Let me share why I never contributed to a Roth IRA but why you probably should. I fully admit that I was once an ardent opponent of the Roth IRA in the past. But as a middle-aged father of two young children, I've come around. Contributing to a Roth IRA is a great way to diversify your retirement income sources.

If you are a student, a fresh college graduate, or someone with a modest income, contributing to a Roth IRA is also beneficial for your retirement. You pay a lower tax rate with your contributions. As your income and wealth grows, you'll appreciate paying no taxes when it's time to withdraw.

If I could rewind time to when I was a junior in college, I should have opened up a Roth IRA and started investing. Don't make my same mistake. Time is the most powerful asset when it comes to investing.

Roth IRA Wisdom From My Father

My dad is in his 70s and he mentioned he wish he'd started a Roth IRA when he was young. When you're in your 70s, you must take required minimum distributions (RMD) from your pre-tax retirement savings accounts and pay taxes.

Given nobody likes to pay taxes, I empathized with his regret. It’s also a good idea to listen to your elders.

With the passage of the Secure Act 2.0, the RMD age increased to age 73 in 2023 and to age 75 in 2033.

But I don't have a problem paying taxes on income earned. It's only when I have to pay a surprise tax where the liability wasn't properly budgeted where I have a problem. This only happened to me once when the state of California passed a retroactive tax of 2.9% for the 2011 tax year.

Now that I'm older and wiser, let me share some of my excuses and encourage you to contribute to a Roth IRA if you are eligible.

Why I Never Contributed To A Roth IRA

1) I didn't have much money left over to save for retirement.

When I first got a job in 1999, I was only making a $40,000 base salary living in Manhattan. $40,000 did not feel like a lot of money back then, especially since I couldn't even rent a one bedroom apartment on my own. Even splitting a studio apartment for $1,800 total required my brother-in-law to be a lease co-signer. In NYC, you needed to make at least 40X the monthly rent in annual salary, and my roommate and I did not make over $72,000 combined.

After maxing out my 401(k) to the tune of $10,500 and paying taxes, I didn't have much left. I needed the ~$200 month left in cash flow to pay for incidentals. Something always tends to come up – like actually having some fun once in a while.

2) I didn't know any better about the Roth IRA.

Ignorance is a common excuse for why we didn't do things. However, it is up to use to get smart for our own good. The Roth IRA was introduced in 1997, when I was a junior in college. Saving for retirement was the last thing on my mind at that age. Getting a job was number one!

The 401(k) was easy to contribute to. It was automatically set up with my employer as part of my employee welcome package. All I had to do was fill out a form indicating how much should be deducted from my paycheck and year-end bonus, if any.

With a Roth IRA, I had to open up a new account. This felt like too much of a PITA at the time. When you are already not feeling rich, you don't normally go out of your way to feel poorer.

Further, there wasn't a ubiquity of affordable online brokerage options or personal finance blogs to provide any guidance.

3) The contribution limit was disappointingly low.

Even though I only made $40,000 my first year, being able to only contribute $2,000 maximum to a Roth IRA felt underwhelming. At age 22, I would much rather have $2,000 in cash than lock it up for at least five years. The poorer you are, the more valuable each liquid dollar is.

Check out the historical Roth IRA contribution limits. It wasn't until 2019 that the Roth IRA contribution limit grew to a relatively significant amount of $6,000. The 401(k) max of $19,500 in 2019 versus the Roth IRA contribution max of $6,000 ratio was only 3.25X. Back in 1999, the ratio was 5.25X ($10,500 / $2,000). Therefore, focusing on the 401(k) was a better choice for me.

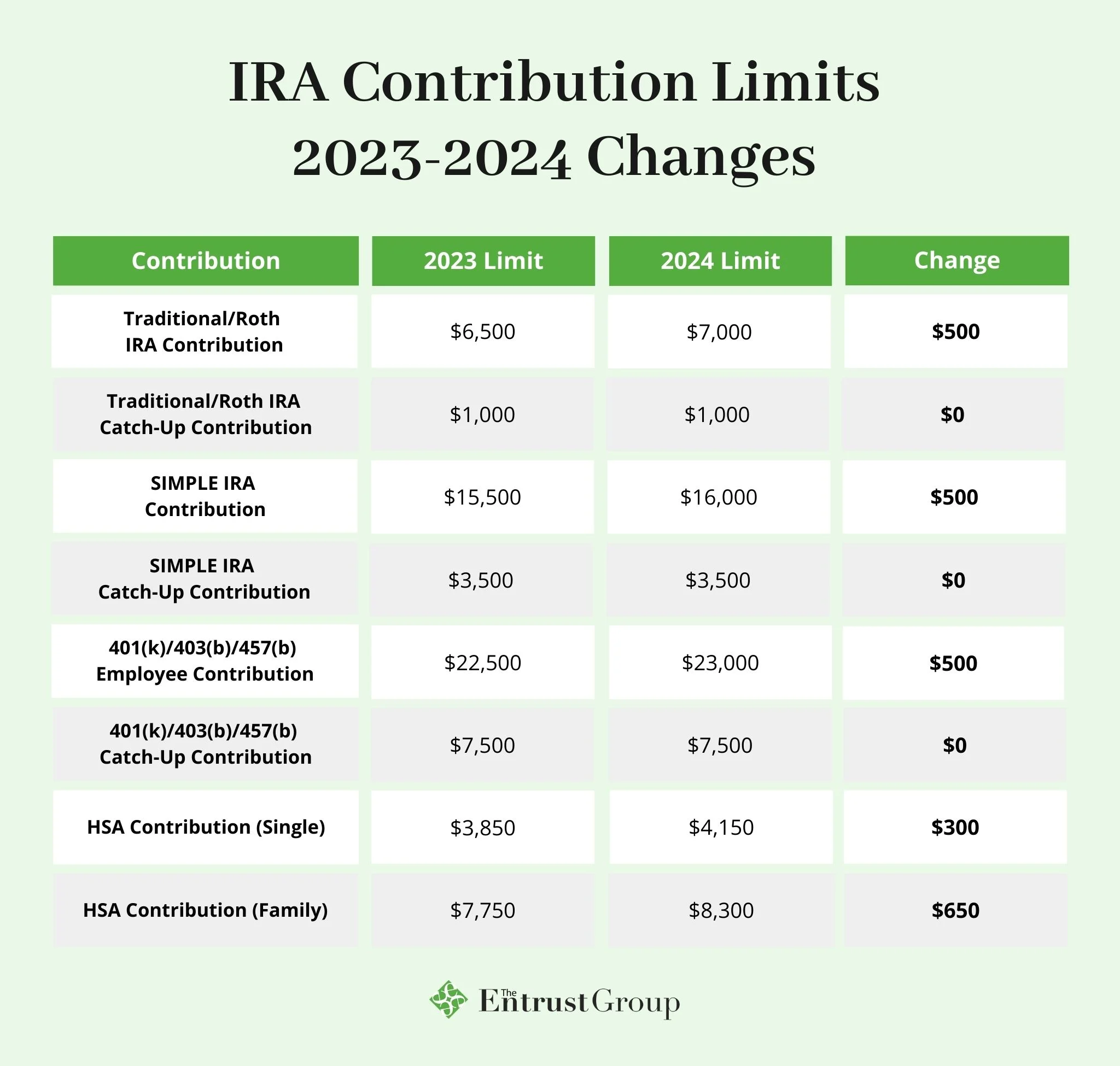

For 2024, the Roth IRA maximum contribution is now $7,000. If you're 50 or older, however, you can contribute up to $8,000 to your Roth IRA. Expect the maximum contribution about to go up by $500 every two or three years.

Pay close attention to the MAGI income requirements below. They determine how much you're eligible to contribute to a Roth IRA.

4) I hated paying taxes.

When you're struggling to pay for a studio apartment with a friend while also working 70+ hours a week, the last thing you feel like doing is paying more taxes up front, which is what the tax-now Roth IRA retirement plan is.

My taxable income was $29,500, which put me at the 28% marginal federal income tax rate at the time ($26,250 – $63,550). Then, of course, I had to pay New York State and City taxes. It felt terrible paying 30% in taxes for a $2,000 Roth IRA contribution. So I didn't.

The only way I'd feel good paying taxes up front for my Roth IRA contribution is if the effective tax rate was 15% or less. Further, I had to be working a leisurely 40 hours a week or less. Working very long hours makes you really bitter about the tax system.

5) I finally started making too much to be eligible to contribute to a Roth IRA.

When I got my lucky break and moved to San Francisco for a new job, I was making a base salary of $85,000 and was guaranteed a $50,000 bonus. As a result, my total compensation in 2001 was about $120,000. This was $10,000 over the maximum $110,000 income allowed for an individual to contribute to a Roth IRA at the time.

Although it was nice to earn more money, it also felt disappointing to be shut out based on an arbitrary income limit. Why wasn't the income limit $150,000 or $200,000? The government was implying not everybody deserves equal treatment.

In San Francisco, I still lived extremely frugally. I shared an even cheaper apartment ($1,600/month vs. $1,800/month in NYC) for the first two years. The $40,000 a year lifestyle stayed with me for another four years. I still wasn't sure I'd be able to survive in the finance world for very long. It was only after I finished my MBA in 2006 did I start to spend a little more.

If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $150,000 for the tax year 2025 to contribute to the full $7,000 to a Roth IRA. Once you make over $165,000, you're not allowed to contribute anything.

A married couple needs to earn less than $236,000 to contribute the full $7,000 for 2025. Once a married couple earns over $246,000, they aren't allowed to contribute to a Roth IRA.

6) I'd be in a lower tax bracket in retirement than while working.

This was the main reason why I thought contributing to a Roth IRA was illogical. Not only did I feel federal income tax rates would come down since 1999 (which proved correct after the TCJA was passed at the end of 2017), I also believed it would be incredibly hard to amass enough capital to reproduce my average W2 income wage.

For argument's sake, let's say I made $100,000 in 1999, meaning that I paid a 31% marginal federal income tax rate, or ~25% effective federal tax rate. My $100,000 turns to $75,000. I would need to accumulate $4,000,000 in capital producing a 2.5% gross yield to match my gross working income. I was bullish on my future, but not that bullish.

The people who are angry at my after-tax investment targets for early retirement, yet strongly believe in contributing to a Roth IRA are demonstrating inconsistent logic. If you don't believe you can accumulate multiple millions, then you should not be contributing to a Roth IRA.

Further, I wanted the option to move to one of our no state income tax states in retirement. By contributing to a Roth IRA while working in one of the highest taxed cities in America felt like I was giving up.

Take Advantage Of The Roth IRA When You Can

After reading all my reasons on why I didn't contribute to a Roth IRA, I hope you see them just as poor excuses.

Unlike me, be super bullish about your future.

I felt so burnt out after a couple years working post college that I thought I was just going to be a beach bum in Hawaii paying zero income taxes for the rest of my life. My grandfather had an old farmhouse I planned on staying in for free, in exchange for maintaining his mango trees.

Instead, I had a good 13-year career in finance. I got promoted to Vice President at age 27 and to Executive Director at age 30. After retiring in 2012, I ended up building Financial Samurai into an asset that generates significant supplemental retirement income.

Further, with the massive bull market that ensued in stocks, real estate, and bonds since I started working full-time in 1999, my passive income has also grown significantly. Therefore, I'm once again back at a high federal marginal income tax bracket, which I definitely did not anticipate in “retirement.”

If you are a student, a new graduate and just started working, or have a relatively low income, contribute to a Roth IRA. You might not have such a low income forever.

The Roth IRA Is Retirement Income Diversification

I've warmed up to the Roth IRA because it is clearly a way to diversify your retirement savings and income. The maximum contribution has also increased to a not-so-insignificant $7,000 a year.

$236,000 is a healthy income for married couples that put them in the top 15% of income earners. Even if you live in an expensive area like San Francisco or New York City, at least one partner should be able to max out their 401(k) and contribute the maximum to a Roth IRA.

Roth IRAs also have no RMDs; they can be assumed by a qualifying spouse upon the owner’s death and rolled directly into the survivor’s account (or a new account in the survivor’s name). They can also be transferred to a designated beneficiary tax free as well, under the same distribution rules as Traditional accounts: lump Sum or 5-year exhaustion.

If you make more than the income thresholds to contribute to a Roth IRA, then consider conducting a mega backdoor Roth IRA. With this strategy, you max out your 401(k) contributions and contribute after-tax contributions to your 401(k). Then you convert these after-tax proceeds into a mega backdoor Roth IRA.

Could Have Had $200,000+ In My Roth IRA By Now

If I was able to contribute $4,000 on average to a Roth IRA and earn a 9% compound return for 19 years, today I'd have about $200,000 I could withdraw tax-free. Over a 50 year period, my Roth IRA would grow to $3,553,000 with the same terms. That's not something to sneeze at!

However, if you're already in a higher tax bracket, then doing a Roth IRA conversion is probably not worth the effort. You likely won't save tax dollars in retirement if you are above the 24% marginal income tax bracket.

Open A Roth IRA For Your Children

Unfortunately, I'm still not eligible to contribute to a Roth IRA. However, at least I'm able to open up a custodial Roth IRA for each of my two children.

They can earn up to the standard deduction tax-free, contribute to a Roth IRA tax-free, let their money grow tax-free, and withdraw tax-free! I won't allow them to make the same mistake as their old man.

My hope is to put them to work for our family business. This way, they can earn income, save for retirement, and learn useful skills.

In 15+ years, I hope they will thank me!

Related: I Could Have Been A 401k Millionaire By 40 Had I Kept My Job

Diversify Your Investments Into Real Estate

In addition to investing as much as possible in your Roth IRA for as long as possible, also consider diversifying into real estate. You can buy your primary residence and you can also invest in private real estate funds for further diversification.

Fundrise runs private real estate funds that predominantly invests in the Sunbelt region where valuations are lower and yields are higher. Its focus is on residential and industrial commercial real estate to help investors diversify and earn passive returns.

Founded in 2012, Fundrise currently manages over $3 billion for over 350,000 investors. I've invested $954,000 in private real estate funds since 2016 to diversify my investments and make more money passively. Once I had children, I no longer wanted to manage as many rental properties.

Another private real estate platform to consider is CrowdStreet. Crowdstreet is a marketplace that mainly sources individual commercial real estate deals from various sponsors around the country. This way, you have more customization to build your own select private real estate portfolio.

Make sure you diversify your portfolio and do your due diligence on all the sponsors. Look up their track record, their management, and whether they have had any blowups before. Although CrowdStreet screens the deals, you have to do your screening as well.

Both platforms are long-time sponsors and Financial Samurai is currently an investor in Fundrise.

Recommendation To Protect Your Wealth

Sign up for Empower the web’s #1 free wealth management tool to get a clear overview of your investments. Empower lets you easily track your net worth. You can also easily plan for your retirement with their Retirement Planner tool.

The more you can stay on top of your finances, the better you can optimize your wealth. I've used Empower since 2012 and my new worth has more than 6Xed since!

Subscribe To Financial Samurai

Readers, who is contributing to a Roth IRA and how's that going? Anybody contribute to a Roth IRA and make more than the income thresholds and have to stop? Is a backdoor or mega backdoor Roth IRA conversion worth it if you are in a high income tax bracket? Anybody now pay more in taxes as a retiree than as a full-time worker? If so, share us your secret to wealth.

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review.

For more nuanced personal finance content, join 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

I have searched to see if there were other questions or a POV on mega backdoor Roths so hopefully not missing it..

I have access to a mega backdoor opportunity through work (tech) where you can rollover an additional 32K into a Roth IRA via after tax pay and after tax bonus contributions. Most big tech companies offer this and most employees are probably pushing the 32- 35% brackets.

What are your thoughts on these if you are maxing 401K and HSA prior and making a solid dent in after tax investments (non Roth)? Still little value given your tax rate should be lower in retirement?

I have gone back and forth on this for 2 years but have maxed out twice.. . Thinking about 2024 and focusing more on non roth.

Conversion is probably a waste of time and money at your ticket bracket. But only you know what it is.

https://www.financialsamurai.com/roth-ira-conversion/

Suggestions for those married, filing jointly, maxing out 401k contributions (plus an LLC employer contribution) when income disqualifies you from taking advantage of a roth IRA?

Sam, I belong to a special class of employee that I believe benefits greatly from Roth IRA contributions, vice Traditional. I am a Commissioned Officer in the Armed Services, and have three (3) categories of pay; Base Pay, a Housing Allowance (called BAH), and a Subsistence Allowance (called BAS). Only the Base Pay is taxable (Fed Tax, FICA-SS, FICA-MC), but the other two are not! Together, BAH and BAS equate to ~25% of my overall monthly pay. Our employee offered 401k retirement account (called the Thrift Savings Plan, or TSP) has both Traditional and Roth options (since 2014), so in essence, I can contribute the MAXIMUM amount permitted annually (2023: $22,500) directly into Roth. Additionally, we are able to have private/personal Roth IRA accounts, separate & apart from the govt retirement plan, and have consistently maxed those out since 2010! I am married filing jointly tax payer, and just far enough over the lower threshold of the 22% marginal tax bracket that would benefit from the tax deferred contributions. So I say feed the Roth Pig and let it ride!

Love it! And for you, I agree. You’ll also enjoy this post on the best income to earn based on the latest tax rates.

I contributed to a ROTH before I had a 401k. It hasn’t grown that much since I focused on my 401k once I had access to one, but I’m still glad I opened one. Everything help when it comes to saving and investing for retirement!

I’m considering converting a small IRA (roughly $45k) to a Roth IRA. I was very curious to see Sam’s thoughts on this but saw he had several different posts on Roth’s (sometimes conflicting :)). Here are my reasons for converting at this point in time:

1.) Why now?: I’m 35 years old and work in sales in a very stable annuity like technology sector with uncapped income, and don’t expect my wife and my combined income to be lower than it is now anytime in the next 20 years. If Biden wins the election he has stated that he will be raising income tax on those who earn over $400k. So I see this year as the best time to convert.

2.) My IRA is small, my tax bill won’t be more than $20k for this one time conversion. Then beginning this year I will fund this Roth IRA via a back door contribution at a rate of $6,000 per year every year until I retire or decide to stop. Effectively funding a Roth while still being above the income limits.

3.) My wife and I both participate in traditional 401k’s which we max out every year. So this new Roth will essentially act as a hedge against our fully funded 401k’s and serve to give us more optionality on retirement spending as well as a more flexibility for inheritance strategy to our children.

4,) Sam asserts that we will all likely NOT earn more in retirement than we do now. However, he does not address the possibility that Marginal tax rates can be raised significantly in the future, so that even if say your retirement income is $150k in retirement, you could be paying a 45% rate on that income in the future like say almost half of Western Europe already does.

Sam and FS community, I’d really appreciate any thoughts and feedback on this strategy, feel free to rip it to shreds :)

What are your thoughts about gifting $6k annually to son who then transfers that $6k to fund a Roth IRA in his name? He is in 20’s, a 1099 employee with about $50k income who does not have access to a 401k.

Goal of these annual gifts is to: have him start understanding investing (we will be discussing investments prior to purchase), let $ grow tax free over his life time, allow him access to some of “my $” before he inherits (age gap is 26 years), and reduce his tax burden/add flexibility on wd’s when he inherits my wealth. Note I may also be doing same with a $9k IRA to get to annual $15k gift max.

Assumptions: he is not going to raid the account for the wrong reasons, I am FIRE at 50 with net worth of $5MM/good cash flow – so $ is a small amount for me and fits in my annual expenses. Also he is sole beneficiary of wife/I’s $, and he has no other debt.

I have put lots of thought to this but alway looking to get more perspectives … thank you.

Best decision I made was to do Roth IRA.

Roth 401K converted to Roth IRA after retirement.

Roth conversions after early retirement when income was in lowest tax bracket.

Retirement funds currently 88% Roth, 12% Traditional

Benefits

1. NO TAXES on distribution.

2. NO RMD

3. NO higher Premiums paid on Medicare.

4. NO TAXES on Social Security

Great benefits

There are many options to adding to Roth for any tax bracket.

Roth 401K

Backdoor

Roth IRA

Can you better explain your situation? How much did you made before you retired? How much are you pulling out each year for retirement? While you’re claiming that ROTH is better, I’d like to see the math behind it.

Sam – great post. Have preferred the 401k route for your same justification. Retirement income will be lower than our working years income by a long shot, so have been focused on growing after tax accounts, 401k, and real estate. The company 401k matching has been awesome kicker to that return and growth. Also have been maxing HSAs and doing 529s. Goal is to get kids through college debt free and then be in position to retire.

Hi Sam,

I’m a recent reader and have loved scouring your posts for the past few weeks; thanks so much!

As an Aerospace Engineer 6 years out of college, I have been investing 16% of my salary into my 401k since I began working (now I will be increasing that to 19k/year per your articles). I have always elected to contribute via Roth 401k. Could you elaborate on if you recommend this vs before tax contributions, and why? (personally I figured I’m making less now than I plan to be making at retirement, hence I’d rather pay my taxes now)

I appreciate the insight,

Jacob

Read through about half the comments and not sure if anyone brought this up:

You make 19,000 a year and your Roth and Traditional 401k contribution limits are 19,000, and you have a 20% tax rate. You live with your parents, all expenses paid.

You also retire in 1 year, your tax rates never change, and your account return is 30%.

With the traditional you put all your income in, make 30% bringing your balance to 24,700, and withdraw, paying your 20% tax rate and ending up with 19,760.

With the Roth you pay your tax and contribute the balance to your account, which is 15,200. You get your 30% return and withdraw, receiving 19,760.

Let’s say instead of making 19,000 you make 30,000. Any non-retirement account money contributes to family expenses.

With the traditional you end up with the same amount, but with the Roth you now have enough money to contribute the maximum of 19,000, rather than only 15,200 before. So now you end up with 19,760 with the traditional, but 24,700 with the Roth.

The secret sauce here is the difference between pre and post tax dollars, which means that with a positive tax rate, equal nominal limits for traditional and Roth make the Roth limit higher in post-tax terms. Even if you invest your tax savings from your traditional contribution, the gains on that investment are taxed, so you will come out better with the Roth, because of the higher contribution limit, post-tax.

If you need the tax saving from the traditional contribution to live on, then this is a moot point, and if your company doesn’t offer a Roth option or the nominal contribution limits are not the same, then it’s also irrelevant. However, if you are saving above your traditional 401k limit and won’t need those finds till retirement, the Roth will always result in a higher return.

Pondering ideas to create a baby roth. I have a 2 year old that I want to open a Roth for but he has to have earned income. In a few years maybe doing household chores will get him some earned income but what can a 2 year old do to have earned income? Modelling for baby products is a possibility. Any ideas from the bright minds here?

Get with a tax professional to identify avenues to invest in a ROTH IRA for your child. Prob best to first have a 529 open and funded monthly prior to the ROTH.

Thank you, I already fund a 529.

This is a little dated, but as someone else said, see a tax professional. Paying your child for household chores and allowance do not count as earned income for kids and can NOT be used to fund an IRA (any type). Modelling for commercials, mowing your neighbors yard, etc, etc, does count though.

I do a backdoor ROTH for me and wife only after maximizing my pre tax accounts. It’s an easy choice for me as the other option would be an after tax investment account. ROTH is excellent for liability protection and as an asset transfer vehicle to your heirs as well.

In fairness to your Dad…he was in his 50’s when the Roth IRA was born. :)

I never agreed with an income restriction on the Roth…with the Backdoor option availble I suppose…although there are tricky pro rata rules tied to that. Lucky for me, my current company allows the elusive in-service/non-hardship withdrawal aka Mega Backdoor Roth option. I feel like I’m making up for lost time. Perhaps your next gig will have the same option, Sam. It’s at a company’s discretion as to whether it’s offered/an option.

Shiver me timbers! I had posted a few times earlier this year expressing my opinion that ROTH contributions are a great benefit for average humans such as my wife and I. I was compelled to post because FS opined that ROTH contributions are not a good idea.

Now, as an early Christmas present, FS has authored a new post promoting the positives of ROTH contributions. I feel like I scored on Jordan (23 not 45) during his dominant years!

Sam, your posts are often thought provoking, as well as entertaining. But I am grinning ear to ear reading an article you wrote that supports ROTH contributions.

Our household is now contributing all new money into ROTH 457 contributions at 15% yearly as well as doing large pretax to ROTH conversions each year without pushing us into a new tax bracket. Our goal is to convert at least 50% to ROTH from our pretax accounts.

2019 ROTH 457 limits are 19,000 yearly, which is huuuuuuge in my feeble mind.

The rest of our plan is:

1. Paying off the mortgage off way early. Currently debt free other than mortgage.

2. Contributing to post tax investment and high yield savings accounts as Sam has discussed.

3. Maxing HSA accounts.

4. 12,000 – 14,000 yearly into 529 plans for our 2 small humans.

We had never even thought of doing post tax investment accounts until FS wrote his article discussing that subject matter.

While funneling pretty decent sums of US currency into ROTH accounts, I figure we are tricking ourselves into investing more. We are putting the same amount into ROTHS as we were in pretax. We felt the pain initially then we did not recognize the difference.

Keep up the fine work Sam! It is a little present to unwrap and read each week.

Be well and Happy Holidays!

Great stuff! And on behalf of the government, I want to thank you for your tax contribution.

Every Roth IRA contributor plans to be a multi-millionaire, which is why they are paying tax upfront because they fear they will make much more in retirement and therefore pay higher taxes.

To have such confidence in one’s financial future is a great thing. How can one not be bullish for our kids?

Let’s just hope the stock market and real estate market don’t collapse too badly, otherwise, the DIRE Movement might really take off!

Cheers

Haha, while we all have plans to be a multi-millionaire, the sad truth is very few of us will ever get there. That’s why I 100% agree with you that for most people, the traditional 401k is better. When I say multi-millionaire, I’m also throwing an additional caveat on that, meaning that it is adjusted for inflation. You may have $2 million 40 years from now, but after 2% inflation over that same 40 years that $2 million is worth less than $900k in present terms money. People need to understand the full picture.

Unfortunately most of the people commenting here are just regurgitating information that they’ve read on the web somewhere. Most people are not good enough with excel equations to run the numbers for their own personal situation.

For me, I’m retiring once I hit 100% income replacement. Which the vast majority of people will never be able to achieve. And for me, I’ve ran the numbers multiple times (ROTH vs Traditional) and I am investing 100% in a traditional 401k. Why would I want to pay taxes at my highest marginal rate right now, versus a lower effective rate later on? That just doesn’t make sense!

I do love your comment for anyone contributing to a ROTH!

On behalf of the government, I want to thank you for your tax contribution.

I do feel like the ROTH was set up by the government to fleece the general public out of more and higher taxes right now. The reality is that very few of us fit a situation where a ROTH makes sense. However the government tries to blanket promote it like it’s the best thing ever because they know it’s a money maker for the government, not for the public.

Sam,

I have long been a proponent of the Roth savings options for a number of reasons covered in your article. Additionally, being an avid saver and religiously maxing out my tax advantaged retirement accounts, I’ve seen the roth as an avenue to maximize the tax advantaged benefits (i.e. the maximum contribution for a roth is ~1.25x that of a pre-tax account, in pre-tax dollars). Given that I’m 30 years old, I’ve “grown up” in an environment with much higher roth contribution limits than most. This is evident by my current wealth allocation as outlined below (rounded directionally for simplicity):

Roth Accounts – Post Tax: $250K (42%)

Brokerage Accts. – Post Tax: $300K (50%)

Trad. IRAs / HSAs – Pre Tax: $ 50K (8%)

To the “tax diversification” point in the article, I’m concerned that I am over-indexed in post-tax savings. My question to you… what is your recommended mix of pre and post tax retirement savings? Should I be pivoting my retirement efforts towards traditional accounts?

Set your solo 401k to allow mega-backdoor Roth contributions, Sam.

Taxes will go up, making tax free withdrawals later critical.

The ROTH is a wonderful way to leave dollars to heirs.

You don’t have to reduce net worth for taxes. $1M in a ROTH is really $1M. $1M in a tax deferred account may just be $600K, or less if taxes go up.

While it is not true that taxes WILL go up, the Roth is a nice insurance policy against tax increases. You really do need to consider whether your tax bracket in retirement will be anywhere near where it is during your working years. If you are a high earner, it probably won’t be.

Good Post Sam, I find the american retirement accounts confusing relative to Canadian accounts. Canada launched a Roth IRA look alike in 2009 (TFSA) and i think they built on it to make a better version. It is post tax contributions with tax free growth in perpetuity, you accumulate contribution room if you miss a year of contributions. It is almost fully liquid (can withdraw at any time but cant re-contribute the withdrawal amount in the same year. An it is available for all income levels – which is great. I don’t know that there are really any drawbacks relative to a taxable account.

It is a great place to hold particularly tax inefficient investments, like REITs (taxable as regular income in Canada) and such.

My stepson turns 21 next month. Our gift to him, which I know he definitely won’t appreciate right now, is sitting down with him and walking him through the process of opening a Roth IRA. We will also start it off with a modest amount and commit to matching that amount for the next 3 years (while he’s in college and only working part time). I really hope I can show him how even small amounts invested early in adulthood can make a big difference later.

Just to clear up a rule that I have seen misunderstood by many and in this feed on Required minimum distributions on an inherited non spousal roth:

There are two options: The first is that the beneficiary has to take out the entire balance by December 31st of the year containing the fifth anniversary of the owner’s death. The second is more complex, but potentially much more advantageous. The beneficiary will have to start taking distributions over the beneficiary’s life expectancy, starting no later the December 31st of the year following the year of the owner’s death (this process is called the Term Certain Method).

If distributions to the beneficiary do not start by December 31st following the year of the owner’s death, the rule requiring a complete distribution of the plan balance within five years will become effective. Generally, a written election choosing the Term Certain approach should be filed with the plan administrator as soon as possible.

Beneficiaries would be well-advised to choose the ability to take withdrawals from the inherited Roth IRA over their life expectancy. The funds in the Roth IRA will continue to grow and compound tax-free while still part of the Roth IRA and the distributions from the Roth IRA will be tax-free as well (as long as the owner had held the Roth for five years or more). Imagine inheriting an account that grows tax-free during your lifetime and pays you tax-free amounts on a yearly basis!

So my really smart mom put probably $4K in an IRA early. She rolled it to a Roth as soon as the rule allowed conversions. (She also contributed the max she could to her employers 503B). She kept the Roth invested and named me the beneficiary. When she passed in 2006, I CAREFULLY read the rules and found a broker that would allow me to take the RMD over my life expectancy in the IRS tables. (instead of 5 years–not everyone would). I have the benefit of a tax free nest egg and an annual gift from mom that gives me more annually than she ever contributed! I am in a higher tax bracket than she was, and I pay $0 in taxes on that RMD. Her actions remind me constantly to learn and read and understand the rules.

If I contribute to Roth IRA, I lose the ability to tax loss harvest. In a taxable account I can invest in low risk tax free bonds and pay LTCG (usually at a zero rate) at MY discretion. Maybe snag a 3K ATL deduction now and then. No rules with a taxable account. I can gift/donate appreciated assets and have step up basis at death. Only a Governmental wealth tax would stop me.

My strategy is to maximize my 401k and then take selective distributions to a taxable account prior to age 70. I am going to pay tax on it either way. The QBD (if employed) adds an interesting twist since I can bring down TIRA/401k bucks to even up my taxable income. This new law makes working in retirement much more attractive.

The only advantage I see to a Roth is it is not included as income for Social Security. If I was younger maybe contributing to a Roth would make sense for its long term tax free appreciation. I do not trust the Government not to change the law over a long term period.

I think timing explains why Roth IRAs never appealed to you, and this is one of the only blogs that I read that isn’t super-positive on Roths.

You became self employed soon after the Backdoor Roth IRA (no income limit!) was made possible in 2010 [1]. It took a few years for it to become popular/the knowledge to spread, and after you have money saved in SEP IRAs from self-employment, the pro-rata conversion rule basically negates the ability to use the backdoor. [2] Finally early in your career, as you’ve mentioned, it didn’t make since since maxing the 401k was better.

Backdoor Roths have been popular for some time and are now officially IRS blessed, but I haven’t heard of a single case where someone got whacked from 2010-2017 even before the official clarification. I’ve contributed to a Roth IRA since the second year of my college and I think it’s one of the best financial decisions I made early – ability to withdraw contributions penalty-free in case of need, tax-free growth.

Now that I’m full time employed I have access to 401ks but it’s still good to have tax diversification, and tax-free growth and withdrawal is still better than taxed growth and withdrawal (fully taxable accounts) or tax-free growth but taxable withdrawals (traditional IRAs above the deductibility limit). After you max out the 401k at $19K annually, Roth IRAs really are the next best choice (“paying more taxes notwithstanding”, besides HSAs you don’t have too many other ways to stash away money tax free)

[1] https://www.forbes.com/sites/jimdahle/2018/11/16/celebrating-ten-years-with-the-backdoor-roth-ira/#41a891d5ce7e

[2] (if you have $50K in a SEP IRA and want to put in a $6K contribution to your Roth IRA via the backdoor, you’ll end up being taxed on 50K/(50K+6K) * 6K = $5,357)

An easy fix to all these mental gymnastics, crystal ball prognosticating is to just make enough money to max out 401k (hopefully your plan has after-tax and in-plan Roth conversations–gives you an extra ~10-40kish in Roth per year depending on how much your employer contributes), max out HSA, max out IRA, and have enough left over for your brokerage account. Easier said than done for some people though.

Also, would be fun to run the math on whether an after-tax investment account with the capital gains taxes and how those gains push you into a higher tax bracket and whether or not it would be close to as beneficial as paying off mortgage debt instead now.

Backdoor Roth IRA has the disadvantage of triggering a 5-year rule where you cant take out your initial contributions (and earnings) without getting the 10% early withdrawal penalty. You would have to wait 5-years to withdraw your initial contribution penalty free. But if you are not going to touch the money till later and build a large nut then no big deal.

A regular Roth IRA you are allowed to withdraw the initial contribution at any time, making that account much more flexible.

Maybe if your city and state hadn’t raped you so much in taxes; you would have been able to afford to invest for your future?

Life has been a struggle, but I feel OK supporting my city to help fund services and infrastructure for all. Just have to keep my head down and work harder and smarter. Hope you’re doing well.