Housing is one of life’s fundamental needs, right up there with food, water, and safety. For decades, though, housing affordability has become increasingly out of reach for the average American. With the median U.S. home price hovering around $440,000 and the median household income roughly $80,000, it’s easy to see why homeownership has become more of a dream than a given.

Enter the potential 50-year mortgage, an idea reportedly being explored by the Trump administration. The concept is simple: stretch out the repayment term to make monthly payments more affordable, and potentially pair it with a portable mortgage, which would allow homeowners to transfer their mortgage to a new property if they move. Together, these innovations could unlock housing security for millions of Americans.

Critics are quick to say that extending debt over half a century is reckless. But I believe it’s a smart step forward – a recognition that our lifespans, careers, and financial realities have evolved. If implemented responsibly, a 50-year mortgage could be one of the most transformative housing tools of our lifetime.

In this post, I’ll also introduce a new concept called the Mortgage Utilization Rate — a simple framework that helps homeowners borrow more responsibly.

Housing Security And Family Formation

For many Americans, housing security is the bedrock of family formation. Couples understandably want a stable home before bringing a child into the world. The last thing you want, especially with a newborn, is to be forced out because your landlord wants to sell or raise the rent. This happens far more often than most people realize.

Once you have a baby, life becomes a blur of feeding every few hours, pediatrician visits, and emotional and physical recovery. The mother needs months to heal. The parents are running on fumes. During this fragile time, the last thing you need is uncertainty about your living situation.

When you own your home, that stress largely disappears. You can focus on raising your child rather than worrying about your next lease renewal. Housing security allows you to channel your energy toward what matters most: your family. Don’t underestimate this benefit.

The Median Age For A First-time Homebuyer Is Growing

The problem is, for a growing share of Americans, homeownership doesn’t even happen until middle age. The National Association of Realtors reports that the median age of first-time homebuyers is now 40 years old, an all-time high. That’s not just a statistic; it’s a reflection of how much harder it’s become to afford a home relative to income growth.

Meanwhile, our life expectancy is around 80 years. We may be living longer, but not by as much as the rise in age of first-time homebuyers. As a result, family formation is being pushed later and later, or abandoned altogether. From a biological standpoint, this trend carries enormous consequences.

If you wait until 40 to buy your first home and start a family, the odds are stacked against you. A woman’s chance of conceiving naturally after age 40 is under 1% per month. That’s like getting into the Indian Institute of Technology in a land of 1.46 billion people, getting an H-1B visa, landing a six-figure job in America, and then rising up to become a C-level executive. It happens, but not often. The result? More couples delaying or forgoing children altogether.

That’s why the 50-year mortgage and the portable mortgage could be such game-changers. They don’t just make homes more affordable, they promote family stability, economic participation, and national renewal. Without enough young families, we face demographic cliffs that threaten long-term economic growth.

The 50-Year Mortgage Is Great — If You Don’t Take 50 Years

The loudest criticism of a 50-year mortgage is that it supposedly chains people to debt forever. If you take out such a loan at 40, you’ll be 90 by the time it’s paid off. Sounds grim, right? But that argument misses a crucial point: almost nobody keeps a mortgage for its full term.

Today, 90–95% of mortgages in America are 30-year fixed-rate loans. Yet the median homeownership tenure is only about 12 years. Before the 2008 financial crisis, it was even shorter — around seven to eight years.

So why would we assume that borrowers would actually hold a 50-year mortgage for five decades? They won’t. Most will sell, refinance, or upgrade long before then.

Getting a mortgage gives you the option to buy, and therefore, the option to sell at a profit (or a loss). Remember, nothing is permanent in life. We don’t really own anything in our short time on earth. But having options is more valuable than being shut out forever.

The Mortgage Utilization Rate Concept

Think about it: if you divide the average 12-year homeownership duration by 30, that’s a 40% “mortgage utilization rate.” In other words, most people use less than half their mortgage’s potential term.

Apply that same rate to a 50-year mortgage and the average homeowner would still end up holding it for only about 20 years — not the full half-century. But realistically, I doubt tenure would jump from 13 years to 20. More likely, it would increase by just 1–3 years at most because life keeps happening regardless of mortgage length.

This is why I’ve long encouraged people to consider adjustable-rate mortgages (ARMs), such as the 7/1 or 10/1 ARM. They better match real-world behavior. The 50-year mortgage simply extends this flexibility further. It’s an option, not a sentence.

A 50-Year Mortgage Provides More Options, More Freedom

The beauty of a 50-year mortgage is that it lowers your monthly payment, giving you greater purchasing power and flexibility. For young families or first-time buyers, this can make all the difference. At the end of the day, life is finite, and we rent everything before we die anyway.

Imagine you’re 32, newly married, and want to start a family before 35. You’ve saved diligently, but without the Bank of Mom & Dad, you can’t quite afford the monthly payment on a 30-year fixed mortgage. You consider waiting for home prices to drop 20%.

Eight years later, you get your wish — housing prices fall. But now, one of you has lost a job, and fertility is no longer on your side. IVF treatments cost $28,000 per cycle, and you’re emotionally and financially stretched thin.

If a 50-year mortgage had existed earlier, you could’ve bought a home in your early 30s, locked in stability, and focused on starting your family instead of timing the market. Time waits for no one, especially not biology.

The longer amortization period doesn’t mean you’re trapped. You can always make extra principal payments or refinance when your income rises or rates fall. The key is that you get to better choose when to buy, instead of waiting indefinitely for affordability that may never return.

The Downsides To Getting A 50-Year Mortgage

Of course, there's not such thing as a free lunch. If the 50-year mortgage were to be introduced, it's important to be fully aware of the downsides as well. Here are some obvious, and not so obvious downsides.

1. Much Higher Total Interest Paid

Stretching a loan to 50 years massively increases the total interest expense, even if the monthly payment is lower. You could end up paying 2–3× the price of the home over the life of the loan. Banks would also likely price a 50-year mortgage higher than a 30-year mortgage because of the time value of money.

That’s why a savvy borrower would shop around and try to secure a 50-year rate that’s comparable to — or even lower than — prevailing 30-year rates. It’s not impossible. Banks frequently run promotions to boost business and attract deposits, and those windows can offer surprisingly competitive long-term rates.

2. Slower Equity Buildup

Your principal is paid off very slowly. For the first 10–20 years, you might barely move the needle on equity unless your home appreciates.

3. Higher Risk of Negative Equity

Because principal paydown is so slow, a small market correction could put you underwater, especially in the early years.

4. Lower Mobility

With so little principal paid down, it’s harder to:

- sell

- refinance

- relocate

You may feel “locked in” longer than expected.

5. Higher Interest Rate Premium

Lenders would likely charge a higher interest rate for a 50-year loan due to the longer risk exposure.

6. Extending Debt Into Old Age

Some borrowers would still be carrying mortgage debt well into their 70s or even 80s. That’s not ideal for retirement security, unless your plan is to never fully pay it off. If this is the case, these borrowers need to share their mortgage debt situation with their children and other loved ones.

7. Encourages Higher Home Prices

Longer-term loans can artificially inflate prices by boosting purchasing power. More buying power = sellers raise prices = less affordability long term. We'll talk about this more in the next section.

8. Psychological Weight of Long-Term Debt

Knowing you’re locked into a 50-year obligation can feel:

- heavy

- never-ending

- restrictive

Even if you plan to sell sooner, it creates a mental drag. Personally, I've never regretted paying off a mortgage by selling or directly paying down principal. In fact, there's a triple benefit to paying down your mortgage I've written about before.

9. Potential for Predatory Borrowing

Some buyers may misuse the lower monthly payment to buy more house than they can realistically handle, increasing default risk. Hence, please follow my 30/30/3 rule for home buying. You may be able to stretch to buy a home up to 5X your household income if you are bullish on your career. But I wouldn't go beyond that.

10. Limited Availability or Resale Issues

If 50-year products remain niche:

- fewer lenders may offer them

- refinancing to a standard mortgage later might be harder

- future buyers may be wary

A 50-Year Mortgage Is Music To A Real Estate Investor’s Ears

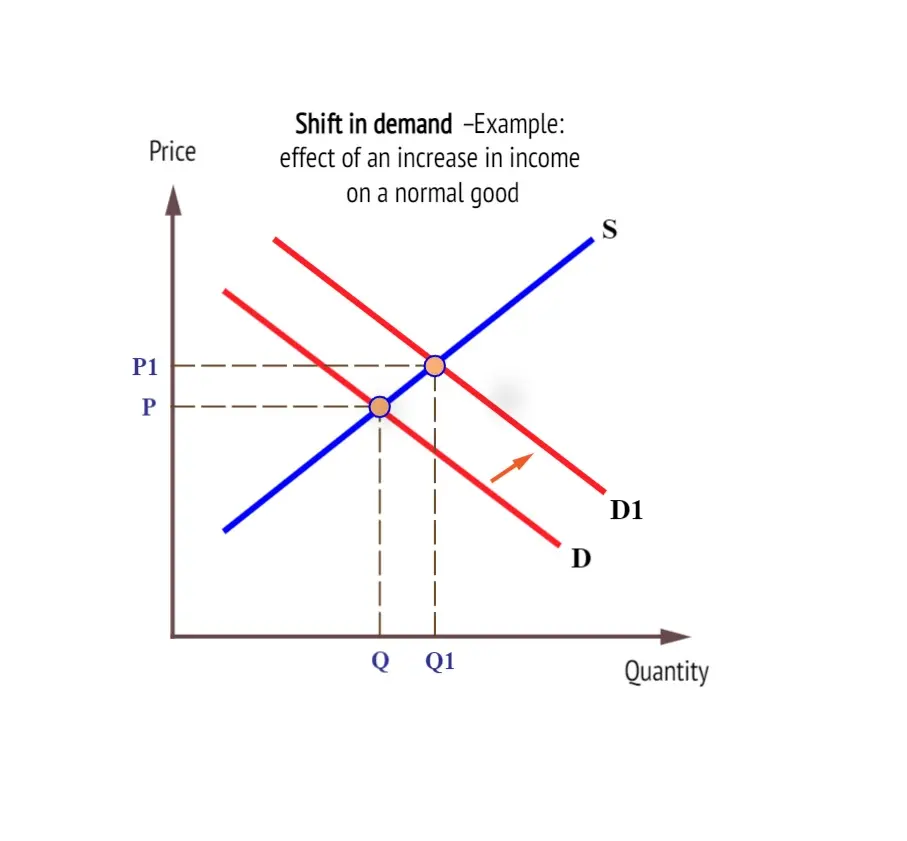

If you’re a real estate investor, you never fight the government — you ride with it. A 50-year mortgage expands the pool of potential buyers, which naturally supports property prices. In other words, it shifts the demand curve to the right, causing prices to go from P to P1 in the chart below.

Historically, housing policy has always leaned toward pro-ownership. The government knows that about 65% of Americans own homes, and those homeowners form a powerful voting bloc. That’s why federal policies — from mortgage interest deductions to capital gains exclusions — are consistently designed to support homeowners.

Remember the 2008–2009 financial crisis? The government bailed out banks and homeowners alike. That set a precedent: when push comes to shove, the government will step in to stabilize the housing market.

I still remember when Bank of America voluntarily lowered my fixed-rate mortgage from 5.75% to 4.25% on a vacation property — unprompted. It boosted my cash flow by $500 a month overnight. That’s the power of policy alignment between lenders and the government.

And now, with the SALT cap raised from $10,000 to $40,000 under the One Big Beautiful Bill Act and talk of a portable mortgage system that lets you take your rate with you when you move, the momentum is clearly pro-housing.

When the government signals that it wants more Americans to own homes, you don’t resist — you invest.

Portable Mortgages: Unlocking More Freedom To Move

While the 50-year mortgage is getting most of the attention, the portable mortgage may actually be the more revolutionary concept. Roughly 70% of homeowners have a mortgage rate under 5%, and home sales is at a three year low, which means people are putting their lives on hold.

Under a portable system, homeowners could transfer their existing mortgage (and interest rate) to a new property. They’d still have to qualify and come up with any cash difference given financial situations tend to change overtime.

Imagine locking in a 3.5% rate and carrying it with you when you move. This innovation would solve the “golden handcuff” problem that’s frozen the housing market since 2022.

Right now, millions of Americans are reluctant to move because they don’t want to lose their low fixed-rate mortgages. A portable mortgage would free up inventory, boost mobility, and make housing markets more efficient — all without driving up default risk.

Combined with the 50-year option, the housing system becomes far more adaptable to real-world circumstances. Young families can buy earlier. Retirees can downsize without penalty. Workers can move for jobs without financial strain.

Invest In The Trend, Don’t Fight It

As an investor, the key to long-term success is aligning yourself with policy and demographic trends, not fighting them.

If the government wants to make housing more affordable through longer mortgage terms and portability, then housing demand will increase. And when demand increases, prices follow.

For homebuyers, the 50-year mortgage can be a bridge to stability when used responsibly. For investors, even if these new mortgage products never materialize, their mere discussion signals enduring support for the real estate market.

Having optionality is a wonderful thing. A 50-year mortgage isn’t for everyone, and that’s fine. But for those who use it strategically, it can mean decades of housing security and greater flexibility to invest elsewhere.

Imagine if you could secure your family’s housing for half a century while still having the liquidity to build wealth in stocks, businesses, or education. That’s not a burden. That’s empowerment.

If you have any solutions to increasing housing affordability in America, I'd love to hear them!

Invest In American Real Estate Passively

Owning real estate directly isn’t for everyone. Between rising insurance premiums, clogged toilets, and random HOA assessments, being a landlord can wear you down fast. But if you still believe — as I do — that real estate is one of the most reliable ways to build long-term wealth, there’s an easier, more passive way to play the trend: Fundrise.

Fundrise lets you invest in diversified portfolios of residential and commercial real estate projects nationwide — without needing a huge down payment or taking on a lifetime of mortgage debt. You get exposure to real assets, managed by professionals, while you sit back and collect potential dividends and appreciation.

You don’t need to be a millionaire or accredited investor. You can start with just $10 and own a slice of America’s housing market. The platform handles the acquisitions, renovations, and tenant headaches for you.

If 50-year and portable mortgages become reality, the housing market could experience a powerful second wave of demand. More buyers means more liquidity and potentially higher property values. Fundrise investors can benefit from that same macro tailwind without ever signing a 600-month mortgage.

You can either be the one paying off a loan for 50 years or the one collecting rent and appreciation during those 50 years. Check out Fundrise here and start investing passively in America’s housing future.

About the Author

Sam Dogen founded Financial Samurai and kickstarted the modern-day FIRE movement in 2009. Every article is based on firsthand experience and deep financial analysis.

Sam has been a homeowner since 2003 and manages a diversified rental property portfolio that generates roughly $150,000 a year in semi-passive income. Through Financial Samurai, he shares practical insights on building wealth, achieving financial independence, and living life on your terms.

Pick up a copy of his USA TODAY national bestseller, Millionaire Milestones: Simple Steps to Seven Figures. He's distilled over 30 years of financial experience to help you build more wealth than 94% of the population—and break free sooner.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get his posts in your e-mail inbox as soon as they come out by signing up here.

What I’d like to see paired with the portable loan to help unlock the housing market is a raise in the capital gains limit exclusion for home sale. Currently it’s $250k for single and $500k for married couples filing jointly.

A the time this was passed in 1997, the median home price was $124k. It has not been readjusted for inflation in almost 30 years. I’d like to see this pushed to $500k for single and $1M for married filing jointly.

Couple those two and you will see inventory flood the market, especially in the starter home segment as homeowners can literally take their entire cap gains tax free and roll it into a larger home, with ideally some leftover to spare.

The best would be no capital gains taxes on home sales, period.

America would be the land not just of the rehab (which it already is), but of the nicest homes in the world – because the incentive would always be there to repair and resell.

This 50-year mortgage proposal is only workable if it’s strictly limited to first-time homebuyers. If investors get access to it, we’re going to see the same problems accelerate—more short-term rentals, more Airbnbs popping up in residential neighborhoods, and more pressure turning actual homes into businesses. We don’t need to fuel another investor land grab.

The wealth divide in this country is already widening, and extending mortgage terms without restrictions will only make it worse.

And honestly, I still don’t understand how people justify paying two to three times the price of any product through decades of financing—especially when the buyer takes on all the risk: depreciation, taxes, HOA fees, maintenance, and all the phantom ownership costs. On top of that, people forget about the major acquisition and sales costs baked into homeownership: escrow and title fees, lender fees, and—when you eventually sell—real estate commissions that can wipe out years of equity in one shot.

For many people, renting still makes the most financial sense: full flexibility, fewer surprise expenses, and the ability to invest the savings in index funds. Over the long run, that often leads to equal or better financial outcomes.

A 50-year mortgage isn’t going to be for everyone. Practically everything in personal finance is that way. Not every investment type, loan type, or asset class is optimal for every person out there. But what it does provide indeed is optionality.

Life today isn’t like it was decades ago. Gone are the days of working for one company your entire career. People change jobs a LOT, move often, change friendship circles, neighborhoods, states, etc. Thus, owning a home for 12–15 years is pretty common. So the point about the “Mortgage Utilization Rate” makes sense because most people won’t hold a loan for 50 years. The long-amortization makes sense to get in earlier without locking in huge payments. Of course people have to be responsible with this and any financial obligation. Optionality is a good thing when handled responsibly.

It’s interesting how ignorant some commenters are who are against a 50-year mortgage. It’s as if they haven’t studied mortgages or finances and have been renters for life who’ve missed out on the huge real estate bull run since 2011-2012.

The 50-year mortgage is just another financial tool, that if used properly, can help. But if used improperly and you don’t know what you’re signing, then maybe you’ll get hurt.

You don’t ban knives for cooking because you can get cut. You learn to use them properly.

The math does not work out for a 50 year loan. A 320k mortgage at 5.98% for 30 years results in a monthly payment of $1914. The same 320k at the same interest rate for 50 years is $1679/month.

But the interest rate on 50 year mortgage will be higher than a 30 year loan. Currently, the spread between a 15 year mortgage and a 30 year mortgage is about 70 basis points. Using the same spread between a 30 year and 50 year mortgage, we can estimate that a 50 year loan would have an interest rate of 6.7%, which results in a monthly payment of $1852 nearly wiping out almost all of the savings.

Larger savings could be realized with interest only loans. Or maybe some of those old option ARM loans from the mid 2000s could be brought back. While we are at it, let’s relax underwriting (aka no doc loans) and let’s bring back Lehman brothers to package all of these loans into CDOs. What could go wrong?

Spot on. The 50 year mortgage is basically the same thing as renting, with almost no equity in the home and all of the risks that come with home ownership

Folks will be bartering a meager monthly savings compared to a 30 year, and in turn will take on a predatory level of debt as more than 90% of the monthly payments are pure interest and will take about 20 years for the principle to be higher than the interest payments.

Take a look at the amortization on a 50 year mortgage. There just no way this is a good deal

I agree. Even the content of the post kind of contradicts the point. The cons list is way longer than the pros. And if ends up inflating prices as the graph indicates, then all the savings disappear. It’s good for banks….and maybe investors. But this post had a long lead up about getting families in homes earlier so they can have children, and I don’t think this moves the needle on that front given it’s not actually going to make anything more affordable in the long run.

The mortgage portability thing is definitely way more interesting….but that seems bad for banks, so that will have a lot more hurdles.

This to me is the main topic, well put Andy, not sure why it seems to be overlooked. There could also be some kind of mortgage insurance required for a 50 year. Now portability sounds interesting. This I believe is one of the main contributors to the shortage of supply. How about loan assumptions? Didn’t that used to be a thing? We are also at a crossroads with fair wages and affordability. We can’t make contractors build houses and if they must pay laborers $50/hr and pay $100 for a 2×4 then the house is no longer affordable and the contractor is no longer profitable. I have cut back eating out cause it’s silly expensive now but I get it, the workers need to make more. What did we think would happen when our government infused the economy with massive amounts of $$ during covid and mortgage rates went to 2-3%. I mean, a 30 year loan for 2.5%, that’s insane, why would anyone give that up outside of moving out of town or paying off the loan?? BTW; there is alot of affordable housing out there in most markets if you’re willing to commute to work. Many remote workers don’t have this problem. Resort towns have had this problem for many years. Yes, we all want to live on Newport Coast or next to lift 9 at Breckenridge but we all have to shop for what’s reasonable, and that does exist in most places.

Although 50 year mortgage rates should be priced with higher interest rates, it’s not necessarily the case. At any given moment, banks are trying to build their mortgage book and attract more deposits. So it is a possibility to get a 50 year mortgage rate that is equivalent to a 30 year Mortgage rate. You just have to be patient and shop around.

Let’s say it’s a raging bull market for the next 7 years. The dilemma is to pay 0.35% higher rate for a 50 year mortgage rate that you can afford the payment, or keep renting for 7 years. If home prices rise by 5% -8% a year for 7 years, you could get priced out forever.

Having options to make a calculated decision as a good thing. Being stuck with no options is not.

To be honest, I still don’t see any tangible benefit big enough to nab a 50 over a 30 yr mortgage.

6%, 30 yrs for a $500k loan is around $3,000/month.

6%, 50 yrs for the same loan is around $2,650/month

Which is around $350 less per month.

If you sell the home in 5 years, for the 30 yr, you’ve paid down around $35k in principle. For the 50 yr, it’s less than $9k. Then if you add back the $350/month that you paid for 5 years, it brings it up to $30k (9k + 21k).

Having options is a good thing, but the advantages of the 50 over the 30 is sparse. There’s a big difference between a 15 vs 30 mortgage. With significant pros and cons for each product. The 50 on the other hand seems like an tepid option that will have more adverse effects.

I think we have a seriously broken market if someone who can afford a house now will be “priced out forever” if they decide not to pull the trigger.

The 50 year mortgage feels like a different flavor of the 5% down mortgages of the early 2000s. Instead of fixing the source of the problem (housing shortage and affordability), we are addressing the symptom (the financing)

It’s funny how people say “instead of fixing housing shortages and affordability”. Yet it’s not something anyone can actually fix. One option is vast expansion of government subsidized housing but this only increases the cost of housing because taxpayers foot the bill and contractors that work on building them get paid double what they would if they were building non-tax subsidized properties. The subsidized housing units are very expensive to maintain and operate and taxpayers all end up paying for this in the name of “fixing the housing problem”. A 50 year mortgage might be a band-aid fix to some. But it does actually help with affordability to some extent. Nobody else has any better ideas so here we are.

The best way to buy houses is to pay cash with current rates. If you are unable to do it and buy your primary residence then 15 year fixed is the best way to go in my opinion. When rates were very low several years ago low I leveraged and bought several properties including rentals using 15-yr fixed but never paid more than 3,5% interest but getting 6-7% mortgage to buy rentals with today’s inflated prices of real estate is not a good idea.

This whole 50 year mortgage nonsense is very reminiscent of what was done with auto loans in offering folks 7 or 8 year loans at high rates like 8 or 10% in order to supposedly increase affordability. Yes it got folks to purchase $50k cars that they cant afford, and kept them stuck in debt, poor, and trapped.

The real winners here are the banks or investors perhaps, not your average american wanting housing.

You don’t think the winner could be a young couple who wants to start a family and was able to get their starter “dream home“? Let’s say the housing market ended up going up by another 4% a year for the next 10 years that they owned it, or appreciating from $500,000 to $750,000+. Their down payment grew from $100,000-$450,000 in that time.

Meanwhile, they had two children and was able to focus on raising them and investing in stocks with their excess cash flow. They didn’t sell the house and walk away with. About $400,000 in equity and buy a $1.3 million house with 20% down and $140,000 left over.

Meanwhile, if they had rented 10 years ago, maybe they didn’t start a family and they probably didn’t turn $100,000 to $450,000.

In economics, there is a lag between what happens in the short term in the long term. If you can take advantage of benefits in the short term, you could do very well.

Didn’t realize you’re a shill for the banks.

Not only a shill, but an investor too who worked in investment banking for 13 years. What do you do? Investing in banking stocks during the global financial crisis was one of the best moves.

But if you’re struggling with housing security in any way, learn how the financial system works better. I definitely recommend you study more about the products and the possibilities.

At the end of the day, getting angry at someone or some proposal is not gonna help you live a better life.

Apologies for the tone, which was admittedly uncalled for and probably a visceral reaction and the byproduct of hitting “send” before taking a beat. That said, if your premise is really that the proposed 50-year mortgage is great for banks, investors and current homeowners? Than I’d say you’re absolutely right, and if that’s the angle you’re suggesting the 50-year mortgage is good for, then you’re right on the money (pun intended). Now, you seem like a smart guy, and what you propose is an “option,” for home buyers, it’s just not a good one for new home owners, so say the vast majority of economists who have considered it. If you seek to be contrarian, that’s perfectly fine, it’s just that part of my criticism is due to the possibility that first-time home buyers may view your promotion of the 50-year mortgage WITHOUT fully vetting the downsides that you cite. I have read your columns for a few years now, and enjoy them, even if I don’t always agree with premise. Reasonable minds can differ right? I just worry that may see pronouncements on social media and take them as gospel, and believe it our not, I’d say you are not an expert with regard to ALL of the subjects that you post about (which is not intended as a criticism per se, but rather a caution that some folks have great difficulty distinguishing between fact and opinion). PS. I‘ve been a lawyer at a large law firm that represents very large financial institutions, and let me tell you, they love the idea of a 50-year mortgage for their balance sheets for any number of reasons (e.g., more interest, lower default rates, etc.). Given my occupation, I’ve been fortunate enough to have reached financial security decades ago, and as the owner of multiple homes, I’d likely benefit from the increased competition (and elevated prices) associated with more folks trying to buy homes via 50-year mortgages. I just think it could be an absolute disaster for my kids and other prospective first-time home owners who would face even higher home prices, and would pay almost all interest and very little principal during the first 10+ years of a 50-year mortgage. But as I note above, reasonably minds can differ.

“Reasonable minds can differ right?” Absolutely. But try to be respectful and not denigrate people. There’s no denigrating people nor is there anger in my article, as the goal is to learn and understand.

But no worries, as getting beat up by strangers online is par for the course when you write publicly. As a lawyer, I’m sure you get a lot of criticism as well.

“Given my occupation, I’ve been fortunate enough to have reached financial security decades ago, and as the owner of multiple homes”

So why are you worried about your children? They will simply inherit your homes or receive money from you. And the thing is, an enormous number of people in your age demographic who reads FS have done well over the past 20 years. How could you/we not with the markets performing the way they have.

Have more options instead of fewer, is a good thing. Just so long as you know what you’re getting yourself into.

Two things. First, I guess you didn’t see or refuse to acknowledge my apology. So be it. Second, I worry about my kids because, god willing, they won’t be inheriting anything anytime soon, and I’d like them to be able to stand on their own and prosper, as they are just starting out, well before it’s time to inherit anything. You’ve doon well, hooray for you, but not everyone has or will be quite as fortune. I understand that some of what helped me along was good luck, and others (say those who spent a load of money on a college education focused on coding — a semi-sure thing 5+ years ago) are not so lucky.,

I said “no worries.”

What is your philosophy of not helping your adult children since you said you’ve done very well financially? What are your plans for the money then?

It is always an interesting case to me when parents pass away and leave their 50 to 60-year-old children money. By then, I’m not sure it’s very helpful compared to when their kids are in their 20s and 30s trying to establish themselves.

You really need to address the fundamental issue, which is a lack of supply and not the absence of demand. You also need to acknowledge that any plan to lower monthly payments by a significant amount will drive prices up faster than they otherwise would.

This is very simple economics, and we have decades of history behind it. Real estate booms when interest rates drop. Why? Because lower rates means lower monthly payments for the same loan balance. That doesn’t simply result in people saving money on their mortgages; it induces many people to take out larger loans than they otherwise would/could have.

It’s not a serious policy if the goal is to help people buy their first homes.

Ok, I’ll get on it! I’ll look into seeing if I can build a couple of ADUs.

When I applied in 2000, they said it would take nine months to get perhaps approval. And cost a lot more so I stopped.

What are some solutions you have in mind?

Well, snark aside, you’re on to something.

The best way to improve access to housing without tanking affordability isn’t lowering rates, extending loan terms, or giving people “cash assistance”; it’s increasing the supply of housing. And one of the top impediments to increased housing is the needlessly long and expensive permitting process.

Rather than focusing on gimmicks that don’t solve (and actually worsen) the problem, the focus should be on how we can more effectively build more housing.

Sure, that makes sense. But how do you plan to increase supply? Perhaps with building incentives or zoning changes? Very difficult to force someone to build without proper incentives.

There are plenty of houses. Homes were built for multiple people ie 3 or 4 bedrooms. They now have an average of 1 person living of them, in the past it was 3 or more. So our shift into being independent and alone has reduced housing dramatically.

Good point. Many more single women buying homes too.

And what if the outcome is that America enters a Japan-like scenario? Japan property prices are today, still lower than they were in 1990. Some 35 years ago! So what if the young couple wants to start a family and bought their starter “dream home”. Let’s say the housing market ended up doing as Japan did between 1990 and 2010 and fell 50%. Their down-payment has been wiped out.

Meanwhile, they had two children and were able to focus on raising them. They invested their excess cash flow, but unfortunately the US market had a lost decade similar to 2000-2010 and they made no money.

So 10 years later, they have lost their entire deposit made for the property and have made no return on equities.

In economics, there is a lag between what happens in the short term and the long term. If you always assume that markets are always facing a bull-scenario over the next 10 years, you could do very poorly.

And housing is getting to the point of ridiculous. If things continue for the next 20 years as per the last 20 years, no “normal” young couple will ever have any chance of getting on the property ladder. Either you will need to be a CEO, have wealthy parents, or as I suggested earlier have 2 wives. We have exhausted all the financial levers – we have low interest rates, we have near zero deposit requirements, we have super-long mortgage terms. Unless we move to the second wife scenario, the crunch-point is coming…………

And to add, I just saw an article that says 53% of homes in the US have fallen in value in the past year. So this assumption that houses ALWAYS rise and are CERTAIN to rise 4% (on average) every year for the coming 10 is a dangerous one.

Hope nobody is assuming homes just go up every year forever. Anybody who lived through the 2008 GFC knows this.

And with huge appreciation from 2020 until beginning of 2022, it’s healthy for homes to correct.

Are you an owner or a renter?

So, 50 or so years ago, a labourer could go to work, while the wife looked after the children, and that labourer could afford a house. Later things got harder, and you needed a professional salary to achieve that. Later, it got harder again, so the wife had to go to work as well. Then, it got harder again, so banks offered loans with super-low deposits (down to 5% rather than 20%). Still, things got even harder, so the latest “innovation” is a 50-year mortgage? What will be next? Maybe the law will change so a man can have 2 wives? Then he can send them both to work to help pay for the house, as 1 working wife will no longer be enough? Or maybe we need 150 year mortgages and leave the “problem” to the next generation. The reality is that what was achievable easily enough 50 years ago, is no longer possible. And a 50-year mortgage is just another stupid addition, that won’t do anything to fix the fundamental issues of affordability. That said, having ranted here, I don’t have any real solution to offer either. But I do know a 50-year mortgage is far far away from the magic-bullet.

Couldn’t agree more. This whole 50 year mortgage nonsense is nothing but an attempt to place a band aid over a heart attack.

Sam should have also highlighted to downsides and cons to the 50 year mortgage to provide a more balanced perspective

There are downsides in the article added.

Curious how long it took you to pay down your mortgage, as I want more people to think about their Mortgage Utilization Rate.

Thanks

Sam offered many downsides to the 50-year mortgage. Read the entire article and you’ll see:-)

With everything, there are trade-offs. While it’s not optimal, the 50-year mortgage option would help younger buyers and could help us with our decreasing population. That’s the bigger issue. With a declining population, we’re going to run into some big challenges.

Thank you, Sam, for another amazing post. I appreciate the positivity of the article and I agree with you. I think we can both agree there a lot of potential drawbacks, but there are certainly many good things that could come from a 50-year mortgage option.

Happy Holidays, to all!

Every analysis promoting the benefits of the 50 year mortgage I’ve seen seems to ignore the single biggest flaw: that it will almost certainly negate the very problem in seeks to address…affordability.

Lower monthly mortgage payments may (in theory) allow certain buyers into a market they previously couldn’t afford, they also allow other buyers to be able to take on bigger loans…bidding up housing prices in the process.

I can’t see any plausible scenario where monthly mortgage payments go down by a meaningful amount that won’t produce a swift increase in home prices. Whether that fully negates the benefit of the “lower” monthly payment for some buyers, I don’t know.

This sounds like yet another well-intentioned policy whose impact will be positive primarily for those who need it the least.

While I will personally benefit from this policy, I don’t think this is sound public policy if the goal is actually helping younger, less affluent people get into homes.

Exactly. It does not do ANYTHING for affordability. It is simple economics. You wonder what delusions the fools who promote these things are under – more than likely they are home owners, and this is another way to boost their wealth! Cause it sure as hell does not do anything to address affordability. Similar to the other delusion – let’s give first home buyers a grant, let’s say $50k – some governments do that. So what happens? All home prices jump by $50k. Again, simple economics. And then there is the famous bank-of-mum and Dad – great for those with wealthy parents I guess, but for those without, it pushes prices even further out of their reach. Until something is done to address affordability, nothing will ever change – and that means producing enough supply at an affordable cost. Once there is enough supply, there is no reason for prices to rise, and given time inflation will help the average person’s affordability catch up. Japan has that scenario, increasing supply by virtue of a declining population and apparently over a million empty houses that can be purchased for next to nothing…………

It’s kind of weird how so many commenters seem against helping younger homeowners by homes. I think these new new mortgages are great and I think maybe people think that everybody will qualify but not everybody will. Like you write in your post, a typical person isn’t going to take 50 years to pay off the mortgage. They will probably upgrade our cell or move within 12 years. The difference in interest expense for a 30 or six mortgage and a 50 if it’s mortgage after 12 years, isn’t that big so doesn’t really matter.

Stop having a cow people.

Weirder still is how many don’t understand the implication of lowering borrowing costs on the price of housing, and therefore on affordability.

So, the maturity length of a residential mortgage fades in importance at 50 years (maybe even at 30 years if they are mostly paid off early). Like how the required APR reporting of a payday loan can be around 380% and is not useful information. Why even have an end date? Like going to the car dealer and telling the salesperson “sell me this car, here is the monthly payment I can afford.” The “Great Financialization” is nearly complete. Like Joni Mitchell sang: they took all the trees and put them in a tree museum and charged the people a dollar just to see ’em.

I love most of your content , but I just don’t agree. It will help for a while until home prices adjust higher to point of squeezing the every nickel out of the middle class they can. Same thing happened with auto prices.

How do we squeeze the middle class if we are enabling more middle class renters to own homes and benefit from long-term property price appreciation?

If we leave things the way they are, housing will simply get even more on unaffordable.

Because we don’t have a demand problem; we have a supply problem. Brining more buyers into a market that already has limited supply will drive prices up. It is fairly obvious that cheaper mortgage payments allow for larger loan balances. Larger loan balances translates to higher buyer offers…which naturally leads to higher home prices.

Unless the plan is to limit the 50 year mortgage to only a certain demographic (young, 1st time buyers, income under a certain amount, up to a certain loan amount, etc.), which I have not seen anyone suggest, this is likely an option that will utilized by many people (who don’t need it) who are looking either to buy more expensive homes or to convert a portion of their current mortgage payment into a new source of funds to DCA into equities, crypto or other assets. Sounds great for those people, but that isn’t the target of this policy if the idea is helping renters get into their first home.

We have a real housing crisis in this country and to me this is not a serious solution. In one scenario, which you acknowledge, it may help people now, but forces up housing prices. Buyers five years from now are screwed like buyers are today. But personally I think it’s vaporware. The conversation is pointless unless we know interest rates and rates on a 50 year mortgage are going to be high. This will simultaneously cut into the monthly payment difference and make the interest side worse. Some people might use it but hard to imagine it being financially optimal for very many. Don’t mind a new tool…but this is it? This is the plan to deal with housing affordability?

“The conversation is pointless unless we know interest rates and rates on a 50 year mortgage are going to be high.”

Not necessarily. Regardless of where the mortgage interest rate is, amortizing across 50 years instead of 30 years would lower the payment.

That OPTION could mean the difference in getting into a desired house, and riding a 7-year bull run in real estate, or sitting out and missing the run altogether.

Certainly, there’s some point where rates are different enough for 50 to cost more monthly than 30? I get that’s unlikely, but the point stands that term length just makes the delta worse vis avis renting and investing. I know you’re very hardcore on real estate, but the reality is we’re already in a situation where math favors renting in many metros. Driving up interest *and* overall prices just seems to make it worse.

It’s fine to give options. I just have trouble seeing how it’s a good longterm financial play for very many people. Wish they’d focus on building housing.

It is an interesting concept. Couple thoughts:

The amortization schedule of a 30-year mortgage makes me nauseous. The 50-year amortization schedule must be grotesque!

But don’t spend 30 to 50 years to pay off the mortgage then. The vast majority of people do not.

What happened to being “mortgage free” going into retirement ? Sounds like a good deal for the banks.

I am 72 years old and five years into a 30 year fixed mortgage. Safe to say I won’t be around to pay it off. If there were a 50 year mortgage, I might have done that instead.

I did a cash out refi at low rates to help out family members who couldn’t afford to buy or even rent a home. Now they have one and are much more secure.

I also refinanced periodically since 1993 to get lower rates, and so I could pay off my very large amount of student loans at 8% (Reagan years interest rate on student loans) and subsume into my lower interest, deductible mortgage.

I certainly don’t recommend doing this; far better to pay off your mortgage before retirement. But it was worth it in our case. Different types of mortgages are just a tool; there is no one size fits all.

BTW, if all goes well, one can also increase monthly payments on a mortgage, thereby shortening the payback time considerably.

Mortgage portability? I think that will be a nonstarter. You had something akin to that back in the day with mortgage transfer without recourse. No longer an option with most lenders. Given inflation expectations, I see the interest rate on a 50 year mortgage being higher than a 30 year. How much so? Unsure but it will matter.

Should 50 year mortgages be allowed? Absolutely. The standard is another question.

The real issue is zoning. You need to change that. I also heard about a land value tax instead of a property tax. That may need to be considered as well. Finally, tax law should change so SALT reflects only property and sales taxes. Another way to encourage home ownership and ensure responsible government spending.

I do like your ARM idea. Didn’t use them because I grew up in the 70s/80s so remember stagflation but you make a strong case.

Enjoy reading your articles. Thought provoking as always.

Something else to consider is inflation. As others have mentioned in the comments, a 50-year mortgage is just another tool in your toolbox. A 50-year mortgage will have slightly lower payments than a shorter term loan in the beginning, but it will get even easier to make those payments the longer you hold it due to inflation, dollar debasement, and increasing wages over time! In 40 years time, those monthly payments will feel miniscule in comparison to how they’ll feel at year 1.

I’m personally most excited about the idea of portable mortgages. My kids are now in college and I’d like to move, but I just can’t get myself to abandon a 30-year fixed rate VA mortgage at 2.25%! If I could take my loan with me, I’d move in a heartbeat. Great article Sam!

Homeowners/investors, yes.

New buyers, no way.

This will only raise the overall price of housing.

Better options-

1.) Salary will need to increase over time

2.) Rates will need to lower

3.) Home price will need drop.

Let this take the years needed.

Most likely a combination of all (3) will happen over the next 5 years.

I fail to see how a 50 year mortgage will do anything but increase housing prices. When one applies for a loan now, the bank will generally preapprove you for a maximum amount. Now if the loan term is changed to 50 years, that maximum number will increase accordingly. Don’t you think the market will very quickly adjust accordingly and today’s 500k house will simply cost 550K? Yet this also increases the amount required for a down payment. What would be next – implementing Harris’ plan to give first time buyers down payment assistance?

I would love your thoughts on the following article which was just published today: boriquagato.substack.com/p/talking-sense-on-housing-affordability

I need to do the math. If I hold my 50 mortgage for a median 12 years, how much equity have I built through my payments? Is it much different from renting?

And “yes” some equity is more than none..but I’m also assuming the risk for home price declines (and stand to benefit from home increases).

I feel like many of the pundits are inherently assuming a 50 year mortgage will be mis-used. (Like the advice to base your retirement income needs on your *salary* not your *spending*. Geez!). It all comes off as oversimplified and paternalistic.

A 50 year term mortgage is a tool. Not a boogeyman or a silver bullet.

And..am I the only one who thinks a 30 year term is already outrageous? The reactions of “50 year term is TOO long” seems specious when the implication is “30 year term is totally fine”. Are we all victims of the mortgage industry marketing that three decades is a magical/the-only-correct term for a mortgage?

Yes, we are victims of the Mortgage industry and lender’s marketing messages.

There has been a lot of fear mongering about adjustable rate mortgages, which I prefer over a 30 year fixed mortgage rate.

It makes no sense to pay a higher mortgage interest rate and fix it for 30 years when the average homeownership 10 year was only about 7 to 8 years before the global financial crisis and 12 years today. Fahr rather pay less in mortgage interest and better match my fixed interest duration with my homeownership duration.

My hope for people reading this post is that they see more clearly what mortgages are, a tool to live a potential better lifestyle. You can buy a home at the wrong time and take on too much debt. You can also buy a home at the right time and take an optimal amount of debt which would enable you to live better and build more welcome in the future.

There are never any guarantees with risk assets. But the more you understand how to use these financial tools, the better.

At least the government was trying something to combat lack of home ownership! Other countries do longer/lifetime mortgages…Japan, etc.

Yes! Propose, discuss, optimize, implement, optimize some more.

Doing nothing and complaining, while our generation gets passed over is not helpful.

Umm no. A 50 year mortgage is only pleasant to the rich, businesses/corporations and governments. It is NOT reasonable in this gig economy with unstable jobs and working conditions, that someone should indebt themselves to a house for 2/3 of their LIFE! That is the most ridiculous thing ever said.

Your whole focus here seems to be wealth-building. But as a result of that you destroy society – which is already happening in the USA. Life is meant to hold enjoyment, not be enslaved to corporations, which seems to have your vote. Honestly, shame on this advice. Houses should be affordable, wealth should be divided equally, pay people a living wage and fix healthcare. This is nuts.

Definitely read the first half of the post about family formation, the value of optionality, and my new concept of the Mortgage Utilization Rate. Housing is a fundamental need and right in America. And starting a family is something many people would like to do, but have a hard time going forward due to the cost of housing and other things.

We’re not building wealth for wealth’s sake. We’re building wealth to try and live a better life. Never forget this.

If you have any solutions to housing affordability, please share. Because if you offer no solutions, what’s the point of complaining? Nothing changes.

Love this response!

Arnold Schwarzenegger once said, “Don’t complain about a situation unless you’re prepared to do something to make it better. If you see a problem and you don’t come to the table with a potential solution, I don’t want to hear your whining. It couldn’t be that bad if it hasn’t motivated you to try to fix it.”

There are complainers who go nowhere, and there are doers. Having real discussions and focusing on the why behind housing issues is what actually moves things forward.

Not only is Ab Me complaining, he doesn’t even seem able to comprehend what he reads — probably just skims the headlines.

Portable mortgages and 50-year mortgages are legitimate tools to improve affordability, just like creating different loan products tailored to different types of buyers. In business, this is called segmentation.

People like Ab Me are one of the reasons I’m so bullish about my own future. The bar is so low that if you simply try a little harder, you’ll blow right past the competition.

Wrong KC. Big assumptions for knowing nothing about me. I personally see the wealth gap grow larger every day and the demands on the respective age groups have drastically grown. MY assumption is you’re perched on your millions with multiple investments, patting yourself on the back for all your “hard work” and donating occasionally (money only – never time!) to charities — solely to benefit yourself and living your own accusation of not solving any societal problems.

Arnold is hardly a cite-able source of goodness, philanthropy and charity. Odd choice of comment. But while you judge behind a keyboard I absolutely and putting in the time and the effort to build a better world for others. Other HUMANS that is. Not corporations. We can see which side of the fence you’re on. Wages are at an all time low and college degrees are at astronomical costs. We don’t need more courses in wealth-building. We need more companies and government intervention on ensuring that there is liberty and justice for all. Don’t break your arm patting yourself on the back. Also don’t falsely accuse others while you’re doing it.

Yet, you continue to complain and offer nothing. If you are still a renter, you belong to blame by yourself and missing out on the incredible Housing bloom over the past 50 years.

Just because other people want to build wealth through real estate and own a home and start a family, doesn’t mean they are wrong.

By reading your complaints, but I do know about you is that you seem quite miserable I’m jealous of progress. Having such a negative disposition is not good for relationship building either.

The ignorance is strong with the KC. Again you are wrong on all counts and not sure how it is considered complaining when I am advocating for the current home-buying generations to be able to afford a home – raise a family – afford a vacation – all on the salaries that have been stagnant for the last 40 years. Oh and without sacrificing their future indebtedness A 50 year mortgage just underlines the greed and acceptance of the ridiculous situation the US finds itself in with home affordability. It’s not complaining KC who cares only about themselves, it’s ensuring that equal opportunity exists for all as per the values the country was established upon. And I’m advocating for that for all citizens – just not agreeing with selfish individuals who don’t want to pay taxes and think that allowing citizens to suffer at the expense of KC’s “wealth building” is acceptable. Grow up and develop some humanity.

Miserable? The furthest thing from it. Why? Because I am applying my efforts to a bigger cause that just being greed-driven and myopic in my day to day. Good luck in your future – hopefully you learn something about being a better person.

Yes and no. The Arnold quote is the mantra of those in power. The is nothing you can do to change systemic problems in America like corporate wages and healthcare and mortgage industry imbalances. It is a mirage to think that since we live in a “democracy” we can do something significant to national policy. The only thing we can do is vote for those who seem to have the message we want, and hope that they get elected and react to our whining (and maybe letters we send them). And if the person we don’t vote for wins we really have no voice or chance to change anything. Sorry but those are the facts.

Disagree with your comment of building wealth to try to live a better life. The amount of consumerism, waste and ridiculous “made up” needs is astronomical in the USA. More than half of citizens shouldn’t have to choose between working their entire lives, or death. Not a “better life” in my book. The lest 6 years have proven that America is greedy and not socially conscious. All that is needed for a better life, is: food, shelter, clothing, community, safety and beauty/education. Let’s be clear that for a growing number of the working poor – many of those requirements are quickly becoming out of reach. How is that better?

Sounds good. Did you decide to relinquish work and wealth building? It would be great to hear from more who have. Whether it’s FIRE, those who work at a non profit, or who’ve decided to join the monastery. Share some of your background so we know where you are coming from. Give me your interest in Wealth, what draws you to a personal finance site?

Do you have any suggestions or solutions on how to improve housing affordability for your children?

Thanks

I don’t begrudge people who have made and earned wealth. I have real concern when the affluent and political leaders look to consolidate wealth amongst themselves and permit businesses to destroy the lives and health of citizens at the expense of said few. That’s not what this country is supposed to be about.

Ok, but what do you do to earn? And do you have any solutions to making housing more affordable?

Not sure how a 50-year mortgage consolidates wealth and permit businesses to destroy lives. Can you elaborate? Thanks

What do you think of these ideas from Graham Steven:

If policymakers actually want to make housing more affordable, there are far simpler and smarter ways to do it:

Raise the capital gains exclusion on home sales to $1 million for married couples, adjusted annually for inflation. That would nudge long-term owners to finally sell and free up inventory.

Let homeowners transfer their existing low-rate mortgage when they trade up to a new property. That would help unlock frozen supply in the starter-home market.

Increase the mortgage interest deduction limit from $750,000 to $1.5 million starting in 2026 to reflect higher home prices.

Those moves would do more for affordability than any 50-year gimmick ever could. Because at the end of the day, stretching debt across generations doesn’t make homes cheaper. It just makes the illusion last longer.

All sounds good to me.

Dude/Maam, you need a mind-shift change. If you play the victim, or the judger-in chief, you will be the victim. There is NOTHING good in envying/judging others’ financial values (the entity responsible for that is out there..it’s just not you), and the only way for the working poor to advance is to figure out how to make and create more value. Don’t turn America into an envy-laden, bunch of indentured servants who are wards of the state (like the average European)! That is a life in hell. Work to be a sovereign man. Change your mindset and get after it! It does take a lot of work…..

google says that only 8% actually take the mortgage interest deduction, this is because of the high standard deduction. My guess is that higher housing prices are the result of the devalued dollar.

Sam,

Definitely need actions to get housing affordable and attainable. At some interest rates this may allow people to get into a house, but at higher rates doesn’t the term kill any benefit of extending the loan? Also not covered here is the down payment/PMI/impact on rate and affordability. If you don’t have the money for the down payment, you have additional long-term financial burden. If you do have the money you likely have the cash flow after required expenses to get a traditional mortgage. So net real benefit for 50 year is questionable to me, even if folks are living longer. If 50 year mortgages got owning to be on par with renting, maybe there is a net benefit for housing security?

I love the idea of a universal portable mortgage and (outside of interests of the financial industry), never understood why this wasn’t the de facto standard already. I will say in making things affordable for first-time homebuyers, this seems only mildly relevant. This favors incumbents who have mortgages with low rates. This may free up supply in the housing market, but those folks moving their mortgage elsewhere will also be competing for their new property to move the mortgage to. So net benefit to new entrants? More selection but more competition?

No issues with attempted improvements in making housing affordable but just trying to think through net effects and if these changes truly make things better for the intended households.

Thanks,

Brett