Buying a home after huge price appreciation needs careful planning. Demand for real estate is strong and may continue to increase with the stock market near record highs, pent-up demand, and declining mortgage rates.

However, depending on your purchase timing, there's a chance you may buy a home at the top of the market without even knowing it at the time.

Buying a house will probably be your most expensive purchase in your lifetime. Thus, it's important to be careful what you buy and when.

If you have to get a mortgage, as most people do, then buying a home can also be one of the scariest and riskiest purchases you will ever make.

After all, tens of thousands of people lost their homes during the 2008-2009 financial crisis because they were over-leveraged. Lending standards have since tightened up drastically. Property prices have also done extraordinarily well since 2009 in many areas.

Important Steps Before Buying A House After Huge Price Appreciation

Here are some important steps to take before buying a home after prices have appreciated a lot. It's great to get neutral inflation by owning your own primary residence. But, you need to be as financially prepared as possible just in case there's an economic downturn or something else bad happens.

I own four properties in San Francisco, one property in Lake Tahoe, and have partial ownership of a property in Honolulu. Real estate is my favorite passive income asset class to build wealth for retirement.

1) Make Sure Your Credit Score Is Great

A great credit score is equal to 760 or higher. A lender determines your mortgage interest rate largely by your credit score and credit report. Therefore, it's important to also know that you have a clean credit report.

TransUnion, Equifax, and Experian are the big three credit agencies. Make sure you get a score from one of them. You can either see your latest credit score from a credit card statement online, or you can check yours directly online.

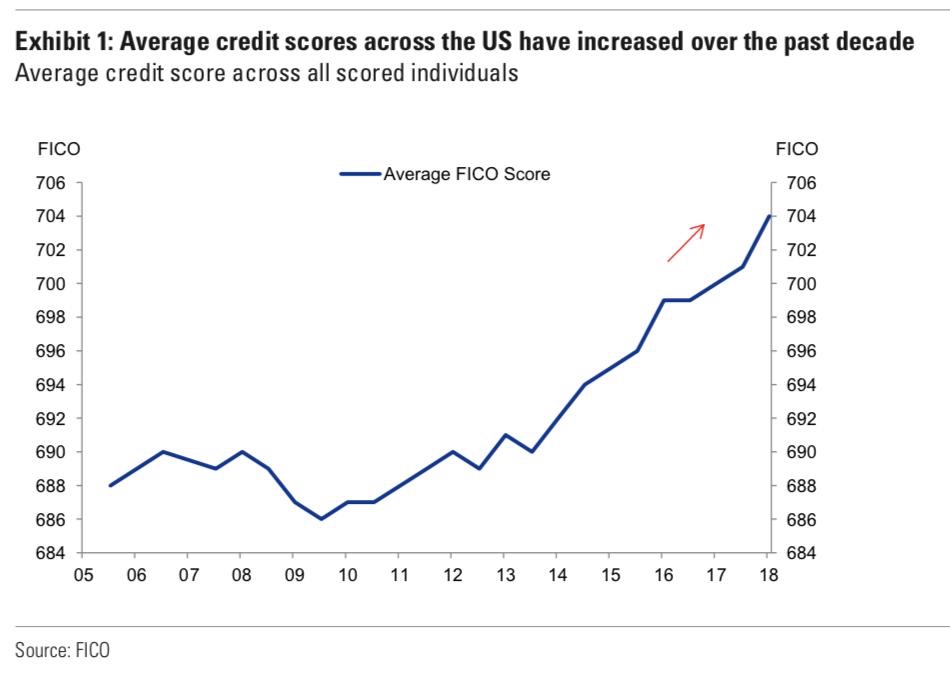

The average credit score is now a solid 710. After huge price appreciation, you need to have excellent credit and financials.

2) Bolster Your Credit Score

If you don't have at least a 720 credit score, you should take steps to bolster your credit score to get a better rate. Here are some steps you can take.

Repair And Dispute Errors: Your credit history is 35 percent of your FICO score. And according to a study by the Federal Trade Commission (FTC), more than 40 million Americans have something that is incorrect on their credit report. A late payment or negative mark from a creditor may seem harmless. But, it can have long-standing consequences. In some instances it could stay on your report for seven years.

If you have errors on your credit report, consider working with a credit repair company. They can navigate the complexities of credit repair, contact the credit bureaus on your behalf, and help remove errors as quickly as possible. Or, simply make the calls yourself.

Spread Credit Card Debt Across Multiple Cards: If any of your credit cards are close to the maximum utilization point, it's time to address that. Lenders typically view borrowing near the max as a red flag because it's an indication that you could be having financial issues. If you have multiple cards, spreading your balance out between them could make sense.

Pay down some debt. Credit score is based on your debt-to-income ratio. If your DTI is too high, your credit score will be negative affected. See more below.

Don't close and open credit cards. Closing a credit card account will not raise your credit score. In fact, in some cases, it may actually lower it. Instead, try to pay down the balance as much as you can, while continuing to make your monthly payments on time. If you have an old credit card you never use anymore, just ignore it. Or at least don’t close it until after you have purchased your new home.

Opening new credit cards before buying a home is also not a good idea. You don’t want creditors checking your credit and seeing you have new cards, as you may lose some points on your credit score.

See: How To Improve Your Credit Score To 800 And Beyond

3) Calculate How Much Home You Can Afford

I created the 30/30/3 rule to determine home affordability. After huge price appreciation, you must stay disciplined with how much home you buy. Leverage is great on the way up. But leverage is a killer on the way down, especially if you have to sell.

Putting 20% down on a property is a somewhat arbitrary number dictated by lending institutions. With 20% down, you don’t have to pay the wasteful PMI insurance. There was a time that affording property meant putting 100% down. But thanks to the development of our banking system and securities system, we’re able to afford more than we ever thought possible.

I believe an individual can comfortably afford a property if they can put down 20% and have a 10% buffer in terms of savings or liquid investments. In other words, a person who can afford a $1 million dollar property can put down $200,000 and have $100,000 in a CD or stock account.

A general good rule of thumb is to also have the mortgage amount take up no more than 30% of your gross income. If you are making $6,000 a month, shoot for a $1,800 a month mortgage or less. If you do want to stretch, most banks allow you to go up to 42% of your gross income.

Affordability in large part depends on rates, future income growth, and job security as well. But in general, a 30%/30% rule is good guidance. You can take advantage of those first time homebuyer loans which allow you to only put down 3-5% as well. You just have to be honest with yourself whether you can really afford a home if all you can put down is a 3-5% deposit.

Related: The Best Time To Buy Property Is When You Can Afford It

4) Save And Invest Aggressively For The Downpayment

The higher the price appreciation, the larger the down payment. To avoid paying for Private Mortgage Insurance (PMI), you need to come up with at least a 20% down payment. Although coming up with a 20% down payment may be tough after huge price appreciation, you don't want to spend even more money on a home.

If your mission is to buy a home, you must save aggressively and invest wisely, depending on the time frame of when you plan to buy the home.

Here's how I recommend your invest your downpayment depending on your purchase date. Below is an example of my recommended asset allocation if you are planning to buy a home within 24 months.

5) Make Sure Your Debt-To-Income Ratio Is Low Enough

The DTI ratio is crucial. You need to have a DTI of under 43%, otherwise, banks will not lend to you. The lower your DTI the better, as your rate will be lower too. There are two DTIs to consider as well.

The Front-End DTI: This DTI typically includes housing-related expenses such as mortgage payments and insurance. You want to shoot for a front-end DTI of 28%.

The Back-End DTI: This DTI includes all other debts you may have, such as credit cards or car loans. You want a back-end DTI of 36% or less. A simple way to improve this DTI is to pay down your debts to creditors.

How do you calculate your DTI ratio? You can use this equation for both front-end and back-end DTIs:

DTI = total debt / gross income

6) Budget For Closing Costs And Extras

Many homebuyers only look at the cost of the home when deciding on whether they can buy or not. But the reality is there are many closing costs and other costs involved with home-buying. After huge price appreciation, you need to understand all the costs of buying a home. They include:

- Home Appraisal Fee

- Home Inspection Fee

- Geological study

- Property taxes

- Home insurance

- Utility hookup/start fees

- HOA fees

- Home remodeling/updating

- Existing propane gas

- Title insurance

Take a look at the various closing costs for the purchase of a $1,750,000 with CASH. We're talking $5,315 in costs. If a loan was taken out for purchase, then the closing cost would be closer to $8,000 due to lender title insurance.

If you haven’t gotten the picture yet, lenders like consistency, including your employment history. Lenders like to see a borrower with the same employer for about two years.

7) Have Stable Income And Employment

You must not lose your job or take a sabbatical if you want to buy a home. Without W-2 income, you are dead to banks. They will not lend, even if you have freelance income.

Banks require at least two years of freelance income to consider it as income towards your DTI ratio. Without two years, you might as well have 0 income.

If you plan to leave your job, it is imperative your refinance your mortgage before quitting or negotiating a severance.

8) Decide Between A 30-Year Fixed Rate Mortgage And An Adjustable Rate Mortgage

Interest rates have been coming down since the early 1980s. Therefore, anybody who got a 30-year fixed mortgage since then has been overpaying.

I prefer an ARM b/c the average homeowner only owns or keeps the mortgage for about eight years. Therefore, to pay a higher interest rate for a longer fixed rate makes no sense.

Besides, I also believe interest rates will stay low for a long time. Finally, an ARM can't go up beyond a certain amount, usually 2% higher.

30-year fixed mortgage rates have been coming down since the early 1980s. I suggest checking the latest mortgage rates online. Get customized, complimentary quotes with no obligations. You win when lenders compete for your business.

9) Budget The Time It Takes To Purchase A House

Buying a house from start to finish generally takes between 1 – 3 months. The average time is about two months if you have all your paperwork and financing in order. Therefore, if you really need to buy a house because of a job move or a new addition to the family, it's imperative that you plan accordingly.

You must get pre-approved by a mortgage lender before bidding on a house, otherwise, the seller will not take your offer seriously. This will take 1-2 weeks with your existing relationship bank.

Once you get into contract, you must get an inspection, negotiate terms post inspection depending on what you find, get your lender to fund your purchase, and sign a bunch of documents.

The Thorough Inspection Process

There are several types of home inspections, but in general, a typical home inspection involves a certified inspector that will go in, around, under, and top of your house looking for anything that could be of concern, such as structural or mechanical issues.

The inspector would also look for safety issues related to the property. Though they will go into crawl spaces and attics as part of their inspection, they will not open walls. They will inspect the plumbing and electrical systems. Inspectors should point out any defect in the property that could cost money down the road for the homeowner.

Then they will put their findings into a nice written report for you with pictures. It basically becomes a miniature instruction manual for your house. No house is perfect, but the report will give you a great snapshot of the property at the time of the inspection. If there are fixes that need to be addressed, this report will certainly let you know.

You should also know that the sellers are not required to make any repairs to the property. However, you can request them through your real estate agent, which will let you know what repairs are reasonable or not. You can also consider delaying close of home escrow. It's a strategy that can help you gain more time and money if you're not in a rush.

Bottom line, I would give yourself more like 4-6 months from the day you decide you want to buy a house.

See: 10 Warning Signs To Look For Before Buying A House

10) Find A Great Real Estate Agent

Shoot for an agent who is regularly in the top 10% of all sales volume for your city. A top agent has the largest network of potential buyers and sellers. Many deals are often done quietly without even hitting the Multiple Listing Service.

Given you are paying a 4% – 6% commission fee, you might as well get the best agent and get the best bang for your buck.

A great agent will not only show you great homes, they will give you strategic buying advice and walk you through the entire process to minimize stress and maximize your chance of getting the best deal possible. After huge price appreciation, you need a savvy agent to help you not overpay.

11) Know The Best Up And Coming Neighborhoods

Do you want to make money on your property or live in the best neighborhood? The answer should be both.

There are many variables to think about when researching your future residents. The key to beginning your research is to determine those variables most important to you. Are you looking for a good school district, a large house, convenience to commuter options, or a specific neighborhood that is extremely friendly and ranks high on Walk Score?

Your real estate agent will tell you to figure out a list of the things you absolutely want in a house. Then they will discuss extra features that you would like to have.

This list will help your agent narrow down the number of houses they’ll show you. Then, your agent can save you time by only showing you houses you’d actually be interested in.

Make sure the house you buy has some unique competitive advantage. Some of these unique characteristics may include panoramic ocean views, an oversized lot, or pre-approved plans to expand.

Related: The Best Cities To Invest In Real Estate

Don't Let Huge Price Appreciation Get In The Way

A home is going to be the biggest purchase of your life. It's absolutely worth doing as much due diligence and preparation as possible BEFORE you proceed.

If the home appraisal is lower than the asking price, be wary. Negotiate down the home price if you still like the home. If there are termites or rot or work that needs to be done to the foundation, be wary. Negotiate like mad so that you don't have any regrets post purchase.

After huge price appreciation in the real estate market, you should be very disciplined. Don't go into a bidding war. Find deals instead and stay disciplined.

Consider investing in commercial real estate given the sector has lagged out of the pandemic. Assets like office and hospitality commercial real estate look particularly attractive.

Invest In Real Estate More Surgically

If you are not ready or unable to come up with at least a 20% downpayment, I recommend investing in real estate crowdfunding with a platform like Fundrise and CrowdStreet instead.

Fundrise focuses on diversified eREITs and you can get started with as little as $10. CrowdStreet focuses on individual opportunities in 18-hour cities. These two platforms are the oldest and most well-run real estate crowdfunding companies today.

Investing in real estate long term is one of the classic ways to boost wealth. With a platform like Fundrise or CrowdStreet, you can invest in commercial real estate across the country without having to come up with a huge downpayment. These commercial real estate opportunities were once only available to ultra-high net worth individuals and institutional investors.

I've personally invested $954,000 in real estate crowdfunding to invest in the heartland. Valuations are cheaper and net rental yields are much higher. My goal is to diversify my real estate holdings and earn more passive income.