Here are the key points from the now passed Trump administration's tax plan for 2018 and beyond. This is the Republican tax plan.

After reviewing the key points, I share my thoughts on how to win under this possibly new tax environment. The audio version is at the end of the post.

Republican Tax Plan Highlights

* No change to existing rules on 401k retirement accounts and the ability to contribute the current $18,000 into the accounts tax-free, and $18,500 for 2018 and beyond.

* Lowers the deduction for mortgage interest for new home loans of $7500,000 or less from the current $1,000,000 cap. Old loans up to $1,000,000 are grandfathered in.

* Limits the deductibility of local property taxes and state income taxes to only $10,000.

* Lowers the top marginal tax rate from 39.6% to 37%.

* The long-term capital gains and qualified dividend thresholds will remain as they are under the current system e.g. those in the bottom two tax brackets are eligible for 0% capital gains and dividend tax rates, those in the middle get a 15% tax rate, and those in the top pay a 20% tax rate.

* No repeal of the 3.8% Medicare surtax on net investment income over $200,000 per person.

* Individuals making over $500,000 and couples earning over $1 million may still pay 39.6 percent

* Reduce the corporate tax rate from 35 percent to 21 percent.

* Doubles the estate tax limit to $11M for individuals, and $22M for married couples.

* Increase child tax credit from $1,000 to $2,000.

* Nearly double the standard deduction used by most average Americans to $12,000 for individuals and $24,000 for families

How To Win Under The New Republican Tax Plan

1) Continue to max out your 401k.

There's no reason not to take advantage of tax-deferred investment growth and potential company matching / profit sharing.

2) Reduce real estate exposure in the most expensive cities.

Slashing mortgage interest deductibility on debt down to $500,000 from $1,000,000 may put downward pressure on homes priced above $625,000. $625,000 is the cut off because most people put down at most 20% and borrow the rest (80% X $625,000 = $500,000).

The real estate segment that will likely come under the most pressure are those homes priced above $1,250,000 and up until about $3,000,000. In this price range, taking out a $1,000,000 or higher mortgage debt is quite common. After $3,000,000, the percentage of buyers who pay cash increases, and the segment will therefore be less affected. However, if there is weakness at lower price points, it will ultimately drag down higher price points.

Areas such as San Francisco, San Jose, Oakland, Manhattan, Brooklyn, Stamford, Los Angeles, San Diego, Washington D.C., Seattle, Boston, may experience weakness at the margin.

Related: Why I'm Investing In The Heartland Of America

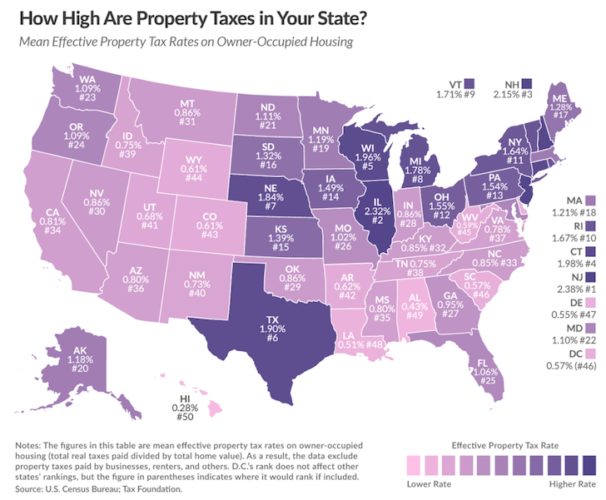

3) Move out of states with high property tax rates.

Limiting the property tax deductibility to $10,000 will hurt homeowners who live in high property tax states or who own expensive property or both. Residents of California, New Jersey, New York, and less so Illinois should look to move or sell their property and rent. Although Utah, Wyoming, Arkansas, Alabama, West Virginia, and Louisiana have high property tax rates, real estate in most parts of those states are relatively inexpensive. Hawaii has the lowest property tax rate, but also one of the highest real estate prices.

4) Move out of states with high state income tax rates. Consider relocating to one of the seven states with no state income tax: Washington, Nevada, Wyoming, South Dakota, Texas, Florida, or Alaska. No longer being able to deduct state income taxes will hurt states like New York, DC, Iowa, Minnesota, and New Jersey the most because life is hard in the states with high tax rates and brutal winters. At least in California, residents can play outside year around. But make no mistake, California residents lose under the new proposal.

If you make between $75,000 – $100,000, $100,000 – $200,000, $200,000 – $500,000, and $500,000 – $1,000,000, the average tax increases are $873, $1,500, $2,800, and $8,555, respectively according to the Urban Institute & Brookings Institution.

5) Get married and make up to $600,000 combined, or stay single if you both are making over $500,000.

The current top tax rate is now 37% for individuals making more than ~$500,000 and married couples making more than $600,000. It would be absolutely nonsensical for two $500,000 singles to get married. If you can make a combined $600,000 as a married couple to pay a 35% marginal tax rate, then go for it.

Related: The Average Net Worth For The Above Average Married Couple

6) Start a S-Corp to earn pass through income.

The Republican tax plan is a net positive for small businesses. If the top tax rate for businesses with pass-through income declines to 25%, you're basically winning if you have operating profits of over $92,000 per individual or $153,000 per married couple because those are the cutoff amounts for a 25% marginal income tax rate.

If you don't have a business idea, then consider switching from full-time employee to consultant and having your old employer pay you a higher rate as a business. They might oblige since they don't have to pay you any benefits.

If you aren't willing to start a business or become an independent contractor, then consider investing in businesses that will benefit from the corporate tax cut to 20%. And if you don't know what company to invest in, then you can simply buy an S&P 500 index fund.

Related: The 10 Best Reasons To Start An Online Business

7) Step on the gas when it comes to building wealth, or die before Trump leaves office.

Doubling the death tax to $11M per individual and $22M per couple should motivate you hoard as much wealth and die before Trump leaves office. As soon as you start thinking about how your wealth can be used to help others, then there's endless upside.

Related: The Benefits Of A Revocable Living Trust

8) Enjoy being a middle class American.

Reducing the $1 million mortgage indebtedness to $750K, raising the child tax credit to $2,000 from $1,000, limiting the deductibility of property tax and state income tax to to $10,000, and eliminating the death tax doesn't affect the middle class.

But what does help the middle class is almost doubling the standard deduction, whether you have a property or not, to $12,000 for individuals and $24,000 for families.

Roughly 70.4% of taxpayers claimed the standard deduction on their tax return, therefore, most Americans will benefit from the increase. Of those who do itemize their deductions, the average claim for 2014 was $27,447 according to the IRS. Therefore, there is a convergence and a simplification of the tax code.

A $24,000 standard deduction for married couples equates to paying a 2.4% interest rate on a $1,000,000 mortgage. Hence, the increase in standard deduction takes some of the sting out of the potential halving of the mortgage interest deduction to $500,000.

That said, property in higher cost areas should still feel downward pressure at the margin because mortgage interest is only one of several itemized items for deduction. The current ideal mortgage amount is $750,000 as that's the limit for mortgage interest deduction.

Related: We're All Middle Class Citizens

Try To Avoid Getting Stuck In The Upper Middle

The GOP tax proposal is telling everybody not to get stuck in the upper middle like garbage in a trash compactor. You either want to make less than $200,000 as an individual or less than $260,000 as a married couple or more than $500,000 as an individual or as close to $600,000 as a married couple.

Everything else will either be neutral or slightly negative. The real frustration is the cost of living for most high income W2 wage earners.

As for me, I plan to generate as much business profits as possible until the next administration arrives. If the business pass through tax rate does get capped at 25%, I will use my tax savings to hire someone to help run the business and write content so I can spend more time with my family. Readers win because I won't end up quitting under the strain of full-time parenthood for the next five years. The economy wins because one more person gets a job and spends.

Altering My Net Worth Composition

I've already sold a very expensive property in San Francisco to lock in gains, simplify life, and diversify into heartland real estate. If the mortgage indebtedness cap for interest deduction does decline to $500,000, I will pay down my principal mortgage debt to $500,000 if previous mortgages above the threshold are not grandfathered. Finally, I plan to leave San Francisco and move to Honolulu where the property tax rate is 70% lower within the next three years.

Hopefully by the time tax rates rise again, I'll be completely sick of making money and want to relax. As a retiree, you want high tax rates so that other people can pay for your benefits. In a low tax rate, bull market environment, it’s best to press as much as possible.

Readers, how do you feel about the latest GOP tax proposal? Will you do anything to take advantage? What are some tax reform issues I've missed?

Hi Sam,

Since the tax bill is pending President’s signature, any thoughts on prepaying 2018 property taxes? We stay in the bay area where annual property tax bills are ~20K or more.

Any thought around 2017 year end tax strategies would also be appreciated.

You might as well try. But, they say it’s not gonna work.

Hmmmm , but bottom line less taxes will be collected . Less taxes means less revenues which mean higher deficits. They are counting on a boom b/c of this ?My feeling is surpluses in taxes paying debt down causes the boom.I guess we will never know b/c congress will make this deficit happen. 36 yrs of this shit so far.

Utah has low property taxes. We will be screwed by the new tax law, but not based on a .68% property tax. Where are you getting your info?

Despite what we hear on the media this plan leaves in place the high capital gains tax, surcharge and the upper bracket. It’s the middle class and poor who get the most benefit since they get a little more from a double standard deduction with the personal exemption phased out and pay lower taxes since the rates because of higher thresholds for each bracket.

The corporate rate will help everyone because everyone directly or indirectly is pretty much invested in stocks through mutual funds or what not. But where it really helps is for small business owners and also it promotes more businesses to be in the U.S. the thing atrump needs to do is to communicate to the public that there is no excuse for companies to ship jobs to Mexico and china now that we will have a lower corporate tax rate and say he wants to see more manufacturing done in the U.S. Companies don’t have a leg to stand on if they claim they can’t compete here with lower taxes negating any higher labor costs.

I just came across your page today. My husband and I have no write off on our taxes. We are mortgage free and make roughly 200K a year. At this point, we would love to save about 150K to buy another home and keep our current home. But if we keep our income without making high contributions to 401ks it will take us a long time, we aren’t young, 52 and 53. We would like to buy our second home in about 2 years? Any advice? We are definitely novices when it comes to all the financial jargon, any advice along the lines of “Financial Advice for Dummies” would be apprciated.

Sam – thanks for a wonderful analysis. Curious what’s your take (and of any other readers) on the impact on the investment property buying in the bay area? I have been in the market for an investment property in the SF (since my primary home mortgage is on a really low rate, I have ability to make a significant down payment, and I am feeling confident about career etc) . Now I’m wondering if that’s still a good idea if the mortgage interest deduction for 2nd home is going to get completely eliminated. Would that have a net downward impact on prices in SF / surrounding areas?

Appreciate any thoughts – happy thanksgiving!

Thanks for breaking down the new tax code for us. Great analysis.

The marriage penalty is one of the reasons why my partner and I choose to stay single. Under the current tax rates, we are in the 28% bracket instead of the 33% bracket. Under the proposed tax rates, we would of move from 25%(single) to 35%(married). We own separate smaller homes instead of one big home so we still can deduct up to a million combined mortgage interest and deduct $20K combined property tax. We will benefit from the increase child tax credit and lower capital gain and dividend taxes. We will hurt equally, single or married, from not being able to deduct our CA state taxes.

I just wanted to say I love this article. You point out those most likely to win and lose but the key take away is identifying the new opportunities. As a homeowner in NJ with 2 kids and relatively high SALT we (my wife and I) may be a losers most years if we did nothing. We do have choices (she has W2 income and so do I as an owner/employee for LLC taxed as C Corp) and we will develop a plan for shifting income/expenses between 2017/2018 if/when a tax bill actually looks likely to pass (If I had to wager it won’t or will be drastically different/watered down). That notwithstanding it’s hard to stress enough the benefit to the upper middle class of doing away with the AMT. In some of our better years (bigger bonuses, higher passive income, or severance pay for instance) we already effectively lost our SALT deductions because we got crushed by the AMT.

Although I am programmed to seek ways in which to take advantage of the current tax system my preference is for some form of simplification that would reduce the number of deductions in return for lower tax rates across the board as I would much rather spend my time enjoying the income I keep rather than having to devise different ways to keep it (just to keep up with everyone else). Talk about inefficiency. In my personal economic view I also favor a reduction in the marginal tax rate we all pay as I do think it incentivizes people, on average, to work harder for that extra dollar if it means they can keep more of it. I’m not saying we need to cut taxes overall but if overall taxes collected were estimated to be the same but you could at the same time reduce the average marginal rate in order to achieve it by limiting deductions… I see it as a obvious benefit to society if not the economy.

Based on others comments its clear there is much political debate as to whether high tax states are being subsidized by the federal government. I think both sides of that debate have good arguments. Without going into detail as my comment is already long enough I would just add that if I have learned anything about statistics in my dozen years of working in corporate America it is that I can twist numbers to tell whatever story you need me to tell. Through that lens it softens the narrative / talking points on both sides.

Wonderful, thoughtful analysis. Thank you

The question no one ever seems to ask is “why are my taxes going up” or “why are my taxes going down?”

If you make more after taxes great, but is this at the expense of healthcare coverage (bad) or because we are making cuts to military expenditures (good). If you are paying more in taxes are you getting more for your money, government administration expenses (bad) or reduction in pollution due to more restrictions and health & safety checks (good).

From a high level though, the Republican plan, the people who used to be deficit hawks, are now willing to hand out $1.5tril in tax cuts to mostly wealthy people with no expectation that it will ever be paid back. Talk about shady business. We can do better than this.

Completely agree! Too often people look at the plan and are fully supportive of it if their own taxes are going down this year, and they’re against it if their taxes go up. There’s far too little concern for the overall tax revenues being collected and what the government plans to spend the money on.

They could give the poor a 0.1% tax cut, the wealthy a massive tax cut, run up the federal deficit, and everyone would still be happy because their taxes go down in the short-run. Unfortunately, the current administration understand this better than the general public.

Sam, Thanks for the write up.

Suggestion…on your chart for tax rates, others say Taxable Income, yours says income. (most work off AGI).

This basically hurts families that already itemized.

This hits families with older teenagers. 18 and up will get no child tax credit yet most 18 year olds are in their senior year, still at home. Also, most college kids are still dependents yet will not get the personal exemption anymore. The personal exemption loss is a huge hit to our family because we already itemized. Thus additional income of $33K (personal exemp and prop tax) will be taxed giving us an additional $5.1K tax increase for a “Republican” tax cut. ‘Upper’ middle income is barely getting by in Southern California with this.

Seems crazy toddlers get a 1600 tax credit and 18 year olds get 0. Means it’s a child care deduction and nothing to do with the costs of raising kids.

What was the purpose of allowing state and property taxes deductions in the first place? Was it to prevent double taxation? Why allow some now yet not others? Why not combine the 10K limit for both? Curious your thoughts?

Not sure why kids get tax credits anyway, since not everybody can have kids, and having kids is an individual choice. I don’t mind if an 18 year old adult’s parent’s doesn’t get a tax credit.

Maybe the state income and property tax deductions were the Federal Government’s attempt to try and equalize the cost of living in America since some states have higher taxes and cost of living than others? The government is all about social engineering.

I just read that you won’t be able to deduct interest on a newly refinanced mortgage of your primary residence under the new tax reform plan. If true, it will decimate the refi industry and make people choose between keeping the deduction on a higher interest loan or refinancing to get a lower rate. You can’t have both. Anyone else see anything on this?

People in the higher end real estate markets should be worried. It is obvious the administration is going after the higher and markets to redistribute the wealth.

From what I understand, it’s not just the higher end that’s impacted by this. It’s all refinancings going forward.

No, from what I understand it’s only for newly purchased homes. All of the articles I’ve read mention that it won’t affect refinancings over 500K

Overall, isn’t it more of a redistribution to the wealthy? If we do end up with significantly lower corporate tax rates, this will disproportionately benefit wealthy individuals who control most of the capital markets.

Also, I can’t imagine many people needing to refi over the next decade since rates presumably won’t drop much from where they are.

Wow, very thorough analysis, Sam!

“Finally, I plan to leave San Francisco and move to Honolulu where the property tax rate is 70% lower within the next three years.”

Can I come visit? :)

I’d just add a word of caution regarding “switching” to independent contractor status and the comment about employers no longer having to pay benefits. It’s not that easy. There are decades of case law and Treasury rulings regarding the difference between an employee and independent contractor. There’s a 20 factor test, based entirely on a facts and circumstances analysis. (Revenue Ruling 87-41, IIRC.) The IRS has demonstrated renewed interested in this issue, especially since it launched an employment tax related research project (read, collecting data so they can target better on audit and collect penalties). Do a google search for the Microsoft case for insight into the distinction and how it affects benefits. My point being, it’s not like flipping a light switch.

It’s a good warning. But everybody has the right to start their own consulting firm. Not everybody has the right to get hired or make a large enough income that would benefit from lower tax rates.

“* Eliminates the deduction for state income taxes”

I’m not sure you’re right about this Sam. There’s talk in legal circles that the language only eliminates the deduction for state and local income taxes for employees but not for business owners that derive their income through pass-through entities.

There might be a loophole for high income business owners after all …

I was unaware that Trump wrote the tax code. I always thought it was Congress. Whether or not he’s in office in 3 years means nothing to the tax code or it’s writers as far as I can discern. With regards to the most expensive counties voting for Clinton, why do you suppose there is a correlation between high taxation and liberal leaning communities? Usually they are Utopia and I wonder why anyone would want to leave?

Here in WY, we love our low taxes, our God, our neighbors, and the things that have kept us free. It’s a terrible place for someone used to living in CA or NY. I doubt that they could stand all the freedom. For those that do eventually make the move, I say “Welcome to America”.

Love your Blog…keep it coming! Just please don’t encourage anyone to come to my low tax state…we like it just the way it is.

I hear he wrote every single word of the tax reform legislation.

How did you know my next post was about everybody investing in Wyoming real estate?

Going to single-handedly raise prices for all Wyomingingings.

https://www.financialsamurai.com/develop-sphere-of-influence-financial-independence/

The Tax Policy Center is a liberal group with usually flawed models. It looks like the SALT tax increases don’t include the offsets from the standard deduction increase and bracket decreases. There’s also no category for < $1000.

There is no state income tax in Tennessee.

There was a state tax on dividend income above a certain threshold. As another commentator mentioned: that dividend tax had been repealed.

trying to wrap my head around this from different family dynamics. After all, a lot of us 60 and older are trying to help all generations in one family and everyone is not equal in income. I loaned my son who is head of household for his family of 2 a small mortgage. He pays me every month at 4% on that mortgage. I have a major disability, so lots of medical expenses, and don’t work that 4% is my safety net. My small home has no mortgage so no interest to deduct but I live in Georgia and have property taxes. We were planning in moving into one home so I would be better able to help him with child care and he could help me with keeping house. this really throws a kink into it. Should I restructure the loan to principle no interest for 5 years? and we should keep two residences? How is this going to work for multi-generational families?

I live in SF and plan to buy a home in 2018. I’m not totally sure what this will do to real estate prices but I’m a bit concerned with the tax rate hike. I’m making over 200k Atm so it might make sense to create an S Corp and funnel all income though that entity. What about real estate income? Regular income taxes are taxed at the highest rate but from what I understand, real estate income is favored heavily. I could buy a duplex in NC or PA. Also aiming for a smaller place or splitting the loan amongst two income earners might work. I need to talk to a tax guy.

The biggest question you want to really delve deep into is whether buying SF real estate in 2018 is a good idea. I’d write a post looking at both sides if I were you.

What a great idea.

Hi Rob — please be CERTAIN to speak to a tax guy. The proposed rules on pass-through income are complicated and specifically exclude professional services firms from the reduced rate. The rules go on to say the rule is intended to benefit capital intensive businesses. That being said, these rules are the default position. Time will tell, but our firm may take the position that even professional services firm have a capital component in order to secure the 25% rate.

A change in strategy is definitely needed in this situation. “Capital Intensive” doesn’t really mean much to me, I suppose companies that are capital intensive are ones that already have enough money to pay 0% in taxes as it stands. They may be aiming for “small businesses”.

Regular income is just not favored. Perhaps, buying real estate and getting paid through capital appreciation is the way to go especially since 1031 exchanges can still be used for investment properties. Referring to the proposed 500k limit on the Real Estate Interest deduction, I wonder whether you can split the loan 50/50 satisfying the limit among two income earners in the household…

Great article!

Sam the man! Awesome post with a lot of info here.

I have a friend who recently cashed out of the NYC market, after buying in 10 years ago at 1M and selling last month for 1.8. He’s getting out of dodge too. Since my mortgage is paid off, and my main expense is the taxes/co-op fee, I’m going to stay put for now, but I am minimizing my income by sitting on the sidelines during these stagnant wages. It just doesn’t make sense for me at 50, when you factor in the commute and the office BS. Some of your points reminded me of another article I recently read about how driverless cars could expand the horizon for commutes, pushing it about another hour out. (based on current drive times) I’m like you. I like to zig when others zag, or as Gretzky famously said….”skate where the puck is GOING to be!” Thanks for taking the time to put this together.

Jim I have to agree. I always like Sam’s blog. its thought provoking and makes me do my homework. I wish I had read it years ago. I might have found a rich man to marry, be 500k better off, and gotten a face lift. He’s always entertaining. Thanks Sam!

Haha hilarious.

I wish I read my site back in 2001. Alas, there is no rewind button in finances or in life.

But there seems to be obvious off-the-wall moves to make in the present to secure ones financial future. But I think most people don’t give a crap.

I think its never too late to work on ones financial future, within reason. Just like you always stress trying to de-stress there is a happy medium. My main stresses come from “most people don’t give a crap.” so true. and their actions whether its extended family ….Ex’s, steps, your own kids ex’s and steps…influence our decisions. suddenly there’s a town hall meeting in your head on how to help yourself without hurting others. The TED on your blog today was good. but its so hard to do in your 60’s. Do you go for safety? or strike out like I do and take lots of falls (literally I have MS)…fortunately the younger me was used to falls so the older me just lets go and meets the ground. Gives a great perspective on what to clean next. that dust bunny under the couch. in finances, the bit monster freezes me. I gotta get over the fear. your a lot of help. Try superoxide dismutase and glutathione peroxidase, catalase for your back when you over do it. works for me!

Also, don’t get caught in the 45.6% bracket that functionally exists for income in the range of $1 Million to $1.2 Million (singles) or $1.614 Million (married).

That wouldn’t be the worst problem to have, but it’s the worst place for your taxable income to fall, tax-wise.

Source: kitces.com/blog/tax-cuts-and-jobs-act-2018-house-gop-tax-reform-proposal/

Cheers!

-PoF

Sam, don’t married couples making more than ~$470k but less than ~$1M benefit by dropping from a 39.6% tax rate to a 35% tax rate? Your article indicated you want to be as close to $1M as possible to benefit.

Are you simply saying skirting under the $1M a year mark is better than skirting just over it? In that case I agree with you. Anytime you are on the bubble of the income cutoff you lose money by being just slightly over the hump (old or new tax plans).

Thanks

Yes.

Isn’t it only the income you earn after a certain threshold that gets taxed at the higher rate? Say you are single and make $210,000 my understanding is you only pay 35% tax on the $10,000 not the whole $210,000.

If not then you would have to make $230,000 just to break even after taxes with what you would have had making $199,999. That can’t be right.

We will benefit greatly from this plan should it go through as written. Tax rate decrease from 33 to 25%. We have always gone with a standard deduction so that going from $12,000 to $24,000 puts a massive smile on my face.

Not a business owner (yet) but I work for one. Seeing the corporate tax rate drop to 20% is amazing.

It looks like almost everyone will benefit from this yet the media makes it sound like it is just tax cuts for the rich. I don’t see how anyone (liberal/conservative) could have much problem with this.

Oh I hope this goes through for 2018. I will eager to do my taxes.

Great to hear positive thoughts. What state do you live in?

Sorry, NC.