Housing security is something I hope everyone will one day obtain. Once you are house secure, you can more easily focus on your career, family formation, and other things you care about. However, if you rent for life, you may face housing insecurity, which can feel especially uncomfortable when you’re older or no longer willing or able to work.

Of course, I understand why some people argue against homeownership. They say it’s a poor investment, a hassle, and ties you down. As a homeowner and a landlord since 2003, I get it.

But many of those who are anti-homeownership have also missed out on tremendous property price appreciation over the years. Most have been renters their entire lives, whereas I’ve been both a renter and a homeowner. I’ve also made and lost money from real estate. Still, I believe homeownership is the path to building wealth for most people.

Real estate FOMO is powerful. But as you crusade against homeownership, try to remember the average person – someone who values stability, may want to start a family, and isn’t some guru making a fortune selling get rich courses or building an online empire.

As a savvy investor, you want to invest in assets that outpace inflation over time. Housing is one of those assets. College, childcare, and healthcare are the three others.

Fix Your Living Costs Sooner, Rather Than Later

To help you build more wealth, your goal should be to fix your living costs as much as possible because inflation is too powerful of a force to overcome. And if you eventually become a landlord, the combination of rising rents and property prices will likely build you a tremendous amount of wealth over time.

Conversely, as a renter, you are effectively short the housing market. The only way you truly benefit is if rents and property prices decline. While they do drop during every cycle, the long-term trend is undeniably up due to the chronic undersupply of housing and a growing population.

Just as it’s unwise to short the S&P 500 over the long run, it’s also unwise to short the real estate market indefinitely by renting. Time and inflation tend to work in favor of the owner, not the renter.

The government also provides multiple tax incentives for homeownership — from the mortgage interest deduction to depreciation to the $250,000/$500,000 in tax-free capital gains if you sell. Through consistent forced savings, you’ll gradually build equity and free up cash flow to invest in other risk assets like stocks, if you wish.

A Difficult Situation With Rising Rents in NYC

Let me share a situation that reinforces why I don’t recommend renting indefinitely. It’s based on my experience helping a relative manage her finances – something I did for free and, in hindsight, carried emotional costs of its own.

I’m witnessing the effects of housing insecurity firsthand, even for someone with a seven-figure investment portfolio, partially because of decades spent renting.

For privacy, I've changed all of the details. However, the ratios are the same.

Year-End Financial Review Time

Whenever I conduct a financial review, I don’t just look at investments. That’s only one part of the equation. To truly help someone, you have to understand their objectives, expenses, retirement timeline, and life plans. You can’t set financial goals without knowing what’s going out the door each month.

My relative has lived in New York City for about 32 years. But she’s been feeling tremendous cost-of-living pressure because her $3,800-a-month two-bedroom apartment has become unaffordable given she only earns about $30,000-a-year as a substitute teacher and other part-time jobs. The only way she can cover rent is by drawing down from her investments.

At the beginning of the year, she asked whether she should move to a smaller apartment in a less desirable area to save. Normally, I would have said yes. But because she had around $1.6 million in various investments (IRA, Roth, Taxable), $800,000 of which was taxable, I told her to stay put for now. At 55, she deserved some stability after multiple moves, including leaving Manhattan to Queens to save money.

Based on my relatively positive market at the beginning of the year, I felt her 60/40 portfolio, which I constructed with low-cost ETFs, could sustain her lifestyle for a while longer. Thankfully, 2025 turned out to be another strong year for the markets.

Now the Landlord Is Aggressively Raised the Rent

Unfortunately, she just got notice her landlord will hike her rent next year from $3,800 to $5,200 a month. That increase pushes her annual expenses from roughly $80,000 to about $100,000, factoring in inflation across other categories as well.

On the surface, spending $80,000 a year when your income is only $30,000 gross is excessive. However, she’s been working, saving, and investing diligently for more than 30 years to build her $1+ million investment portfolio. And as we age, most of us want to maintain or even improve our standard of living, not cut back.

Based on her net worth and my market outlook at the beginning of the year, I believed maintaining her lifestyle was reasonable for one more year. To be frank, I also didn't have the heart to tell her to downshift her lifestyle at her age. She has the net worth at her age.

Still, the math tells a tougher story.

To sustainably support ~$100,000 in annual spending, you generally need between $2 million and $2.5 million invested, assuming a 4%–5% withdrawal rate. She’s close, at ~$1.75 million total with $880,000 in a taxable portfolio to draw from, but not quite there.

And while the numbers might suggest she could make it work, the emotional reality is very different. It’s incredibly hard to withdraw $5,000 – $6,000 a month from your portfolio after a lifetime of saving. One 10% correction and such a withdrawal amount would feel impossible.

Get a Higher Paying Job or Downgrade Your Lifestyle

The rational solution is clear: cut expenses and boost income. Unfortunately, finding a higher-paying job at age 55 in a competitive, age-sensitive job market is difficult. She had been out of the workforce for years as a stay at home mom.

At least, for one more year, she managed to enjoy a lifestyle that her finances didn’t fully justify, thanks to a roughly 10% portfolio gain. It was a risk we took at the beginning of 2025, that has paid off. But the grace period is over. With a 35% rent increase looming and the S&P 500 trading at 23X forward earnings, it’s time to downgrade.

Just the fact that we have to take risks simply to maintain our current lifestyle shouldn’t be happening as we reach our 60s and approach traditional retirement age. By that stage, we should feel secure about our finances, not anxious about whether our landlord will hike our rent or ask us to leave. Do you really want to face this indignity and insecurity at this age?

And let’s not forget the nearly 20 percent drop in stocks in March and April of 2025. That was the only time my relative contacted me about her investments, and in a panic. It was a reminder of how fragile that sense of stability can be when everything depends on market performance. We could easily correct another 10 percent plus again.

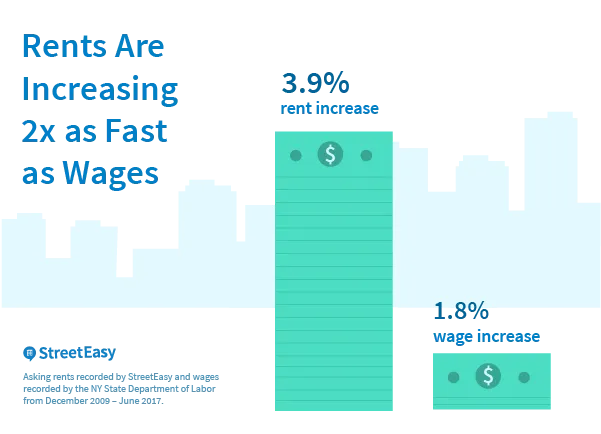

This is the sad reality of lifelong renting. Over time, rents tend to rise faster than wages and inflation. Eventually, you get squeezed hard enough that you have to move – sometimes far away from the community you’ve built.

Greater Peace of Mind with Homeownership

When you own your home, you fix roughly 85% – 90% of your living expenses for as long as you own it. You’re no longer at the mercy of your landlord raising rent or selling the property. You have housing security – a form of peace that becomes increasingly valuable as you age and your career energy wanes.

Because let’s be honest: as you get older, your desire and ability to grind for income decline. If you take time out of the workforce – for parenting, caregiving, or simply burnout – it can be hard to find another well-paying job later on.

Owning your home eliminates that uncertainty. It’s a financial and emotional anchor.

Median Age of U.S. Homebuyers

Below is a sad yet fascinating chart showing the rising median age of U.S. homebuyers. For first-time buyers, the median age is now 40.

You could argue this reflects worsening housing affordability as renters are being forced to save longer before they can buy. But you could just as easily argue that this trend underscores the value of homeownership, given how much housing has appreciated over time.

After more than 45 years of the median homebuyer age steadily increasing, do we really think this trend will reverse anytime soon? Unlikely. Demand continues to outpace supply, and more foreign real estate buyers are scooping up what still looks like inexpensive U.S. real estate compared to their home markets.

Just look at what has happened in Canada, where the government openly allowed foreign buyers to purchase real estate, sometimes with illicit funds, for decades. As a result, foreigners helped drive prices to levels that became unaffordable for many local citizens.

When there are massive financial incentives at play, it’s hard for some politicians to do the right thing. Eventually, if you don’t see the value in owning U.S. property, someone else will. Do not rely on power-hungry try politicians to help you.

Please Don’t Rent Forever If You Don’t Have To

My relative could have bought a two-bedroom condo 8–10 years ago. I wish we would have had a financial consultation back then, but I had no idea about her finances then. She chose the flexibility of renting instead.

Had she purchased back then, her monthly housing costs would now be relatively fixed, and her condo would likely be worth 20%–40% more. Not a fantastic return compared to the S&P 500, but a great trade-off for stability plus appreciation on a large asset.

If you know where you want to live for at least five years — ideally 10 — buy instead of rent. Inflation is simply too powerful to combat indefinitely, and rent increases don’t stop for anyone. Further, the return on rent is always negative 100%. You will never have the option to make money from the rent you pay.

Perhaps if housing costs continue to soar, new political leadership will step in with more effective solutions. But I wouldn’t count on it. Depending on the government to save you is an unstable strategy. Depending on yourself, on the other hand, is the foundation of financial freedom.

In the end, owning your home isn’t just about money. It’s about peace, dignity, and control of your life. And if you can secure that for yourself, your family, and your future, why wouldn’t you?

Build Your Castle While You Can

Life is unpredictable, and we all face different financial and personal challenges. But the one thing we can control is how much we depend on others for our basic needs. Shelter is foundational. Once you secure it, everything else—career, family, purpose—becomes easier to manage.

Whether you choose to rent or buy, the key is to make a conscious, numbers-based decision. Just know that, ironically, the longer you rent, the harder it becomes to break free.

Here are five actionable steps to move closer to housing security:

1) Run your rent vs. buy numbers every year.

Don’t rely on old assumptions. Plug your rent, income, and local home prices into a calculator to see where the crossover point lies. When rent inflation is factored in, ownership often wins sooner than expected.

2) Think in decades, not months.

If you plan to stay put for at least five years, buying usually makes sense. Real estate rewards time and patience, not market timing.

3) Save aggressively for a down payment.

Treat your down payment fund like an investment in freedom. Even if you don’t buy right away, that savings cushion builds optionality and discipline.

4) Buy what you can comfortably afford.

You don’t need your dream home right out of the gate. A modest, well-located property that keeps your monthly expenses stable is often the best wealth builder. Please follow my 30/30/3 rule for home buying.

5) Don’t rely on luck, politicians, or anyone else.

Markets shift. Policies change. Promises fade as politicians promise the world to get into power. But owning your home gives you control over one of life’s biggest variables – your cost of living. It’s a personal hedge against uncertainty.

If you rely on politicians to feed and house you, those same politicians can just as easily take that support away. Look no further than the recent government shutdown, which created food insecurity for the roughly 42 million people who depend on SNAP benefits.

Bottom line: If you can buy and hold for the long term, do it. Renters must constantly adapt to the market, while homeowners eventually let the market adapt around them.

Build your castle while you can, because once you do, you’ll have the foundation to live the life you truly want.

Readers, what are your thoughts on renting for life? If you’ve been a lifelong renter, do you believe you’ve built more wealth than if you had purchased a primary residence? Have you ever been forced to move because your landlord imposed an aggressive rent hike? And why do you think some people who’ve never owned a home are so strongly against homeownership when there is so much data showing the median net worth of a homeowner is far greater?

Invest In Real Estate Passively

If you can’t buy a home yet, don’t sit on the sidelines while housing prices and rents keep rising. You can still participate in the real estate market and build wealth over time — without needing to come up with a massive down payment.

That’s why I’ve invested with Fundrise, a platform that allows everyday investors to gain exposure to residential and industrial properties nationwide. With over $3 billion in assets under management and 350,000+ investors, Fundrise makes it easy to own a piece of the real estate market that continues to compound in value.

Real estate has historically been one of the best ways to hedge against inflation and grow wealth passively. And with a minimum investment of only $10, anyone can start investing today.

Fundrise has been a long-time sponsor of Financial Samurai because our philosophies align — consistent, disciplined investing in tangible assets to build financial freedom.

Get a Personalized Financial Review Before the Year Ends

If you’ve ever wondered whether you’re truly on track toward housing security and financial independence, it helps to get a second set of eyes on your plan. I’ve been writing about personal finance since 2009, but some of the most rewarding work I’ve done is helping readers one-on-one — from optimizing portfolios to mapping out home-buying timelines and passive income goals.

Whether you’re a lifelong renter debating when to buy, or a homeowner deciding whether to upgrade or downsize, I can help you think through the numbers and the emotions behind each decision.

To close out the year, I’m opening seven consulting spots for readers who want a personalized review before 2026. You’ll also receive copies of my USA TODAY bestselling book, Millionaire Milestones to help you continue building wealth and confidence on your own.

Check out my personal finance consulting page if you're interested. I look forward to meeting some of you!

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

Hi! Fellow international reader here from Indonesia. I think ‘long’ on housing works on market where vacancy rates are chronically low. In indonesia jakarta we experience easy 20-40% occupancy on certain housing categories.. so make sense to actually rent

It does not require betting that housing prices will decline. It requires earning a higher rate of return in the stock market than in real estate. For example, if a renter in Los Angeles County in 2004 invested in the S&P 500 the equivalent 20% down payment of someone who bought the median house ($400K in 2004), i.e. invested about $80K in stocks, and invested the savings from renting each year (which was lower than the cost of owning) over the next 20 years, the renter in 2024 would have had about $825K in his stock portfolio while the homeowner would have had only $700K in equity (assuming a 30 year mortgage).

Robert Shiller (of the Case-Shiller Home Price Index) says as much: ““Trish Regan: “People trap their savings in a home. They’re running an opportunity cost of not having that money liquid to earn a better return in the market. Why do it?” Robert Shiller: “Absolutely! Housing traditionally is not viewed as a great investment. It takes maintenance, it depreciates, it goes out of style. All of those are problems.””

In 2025, it is still cheaper to rent than to own in all 50 of the largest metro areas (and if you manage to get a rent-stabilized apartment, the numbers are even better).

If you were 10 years younger and starting a family in San Francisco or the Peninsula today, where would you try to buy a 3 bedroom single family home today and not feel like you got screwed by a sudden 20% price increase or become “house poor”?

Assume that you and your spouse work as a consultant or other mid level white collar professional in the city downtown, but in addition to the typical Nvidia, Google, Meta employees, you are currently since 10/2/2025 competing against dozens of cash rich OpenAI employees who all are in their 30s also thinking about settling down/ diversifying into real assets and need a short dependable low stress commute to work.

You also fear that the bubble won’t burst for another 1 year at least an anthropic and other firms will have tender offers soon too.

Personally, I’d buy a single family home on the west side of San Francisco. Space and peace and quiet, better value, and tremendous number of economic catalyst.

https://www.financialsamurai.com/why-san-franciscos-west-side-will-keep-booming/

I’ve seen the catalyst before. Private companies going public and their employees flooding the real estate market with cash offers. Bidding wars ensue and it can get very difficult to compete against these folks.

It sounds like renting and owning both have their risks and rewards – it’s just a question (imho) of being aware of both risks/rewards for each scenario and going into the situation with a gamplan that will mitigate those future risks (as much as possible).

In any case, thanks for all the thought-provoking articles – best wishes to everyone and hope people do find good solutions to their RE challenges!

Renting

Risks:

Rewards:

Ways to mitigate risk:

Owning

Risks:

Rewards:

Ways to mitigate risk:

Tell your auntie to go to a month-to-month lease until January 2026. Maybe something good might actually come out of Mamdani winning – maybe your auntie will get her apartment rent stabilized.

Wow, that’s an aggressive rent hike! How sad to know this is a realty for so many.

We used to be against home ownership. There were/are many reasons, but they’re all emotional/psychological stances. The upfront figures gave us sticker shock and by working in the trades, we knew all too well how expensive unexpected maintenance could be. The truth is, we didn’t want to be the ones responsible for it.

I also believe that being a renter until now (33 + 36 y/o) has most certainly allowed us to build a significant amount of wealth. We lived in the SF Bay Area 2015-2021. We found lovely landlords that charged well below market price and only increased rent by $100 every two years. We saved and invested ~50% of our income during those years.

We did play around with numbers to purchase a home back then, but we never pursued it because it felt so out of reach and the homes that we would have been able to afford required a lot of work. Would we have been wealthier if we purchased, anyhow? I have no idea, but I do know our expenses would have been significantly more, overall.

Now that we’re back in Florida and our business continues to show promise, we recently ran the figures and purchasing most certainly makes sense for us.

That’s key and it circles back to your point (above) about running the figures annually: revisit your stances as life changes. I also agree that the best time to buy is when you can afford do so, financially or otherwise, or else a home will continue to be out of reach.

In fact, we have been following your 30/30/3 Rule and have found ourselves in a great buyers position for a home in the coming months. Our market shows some promising options and we feel relieved to know what we can truly afford while still prioritizing the pursuit of financial independence. If we can find the right deal, our housing expenses will account for 10-15% of our monthly gross income.

We’re grateful for all of your insight on the topic of home ownership, truly!

When I was in grad school, I was given a lesson on why to buy vs. rent and it had nothing to do with finances. My spouse and I moved across the country and were newlyweds not sure where we would live long term, so we rented. This worked great, we moved to different areas of the amazing city we lived in and had a blast. As I was nearing the end of my graduate studies, thesis defense date set for Feb, we received a notice sometime in the late Fall the couple we were renting from wanted to move back into the unit and wanted us out in December. Ha! I told them it wasn’t going to happen. Fortunately they were reasonable and we tried to be accommodating and moved out in March after I defended. But what a curve ball and not what I wanted to deal with during a stressful time – and I was interviewing for jobs for my next step, so not sure where we were landing next. My goodness – I had to end up crashing with my parents for two months as I figured out what job I was taking. Not how I envisioned transitioning from one area to another. Having control of when you leave a location and not having your life upended is worth a lot!

Phew! I’m glad things worked out for you! Yes, the unanticipated curveball is both stressful and unnecessary if you own. But given you were just graduating from grad school, renting was the right move since you want to go where the best job opportunities are.

About to get asked to me leave or be forced to leave due to a hike in rents when you’re in your late 50s the sad and undignified. If someone is paying their rent and taking care of the property, nobody should be forced to leave during retirement age. But if you don’t know the property, then the owner’s rights trump the renter’s.

Sam, notwithstanding all of your arguments above, would you concede that, with a few random outliers based on very specific RE markets during very specific time intervals (e.g., COVID), renting and investing the difference in the S&P 500, assuming you have the discipline to automate this savings (and the intestinal fortitude not to tinker during downturns), is the winning formula? One caveat to the math is the loss of the 5x leverage you get with a mortgage, and one caveat to the practicality is the lifestyle aspect of owning vs renting.

I was a long time homeowner who relocated for work a couple years ago and have been renting since. I struggle with buying because, while buying gives us better lifestyle options in our local market, the math (per my comments above) goes the other way. Home prices will likely continue to march higher over the long haul, but I have a good income and NW and believe I can absorb that, even though no one likes to pay more.

It’s a maybe, partly due the lack of leverage and the smaller absolute investment amount for the first 10 years investing in stocks. Most of the growth comes from contributions, not returns, for most people.

I’ve got a great post coming up that highlights exactly what my 401(k) returns were from 1999 until 2012 when I retired, including Company matches. Then I highlight my gains from 2012 to today, with absolutely no contributions because I rolled it over to an IRA and no longer had a job.

I was extremely disciplined in maxing out my 401(k) for 13 years and then invested in a taxable brokerage account. But I still made a lot more money by the single family home in San Francisco in 2005 and selling it in 2017.

See: Why It’s Harder To Get Rich Off Stocks Than Real Estate

I’m in Denver and run the same thought exercises. It really is a lifestyle choice and RE data is city, neighborhood and even street specific. Friends would ask me 3 years ago when I would buy – I held off and invested aggressively as I felt the market was too hot. Currently living in a class A rental that hasn’t increased rent in 2 years and many rentals now offering 4-12 weeks of concessions. I frequent open houses for fun and while I could buy outright in many neighborhoods, I’ve stood firm. Recently walked a house in an excellent neighborhood asking 5% under 2022 sales price.

The problem is that, like any good stock broker or financial advisor will tell you, “past performance does not guarantee future results.” You are trading your housing security for pie-in-the-sky returns.

A hot topic, rent vs buy… The consensus is that rents increase at the rate of inflation, on average. So the 20-40% gain after 8-10 years that you cite, if she had bought property, is just the rate of inflation. Not a great investment, and probably in line with her increase in income, again, on average. Buying can of course turn into a good investment from external factors, such as the growth in the local economy or changes in policies, like the one you mention in Canada. New York is New York.

I would argue that both there is never and it always is a good time to buy, as is to rent. Given her 1.75M portfolio, buying, even now, is a valid option. If that gives her peace of mind, why not?

Also, the point that the return on rent is -100% does not include all the maintenance and taxation of housing that has to be taken into account. In a past post I believe you suggested renting in luxury locations and buying in affordable places, there was even an acronym for that, as a way of investing in real estate. Are you suggesting something like that to your relative? It would be a valid option, so that she has a property to go when she grows older and she can still enjoy living in New York, and near her workplace I would assume, until then.

It seems that your relative is having a quite low income (30k) and high annual expenses excluding housing (35k), so rent vs buy isn’t the only problem from what I see there. Also, you cite median prices at around 3500 so her rent hike means that she might have to move, or negotiate, not leave New York, a risk one takes when renting, but also an opportunity to find something better.

Your family member’s financial situation as pinned to rent and the tough choices they have to face, certainly to move now given the rent increase underlines the point Sam of securing home costs at a predictable level so as to avoid this circumstance in life, and also of course making investment gains from what would have been an excellent bull run in property over the past ten years in NYC. So in many cases buying, maybe in the suburbs makes sense as the costs of apartments and homes in NYC now average close to $1,000,000 which are indeed a difficult reach for so many. At the same time however, as someone who achieved FIRE at 45 this year, securing financial freedom was a goal and my goal I think would have been compromised had I taken on the extra costs of an HOA and mortgage. I’m not sure I would have had the confidence if I was carrying those and securing rent under a certain level, was a goal, I’ve lived frugally in these apartments, with a small family now (one young daughter now) and taken advantage of all that there is to do in the city culturally and socially outside of my two bedroom apartment. The HOA’s in NYC can be a killer as they are akin to rent anyway so it’s really careful to consider the balance of rent vs. buy in the long term, if one is disciplined, you can seek affordable rent (so many rent stabilized apartments in the city still exist) or a purchase that makes sense, but I would recommend keeping the field open to the options you can hunt, especially if you wish to FIRE as a main goal. It’s maybe a little different if you are ok to work for 30 years to pay the mortgage off, but a mortgage can also be a kind of lock-in to your life. Now that I’m FIRE and have time to pursue my passions and side hustles in a more satisfactory way, the investments I’ve made are still paying the rent and annual budget, and maybe extra income can go to an apartment I’d own, more space….that NY Times rent vs. buy calculator has been really helpful. Although I’m sure I’ve lost lots of $ by not investing in a house, I also like at this point not having that $ locked up in HOA as it’s working passively for me in fixed income. Anyway food for thought if FIRE is your goal!

well said, I feel the same way in NYC not having achieved FIRE yet. Curious what are your passive investments? I’m stuck in the decision of moving assets from capital gains to cash flow. Could use some stable cashflow to have peace of mind yet FOMO in stock markets has been more prevalent

I would avoid trying to pay as much capital gains as you can. If you still have a job, you don’t actually need the passive investment income to sustain your living expenses. Just feel good knowing that you have the option to do some of you need to.

Thanks Romina. I defer to Sam’s advice as I’ve still a lot to learn in the financial arena and it seems continuing to direct funds into employer retirement program is quite advantageous. That said, for many years I used CD’s for conservative gains until I learned the very real tax advantages (especially for a New Yorker) of Treasure Bonds and Bills for passive income.

Not everything is under control if you buy. Taxes and insurance can skyrocket. I expect Mamdani will be raising NYC property taxes…

The goal is to fix as large as a percentage as possible, which I calculate as at least 85% if you buy.

While I don’t necessarily disagree with your overall premise, I think you are overselling the stability of homeownership with the statement “When you own your home, you fix roughly 85% – 90% of your living expenses for as long as you own it.” Homeownership involves multiple variable expenses in addition to the fixed mortgage payment.

Insurance costs can skyrocket from one year to the next; just ask anyone in Texas, Florida, California, or Arizona. Property taxes are reassessed yearly (and rarely go down). There are unexpected repairs and expected capital expenditures (roofs, furnaces, and HVAC systems). And HOA fees can be raised and are subject to periodic special assessments.

A conservative estimate in rental real estate is that you will spend 50% of the total revenue (rents) on these variable, non-mortgage expenses over time. That is likely overly conservative for your personal residence, but it is closer to reality than 85-90%. While no one can raise your rent, living expenses are most certainly not fixed just because you own your home.

Thanks for sharing.

Do you mind sharing a rental example that shows that 50% of the cost of ownership is in taxes and insurances? What region of the country or city are you looking at where it’s that high? Is that what you are paying?

Here in California, we have Prop 13 which throttles the annual increase of property taxes closer to about 2% a year.

Thanks.

South Florida, east of I-95, in Palm Beach, Broward, and Miami-Dade counties, has very high insurance costs and very high HOA fees due to the tragic Surfside building collapse of 2021. Some highrise condo owners were assessed as much as $300,000 by their HOA as a special one-time emergency assessment to make sure that their building was stable and safe on apartments valued at less than $500,000. My mom lives in the area; she’s never complained about property taxes but after several hurricanes, her homeowners insurance company dropped her and many others and she had a terrible time finding a company to cover her. Her insurance is very high.

I’m sorry to hear about your relative and rent increases in nyc. This is a really tough one, for upcoming younger generations. For young generations and depending on their formal training and their type of relevant jobs: such jobs tend to be in a least major metro or medium cities, where home prices are higher. Alot of employers now still require part-time working at office. Not total remote. So best scenario for youngsters is rent but save for down payment to buy home in a few yrs. Or find a job in a lower cost region and buy there.

Coincidentally a Canadian nephew and gf are living in a nice nyc apt. Rental for past 2 yrs. They work there and do work in high tech., but firms require now part-time office work. They were living and working in San Francisco area for 3 yrs. After university.

I am aware they are earning $$$that equivalent it job salaries are very rare in Canada. Not sure if they thought long-term where to live, etc. ah, being young and seduced by high salaries.

Experienced, qualified teachers are in demand in u.s. and parts of Canada. Your relative could have considered another region in u.s. Teaching has become far more demanding because of major challenges in classroom discipline and some students with behavioural problems that older generations didn’t witness in scale when we were students.

Thank you. After 30 years of living in one place, you’ve built a network of friends and acquaintances, and you start enjoying the familiarity. To just get up and move to save money is not easy for most people. And you have to do that in your late 50s is even more difficult.

I understand this and more difficult especially if a person has a child still at home.

@51 accepted a terrific job offer with govn’t and had to…move to Alberta from Vancouver BC. Enjoyed latter for 8 yrs. Yes, drastic geographic relocation can be a challenge later in life.

It was nearly desperate after job search for 18 months. I had finished a contract job previously as a manager. There is ageism that creeps in during job search, no matter how qualified re education, skills and relevant work experience. I knew no one in Alberta and relied on knowledge of my partner who was forced to relocate and live in same city by employer 2 yrs. before retirement. Life can be a bit cruel.

In the end, glad to work for municipality at tail end of career instead of private sector. It plugged me immediately with faster knowledge and local supports about my adopted city.

Yes, did buy a home since its cheaper to buy where I am.

An 80 yo relative owns her $500k Florida home and can’t afford the property taxes and insurance. She only lives on social security payments. Her son pays the taxes and insurance but it is not sustainable. Many Florida homeowners are in the same boat and are losing their homes. My relative needs to sell her house and either rent or buy something much cheaper. Equity is a waste if it is not used. The house is killing my relative’s finances and the son is totally depressed. He had a wife and kids to feed.

This is a situation in which a reverse mortgage makes sense. Unlock that equity and use it to pay bills and live life while it lasts. No need to have her son stress over covering her bills.

But what if you move into a bubble? I moved to where I am and houses were going up so quickly, that the signs advertising them had to have the prices on them “Houses from the $250,000s” painted over every two weeks for several years. I saw where this was going and simply sat tight. Seven years later, everything collapsed (2008) and house prices became roughly what they were when I moved here. Yet my salary in that time had gone up 80%. I got a fire sale house (and later a < 3% mortgage to go with it). So now I had a portfolio (I was already investing) and a house.

Wait a minute, did you just answer your own question?

When there is a bubble, you remain disciplined, and you, Buy when evaluations makes sense.

Please don’t rely on the government to provide affordable housing. There won’t be enough and you will have to win the LOTTERY to get one. It’s not worth it.

Save and invest for that down payment as if your happiness and freedom depends on it.

Very true words, especially as you get older. You don’t wanna put your expenses or your lifestyle in the hands of someone else. And if you live in a non-rent stabilized apartment or home, that is exactly what you are doing. And that is exactly the opposite of the security One should feel as they approach retirement age.

It’s also so funny to hear this one financial guru who is childless and living in New York City talking about how renting is the best. Meanwhile, he’s missed the entire New York City boom for the past 15 years. Good for him for making a killing selling overpriced online courses on how to get rich. But most people aren’t doing what he’s doing. And he’s not fraud anyway.

That is a tough spot to be in especially at that phase in life and a limited income. Hopefully she will find some great positives when she does downsize and reduce expenses. Inflation is much better than it was several years ago but man it’s still brutal. I cringe at how much things cost. And that rent increase she’s facing is unsustainable. Best of luck to her.

“Unfortunately, she just got notice her landlord will hike her rent next year from $3,800 to $5,200 a month.”

That’s obscene. Now you know why Mamdani was elected. I like to think of myself as free market but I think there should be a cap on how much a landlord can raise rent in one year. That 40%! We have that for property taxes in VA. Why not on rents? Why should that be different.

Yes — in New York City there’s no fixed cap on rent increases if the unit isn’t rent-stabilized, which this one is not. The only requirement is proper notice: 30 to 90 days depending on how long the tenant has lived there.

It’s the same story in San Francisco for single-family homes and condo units that are exempt from local rent control. There’s no hard cap, but landlords still behave rationally. They’ll try to charge market rent, and if they push too far and the tenant leaves, they take on vacancy risk.

The silver lining here is that if the true market rent is around $5,200 a month, the tenant effectively saved $1,400 a month for at least six months — if not a year or more — by paying below-market rent.

Of course, the anti-homeownership crusaders will argue that she saved and invested the difference every month. But we both know that’s not what happened — and it’s not what 95% of renters actually do.

A lot of the individual rental home owners are hard working people not much different from renters who would see raising rent as one of the few ways to help them get out the rat race. They put a lot of investment in and should not be penalized. They are also not responsible for the renters’ difficulties because they could not afford such loss either. Things get murky when the landlords are companies, or individuals who own lots of them, like over 10 units. Those would have higher leverage against individual renters. So theoretically they could be more flexible with renters because they could tolerate higher loss margins. People simplify the conflicts of landlords vs. renters, as if one side is profitable seeking villains and the other side is innocent victims. It is never this simple.

You are free to invest your $ in rental units and rent them at a rate and annual increase you think is “fair. It gets really tiring when some folks believe they should be able to dictate what others can/cannot do with their property.

If the fair market rate increased XX% why should they not be able to charge it? If they are charging more than market, renters move out on their own accord. In other words, free markets self regulate just fine.

Last thing we need is more Gov’t intervention in the marketplace. I live in Oregon, one of the worst run states in the country. The more the Democrat government implements “fixes,” the worse for everyone (Including renters) it gets.

Sam is correct – do not rely on Gov’t or others; take charge of your own financial life.

On the surface, yes that rent increase is obscene. However, look at it from the opposite angle. Because of Mamdani this landlord hugely hiked the monthly rent because it has been all over the news that Mamdani would cease rent hikes! Elections have consequences as people like to say and unfortunately you are just seeing the result.If not the hike, its selling it to the highest bidder and one less rental unit becomes available (which does what? Increases the monthly rate of rent due to decreased supply!) Further proof that twisted ideas like Socialism do not work.

IMO, it depends, if its a primary residence then yes its a no brainer, you want to buy if you’ll be in area 5 plus years. Technically, the reason real estate returns is so high is mainly just because of leverage. Most people have at least 5 to 1. so if real estate returns 5%, thats actually 25%. Then the tax incentives make it a no lose situation.

An example would be I was looking at my parents house back in 1985, they bought at 190k, Its now worth close to 1.1 million. looks like a huge gain but in reality thats only a 4.4% annualized return. But with leverage, tax incentives and the fact you’d be living in house( Since you’d have paid rent for 40 years) make it a great investment.

If these three factors didn’t take place then the stock market is the better investment. 38k down payment annualized return of 11% would be 2.5 million. Even gold would be better than real estate.

All true. But out of 1,000 people, how many people who decided to rent would have invested the $38,000 down payment into the S&P 500 and left it alone for 40 years? I would say less than 10%, and probably closer to 5%. The discipline to do that is enormous, and life often “gets in the way” where there is always something to spend money on.

So in 40 years, your parents have a $1.1 million paid off asset they can sell with a $500,000 tax free gain. They probably ALSO invested in stocks once they got their primary residence out of the way by buying one. I’m confident your parents are wealthier than 90% of their peers who decided to rent for the past 40 years.

Ask them!

When we are left to our own self-discipline, the natural course of action is to not work out 2 hours a day, cut carbs, and eliminate sugar even though we know we’ll improve our health as a result. Our natural course of action is to lose discipline, watch TV for 8 hours a day, and stuff our faces with pizza and cheeseburgers.

Owning our primary residence helps keep us disciplined.

I have helped a friend and my sister manage their investments. And, I think that I provided prudent advice on investing. The same advice has worked spectacularly for my finances, anyway. Life “got in the way” for both of them and having a nice pot of money to access was irresistible. Cars breaking down or landlords raising the rent were considered “emergencies” and treated as such, but that could not be further from the truth! These things can be planned for and are guaranteed to happen. The option to cash out investments felt safe at the time was chosen over the option that required risk.

I agree that 5-10% of renters would invest the money they save. That made me think. When calculating the benefit of renting vs. owning, multiply the end value of the invested money by 10% and use that as the expected value of investment returns.

Sam, it’s more like 1-2% in my opinion. I think the true number of people who made conscious decisions to not pursue home ownership and committed to “saving the difference”, is miniscule.

Perhaps. I just wanted to be conservative in my assumptions.

I have consulted with many people this year as part of my Millionaire Milestones book promotion. There is a tremendous amount of economic leakage that isn’t going towards investing that can be tightened up for sure.

Real estate provides an excellent form of investment for discipline. This is why owning the primary residence makes sense. This is why it is best to leave your kids property instead of other more liquid assets. They can’t spend it on nonsense so easily…