The first rule of financial independence is to never lose money. If you lose lots of money, you ultimately lose lots of time. And time is your most valuable asset. Don't go too backwards!

The second rule of financial independence is to never forget the first rule. As one of the founders of the modern-day FIRE movement, it is important to keep going forward on your FI journey.

My Journey To Financial Independence

In 2009, I made myself two promises when I started Financial Samurai: 1) write 3X a week on average for 10 years and 2) never lose money again.

We had just gone through a financial beating where my net worth got slashed by 35% – 40% in just six months. The pain was too much to bear, so I decided to take up writing instead of drugs and alcohol.

I knew that worst case, if I stayed committed with Financial Samurai, in 10 years I'd have the option to escape full-time work. When you spend at least 10,000 hours on your craft, you will have opportunities.

Further, I knew that if I never lost money again, in 10 years by simply earning a conservative 5% rate of return plus annual savings, I'd surpass the net worth that I once had before the financial crisis by at least 2X.

Achieving financial independence takes discipline and patience. But once you get there, you'll realize all your effort was well worth it.

The First Rule Of Financial Independence

The first rule of financial independence states that you should never lose money on your path to financial independence, especially after achieving financial independence. It's not easy to do, but with the proper asset allocation, you increase your chances of at least losing less money than the average investor.

If you lose 50% of your net worth, you need a 100% gain to get back to even. But worse than trying to recoup your losses is the loss of time. The older you get, the more you realize everything you want to do is a race against death.

Once you've experienced financial independence, when your gross passive income covers your desired life's expenses, you never want to return to the salt mines again. Protect your cash flow at all costs!

Risk Assets Will Inevitably Go Down

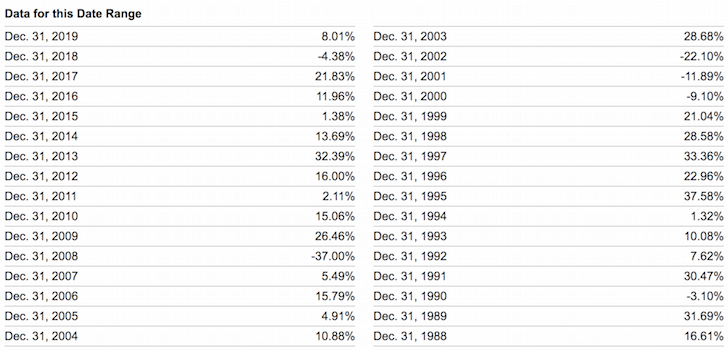

Ideally, your investments never go down, but we know from history that in any given year, there's a ~30% chance the S&P 500 will end in the red. Therefore, it's almost impossible to never have a down year with any of your risk assets.

So what is a financially independent person supposed to do? The solution is to either completely de-risk, diversify, or have alternative income streams beyond your passive income to bolster potential investment losses.

If you cannot avoid losing money in your investments, then you must certainly avoid an annual net worth decline. The solution here is to buffer your potential investment losses with aggressive saving and additional sources of income.

Financial Independence Archetypes

There are different levels of financial independence. Let me share some examples of various financially independent archetypes I've met. We'll discuss how they plan to always follow the first rule of financial independence.

Financial Independence Archetype #1:

60-year-old couple, $3 million net worth, $90K passive income, $90K total income, $50K expenses

Due to inflation, $3 million is the new $1 million. We've got to move past the belief that having a $1 million net worth means you're a millionaire. A $1 million net worth means you're earning about $30,000 – $40,000 a year in gross passive income. This does not reflect the traditional millionaire lifestyle.

With a respectable $3 million net worth, however, archetype #1 lives a comfortable lifestyle off a low-risk 3% return or $90,000 a year in net passive income from AA-rated municipal bonds.

The 60-year-old couple has no debt and their kids are independent adults. They could increase their withdrawal rate and eat into principal, but they want to remain conservative.

The couple has no desire to work part-time or consult for money. They are happy with what they have.

Since they only spend $50,000 a year, they get to reinvest $40,000 a year to earn another $1,200 a year in net passive income to keep up with inflation and boost their financial buffer.

Their net worth should never go down because there has been a 0% default history on AA-municipal bonds in their state.

Further, within five years, the couple expect to begin receiving an additional $40,000 total in Social Security for the rest of their lives.

Related: When To Take Social Security? Make So Much It Doesn’t Really Matter

Financial Independence Archetype #2:

Late 30s, $10 million net worth, $208K passive income, $80K part-time consulting income, $288K total income, $130K expenses

This couple hit it big when the husband started early at a hot startup that went public after 10 years. At the age of 38, the husband decided to retire and live off the $10 million after-tax windfall after he sold all his company stock.

He married a school teacher eight years his junior. He then asked her to spend more time with him in retirement to travel. They're planning to have their first child in the next two years. They want to do the crazy dual stay at home parent thing.

Because the couple is relatively young, they feel comfortable taking on more risk. Further, with part-time consulting income of $80K a year, they only need to earn about $50K after-taxes to fund their $130K in annual expenses.

As a result, their net worth is composed of: 20% in the S&P 500, 20% in their primary residence, 50% in AA-municipal bonds, and 10% cash.

When To Take More Risk On Your Financial Independence Journey

60% of their net worth will generate about $180,000 in passive income at a 3% rate of return. The $2 million S&P 500 index position also generates about $28,000 a year in dividends due to a ~1.4% gross yield. Add on the $80,000 in part-time consulting income, and we're talking $288,000 in annual net worth increase, or 2.8% +/- any increase or decrease in the value of the S&P 500.

With $2 million of their net worth exposed to the S&P 500, this couple can afford to lose 13% in their stock holdings before their net worth starts going down. They are indifferent about the value of their $2 million primary residence because they plan to own it forever.

Their ultimate goal is to grow their net worth by a stress-free 4% a year. At this rate in 10 years, their net worth will have grown to about $15 million. If there is a particularly rough patch in the stock market, the husband will ramp up his consulting work. He has the capacity to earn up to $250,000 a year in consulting.

Worst case, they could invest $10 million of their liquid net worth in 10 years in a portfolio of municipal bonds. These muni bonds would yield them $300,000+ in after-tax passive income. And Treasury bonds now yield ~4%.

Even if their expenses grow from $130K to $200K after conceiving a child, they'll still have a $100,000 a year gross surplus of cash flow. This couple is unlikely to ever lose money again.

Financial Independence Archetype #3:

40s, $5 million net worth, $150K passive income, $300K active income, $450K total income, $120K expenses

$5 million is the recommended minimum you'll need if you want to retire comfortably in an expensive city with a child. One look at the budget and you'll recognize this reality.

Archetype #3 is in their 40s with one 5-year old child who began attending private kindergarten that costs $30,000 a year. The couple's total after-tax living expense is $10,000 a month.

The couple is financially dependent and are no longer working full-time jobs after 20 years of grinding away. The difference with this couple and the other two couples is that they have an online business. It generates $300,000 a year in gross income.

The wife started her online store selling a variety of women's goods on the side while working as a Marketing Director.

She read Financial Samurai and thought, why not utilize my expertise at my day job and create something of my own. After all, one of the best ways to get next-level-rich is to grow your own equity.

Solid Income Generation

With a combined $450K a year in gross income and only $120K in annual after-tax expenses, they have roughly a $300K annual gross buffer. Therefore, this couple is willing to take more risks with their investments.

Their net worth is currently composed of 30% in various large cap dividend stocks, 25% in real estate, 40% in AA-municipal bonds, and 5% in a high yield online savings account.

With $1.5M in stocks and a $300K annual gross surplus after expenses, this couple is able to withstand a 20% decline in their stock portfolio before they start losing money.

Using Financial SEER, this couple's Risk Tolerance Multiple is a reasonable 13.8X if using a 35% expected average bear market decline. Their risk tolerance multiple is just just 7.9X if using a 20% expected decline in their stock portfolio.

This couple's ultimate goal is to achieve a $10 million liquid net worth by their 50s. Once they do, they can generate ~$300,000 a year in passive income and hedge against a decline in their online business.

Never Lose Money Again

Unless you're risking other people's money, it's actually hard to lose much more than 20% in a well-diversified public investment portfolio. Yes, we know the average bear market declines by roughly 35% since 1928. However, that's for stock performance alone.

Once you construct a balanced retirement portfolio of stocks and bonds, the volatility declines tremendously. Add on alternative investments, and it may be even harder to lose 35% in any given year.

Take a look at the worst year performances of the following balanced portfolios below. Even with a 60% / 40% weighting in stocks / bonds, -26.6% was the worst annual decline.

Major Point For Financial Independence

If you've actually achieved financial independence or are clearly on your way to financial independence, there's no way you should be risking the majority of your net worth in risk assets. Build alternative income streams to support your plane if one engine burns out.

Please know that you are only financially independence when you have enough passive income to cover your basic living expenses or more. You can try and trick yourself into thinking you're financially independent by saying you're Coast FIRE. You can also try to change the rules of FIRE to suit your needs. But you'd only be tricking yourself.

If you are not comfortable with what you have, then you have not yet achieved financial independence. In other words, your financial independence number is not real if you don't change your life. You might even be making your spouse continue to work at a job she hates because you are not financially secure enough to let her enjoy freedom too.

The FIRE Journey Will Be Bumpy

We must also recognize that except for 2018, it's been easy to make money each year since 2009. Not only have stocks performed well, but so have bonds, real estate and other alternative investments.

Therefore, let us not overestimate our investing prowess. Confusing brains with a bull market is a dangerous mindset. I've known too many people to take excess risk only to lose it all and then some.

The good thing about the 2022 bear market is that wakes people up from complacency. Complacency leads people to violate the second rule of financial independence: never expect your income to always go up. The second rule of financial independence is also the second biggest financial mistake you can make.

Learn To Be Happy With Enough

The feeling of never losing money is wonderful. We just need to be aware that there's a never ending amount of money to be made. It's okay to love money. But, as soon as we find a way to let go of our desire for more, we tend to feel more satisfied and happier.

Finally, the great irony of following the first rule of financial independence is that you may actually end up making much more money long-term. When you've structured your finances to be bulletproof, you've essentially created your own perpetual trust fund.

It is precisely your financial security that allows you to take more risk. And it is the risk-taker who tends to gain all the spoils.

After blowing up my passive income in 2023 by buying a new forever home with cash, I'm technically no longer financially independent. I'm about $50,000 a year in passive investment income short. However, fret not. My blow up was on purpose given I wanted to buy the nicest home I could afford when my kids are still living with us. In addition, with my daughter going to school full-time starting in September 2024, I'm got more free time to work.

I'm grinding my way back to FIRE by December 31, 2029. And you know what? I'm invigorated to earn again! Every person needs a purpose. It's nice to have a clear goal to make more money again.

Related: What Does Financial Independence Feel Like?

Invest In Real Estate To Build More Passive Income

Real estate is my favorite asset class to build wealth and achieve financial independence. However, after owning a certain amount of physical properties, there becomes too much work involved in land-lording.

As a result, one suggestion is to invest in private real estate funds and deals online. This way, you can diversify your portfolio, earn more passive income, and minimize stress. Here are my two favorite platforms.

Fundrise: A way for all investors to diversify into real estate through private funds with just $10. Fundrise has been around since 2012 and manages around $3 billion for 350,000+ investors.

The real estate platform invests primarily in residential and industrial properties in the Sunbelt, where valuations are cheaper and yields are higher. The spreading out of America is a long-term demographic trend. For most people, investing in a diversified fund is the way to go.

I've invested $954,000 in real estate crowdfunding so far. My goal is to diversify my expensive SF real estate holdings and earn more 100% passive income. I plan to continue dollar-cost investing into private real estate for the next decade. Both platforms are long-time sponsors and I'm currently invested in Fundrise.

Recommendation To Achieve Financial Independence

It's easier to achieve financial independence if you diligently keep track of you finances. To do so, sign up with Empower, a free financial tool online. It aggregates all your financial accounts in one place.

I've been using Empower to track my net worth since 2012. As a result, I have seen my wealth sky rocket during this time period.

Their 401K Fee Analyzer tool is saving me over $1,700 a year in fees. They've also got a great Retirement Planning Calculator. It uses real data and Monte Carlo simulations to produce realistic retirement results.

There's no rewind button in life! Let's not waste any more time.

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Please share, rate, and review!

For more nuanced personal finance content, join 65,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.

Hi Sam,

I was reading this article in conjunction with today’s article.

https://www.financialsamurai.com/capital-preservation-investments/

Like you, I’ve gone through the tech bubble (although I was just starting off) and the financial crisis where I lost more money. Obviously, the worst of all was the COVID-19 crash. This is normal since my portfolio grew a lot along the way.

I agree with the rule to “never lose money”. But I apply it differently. I try not to care too much about market volatiliy (what is called “risk” in the financial industry), even if it’s hard sometime. I learned with time that the “risk” of a stock price decline could instead reveal to be an “opportunity” if the company is a good one that manage to go through the short term difficulties.

Instead, my goal is to avoid investing in financially weak companies that seems good candidate for bankruptcy and avoid overpaying for companies that sell for stellar P/E or have no P/E at all. For example, Sears and Radio-Shack were very obvious insolvent companies, while Macy’s and Best Buy had solid financials.

I’ve made a lot of money with companies that have gone down a lot. Here are some example :

– Best Buy : bought at 23$ in 2012, the price went down to 11$, sold the majority of my position after the pandemic at 100$. Best Buy had enormous losses from going out of Europe and China, but the US/Canada was very profitable.

– Abercrombie & Fitch : bought at 11$ in 2017, the price went down to 8$ during the pandemic, but I had already sold 2/3 of my position in 2018 for 27$, sold the rest of my position for 27$ after the start of the pandemic. The stock is now 33$ per share… When I bought, the company was going through enournous difficulties, but the amount of cash they had in the bank account was more than the stock price ! So, this was a great cushion.

– Applied Materials : Bought for 60$ in 2018 at the market top. The stock immediately dropped to 30$. I doubled my position (for half the price). At this price, the company was generating 10% earnings and 3% annual dividend. This was a no brainer… The company eventually benefited tremendously from the pandemic (as a chip equipment maker). That was totally unexpected. I sold half my position in 2021 for 100$. I kept the other half and they are now worth 150$. Those are equivalent to free shares for me – since the realized gain pay for the remaining shares. And they are still earning 10% per year due to the increase in profits. I don’t know if this will continue in the future when the chip shortage will be resolved however…

Anyway, those are just a few examples. Each of them are not necessarily big amounts in themselves. But I try to repeat this strategy as much as I can. So this can become a reliable way to grow my investments over time.

This way, volatility become an opportunity, instead of a risk.

The COVID-19 made this quite difficult to apply, because it was so unexpected and unpredictable. Some of my investments performed tremendously well. While some others were hurt badly. Diversification helped me a lot in this situation.

I would want to go back to investing actively when the pandemic is over. This will be easier to do when we go back to some sort of normalcy. Let’s hope it will happen sooner than later. I’m very tired of this pandemic …

Anyway, love all your blog. Hope what I write make sense. Feel free to comment if I you agree or disagree with this strategy.

The one thing I’ve realized since starting in 2009 is that a lot of people have made a lot of money since.

Therefore, my fear is that we’ve become overconfident in measuring our risk tolerance and our investing abilities.

It’s one of the reasons why I wrote, Your Risk Tolerance Is An Illusion. But I’m also hopeful we’ll all learn from our mistakes and get better over time!

I agree with you. It is always my fear to invest in an overvalued stock market. However, equities don’t have a limit on the upside. It’s not because they have done well in the past that they can’t do better in the future. It’s different than a bond where an increase in price limits any potential increase in the future. Gains on bonds are ultimately capped by the face value of the bond and the coupons.

One example that helped me understand this concept during the pandemic was looking at the Zimbabwe Stock Exchange (ZSE)… If things were bad in developped countries, then surely things would be much worse in Africa ?

Here is the most recent data : +345% in 2021. One would think : “this is certainly loss-recovering after a very bad 2020 ?” Hell no ! The stock market is up 4596% over 2 years !! (Here is the link : https://www.african-markets.com/en/stock-markets/zse)

The most important to look at the facts. For that reason, I plan to read as much earnings reports as I can in 2022. That will help me determine if actual prices are justified. If they are not, then I will seriously consider reducing my positions (risk).

There are many reasons why companies could have a very good performance in 2022 :

– more stimulus from governments in coming years (infrastructure bills);

– additional money circulation due to past stimulus (purchases made with stimulus money is now a revenue ready to be spent by another person);

– additional savings and reduced spending during the pandemic should come back to normal (recovery stocks);

– potential additional borrowings from real estate appreciation as well as increased spending from stock market gains.

Reading how companies are doing in their coming earnings report will help me understand what is going on right now and what companies expect for 2022.

Also, 4 of my 5 biggest positions are relatively secure investments :

1) Couche-Tard : 61% earnings growth over the last 3 years, PE around 16.5, very high quality company, will probably soon surpass 7-Eleven as the biggest convenience store operator in the world.

2) Suncor : 5% dividend. 7.7 forward PE. Biggest oil company in Canada. This is the “Exxon” of Canada. Upside potential in case of an energy crisis following years of underinvestment in the production of oil.

3) TC Energy : 5.6% dividend. 13.5 forward PE. Pipelines. Super stable operations. Almost like real estate. Potential lawsuit gain from cancellation of Keystone XL by Joe Biden worth 15$ per share (25% potential one-time gain).

4) Riocan : 4% distribution. Real estate. No need for additional description. :-)

I will stay more cautious than I was in the past. But I’m not sure “cash” and “bonds” are the right answer for safety in this environment.

We may not get +4596% return over two years, like in Zimbabwe. But my bet is the “sign” in front of the number will be on the same side…

Anyway, thanks for sharing your thought with all of us. Really appreciated !

Both Bernstein and Swedroe in their writings suggest CASHING IN YOUR CHIPS when you have won the game. I recently invested in PFFD as suggested by author Rick Ferri. It is a preferred stock index fund yielding around 5.5%

I’ve thought about the topic of running out of money quite a bit. I’ve landed on the option of always doing something to earn at least some income. This serves at least two purposes in that you augment your investment earnings and second it gives you something to do.

Thanks for the reply Zen Master. I appreciate your thoughts. I am still learning about how bonds and preferred shares of stocks work. So I do have a question. You said “the corporate bond market is presently stretched, featuring record high debt to GDP and record low high-yield default rates”. Can you say that across the board? For example, I recently purchased some corporate bonds of companies that are in good financial shape, have good management and produce a stable product. If I understand, a company’s bond is the highest priority above their common stock and above their preferred shares. So in order to default, they would have to default on the stocks first. So it seems to me that how stretched the company’s bonds are should be based on the financial stability of the company. I will soon be in a low tax bracket and all of my income will be from my IRA. I do not own any muni bonds. Right now I am about 10% cash, 10% corporate bonds, 30% preferred stocks and 30% real estate and 20% growth stocks. All things considered, I am averaging about 5% yield, which is about where I want to be. But I am just concerned about preparing best I can for the coming recession.

Good article and discussion. When I read most articles about asset allocation, I always get confused about bonds. At least in this article, it’s clarified that you are talking about municipal bonds. However, what do you think about corporate bonds and preferred stocks of the solid companies you have been investing in? As a defense, I have moved about half of my investments to the bonds and preferred stocks of the same companies I have been investing in. That way I have confidence in the company and management because I have thoroughly researched the company. But moving to their bonds and preferred stocks, I get a better dividend and for the most part, less volatility. So what are your thoughts on bonds and preferred stocks of solid companies?

Jim –

I agree that most people are too generic in talking about bonds. You wouldn’t talk about all “stocks” in the same way, and the fact is various “bonds” are not all alike.

That said, corporate bonds may differ from municipal bonds in terms of credit risk, call risk, and liquidity risk and — unlike municipalities, which have no shareholders — a company’s management interests and incentives may align more with stockholders, not bondholders. Know what I mean? Worse, the corporate bond market is presently stretched, featuring record high debt to GDP and record low high-yield default rates (both harbingers of a stretched market).

What if (when) the economy weakens? What if (when) the tide goes out? Will the corporate bond market show greater weakness than anticipated? It seems to me as though the corporate bond market is perched on about as much risk as the stock market. The tide will turn eventually and, in my opinion, these bonds will get hit.

In my view, the same is not true for municipal (or other government) bonds. Could there be some municipal bankruptcies or defaults? Sure, but muni bonds, in general, are not subject to the same default risk as the corporate bond market and if you’re particularly focused on a diversified basket of investment-grade “general obligation” bonds, you’re going to be fine as long as the entire country doesn’t go under … and then nothing is safe anyway. You’ll want guns and ammo.

On the other hand, I think liquidity is one of the negatives of muni bonds. The market is much, much smaller than the corporate bond market. Moreover, even in the financial crisis, muni bonds suffered a dramatic fall in value — around 15% versus the stock market of around 50% — but the bonds also recovered quickly (within about 60 days of bottoming).

Of course, the primary feature of muni bonds is not safety, it’s the after-tax yield. If you are in a very low tax bracket and “no tax” state, muni bonds are not for you as you could do better (i.e., get a higher yield with equal safety) with other taxable government bonds. So the prime candidates for muni bonds are those in a higher tax bracket and/or in high tax states.

That’s my 2 cents anyway. Does anyone disagree?

Random thoughts;

I strongly recommend Swedroe’s new book on Retirement. It answers most of these questions on asset mix, Social Security strategies and risk.

We already live in a hyper-inflationary environment for Health care.

The ability to “cut back” on expenses is a powerful financial tool.

Most Armageddon scenarios will be local, i.e. Hurricane Sandy. A 4-wheel drive vehicle with a full tank of gas may be the ultimate survival tool.

Preparing for unlikely scenarios such as War are likely to be too expensive and ineffective.

You simply cannot protect yourself from all types of risk.

The biggest risk to your financial future is your own behavior. Under stress humans almost always make the wrong decision financially.

Stocks correlate with Bonds? That’s new to me.

Great post and awesome comments.

I’m an Aussie so some of the terms on here don’t make sense but I love the theory.

I’m earning $300k pa in wages. I have no passive income as I bought a house for over $1.8m in the middle of SYDNEY. That’s cheap here and the house is a knock down. We are living in it to save so we can rebuild.

I hate the long hours and stress of my job. It’s tough stuff and I’m thinking of taking a demotion and pay cut for a healthier and happier life.

43 no passive income. I have $425k in my super fund in balanced option.

The only way I see financial freedom is to either keep slaving away or sell my house and move to a cheaper area.

I think I earn good money but I’m nowhere near and of the wealth of the people on the page. How did everyone accumulate so much wealth through being a wage slave? I’m really curious and wondering if you have cheap housing or you have invested young.

I have a partner with minimal assets and low income but we have no kids and a $60k mortgage.

Cheers from Australia.

I’ve been trying to follow the ‘don’t lose money’ principle for years. So far so good, the thing is I only started investing at the beginning of the bull market. Not really been into a full blown meltdown like 2008 or ’01/’02.

I’ve been telling myself since the beginning of 2018, don’t confuse brains with a bull market. So I took the majority of my stock portfolio off the table and put it to good use in my mortgage savings account generating a 4.3% tax and pretty much risk free (a mortgage type only known in The Netherladsn, for which I’m personally very grateful!)

After the correction in December 2008 I carefully put some money into my portfolio, but taking it slow! As Buffett had said on many occasions, don’t risk what you need and have for something you don’t have and don’t need!

Good luck!

From what I’ve read, the Financial samurai and I share many common investing experiences.

In general financial samurai tends to skew more conservative than the advice I dish out and live by. I would suggest in each scenario to be more aggressively invested reducing AA bonds and money markets. I’m not advocating zero cash, but at today’s interest rates I increase reliance on lines of credit for that rainy day fund.

Too many friends live by the “never lose” motto. They move forward but not on track for early retirement which is the point of this site.

My philosophy is to not fear loss and risk, just don’t lose your shirt. Make sure you are flexible with your expenses. There’s no law that says your kid has to attend a $30000 kindergarten. Or cut that Hawaii vacation if things go sour. Clearly the people profiled are not living on the edge. They should scale up and down their expenses in accordance with their investment performance.

I was raised middle class. The success I’ve achieved is gravy and beyond anybody’s expectations. If I had to go back to a middle class lifestyle, it wouldn’t be the end of the world.

I am not understanding who are you writing this article for. How about writing an article for those of us without “…$450K a year in gross income…” and with numbers that make sense.

In your opinion, what income “makes sense” and who do you think owns this site? Do the two other examples of making less not fit your desire? If not, feel free to expound on what I should be doing on my site to appease you.

What he is saying is that because he doesn’t make much money, he wants you to adjust your writing based on his lifestyle instead of do more to improve his own worth.

This is the same type of person who tries to put someone down to make themselves feel better. Don’t bother with these type of losers.

They cannot get inspired or learn from others. They are always angry.

Gee what’s a pretty nasty response mate. I think it’s a great question Kel asks as the numbers in the examples are very high indeed

The real loser is Kel…

Andy seems quite mad at Kel West!

Anyway, according to the Financial Samurai demographics (https://www.financialsamurai.com/who-is-the-typical-financial-samurai-reader/), 45% of readers make over $100,000. The median US household income is around $60,000.

So I take it that “kel west” is just asking for lower numbers & examples for the 55% of readers who are under $100,000.

With that said, the principles are what matter most. Don’t get too caught up on the numbers provided in the example, Kel West.

I really liked the data under the never lose money again section, but this line really hit me: “The older you get, the more you realize everything you want to do is a race against death”

Well written Sam!

I can’t stand to lose money, it hurts and feels like I’ve taken a leap back. And then I keep thinking about how many excruciating hours I have to put in to make it up the loss.

So I’ve decided to take the very slow (almost equally excruciating) path to FI by doing only fixed deposits. At least it feels like I’m always plodding forward and never stepping back.

Sam,

Do you have a post about building passive income using municipal bonds? I live in a state with no state tax, not sure what kind of bonds I should target for safe income. For instance, which munis are higher risk and should be avoided. Which states have a history of insolvency? etc.

Appreciate your advice.

Type 4 -mid 30s, 50k in 401k. No passive income. 80k salary mid Atlantic.

???

Probably need to swing for the fences more and start building passive income. No idea about this couples expenses and utilization of time. There should be upside to the $80K between two people.

Quality post and interesting comments. I’m in my early 30’s, live in NYC, wife/kids, with a $2M NW. W2 wage slave and imagine will certainly need considerably more to likely feel “comfortable” so I am still predominantly invested in equities to the tune of 80%ish of my NW with the remaining balance in the essentially cash. This is on top of the fact that most of my comp is beta to the market as i work in money management. Hard to materially derisk given I am still so young and in the middleish of my financial journey. I suppose I could throw in the towel and live a “solid” life off 4% plus my wife’s modest income, but that ain’t gonna happen.

A bit slow, from 3/1 9:30 am post

Do not believe in end of world theories,

If your right you loose,

If your wrong you loose.

Truth

I’m still willing to lose money even though I don’t need to take the risk at this stage of my life. I’ve been playing the ”game” of saving, investing, and accumulating wealth for 30 years now. I’ve been reasonably successful and have enjoyed my financial journey so far. The extra money will not add any value to my families life. We’re quite satisfied with what we have. However, I enjoy the “game” and I’m gonna keep playing.

Thanks, Bill

Not sure if anyone has any input. If I’m fine with adjusting my retirement time horizon, is staying 100% equities considered completely stupid? I’m about 1/3 of the way there and in my mid-40s. Theoretically sometime between 8 to 11 years to reach FI; provided nothing crashes super hard. Saving a lot more than before; now at 40% of gross.

Or, is it time to start being more conservative? I’ve just always been aggressive and not flinched when losing a high percentage of wealth in stocks.

I’m pretty much much Archetype 1. But we don’t feel that compelled to be as conservative with our piggybank. Embracing that we will likely have a bigger piggybank upon our deaths, my kids will be getting most of our money anyway. It’s really family wealth and well being.

So, since the kids have started working, we have been fully funding their Roth IRAs and their company retirement accounts (Roth 401 when available). Each and every year from day one. It all falls below the annual gift tax limit. The kids are eventually getting the money anyway and both kids are in tune with the overall goal. But they are savers from our teachings.

I don’t expect them to become spendthrifts with the extra yearly money and they have not. And I can only see getting a larger chunk of money upon my passing as a larger temptation than having it build up over time. My parental role is not to control their actions, but to guide them into adulthood (and in this case, into retirement). So far it all looks great. And I will hold my tongue when one of them comes home with any expensive purchase that I think was a waste of money, paid for with “my money”.

Interesting.. 100% bonds?? The historical rate of return is misleading, we need to look at the real inflation adjusted rate of return of the asset classes. The real rate of return on bonds is much lower. Probably closer to 2% versus the 5% you have here.

The 100% stock allocation at 4% withdraw rate has the highest long term success rate of not running out of money. If you bump it down to 3.5%, even with the massive short term market swings, in the long run, you’ll be fine.

This is good. I’m a lot more conservative now and I don’t want to lose any money either.

I exchanged quite a bit of equity to bond and money market fund recently. At this point, we should be able to maintain our net worth if the market drops less than 20%. More than that and our net worth will go negative for the year.

It’s not a huge deal. If the market drops 20%, I’d rebalance and pick up more stocks.

The key to not losing money is to have income, whether passive or active. From the 3 scenarios, the income makes a big difference. The more cushion, the better.

Our risk tolerance has decreased as our net worth has grown – we’re not competing against a market return anymore, just a return that will allow us to achieve all of our goals. But you’re right – having a nice pile does open up opportunities and there are even more chances of increasing the pile if you’re game.

One of the best parts about your posts are the comments.

For me, my total net worth is 3.7 mil not counting primary residence which in the Bay Area is 1.1 mil. I figure I need 100K for retirement. 24k already comes from Social Security so we want about 76k. I am building a TIPs ladder, well not exactly a ladder. I am buying them all through the treasury auction (not the secondary market which is what you would have to do if you wanted a true TIPS ladder) so I may buy two years worth of ten year or 5 year TIPS in the future as the treasuries become available. I buy 5 year and ten year TIPS usually in 200k increments. I buy short term treasuries until TIPS become available always looking at the Treasury auction calendar. I want 25 years of TIPs which will be at about 2.5 million.

The remaining 1.2 million is what I invest in risk assets. So this allows me to keep pace with inflation and keep my withdrawal percentage at a respectable 2% of entire portfolio. When my wife reaches age 70, she will also be eligible for social security where we will receive 50k between the two of us, and at age 65 she will receive about 8k a year in pensions further reducing what we need.

So knowing, I have enough to live on for the next 30 years allows me to sleep comfortably while at the same time allowing me to invest in risk assets to hopefully outpace inflation, and manage as a legacy for my children.

My only concern is a neurological disorder I have but then I think, there is one thing worse than being disabled and that is being poor and disabled.

That is a great first rule. I believe Warren Buffett added a second rule to that…”never forget rule no. 1″.

Sometimes people won’t adhere to the rule until they have experienced the consequences of breaking it. I remember a decade again when I wanted to juice my investment returns, I started to get into option investment (probably more speculating). I wrote a call option which expired without being exercised.

It was great, got to pocket the premium. Then with this win, I decided to buy a put option for $35k thinking I would be able to make good money when the stock price corrects after a huge run up.

I ended up losing the entire investment. The stock price went up and up and I was too stubborn to close out the put when the put price was dropping. Didn’t want to admit defeat at the time.

That was a very painful lesson. And now I am a true believer of the first rule.

A “down” year is not a “loss” unless you sell. Don’t sell. Don’t ever sell (for sure don’t sell all of your holdings). When it comes time to live off non-business investments, I plan to stay heavy stock (80-90%) and bonds (20%-10%). And I plan on living off dividends only (~2%) from VTI/VTSAX (total market index). I’m not worried about down years/bear markets with that set up. I am one of those believers that the market will always recover and go higher (and if it doesn’t, money won’t be an issue).