tax System Is Wrong

4) Makes you reduce costs.

Paying for something in cash hurts more than paying for something with a credit card. Cash is tangible and requires the act of counting. When you've got to input your W2 tax figures, HOA costs, and business costs one by one, it hurts! And because it hurts, you'll be much more cognizant of figuring out ways to reduce costs.

5) Increases your knowledge.

Teach a person to fish. The reason why so many people get screwed over with bad purchases, expensive mutual fund fees, and higher than necessary interest rates is because people who know better take advantage of people who don't know better.

Think about the classic situation where an unassuming person brings in her car for an oil change and comes away with $1,000 worth of repair suggestions. It happens all the time. The more you know, the more you'll be able to protect and grow your money.

6) Saves you time.

For the first two years after college I allowed tax preparers to do my returns. Each time I had to gather my documents, schedule an appointment, pay for parking or transportation, and sit down with them for at least an hour to explain my situation in order for them to do my taxes to the best of their ability. I also had to go back again to answer any other followup questions, pick up my documents, and pay the bill.

Now I don't have to explain myself to anybody. I can do my taxes from the comfort of my own home and pay for everything with clicks of the button thanks to the internet. If I need tax help, I can utilize TurboTax's help service or simply search for questions online.

Related: Five Lessons From Doing My Taxes For Over 10 Years

7) Saves you money.

$49.99 is cheaper than $375 or $1,000. The biggest fear is that a self-preparer somehow screws up on his/her taxes and owes more or gets less back than possible. The simple solution is to double and triple check your work by going over each step.

Your tax software will also check for errors as well. You'll learn that there is no more a CPA can do for you if you are doing your taxes right. All those commercials about a tax software finding you extra money are targeted towards people who don't know how to follow instructions and do their own taxes properly.

The most common errors I see are: 1) forgetting to input the cost basis for your securities; 2) forgetting to include all costs associated with your rental such as the HOA, mortgage interest, marketing, cleaning, repairs, and travel expenses; 3) forgetting to include all interest income; 4) double counting your primary mortgage interest; and 5) forgetting to input all your charitable deductions.

Related: How Higher Taxes Saved Me A Boatload Of Money

8) Keeps your privacy.

If you are a private person who doesn't want anybody to know your business, doing your own taxes is the way to go. Think about all the bank tellers who know exactly how much you have with their institution every time you deposit a check.

Very few of them stay for more than a couple years, so the longer you are around, the more people know about your finances. We derive comfort from returning to the same primary care physician year after year partly because of trust, but also because of privacy.

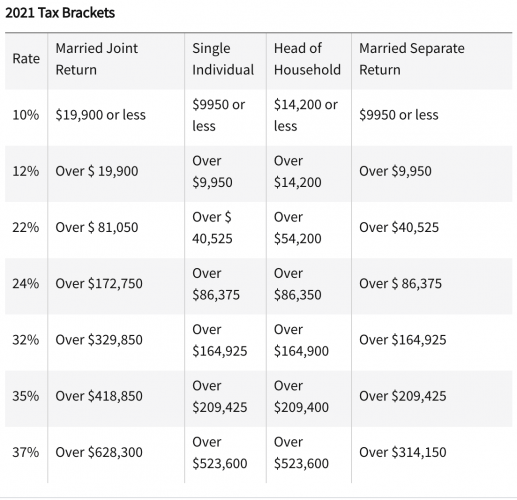

Below are the 2021 Federal Income Tax rates:

Do Your Own Taxes – They Are Your Biggest Liability

It should make everybody sick to their stomach that the government usually takes more from you than you can save. I introduced the Total Income Taxes to Total Savings (TITTS) ratio to motivate you to save more and reduce your taxes. Everybody should shoot for a TITTS ratio of 50% or lower to get ahead.

Most people will ignorantly go through life not knowing where their money is going. If more people did know how their money was being spent, I strongly believe the government would be much less corrupt and much more efficient with fiscal spending because there'd be more accountability. With more efficient spending, we could see a large positive shift in GDP and lower unemployment.

The most pragmatic solution is to probably have someone do your taxes the first time around. Sit down with him or her to go over your entire tax form and ask questions along the way. Once you've grasped the basics, go ahead and do your taxes online on your own. You might make some mistakes here and there, but don't worry, the IRS isn't some cruel organization who will punish you to oblivion. After several tries you'll never want to let anybody do your taxes again.

I've used tax software like TurboTax for the past 11 years now because it's easy to use. I also love how my info rolls over each year saving me time. It's never been easier to do your own taxes. Just make sure to get the software version that best suits your needs.

Further Reading

Tax Savings Recommendation

Start A Business: A business is one of the best ways to shield your income from more taxes. You can either incorporate as an LLC, S-Corp, or simply be a Sole Proprietor (no incorporating necessary, just be a consultant and file a schedule C).

Every business person can start a Self-Employed 401k where you can contribute up to $54,000 ($18,000 from you and ~20% of operating profits). All your business-related expenses are tax deductible as well. Simply launch your own website like this one in under 30 minutes to legitimize your business.

Here's my step-by-step guide to starting your own website.

Updated for 2021 and beyond. Taxes are at the lowest levels they've been in years. Take advantage to make more money and invest for your financial future!

Except that I input the same data and my CPA, Turbo Tax, and HR Block all come up with different amounts – none of the income value or tax amounts match. So, how do you know which is correct?

At least if CPA does it, then if the IRS questions, the CPA will have to provide answers.

The CPA won’t necessarily be correct either.

[…] Why You Should Probably Do Your Own Taxes […]

Great article. Thanks for the info, you made it easy to understand. BTW, if anyone needs to fill out a tax forms, I found a fillable blank tax forms here . This site PDFfiller also has some tutorials on how to fill it out and several tax forms that you might find useful.

I’m a CPA , I can do taxes but I usually don’t, I do internal auditing, private accounting, among other things. However, I must say the more complex your taxes get, the better you’d be hiring a professional to do it for you. If you make less than 120k, don’t have investments, among other things, a $50 software can do trick. I do taxes to close friends and family, but I rather do business/ management (P.S: Now working on my MBA , in one more year I will have CPA, MBA after my name yay!!!!)

Couldn’t agree more, both with you, and with David’s comment about pre-planning.

I’ve been doing my own taxes, and now our taxes, forever. First with Turbotax, now with TaxCut.

The best thing about them is how easy they make it to run what-if scenarios – should we file jointly or separately, what happens if we buy a rental property, or have a baby, or lose a job.

But if I were to start my own business, say an LLC to run rental property, I’d consult with an advisor first to make sure I’m ready for quarterly taxes, etc. to get it right the first time.

No one wants a rude shock come tax time.

I am a CPA but never focused on taxes. I have always prepared my taxes using TurboTax.

Being a CPA, my friends all assume I do taxes and ask for help. What I tell them is that a tax preparer will ask you some questions but will simply enter the information you provide into the correct forms and boxes – basically data entry. Data entry is hardly a value add skill.

For the vast majority, their taxes involve little more than data entry.

The value in hiring a CPA (not HR Block type) is in the tax planning advice they can give you. This is a proactive service before you do something (start a business, sell a business, buy a rental property, make investments other than stocks, etc.). Their advice can often save you much more than their fees cost. You don’t have to use them to prepare your taxes.

The only people that should use HR Block type tax services are the severely financial illiterate.

PS – Sam I am new to the site and really enjoying it – the content, voice of a financial professional like myself and a very similar investment/lifestyle philosophy.

Welcome to my site David and thanks for sharing your opinion.

It is interesting to know that a tax preparer simply data entries all your info into a software that you yourself can do, and probably more efficiently. Of course we’ll always have some random questions here and there, but hopefully the internet can answer one’s questions.

I think going through a tax preparer for the first couple times is very helpful. But afterward, one can do it all on their own nowadays.

As a CPA, I’ll chime in on this one. Doing your taxes yourself is like just about any other do it yourself project. If you commit the time to understand what you’re doing you’ll probably benefit from the experience. But to be honest, many people are not well equipped for this. I spent a season as a “Tax Advice” agent at Turbo tax and dealt with a lot of customers who were in way over their heads.

I have no doubt that most readers of this blog will do a fine job doing their own taxes, but this readership is hardly typical of the general public.

Thanks for pitching in Chris. I’ve overheard some folks who were getting 1X1 help at an H&R Block office, and I have to agree. Many people need all the help they can get. Even if the software is dummy proof, you might still not know about all the documents you need to have to initiate the software.

That said, could it be that if you were that bad at understanding taxes, you would have the most simple tax forms to file ie only W2?

That is certainly true in many cases. Still, you would be amazed. At the lower end of the literacy scale, I’ve seen some monumental whoppers. The software is not as idiotproof as you think.

Like many readers, I’ve done my own taxes since I was a teenager some 35 years back. Started in paper, but moved to TurboTax when PCs became common.

Mrs_Wookie is a CPA (now retired), and all my engineering friends assume she does our taxes. She’s always quick to point out that her specialty was never taxes (it was SEC reporting), so she happily lets me do it. Her ‘network’ of CPA friends has come in handy a couple times when we had unusual tax issues (e.g. extension payments paid to us to keep a real estate contract alive).

I find TurboTax pretty easy to use, though the K-1 stuff from Master Limited Partnerships gets to be a little complicated. Each K-1 adds about an hour to my prep time, and sometimes the minutiae doesn’t seem to have a proper home. Having been audited once or twice in the last 20 years, I’m not really afraid of it. You meet, figure out what was or was not correct, you pay what you owe. None of it is life changing.

Great article Sam. I’ve done my taxes myself ever since I had to file them, but this year things are a bit tricky with the traveling and business and I’m wondering if a professional might be worth the investment, in that he’ll save us more money than he costs. Do you think that’s a myth?

Last year, I went to a certified tax preparer and was charged $50. Not bad. This year, I’d really like to dig into it myself because – as you said – no one’s going to care more about my money than me!

I’ve always done my own taxes and did the cheapest filing software possible. But this year was the first year that my taxes were a little more intimidating (with 3 different businesses showing revenue) and I wanted to reduce my tax liability.I have a local CPA charging me $250 and I am confident he will lower my tax amount due versus what I would have done on my own.

I forgot to add my personal use of my advice:

My business’ pension plan: I pay an actuary. Legally required and rightly so.

My business: I pay a CPA for the annual taxes. I take care of the payroll, 940 and 941s. I also maintain multiple spreadsheets to keep logs, reports, and to tax plan. I know to within a couple percent my actual tax liabilities any day of the year.

Personal taxes: Now done by the CPA, because she charges me a modest fee as part of a package deal and the nexus between business and personal has become murkier since I started to use section 105 plans.

The expertise costs me about 1.5% of my net earnings. The savings are multiples greater in avoiding friction with the IRA in the form of penalties and interest from errors and late reporting.

Learn a lot to be an informed consumer,

but do not be so foolish as to not pay for expertise when warranted.

Know what you know, and in particular know what you do NOT know.

[/end of homilies]

I own rental properties internationally, so my family pays a tax preparer to do our taxes. My share is typically $500-1000. It is way too complicated to square things with the IRS and the CRA (I’m in Canada, property is in the USA) alone. Before I owned this property I always did my taxes myself.

Hi Sam,

First off love your blog – and share many of your viewpoints. I read often, but never comment. This was the first article, I was a little surprised by. I used to be a volunteer for Volunteer Income Tax Assistance / Center for Economic Progress – which completed tax returns for low income families and had some basic personal finance help (e.g setting up a savings account). H&R Block was seen as the enemy, primarily using marketing tactics to target lower income individuals, charging higher than average prices, and insane interest rates for anticipation loans. Furthermore, they are known for not attracting the best people thus are not known for advice.

A few friends in the management consulting world mentioned that H&R block is having a really tough time moving up market to capture high income people due to their reputation. Was surprised you felt confidence in having brick and mortar stores that you could go to if there was an issue. I have a hard time imagining that anyone at H&R block would be able to tell you something you didn’t already know. Or having people that could resolve the issue.

Just sharing my thoughts… Thank you for all your wonderful blog posts – I enjoy reading them.

Elizabeth

Good perspective Elizabeth. It is exactly because the H&R Block advisor couldn’t tell me more than I know which is why I didn’t use him any longer.

It’s important that we differentiate between the H&R Block software, and the H&R Block tax advisor. I’m focused on the H&R Block software which I’ve used for over a decade. I’m pretty sure Turbo Tax, Tax Cut and others do just as good of a job. But I can’t write about them because I’ve never used them. I only want to write about what I know, and I know H&R Block’s tax software is great.

The H&R Block advisor I had one year was also nice. Funny guy who helped me. I didn’t want to spend $375 anymore b/c I figure it all on my own, and he was using the software. I didn’t want to go meet him, give him my private documents, explain stuff to him any more. So back to the point of my article: I highly advise everyone do their taxes on their own.

Thanks

I just read this so I am a few days late with my comment but I only pay $85 for tax preparation with a local company here in Wisconsin. For years they only charged $55 and only in the past couple of years increased their fee! This includes the e-filing also.

But I am very organized and the preparer this year said I should just do my own because I have all my ducks in a row, but for the small amount they charge, I’m just going to have them do it.

That’s not expensive at all. Might as well use them, then you can ask questions too.

My wife works at H&R Block as a tax pro and the last few years has done our taxes. For most of the readers here, I would suggest doing your own taxes and if you aren’t sure about something, go to a local office. When you do, ask to work with a master tax advisor or better, an Enrolled Agent. CPAs don’t need to pass an exam with the IRS, but EAs need to pass this exam every few years so they can represent in front of the IRS. Taking these steps will make sure that the person you’re working with actually knows what they’re talking about.

I think #1 is the most important of all. It is true most tax “experts” don’t work hard enough for you to give you the complete deductions you deserve. There have been cases where I go do my taxes and they have never asked me a question about other possible deductions.

I’ve had a great experience doing my own taxes. There is a lot to learn from them, and a lot more deductions that I had never imagined possible.

I’m old enough to remember doing my taxes by hand, but was lucky enough to be in technology and really on the leading edge of using computer-based tax preparation software. I’ve used TurboTax since back in the days of DOS and no internet. I’ve always been happy with the product and the results. I pay a bit more than you, but through the years they have been responsive to questions and complaints.

I have always dome my own taxes. I did them by hand in the early days, and then using computer programs: Mac-In-Tax, Turbo-Tax, and TaxAct online.

I couldn’t agree more Sam!

I’ve done my own taxes since I was literally 16 years old (more than 30 years ago). I’ve combed through various pieces of the tax code, and I’m always pleasantly surprised when my taxes paid are very minimal due to tax write-offs (my 4 biggest are the $4,000 in tax credits I have walking around my house … er, I mean kiddos).

I have had my taxes examined twice in my life by a CPA to ensure that I was at low risk for audit, and to ensure that I didn’t take invalid deductions. The cost of the CPA was usually about 3-4 times what it costs me to do in TurboTax.

I also have my taxes completed by February 1st and submit them as close to that date as possible. We already have received our tax checks and put them to good use in our brokerage account. :-)

I agree that for the average return, most everyone can prepare their own return. I have used a CPA for years, although I send him a spreadsheet. I needed a CPA when I had businesses and real estate. Since I have a long term relationship and just send him the information, he charges me about $150. The benefit is being ale to ask questions during the year for free.

I do my own taxes too. 9 businesses (1 S-Corp, 8 LLCs) and my own personal. My accountant was always late. I always found more receipts after I had already subbmited my information to the Accountant.

You can download TurboTax corporate edition for as low as 59.98 and Home and Business for 45.99. An accountant would probably be $250 minimum for each return I have.

I could not agree with you more. I often say no one can care as much or more about your money than you. I know and love someone who always says “I’ve got somebody who does this, somebody who does that” and this terrifies me because of the level of blind trust he gives to people. He doesn’t know what they are doing, whether they are truly qualified, and doesn’t care to yet he knows another person in his chosen field (he and the other guy are at the top of those in their field in this entire state) who is being fleeced because of this very SAME mentality. Yet, when I remind him of this and the fact that no one else can care as much or more about his money than him, he glazes over. He does not care to learn and for that reason he an many people pay dearly. Nevertheless, I worry for him very, very often.

Every point made in this article and by many commenters are valid however no one talks about the value of speaking with a knowledgeable and reputable CPA. It’s all about how you use your tax professional. I pay 500 and spend 2 hours with my accountant once a year, mostly talking tax strategy. He has done my taxes for the past 5 years and as a result all my rental properties and generic information are just copied over from last years file so it’s not spent giving endless forms rather a quick update and new items etc…

I look as the 500 spent towards tax advise not preparation. Considering his hourly bill rate is in the 400 it’s a steal for me. Besides tax preparation is tax deductible. I think it comes down to personal preference, however I would not ever go to HR Block or similar.

The advice is a good angle to take, and I did recommend folks sit down with one in the very beginning to learn the basics and more if possible.

But after the first or second year of discussing taxes, there’s not that much more your professional can do for you 1) tax software has captured everything and is always updating. if they don’t they go out of business, 2) you should have learned a lot of ways to minimize your tax liability already.

I prefer using a CPA now. Maybe after a few more years of using the CPA I’ll try to file on my own, but with K-1s and real estate, it can be tricky. Better to get it right the first time than struggle through a painful audit. I guess it depends on how clean your taxes are. If you are a salaried employee and your investments in the market, seems advisable on your own. If your investing isn’t so vanilla, or accounting isn’t your strength, probably less risky to defer to a professional.