Refinancing now may be smart as mortgage rates are low but may head higher as the economy recovers. However, if you are struggling to pay your mortgage you may be considering walking away. If you do, there are non-recourse states where you can walk away from your mortgage without the bank coming after your other assets.

Let's say you are so underwater on your mortgage that you feel it doesn't make sense to continue paying anymore because you don't think value will ever recover.

This happened a lot during the financial crisis in 2008 – 2009. Homeowners just gave up because banks were so stubborn in allowing underwater homeowners to refinance. As a result, many homeowners just stopped paying altogether.

Have you ever wondered why there have been so many foreclosures in states such as California, Arizona, and Nevada? I'll tell you. They are non-recourse states.

The 12 Non-Recourse States

The following are the 12 non-recourse states where you can walk away from your mortgage and not have the lenders come after your other assets. Of course, each state will have some different methods of trying to recoup bad debt.

- Alaska

- Arizona

- California

- Connecticut

- Idaho

- Minnesota

- North Carolina

- North Dakota

- Oregon

- Texas (yes for home equity loans, first and second mortgages could be pursued for recourse)

- Utah

- Washington

If you so happen to own property in one of these states, and have substantial assets elsewhere, you can legally hand over the keys to the bank and exonerate yourself from the mortgage with no penalty against your other assets!

The Benefit Of Non-Recourse States

Here's an example of walking away from a mortgage if you live in one of the non-recourse states.

You have a million bucks in the bank and you bought a house for $800,000 several years ago by taking out a $750,000 mortgage. Real estate market crashes and the value of the home is now $400,000. You’ve already paid $50,000 of the mortgage principal over the years.

$300,000 of your mortgage is now unsecured ($700K mortgage balance – $400K value of property), which means your house is now an under-secured debt.

Because you live in a non-recourse state, if you turn over the collateral (your house), your lender cannot collect on the $500,000 unsecured debt. The lender assumed this risk when they approved your mortgage application, and you can walk away with your $1 million in cash and live happily ever after.

However, say you bought the house for $800,000 with a mortgage of $300,000, and then a few years later took out a second mortgage worth $500,000. Real estate market crashes and the house is now worth $100,000, leaving you upside-down on the house by $300,000.

If you turn over the house, you can walk away from the first $300,000 mortgage, but you’re still liable for the second $300,000 mortgage. Since you no longer have the collateral, the second mortgage is now an unsecured debt. Unsecured debts can be discharged in bankruptcy.

Bankruptcy Option For Real Estate

If you want to file for bankruptcy, the $1 million cash is a problem. Since you’ve got the cash on hand, the court is going to say you have to pay back your second mortgage. But who has $1 million cash in this economy? More realistically, you have $1,000 cash.

Chapter 13 Bankruptcy

If your income is above the median, you are eligible for a Chapter 13 bankruptcy. In a Chapter 13 bankruptcy, the debt is not completely erased, but is instead consolidated and restructured into an affordable monthly payment. The debtor creates a three to five year affordable repayment plan to pay off a portion of the total debt.

Chapter 7 Bankruptcy

If your monthly income is below the median for the state you live in, you are eligible for a Chapter 7 bankruptcy, which is a total liquidation and discharge of all of your debts, including the $300,000 second mortgage. The slate gets wiped clean and you get a “fresh start” to start rebuilding your credit. You are eligible for a new FHA home loan 2 years after your bankruptcy is discharged.

If your creditors are harassing you or if a creditor has served you with a court summons, if you’re facing a repossession or foreclosure, or you are only making the minimum balance on your credit cards, you should seriously consider filing for bankruptcy.

If you feel like your finances are way outside of your control, bankruptcy is the “fresh start” you need to get your financial health back in your own hands.

Most bankruptcies are caused by one of three events: loss of job/failed business, medical emergency or family emergency. You may have been living within your means just fine, but then you lost your job and defaulted on a payment.

One missed payment can change your interest rate from 8% to 39%, causing your debt to quickly mushroom out of control. Perhaps you or a loved one suffered a heart attack, resulting in thousands and thousands of dollars of medical bills that you simply cannot manage.

Is It Right Or Wrong To Walk Away From A Mortgage If You Can Afford It?

There are actually plenty of people in California who have substantial assets who simply walked away from their mortgages during the previous financial crisis. After all, California is one of the non-recourse states.

Financially, it makes sense, especially if you've put very little down. Legally, you have every right to walk away as well. After all, the banks performed due diligence and made the decision to lend you money. Nobody forced the banks to do anything, as perceived profits are what drove them to lend.

Sure, for the first 7 years, your stellar 780+ credit might get trounced to 570. But, if you have another fine property you are living in, and another vacation home down in Malibu, what do you care whether you can't get more credit or not? You're already living the dream and catching a break from an investment property that went sour.

I, personally, would never walk away from my debt obligations because it feels extremely dishonorable. Even though I bought a vacation property that collapsed during the crisis, I've continued to pay the mortgage every month as agreed upon until this day.

Those who walked away from their properties in 2008-2010 have not seen a rebound in net worth. Instead, they have fallen way behind because the stock market and real estate market had a huge recovery since 2009-2010.

If you are going to buy property, buy property and hold on for the long term. Transaction costs are a killer, and selling during downturns not only wipes out your equity, but may permanently leave you behind for the rest of your life.

Be Disciplined About Buying Property During A Pandemic

Demand for property is soaring in the new decade because mortgage rates are at record lows. People also want to own nicer homes and real assets. Therefore, if you're looking to buy property, buying before there is herd immunity may be a good idea.

Real estate demand in non-recourse states such as Texas and Washington continue to be very high. Both those states have no state income taxes either.

2020-2021 is not like 2008-2009 where homebuyers were overextended. Banks have been much stricter since the previous financial crisis. Today, the average credit score for an approved mortgage borrower is 770. Homebuyers are also following good home-buying rules like my 30/30/3 rule. Further, there has been a lot of equity built up in the housing market.

Let's just make sure our economy doesn't experience a housing implosion relapse again. We've got enough problems in the economy and in health to deal with!

If you live in one of the non-recourse states, you should still run the numbers and make sure you can comfortable afford a home. Just because you can walk away from a property without as much consequence in a non-recourse state doesn't mean you should.

Real Estate Recommendations

Refinance your mortgage. Check the latest mortgage rates online. You'll get real quotes from pre-vetted, qualified lenders in under three minutes. The more free mortgage rate quotes you can get, the better. This way, you feel confident knowing you're getting the lowest rate for your situation. Further, you can make lenders compete for your business.

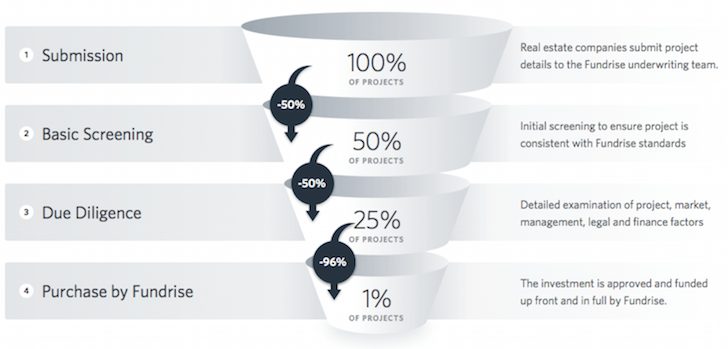

Explore real estate crowdsourcing opportunities. If you don't have the downpayment to buy a property, don't want to deal with the hassle of managing real estate, or don't want to tie up your liquidity in physical real estate, take a look at Fundrise, one of the largest real estate crowdsourcing companies today.

Real estate is a key component of a diversified portfolio. Real estate crowdsourcing allows you to be more flexible in your real estate investments by investing beyond just where you live for the best returns possible.

My other favorite platform is CrowdStreet. CrowdStreet focuses on individual investment opportunities in 18-hour cities where valuations are lower and growth rates are higher. CrowdStreet also occasionally offers speciality funds. If you like to build your own select portfolio, CrowdStreet is a fantastic platform.

Personally, I've invested $810,000 in 18 real estate crowdfunded projects across the Heartland and South. I love earning passive income and diversifying away from my expensive San Francisco holdings.

Non-Recourse States is a Financial Samurai original post. I've been helping people achieve financial freedom since 2009.

Hi – Is Texas actually a non recourse state? I’m seeing conflicting informatin online

Mostly yes.

Home equity loans are non-recourse in Texas. First and second mortgages are recourse and the mortgage company could pursue a deficiency action. While deficiency actions on mortgages are somewhat rare, they do occur. In a deficiency suit, you should be entitled to an offset up to the fair market value of the property at the time of the foreclosure. Meaning if the property was sold for less than the fair market value, you could be entitled to an offset of the difference. Therefore the mortgage company could only get a judgment for the difference between the fair market value and the amount owed.

Thanks! Why are deficiency judgements rare on a first mortgage in Texas?

Based on the data. It’s really tough to go after people’s homes in general. Takes a long time and costs money.

Scenario: Home collapses due to earthquake, no earthquake insurance. Property w/ house previously valued at $600,000, but is now only worth land value (maybe $250k). Mortgage is $420,000, my having banked $150,000 recently for basement remodel/emergency while concurrently lowering my payment. Can I hand over the keys and walk away without penalty? Thank you for your time and expertise.

A little back ground. I am a veteran and had a VA home loan in Oregon in 2008, lost the house due to work cutbacks in 2009. When I signing the house over to the bank the VA was on the hook and paid a $100,000 to the bank. Due to the payoff I essentially lost my VA home loan benefits (benefit was all used up in the payoff). However, as I understand it the bank also received bailout money as part of the Feds bank bailout program.

My question is this: Did the bank double dip by taking the VA payoff and the Fed bailout money on the same home loan? Does the fact of Oregon being a non-recourse state play into it at all?

Thanks for your time.

I own a house in PA, but due to illness i couldn’t afford the mortgage any more, and the mortgage company started to foreclosure proceedings… that was in 2000. 20 years later i am still in the house, and cannot get in touch with anyone to respond since they stopped talking to me in 2003. I want to consider this property abandoned by the mortgage company, can I do that?

I live in a WA State which is a non recourse state and I’m 64 years old. I currently live in a double wide mobile that I paid off in full 2 years ago. Last year I bought a distressed home for about 1/2 the appraised value at a online Hubzo auction. The house needed about $100K in repairs to make it livable so I took out a $100K loan out on the double wide to pay for the repairs. All repairs are now completed and the Ocean house on the water is beautiful and ready to move into and appraised for $375K. So I put the double wide up for sale intent on moving in the Ocean house the buyers inspectors discovered it needs about $70K i repairs before I can sell it for $110K. If I do the repairs I will only realize $40K as profit. If not I will only owe the monthly payment on the existing $100K loan and go into my retirement almost debt free considering. My question is it legal for me here in WA state to just walk away from this house and not face any recourse because it is a non recourse state? Meaning I only pay my insurance and property taxes on the house until the bank officially reclaims the property and house. Please I am only asking for legal advice here as to the negative ramifications I might encounter by walking away from this property’s loan. And letting the house go back to the bank. Example is there a time limit the applies to how long I had to have the loan, or if because I had it paid off then went back and refinanced it, or anything like that. Thank you for your assistance.

I would consult a real estate attorney as this could potentially be construed as mortgage fraud if the period of time between the purchase of the second home, the refinance of the first home, and the default on the first home is too short. Any undue hardship that led to the default should be well documented along with supporting evidence that shows you couldn’t or shouldn’t have known about the necessary repairs prior to the refinance. If there is any doubt then I would continue payments or try to refinance the retirement house to pay off the loan on the first house and then sell it.

I am in Oregon. I am a lien holder. Paid cash sold house with owner carry. They completely destroyed house in 4 years then walked away. There is more damage to the house than what it is worth. What about us???? “I’m walking away and releasing all interest in the home back to you. I also want you to get my name off the house.” Really? You want me to take back a destroyed house and pay the fees to get your name taken off? Wow. My response: “You can move the house, sell the house or walk away from the house but our contract still stands. You signed you would pay me and you still owe me whether you keep the house or not. If you want your name taken off the title you go pay the fees to have that done. I will remain the lien holder. Our contract doesn’t say if you choose to not keep the house you don’t have to pay me. UGH! Cool you change your mind or make bad choices and I get screwed? I remember a day when your word meant everything and now it doesn’t mean shit even if you get it in writing.

I wonder if not doing a refi on a purchase could be considered defacto “Earthquake Mortgage Insurance” of sorts. Since there’s no existing product I can buy on the marketplace that makes my condo mortgage “go away” in the event of a devastating earthquake that destroys my building which doesn’t have earthquake insurance, this seems like a good substitute with the only caveat of a damaged credit report. Am I missing anything? Might be worth not refi-ing and considering the premium (overage paid per year) to be this “insurance”. Obviously, I hope this doesn’t happen as I’m long SF Real Estate.

Money never sleeps and is never moral. The banks aren’t being charitable about lending money, and neither should one feel the same in paying it back( or not ). Anyone who thinks banks don’t price “strategic default” into their rates is simply naive. Why should individual citizens have to play by some silly “Marquis de Queensbury” rules that corporations don’t. Stop trying to inject morality into a financial transaction. As long as existing laws are obeyed, there is no foul.

But yet, i bet you take advantage of all the Tax Return laws to maximize your check from the government every year. It’s immoral people like you and all your tax loopholes that are driving this country into the ground.

I lost 7 properties and paid until my money was all gone, renters stopped paying rent, vandalism and criminals who trashed properties also decimated me financially….but I kept paying and kept paying, I had one house to fall back on and the bank from hell, Chase messed with my mortgage and refused to fix it or give an accounting, now they stole it. I say be careful, be very careful.

The banks are not acting honestly or with respect to us and now they stole my last house. I lost the equity I built and am soon to be in the street at age 60…..never had anything but perfect credit. Impossible to rebuild and very sick. I agreed always we should pay debts but the system is broken and the banks are crooked today. The bible also warns to not be in debt in the last days. We are here folks.

Almost funny reading some of the comments here. Many Bible quotes and morality inferences. Really, People?

Its a mortgage using real property as the collateral!

No more, no less.

I can assure everyone that in the USA mortgage lenders do not utilize the Bible, the Koran or any other religious tome in their construction of financial instruments.

Real Estate mortgages are offered and granted (or not) as a result of utilizing experience combined with hard nosed financial due diligence, and the contracts are overwhelmingly advantageous to the Lenders, not the Purchasers.

Listen closely now – the mortgage is ONLY granted after the Purchaser qualifies for the deal with Down Payment or whatever is demanded by the Lender. The list of qualifiers and codicils takes 10 minutes to read, only if you don’t pause while scanning the document.

If the Purchaser “Defaults” in any manner – if they stop paying property insurance, property taxes, trash the property in a manner that causes significant loss of value, or become delinquent beyond 60 or 90 days, the Lender has solid legal standing to evict the Purchaser and take the property as their own.

And the Lender will care not one iota about where the person or family will live after they snatch the property.

That’s it, Boys and Girls.

The Lender receives the documented property if the Purchaser defaults.

That’s the remedy for the Lender, plain and simple.

There are no after life penalties. The sky does not fall.

Your first born will not be taken.

The Four Horses of the Apocalypse do not come thundering after the Purchasers in default.

So tell me, please: why is it “morally OK” for the Lender to evict a Borrower family for late mortgage payment – a situation typically caused when all other options are exhausted, and all savings are gone – but “not OK” if a Borrower chooses to remove the untenable burden of a hopeless mortgage property by Walking Away before their lives are ruined?

Read this post: Why Debt Welchers Are Admired

It’s the craziest thing in America I tell ya. Go USA!

THANK YOU so much for a fair and factual comment. It’s probably one of the best I have ever read. It’s bad enough to have to default when you never have before, to lose your credit standing, to have to rent in your middle age years instead of being a home owner, but on top of all that to have to deal with the so called religious people heaping guilt on top is just too much. Why they are so overly sympathetic to the banks is beyond me. Really, I lost more than the bank did. And I didn’t lose it all in foreclosure, I lost it the day my home value plummeted from $210K to $50K in the first 6 months I owned it. It would never recover fully and I do not have the years left to have to pay down the difference if I had to sell. If anything, I think the banks should have seen a bubble coming and modified their lending and appraisals. If I had been warned I may have chosen to rent instead of buy at the market peak in 2006. They were playing the game of musical chairs with homeowners and I lost. After the bubble burst I did what I thought was best for me which was to walk away. Little did I know how very much the cards are stacked in favor of the bank. I lost my $30K equity. I lost my credit. The bank does not have to take back the house. The bank does not have to settle or negotiate with you. The bank can just wait and wait. The law does not require any speed on their part. The bank can cash in on the private mortgage insurance. The bank can get a foreclosure judgment and then just sit on it waiting for the property values to rise leaving you in limbo. If no one bids on the house at the foreclosure sale the bank can buy it back for $10 ($2000 in my case). The bank can send you a 1099-C cancellation of debt for the difference ($180K) which you have to claim as income on your taxes (then if it is your primary residence you can use the temporary deduction that will expire in 2014). The bank can then pursue you for the difference with a deficiency judgment (yup the same $180K plus interest and fees so its more like $250K less the $2K ), And last of all the bank can sell you home as a bank owned property (sold mine for $125K and keep the profit.) So the bank gets 25% from the PMI $50K, write off the loss with interest and fees of $250K giving them maybe a net income of $25K, and still chase you for the rest of your life for the $248K. And that is all legal. I will forever owe that $248K. Oh yes, AND they got a government bail out. Please STOP feeling sorry for the banks!!!! How about a little kindness and understanding for people who bought at the wrong time at the height of the bubble, especially in the most overheated markets. We lost everything. Walk away or not, the die was cast when the bubble burst.

I forgot to mention that the bank also gets the profit from selling it.

So roughly, 50K + 25K + 125K = 200K on a 187K original loan. AND still chase me for $248K. It’s insane how much they profited.

Debt welchers are very admired. Your comments and others makes me want to borrow a boatload and stick it to the banks of things don’t work out either. But I feel bad still making other people pay for my choices.

Check out this post: https://www.financialsamurai.com/why-debt-welchers-are-admired/

So much wrong with that article I hardly know where to start. I AM that person who always does the right thing. I never missed a payment on anything before or after. Bad things happen to good people. Lucky the writer was wealthy enough to afford a $2777 per month mortgage payment. Obviously he felt he could weather the storm. Don’t know how much his value dropped, but probably not 75% like mine. My mortgage payment was $1400. I could afford the payment but I could never afford to sell, EVER. I don’t have $100K to cover selling at a huge loss. I am close to retirement and that would nearly wipe me out. Having a home that would cost me my life savings if I ever had to move was a huge stressor. The bank did not want to negotiate AT ALL. I tried to do right by them by asking to work with me. Better for them to get something rather than nothing. (Naïve on my part, see my comments above. They knew they held all the cards.) After all, they approved the value of the house too. How would you feel if you bought a car for $70,000 and drove a car off the lot and the next day it was worth $20,000? The lender would be thinking they were very smart, but I bet you wouldn’t be too happy. Maybe you intended to drive that car until it dies anyway so you wouldn’t care. Most people do not buy homes intending to live in them until they die. Most people expect to be able to sell. Worse case you come out of pocket a little, but $100K, your life savings? No. My home devaluation was extreme. There should have been acknowledgement that something went very wrong and a willingness to negotiate down the principle. As for the bible thumpers (and I love the Lord) they should read and meditate on Deuteronomy 15. Please understand that I agonized over my decision. It was one of the worst times of my life. I do care about other people’s thoughts. What I see is that some people are resentful and judgmental even hateful. I think that is because they are not happy about their decision to do the right thing, the moral thing when they see people like me getting a “free pass” it seems like I am getting rewarded for doing wrong. I think the people you should be resentful to are the bankers who have so much and who should be more understanding and giving to people who by no fault of their own find themselves in difficult situations. The housing bubble was in so many ways worse than even the market bubbles because it put people out on the street. Where was anyone’s concern about that? I don’t believe that God would have sided with the bankers. If you can afford to absorb the losses to your equity, then you can decide to stay in your underwater home and keep paying. But if you can not feel compassion for others who are in worse situations that you, then, at least please let it go and stop harboring ill will toward people who felt they could never recover from the huge losses and decided to walk away and pay the consequences, which also are severe. We all were affected by the same economic event, sad that instead of polarizing on the issue, we couldn’t have all worked together and created solutions for the greater good.

So true, Wiley, so true. One other FACT that will astonish and confound the many decent folks who feel they are being dishonest if they stiff the mortgage holder.

If the institution loses on the deal, you are not stealing money from depositors; the money for your mortgage loan was not money on deposit by normal people who now are on the hook because you exited. That DEBT was created at the moment you signed the loan papers; it didn’t exist before you put pen to paper. They did not provide the check at closing with money in their vault…YOU DID when you gave them permission to conjure up the loan amount and then charge you 2.5 time the loan value over the next 30 years for the privilege.

You can and should stiff institutional lenders every chance you get if it is to your financial advantage. They are predatory and, as Wiley points out, do not pray OVER you…they prey ON you. We would have a more just financial system if all Americans understood the law, the debt system of finance we have and adjusted their own morality to the reality.

In other words, more Financial Samurais cutting of the Bad Guys at the knees.

[…] crisis, the smart economic thing to do would have been to stop paying my mortgage. California is a non-recourse state where lenders can’t come after your other assets to be made whole. Throwing good money after […]

I am one of those that is underwater by roughly $60K! We took an 80/20 loan. Will I ever recoup the $60K? I am seriously doubting it. Right now I am renting it out. We have to cover about $300/month along with the rent to cover the mortgage. That’s called NEGATIVE cash flow! We will be retiring in 2 more years.

It seem that all our lives we have been getting financially screwed. If that is our fault, so be it.

However, I will not go on living with this property noose around my neck. Sorry if you find that non-ethical. We will walk away.

For those who are currently facing paying taxes on a large short sale deficiency because the government did not extend the short sale provision this year, this is the answer. If you live in a non-recourse state, the amount of the deficiency is not treated as income, but rather is added to the sales price to determine your gain on sale. In my case my deficiency was $70k, which was added to the sales price, leaving me with only a slight gain on sale in the end. That small amount tax was nothing in comparison to considering it as income.

Talk to your tax attorney about using the non-recourse option if you short sold your investment property. Worked for me!!!

Mister Financial Samurai, in AZ I am not in the no-recourse situation if single dwelling family and I have more than 2.5 acres?

Thank you

Where’s my bailout? I purchased my home in 05 gambled and lost. You all know what my real estate agent said. Sound investment that will appriciate in 5 yrs and you can walk away with 100K; yea right! We all want to do the right thing; but if you’re paying a financial adviser and he says walk away your a fool not to. Look at all the tax loopholes. Who came up with those? Tax lawyers that advise rich people. Dah! As Americans we have got to stop sitting around judging people. How constructive is that? We have to come together and realize that it’s such a good ambition to own a home. It should never have been manipulated by greed. A moral value the home and family is sacred. I can’t afford my home now. Where does it say I now have to bite the bullet and stay? Sacred things have a morality of their own beyond the pail of the common man. Just saying…..

Perhaps give the government a ring or write em a letter and ask for your bailout? The government has been forking over billions of dollars to bail homeowners out with NEW subsidized loans, loss forgiveness, etc. Kinda crazy!

Does living in a non-recourse state like Arizona automatically save you from any tax consequences? Even in 2015?

no, everything I can read is no.

I am also seeing that you are not a no-recourse situation if you are a single family and have over 2.5 acres. Is this correct???

Just thought I’d say that most banks are out to make as much money as They can from you, and they don’t care how they do it. And if they need to make up the losses they do it by coming to the taxpayer for Bailouts. So why is it that everybody’s telling you how bad believe it is morally?

If you have the time, please read this it will change your perspective on what’s really going on in this country. I know most people just don’t have the time to read, but I guarantee most people have no idea?

The coming collapse of the petrodollar system by Jerry Robinson

This will be very hard for most people to except, but it is the truth!

Thank you for this post.

First, ANYONE making moral judgments about people walking away are, at best, nuts in my book. Anyone else realize the government probably owns 50% (not on paper) of the big five banks with all the insured mortgages AND the billions in bailout money? The banks were bailed out for gambling with OUR MONEY because THEY KNEW the government would save them; they were too big not too. So, the banks can go pound sand in my book.

Second, if a person is going to declare bankruptcy and walk away, can’t they just rent the property out on as long a lease as possible… at ANY amount of rent they can collect?

This completely encumbers the property for a new owner/title holder as, as far as I know, the rights of an existing tenant trump those of the new owners. Every lease I’ve seen is ‘inherited’ by the new owners, thus protecting and preserving a tenants stay for the duration of the lease.

This seems especially true in a non-recourse state. First, the bank would have to know you actually collected rent. Then they’d have to get a copy of the lease. Then they’d have to actually pursue civil action. Seems doubtful when they often don’t even go after the principal balance of those who walk.

Curious on your thoughts! Thanks, Thomas

Is it really that simple? I have a condo that was purchased for $150,000 and the units in this complex are now selling for $90,000. I have been searching for any information on this subject and found your website. I am pre-qualified for a home loan, but would like to be educated on the process of walking away from my current mortgage. Any advise you can give would be greatly appreciated, I am willing to pay for a consultation, I just don’t know where to turn for the answers.

It’s pretty straightforward. But you should initiate a dialogue with your bank first.

If you are interested in consulting, here is my consulting page: https://www.financialsamurai.com/fs-online-services/career-personal-finance/

For all the moral people. You are letting your morality get in the way of your business decisions. The banks never let that happen. Remember the banks are the ones that came up with liar mortgage loans so they could quickly resell them and they also knew properties weren’t worth what the appraisal were saying because they were packaging these loans and re-selling them to pensions.

And banks get the US taxpayer via the government to bail them out.

I live in a non-recourse State and have two condos that are under water and have been for some time. They both have 2nd mortgages that were there from the original sale of the properties (80/20 loans). Are both 1st & 2nd loans – since they were there from the origination – covered under the non-recourse laws? Or can the 2nd lien holders still come after me? Both of these condos were purchased by first time homebuyers and not as investment properties. They turned into rentals after the market crashed and we couldnt sell them. Thanks

It is to my understanding that once you take out a second loan (aka HELOC), the properties become recourse. Please ask a lawyer and mortgage officer for details.

If they really want change unfair laws, start with divorce law. It happens 50% of the time yet it is still unfair. Then change the walkaway law . Although, when you buy real estate, there should be a guarantee that it will not lose 1/2 of it s value within 5 years too. Fair is fair

I would like to know a couple of questions, #1 I filed chapter 7 in CA on a 2nd and it was taken down to $00.000 on credit reports, do i have to pay. Also with GMAC bankruptcy on my husbands property they have sold it to a ‘debt collector’ who paid pennies on the dollar green tree…..according to FTC law a ‘debt collector’ cannot charge interest and the cannot threaten to foreclose your property…a ‘debt collector’ is totally different than a Bank…help anyone know these answers?

IDAHO is a recourse State. Lenders can and do go after mortgagors for deficiency after foreclosure. The information that it is a non-recourse State is in error. The mortgage is a personal liability only secured by the real property, and thus the debt remains as a personal liability of the mortgagor after foreclosure.