The average credit score in America is now 715 according to Experian in 2025. Back in 2019, the average credit score was 703. Hence, the average credit score has been inching up over time as household balance sheets strengthen and the excess of the past fade.

During a global pandemic, the average American improved their wealth and their financial health. Not only has the average credit score in America improved, the average saving rate has also improved as well.

When the U.S. saving rate surged in 2020 to a high of 32%, so did lending standards. Now in 2023, the U.S. saving rate is back to around 5%.

Average Credit Score By Generation

Here’s the average credit score by generation as of March 2024, per VantageScore CreditGauge data shared with Financial Samurai:

- Gen Z (18 to 27): 665

- Millennials (28 to 43): 687

- Gen X (44 to 59): 710

- Baby boomers (60 to 78): 746

- Silent generation (79 to 96): 750

In other words, the average credit score improves as generations get older. This makes sense as improving your credit score takes time with consistent on-time payments and usage.

Lending Standards Are Still Tight

During a previous mortgage refinance in 2019, my loan officer said that he hadn't worked with a borrower with under an 800 credit score in over two years. I was surprised to hear this because I clearly remember banks offering the best refinance rates when you had at least a 760.

At the beginning of my refinance process, the mortgage officer asked whether I had over an 800 FICO score. I told him I thought so. But I felt like I had been caught in a lie because I didn't know for sure.

However, if I had said “no,” I felt like he would have hung up on me. He gave me this “you better not be wasting my time” vibe.

With the mortgage industry even tighter today thanks to so much demand, borrowers must really have their financial ducks in order to get the best rate.

For those interested, let's review the fundamentals of the credit score.

Credit Score Range And Fundamentals

Your credit score ranges between 300 – 850. Therefore, the average credit score should be somewhere around 575-600 if the scores are equally distributed. But they are not.

If your score is between a 300 – 579, you're probably never going to get credit due to some type of non-payment you made in the past.

If your score is between 580-669, your rating is fair, but you're still considered a subprime borrower. As a landlord who checks credit scores, I've seen doctors right out of medical school with scores in the low 600s due to massive debt and a short credit history.

It's only after you get over 700 are you considered an attractive borrower. In the past, the magic number was 720 or above. Today, it seems like the average number has shifted to 740 or above.

For more detail, take a look at the FICO score ranges by Experian, one of the big three credit agencies. The average credit score in America can be divided into five score ranges.

Factors That Affect Your Credit Score

We obviously want the highest credit score possible in order to get the lowest borrowing rate and the most amount of credit possible.

You also need at minimum a 580 FICO score to get an FHA loan with the ability to put down only 3.5%. If you have under a 580 FICO score, you need to put down 10%. The more down the better I say.

The FHA government program seems irresponsible to require so little down.

Here are all the factors that affect your credit score.

- Payment history for loans and credit cards, including the number and severity of late payments

- Credit utilization rate

- Type, number and age of credit accounts

- Total debt

- Public records such as a bankruptcy

- How many new credit accounts you've recently opened

- Number of inquiries for your credit report

The most important factors in your FICO score are your payment history on loans and credit cards, total debt, and the length of credit history.

Not considered in your FICO score analysis is your race, color, religion, national origin, sex or marital status, salary or occupation, or where you live. It's the same law when you are deciding on a prospective tenant.

The Average Credit Score Over Time

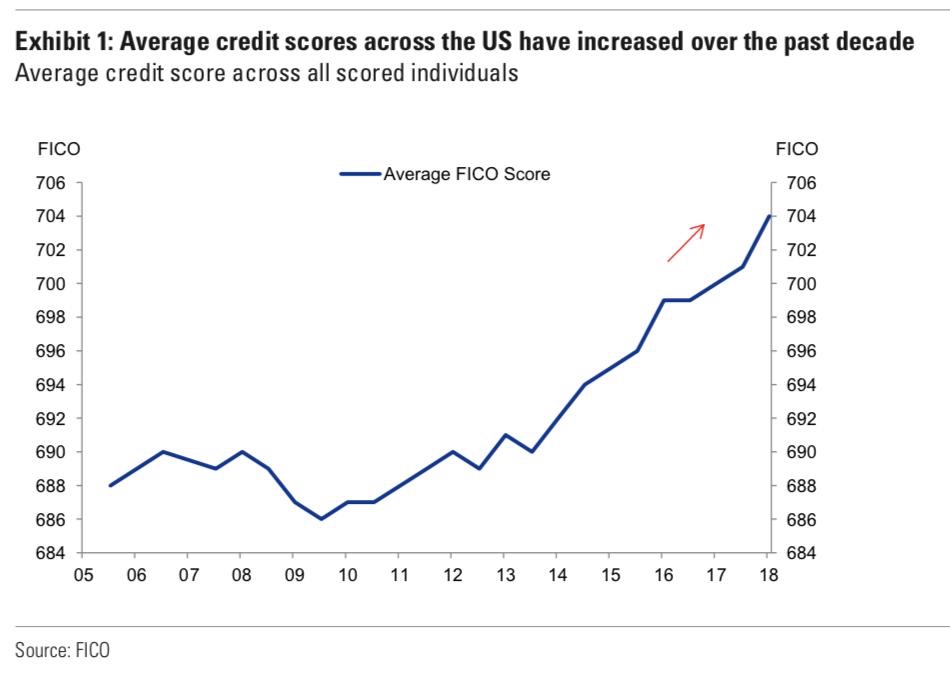

Now that we know some credit score fundamentals, take a look at the average credit score over time according to Fair Isaac Corporation (FICO). As Experian just reported, the average credit score is now about 710.

Are you impressed with your credit score improvement or what? While the chart makes the improvement appear like a San Francisco historical home price chart, in actuality, there's only been a 3.5% increase since the bottom in 2009 (686 to 710). Either way, I'm impressed the average American is now wealthier and financially more responsible.

The trend is our friend!

Since the financial crisis, banks have become very picky about whom to lend to. For example, I was rejected for a refinance back in 2015 because I didn't have two years of 1099 (freelance income) history despite having a large number of assets.

Always refinance before you leave your job. Once you lose a W2 income, you become dead to banks. You will likely need to show 5X more assets than the amount you are trying to refinance before a bank will be willing to refinance.

Average Credit Score By State

Below is an interesting look at the average credit score by state.

It looks like folks in Washington, Oregon, Vermont, New Hampshire, Massachusetts, North Dakota, South Dakota, Kansas, Utah, Colorado, Minnesota, and Iowa have the highest average credit scores. I'm impressed with Minnesota at 720.

On the other hand, residents in the South don't seem to be as financially responsible. Perhaps warmer weather makes people less motivated? 658 for Mississippi and 661 for Louisiana is pretty low. Then again, Hawaii is always warm and has a credit score of 705. Therefore, perhaps borrowing and paying back money is a cultural thing.

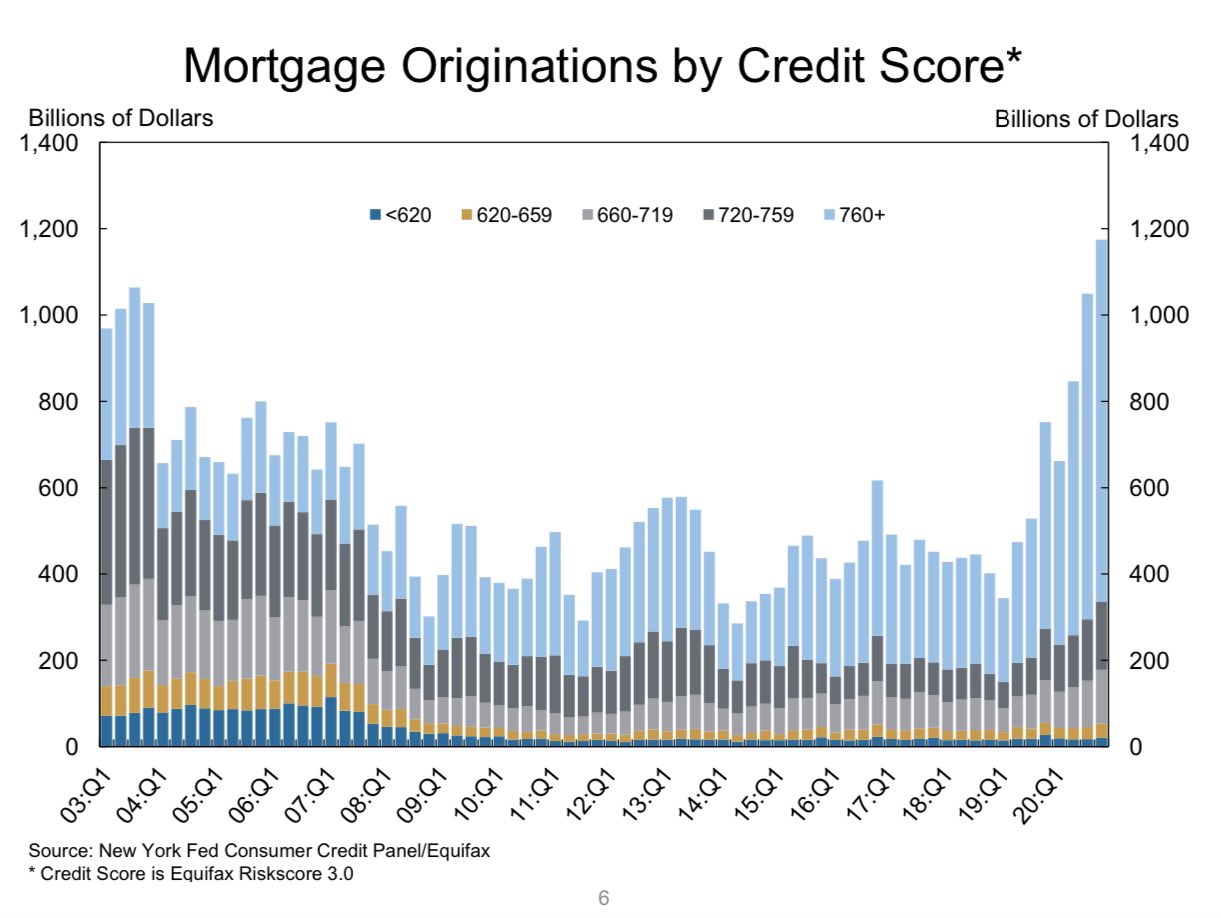

Average Credit Score By Mortgage Origination

Below is the latest mortgage originations by credit score. Notice how those with a 720+ dominate.

With stronger lending standards, low mortgage rates, and a large increase in home equity since 2009, it's hard to envision another housing market crash similar in magnitude to the one that occurred between 2007-2010.

Let's say you put down $200,000 on a $1,000,000 home in 2012. You locked in a 10/1 ARM at 3.25%. Since then, your property has appreciated to $1,500,000. Meaning you've got at least $700,000 in equity if you didn't take out a HELOC and spend it.

Further, your income has increased from $170,000 to $215,000 and your liquid net worth and pre-tax investments have increased from $250,000 – $600,000.

Even if your $1,500,000 home declines by 30%, it's still worth $1,050,000, or $50,000 more than what you bought it for. You're certainly not going to suddenly stop paying your mortgage and allow the bank to confiscate your remaining $250,000+ in equity with a foreclosure.

New buyers could get smashed if there's a correction and they need to sell. However, new buyers today are more creditworthy than buyers of the past. They are more likely to follow my 30/30/3 rule for home buying as well. Therefore, it's very hard to see a cascade of foreclosures like before.

My Credit Score Just Made It To The Top Level

I was worried that I was telling an untruth when my mortgage guy asked for my credit score. But, I really didn't know for sure. I just assumed it would stay above 800 since the last time I tried to refinance in 2015.

However, it looks like my credit score just squeaked by at 804 back in 2019 when I refinanced my previous primary residence. Today, I assume my score is still above 800.

Your Credit Score Won't Stay Static

What I find interesting about this latest credit score is that it actually went down one point since 2013 when I first wrote about joining the 800 club. There is no secret handshake. But there is a peace of mind you're always going to get the best terms with lenders.

Perhaps the credit score decline has to do with me paying off my rental condo in 2015 and paying off $815,000 of mortgage debt in 2017 after I sold my rental home. Hard to say because like a Lannister, I always pay my debts.

The other interesting thing about this credit report is that it says the scores range from a low of 334 to a high of 818, instead of a range of between 300 – 850. Equifax has a slightly different credit score range than Experian and TransUnion.

An 800+ Credit Score Is Your Goal

Finally, even though I got an 804, it still only ranks higher than 86 percent of U.S. consumers. This is a bullish indicator for the economy and the real estate industry. I thought a 804 would be at least in the top 5% for credit scores.

If someone like me who always pays his bills on time and has seen a healthy net worth increase since the financial crisis is still outranked by ~14% of Americans, then surely America as a whole is doing well. Go USA!

Order My New Book: Millionaire Milestones

If you’re ready to build more wealth than 94% of the population, grab a copy of my new USA TODAY bestseller, Millionaire Milestones: Simple Steps to Seven Figures. With over 30 years of experience working in, studying, and writing about finance, I’ve distilled everything I know into this practical guide to help you achieve financial success.

Here’s the truth: life gets better when you have money. Financial security gives you the freedom to live on your terms and the peace of mind that your children and loved ones are taken care of.

Millionaire Milestones is your roadmap to building the wealth you need to live the life you’ve always dreamed of. Order your copy today and take the first step toward the financial future you deserve!

Subscribe To Financial Samurai

Listen and subscribe to The Financial Samurai podcast on Apple or Spotify. I interview experts in their respective fields and discuss some of the most interesting topics on this site. Your shares, ratings, and reviews are appreciated.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise because money is too important to be left up to the inexperienced.

Wow 710 is higher than I would have expected especially with the pandemic. Glad to see the average credit score is going up not down.

Thanks for the inspirational post to get me to check my own. I’d been meaning to check my score for a while and just kept getting distracted.

Looks like mine was holding steady at 855 but just went up to 861 last month. That’s higher than I would have guessed. Nice!

Now I need to go check my credit report. I haven’t done that in a while.

Looks like your voting readers with “Very Good” or a better score are the huge majority of your audience. That’s too bad, as most of your advice would be very helpful for those below these ranges. I try to pass on your blog to as many people as I can. I really appreciate your commentary.

Sam,

I would love to see you research the effectiveness of credit scores. Who do credit scores benefit?

One impact which bothers me is the more credit pulls done the lower your score goes. If I am looking for a mortgage, I am going to stick with one company rather than shopping around because I don’t want my credit score pulled 5 times reducing my score to achieve a favorable financial result to me. Not shopping around benefits the lenders.

Credit scores are also reduced when we open new accounts and close old accounts. I am not sure why this would make me less likely to pay off debt. It only seems to benefit the banks by keeping us from shopping for the best deal. Consumers switching cards has a negative impact on banks because it increases their customer acquisition cost.

Credit scores do not take into account the overall financial position of the borrower, only their relationship with debt. It seems like a short sighted measure to me.

It seems credit scores are designed to help banks reduce costs and keep customers. I know there are components meant to help determine the ability to pay, others seem to be throw ins for lenders.

That is why you mortgage shop at the same time (keep it to less then 30 day window ) even then the lowered score is temporary

Hey. New reader here. Used to check my score constantly, then stopped for about a year. Just checked now. It’s 755, which is a bit lower than it was, but still good.

To clear up the scoring question Sam made at the end of the article, almost all mortgage underwriting in the United States is done on three scores; using the current public nomenclature FICO and the CRA’s (Experian, Equifax, and Transunion) use, they are explicitly

EQ FICO 5

TU FICO 4

EX FICO 2

There are more technical terms but be aware that most of these are not what you get free with your credit card or similar: those are likely FICO 8 (released after the above-mentioned) or Vantage which is not widely used anywhere in the credit market.

Anyway current scores from FICO 8 and above do have real world max of 850; however the 818 max seen on Sam’s mortgage app report is the real world max of EQ FICO 5… and an 804 is an outstanding score on that algorithm, objectively better than my 822 EX FICO 8 for example.

It’s the GSE’s that mandate the three listed scores above, and since they are the bulk of the conventional secondary mortgage market, everyone just uses them virtually across the board… still nearly 15 years after their release (and 20 years in the EX score which is from 1998).

Yes I know far too much about this ;)

Awesome explanation! How do you know all this stuff?

I get fixated on things, and nearing 8 years ago when I realized I needed credit to obtain a mortgage anytime in the near future because of financial idiocy earlier in life, I wound up getting interested in credit scores and the algorithms underpinning them.

Off and on since then I basically have been researching and testing things and partook in a credit oriented forum community with similarly-minded folks and learned a metric ton.

Basically was yet another distraction but it has been a useful party trick sometimes hah.

Here in the UK the credit score algorithms are just as convoluted. According to Experian, my wife has a much better credit score than I do. We both find that somewhat surprising given she is a secondary cardholder on many of our credit cards and her pay, while very healthy in absolute terms, is significantly lower than mine. But hey, that just means she’ll be the primary applicant when we apply for that mortgage!

832 FICO as of this month. I check regularly, due to a couple credit cards giving monthly credit score updates as a perk of the card. It’s been a huge jump for me over the past few years. I was always in the mid to high sevens… 757 when I got my first mortgage, but seems like even though my debt has hovered right around 0% for everything, but the house payment, and I use credit cards as a 30 day deference, and single payment of most of my monthly expenses, I’m not sure why my credit score is so high.

I’d expect high sevens, but nearly perfect credit for someone who sort of uses other people’s money to defer payments to a single bill seems like I’d be less desirable than someone who borrows more, but routinely pays on time.

Either way 834 for me, and it’s sort of a shame because it’s not really doing me any benefits since I have no plans for future let and at the moment.

People should know that high credit score is not something they should be proud of because credit score is tied to how much debt you have. The more debt you have, the higher credit score you get.

A millionaire once said he probably can’t go out and rent an apartment because he has a zero credit score since he buys everything with cash. So even though he can’t rent an apartment but he can buy that apartment with cash. Now that’s something to think about.

I dunno. We own our home and cars, no mortgages or car payments (of course, the newer car is ten years old), have no loans of any sort, charge almost everything, and pay it all off every single month (which means the credit card companies probably refer to us as deadbeats).

Despite this, our credit rating has hovered just above 830 for the past decade (goes up a point or two one month, then back down the next).

Same situation here, our mortgage was paid off quite some time ago and we’ve never had an auto loan as we’ve always paid cash for our cars. We use a credit card for every purchase and pay it in full every month, never paying a cent in interest. Our credit score is consistently above 830. Our 22 year old daughter, who has been an authorized user on our card since age 16, has a credit score that dipped just below 800 because she applied for, and received, her first credit card in her own name. ( She recently graduated college debt-free and started her first job.)

I recall reading recently that the credit rating agencies over the last 2 years have been re-configuring their formulas and that the result are higher scores across the board.

Not exactly; FICO 8/9 penalize old dirt less harshly than the older models do. Also they often have higher real world scoring maximums which shifts everything to the right as well.

We are also seeing the first wave of foreclosures and BK’s from the mortgage crisis hit their report exclusion time (10 years) and the lates people racked up back then dropped at the 7 year mark.

There is a lot of chatter about increasing credit scores but ultimately any lender making a credit decision on FICO alone is doing it wrong… as someone else mentioned income is not factored because that information is not on a credit report.

Really getting a high credit score is just having some number of trade lines (open ones on modern algorithms) with low balances on them… and the longer they have been opened the better.

Then it’s just never missing a payment or being late on anything if you want to reach the highest scoring echelons.

Racking up a bunch of revolving debt is the last thing you want to do for one’s credit score short of slow paying or defaulting.

I agree, Ellen. I’d like to see large paid off assets (like your primary house) plus being debt-free as a better indicator of credit.

Most markets do not have appreciation like in your example. So you example only works in 1/2 the markets in the USA maybe less

I’m rocking an 835 at 37 years old. I have a mortgage I owe 7k on, a vehicle worth 20k that’s paid off, a second vehicle I owe 13 with zero percent interest that was for 72 months, 5 credit cards totally 115k in available credit with a zero balance on all. I pretty much just work all the time between a full time job and a small business owner. I’m ready to get a nicer house soon but the housing market is pretty inflated right now so I will keep saving.

After reading about trendlines on another blog, I recently added my 21-year old, college student son to one of our credit cards as an authorized user. I figured it would help build his credit score for the future after he graduates.

He got on creditkarma and found that his score has gone from nothing to 760 and shows he has healthy 9 year credit history. Maybe others are increasing their scores in similar ways.

In 2012, I was relocating due to work, and I began the process of mortgage pre-approval. The mortgage broker ran my credit, and said I had a score of 690. Taken aback, I said there must be a mistake, he must mean 790. No, he found that there was an unpaid bill on my credit report.

9 months earlier, my infant daughter needed a nebulizer. The wife arranged for it, and it was delivered to our house. The wife stated that the insurance would pay for it. A few months later, we got a bill for $80. My wife was starting back to work, and following up on that bill got lost in the shuffle of life. When I got a bill stating that it went to collections, and with fees it was now $110, I just paid the damn thing.

As I learned, once it goes to collections, it doesn’t matter if you pay it or not, the 7 year clock has started. Assuming my rate on my mortgage would be .5% higher due to the lower credit score, on a $306,000 mortgage, it would cost $32,000 more in interest over the course of the loan.

I called the collections agency (which was a branch of the medical device company), and begged and pleaded to have them remove the delinquency from my credit report (since I did pay the bill months earlier). The woman on the phone wouldn’t budge. My wife grabbed the phone, and asked for a manager. As a 1 time curtiousy, he agreed to remove it. That phone call saved me $32,000.

It turns out that these mishaps with insurance companies are common, and it can take many months to work them out. There was a rule passed stating that when insurance does pay the bill, the delinquency must be removed from the person’s credit report. I suspect this has something to do with the increase in scores.

http://money.com/money/4943931/new-rule-medical-bills-credit-reports/

Also, in the latest FICO score modeling, these are taken into consideration:

• Third-party collections that have been paid off no longer have a negative impact.

• Medical collections are treated differently than other types of debt. Unpaid medical collections will have less of a negative impact on FICO® Score 9.

• Rental history, when it’s reported, factors into the score – this may be especially beneficial for people with a limited credit history.

https://www.myfico.com/credit-education/credit-scores/fico-score-versions

827 last time I checked several months ago. I don’t think it matters much to me at this point because I don’t plan on taking any loans for the foreseeable future.

I do find it risky to the banks that they ask for your annual income for credit limit but they don’t verify. I have about $70,000 limit and my income is low right now.

The banks will verify your income if you’re doing any loan other than a credit card. They collect two years W2s at minimum, and I’ve had to collect paystubs and other documents from customers for HELOCs and the like.

Sincerely,

ARB–Angry Retail Banker

Yes, one could theoretically overstate income by a very large amount and then get 100’s of thousands of dollars credit and it’s unsecured.

Also, when I applied for a mortgage a few years ago with my wife, they did ask for multiple years of w2’s but our income was very low those years (certainly not enough to cover a mortgage). They only really cared that we both had the current jobs we had at they time which we only had for less than 6 months. And there was no money down. I look back and think about it and it seemed very risky for the bank.

Eh, not really. Not under normal circumstances. I’ve had a number of applicants that said one thing on their applications and then gave me W2s with lower numbers. Depending on the situation, Loan Department would either ask for a written explanation of the discrepancy or issue a denial of credit.

The banks I’ve worked for never allowed hundreds of thousands of dollars of unsecured credit to be issued. The last bank I worked for allowed a maximum of $50,000 of unsecured credit to be issued in the form of a fixed rate loan. Any higher and it was home equity or bust.

I should point out that I am only talking about retail consumer lending, not commercial or private banking lending. I’m sure things are very different for UHNW clients.

I don’t know what income you had that was considered “low”, but it was probably high enough to convince the bank of your ability to repay (at least when couple did with your high credit score, employment history, and DTI). Many different factors come together to form an underwriting decision, and often in unexpected and even counterintuitive ways.

Was that loan a risky loan? Sure, I guess. I personally wouldn’t know. But that’s not the same as the bank not verifying income.

Of course, different banks have different policies. And while what I described are fairly standard industry practices, of course there are gonna be outliers.

Sincerely,

ARB–Angry Retail Banker

I’m a heavy credit user and have built up my real estate investments often funding myself with 2% or 3% balance transfer offers. I always transfer the balance to a new card, as needed, to maintain that the 3% rate.

I’ve noticed that my lenders are increasing my credit limits without me even asking – and on cards I’m not using right now! I think that’s attributable to the current macro-economy, though too, I always pay bills promptly. This increase helps my overall balance-to-credit limit ratio. I don’t think I deserved this on my own, but I’ll take the benefits. Even with 40k+ in credit card debt my score has RISEN over the years from 740 to 800+. Go figure. I’m glad they like me.

I’m earning incredible interest returns on my REI. I just sold an investment property for the first time, after owning it for 4.5 years. My cash-on-cash return averaged 175% annually. 175% is not a typo. I would not have been able to purchase the property, (on land contract), without the initial 3% balance transfer. I then made (actually my tenant) only the minimum payment each month, usually 1% of the balance. My credit cards have provided me with access to the cheapest loans – without 30 page document requests(!) and cheaper than mortgage rates(!) – for years. I love them!

On the face of it, I agree with you that a higher average credit score is a good sign for the economy. If nothing else, a higher credit score should make the cost of borrowing lower, especially for a mortgage. That should hopefully offset some of the headwind against real estate such as the SALT limitation, and the recent increase in the mansion tax in NYC.

Lower cost of borrowing should, hopefully, also spur on increased investments.

Sam, FICO has artificially inflated scores in the last few years by making updates to the credit scoring models. Feel free to do some quick searches. There have been several articles about this. Their goal i believe is to allow more people to be able to qualify for financing. The economy has also played a role. More employment equals a greater ability to make timely payments. I don’t personally believe mainstream America is more responsible today than 10 years ago. People reading finance blogs are not “average” Americans from a financial management perspective. This is evidenced in the percentage of respondents to the poll who have high 700+ credit scores. Hope you are doing well!

I just checked mines the other day and it’s just above 800. I didn’t really check my score until a year ago when we started looking for a home since your score has an affect on the type of rate you will get on your mortgage.

I think it’s a good thing the average credit score is getting better now. It shows that more people are aware of taking care of their finances by making their payments on time and know that their credit score is really important when you make big purchases like a home and car.

“If someone like myself who is in his early 40s, always pays his bills on time, writes about personal finance 3X-4X a week, and has seen a healthy increase in net worth since 2009, yet is still outranked by 14% of Americans, then surely America as a whole is doing well.”

Age, blogging frequency & net worth play no direct part in your FICO score.

As an example, if you pay for everything with a debit card, your FICO score will likely be higher. However, there is a whole subculture dedicated to maximizing credit card benefits such as cashback or airline miles. Charging a lot to your credit cards (even if you pay it off full and on time) will lower your FICO score.

Also, negative credit events (bankruptcy, debt turned over to collection agencies, foreclosures) affect your FICO score for 7 to 10 years. I think much of that avg FICO score increase is just the expiration of these events being considered in one’s FICO scores.

How would debit card transactions affect credit score?

You’re right that debit card transaction don’t help your credit scores directly. I assumed no one uses cash or cryptocurrency so that left debit card as the primary form of point-of-sale transactions.

The sentence, more accurately, should have stated “If don’t use your credit cards, your FICO score will likely be higher.” The credit utilization ratio stays at zero which is beneficial to your FICO score.

The trick is to pay your credit card off 1-2 days BEFORE the statement close date. For example, I usually spend about 100k on one of my business cards (buying inventory) per month. That card closes on the 14th each month. So I have a calendar reminder on the 12th to pay the full balance. That when the statement closes for the month on the 14th, it closes with me having near a $0 balance on that card. If I do that, my credit score is 830 consistently. If I forget to do that, my score drops 80-100 points because suddenly my credit utilization rate goes through the roof.

The 3 credit reporting agencies check your accounts at different times. I suspect you are basing your 830 score from a free FICO score benefit from your credit card company or bank. They likely use the same credit reporting agency each month which is why there is a pattern. In other words, the company is calculating your FICO score on the same day each month. It’s possible to get FICO scores from 3 sources on the same day and get 3 different scores.

What you are seeing only underscores the randomness & lack of validity of the FICO score. Perhaps more accurately, the precision in the score does not warrant 1 point increments. Are you any more or less creditworthy because you pay your credit card bill in full on 12th vs paying your credit card bill in full on the 14th?

Mine used to be above 800, then a 10 yr old CC account with PayPal got closed due to inactivity. Dropped my score by about 40 pts, with no other changes.

Wow, outranked by 14% of Americans.. Sam, you still have got some work to do ;)

As a European I’m always a bit amused by the tips and tricks you read online to bump up your credit score.. Makes me wonder about the real value of the credit scores.. But again, I’m not familiar with the concept as this is not common in Holland.

In Holland all (consumer) debt (above EUR 250) is registered in a central register that can be accessed by all banks, etc. Based on that they apply certain thresholds for financing purposes.

Here they are not really focused on history. For example if you become a Dutch citizen and you have a job, 1 minute after you become a Dutch citizen you can get a mortgage/mobile Phone subscription, etc.

From what I’ve heard that’s not possible or very difficult in the US…

I never knew or monitored my FICO score 5 years ago, then the credit card companies started offering it for free every month to check on. I’ve loved monitoring it and watching it rise, like reading the news every morning I sign into my accounts making sure everything has been paid.

Maybe that’s one reason why credit scores have gone up. More people are aware of what their credit score is and therefore are more willing to be financially responsible.

Could be that simple. What you track you can measure.

Good stuff.

This to me is mostly an indication of how much debt people had, and how much they have paid off, meaning they still have 10+ cards but with minimal utilized debt. So the key to an 850+ score is having lots of debt at some point, then pay it off, without closing any cards (because this will reduce the score).

What your latest credit score is? 790

When did you last check? Yesterday

Do you agree with me that the trend towards higher credit scores is a good sign for the U.S. economy?

The high scores are showing that people are making their debt payments on time which is a good thing. It’s so simple to get a super high credit score. It doesn’t really do anything for me though besides allow me to get a mortgage or auto loan which I don’t want either currently. It’s nice to have the option to borrow if I decide I want to though.

I don’t even have a credit score.

I have had just one credit card in my life, the same one for about 33 years, which gets paid off every month. I bought my house with a loan in 1991, which I paid off in about 4 years. Net worth about $4 million.

Occasionally I get rejected for something (opening a new account somewhere, etc) because my of credit score “problems”. Once Ally bank wouldn’t let me open a new CD because I had no score – though I had several hundred thousand dollars sitting at their bank at that very moment, and had been a customer of theirs for several years.

I have tried to figure it out a couple times with the credit bureaus, but I get nowhere. I’ve never had a single stain on my record – it is just that there is essentially no information in my record. So now when it comes up, I just laugh and move on.

So it is hard to convince me that a credit score is meaningful, even though it obviously matters to some people.

How do you have no score when you currently utilize a credit card?

If you use a credit card and reliably pay it, you have a score and its likely decent.

Lots of those mortgage defaults are finally falling off people’s credit reports?

I think so. Just saw this article on Yahoo via USA Today about Boomerang buyers coming back:

The housing bust was caused by lenders who doled out subprime mortgages to Americans who couldn’t qualify for conventional loans. Many of the mortgages required low interest-only payments initially that ballooned after a few years. The model worked as long as home prices kept soaring, allowing homeowners to refinance. It unraveled when prices plunged and the Great Recession caused millions of people to lose their jobs and fall behind on their mortgage payments.

From 2006 to 2014, there were 7.3 million housing foreclosures and 1.9 million short sales, according to CoreLogic, a housing research firm. After a foreclosure, a prospective buyer must typically wait seven years to qualify for a mortgage guaranteed by Fannie Mae or Freddie Mac. The wait can be three years in certain circumstances, or for a Federal Housing Administration loan, but people who wait seven years generally benefit from higher credit scores and lower interest rates.

A short seller generally must wait three years to buy again.

Of 2.8 million former homeowners whose foreclosures, short sales or bankruptcies dropped off their credit reports from January 2016 to November 2018, 11.5% have obtained a new mortgage, according to a study by credit rating agency Experian for USA Today.

Fifty-three percent of the remaining 2.5 million had prime or super-prime credit scores in November, notes Experian Vice President Michelle Raneri. “That’s 1.3 million people who have really good credit,” she says. “Maybe they don’t realize they would qualify now.”

Some economists say many of those affected who wanted to become homeowners again already have done so. “I’m less convinced this is going to move the market,” says Ralph McLaughlin, deputy chief economist of CoreLogic.

Michael Fratantoni, chief economist of the Mortgage Bankers Association, says young people will be a far greater force in the housing market than prime-age boomerang buyers the next few years. There are about 31.7 million 24- to 38-year-old renters in the U.S., according to CoreLogic.

Thanks for the reply! My guess came from personal experience.

I’ve noticed too that average credit scores among my peers seem to be going up. People with many student loans also tend to have higher credit scores since those loans are considered “paid on time” when they are in deferment during school. I don’t feel a high or low average credit score for the country has much of a correlation with anything.

I kind of look at credit score as BMI. My BMI is lower than Lebron James, but he is much more athletic and healthier than I am. It’s just one snapshot of someone’s finances.

I enjoy this comparison of credit score to BMI.

I tend to think credit scores are going up because everyone is paying with card for everything these days, and cash has gone the way of the dodo.

Sam, I totally disagree with you that the trend in rising credit scores is a good thing for the U. S. economy. My score is an 824, due largely to the fact that I make my loan payments on time. The key word here is loan. People with long-term student debt, mortgages, and car loans can get very high credit scores if they have a perfect payment history. And given our low unemployment rate and the dramatic rise in stock and housing prices over the last 10 years, why wouldn’t they have a perfect payment history? Still, these are all loans, and when we enter a recession and people lose jobs and stock and real-estate values decline, we will start to see cascading loan defaults, which will of course worsen the recession. The amount of debt in America is massive — according to Forbes, just the 18-29 year old demographic currently owes over $1 trillion! How will their young credit scores look when unemployment rises and they are the first some of the first to lose their jobs (or not get jobs in the first place)? There is currently a growing bubble in credit scores, and I never find bubbles comforting unless I’m in the tub!

Gotcha. So you’re saying you’d rather see a declining trend in credit scores and a low credit score average as a good indicator for the economy? If so, can you elaborate on that?

Debt is massive, but wealth is even more massive.

Don’t forget, when you say you’re doing great, but everyone else isn’t so much, you are everyone else.

Haha I’ve read you for long enough to know you’re ribbing me a little! Obviously, according to my thesis the rising credit scores are linked to rising debt that people, especially young people without much accumulated wealth, are currently able to pay. I think they won’t be able to pay once we enter a recession. So taking comfort in rising credit scores today is a bit like people taking comfort in rising home values prior to the last recession — the seemingly good news of the rise masks the potential debt problem on which the good news is based. So it’s not that declining credit scores would be a good indicator for the economy, but a decline in the debt upon which those scores are partially based likely would be.

I agree with your input. It’s not a popular opinion, but credit score is a feel good number. The algorithms change mysteriously like Google search algo. The fact all of ours went up, despite no change in behavior, shouldn’t be summarily accepted as good.