Is earning $1 million a year, at least a top 1% income, enough to retire early? Most would say yes. However, some people who earn $1 million a year having a hard time letting that money go.

After all, all you've got to do is work one more year and you will make another $1 million! For most people, I'm sure they'd happily sacrifice working at a crap job for another one million dollars.

Meanwhile, there are plenty of undisciplined high-income earners who spend everything they make and then get into debt. It doesn't matter if you're earning $1 million a year if you're spending $1.1 million a year! You will never retire early at this rate.

This article explores when earning $1 million a year isn't enough to retire early. Many high-income households in big cities are having a difficult time escaping the rate race to do something new.

Invest in private real estate to boost passive income and returns

If you want to boost your passive income, invest in real estate. The combination of property price appreciation and rental income growth is a powerful wealth creator. Real estate enabled me to retire at 34 due to a portfolio of rental properties that generate over $120,000 a year. You can invest 100% passively in real estate through Fundrise, with an investment minimum of only $10. I’ve personally invested over $290,000 in Fundrise so far as it is my favorite private real estate platform.

When Earning $1 Million A Year Isn't Enough To Retire Early

We know that a $300,000/year household income is pretty middle class if you live in an expensive coastal city like San Francisco or Washington DC.

However, we can all agree that earning $1,000,000 a year or more makes you rich, especially since a top 1% income level starts at roughly $650,000 as of 2024. No household earning $1,000,000 or more should ever struggle unless they leveraged up and their investments imploded.

If you make $1,000,000 a year or more, you're free to celebrate. Just don't tell anyone lest you want an ax-wielding robber waiting for you in your living room after an evening of fine dining.

Below we'll explore the lifestyle of a typical household earning $1 million a year living in New York City. A family anonymously shared with me their expenses, and I've done my best to tell their story without sharing their exact details.

This post will give you a taste of what it's like to make $1 million a year. You'll also get to decide whether making a top 0.1% income is truly worth the price.

Very Profitable Earning $1 Million A Year

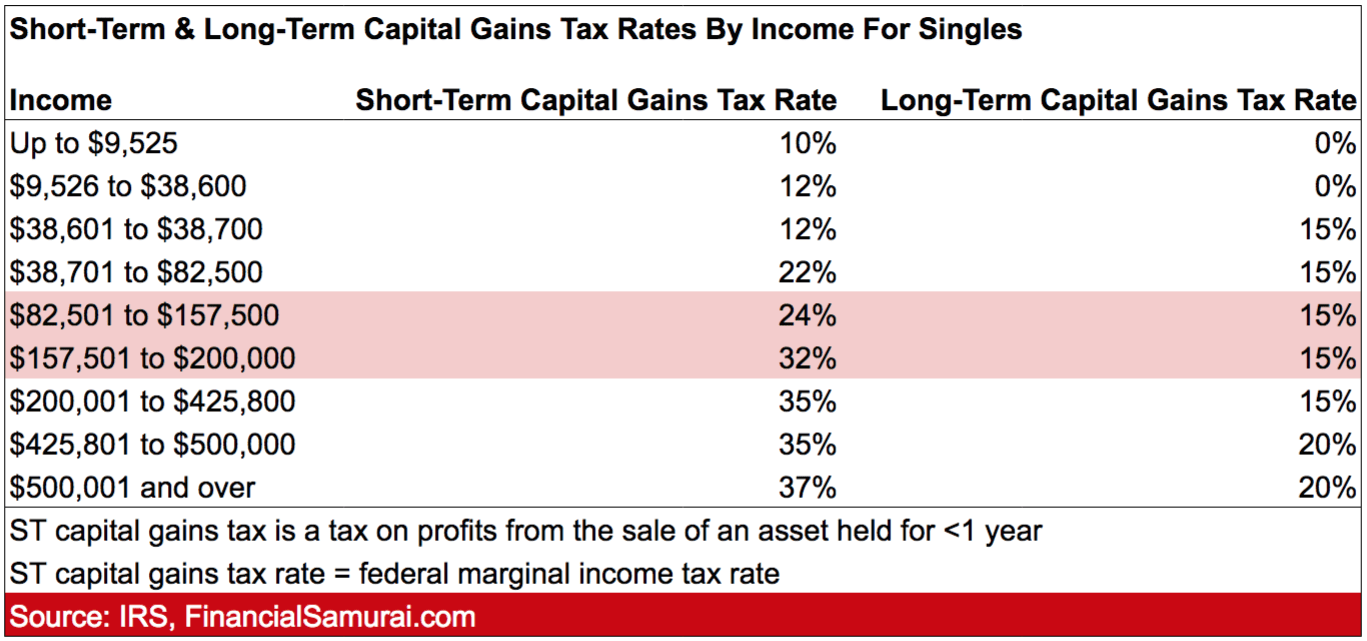

After tax cuts were introduced in 2018, making more money has never been more profitable. Not only did the top federal marginal tax rate get cut from 39.6% down to 37%, the income threshold for the top federal marginal tax rate also rose from $418,400 to $500,000 for singles and from $470,700 to $600,000 for married couples.

In other words, there's never been a better time for earning $1 million a year! However, beware as President Biden is looking to raise the federal marginal income tax rate on households making over $400,000 to 39.7% again.

So, if you've been wanting to make over $500,00 a year as an individual or over $600,000 a year as a married couple, now is the time to do it. You're essentially getting about a $15,000 federal income tax break if you make $1,000,000 now versus in 2017.

But as we are all well aware, the desire for money and prestige tends to corrode lives after a certain point. Once you make over $200,000 as an individual or $350,000 as a family, there is no additional happiness that accrues from making more money.

Instead, lifestyle tends to deteriorate due to longer hours at the office, more stress, poorer physical health, and less family time.

$1 Million A Year Profile

Rachel Chen is one such person who doesn't know whether the $1 million lifestyle is worth it. At 45, Rachel is one of several portfolio managers at a small hedge fund with $1.5 billion in assets under management.

She toiled as a research analyst on the sell-side for six years before making the leap to buy-side analyst at 28. At 37, she was finally promoted to portfolio manager.

Rachel's husband, Colin Chen, 43, has been a stay at home dad since their second son was born in 2011. Colin used to make about $350,000 as a strategy consultant, but got tired of all the travel and decided to give up the grind, especially after Rachel started making more.

Colin has been working on a non-fiction book to keep intellectually stimulated. But it's hard to stay focused with the kids and his wife's robust earnings. It took Colin several years to get comfortable being a stay-at-home dad.

Related: My Secret To Retiring Early With A $4 Million Net Worth And Two Kids

Income Statement Of A $1 Million A Year Household

Let's take a look at the family's income statement and household budget. As you will see, earning $1 million a year goes fast due to taxes and other living expenses.

Income And Tax Analysis

After contributing $22,500 to her 401(k), Rachel has a taxable income of $977,500. Her income is in the 37% federal marginal income tax bracket, and she pays an effective federal tax rate of 40%, or $379,920.

Given this household lives in New York City, they pay a State tax rate of 6.85% ($323,200+), and city tax rate of 3.87% ($500,000+). Paying Federal + State + City taxes is a lot of money. Can you imagine paying $379,920 a year in income taxes?

As a W2 wage earner, there's really no way around this enormous annual tax bill. Due to the SALT (State And Local Tax) limit of $10,000, high-income earners in high income tax states such as California, New York, New Jersey, Connecticut, Oregon, Minnesota, and Iowa lose out. Before 2018, the deduction was unlimited, but subject to Alternative Minimum Tax.

Even though the marriage penalty tax has been abolished for two singles who individually earn up to $243,725 in AGI, the SALT cap limit of $10,000 is a marriage penalty tax. If you have two unmarried taxpayers both paying $10,000 in SALT, they will get an aggregate $20,000 when they file, whereas if they get married they suddenly lose $10,000 in deductions.

Below are the 2024 federal marginal income tax brackets. By earning $1 million a year, the Chen household has to pay the top marginal income tax bracket of 37% plus state tax plus city tax. The total tax rate for income above $731,200 is over 51%!

EXPENSE OVERVIEW

Private School Tuition – $122,400/Year

The couple forks out a hefty $122,400 a year for their two sons to attend The Dalton School. Tuition includes books, computers/tablets, and lunch.

Given mom and dad went to Yale University, they'd like their children to also go to Yale University. They know that Yale and all the prestigious private schools have a legacy system which gives children of alumni a huge leg up in admittance, no matter their racial or economic background. Some call this affirmative action for rich kids.

Although legacy children have a roughly 3X higher chance of getting admitted than nonlegacy students, there is an understanding that alumni should provide regular donations to stay in good standings. Therefore, Rachel and Colin together donate $5,000 a year.

Finally, the Chens also contribute $64,000 combined to their children's 529 College Savings Plan. The maximum gift tax limit is $17,000 per adult per child. They are fortunate to have paid off their student loans years ago.

Below was the private school tuition rates for the 2024 school year. If they just sent their kids to public school and invested the cost of tuition each year for 17 years, they'd have at least $1.14 million more per kid.

Food And Entertainment – $4,480/month

New York City is the best city in America for food and entertainment. Although many in San Francisco might contest this claim, the entertainment part of the equation is truly second to none.

The classic mutton chop at Keens Steakhouse costs $60 before tip and tax. Add on a glass of Cabernet Sauvignon, some creamed spinach, wedge salad, and a 1/2 dozen fresh oysters, and we're easily talking $150 per person. A meal at one of my favorite restaurants, Le Bernardin, will easily cost $600 for a couple with wine pairing. Have a look yourself.

After a nice meal, the family like to hit up a Broadway show. Tickets range from $60 up to $1,500 on average for the latest hot show. But given they aren't earning multi-millions, they often settle for $250 tickets at most. In other words, a date night out easily costs $1,000+. Good thing they only go to shows about once a quarter because they're often too busy or too tired to do anything more than have a meal at their favorite local sushi restaurant for $150 total.

When the Chens are not eating out, they're eating home delivery from GrubHub, or having a simple home cooked meal prepared by Colin. Living in the culinary capital of America is both a blessing and a curse. Both Rachel and Colin are constantly watching their diets and working out so they don't die prematurely.

Housing – $14,958/month

They own a 5 bedroom, 3 bathroom, 2,700 sqft brownstone in Park Slope, Brooklyn they bought in 2016 for $2,600,000. It was a fortuitous time as their brownstone has appreciated by roughly 50% to $3,800,000.

When their first child was born in 2008, they had owned a $1.3 million, two bedroom, one bathroom condo on the Lower East Side bought in 2004. They realized very quickly that they needed more space for two kids. They plan to live in the house until their youngest goes off to university in 11 years.

Their mortgage is $9,800 a month, $3,300 of which goes to paying interest and $4,500 to paying down principal. Then the couple has property taxes $3,926 a month, maintenance, and insurance.

Things tend to break or leak with old brownstones. They didn't truly realize how much more it would cost to maintain a larger home with outdoor space compared to their condo in Manhattan. At least the Chens are building at least $4,500 a month in equity.

With the SALT deduction capped at $10,000, they will be losing out on thousands of dollars of tax deductions. As a result, they've diversified into real estate crowdfunding to take advantage of heartland real estate where valuations are cheaper and net rental yields are much higher.

Vehicles And Transportation – $2,842/month

Colin is a car enthusiast, and Rachel appreciates the utility and safety of an SUV for her kids. As a result, they own the newest Range Rover Velar and Porsche 911S. The P380 Dynamic Velar is leased for $800/month. The Porsche 911S costs $1,100/month.

The Chens drive their Velar to the Hamptons many weekends during the summer where they rent a vacation house with friends. Colin drives his Porsche to the country club to play golf a couple times a week while the kids are in school. It's his way of staying in shape and socializing given most of his peers still work full-time jobs.

Vacations – $36,000/Year

The Chens take two vacations outside of New York City a year plus a staycation. Before the pandemic, the Chens would spend closer to $40,000 a year. Post pandemic, the Chens decided to stay in NYC for one week to save money.

Given Rachel works ~65 hours a week, vacations are extremely valuable to her so she can recharge and spend quality time with family. The thing is, even when she's on vacation, she's checking in with her analysts and following global stock markets at all hours.

Rachel has long felt a tremendous amount of guilt for being away from her kids for so long, but she also realizes she's in an enviable position to maximize her career earnings while the stock market is still hot. Eventually, the market will turn and it will become much harder for her to outperform.

International Travel Is Not Cheap

The Chens' favorite vacation spots are mostly in Europe: Dubrovnik, Almalfi Coast, St. Tropez, Provence, and Mallorca are some of their top destinations. It's easy to fly to Europe from the East Coast, but every other year, they'll take a trip back to see extended family in Taiwan. They also love visiting Japan, Thailand, and Vietnam when they can arrange two consecutive weeks off.

Each international trip for a family of four costs roughly $13,500 for the week. The cost can be broken down as follows: $4,000 – $6,000 for economy class flights, $4,000 – $5,000 for 7 nights at a five-star hotel, and $2,000 – $4,000 for food, excursions, and souvenirs.

Clothes For Four – $24,000/year

Rachel loves clothes and shoes, and Colin doesn't mind dressing up nicely to match his lovely wife, although he prefers to wear athletic gear all day. As a fund manager who expects to be taken seriously in a male-dominated industry, Rachel dresses her position.

Her pantsuits from Gucci, Dolce, and Chanel easily cost between $2,000 – $3,500 each. On average, she buys one work suit once a year to keep her threads fresh, although sometimes she buys a couple during holiday sales.

With every power suit must come matching Manolo Blahniks or Jimmy Choos at the cost of between $800 – $1,000 a pair on average. Below is a regular blue satin pump by Manolo for $995 before tax at Nieman Marcus.

After the pumps, Rachel must of course own a work-appropriate tote bag that can cost anywhere from $1,000 – $3,000. She prefers the understated Prada bags with their hard waterproof exterior. Below are some of her clothing examples.

Simpler Clothes For The Dad

Given Colin is a stay at home dad, he doesn't need to spend anything on work clothes. However, he does own and appreciate an array of finely cut blazers to go along with his designer jeans and button down shirts for when they go out.

Each custom blazer costs between $1,000 – $1,500 on average. Designer jeans run between $180 – $300, and shirts from the likes of Thomas Pink can range from $80 – $250. He only has one watch, a stainless steel Royal Oak Audemars Piguet he bought for $16,000 years ago.

Charity – $24,000 / Year

The Chens feel extremely fortunate to be in their position as second generation Americans whose parents worked lower income jobs to put them through school. When you are given the opportunity to make it beyond your wildest dreams in the greatest country on Earth, the Chens feel it's their duty to regularly give roughly 2.5% of their gross income to charity.

Rachel and Colin are particularly passionate about helping foster kids get through a difficult system in order to be given a fair chance at life. They know their sons are extremely fortunate to attend private school, and deep down they feel it is unfair that their kids can have so much, while other kids, through no fault of their own can have so little.

Finally, they donate to organizations that do research on nystagmus, a visual condition their youngest son inherited. Nystagmus is a neurological condition that causes involuntary movement in the eyes, which leads to worse than 20/20 visual acuity, even with the use of glasses, contacts, and surgery.

Net Worth Summary After Earning $1 Million A Year

Rachel has a target of working for 15 more years until her youngest son graduates college. Once both kids are through college, this will free up roughly $200,000 a year in after-tax children related expenses, which is equivalent to roughly $333,300 in gross income based on their 40% effective total tax rate.

After 15 years, the couple should be able to accumulate at minimum:

- $277,500 in 401(k) plus $150,000 in profit sharing

- $816,495 in after-tax cash

- $500,000 in principal pay down (leaving $1,000,000 left in mortgage)

For a base case net worth increase of roughly $1,600,000 without any appreciation in their investments or house.

Future Net Worth Growth

Assuming $106,666 in base case net worth growth over 15 years, no compensation increase during this time period, and a current $3,000,000 net worth, including the equity in their primary residence, the Chens will realistically have a $10,000,000 net worth by the time their youngest graduates from college using a 6.2% annual growth rate.

She'll be 60 years old and he'll be 58 in 15 years.

Once their brownstone is paid off, they'll save an additional $86,000 a year in after-tax cash flow, equivalent to $145,000 gross based on a 41% effective tax rate.

Therefore, the Chens can afford to maintain their lifestyles earning just $500,000 a year once they no longer have mortgage debt or child expenses.

With a $10 million net worth, all they would need to do is figure out some way to generate a 5% return to live a great retirement and diligently track their finances to make sure there's no leakage.

They've been surprised at how some of their rich friends ended up with so much less because they weren't aware of their risk exposure during a downturn or how much they were spending.

Not Sure If It's All Worth It

On paper, everything looks great for the Chens. Yet, Rachel tells me she doesn't know if it's worth working 65 hours a week for the next 15 years. Even the finest lobster at Le Bernardin or the most picturesque luxury villa off the Almalfi Coast gets old after a while.

Rachel sees a therapist every other week to help her manage the constant pressure she feels to provide for her family, outperform her peers, and outperform the markets. The market takes no prisoners and every month she starts with incredible anxiety. This type of pressure has begun to pulverize what little peace and quiet she has left inside. She's also recently begun to develop heart palpitations, which has her worried.

Colin Feels Down Because He Doesn't Have More Purpose

Colin also sees a therapist once a month to help him get through his feelings of unworthiness for being a stay at home father. Although he's truly a great dad, he often feels gutted to have given up his career.

None of his friends, who all work, understand what he's going through. He feels isolated and occasionally depressed. Sometimes he gets jealous of Rachel's success, which leads to fights.

If there was ever a case of money doesn't buy happiness, this is it. My suggestion to Colin is to do some part-time consulting to help fill the void. 15-20 hours a week is the perfect balance because it will give him purpose, something to do, and inject him back into society while his kids are in school. Part-time consulting is what I plan to do once both my kids are in school starting September 2024.

Rachel Wants To Spend More Time With Family

What Rachel misses most is spending time with her boys, who are growing up too fast for her liking. She knows that she might only have 5-6 years left to spend time with her sons before they would prefer spending all their free time with their friends. Before she knows it, they'll be off to college where she might be lucky to see them twice a year.

Rachel envies Colin's time at home. Most of her girlfriends are stay-at-home moms who take turns hosting playdates when their kids are off. These moms go to every school event, every social function, play pickleball five days a week, and don't seem to have a care in the world. When their kids are in school, they often go to brunch at Blue Water Grill with bottomless mimosas over mounds of freshwater oysters.

Rachel and Colin recognize they are fortunate. The Chens just wonder whether the grind is worth it, especially when they see friends from high school leading happy lives earning much less.

But the family does worry their kids will be downwardly mobile. After all, a $1 million income is a top 0.1% income level. The chances are low their children will earn the same amount.

As a result, they seek generational wealth equal to at least $10 million. They know they don't need this level of net worth, however, when you're living in New York City, it seems as if everybody has a ton of money.

The Need To Generate A Greater Net Worth

The only way to live a freer life is to drastically reduce expenses, change their lifestyle completely, or accumulate at least 20X their annual expenses in net worth. At their current $500,000 annual burn rate, Rachel will truly need to work another 15 years to finally experience the joys of financial freedom.

If I was Rachel, I'd either ask for a sabbatical or dial back work to 40 hours a week for less compensation if she cannot outperform. Making less money with less stress, fewer hours, and a lower effective tax rate sounds so much more reasonable. They'll have to cut down on entertainment, clothes, and travel, but they'll gain back so much more quality time as a family.

At high income levels, retiring early is a choice. Yet so many people cannot or will not because oftentimes, the money is too hard to quit. 10, 15, 20+ years later, they find themselves still grinding with golden handcuffs, wondering where all the time went.

Cut Expenses And Get A Consulting Job

The key for the Chens is to reduce their $500,000 annual expenses.

Going down to “just” $400,000 and investing the $100,000 every year would enable them grow their net worth by an extra $2.7 million over 15 years, using a 7% compound rate of return. Alternatively, Rachel could retire two-and-a-half years earlier and still achieve a $10+ million net worth if the housheold spent $100,000 less a year.

The other solution is for Colin to get back to work. He doesn't need to go back to strategy consulting full time making multiple six figures. Colin can simply take on part-time freelancing work to boost their household. Part-time work would also give Colin more purpose and make him feel less lonely.

Making $125,000 – $180,000 a year working 20 hours a week as a consultant is relatively common in New York City, especially with Colin's skillset and experience. 20 hours is just enough to feel productive, while not enough to make yourself miserable about work. Colin will still have enough free time to play with the kids, pick them up and drop them off from school, and take care of the house.

Make Hard Choices To Create A Better Life

At the end of the day, the Chens have choices that will enable them to lead a better, more balanced lifestyle. They need to appreciate how fortunate they are to earn so much. In addition, they need to try and let go of social comparisons.

The last thing they want is to look back on their life at age 60 and regret having worked so much. Yes, they'll probably have a $10+ million net worth, but they probably wished they would have enjoyed their lives more.

Sure, their kids might have graduated from top universities. But for what? To work in the same professions as they did for the next 30+ years and be miserable half the time? Surely there must be more to life than status and money.

Track Your Finances Wisely

Even if you are earning $1 million a year, you must build a big net worth and track your finances. To do so, sign up for Empower, the web’s #1 free wealth management tool to get a better handle on your finances.

Run your investments through Empower's Investment Checkup tool to see exactly how much you are paying in fees. After you link all your accounts, use their Retirement Planning calculator. It pulls your real data to give you as pure an estimation of your financial future as possible. What you measure can be optimized.

Earning $1 million a year is great, but you've got to save most of it and invest it. The other problem with earning $1 million a year and then retiring early is that you actually have to give up $1 million a year! The higher your income, the harder it is to walk away.

Invest In Real Estate

Earning $1 million a year is great, but you need to invest the money wisely as well. Real estate is a core asset class that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties.

Given interest rates have come way down, the value of rental income has gone way up. The reason why is because it now takes a lot more capital to generate the same amount of risk-adjusted income. Yet, real estate prices have not reflected this reality yet, hence the opportunity.

Take a look at my two favorite real estate syndication platforms:

Fundrise: A way for all investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and now manages over $3.3 billion for nearly 400,000 investors. It invests in the Sunbelt, where valuations are lower and rental yields tend to be higher. The minimum investment amount is only $10 so you can easily dollar-cost average into your investments.

CrowdStreet: A way for accredited investors earning $1 million a year to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build your own select real estate fund with CrowdStreet.

I've personally invested $954,000 in real estate syndication across 18 projects to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$350,000. Both platforms are long-time sponsors of Financial Samurai and Financial Samurai is an investor in Fundrise.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out Fundrise Venture, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 65% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI!

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum. I'm also an investor in Fundrise Venture to the tune of $150,000+. See my dashboard below as I continue to dollar-cost average into the fund.

When Earning $1 Million A Year Isn't Enough To Retire Early is a Financial Samurai original post. Join 60,000 others and subscribe to my free weekly newsletter.

Wow. So much money flowing through that family, and so little of it sticking. It sounds extremely stressful. I would change almost everything, but inertia is a powerful force.

I’m from NYC. The brownstone is/was a want. With two boys, they could of shared one room while the parents shared the other in the condo. Same for the two cars while one parent literally isn’t working. They really need to give over their finances to a money manager.

I appreciate this, and everyone spends their own way, but honestly they are just spending as if they earn 1.5m – 2. Would be curious if there’s deferred comp not included. A few comments:

– They are saving 22.5k (401k) + 65k (529) + 24k for charity that is optional = 110k of savings

– The cars are crazy. 2 cars?! I have plenty of partners (3.5-4m+) that have one car, and that car is a nice volvo, lexus, etc. This is NYC – the car gets beat up. I get it if they’re car enthusiasts, but this is superfluous

– Dalton’s far if they’re in BK. ha!

FWIW, our spending is similar or actually 25-50k less (560k less 60k for private school [instead one child and FT nanny] less the savings and charity as we include that as savings = ~400k spending for this family) and earn ~1.6 with a bunch of deferred comp in addition. Less on cars, a bit less on vaca, 40k less on housing, but more on dogs, fitness, cleaning person

Somethings wrong with this picture

Most likely 50%+ of that comp would be in the form of bonuses so <500k. 500k base gets you say 300k ish gross

So you're praying every year your firm does well in order for bonuses to sustain spending? That seems extremely risky

What happens if she gets fired, or her firm blows up? There's no safety net here

That’s how finance is – as you get senior, majority of your pay is bonus. You can’t “live within your means” and only spend salary. You would have 50-year old senior folks who make $5m per year spending based on making 400k…

What you do is before building up your spending, you also build up your safety net. So if you are 50 and making 5m per year but 400k salary, hopefully you have 5-10m+ in the bank

I hope this couple finds their way to a more fulfilling, prudent lifestyle. I found this to be a depressing read. If intent of article is to demonstrate how not to manage one’s finances with a high income, mission accomplished.

Life insurance at only $2m poses a serious risk to the family should something happen to Rachel. She needs 10x her income. Her husband should have some, too, though the caps will be (unfairly) limited.

Good recommendation to up the life insurance benefit.

Why they dude is not working at least part time is beyond me. Even if he Made 40k net per year, they could put that money to buy rent property or some investment fund. Is not like the kids need him there 100% of the time.

If only they knew someone who manages investment funds.

This situation is a bit insane, but one I can relate to on a smaller scale. My wife and I recently cracked $200k household income and it’s amazing how that can get gobbled up before you know it. Careful budgeting has brought us back from the brink of living paycheck-to-paycheck, but again it came as a total shock that this kind of predicament at that income level was possible. Our current conversation is what side hustles can we layer in during our 7p – 10p evening hours when the kids have gone to bed to afford us to: a) accelerate debt pay-off (credit card, car loans, student loans, mortgage) and b) take vacations. The goal is to leverage savings on debt payments to invest for retirement, real estate, and also to position ourselves to pay cash for larger purchases in the future – like when we need to replace our cars, home repairs, appliance purchases, etc. These hours are now mostly spent with BS time wasters like phone scrolling and TV, so it would not only not take away from quality family weekend time, but it would also reduce the rate at which we’re killing our brain cells with such foolish pursuits. Win-win!

The Chens are in an enviable position in that some minor sacrifices for a short period of time could completely flip the script. I have my thoughts on their needs for therapy to cope with what reads like a misalignment of earning potentials causing each partner to be sort of forced into a situation that causes some internal conflict. Again, I can somewhat relate, having delved into a career change and then becoming a stay at home dad upon the birth of our first child. Try as I did, I just could not get comfortable with being at home.

I read another commenter also question why Mr. Chen doesn’t work at all. I think that if all of their kids are now in school most of the day, he should definitely jump back into the workforce, if even in some side hustle, flexible capacity.

“Try as I did, I just could not get comfortable with being at home.” This is one of the hardest things I’ve had to struggle with as a dad since 2017. I made a commitment to be a SAHD for the first five years of my sons life. Then we had a daughter in 2019.

So starting in Fall 2024, I’m giving up on early retirement and going back to work. I man needs to earn and feel purposeful! At least I do.

She is making 600k. Dude is Playing golf in mid week. He is at very high risk, for reasons that should be evident.

Because the ROI on time isn’t worth it. Okay an extra 40k when you’re making net 600k? It’s immaterial relative to the time he’d be giving up

Clever article to generate many comments on the work, spend, die merry go round.

Take if from an old guy that flourished on top of the mountain for decades and somehow kept his sanity.

Happiness is the new rich

Inner peace is the new success

Kindness is the new cool.

Be humble and kind to everyone on the way up, you will see them all again on the way back down.

No success in your business/financial life can compensate for failure in the home.

What will your legacy be ?

Rachel is a fund manager, but since she manages her own finance this way, I wouldn’t use her company to invest my money. How does she evaluate companies if she sees how they spend money mostly on expenses, not investment like she does? I think she should do something about that tax billl of 400K, pay a great accountant to figure that out for her. She should also pay off the house within several years. Cars should be paid in cash. Private school expense is fine since the family can afford it. It helps them to build a top social circle and contribute to future connection for work to generate high income level. Charity is fine too since it help finding a cure for the condition that her son has. Yale donation is fine since it’s a part of investment for her kids’ future. Work clothes is fine since it helps her feel her position and in-character when she’s working, it helps generating that kind of income. Colin should stay home to care for the kids since his wife works all hours. It will make a difference to the kids’ future. Applaud to him! It’s a sacrifice for the family. Staying at home is hard. I know since I did it myself for several years and couldn’t do it anymore and went back to work even though I knew it would be better for the kids if I stayed home. ( We have enough income and I do’n’t have to work for money). Travel, entertainment, and food can be reduced by finding alternative ways of enjoying themselves. Invest more is definitely a must.

This is nonsensical. Pay someone to reduce the tax bill? She’s a w2 employee. You get taxed on your earnings. The methods to decreasing taxes in scale are (I) make less money or (II) real estate investments. They seem to have a busy life – finding real estate investments to offset taxes seems like a bad use of time

To reduce the tax bill, Colin could:

1) Find a real estate investment and manage it himself.

2) Start a company such as a website and deduct business expense such as a part of his car expense, computer expense, room in the house, etc.

3) Pay an accountant who understands tax saving strategies and can suggest some.

The answer isn’t Colin spending a bunch of time to save an add’l 50k-100k per year with a bunch of risk (real estate investment going down or risk of being audited) when she makes that. It is much much easier for her to increase her income.

There are no other tax strategies when you’re a w2 employee that don’t involve a big tradeoff on time

If Racheal quit work, she would save $379,000 per year

And not make $1 million a year before taxes.

In my book, your disposable income is after taxes so they are earning more like 600,000k. Still impressive but far from the million.

Their spending is insane to say the least.

So depressing – reads like a modern day prologue to Bonfire of the Vanities.These 2 have no clue what makes them happy, but then again neither do most people. At least he enjoys golf – I wonder if the wife enjoys anything beyond the recognition of being a PM at a hedge fund. Raising kids in the cty is all about status – everyone I know that works in Manhattan lives in NJ with some using the excellent public schools in towns like Mendham and others opting for exclusive privates like Peddie.

At the now age of 62, I’ve noticed that among my peers there exists a certain type of wealth associated with the amount of grandchildren you have. I have 3, so some of my friends are very envious.

Thoroughly enjoyed the read. More than the financial breakdown itself, I really enjoyed reading about what they struggle with, what they enjoy doing, etc. Just goes to show you, no matter what income bracket you’re in, there are so many relatable issues.

I could already see people coming here to question their life choices, but “Rachel” is working hard, saving for the future, investing in her kids, enjoying a luxurious lifestyle, and paying a fair share in taxes. However, it must sting to have to pay nearly $400k in taxes…

Anyway, thanks Sam for breaking down their finances in this article. Hope to read more articles like this in the future!

I agree — super insightful and really enjoy reading these “deep dives”. The “Chen’s” were gracious in opening up to you and I was able to take away a few things to apply to my situation.

Would be super interesting to do a few of these pieces with varying incomes and varying COL locations.

Thanks Sam!

Wow … this is crazy to read. Not everyone making 1 million + is living like this though. Hit me up if you want to deep dive into someone making a bit more (w2 based) than this but living and saving completely differently. This couples expenses are out of control and unjustified unless they love working and aren’t looking for financial freedom and time to themselves. There’s just so much fat to cut … Also, they aren’t planning on the floor dropping out on them.Things can change on a dime and those fat incomes may be a thing of the past. In my humble opinion they should stop living like that huge income will always be an option as long as they deem its worth their time and effort.

You are absolutely right. I retired this year at 56 after making over $1M per year for the last 10 years plus selling my business in a HCOL area. I never spent like that.

However, for the next couple years we are spending above our base budget on bucket-list travel.

What’s your net worth and age may I ask?

Trying to understand how much folks who earn big money keep, thanks

Similar scenario for me Sam. In the “earn, save, invest” dynamic, if you can max earnings (e.g., make $1M for a number of years) but control your spending you can save enough to retire rich and early. Because you controlled the spending during that peak earning period, your spend level in retirement will barely change and be very aligned with a great lifestyle, hopefully forever.

It was very HCOL, all the same context as the “Chens”, all the same line items. ps: As you noted in your table, and as I’ve said elsewhere, that NY scenario is Toronto except with even higher costs and much higher taxes! Yes, imagine that.

In my case, I found it really didn’t matter much what happened with “invest”. I overpowered it with earning and saving and was able to retire mid 50’s with no real lifestyle change after earning $1M for a number of years. Net worth $10M+ when I stepped away.

What were the Toronto taxes like? And what line items in the budget are even more expensive in Toronto?

What did you do to earn $1M? Thanks

Painful. Marginal tax rates on these incomes if you live in Toronto are just over 53% (combined Federal and Provincial). Your effective tax rate on $1M would be just over $500,000. Plus you pay 13% VAT on everything you buy. And people who make $1M tend to buy a lot! Add in substantial property and other miscellaneous taxes and your total tax load is in the range of 60%-65%.

Canada doesn’t produce much of anything anymore except basic goods. Most everything one might consider a luxury or high-content consumer good or foodstuff is imported. This makes most things expensive to us. Everything must be represented in French as well as the second official language, adding layers of cost on every item produced or imported: every item. Cars are much more expensive. Electronics of all kinds. Food of all kinds. Housing stock is now priced out of control to rent or buy. Financial products. Internet and phone services. The list goes on.

Forgive me for preferring not to say what I did, here in this space.

44 years old. Net worth = 2.5 million. But I’ve only been making this super high income for the past 1.5 years. Before that our income was closer to 200k

Thanks for sharing. I hope you can make big bucks for years to come and save a majority of it then call it a career!

Earning the big bucks generally doesn’t last for long, so you’ve got to seize the moment when you have the opportunity.

Husband (finance) and wife (medicine) both 40 years old.

Children: 2 (pre-K)

Location: TX (formerly NE+West)

Education: both spouses Ivy League PhD or MD

Net worth: $16.5M (public equities + fixed income + RE + private equity)

Realized household income 2023: $1.35M

2023 Federal taxes + FICA: $430k

Savings: $88,000 (max out wife’s 403b+457b, my 401k, 2x IRA, HSA) + $75,000 principal amort. + $120k whole life + $300k taxable brokerage = $583k

Expenses: housing $110k, au pair + private day care $40k, vacations $26k, vehicle (2x, gas, ins., parking) $24k, CC spend $90k, gifts/donations/misc $47k

Note: our incomes are structured so that clearing 7 figures is nearly guaranteed ($1M+ since 2017), so we take advantage of our risk budget and systematically invest into levered RE/PE. Income fluctuates between $1.2M and $2M. Including investment gains and savings, net worth typically goes up by $1.5M/year. We don’t care much about how we burn cash as long as min. 40% of gross income is saved/invested.

– For kids’ education: we’d rather buy more tech stock in their UGMA/UTMA. If not Exeter/Andover for 9-12, the public schools in our neighborhood (median home prices $2.5M) does the job. If they don’t go to Harvard, we don’t care.

– Both vehicles are Toyota LE trim: one is a minivan, one was purchased used.

– Almost always fly business but we squeeze points.

– Where we would like to spend more money: family personal assistant, vacations, a nice campervan?

Nice. Given you both god PhDs, how did you ramp up the wealth so quickly?

Any one of you want to take it down now that you’re 40 and have a higher net worth now?

Sorry about the repeat post…

At the tail end of the distribution, don’t you think intellectual capital matters far more than modeling on spreadsheets or wining/dining for deals? We did well by using proper leverage in real estate and private equity. Deep understanding of asset pricing + capital structuring and knowing how to manage risk turns out to be great. My wife’s an MD/physician.

We have no plans on slowing down. My wife would always choose to spend her 50 hours treating patients, and I would always choose to spend my 50 hours investing. Both our schedules are relatively tame that we never feel our time with the children are cut short. In fact, we would never want to spend more than two weeks consecutively to just relax. Our kids would go nuts!

Networth is really just keeping score now, I want to see it go up consistently every year for progress, much like increasing my reps on the bench. I care less about income, but I would guess my family wouldn’t see a step change in quality of life until we consistently get into $3M+ zone.

Husband (finance) and wife (medicine) both 40 years old.

Children: 2 (pre-K)

Location: TX (formerly NE+West)

Education: both spouses Ivy League PhD or MD

Net worth: $16.5M (public equities + fixed income + RE + private equity)

Realized household income 2023: $1.35M

2023 Federal taxes + FICA: $430k

Savings: $88,000 (max out wife’s 403b+457b, my 401k, 2x IRA, HSA) + $75,000 principal amort. + $120k whole life + $300k taxable brokerage = $583k

Expenses: housing $110k, au pair + private day care $40k, vacations $26k, vehicle (2x, gas, ins., parking) $24k, CC spend $90k, gifts/donations/misc $47k

Note: our incomes are structured so that clearing 7 figures is nearly guaranteed ($1M+ since 2017), so we take advantage of our risk budget and systematically invest into levered RE/PE. Income fluctuates between $1.2M and $2M. Including investment gains and savings, net worth typically goes up by $1.5M/year. We don’t care much about how we burn cash as long as min. 40% of gross income is saved/invested.

– Wife and I both average 50 hours/week and relax 4 weeks/year

– For kids’ education: we’d rather buy more tech stock in their UGMA/UTMA. If not Exeter/Andover for 9-12, the public schools in our neighborhood (median home prices $2.5M) does the job. If they don’t go to Harvard, we don’t care.

– Both vehicles are Toyota LE trim: one is a minivan, one was purchased used.

– Almost always fly business but we squeeze points.

– Where we would like to spend more money: family personal assistant, vacations, a nice campervan?

This kills me! Their tax rate is substantial. With that kind of income and hours she is putting in most likely, I would be looking to diversify my income streams. Look at buying a freaking business or two to offset your tax burden and add additional income streams. Have your husband help manage. Drop the excess spending to keep up with the “status quo” to something that does NOT go out of style next season. Get rid of freaking country club membership unless you are getting business leads from the membership.

They are displaying a personal finance acumen akin to Mike Tyson. They make 2.5x’s per year more than I do, but I save 4x’s per year what they do. Just thinking about their situation makes me want to save even more. They need to watch “ESPN Films 30 for 30: Broke” and then have someone explain to them, they will be the stars of the non-athlete version of that movie if they don’t change their ways.

I’m glad you’re motivated to save more!

LOL. I either misread their bottom line yearly post tax/post expense savings or Sam fudged the numbers when he updated the article (I think it’s the later). An earlier version of their expense spreadsheet had the 401k contribution as $18K (the current listed 22.5K would be impossible when the article was first published back in 2018) and their yearly savings post tax/post expense at approximately $54k. Anyhoo, we all likely agree that the couple in question has a disturbingly high spend rate. And this story still makes me want to save even more!

Oh, I updated it for 2023. Gotta do so given prices and expenses have increased a lot since then!

I’m willing to hear an argument for any of these line items taken individually. But taken together, it’s way too much. If I were in this position, I would start by making sure at least half of my post-tax income went into investments of some kind, then figure out what kind of lifestyle I could afford from there.

At any rate, there isn’t a whole lot you can do about the 401K/HSA/taxes section, so that’s fine. Their housing expenses are also pretty reasonable given their income as long as they didn’t buy a house that was poor value for the price they paid. And of course, this cashflow is going into equity in the home rather than into the wind. Transportation expenses are also fairly reasonable given their income, although I wonder if owning a car in NYC isn’t more of a hassle than it’s worth. I also find it somewhat hard to argue with the healthcare, charity (tax writeoff?), and life insurance section, although their net worth is high enough that their kids would be fine without a life insurance payment even if the mom were to die tomorrow.

It’s the other two sections that are egregious. As for the education, I’m sure the parents see sparing no expense as a priceless investment in their children’s future, which is a somewhat noble sentiment, albeit a misguided one in my opinion. It would be far smarter to either go to a magnet school of some kind (of which there are plenty in NYC), live in an area with acceptable public schools, or if the dad is staying home anyway, consider homeschooling. Now, maybe there is some kind of marginal benefit to spending on this level of education. But at $7.5k/kid/month? Accumulate that at 8% from birth (preschool at the latest? probably also daycare) to high school (or college) graduation. You’d have something like $3.25m per kid in investments. That’s enough to pay full tuition at any university in cash, buy a very nice house outright, and still have $1-2m to either put into financial investments or start a business of some kind. This feels far more defensible, especially given that the parents already have a solid network and the kids can scratch any intellectual itch just reading on their own and talking to their dad (who has tons of free time), not to mention going to all sorts of events in NYC. I will say that the children’s lessons feels worse than it is when you consider a sleepaway summer camp in there.

At $137k/year the entertainment/food expenses are also pretty indefensible. I wish they would have disaggregated groceries (necessary) from eating out (unnecessary). Especially given that the dad isn’t working, he should cook at least a few times a week. And there are plenty of great restaurants in Park Slope (not to mention the rest of Brooklyn or even NYC as a whole) that are very reasonably priced. They don’t need to be going to fancy restaurants more than like once a week. The country club makes sense if you love playing golf, the clothes make sense if you’re really into fashion, travel if that’s your passion. But going all out on all of them is excessive. You need to figure out what you truly like and economize on the rest.

Found the article quite insightful, as from the age of 12 I feared becoming like this. Trapped and unable to be confident in my financial stability. I sought to be financially literate and began a retirement account at 16. I’m only 19 now, but I’ve been able to max out my Roth IRA contribution every year and intend to continue doing so. Probably won’t be making nearly as much, but hopefully, I can avoid the same mistakes.

It’s a bit pitiful. The exorbitant costs and unwillingness to compromise. Felt rather sad when reading this.

For those of us who are divorced, ‘child support’ is a major financial obligation.

My ex-wife is upset because I convinced our family court judge to let me use a child support trust in the form of a special purpose joint checking account that BOTH parents put money into in order to provide for our children’s needs. This makes providing for the children’s needs a shared responsibility instead of requiring the paying parent to provide a government mandated lifestyle for the children, and by inference, the custodial parent.

My children tell me that their mother is furious because she can no longer spend the ‘child support’ on herself and her live-in boyfriend. I’ve also noticed that the kids are no longer coming to me and telling me that their mother said that I need to pay additional expenses such as school field trips, clothing, haircuts, et cetera because those things are not being paid for out of the child support trust account.

I’ve never had a problem with providing for my children’s needs. I do object to family courts allowing my ex-wife to treat what is supposed to be child support as additional income that she can spend any way she damned well pleases.

I somewhat relate to the story. My wife and I live in Queens, having moved here after having lived in Manhattan for a decade or so. Kid is 25, has a job so those expenses are gone. College was 62k/yr and private school was low 40’s. That sucked up disposable income for many years.

My wife worked as a CFO for a public company making about 250k/yr. I worked on wall street making with a very volatile income, ranging from 150k/yr to 950k/yr depending on which job I had.

We both lost our jobs in ’09 and income dropped to zero.

We’re both immigrants and worked our way through our respective schools (she has a masters in accounting, I have an MBA in finance.) We both worked 65+ hrs week plus work dinners / events at night and on weekends which sounds great if you don’t have to do them but they get pretty old fast.

I started my own business (investment management) in 2012 and the first couple of years lost money on it. Growing assets is hard and compliance is very, very expensive.

We lived off my wife’s income. In the meanwhile we moved to Queens and bought a 2 family, which, in hindsight, was probably one of the best moves we could have made. Our housing expenses are literally a (small) source of income which makes us sleep better at night. I understand that had we taken the same amount of equity and leverage and put in equities the return would have been higher but it provides peace of mind.

Long story short, the business is grew and my wife quit her job to join me (which increases concentration risk) but financially it’s going well. We’re back to making 600 – 800k which may sound like a lot but frankly our lifestyle does not allow us to enjoy it. Working Saturdays and Sundays is par for the course.

And, like other commenters have pointed out, it’s not like we can just work less and take a commensurate decrease in income. You’re either in or you’re not.

Having non-W2 income is good. We can save a lot though our pension plan and a lot of expenses are now business expenses which helps tax efficiency. Given the nature of our business we need to be in NYC so there is really no way around the taxes that come along with that.

We have a modest lifestyle – tenants to take care off and 1500 sqft of living space of us (more then enough). We own a used compact car that we use for business and groceries. We can’t take vacation – we can only take day flights with WiFi because we are expected to be always on call. Vacation is a due diligence trip to Cleveland on Thursday / Friday with the weekend tacked on to come back on Sunday. Travelling coach and staying in mid-priced (200/night or so) hotels.

Having been on the other side of the pay scale (making less than 40k in NYC for the better part of a decade) for years and years I understand the irritation / anger that some people feel when they read a story like this. How can you make over half a mil and not be happy? The answer is pretty straightforward – money is only part of what makes life work (or not). There is way more to life than $$. And especially as you get older and friends around you are starting to have diseases and / or die money takes on a different role.

What keeps us pushing forward is the desire for alternative income sources. We are working on buying rental properties (along with the proper management to take care of them) to provide with sufficient cashflow if this gig disappears. My guess is that we use around 120k/yr of after tax income and the rest is saved. To generate 120k of rental income you’ll need at least 2mm of rental real estate @6% effective yield. 6 may seem low but I think most people underestimate the cost of management and maintenance. Add 10% vacancy and you’re up to 2.2mm worth of assets.

The Chens don’t have a lot of options. She is either a PM or she is not. I completely understand the stress between them on the various issues. I am not crying for them but their life is not a walk in the park, just like most other people. Their issues are just different, not better or worse than those of people who make either more or less than they do.

Very thoughtful comment. It’s a great point that for many of these professions, you’re either in or your out, which presents its own set of binding constraints, which as you note aren’t better or worse than those of others, they’re just different. Very interesting perspective.

Long time reader, great articles.

Question: Is it truly realistic their net worth gets to 10 mio since this assumes their primary residence equity has to increase by 6.2% each year as well? Home prices wont go up 6.2% a year… Or did I interpret the sentence below correctly?

“Assuming $106,666 in base case net worth growth over 15 years, no compensation increase during this time period, and a current $3,000,000 net worth, including the equity in their primary residence, the Chens will realistically have a $10,000,000 net worth by the time their youngest graduates from college using a 6.2% annual growth rate.”

I think we are probably a tough audience here on this website since most of us are probably savers. To me though, it’s only worth it to work hard when I know there is a payout for what I value – which is financial independence.

If what they value is keeping up with the Jones, then they are succeeding. Maybe this *is* their life’s goal, and maybe it’s not. It doesn’t sound like they are very happy – and I don’t know if you can count of this income level until you are 60. I mean, can you keep this pace up? I can barely keep up the facade at my basic corporate job, but I do it and it’s easier because I know nothing in my life will change if I lose it because I have been saving for so long, so the pressure if off.

Just like others have said, I also save more than them on a tiny fraction of what they earn. I work just 9 to 5ish and still feel like I miss out on many things in my daughter’s early school life, unlike my husband who works/earns less than I do. But, I don’t resent him for it, and he doesn’t resent me. It’s just how it’s worked out – and we would both be fine if we reversed roles. Maybe the extremishness (sp?) of the Chen’s life is what breeds those arguments. I wouldn’t pass up the opportunity to earn $1M a year, but I’d cash out after a few years, I know I would.

Good for them though, I hope they make the most of their situation and if they benefit from this post or make changes because of it, I’d love to hear what is now different in their lives and what/when their retirement will look like.

As a financial analyst i have no problem with anything in this post. from a 30k foot perspective, first they have a net worth of 3 million and no debt other that their mortgage which is reasonable and in an appreciating asset. they have no school loans, no aggregous CC debt and while i’m not a car guy at least they are leasing a porsche and don’t have a 60k loan or something. bottom line: they are not stuck. they could, if willing to make different choices, move tomorrow and retire. would just require perhaps a value shift. with two yale degrees they could also easily find something to do in smaller town to augment if needed.

my hope is that they realize they DO have a ton of choices and are blessed with that. any angst they have is completely based on choices they are making. they are financially independent right now.

Agreed. Finances are not a problem. However, it looks like they could do some things to limit their downside exposure… namely, divorce. Seeing a shrink regularly can be healthy, but they are both going for different reasons and without one another. Perhaps a couples therapist would help them work things out while growing closer together.

Where does one start to comment on this?

A) 529 amounts are a form of savings so they should be added to the net cash saved, the 401k (any match from her employer? If yes, how much?) and the health savings. As a seperate row item they can also track unrealized investment income (incl. paid off principal and estimated house appreciation) just for giggles.

B) Colin goes to a shrink cause he feels useless but chooses to mooch driving a Porsche to the country club? Is this serious? Why doesn’t he get a job? If he realizes he can no longer hold a high paying high responsibility job, any job would do really. Since when do men stay at home. A job makes a man feel like there is something between his pants (it sure as hell has this effect for me).

C) why so expensive private schools? Any elementary school so close to tuition to a Yale is just ridiculous, have no return on investment, and helps towards nothing other than say how much you pay for private schools.

D) she works 65 hour weeks but she gets 5 weeks off? Isn’t this too much vacation for her industry? Assuming it is not, why not go to cheaper vacations? It is not the experience they are seeking, the price tag is more valuable to Han the experience itself the way I see it.

E) she constantly makes more than $1M? How long has this been th case? What is she going to do when she gets fired or laid off with only $3M saved? And how did they accumulate that amount assuming they were making way less when they started their careers (and presumably burnt the vast majority of those lower earnings if I had to guess based on their appetite to add cost just for the sake of it).

Other notes: property tax rates are low in NY compared to Houston; makes sense given the delta in home prices.

It is obvious that the couple wants to spend that much cause they just enjoying spending. Just like a gambler likes spending all at a casino, a drug addict gives everything for one more high etc. This is not what they have to spend to have a good and luxurious life in NY. I’m no stranger to making money and spending for a high standard of living. I make around 200k as an FP&A Director in a Fortune 500 in Houston, TX. I was promoted last year and before that I made around 140 as a manager. I went to Rice for my MBA and I live with my fiancé (who is employed of course) on the 29th floor of an uptown high rise that I rent for $1,725. I drive a Lincoln Navigator L. I spend about 5.7k a month. This amount has been rising at a 4% CAGR since I got out of grad school 10 years ago. I expect not to go above 9k per month (in today’s money) once kids are added to the mix and we buy a house in a decent suburb (of course the fiancé will keep working and contributing what sh can).

Part of why Colin may not work is if he makes a fraction of what Rachel does, then all of that will essentially be taxed, when you view the income/tax as a whole. But maybe not if he can get a good job with his presumable MBA and loads of contacts. Nonetheless, I am side eyeing him… how’d he get such a good gig from you, girl? The kids are in school full time and there is a load of money spent monthly on extracurriculars for them- so there appears to be sufficient childcare such that he can golf less and take on some more income-generating stress so he can be truly sympathetic to his wife and enable her to downgrade to another job.

The problem with the couple is they are keeping up with the Joneses when they are not as rich as the NY-Jones. Those Dalton parents make well over 1mm/year so Rachel and Colin are on the lower end of that spectrum, but trying to keep up with the rest of the parents. Accept your place on the NY totem pole- y’all haven’t “made it” yet, then reel in the outlandish spending you CANNOT afford. For real, this is vacuous and vomit worthy and I’m a NY attorney.