The 401(k) has replaced the company pension as the primary way Americans save for retirement. Add on Social Security benefits and after-tax investments, the 401(k) is one leg of the three-legged retirement stool. But are you wondering whether you can have too much in your 401(k)? Let's discuss!

Given the importance of the 401(k), a Financial Samurai Forum member is wondering whether it's possible to have too much in his family's 401(k) account.

Here's what he writes:

My wife and I are both around 50 years old. We want to be able to retire at 55. We max our 401(k) contributions each year and have a pretty good chunk in 401Ks – approximately $2.5M currently.

Currently, we are in the max tax bracket, so reducing our income with 401(k) contributions is appealing.

Finally, we have about $700K in after-tax accounts and $100K in Roth IRAs.

My current thoughts are to convert at least some of the 401(k)s to rollover IRAs, then to Roth IRAs over time after we retire and have lower income.

For now – are we better to continue to max the 401(k)s, or stop making 401(k) contributions and start making Roth 401(k) contributions (which will cost us 37% tax on $52,000 of extra taxable income), but may benefit us in the future?

Can You Have Too Much In Your 401(k)?

For starters, accumulating a $2.5 million combined 401(k) balance at 50 is quite an accomplishment.

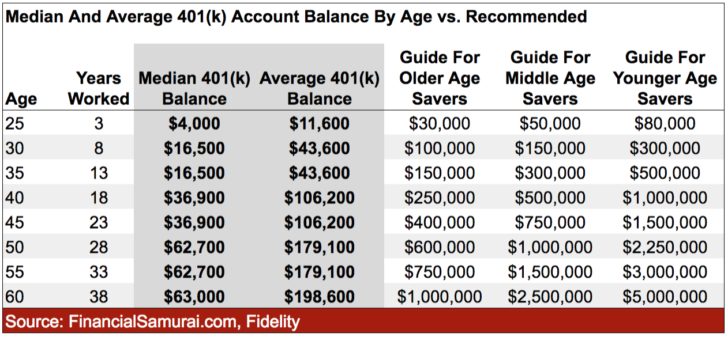

According to my recommended 401(k) guide, this couple is doing extremely well and has $1.5 million above my guidance for Middle Age savers. See chart for more details.

The key to creating a healthy 401(k) balance is to max out your 401(k) each year for decades. Stocks return on average about 7% – 9% since 1926, while bonds return about 4% – 5% during the same time period.

Based on your risk tolerance, it's important to follow a proper asset allocation strategy so that you can sleep well at night and make a return according to your needs.

Dial Down Risk As You Get Older

As you get wealthier, your risk exposure should go down as you get into capital preservation mode. The last thing you want to do once you're past your 50s is to lose a bunch of money and have to start over!

So for all the young folks out there who are simply making excuses for why you're not there or don't want to save more, please get your head on straight before you wake up 10 years from now bitter you have no options given your lack of funds!

I'm always going to be an advocate of maxing out your 401(k) no matter how much money you already have in the account. The estate tax limit per person as of 2019-2024 is a whopping $11.4 million. 99.9% will never achieve that limit, so you might as well keep on saving.

It's always better to have a little too much than a little too little.

But it's always good to hear an opposing point of view in order for all of us to make the most informed financial decision possible.

Yes You Can Have Too Much In Your 401(k)

Let me first argue why you can have too much in your 401(k), especially if want to retire before the age of 59.5.

A key component of your retirement income and investments is taxes. Are you properly diversified or not? And if not, are you able to take a larger tax hit than potentially necessary?

The obvious downside of having too much in your 401(k) is that you will eventually need to pay taxes and no one can predict future tax rates. Also, you will be forced to take a required minimum distribution (RMD) at 70-1/2 even if you don't need the funds.

It may be better to have a diversified retirement portfolio with a Roth IRA, where you've already paid taxes up front, therefore no longer have to pay taxes upon withdrawal, as well as a pre-tax 401(k) plan.

Diversifying Retirement Plans Is Smart

Finally, this is what really made me think twice about maxing out my 401(k) going forward. I met with a wealth advisor/estate planner. He mentioned everything I own gets a step-up in tax basis when I pass away, the 401(k) and traditional IRAs do not.

If retirement plans are funded with pre-tax dollars, they are 100% taxable to my heirs once they start tapping into the funds.

The estate planner's advice was that if I planned to bequeath anything to charity, bequeath the 401(k) first and avoid the taxation issues.

Personally, I like to spread the taxation risk by putting my money in various retirement accounts, IRAs, 401(k)s and Roth IRAs.

Track Your Consumption

Besides tax diversification risk to having too much in your 401(k), there's also the risk of simply dying with too much money. If you have too much in your 401(k), then you overworked yourself!

What if you spent your entire life scrimping and saving in order to max out your 401(k). You end up with $2.5 million like this couple, and then you die at 61. What a waste!

It would have been much better to consumption smooth across your entire life by living it up more. This is why everybody needs to also create a financial expenditure plan. One of the best ways I've been able to do that is by using Personal Capital's free retirement planning calculator.

Analyzing Your Retirement Cash Flow

The retirement planner allows you to input expected expenses and calculates your pro forma income so that you have enough cash flow when you want to retire to live a good life. Below is an example.

In the above example, this person has a 99% chance of retiring in great shape given his projected retirement income is $18,416/month versus his projected or desired retirement spending of $12,500.

But having an almost $6,000/month extra spending buffer might actually be too much. That's $72,000 a year in potentially unnecessary income. To generate $72,000 a year in retirement income at a 4% rate of return would require $1,800,000!

Therefore, it might be better to spend a little more and enjoy life more before the retirement date than to try and accumulate $1,800,000. Instead of having a $6,000/month buffer, perhaps a $3,000/month buffer would do. That would bring the required capital accumulate to only $900,000 using a 4% rate of return instead.

Maxing Out The 401(k) Mindset

At the end of the day, I think the wise move is for this couple to continue maxing out their 401(k) to the tune of $19,500 each as of 2021. In five years, their 401(k)s will be bolstered by another $195,000 of pre-tax contributions that would have been taxed $70,300 if they didn't contribute.

Once they retire at age 55, they can simply live off their $700,000 in after-tax investment accounts until 59 1/2, when they can start withdrawing from their 401(k) penalty-free.

$700,000 will only generate $28,000 a year in income at a 4% rate. Therefore, the couple would likely need to eat into principal.

Different Ways To Withdraw From 401(k) Early

Alternatively, the couple can follow the “Rule Of 55” if they do not want to wait until 59 1/2 to begin taking money out of their plans.

The Rule of 55 allows an employee who is laid off, fired, or who quits a job between the ages of 55 and 59 1/2 to pull money out of his or her 401(k) or 403(b) plan without penalty. This applies to workers who leave their jobs anytime during or after the year of their 55th birthdays.

The other strategy is to follow Rule 72(t), also known as as the Substantially Equal Periodic Payment or SEPP exemption.

Using this type of distribution rule, you would start by calculating your life expectancy and use that to calculate five substantially equal payments from a retirement plan for five years in a row before the age of 59 1/2.

Negotiate A Severance And Retire

The final strategy is to negotiate a severance to provide a financial runway in retirement. With $2.5 million in their combined 401(k)s, it is likely this couple has been with their respective employers for a respectable amount of time. If there is no pension, then they are prime candidates to receive a severance due to their years of loyalty.

If you are going to quit your job anyway with no pension, then you might as well attempt to negotiate a severance. A severance package regularly equal 1-3 weeks of pay per year worked. If the couple earned $700,000 combined and worked at their jobs for 20 years, they could receive 25 – 75 weeks worth of several equal to $269,230 – $807,692 plus subsidized healthcare.

I don't think anybody can really have too much in their 401(k). If you feel you do have too much and need to tap it early, then you can always borrow from yourself or worst cast, pay a 10% penalty.

Leverage Free Wealth Management

It's always better to have too much in your 401(k) than too little! Definitely check out Personal Capital and leverage their free financial tools to help you grow your wealth. I've been using their tools since 2012 and have seen my net worth skyrocket with the market.

One thing I realized post-pandemic is that if I had stayed at my job until age 40, instead of leaving at 34, I would have become a 401(k) millionaire. Let your contributions, compounding, and company matching work for you!

About the Author:

Sam worked in investing banking for 13 years. He received his undergraduate degree in Economics from The College of William & Mary and got his MBA from UC Berkeley. In 2012, Sam was able to retire at the age of 34 largely due to his investments that now generate roughly $250,000 a year in passive income largely thanks to his investments in real estate crowdfunding. He spends time playing tennis and taking care of his family. Financial Samurai was started in 2009 and is one of the most trusted personal finance sites on the web with over 1.5 million pageviews a month.