A stock market downturn will eventually come, whether you like it or not. As someone who worked in Equities at two major Wall Street firms since 1999, I've seen so many stock market massacres. In fact, during the height of the pandemic, I predicted the stock market bottom in March 2020.

Let me share with you how to weather the next stock market downturn so you don't have to waste too much time trying to make back all your losses. Remember, if you lose 50%, you must gain 100% just to get back to even!

I encourage investors to go over their stock portfolio allocation to make sure it matches your risk tolerance. Further, I strongly believe real estate is going to outperform stocks in this environment due to record-low mortgage rates and a desire for real assets.

Four Ways To Weather A Stock Market Downturn

1) Keep buying.

This is the exact opposite of what your emotions would have you do. When the market is falling and investors see their hard-earned money depleting in front of their very eyes, the natural reaction is to sell and hold on to what they have left. This reaction, however, is the absolute best way to lose money.

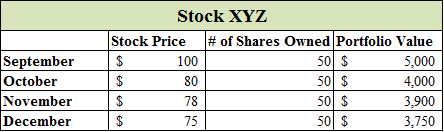

If the stock value falls by 25% and an investor promptly sells, they have just guaranteed themselves a 25% loss. As you can see below, instead of a $5,000 portfolio value, the investor would be left with just $3,750 after the sale.

What if, instead, they decided to buy when the market was tumbling, and then the stock returned to its original share price? One might think that the difference would be insignificant, but letís take a look and see for ourselves.

The stock price fell for three straight months, but the investor continued to contribute $300 both while it was falling and during the rise back up to the $100 mark. With a portfolio value of $5,000 in the beginning, you would expect that his overall value would be $6,500 after the five months since the stock price returned to its $100 value.

However, this is not the case. Thanks to dollar cost averaging, the portfolio balance is actually over $6,800! Instead of selling shares in a down market, consider those shares to be discounted and continue to buy. When the price returns, the value of your portfolio will stun you.

2) Short the market or hedge.

Many have heard the term shorting the market, but few really know how to do it (and do it successfully for that matter). In its most basic form, one would borrow shares of stock and sell them with the agreement of buying them back at a later date.

By selling near the peak of the market and buying after it tumbles, moneycan be made with this investment strategy. As a concept, the idea sounds fairly simple, but executing it at the right time is quite difficult. This is why many investors choose to leave this to the professionals.

Instead of jumping in and out of individual stocks during a bear market, wise investors simply find inverse ETFs that will short many companies at once. Examples of such ETFs are: Short Dow 30 (DOG), Short S&P 500 (SH), and Short QQQ (PSQ). By investing in funds like these in a bear market, portfolio values would soar. However, keep in mind that if one selects these funds outside of a bear market, they will likely fall in value.

I think the best way to invest is to keep investing on a regular basis for the long-term.

3) Buy Commodities.

When the stock market falls, the value of commodities (ie. gold and silver) tends to rise, often because of the uncertainty in the market. Take a look at the chart below. The black line is the value of the Dow Jones Industrial Average (DJIA) from 1970 to 2012, and the yellow line is the spot value of gold during the same time period.

For many years, gold sat steady below the $500/ounce mark. Then something happened the value of the overall stock market began to crumble. Suddenly the demand for shares of stocks decreased and the demand for tangible assets shot through the roof.

Since there is only a finite supply of gold, the value of each ounce increased with the spike in demand. Within just three years, the value of gold increased by more than 300%. If you see a bear market coming on the horizon, be sure to invest some of your money in precious metals. They are a fantastic hedge against a down market.

Source: www.goldsilverworlds.com/gold-to-silver-price-ratio-dow-jones-to-gold-price-gold-vs-us-dollar-rate/

4) Maintain your asset allocation.

We all know that it is wise to have a well balanced portfolio (ie. a certain mix of stocks, bonds, cash, etc.). But did you know that keeping your balance is essential to earning your maximum amount in the market? As the market rises and falls, your desired allocation will change. As an example, the stock market may rise quickly and the value of bonds may decrease.

With this simple phenomenon, your desired asset allocation will become severely out of balance, causing you to own a greater share of stocks than you desire. With a diversified portfolio, you can better weather a stock market downturn.

If you do nothing and the value of your stocks experience a correction and your bonds once again rise, then your net gain is essentially zero, as both investments have returned to their initial value. However, if you would have reallocated (or rebalanced) your stocks and bonds to back to your desired ratio prior to the correction, then you would have sold off those high-valued stocks to purchase more low-valued bonds (sell high, buy low).

Then, once the stock values decrease and the bond values increase, your portfolio will be much larger than if you would have done nothing at all. When there is volatility in the market, be sure to rebalance your portfolio for maximum profitability.

5) Diversify Into Real Estate

My favorite way to weather a stock market downturn is to invest in real estate. Roughly 40% of my net worth is invested in real estate because it is more stable, provides shelter, and generates income.

In addition to owning your primary residence and rental properties, I suggest owning public and private REITs to truly diversify and get long real estate. In a low interest rate environment, assets that generate cash flow become much more valuable.

Take a look at my two favorite real estate crowdfunding platforms. They are free to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially higher growth due to job growth and demographic trends. If you have a lot more capital, you can build you own diversified real estate portfolio.

I've personally invested $810,000 into real estate crowdfunding to help weather any future stock market downturns. Take a look at how well Fundrise did in 2018 when the stock market was down. Fundrise also significantly outperformed in 1Q2020 when the stock market was melting down.

Economic Shifts Are Important To Pay Attention To

There are always those that think the market will forever rise. Then there are others that constantly see the impending doom and gloom. It is best to avoid both of these types. Instead, view the market objectively and perform the research through trusted sources. A stock market downturn will happen. When it does, your goal is to try and outperform.

If there are signs that the market may soon be falling, take a more conservative approach in your investments. If you lose 50%, it takes 100% to get back to even. Remember the first rule of financial independence: never lose money!

Finally, I highly recommend everybody sign up with Personal Capital's FREE financial tools. You can use Personal Capital to track your net worth, x-ray your investment portfolio for excessive fees, manage your cash flow, and better plan for retirement. I've used Personal Capital to optimize my net worth since 2012. They have the best financial app and tools on the web today.