Rising rents are a boon for rental property investors and landlords. Rising rents is one of the main reasons why real estate is my favorite asset class to build wealth. If you own rental property long enough, you will build far greater wealth than the average person who rents.

However, rising rents come at a cost for renters. With inflation inflated, it makes sense to go long real estate to benefit. Inflation acts as a tailwind for rents and property prices.

In this article, I'd like to discuss whether it's fair for landlords to build wealth through owning rental properties. If you want to invest in residential real estate passively, check out Fundrise, my favorite private real estate investing platform. Fundrise manages almost $3 billion in assets for over 350,000 investors.

I've personally invested over $300,000 in Fundrise to diversify my real estate holdings and earn more passive income.

Being A Landlord Isn't For Everyone

I have a love-hate relationship with being a landlord. On the one hand, being a landlord has been instrumental to our path to financial freedom. Rental property income accounts for roughly half of our total passive income of ~$300,000.

On the other hand, having to deal with difficult tenants and maintenance issues is a source of stress.

As I've gotten older, my desire to be a landlord has waned. Therefore, I started investing more money in REITs like O and OHI, a real estate ETF called VNQ, and real estate crowdfunding. Being able to invest in real estate and earn income 100% passively without having to deal with any issues is my ideal scenario.

Now, national rents are rising and so are the fortunes of landlords. Once again, I find myself conflicted as a mom- and-pop landlord who wants to provide the best source of housing for my tenants.

At the same time, I also want to do the best I can to provide for my family. To do so requires optimizing rental income to keep up with the market given the cost of almost everything is always rising.

National Rents Were Rising Fast

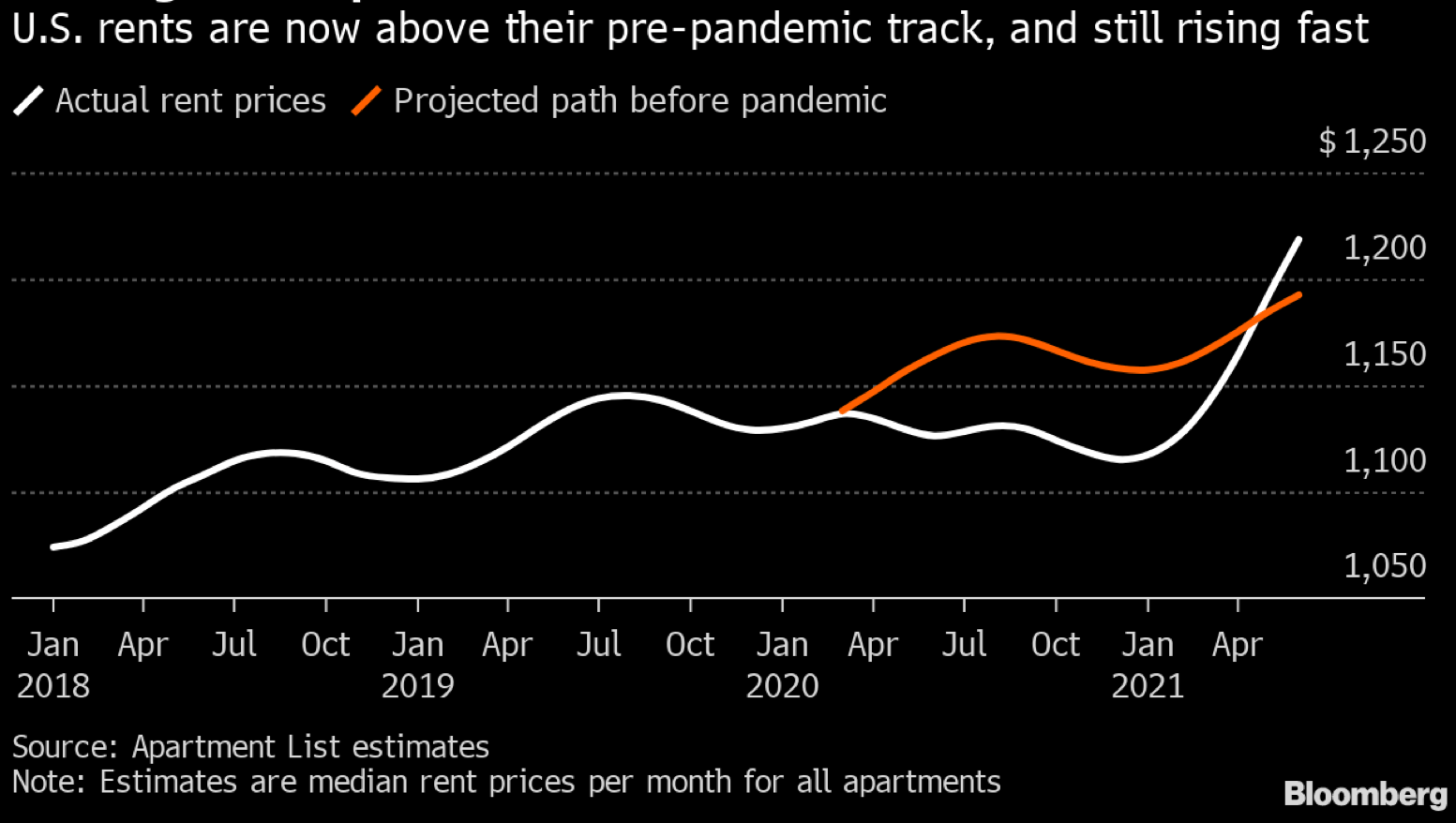

Take a look at this chart created by Bloomberg with data from Apartment List. It shows U.S. rents are now above their pre-pandemic track with no signs of slowing yet. The steepness of the white line is intense and puts upward pressure on inflation.

Of course, rent increases in cities vary on a case-by-case basis. Big cities like New York and San Francisco are lagging 18-hour cities like Phoenix and Dallas. However, as a whole, mainly due to tight housing supply, there is upward pressure on rents.

As a Financial Samurai reader, you may have gotten lucky by reading and acting upon, Rental Properties: The Investment Case For Buying More on September 20, 2020, right before the surge in rent prices. I wrote the post mainly because I could start to sense an uptick in demand after quickly finding a new tenant for my old home.

Today, I continue to believe buying rental properties is a wise investment due to the powerful combination of rising rents and rising principal values. The housing market has years of momentum left, although it is slowing down from current levels.

Further, inflation is simply too powerful of a force to combat long-term. You want to ride the inflation wave, not stand in front of it and let it pummel you! As mortgage rates finally start coming down, the demand for real estate will increase. As a result, property prices are likely going to increase as well.

Mom And Pop Versus Institutional Landlords

Unlike the smooth lines in the rent chart above, true rental price growth is more like wide steps. Rental leases are usually for a year. And rents are sometimes not raised once the initial lease period is over.

Even if you were able to buy a rental property during the middle of the pandemic and rent it out, you won't benefit from the rise in rents until you increase your rent yourself. This is where many mom-and-pop landlords, including myself, run into walls.

I don't like raising rents, so I don't, even if the cost to operate my rental property has increased. Instead, I typically just eat the rising costs and patiently wait until there is rental turnover. Then, I discover the market at the time and charge accordingly.

In contrast, institutional landlords are profit-maximizing machines. Part of the reason is that they have shareholders who demand maximum performance.

Unlike mom-and-pop landlords, institutional landlords are not building personal relationships. Everything is strictly business. At least landlords can use problems as teachable moments for their children.

How To Raise The Rent Without Awkwardness

There is a way to raise the rent as a mom-and-pop landlord without feeling bad or needing to send out an uncomfortable notification. The solution is to make rent terms clear during the initial lease agreement. If both parties agree, then expectations are set. Here is an example of a good rental lease agreement.

In the initial rental lease, you can propose a rental escalation schedule after the initial lease period is over.

For example, you might state the first year's rent is $3,000/month followed by $3,100/month in the second year and $3,200/month in the third year. Or you can put in the rental lease that rent will automatically increase by 3% a year after the first year.

By setting terms upfront, both sides can better calculate their budget. And if both sides agree to the terms, then there shouldn't be any awkwardness during the length of stay if both sides are following the terms of the lease.

Happiness is about setting proper expectations and not deviating from them. As rents skyrocket higher, it's important to educate your tenants about the current state of the market.

Rent Increase Example

In my latest rental lease agreement, I provided a $300 discount to my asking price of $6,850/month for the first year. I wasn't sure about what the true rental market was for a four-bedroom, three-bathroom house in my area. But I figured it had to be between $6,000 – $7,000 based on my research. $6,550/month was in the ballpark so I went with it.

As part of the lease agreement, I then stipulated that starting in the second year, rent would increase to $6,850/month if everything was in good standing. Remodeling your property for more rent and value is a smart passive income boosting strategy.

The tenants were happy to sign because they felt like they got a deal for the property they really wanted. It was a competitive situation between them and another set of tenants.

I was happy to sign because they seemed like a great family with a strong household income. Further, I expected their household income to continue to rise, which it has based on how the husband's company stock has performed (+70% in 12 months).

Given both sides have followed the rental lease agreement, I don't see any reason for conflict once the second year starts. Further, they are following my recommended housing expense guideline for financial freedom.

Are Rising Rents And Property Values Fair To Tenants?

Fairness can be a tricky subject to tackle, especially when it comes to housing. Housing is a human right that gets further out of reach if home prices rise quicker than income for too long.

However, when it comes to answering whether rising rents and rising property values are fair to tenants, let me share my perspective as a previous tenant. I would think most landlords were once tenants as well.

When Rent Became Unfair

When I was a tenant in my 20s, all I wanted was a quiet and safe place to stay. I had a budget of up to $1,800 a month and rationally looked for properties within my means. I was always thankful when a landlord accepted me as their tenant. Therefore, I always paid on time and took care of each place.

It was only when I had an alcoholic neighbor upstairs who would frequently drink and blast his stereo until 3 am that I felt the rent I was paying was unfair. I often had to get into the office by 6 am and work 12-hour days. Therefore, sleep was extra important to me.

No matter what I said to the landlord or to the neighbor, the noise disruptions kept happening. Every week, I'd see the blue recycling bin overflowing with beer cans, crowding me out.

Therefore, after a while, I didn't think it was fair to keep on paying the rent I was being charged. I certainly wasn't going to pay a higher monthly rent if they asked.

I had a decision to make. After six months of no noise improvement, I could either find another place to rent or buy a place after my lease was over. I decided to take a risk and buy in 2003.

I didn't want to completely not pay rent because I signed a contract. A Financial Samurai always honors a contract.

What Landlords Owe Tenants

When I was a tenant, the appreciation rate of my landlord's property did not matter to me. I had no ownership of the property. From a financial standpoint, what mattered to me was the value I was getting for the rent I was paying.

If the landlord asked for a rent increase, I would determine whether the new rent was worth the price compared to other alternatives in the market. I'd determine how big of a hassle it would be to move. I'd also search for comparable rental properties and move if there was a better deal. Finally, if I had a great urge to buy, I'd leave as well.

I understand not everybody has the same options. But we all rationally decide the best use of our money and time.

Fundamentally, landlords owe tenants a safe and functioning place to live. This means working plumbing, electricity, and heating.

If the plumbing and electricity don't work, they must be fixed. If there is water or wind seeping through the windows or walls, the issues must be addressed in a timely manner. All other agreements should be included in the lease.

The landlord does not owe the tenant a cut of the property's price appreciation. Nor does the landlord owe the tenant a discount to market rent. Being a landlord can be a very difficult job. However, in order to keep great tenants, a landlord will sometimes keep rent the same or reduce rent.

Related: Being A Landlord Tests My Faith In Humanity Sometimes

Example Of Reducing A Tenant's Rent

During the middle of the pandemic, one tenant in my condo rental property, unfortunately, came down with some type of cancer. She said she needed to go back to Boston for treatment for six months. She had a roommate who would stay behind.

Due to the pandemic, the remaining roommate didn't want to find another roommate. The remaining roommate also didn't want to move out after three years. She loved the location across from a big park. She also enjoyed the deck. Further, the tenant with cancer wanted to come back to the same place.

We all agreed that in six months things would likely be better. Therefore, we came to a mutual agreement where the overall rent was reduced by 25% for the six-month period the one roommate was gone. The remaining roommate would pay the majority of the rent for having the place to herself.

Despite receiving less rent, the arrangement worked for me due to simplicity. No effort was required on my part to supervise the move-out process and find new tenants. Further, the tenants have been great during their tenure.

The tenants were very appreciative of the compromise. I haven't raised the rent on them since they moved in, nor do I plan to in the foreseeable future.

Related: Invest In The Single-Family Real Estate Boom Without Being A Landlord

A Positive Way To Look At Things For Tenants

Although a 15% year-over-year gain in home prices translates to a $49,000 gain for the median homeowner, there is a positive way to look at rising home prices for tenants.

You may laugh at this positive outlook, but I try to see the positives in everything.

Due to the pandemic, millions of tenants have stayed home much longer than during pre-pandemic times. Therefore, utilization rates for their homes are much higher.

For example, one set of tenants went from working in the office for ~10 hours a day (includes commute) to working from home for nine hours a day. Over the course of a month, that's 180 more hours in my rental property or a ~25% higher utilization rate.

Then, when you add in not going out to social gatherings for a whole year, that may result in another 10% increase in property utilization for a total increase of 35%.

If a tenant's rent stayed the same or increased by less than 35%, the tenant is getting better value for their money.

On the flip side, the landlord will likely incur more deferred costs due to the higher utilization of toilets, ovens, microwaves, faucets, showers, rugs, wood flooring, and HVAC.

Another positive way to look at things for renters is that property prices are rising faster than rent increases. For example, if a property appreciates by 10% but rent only increases by 2%, the renter is getting an 8% better deal.

Related: How to buy property below fair market value

Try Not To Rent Forever If You Want To Get Rich

Renting is great if you don't know where you want to live long-term. Perhaps you just graduated from school or your job situation is in flux. However, once you see yourself living somewhere for longer than five years, I would strongly consider owning.

The combination of rising rents and rising property values will naturally build wealth over time. In comparison, the return on rent is negative 100% every single month. Renting gets you a nice place to live, but there is no investment optionality.

Start Investing In Real Estate

If you cannot afford your own home, then you should try getting neutral real estate inflation by owning some type of real estate. You can do so by buying publicly traded REITs, private eREITs, real estate ETFs, home building stocks, online realtor stocks, and home decor stocks.

Let's say the median home price in America is $400,000. If it goes up 5%, that's $20,000. If the median household income of $70,000 goes up 5%, that's only $3,500. The median household income would have to go up by 28.5% just to stay even with a 5% median home price appreciation. Further, the household income is in pre-tax dollars.

Over the long term, there is simply no way the typical American's household income growth can keep up with home price growth due to valuation differences. If you add on a bull market in housing, where price growth rates are in the double digits, then the first-time homebuyer or renter really falls behind.

The main solution is to aggressively invest your disposable income in stocks or other risk assets that have the potential to appreciate. Unfortunately, when an activity is optional, it's very easy to not do it.

The Sneaky Rental Trap

Be careful about the inadvertent rental trap as well.

Because rents often don't keep up with the market due to landlord reluctance and rent control, renting tends to become better value for tenants over time. However, please be aware of the opportunity cost of renting, which is the price appreciation of real estate.

Back in 2002, I remember talking to one of my favorite sandwich shop owners. He told me something very poignant after I ordered a Reuben.

He said, “Sam, instead of making sandwiches for the past 30 years for eight hours a day, I should have bought this building that I'm renting from when I had the chance. If I did, I would have made more money and retired much sooner!” The owner was in his late 60s at the time.

I'm pretty sure in 30 years, there will be another sandwich shop owner somewhere who wishes he had bought real estate today.

If you don't want to buy property, that's fine. Make sure you invest in something to keep up with and hopefully beat inflation. One day, you will no longer want to trade your time for money. When that time comes, you'll be thankful for your investments.

Benefit From Rising Rents Without Being A Landlord

If you're interested in investing in rental properties without the hassle, check out Fundrise. Through its private eREITs, Fundrise is building a portfolio of institutional quality rental properties around the country. Fundrise is targeting lower-cost areas that are seeing improving demographic trends with rising rents.

Investors can get started with diversifying into real estate through private funds with just $10. Fundrise has been around since 2012 and manages about $3 billion for 350,000+ investors.

If you are an accredited investor and a real estate enthusiast with more time, you can build your own diversified real estate portfolio with CrowdStreet. However, before investing in each deal, make sure to do extensive due diligence on each sponsor. Understanding each sponsor's track record and experience is vital.

CrowdStreet focuses most on individual deals in 18-hour cities where valuations are lower and growth rates tend to be higher. CrowdStreet also has the occasional fund offerings as well that focus on specific asset classes like build-to-rent.

I've personally invested $954,000 in real estate crowdfunding across 18 properties. My goal is to take advantage of lower valuations in the heartland of America and earn income 100% passively. The “spreading out of America” is a permanent trend, especially post-pandemic.

Both platforms are long-time sponsors of Financial Samurai.

Order My New Book: Millionaire Milestones

If you’re ready to build more wealth than 90% of the population, grab a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

You sound like a reasonable person and landlord, something which seems to be lacking lately. I actually just left an apartment, 2B 2B, because they jumped up the price by…about $300 with almost no warning. They told me on the 15th that it would go into effect on the first and I just wasn’t going to be able to find another job in time.

Hmm, there are rules for how long a landlord needs to give before raising the rent and by how much usually.

In SF, landlords must give at least a 30-day notice. And if under rent control, you must follow the annual increase max.

Canada is currently suffering and has been suffering from renovictions, thanks to the so-called ‘rent control’. It is especially bad here in BC. Property values went up SO MUCH, every landlord looks at their house and sees $$$, then fills out the paperwork, saying they need the current tenant(s) to leave because they are renovating and allowing family to move in, then they do that, jack the rent up…in some cases by 50% or more, and then get new tenants. The board is so busy with tenants who aren’t paying rent, they don’t have time to investigate all these claims, so they just let it happen. I am paying $900 a month for one room that is 600sq ft with shared coin laundry on a very busy and noise street, and I feel extremely LUCKY to be paying so little. I have friends that paid $590,000 for the 1200sq ft house, and THEY feel lucky to be paying that. The houses here are absolutely insane. Finding a place to live that is reasonable with our relatively low wages is extremely hard. Landlords are making thousands, and the rest of us are trying to find a third and fourth job just to pay. 50% of your income should not be going just to rent. Some people pay even more.

A new building is almost done being built, and they’re advertising ‘micro suites’ that are 300sq ft for the same rent I pay now. I am always watching and listening for the homeless and the bakery downstairs to make sure no fire starts, because if that happens, I will have to leave this town and move somewhere up north, where I’ll be miserable, because I won’t be able to find a place that even has the tiny amount of space I have now. It’s sickening.

How much do you think government corruption or mismanagement are the reason for why housing costs are so high in Canada?

I just wrote a post saying that if the United States housing market got as hot as Canada’s housing market, prices would be up between 30-70%!

https://www.financialsamurai.com/what-if-the-u-s-housing-market-turned-into-the-canadian-housing-market/

Sam, like you I’ve worn a little thin on being a landlord. My rental properties along with my primary residence have absolutely experienced ridiculous levels of appreciation especially in the past few years, essentially doubling. This of course is why I put up with the headache.

I noticed over the years you have not often failed to mention REITs at least in passing in your writing. Maybe I’ve missed it but have you ever devoted an entire article to REITs in detail? I’d like to get some thoughts about possible unforeseen pros and cons from someone who has spent some time invested in them. Thanks

I would be interested in what REITs Sam owns as well.

INVH, AMH, O, OHI, HD, VNQ.

Gearing up to buy some Redfin as it has come off.

How about you guys?

I’m a renter and am fortunately locked in during the pandemic drop in prices. I pay my rent on time every month and I don’t cause trouble. I’m sure my landlords are not too eager at raising rents and trying their luck with another wildcard renter.

Some have mentioned the low supply of housing in America. Specifically, here in SF, there is of course the famed (or infamous) single family home zoning laws. However, in addition to SFH zoning, another culprit to the lack of housing supply is Prop 13. It is unclear to me why anyone would ever sell in CA given Prop 13 ensures one can pass along favorable property tax treatment to heirs. Eliminating Prop 13 will level the playing field and open up quite a lot of housing to those who can pay market rates rather than rates held more or less still due to an arbitrary point in time.

Here’s a really cool site that shows you what everyone is paying in property taxes:

officialdata.org/ca-property-tax/

Renters always think eliminating Prop 13 will help them get in the market. However, the rationale behind Prop 13 remains more valid than ever, when property values are rising so fast.

As a 50 year old native SFer, in my lifetime, everyone has always wanted to move to SF. There will never be enough housing to accommodate everyone, even if you eliminate the rent control that’s keeping supply even tighter for young folks and new arrivals. Creating more density by zoning changes without infrastructure investments is a recipe for disaster, not to mention it’s effect on the character of the city. As it is, CA has one of the more reasonable property tax rates at +/- 1.24% of purchase price.

Once you own and start to retirement plan, you want to know you won’t be priced out of your own home within years, due to a boom in real estate prices (and therefore rising property taxes) and/or new arrivals who vote in new taxes to fund large spending programs. It’s one thing if you’re FIRE and your property tax goes up 15-20% YOY but can hustle more to keep up, but it’s another thing if you’re in your 60s and beyond and have already worked a lifetime and are helping adult children/elderly parents on a fixed income.

Your point about treatment of heirs is not informed by facts. Look into Prop 19, the real estate industry backed proposition which eliminated the transfer of property tax basis for heirs for anything but primary homes. It also capped the amount eligible for heirs of primary homes to $1M of assessed value — a pittance in SF Bay Area/Coastal CA. Folks over 55 can now sell/downsize, and keep their property tax basis, so it’s misleading to say there is no incentive.

Instead of looking at what others are paying for property taxes for their homes, I suggest looking into what your neighbors are paying in rent-controlled apartments in SF, NY, or beyond. There’s just as much disparity — except renters never have any skin in the game (fix and maintain homes, invest in upgrading and being compliant with new codes, etc.).

I am neither for rent control nor for changing SFH zoning in SF, actually.

So capping the amount eligible for heirs of primary homes at $1M of assessed value is not enough? What should it be?

“It’s one thing if you’re FIRE and your property tax goes up 15-20% YOY but can hustle more to keep up, but it’s another thing if you’re in your 60s and beyond and have already worked a lifetime and are helping adult children/elderly parents on a fixed income.”

–Why are these are different? Why can’t 60 year olds move to LCOL states if they cannot afford the increase in property tax? What if FIRE folks have to take care of family members on a fixed income?

Not sure what the right cap should be, but not all heirs have high-powered jobs or income to stay in the family home. It’s pretty harsh to say they just need to be banished to a LCOL area when their parents toiled and saved to provide for their less fortunate children.

And as for 60 year olds moving to LCOL states…Wow. Should we also go down the road that people need to sell and move on to retirement homes? All communities need some stability. There are many reasons why picking up and moving isn’t as easy as you’d think. People have family/support systems, or health reasons why they need to stay put. People of color/LGBT folks often don’t feel comfortable moving to many red states. Adult children of said 60 year olds could need grandparents to help out, etc. etc.

I would hazard to propose that if there wasn’t Prop 13, much of the US would be immediately overwhelmed by Californians FORCED to geo-arbitrage…accelerating and displacing people from Boise to Boulder. even more than is happening already.

Good luck on your real estate journey. Hopefully you will achieve your goals, whatever they might be.

Do you think PoC/ LGBTQ+ folks are the prime beneficiaries of prop 13? Since you bring up PoC, how are first generation immigrants supposed to get their foot in the door when they will be paying the highest property tax burden in a neighborhood if they buy tomorrow? If everyone in CA paid their fair share of property taxes across the board (not due to purchasing at some arbitrary point in time) perhaps it would not need to be at the rate it is.

I cannot imagine the majority of wealth in SF and the US to be concentrated in the hands of PoC and LGBTQ+ folks due to systemic racism and prejudices. In fact, minorities are likely be paying far more in property tax than their white neighbors who bought their homes in the 1970s because the majority of old money and generational wealth is in the hands of white families. As such, prop 13 reinforces such a trend.

In addition, I would be for changing SFH zoning laws too to accommodate more folks into SF however I just don’t think the infrastructure as is can handle it.

At least we agree on the outcome though! Cheers!

POC/immigrants aren’t the prime beneficiaries simply because of demographics. My point was to highlight that not everyone can move to LCOL areas. There is an indirect benefit because rent control is unsustainable without a corresponding cap on property tax increases.

Your point about historic white wealth applies across the country, where there is no Prop 13. Why shouldn’t they hold the wealth? The country was majority White for centuries.

Still, everyone can benefit from Prop 13, including younger whites. I speak only as a first-gen immigrant, LGBT, who went to a SF public school, majority non-white and immigrant. (Whites were <20%). We were too focused on getting our toehold rather than what others pay in property tax. We look more at opportunities, rather than inequities/legacies of the host country. We aspire to wealth instead of resenting those who came before and made it.

Most now own homes in the SF Bay Area and beyond. This includes ALL my originally poor relations (some who still don't speak English) who have bought homes/investment properties in San Francisco. You'd be surprised how much of SF real estate is owned by mom and pop immigrants.

In fact, I pay market rate taxes for a 5-unit building I purchased in SF in 2020 and pay 900% more in property tax than the ones my parents bought in the late 70s. But I'm reassured to know, I pay less tax, percentage-wise in SF in 2021, than I do in my primary home in Manhattan. My maintenance/property tax there has gone up 45% in 8 years, yet the values have not doubled like in SF.

My unsolicited advice to anyone who will listen: take advantage of the laws that help build wealth. There are too many historic inequities/obstacles that can bring one down. Every generation has it harder than the next.. Boomers vs Gen X vs Millennials, vs Gen Z. (My brother-in-law recently shared his "high" tuition of $900 a year from Columbia U. in 1967, $7300 in today's dollars!!) The only thing to do is work harder, save more, stay focused on the goal.

Good luck! You will likely get there sooner than you think, despite the perceived obstacles.

|| Why can’t 60 year olds move to LCOL states if they cannot afford the increase in property tax?

Why should they be forced to? They didn’t cause the market melt-up, and they don’t benefit from it until they sell, at which time they pay tax on the gain.

Property Tax is RENT paid to the government, nothing more, nothing less. The core of Prop 13 is rent-control for homeowners.

Relying on the government to solve any of life’s problems is foolish at best, dangerous at worst. I also find it ironic that most on this forum would not trust the government to baby sit their cat, yet freely dispense of wisdom on how the government can solve poverty or housing.

The answer is simple, people can and will make a better life for themselves if they are motivated to do so. They always have and they always will. I am an example of that fact as are many of you. It is arrogant to believe somehow only “we” can prosper, or the deck is stacked against the poor in ways they can never overcome – it always has been and always will be – but this is still the greatest country on earth and immigrants come here every day and build wealth proving it can still be done.

Frank, I don’t think you’re arrogant to believe that since you are an example of living a better life, other people can to. Feel proud of your accomplishments!

If your 401k, Social Security, Medicare, and any other type of government subsidized benefits is there for you/us when it’s time, then great. If not, it’s OK b/c we focused on building wealth on our own.

Thanks for the great post Sam!

You hit the nail on the head when you mentioned that most people won’t invest in stocks because it isn’t mandatory. I have seen that time and time again.

Sam – Your advice is so sage. Hope you keep on publishing quality content!

The nice thing about mom-and-pop landlords is the flexibility. Management companies wouldn’t lower the rent temporarily and the problem would escalate.

I gave my long term tenant 50% off rent for 9 months last year. He went to Europe and worked from there. This is at our duplex where we live in one unit. In return, we got to use his living area as office space. It was much needed because everyone was working/schooling from home last year. It worked out pretty well. We lost some rental income, but it wasn’t a huge deal. I’d rather keep our stable tenant happy.

During the pandemic, property prices increased drastically in A heartland city where I own properties in. My tenants are still willing to renew their leases (for those that have leases ending soon) at an increase of 21.8%. The rent that I’ve been charging was market rate at the time (1-2 years ago). There’s no rent control there and it’s relatively simple to evict.

Wow! That’s one of the largest rent increases I’ve heard of after only 1-2 years. If they are willing to pay that much more, than all is fair then. Good luck!

For Californians, raising rents is a must due to AB 1482. Single family rentals may be exempted from the law but your contracts must include specific language. For multifamily rentals, failure to adequately raise rents will absolutely catch up to you when you go to sell. For those who are unaware, appraisers use three methods for determining value: cost, sales and income. Naturally, for income producing multifamily residences, the income approach is most applicable – search Cap Rate. Don’t fall asleep at the wheel, treat your investment property as a investment.

I started investing in rentals 15 years ago with one, paid for with life savings, and invested 100% of the profits ‘compound interest style’ into other rentals as they came along, paying cash for all. I now have 17 rentals all paid for, with a net value of 2.7 mil due to appreciation. (way) Over six figures net in passive income aint bad either

The best thing I ever did was hire a >Quality< property manager to manage them. They are out there, but require some detective work to find a really good one that works for you. Most just collect the rents, send you the rest, and you can get stuck real easy. My current manager only charges 10%, but for that fee they get 100% of my headaches!! NEVER,EVER let the tenant know you are the owner, or they will use that against you anytime they want special treatment, lower rent, etc. Trust me on this one, it will save you lots of headaches, late night phone calls, litigation and in the end, money.

Remember, this is a business, not a hobby or a social program. It is designed to make you money. Rent increases are just a part of the game, a necessary part of doing business.

Every rental I’ve had they know I’m the owner and never heard any weird or unreasonable request. Might be location/price point though.

Why doesn’t an Amazon employee get their entire, say $300K, compensation in equity and then take out a line of credit on X%, for example 50% or 100% of the total compensation? This would reduce their income tax.

RSUs are taxed as regular income, with a tax bill immediately due on vesting dates. So there’s no escape on that route.

ESPP purchases aren’t taxed until sale, but you already paid income taxes on the money used to purchase them.

ISOs are where it gets complicated – some ways to buy cheap, though you’d still owe for capital gains. Lots of ways to screw up here – have a tax bill for worthless options.

We don’t raise rent regularly on tenants, not because we “feel sorry” for them but because the cost of turnover makes it to our advantage to keep good tenants happy. I was a renter in Chicago for 10 years and hated the places that had a regular increase and usually moved. I was a good tenant that paid on time and in full reliably and took good care of the unit. Now as a landlord I want to keep those kind of tenants. So we raise rent only after a turnover. But of course rental markets are different and if your expenses increase that much each year it makes sense to increase rent annually by % and specify terms in lease.

I usually move rents up if the tenants are so so or the occasional bad one. Good ones maybe once every 2-3 years by a small % or so.

Rents must go up to keep up with the higher expenses and “real inflation”.

Turnover is a very high expense and must be factored into how much and how often you raise rents on very good tenants. Always easy to reset the rent on the next tenant at any rate.

Same. I don’t raise rents on good tenants. I have a full time job, and I hate having to move tenants out, get the unit back to rent ready condition, advertise and show it. I’d rather leave a little money on the table, then raise rents when someone moves out.

As much as people focus on the land or the property, real estate is a people business. Your tenants can be your biggest asset, and good tenants can make or break an investment. I try to look at it holistically – rent, wear-and-tear caused by the tenant, maintenance requests, turnover cost to find a new tenant, etc. There is no question my property taxes and labor for maintenance has gone up over the past two years which eats into my cashflow if I don’t raise rents. But I try to consider all factors – on the revenue and expense sides- when determining whether to raise rent, and how much.

I have a found a good property manager to be an absolute game changer. They are extremely in-tune with the market so that I can make the most informed rental decisions, they have systems in place for maintenance and preventative care and they have the scale in knowledge to advise in tricky situations. And don’t forget the opportunity cost – getting the time back I would otherwise spend managing properties is worth more to me than the 8-10% fee I am paying.

The Real Estate Captain –

I hired professional property management and everything is working out great! I can focus on other task and grow faster in life

Michael E. Gerber: The E-Myth

The resources of a PM company are probably one of the most valuable things included in the fee. That said I self manage our two properties after using a PM company for the previous eight years. Showing the property and qualifying tenants is definitely time-consuming. But after that, there’s not much to do. I like to do a maintenance check-in twice a year and maybe a couple of calls over an entire year. For me, keeping 10% off the top is the better deal.

We try to sell our first home in 2008 due to out of state move but couldn’t sell it so we became landlords. I had no idea how to invest in stock market at that time and kids were too young 5 and 3 yrs old . Being a stay at home mom I thought I can handle the tenants. Every time tenants moves out I have to spent thousands in repairs , new paint , door fixes etc mostly considered wear and tear so it came out from my pocket . Every new tenant behaves like they are the neatest person with outrageous demands . I kept on doing all of the repairs although the house was only 10 years old at that time.

After couple of years we bought 2 more properties in same Neighborhood, it’s a very nice area with high HOA to keep the neighborhood in prestige condition. Same horrible stories with tenants got multiple tenants evicted via court orders . It was a continuous battle and I kept on fighting because I thought that’s our best investment option being immigrants who have no idea how investments work in USA and no one to guide , both of our dads passed away.

I calculated after paying property taxes as they are very high in Austin TX , home insurance , repairs , HOA fees etc I was barely making 5% profit . I never hire management company to keep cost down and dealing with everything remotely we moved to CA in 2008. As you know in TX property tax is not capped so when prices start rising the tax bill starts getting huge and rents don’t increase at that level.

Fast forward this year I was so done with tenants and property values increased almost 150% since we bought. Now due to increased home value , property tax gets double , you cannot double the rent . After reviewing my calculations we can barely make 2% profit to me it was not worth the effort anymore , all 3 properties are paid off.

Finally we sold 1 last month and 2nd is under contract for 3rd property we filed eviction order through court , keep getting HOA violation notices because tenants is not following the guidelines .

I’m a hustler but dealing with all those difficult tenants for 12 years with 2 young kids was too much. In the end all that hard work paid off , almost done with this chapter and excited for new opportunities .

Thanks for sharing! I totally empathize with your situation bc I sold my main rental property in 2017 after becoming a father. It was too much to deal with the archetype of tenants I kept on getting for three years. So I reinvest of the proceeds in completely passive investments.

See: https://www.financialsamurai.com/why-i-sold-my-rental-home/

I’ve never had to spend a lot of money to fix the place after the tenants left. Based on the lease agreement, and based on the rental deposit, they always return things as they were when they first moved in.

Congrats on the sales. They should make all your hustle worth it.

What do you plan to do with the proceeds?

Underwriting good tenants a skill. I think this lady likely could use some work on that plus you’d be surprised how much you can use the security deposit. You don’t have wear and tear like indicated in her post. The depreciable life for most of those things is every 5-10 years, not every year.

In TX properties were not that expensive till 2019 so most people who have good credit score buy the house the renters are mostly with not so good credit score who lease houses for families or undocumented. The rent is on average $1700 and no one will pay you more than one month rent as security deposit . When they move out in 2 years the house usually needs way more than $1700 worth of work example one of my tenant moved out last week , he never mentioned any water leak in bathroom after the inspection we found out tub faucet leaking behind the wall and the vanity is soaked it’s way more than $1700 repairs on just one thing. Keep the rotation on 3 properties and it adds up quickly . Last few years I hired the leasing agency just to find good tenants and nothing changed same issues. I think it’s the demographics.

That is true everywhere and I haven’t had that problem. I’ve had 1 tenant out of about 20-25 that the security deposit didn’t cover everything and they lived there 6 years. PS price slightly below market in rent and you’ll get 10x the number of applicants and you can get the 760 credit score that makes 8-10x income to rent rather than 600 and 3x. Make sure you use Zillow, trulia, hotpads, Craigslist etc.

I read almost all of your articles so of course saving gain is the key I’m working with CPA and 1031 attorney to figure out a very complicated exchange .

Try Not To Rent Forever

Renting is great if you don’t know where you want to live long-term. Perhaps you just graduated from school or your job situation is in flux. However, once you see yourself living somewhere for longer than five years, I would strongly consider owning.

The combination of rising rents and rising property values will naturally build wealth over time. In comparison, the return on rent is negative 100% every single month. Renting gets you a nice place to live, but there is no investment optionality.

^

You know a lot of big name personal finance/money “gurus” disagree with this statement?

I’m not aware. What were the reasons for missing out on one of the biggest real estate bull markets in history?

I know one guy who sold his property in 2012, at the bottom of the market. But at least he invested in stocks.

Would you say that their anti-real estate stance is an argument for why it is fair for landlords to benefit from rising rents and property values?

I think JL Collins sold his house in 2012 at the bottom of the market.

That was a bad move.

Another good benefit of the recent economic changes for tenants is that renting is comparatively more affordable. If the cost of a house goes up 40% this year and my rent only goes up 5%, then my apartment just became 35% better value compared to buying.

Agree. The question is, whether rents will try to keep up and go up as much as well. They might eventually. However, I bet a higher likelihood is that rents will not rise as much, and that real estate valuations will just get relatively more expensive.

Takes time for rents to adjust as quickly. But less so if you invest with institutional real estate investors.

I have been renting a property and have not raised the rent since the tenants moved in 2017. I have inspected the property twice and it is in better condition than when they moved in. They take care of all of the maintenance and just deduct it from the rent. I know I could raise the rent but I feel more comfortable knowing I have an excellent tennant. She lived in her last rented property for seven years and only moved because the property was being sold.

Seven years is great stability and you love it when a tenant takes good care of your property for sure.

However, depending on rental laws, you may not want to deviate too far away from market rates. There is a situation where your tenant stays forever and you get stuck way under market for too long.

But then again, great tenants do provide great peace of mind.

Sounds like liberal socialist logic, you seem to lack a basic knowledge of free market pricing and why it’s critical to individuals ability to live in liberty and living in a free society!

You are welcome to compete and provide cheaper rent if you think their is a market

You’re right. I’m trying to learn how to get better every single day. If you have some tips, feel free to share.

Hearing productive advice from the community is always something I look forward to.

And that’s one of the beauties of real estate. Even though I don’t know much, I’ve been able to benefit in a rising market. The same goes for other landlords who may not know much either.

I did try to offer a big discount to a preschool teacher because he didn’t make much. But he declined, all the way to see if my offer is still open several months later after he went to look what was out there in the market.

See: https://www.financialsamurai.com/how-to-recognize-financial-opportunity/

I have personally taken the opportunity to transition most of my rental properties over to property management. The increase in rent has afforded me the ability to net the same amount of income, divest myself from the day to day operations headaches, and use increased rents to pay for the cost of professional management. Spending the extra dollars on property management would not be necessary, if dealing with tenants hadn’t become an irritation. Ironically, I always kept my rents below market level. When it became too much to deal with, it was an easy call for me to “pay” somebody to deal with the management.

Is this “fair?” Not sure, but it is what it is. I know that as a new landlord I was burned on a number of occasions by tenants. Some did not pay or were chronically late. Others left abandoned belongings that I had to physically deal with and pay to remove. I was correcting items that went well beyond normal wear and tear. I suppose that would not be considered “fair” as well?

I can say confidently, that by my taking a risk to purchase the property I was able to provide shelter and a home to many people whom otherwise would not be able to afford to live in the neighborhood/house that they were renting. Due to leveraging my down payment, creditworthiness and risk of assuming the mortgage, I provided the opportunity to trade up lifestyle for many families.

I feel like the market dictates what is fair.

Smart move if you can get a reliable and trustworthy property manager.

I think everything does start with tenant screening though. You could have a great property manager, but if the tenants or not ideal, things will likely still be bad.

Therefore, it’s worth really taking your time the screen prospects and be willing to pass on ones, even if they can pay full rent.

“The main solution [if you rent] is to aggressively invest your disposable income in stocks or other risk assets that have the potential to appreciate. Unfortunately, when an activity is optional, it’s very easy to not do it.”

This sentence is exactly why the home is the most common wealth builder in the United States, where saving is optional or unreachable for most. I find the lack of affordable housing in the country unfair to younger generations, as the housing shortage and increasing demand leads to a market that prioritizes seasoned buyers at their expense.

Hopefully, with the increase in remote work that has exploded during the pandemic, a redistribution of the population can alleviate this to a certain extent, but what is needed is a dramatic increase in the housing supply through federal policymaking.

Total agree.

I do well enough to either invest in RE (buy my own place) or the market, but not both, therefore, I rent at a fairly reasonable rate (for NYC anyway) and shove 40%+ of my yearly income into my IRA/401k at an asset allocation that lets me sleep at night. So far its paid off despite renting many years, and despite coming to this strategy in my 30s as opposed to 20s. The plan is to geo-arbitrage later and find a nice place in a more affordable market that I can hopefully purchase in cash.

You need a plan commiserate with your needs. Some don’t make enough to be afforded any ability to plan. Many do and simply don’t know what to or it doesn’t occur to them or they are simply unwilling to make needed tradeoffs/sacrifices to do so, preferring the trappings of a life they ‘deserve’ vs the security of knowing they will make it through life with all they need. Those who fail to plan plan to fail.

I couldn’t agree more that having a plan is critical to success. That is great that you plan to capitalize on geo-arbitration later on, what markets do you have in mind?

For my personal circumstances, Florida makes sense due to familiarity with it and a large social network out there. Sure I could move to some random US state, cheaper, but with nothing and no one….doesn’t make sense.

Also, I’d personally be fine (at least with my now thinking) with not going the home route and being fine with the very nice condo route. The actual city/town I’ll determine when I decide to go and where is near enough to my friends.

If you own your place outright down there, a basic life can likely be had for 25-30k +taxes, including a car, food (i cook much more than I go out to restaurants) and for your HOA/CC/taxes. If you’ve saved enough, it should be no sweat, and one should have plenty left over for either the better place, eating out, traveling if that’s what you want to do.

The plan can always change, but having a goal/plan gives us something to work towards, especially if you ran the numbers and you’re way in the win column (even with anticipated inflation)

Can you elaborate on “… dramatic housing supply through federal policymaking” please? It’s easier said than done, and many times, doesn’t go as planned. So, cusious what you propose.

There will not be a dramatic housing supply increase anytime soon if ever, purely wishful thinking. With land, labor and input costs all soaring, builders either aren’t building or they are building for the upper half of the market, including luxury apartments instead of entry level or mid tier.

It is wishful thinking, in our current political climate this will not get passed through. Coupled with the fact that high end homes are selling like hot cakes, there is little organic potential for this to happen. Nonetheless, recognizing the problem is the first step.

I don’t know the solution to this, it is much easier to recognize a problem than to have the answer. The only thing that comes to mind is Great Depression era infrastructure spending, but rather on homes. The added benefit of this would be providing new skills to laborers who can become contractors in their own right.

When I was a renter I always paid on time. But once I had a roommate that started paying late about 6 months into our lease. He really started to get on my nerves too and the stress of not knowing if he would make rent became too much. So I pretended we couldn’t renew after the first year. He moved out, I stayed on, and got a better roommate to replace him. That was a win-win for both me and our landlord.

After about 12 years of renting I couldn’t take it anymore and bought my own place. It wasn’t much, but it meant everything to me. And I’m so glad I bought it when I did. I saved aggressively and bought a nicer place when I got married and turned my first place into a rental. I’ve learned to really take my time screening tenants and so far things have been going well. Having a great tenant/landlord relationship is key and makes everyone happy.

Thanks for the great post Sam!