After a banner year in 2020 and an even stronger 2021, more people are thinking of cashing out of stocks to buy real estate. After all, real estate is a real asset that provides utility and tends to hold its value. Stocks are just digital values that could plummet in value over night.

Seeing your stocks go down by 30% in March 2020 is a wake up call for all stock investors. At some point in time, you should use some of your stock gains to pay for a better life. Otherwise, what's the point of investing?

Cashing out of stocks to buy real estate is gaining steam. And that's exactly what I'm doing right now. I'm bullish on the housing market and I thought stocks were overvalued.

And guess what? As I revisit this post, the S&P 500 did indeed crash by 20%. Although, with rates up a lot, real estate is looking vulnerable. But all the more reason to buy real estate now and get better deals before mortgage rates decline again in 2024 and beyond.

Extending The Gains For Longer By Buying Real Estate

One of the wealth tenets I've followed since the first dotcom crash in 2000 is to always convert funny money into real assets. My definition of funny money is an investment that makes an irrational return in excess of fundamentals. There are obviously various levels of irrationality.

Some friends and colleagues went from huge stock market returns in 1999 only to lose everything and more in 2000. Going on margin was partly to blame. While some stocks like Webvan and Pets.com literally went to zero.

Over time, I noticed those who turned their dotcom fortunes into Manhattan or San Francisco real estate during the early 2000 era were able to extend the value of their fortunes and do quite well. As a result, young Samurai followed suit.

Of course, many homeowners ended up getting slaughtered during the 2008-2009 financial crisis buying too much home, just like stock investors who went on margin in 2000. But those who bought responsibly and were able to refinance and hold on saw their gains return.

The question I have now is whether we should cash out of stocks and buy real estate.

I'd like for everybody to thoughtfully pitch in with their opinion. Everybody's circumstance is different, which is why it's important to listen to as many different perspectives as possible.

There is no perfect answer.

Cashing Out Of Stocks To Buy Real Estate

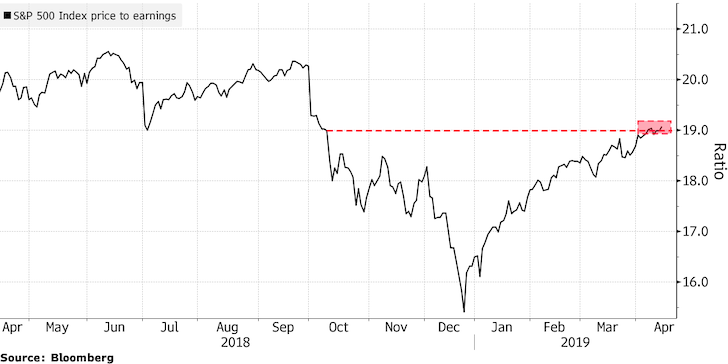

The reasons why I'm wondering whether to cash out of stocks and buy real estate are due to the following:

1) We've recovered all our funny money gains.

The S&P 500 and the NASDAQ are sitting at record-highs. My House Fund, consisting of stocks and bonds, went from about $2 million down to $1.6 million during the March 2020 correction. It now is back up to $3+ million for a $1.4 swing. I'm sure many of you have seen similar percentage magnitudes of recovery if you calculate recent trough to peak levels in your portfolio.

2) Real estate is lagging.

San Francisco median home prices went down ~11.5% from its 2018 peak. We've seen similar weakness across many major cities in America and around the world. The weakness provides some solace that some steam has already been let out of the real estate market.

3) Affordability increasing.

With lower median prices and declining mortgage rates, interest in real estate is increasing. There's also a strong demographic trend as Millennials are the largest home buying demographic and are starting families.

The 10-year bond yield was about 3.3% in 4Q2018. Now it's below 1.3% in 2021. Affordability for real estate has gone way up.

4) Tech IPO spillover.

Names such as Uber, Zoom, Airbnb, Lyft, Robinhood, and more have all gone IPO. Liquidity is flowing into the market. While I've written there is a chance the hype will awaken a slumbering supply bear, my experience post-Facebook's IPO is that it will take about one year for the wealth effect to spillover into real estate.

5) A strong desire to create utility out of stocks.

Stocks provide no utility, whereas real estate does. It is a wonderful feeling to make money in stocks and convert gains into something tangible. To be able to use real estate as a second home, an office space, or as a new primary residence for an expanding family to enjoy for decades is a win.

Due to the global pandemic, we're all spending way more time at home. As a result, the intrinsic value of real estate has gone way up.

Living Our Best Lives Now

The entire purpose of achieving FIRE is so that we can live our best lives now.

When we invest in stocks, our hope is to generate profits so that we can live better lives in the future. Of course, we can also invest in stocks to produce dividend income to live off of today.

But if we really wanted to generate income to live our best lives today, there are more prudent, better ways to earn higher amounts of steady passive income with lower volatility.

The downside to cashing out of stocks and buying real estate is that one might be jumping out of the frying pan and into the fire. With rising inventory and a slowdown in the economy, real estate prices could continue to soften in the coming years. Leverage up too much and financial pain could ensue.

Keep The Good Times Rolling

I just keep going through what played out during the 2000 dotcom bubble. As stocks crumbled in between 2000-2002, real estate picked up steam because mortgage rates began to decline. Stock investors started seeking shelter in real estate and REITs in particular performed the best between 1999-2018.

The $400,000 recovery in my House Fund portfolio feels like funny money to me. It's like buying a $2 million property for only $1.6 million or a $500,000 property for only $100,000. What a bargain!

Further, the real estate market generally lags the stock market by around six months in terms of recovery or declines. Therefore, with the stock market up so strong YTD, it feels like there's a window of opportunity to buy property right now before prices catch up.

Given interest rates have plummeted, the value of cash flow has gone way up. It now takes a lot more capital to generate the same amount of risk-adjusted income.

Finally, depending on how much wealth you have, you don't have to cash out 100% of stocks to buy real estate. You can consider rebalancing your net worth more towards real estate while still investing a good percentage in stocks.

Taxes can really put a damper on returns, so make sure to calculate the resulting tax consequences of cashing out before making any moves.

Where And What Real Estate To Buy

The obvious question is where and what real estate to buy if one does cash out of stocks.

We should buy what we intimately know and buy in markets that will see the strongest job growth while also having attractive valuations.

I know San Francisco the best, hence I will focus one part of my search looking for ocean view properties that have expansion potential. Fixers listed by out of town agents are always my favorite types of properties to buy.

Then I'll continue to look at non-coastal city real estate that has the highest potential to be the next Silicon Valley. Cities like Austin, Houston, and Denver have already been discovered.

But there are many other cities like Birmingham and Des Moines that have yet to receive much fanfare that can be invested in through real estate crowdfunding platforms like Fundrise and CrowdStreet.

Fundrise has eREIT funds for diversified real estate exposure. Meanwhile, CrowdStreet focuses in individual commercial real estate deals in 18-hour cities.

Both platforms are free to sign up and explore. I’ve invested $954,000 in private real estate funds so far.

Invest In Private Growth Companies

Finally, consider diversifying into private growth companies through an open venture capital fund. Companies are staying private for longer, as a result, more gains are accruing to private company investors. Finding the next Google or Apple before going public can be a life-changing investment.

Check out the Innovation Fund, which invests in the following five sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

Roughly 35% of the Innovation Fund is invested in artificial intelligence, which I'm extremely bullish about. In 20 years, I don't want my kids wondering why I didn't invest in AI or work in AI! And valuations for private growth companies have become much more reasonable post pandemic.

The investment minimum is also only $10. Most venture capital funds have a $250,000+ minimum.

In addition, you can see what the Innovation Fund is holding before deciding to invest and how much. Traditional venture capital funds require capital commitment first and then hope the general partners will find great investments.

Dude I LOVE real estate too but you’re pushing some anti-stock market propaganda.

Real Estate provides utility because they are buildings with rooms. Families can live there! You can have office space!

Stock market provides utility because companies grow. Work at a company, you can buy your family food and shelter! If you work at a successful company, maybe you can provide family vacations, education and opportunity.

Real Estate is real, not imaginary. It is legit, and reliable. But if you use a little imagination, you can see both have tremendous utility for many people around the world.

Thanks for your comment! About 30% of my net worth is in stocks and 50% is in real estate.

I like both. However, I think returns for real estate will do better than stocks now. Further, real estate is more stable.

I’m all about passive income generation as a retiree.

Hi Sam,

I really enjoyed reading this informative article. I could really use some of your wisdom. I’m 26 years old, a full time student, and a veteran. In 2014 I began investing and I’ve been maxing out mine and my wife’s IRA’s ever since. I’ve also been investing in index funds and ETFs, with an emphasis on growth. We are 100% in equities and our portfolio is about $275,000. I have always leaned towards the simple adage of basically ignoring headlines and just investing diversely and consistently. That has worked pretty well so far. Still, I’m scared that we have just been in a once-in-a-lifetime bull market and that funds like the S&P 500 may flatten or decline over the next 10 years. I’m thinking about cashing out maybe like 100,000 and buying some cheap rental property. I can’t get a mortgage with my low student-life income right now, or else I’d buy a home for my wife and I to live in, so I would try to find like a cheap condo or something. I’ve been looking at some for like 85,000 in Myrtle Beach. Am I thinking irrationally? Thanks

If the stock market looks overpriced, what does that say about the Bay Area housing market. Isn’t that the biggest bubble waiting to burst with 40-50% of people wanting to get out of there as soon as they can according to the surveys. If you’re looking for real estate, seems like somewhere outside of the Bay Area is a better bet.

I actually think San Francisco is one of the cheapest international cities in the world.

https://www.financialsamurai.com/the-cheapest-international-city-in-the-world-san-francisco/

But I’m also diversifying into the heartland of America too.

https://www.financialsamurai.com/focus-on-investment-trends-why-im-investing-in-the-heartland-of-america/

I sold my rental property because I wanted to pay off my primary residence and experience debt-free living.

Now I feel stupid.

Big mistake. Unless there’s an earthquake.

Sounds like you listened to too much Dave Ramsey lol

Sam,

How about an article with guidance for folks who are near retirement and want to protect their 401k from the coming crash? Market timing is impossible, and jumping into TBills seems too conservative. Even bond funds have risks. Any thoughts?

Hi Sam,

I read your posts often and I’m a huge fan of the website.

I am NYC school teacher, and I have eschewed purchasing real estate in the Tri-State area for years. I have always found reasonable rent, and worked hard to max out my 403B account.

NYC school teachers get a handsome, guaranteed 7% rate of return on our tax deferred 403B. I have been maxing it out for many years. You’d be shocked at what a small percentage of teachers recognize how huge a benefit this is. We also have a defined benefit pension, which I can retire and claim at 55-years-old. I am currently 37, and on a great career trajectory.

My wife is an architect, and she works in Midtown. Together, we have a combined gross income of $220K. We have an infant son, and we pay $2100 a month for a two bedroom apartment in a very desirable Queens neighborhood.

My question is, should I continue to max out my 403B to a tune of $19K a year, watch the interest snowball, or start dialing down my input to have a bigger downpayment?

I just feel that owning real estate for “middle class” people in the Tristate area is a “want” and not a “need”, especially since rents are coming down.

I now feel the pressure to purchase a home and move to the suburbs. Homes in neighborhoods with decent school districts and sane commutes are around $700k. I would like to move when my son is five or six, so we have some time.

Is it really worth saving $200k for a downpayment, and then tying it up in a house which will be over 60 years old and need work? Is there a better place for my liquid dollars than a house?

My wife and I are frugal, hardworking people and this is a huge decision.

Thanks!

What you call “arbitrage” I call market timing. The chances of successful market timing are very low, as you know. Its easy to look back and say “see, if you got out of stocks here and got into real estate there, well that woulda been a great move!” Bullshit. I am a Los Altos native so I am very well aware of the ins and outs of the Bay market. I made and lost plenty of money both in 2000 and 2008. Since 2008 I bought quite a bit of real estate, because I was disillusioned with stocks. Now. I have a more balanced approach. I buy index funds on the first business day of every new quarter. This entirely eliminates any suggestion of market timing. I am always looking for real estate, and I buy when the numbers work. “when the numbers work” is a rubric that has nothing to do with the overall state of the market.

Indeed. Check out this post: Every Decision You Make Is Market Timing because life is unfortunately finite.

Are you retired now? Any other investment and financial tips you have to share? Thanks

I’m not retired, I don’t think I will ever “retire”. Working less, yes I could imagine that at some point. But I am definitely still in the asset accumulation phase. I am pretty highly leveraged, so far that has been working out well. Another great thing about real estate. I wouldn’t be able to sleep at night with leverage in stocks. But I have no problem with leverage in real estate as long as the fundamentals of the individual properties are sound.

Always a great insights Sam, thank you. Given most of my assets are in taxable accounts, divesting out of stocks is going to cost 15-20% in capital gains – which, given the S&P 500’s performance over the last 10 years, is going to be substantial. That means locking in a loss in overall net worth to avoid a potentially larger reduction if there’s a downturn. I’d certainly like to de-risk and rebalance as per your guidance so, do you have any advice on how to minimize this, how best to decide when this is a good idea, or what the right rebalance might be?

Got to focus on your losers and underperformers first. I’d also consider shifting new cash flow into real estate if that’s what you want to do, instead of stocks. That will then have no tax consequences.

I’m going to allocate more to real estate crowdfunding as it’s been good so for since 2016 and 100% passive. I really feel strongly that we should be investing in the NEXT Silicon Valley and buy real estate there.

Thank you Sam. I’m already following your advice about redirecting new money (and switching off auto dividend reinvest, which was a big one). In my case, this mostly redirecting to munis, as my employer – like many financial institutions – doesn’t permit crowdfunding as it considers it private placements. Can’t do much about the underperformers though, as all of the indices have rocketed up in value.

There has never been a “cut” to any of your mentioned items. More money is being spent on them now than ever before. We spend more on education than almost every other country in the world. We spend more on Healthcare than any other country and or standard of living is one of the highest.

Plus with the trillions of dollars in normal everyday people’s 401k’s and IRA’s not all the wealth has been transferred to the ruling class. It seems like Mr. Samurai and myself were able to tap into some of that wealth from the stock market.

Hi Sam,

I have a question about the performance of real estate VS stock in the economy down turn. Since the market is at its high point, and many people are worried that crush could happen in the next few years. I am wondering which asset will suffer more in an a crush like 2000 or 2008? I know that in 2008 stock fell more than 50%, and bay area house lost about 20% to 40% depends on the region. But considering the house is usually purchased with 2X to 4X leverage, it seems that those who purchased house at peak time will actually suffer more than who hold stock.

So what’s your opinion about this? Do it imply that we should be more cautious about leverage at this moment? And can you share your insight about the recovery of stock vs real estate after the crush? Thanks!

Sam, I am a long time reader, but infrequent poster. I have been investing in the stock market and real estate for more than thirty years. My experience has been to consistently invest in the stock market regardless of the perceived level, and diversify accordingly into index funds of different assets classes. The stock market has always risen over longer periods of time, so stay the course for the long term has been my strategy. I also buy (rental) real estate, but in a very different manner. I look for opportunities to leverage inequities in particular markets. This required a very intimate knowledge of my specific real estate markets, rental rates, vacancy factors, demographics, etc.. It also required a specific knowledge of hard real estate components to recognize those opportunities for repositioning for appreciation. I have a very specific strategy that has provided a consistent average ROI in the 10%-15% range across my real estate portfolio year-in and year-out. I’ve had high years in the mid-20% range (utilizing leverage in a very controlled manner), and my worst year was 9.7% in real estate (2018, due to the deleveraging of assets, a natural occurrence as properties pay off). I currently own fifty-four rental units at present. I have roughly half of my assets in the stock market and half in real estate, and would eagerly buy more real estate, if the opportunity presented itself. Unfortunately, my markets aren’t providing quite as strong of a buy opportunity at present. Rest assured, that will eventually change and I will buy more when the opportunity is right again.

So, I would argue, if you have an intimate knowledge of your market, fully understand the projected ROI of the assets in your market, and can leverage opportunities to create appreciation of those real estate assets, then by all means diversify some portion of your portfolio into your real estate market. If not, then stick with your known. Both real estate and the stock market are wonderful long term assets, but with very different opportunities of inequity, and more importantly, very different knowledge requirements.

That’s a very savvy answer. You seem to be very disciplined and focused. Impressive.

Impressive approach. I am a young guy, 27 years old. I played in the NFL for 4 years and have been fortunate to make some money and be able to buy a two family rental home almost 3 years ago which has done excellent for me.

I love real estate, but I also can’t help but believe that as long as you know you can wait it out, nothing beats growth stocks in the long run. Well diversified and you have to know your plan and yourself. For my 401k which is up to a pretty good number I am all small and mid cap stocks. I just don’t see the point in bonds or even large cap stocks for me. This is an account I likely won’t touch for another 30+ years. Some say I should diversify more and buy bonds too, international stocks, large cap dividend stocks, but I just don’t see it.

I am also considering going into wealth management. This is a great website and I look forward to reading and commenting more.

Cheers,

Kris

For more than three decades the stock market has served as the primary financial mechanism through which the American ruling class has carried out an unprecedented redistribution of wealth from the working population to the rich. Under Democratic as well as Republican administrations, the Dow has risen 17 fold since 1985 on the basis of a relentless assault on workers’ jobs and wages and cuts in education, health care and other social services.

There’s no money for schools, but plenty for luxury vehicles, penthouses and vacation homes.

This won’t last. You can only stand on a people’s necks for so long.

Great stuff. I enjoy reading your consistent negative rhetoric.

Can you provide some potentially good solutions so we can rise up? Thanks

I hear your concern Socem.

But being that you are so aware of how promising stock market returns are, I take it you do take advantage and invest yourself right?

Cheers,

Kris

Hey Sam, great article. At first I was bewildered, but then again people who think one step ahead are long term successful.

I remember your long ago article about Golden Gate Heights. Do you still think its a great area/price to buy currently?

Al, what are some things you are specifically bewildered about?

Yes, I think buying property in Golden Gate Heights if it has an ocean view is still a no-brainer over the next 10+ years. No other international city in the world has property with ocean views that trade at a discount.

Bewildered was too strong word, in the sense that I read with great interest the process of how you sold your property near the marina. And I thought you weren’t coming back to real estate for a long time! I don’t have deep knowledge of the markets, so was just curious what your thought process was before reading the article.

By the way, I’m one of those people who bought relatively recently in Golden Gate Heights. It was only after I closed that I remembered its the very neighborhood you mentioned in your article! While I don’t have panoramic views, I still can see the ocean/sunset, I fully agree with your opinions of the the area, and love it!

Congrats!

I sold in 2017 and the markets went up then went back down, we we are right back to where I sold. Official p/sqft was $1,323, which I’m still very happy about since the house was on a busy street next to the busiest street in the city.

I bought two years of time to be a SAHD and I’m appreciative.

Love GGH and the peace and quiet and think there’s another opportunity now.

If you are 10 years away from retirement it might be good to take some cash and buy your retirement home. You could use it for a rental till you are ready. When you do retire sell your existing home and pay off the mortgage on the retirement home with the proceeds. Then you are retired where you want to be with no mortgage

I am 35yo 500k net worth and renting. I do not plan to buy real estate in the next year.

I believe real estate is overvalued and will be in a medium term (~3 years) bear market. My rationale is that real estate is a safe haven asset similar to bonds. Let’s say real estate yields a 3.5% price appreciation per year. Around the world government bonds world between 0% and 2.5%. Therefore, if you are a wealthy billionaire or pension fund it is smarter to overweight real estate relative to bonds for the last 10 years. 3.5% real estate returns is better than 0-2.5% bond returns without much additional risk.

As government bonds normalize back to their long term returns of about 4% the lesser real-estate returns are comparatively less attractive. This will result in billionaires and institutions selling real-estate as they move to a more even weighting of bonds in their portfolios. The result of this will at least be lower prices as real estate is sold, and could possibly be a big price drop if people start panicking and there’s a rush to sell out of fear prices will keep going down.

Gotcha. Have you been able to benefit from real estate price appreciation since you graduated high school or college?

I’ll be excited if Barnes normalize. As I have a decent waiting. But I think interest rates are going to continue to remain depressed for a long time.

My FI target is $3MM so I’m still in wealth accumulation mode and therefore am 100% invested in stocks.

I expect the 30 year treasury to be above 4% in 24 months time so I’ll look into diversifying into bonds and real estate at that time.

Got it. Are you interested in taking a bet on the 4%? I will bet that it won’t reach 4% at anytime during the next 24 months.

With a $3 million net worth target with a 3 million net worth target, let’s do $100 at the minimum!

Will use this comment section as proof. Further, you should consider shorting bonds if you think rates will go up so high.

Remember that in 2013 with the federal funds rate at 0.25% that the 30 year treasury yielded 3.8% in an event known as the “taper tantrum”. The “taper tantrum” was the market re-setting bond prices to market price. The FED then swooped in and purchased $1 trillion in treasury bonds which, due to the rules of supply and demand, massively dropped bond prices again. The lesson is that the market price for rational investors is closer to 4% and it takes the federal reserve acting as a purposefully irrational investor to depress bond prices.

So the first question is, is the secular federal reserve tightening or loosening monetary policy? Powell is very very clearly a secular tightener which means without the market forcing him to do something, if Powell is left to his own devices he’s going to tighten rates.

So then the next question is when will rates start tightening again? Well in 2016 we had an early-year crash and Yellen paused rate hikes for a time but then hiked rates about 12 months later in December. I think Powell will take the same path where as the danger from the crash subsides he’ll start rate hikes again in December 2019. If he continues for 4 0.25% rate hikes throughout 2020 then by my reckoning the federal funds rate will be at 3.25% and the treasury yield will be over 4%.

Sure. But remember, the Fed can raise rates and the 10-year yield can stay the same or decline.

The Fed doesn’t dictate the 10-year bond yield, the market does.

I love our bet! We can just send money electronically via Paypal or Venmo.

I’m on record since 2009-2010 saying interest rates will stay depressed for the rest of our working lifetimes, and I’m going to stick with it.

Sam-First time caller, long time listener here. Great article that really makes you think. I have been on the fence about doing the exact opposite – turning a couple of my rental properties into stocks. We are closing on the sale of one of our rentals next week. I have been seriously thinking about putting up some storage units, but I have also been considering just going with index funds. Either way should be a pretty solid investment, but this article has my brain spinning again :)

If you want cash flow real estate is the way to go. 4x leverage (for rentals) which cannot be obtained in the stock market.

If you want appreciation and simplicity then I’d stick with stocks.

I’m not a momentum chaser and I think shifting money between asset classes to anticipate the business cycle is way above my pay grade.

Personally all of my excess income is going straight to the bank now. I see both stocks and real estate as overpriced. I already own enough of each that I don’t feel greedy. I’ll patiently wait for some deals after the next downturn.

Sam,

Have been a long time reader of your blog – this is my first post.

My wife and I both work in tech with more than 70% of our networth in stocks, particularly concentrated in enterprise SaaS.

I am always surprised by the similarity in our hypothesis. Just a couple weeks before you published this article, we moved out of some of our stock investments (given the uptick in big tech SaaS over the past 2-3 years) and moved the capital to real estate – purchased a single family in Reno. I know the Reno market is frothy however we were able to negotiate a good deal (IMHO) . Our first investment property, fingers crossed.

I am like you and have some investments in enterprise SaaS companies like Okta, Now, Splunk. Their valuations seem extremely expensive using the normal evaluation metrics. If you were stranded on an island, and wont have access to the internet, which SaaS company would you hold for the next 10 years? I like SaaS because they solved a real problem, scales easily, almost no variable costs and distribution cost. But boy, their valuation is so frothy.

I think shifting out of stocks for opportunistic real estate is not a bad idea at all right now. Sounds like you’re always shades of gray rather than black / white, so shifting from extremely high valuations and one of the most impressive runs in history seems like a good punt. Good luck!

i am going to flip the switch on you here Sam. I am 26 – have around 35k in cash. I max out my 401k as well. Would you invest it into some stocks and leave it for awhile or look to put ad own payment on a house?

Would love to hear any ideas.

Sounds like a good idea but we had thought about it. Stocks are fairly simple to buy, Real Estate has all other kinds of issues, renters, maintenance, property taxes and all the other costs associated with it. My house in Fremont, CA is over a million dollars now. I looked at Real Estate in California and just the property taxes alone (because of prop 13) are killers. Trying to relocate and downsize in retirement is onerous enough unless they pass the property transfer tax initiative in the coming election.

For me I just reduce my stock exposure and ladder with inflation protected bonds. I am only 30% exposed right now to stocks because of high valuations. I will start to reverse dollar cost back into the market when I see valuations return to an appropriate level

I like diversification – while pouring money into standard Roth and sep retirement funds, the advantage of leveraged debt in real estate can’t be ignored. Plus other tax benefits. I have percentage of funds on sideline in Safe investment to buy in next downturn. This will benefit my position over next 20 years IMO

Sam, thoughtful post, as always. Asset Allocation decisions are always difficult. As many have said, my view is rental income is important to ensure the success of real estate investments. In our situation, we really don’t want to deal with the “renter issue” in retirement, especially given our Great American Road Trip this summer. I’m keeping a lot of dry powder, but maintaining a ~50% exposure to stocks as a long term play. We do keep some REIT’s in our allocation (and Peer-To-Peer), I may look at increasing them slightly based on your post, though the risk of future interest rate increases does bear consideration. Always difficult, indeed.

Sam – overall, I do like rental properties. I am actively looking to continue to add to my rental portfolio in NYC.

If tax isn’t a factor, I would convert most of my stock holdings over the next 3-6 months and put that money into work in rental properties in NYC (with maybe a max 10% net worth weighing in public equity). Right now, a steady cash flow stream is probably more important to me than appreciation of assets – and I feel rental properties provide monthly cash to me better than stocks.

There are a lot of factors potentially working against real estate in NYC (such as the recent increase in transfer tax and mansion tax) but I am a long term investor. I like the cheap financing available now and people will always need a place to live. And I bet people will continue to be interested in living in NYC for decades to come.

I am not sure how to realize my equities in a tax efficient manner. I might explore creating my own O-Zone Fund but then that isn’t a strategy (purchase price of a property is 50% of total cost so need to spend a lot of money/time to renovate/build out) I currently employ.

If you know of any good tax efficient manner of converting funny money in stock appreciation, please share.

Have you considered a self directed IRA for using funds from your ira or 401k to purchase real estate. It helps avoid many of the tax burden from liquidating stocks and bonds.

I wouldn’t entirely because of the carrying costs involved. Property taxes namely. It looks good on paper, but you don’t have to pay hundreds of thousands per year in holding taxes on stocks. So if you’re stuck waiting a few years for your real estate to pan out….. The bill will feel hard to swallow. Also – Dealing with renters sucks.

Unless of course you have an expected purpose beyond just a rental property. If you need more space for a business venture or other purpose, then by all means.

I totally agree. The carrying cost is onerous. But I’ve got some ideas for the property and I put together a post but I’ve been thinking about for the past couple of months.

I’m thankful he in a position where I don’t need the rental income, and would like to have this property as a Financial Samurai office or as a place to house a childcare help of our family expands. Lots of options.

That’s where the intangible benefits start to add up. How much is office space worth to you? How much is having an optional place to put staff / help / visiting friends / visiting family? Worth 100K in taxes? It becomes less about the math and more about your preference.

Mathematically – I probably would advise against what you’re suggestion. But clearly this is about more than the numbers to you.

Good luck!

Have you considered using your stock portfolio to qualify for a mortgage? I think it’s called an “asset based mortgage” or “asset depreciation mortgage” and Quicken loans does them (according to Reddit and your fellow FIRE blogger Darrow Kirkpatrick). I’ve considered it but I’m not as bullish on real estate as you are and I’m not particularly interested in becoming a landlord right now.

Yes, asset based pricing works to get a mortgage. Not a bad idea, but I want to continue focusing on reducing debt.