I realized something important for all of you who have automatic mortgage payments and also like to automatically pay down extra principal each month. It is don't forget to adjust your mortgage autopay amount down when rates increase.

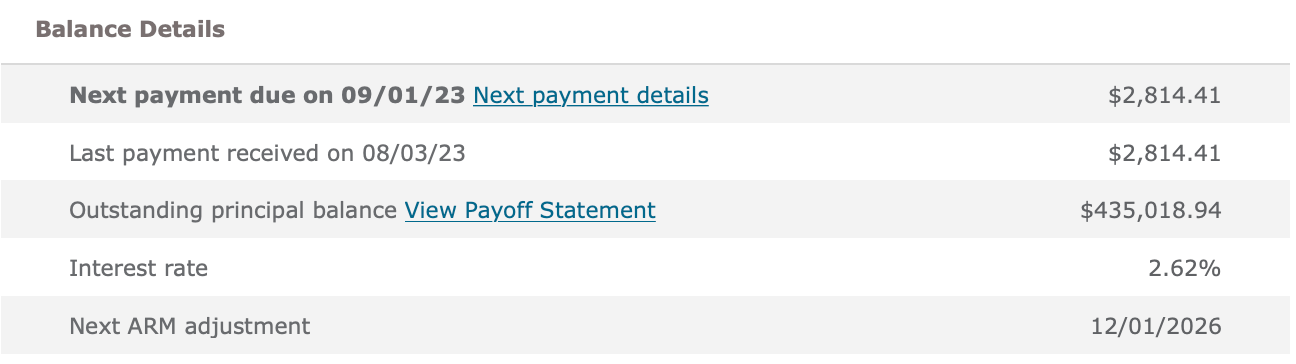

When I refinanced a primary residence loan in 2019, I decided to get a 7/1 ARM at 2.625% with no fees. I had gotten a 5/1 ARM when I purchased the house in 2014 for 2.875% and I wanted to refinance before the rate reset.

Given I have an ARM, I always like to pay extra principal with each mortgage payment. So instead of making the regular $2,814.14 mortgage payment, I decided to pay $4,500 automatically each month.

$4,500 is a nice even number which pays $1,685.59 extra toward principal. This amount is on top of the $1,847 (goes up every month) that is already going to principal from the $2,814.14 mortgage payment. Not bad since the mortgage rate is so low.

Not only do I like taking out cheap debt to live a better lifestyle, I also like the feeling of paying down debt. Automatically paying down extra principal each month ensures I am making financial progress, even if I didn't do anything else.

Over time, the extra forced savings from paying down more principal adds up! And when you're finally done paying off your mortgage, you own a nice asset that can be rented out for cash flow.

Why Adjusting Your Automatic Mortgage Payment Is Important

Reviewing my mortgage payment history since 2019, I have consistently paid $4,500 since the beginning.

Most people just pay the mortgage amount each month, but not me. And maybe not those of you who like to accelerate your debt repayment as well.

However, since 2019, mortgage rates have surged higher thanks to the pandemic, government stimulus, supply chain issues, and the strong economy. Since 2021, I've also written posts such as:

- Paying Off Your Mortgage Is A Bad Move When The Yield Curve Is Inverted

- Negative Real Mortgage Rates Means Don't Pay Down Your Mortgage

In other words, even though I was recommending to not pay down extra toward a mortgage in a high mortgage rate, high interest rate, high inflation, and inverted yield curve environment, I was doing just that!

As someone who tries to act congruently with my beliefs, I was surprised to learn I had missed this financial move. As soon as I realized my inconsistency, I called the bank and had them lower my payment from $4,500 down to $2,814.14.

Paying down extra principal when the yield curve is inverted is suboptimal because you reduce liquidity in the face of a potential recession. If bad times return, you want as much cash flow and liquidity as possible to survive.

Paying down extra principal is also suboptimal when Treasury bond yields and inflation are high. You could earn a greater return risk-free and inflation is already paying down debt for you.

Why I Missed Lowering My Mortgage Payment

With over 40 financial accounts to manage, it's easy to miss things. I set up automatic payments for everything to eliminate missing payments. But the downside is that I sometimes fail to adjust my payments when conditions change.

The more complicated your net worth, the more you will miss things. There might be some big winner stock you've been holding for years that's now in the gutter. It's easy to lose track.

This is why tracking your net worth diligently using Empower or another free wealth management tool is important. Having at least a quarterly, if not monthly financial checkup, is important.

Benefits Of Autopay And Paying Down Extra Debt

Paying an extra $1,685.59 toward principal for 48 months ($80,908.32) isn't the end of the world. I now have $80,908.32 less mortgage debt for this one property. I've accelerated the time to completely pay off the mortgage by several years.

However, from March 2022 until August 2023, I could have earned a guaranteed 4% – 5.5% return in Treasuries. This return compares favorably to the 2.625% return I made paying off the debt.

There is also another benefit to paying off a negative real estate rate mortgage, and that is saving money from a potential bear market. The extra mortgage principal payments I made in 2022 saved me from a ~20% loss plus the 2.625% in mortgage interest expense.

If I had never remembered to adjust my mortgage autopay, things would still be fine. I would simply have a lower principal balance in 2026, when my ARM resets.

I know only about 11% of mortgage holders have an ARM. However, if you get an ARM to save money, you might be more inclined to pay off your mortgage quicker. With a 30-year fixed mortgage, there is no sense of urgency to pay extra toward principal. So you tend not to.

When To Resume Paying Down Extra Principal

It's optimal to stop paying down extra principal automatically each month when rates are high and the yield curve is inverted. Therefore, the logical conclusion is to resume paying down extra principal when rates are low and the yield curve is upward sloping.

Specifically, I would resume paying down extra principal automatically when Treasury bond yields are equal to or less than your mortgage rate. The lower the 10-year Treasury bond yield is below your mortgage rate, the more you want to pay down extra principal.

Another time to start paying down extra principal automatically is when your cash flow and savings amount is strong, and you don't know where to invest the extra cash.

When in doubt, pay down debt.

We Will Earn, Save, And Invest More If We Want To

One final takeaway from this post is that most of us will rationally take action to improve our finances if we need to. Therefore, I wouldn't worry too much about being permanently stuck financially.

I found this mortgage payment mismatch because I was motivated to find more ways to improve cash flow. We are in the process of buying another house. In addition, there is the potential for another recession.

As a result, I reviewed all our expenditures and realized this was the one expenditure that could free up a significant amount of cash flow ($20,227/year). I've also thought about going back to work to boost income and reduce healthcare expenses.

If I didn't feel the need to boost our finances, I probably wouldn't have connected the dots about this automatic mortgage overpayment. But I would have if I found myself in a cash crunch.

If we need more money, we'll find a way to save more, slash costs, and/or earn more. This logical behavior is a win for us all.

Reader Questions And Suggestions

Do you pay extra principal through your automatic mortgage payments? If so, how much more do you decide to pay? Have you remembered to lower your extra principal payments once risk-free rates surpassed your mortgage interest rate? Are you trying to improve cash flow due to another potential recession?

If you're shopping around for a mortgage, check out Credible, a mortgage market place where you can find personalized prequalified rates. Credible has a handful of lenders on its platform competing for your business.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

Join 60,000+ others and sign up for the free Financial Samurai newsletter and posts via e-mail. Financial Samurai started in 2009 and is one of the largest independently-owned personal finance sites today.

I am really struggling on a decision here so hoping for some feedback! Currently have one mortgage on a house in Atlanta at 5.5% 10/1 ARM. Currently its rented but one day plan to live there (probably not a forever home). Pulling $3,500 in monthly rent and mortgage payment is $2,997.93 with $525K left (20% down at close). Property taxes went up substantially this year as well ($4K > $9K). No other debt on the books and a $1M + portfolio. Should I be paying off more principal monthly or since rent is covering the mortgage let it ride and keep DCA into taxable accounts + real estate crowdfunding (rental properties are not for me) and take advantage of the high interest rates with MFs and TBs? According to your rule, I should be putting around 45%-55% of avail cash toward paying down principal. Would love any thoughts you might have?

– Will

I pay $19.27 extra to bring my payment up to an even $2850. I doubt I’ll ever pay a large amount of extra on this place.

Sam, I have a large parent student loan balance ~ $200k. I have a personal stock account with enough Apple shares to satisfy the $200k student loan balance in full. For this particular stock account my total balance [Apple + other securities] is about $350k. I’m 60yrs old and don’t want to sell my Apple shares. I think Apple will continue to grow and provide a good cushion heading into my retirement. What are your thoughts if I want to take a margin loan to pay off the student loans? Wouldn’t this allow my Apple shares to continue growth without selling? I do understand there is an interest rate attached to the margin loan and the details are not completely clear in my mind. THANX!!

Instead of paying down extra principal each month, it would be better to allocate the extra payments into T-bills which are likely generating interest at a rate of 2-3% higher than most people’s mortgage rates. Once the spread on the T-bill shrinks you can then let the T-bills mature and use that money (which has been gaining compound interest) to pay down the mortgage via a Recast. By doing so, you have effectively put more money into paying off your mortgage than you would have if you just made the extra monthly payment plus you now have increased your monthly cash flow for the life of the mortgage because you Recast. It is a win-win situation.

Sam: I’d suggest instead of paying down your mortgage, put away the $4500/month in cash (which yields ~5% now). This gives you basically a ‘free’ call options: when your current mortgage is due in 2026, you can either use the accumulated cash to pay off (part of) your mortgage, or in the meantime if stock market tank you can buy using those cash. Until 2026, your cash will compound at 5%, which beats your 2.65% mortgage rates.

Hi Eric, please read through to the end of the post. Thanks!

I’m close to paying off my mortgage thanks to extra principal payments. I tacked on an extra $500 initially and then increased it to $1000 and then ad additional $500 every time I had significant raises or bonuses. It’s really made a difference over time. And I can’t wait to pay it all off soon.

First time commenter, but I have been lurking for years. I really enjoy your posts!

In 2021 I bought two investment properties, a condo and a duplex, on 5 year fixed rates of 4.47% and 4.5%, respectively, through my credit union.

But I’m a little worried about the interest rate reset on them for 2026, so I have decided to use some of their positive cash flow to pay down their mortgages faster because the net risk-free interest that I can earn is not much greater than debt pay down, and using the tenant’s money to pay down the mortgage more quickly seems like a more prudent and fair strategy that keeps the money in the respective properties which will stabilize the rents for when the rates reset.

Nice!

I have a slightly different plan. Even though it wont be financially optimal, I plan on increasing my payment to force myself to save more and to also get used to paying a higher amount in the event we upgrade to a bigger house.

Sure, that works and is good expense accustomization practice.

We bought our house in last 2019 and closed with a 10 year ARM at 2.65%. About a year or so later we refinanced into a 30 fixed at the same rate, my plan is to never pay off a single cent of principal sooner than I have to!

Smart move! Although, I don’t suggest calculating the entire amount of interest you will end up paying after 30 years.

If you see the number, you might get motivated to pay down extra principal! ;)

i’m sure it’s a lot, but I can make more than 2.65% with just cash in my money market, or I bonds, or sitting in a total stock market ETF over the remainder of my mortgage. mortgage rates may never get low enough for me to start paying off more principal.

True. You can lock in for 30 years a 4%+ treasury bond right now.

I did exactly the opposite and lowered the payment. Our cash makes from 4.75% in MM to 5.45% in T-bills. My mortgage is 2.25%. I used to pay $2000 monthly including $600 of extra principal, but now lowered the payment to $1500 since I see no point of wasting money on principal.

Sounds like you did the same?

You are right. I haven’t read the entire post.

We don’t make pay extra. Our mortgage rate is low so I don’t feel the need to.

Also, we plan to move in 6 years. I don’t think it makes any difference in our situation.

Yes, I pay enough extra on my mortgage to equal an additional principal payment. And, even though my interest rate is 2.65, I like saving the interest on those extra payments. I also have automatic T-bill investments.

Good stuff also having auto T-bill investments! A good solution I didn’t think of.

Payment is $1515 on a 2.45%. We sent $1800 as it’s a nice round number and minimal impact on cash flow. The concepts and criteria you present are excellent, but I suspect few would take the change in overpayment and actually put it in T-Bills.

Advancing debt payoff automatically is a good motivator.

Yeah, the automatic extra principal payment is like a nice security blanket. Even if you do nothing to advance your finances one month, you are guaranteed to do so with the autopay.

Even if you don’t buy treasury bonds with the excess, cash flow, online brokerage accounts like Fidelity automatically keep your cash in a money market account like SPAXX that pays 4.85% currently.

Just have to be aware to optimize! And I was not aware until a need arose.

Great article, thank u. I took a similar approach but with a 10y I/O cuz I wanted to short interest rates and I’m high tax bracket. The positive carry from having that locked up low cost debt has been great. I do use 1/2 the carry to reduce the balance – and the maturities of the underlying are laddered for obvious reasons.

I thing I keep seeing from u is the urge to go back to work. I know what u wrote, (1) but is it the hours of the day, (2) some unfinished business u need to accomplish, (3) interaction, (4) money – wages, insurance, and other benefits from working or (5) other.

I’m at the end, late 40s and financially secure, but u have me second guessing being able to ride off in sunset! Albeit I’ll do something PT with no stress and health insurance (7a-12p – one can wish)

I’ve been free for 11 years to do everything that I’ve wanted to do. With my youngest going to school full time, it’s time to get involved in society again.

What do you do for a living? I’d take a sabbatical first before you engineer your layoff. Don’t just quit and leave money on the table!

Never would leave $$ on table. Always find a way to be laid off with severance and vesting.

I think a better financial move for those that want to pay down extra principal on their mortgage each month is to instead place that money into T-bills which is likely 2-3 percentage points higher than your mortgage rate currently. Do that until the T bill rate decreases and the spread shrinks. When it does, then use that accumulated lump sum to recast the mortgage. The result is you increase cash flow for the life of the mortgage and due to higher t-bill interest rate and compounding interest ultimately pay down more principal than you would have if you stuck with your extra monthly principal paydown method.

I bought my house with a 5/1 ARM in 2016 at 3%. In April 2021, it adjusted down to 2.625%. So while everyone else was paying to refinance, I was gloating that my rate went down by paying and doing nothing. In April 2022, it went up to 3%. That was OK, especially since I was finishing my basement and I needed the cash. And I decreased my investments in 2022 a bit too, as I thought the market was too high. Unfortunately in Oct 2022, when the market was low, I didn’t have the cash to invest since my basement remodeling was coming to a close. And in Jan 2023, I only wanted to invest slowly, not knowing where the market was going to go. Then in April 2023, my mortgage rate went up to 5%. I did get some nice bonuses from work, and I had cut back on investing in the stock market, so I am putting more into the house now.

At least your basement is done and your house is worth more.

Your rate is still low and the blended rate over the years is likely lower than if you had gotten a 30-year fixed.

Sounds like winning to me.

How’s this winning? Could have locked sub 3% for years but is now stuck with much higher rates for probably rest of the life. What am I missing?